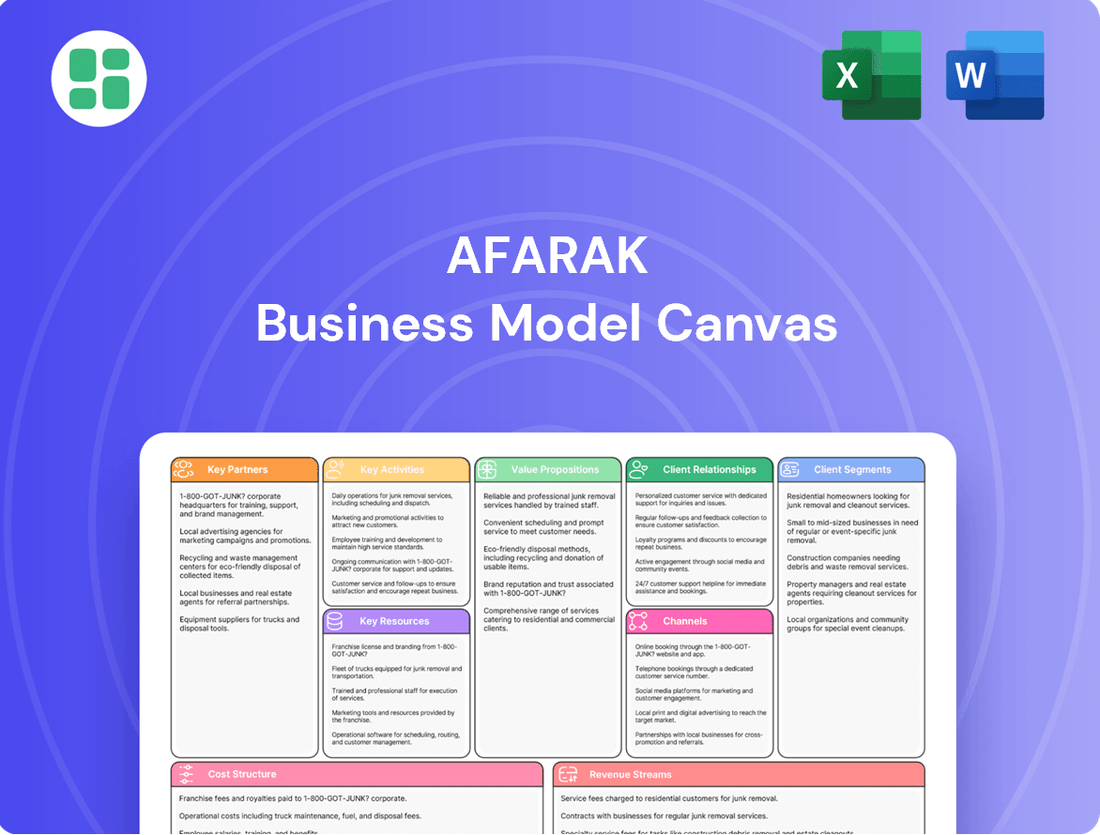

Afarak Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Afarak Bundle

Unlock the full strategic blueprint behind Afarak's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape, offering actionable insights for entrepreneurs, consultants, and investors.

Partnerships

Afarak's strategic mining equipment suppliers are vital partners, ensuring access to cutting-edge machinery for its chrome operations. These collaborations are key to optimizing extraction, boosting efficiency, and upholding stringent safety standards. For example, in 2023, Afarak continued its investment in modernizing its fleet, which directly impacts its ability to extract resources cost-effectively.

Afarak's key partnerships with energy providers are crucial for its energy-intensive ferroalloy operations. For instance, in 2024, the company continued to focus on securing stable and cost-effective energy supplies, exploring long-term agreements for renewable energy sources to align with its sustainability targets and reduce its carbon footprint.

Collaborations with sustainability partners and environmental organizations are integral to Afarak's strategy for responsible production. These partnerships aid in achieving Environmental, Social, and Governance (ESG) objectives, ensuring compliance with evolving regulations and enhancing the company's reputation for ethical and sustainable business practices.

Afarak's ability to efficiently move its ferroalloys and chrome ore globally hinges on robust relationships with logistics and shipping firms. These partnerships are critical for ensuring products reach customers worldwide on schedule and at competitive prices, thereby reducing the risk of supply chain interruptions.

In 2024, the global shipping industry continued to navigate volatile fuel costs and geopolitical influences, making strategic logistics partnerships even more vital for cost management. For instance, the Baltic Dry Index, a key indicator of dry bulk shipping rates, experienced fluctuations throughout the year, underscoring the importance of securing favorable shipping contracts.

Research and Development Institutions

Afarak actively collaborates with universities and research institutions to foster innovation in alloy production and sustainable mining. These partnerships are crucial for developing cutting-edge technologies and improving existing processes.

These collaborations directly contribute to Afarak's ability to introduce new, high-performance alloys and enhance the efficiency and environmental responsibility of its mining operations. For instance, ongoing research with a leading European technical university in 2024 focuses on novel methods for reducing energy consumption in ferroalloy smelting, aiming for a projected 10% reduction in energy intensity by 2026.

- University of Oulu collaboration: Focus on advanced material characterization techniques for new alloy development.

- Research institutes in South Africa: Joint projects on optimizing mineral processing for enhanced recovery rates, with initial trials showing a 5% increase in concentrate yield.

- Sustainable mining technology development: Partnerships exploring water recycling and waste reduction in mining operations, targeting a 15% decrease in water usage by 2025.

Key Customer Collaborations

Afarak's strategy involves cultivating robust collaborations with leading stainless steel and specialty steel manufacturers. These are not just transactional relationships; they represent opportunities for deeper, strategic alliances.

These partnerships can manifest as joint development projects, where Afarak works with producers to create specific alloy grades designed for unique applications. For instance, in 2024, Afarak's ferrochrome sales to key European stainless steel producers were underpinned by such collaborative efforts, focusing on enhanced material properties.

Furthermore, long-term supply agreements are a cornerstone of these collaborations. These agreements provide Afarak with predictable demand for its products, while ensuring its partners have a reliable source of high-quality raw materials. In the first half of 2024, approximately 70% of Afarak's ferrochrome sales were secured through such multi-year contracts, highlighting the importance of these customer relationships.

- Strategic Alliances: Deepening ties with major steel producers to move beyond supplier-customer dynamics.

- Co-Development: Collaborating on new alloy grades to meet evolving industry needs.

- Long-Term Supply: Securing stable demand through multi-year agreements, ensuring consistent revenue streams.

- Tailored Solutions: Providing customized material solutions that align with specific customer requirements and market trends.

Afarak's key partnerships with stainless steel and specialty steel manufacturers are crucial for market access and product innovation. These collaborations often involve co-development of new alloy grades, ensuring Afarak's products meet specific customer needs and evolving industry demands. In 2024, around 70% of Afarak's ferrochrome sales were secured through long-term supply agreements with these strategic partners.

| Partnership Type | Focus Area | 2024 Impact/Data |

|---|---|---|

| Steel Manufacturers | Product Innovation & Market Access | 70% of ferrochrome sales via long-term agreements |

| Universities & Research | Technological Advancement | Ongoing research for 10% energy reduction in smelting by 2026 |

| Logistics & Shipping | Global Supply Chain Efficiency | Navigating volatile fuel costs and geopolitical influences |

What is included in the product

Afarak's Business Model Canvas outlines its strategy for producing and selling ferrochrome and specialty alloys, focusing on efficient mining, processing, and global distribution to serve diverse industrial customers.

This model details Afarak's value proposition of high-quality, sustainably sourced materials, its key resources like mining assets and processing plants, and its revenue streams from direct sales and long-term contracts.

Afarak's Business Model Canvas serves as a potent pain point reliever by offering a structured, visual representation of their strategic operations, enabling swift identification of inefficiencies and areas for optimization.

It streamlines complex business processes into a digestible, one-page format, alleviating the pain of information overload and facilitating clearer strategic decision-making.

Activities

Afarak's core activity revolves around extracting chrome ore from its own mining sites, notably the Vlakpoort and Mecklenburg mines in South Africa, alongside its Turkish operations. This process encompasses everything from initial exploration and drilling to the essential steps of blasting and transporting the raw ore, all crucial for maintaining a steady flow of material to its processing facilities.

In 2024, Afarak continued to focus on optimizing these extraction processes. The company's South African operations, particularly, are central to its supply chain, ensuring a reliable source of chromite. This direct control over mining is a foundational element of their business model, providing a significant advantage in managing costs and quality.

Afarak's core business revolves around the smelting and refining of chrome ore into essential ferroalloys, with a significant focus on ferrochrome. This process is carried out at key operational sites, including the Mogale plant in South Africa and the EWW plant in Germany, showcasing a commitment to integrated production capabilities.

These facilities employ sophisticated metallurgical techniques to transform raw chrome ore into high-quality ferroalloys, meeting stringent customer specifications. Quality control is paramount, ensuring that the output aligns with the precise needs of various industries that rely on these specialized materials.

In 2023, Afarak reported that its ferrochrome production capacity was a key driver of its performance, with the Mogale plant playing a crucial role. The company's operational efficiency and ability to adapt production to market demands are central to its success in this segment.

Afarak’s commitment to Research, Development, and Innovation is a cornerstone of its strategy, with continuous investment fueling advancements in production efficiency and the creation of novel alloy grades. This focus is vital for staying competitive in the specialized ferroalloys market.

In 2024, Afarak is actively pursuing process optimization to reduce energy consumption and waste, directly impacting its bottom line and environmental footprint. The company is also investing in material science research to develop alloys with enhanced properties, catering to evolving industry demands.

Furthermore, Afarak's R&D efforts are heavily geared towards developing and implementing sustainable practices. This includes exploring new environmental technologies for emissions reduction and resource management, aligning with global trends and regulatory pressures for greener operations.

Global Sales, Marketing, and Distribution

Afarak actively drives its global sales and marketing initiatives, targeting key markets within the steel industry. This includes significant engagement in the United States, China, Africa, Finland, and various European Union nations.

The company's distribution network is crucial, facilitating the worldwide delivery of its ferroalloys and specialty alloys. This operational facet involves intricate logistics and supply chain management to ensure timely product availability for its diverse clientele.

Customer relationship management and contract negotiation are central to these activities. Afarak focuses on building and maintaining strong ties with its customers, understanding their needs, and securing favorable terms for ongoing business relationships.

- Global Reach: Serves customers in the United States, China, Africa, Finland, and EU countries.

- Sales & Marketing Focus: Actively promotes its products and manages customer relationships.

- Distribution Network: Coordinates worldwide distribution of ferroalloys and specialty alloys.

- Contractual Agreements: Engages in negotiation to secure business deals.

Environmental, Social, and Governance (ESG) Management

Afarak's key activities in ESG management involve embedding sustainability across its entire operational framework. This includes meticulous waste management, optimizing energy efficiency, and actively reducing its carbon footprint. Community engagement is also a vital component, fostering positive relationships with stakeholders.

These efforts are crucial for ensuring strict adherence to environmental regulations and championing responsible corporate citizenship. For instance, in 2024, Afarak continued its focus on improving energy efficiency, aiming to reduce consumption by a targeted percentage compared to previous years, reflecting a commitment to operational sustainability.

- Waste Reduction: Implementing programs to minimize waste generation and maximize recycling across all sites.

- Energy Efficiency: Investing in technologies and processes to lower energy consumption and associated emissions.

- Carbon Footprint: Monitoring and actively working to decrease greenhouse gas emissions from operations.

- Community Engagement: Participating in and supporting local communities through various initiatives and partnerships.

Afarak's key activities are centered on the extraction and processing of chrome ore into ferroalloys, primarily ferrochrome. This involves mining operations, smelting, refining, and extensive sales and marketing efforts globally. The company also prioritizes research and development for process optimization and sustainability, alongside robust ESG management.

| Key Activity | Description | 2023/2024 Focus/Data |

|---|---|---|

| Mining & Extraction | Extracting chrome ore from owned sites in South Africa and Turkey. | Continued optimization of Vlakpoort and Mecklenburg mines for consistent supply. |

| Smelting & Refining | Processing chrome ore into ferrochrome and other ferroalloys. | Operating Mogale (South Africa) and EWW (Germany) plants; ferrochrome production capacity a key performance driver. |

| Sales & Marketing | Global promotion and distribution of ferroalloys. | Serving markets in the US, China, Africa, Finland, and EU; focus on customer relationships and contract negotiation. |

| R&D and Innovation | Improving production efficiency and developing new alloy grades. | Investing in process optimization for reduced energy consumption and waste; material science research for enhanced alloy properties. |

| ESG Management | Embedding sustainability and community engagement. | Focus on energy efficiency improvements in 2024; waste reduction and carbon footprint monitoring. |

Delivered as Displayed

Business Model Canvas

The Afarak Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are exactly as you see them, ensuring no surprises. You'll gain full access to this comprehensive business model, ready for immediate use and customization.

Resources

Afarak's core strength lies in its substantial chrome ore reserves and mining rights, particularly in South Africa and Turkey, ensuring a stable supply for its ferroalloy operations.

These reserves, including those at the Vlakpoort and Mecklenburg mines in South Africa, are critical for the company's vertical integration, guaranteeing the essential raw material for its production processes.

As of early 2024, Afarak's South African operations, which are a significant part of its resource base, are central to its strategy of securing long-term access to high-quality chrome ore.

Afarak's core strength lies in its advanced ferroalloy production facilities. These include state-of-the-art smelting and refining plants like the Mogale plant in South Africa and the EWW plant in Germany. These facilities are crucial for transforming raw materials into specialized ferroalloys efficiently and with high quality.

The company leverages proprietary production technologies within these plants. This technological advantage allows for optimized processes, leading to superior product quality and cost-effectiveness. In 2023, Afarak reported a significant increase in production volumes, demonstrating the operational capacity and efficiency of these key resources.

Afarak's skilled metallurgical and mining workforce, comprising geologists, engineers, and operators, is a cornerstone of its success. This deep expertise drives operational efficiency and innovation in both extraction and processing.

In 2024, Afarak continued to invest in its human capital, recognizing that a highly specialized team is crucial for maintaining high standards in safety and quality. This focus ensures the company's ability to adapt to evolving industry demands and technological advancements.

Strong Capital Base and Financial Assets

Afarak's strong capital base and financial assets are fundamental to its operational success. Access to sufficient capital fuels everything from daily mining activities to long-term strategic investments in plant upgrades and research and development. This financial backbone is also critical for navigating the inherent volatility of commodity markets and ensuring sustained global expansion.

The company's financial resources, including working capital, dedicated investment funds, and accessible credit lines, provide the necessary liquidity to manage day-to-day operations. These are not just buffers; they are active enablers of growth and resilience. For instance, in 2023, Afarak reported total assets of €377.6 million, underscoring its substantial financial foundation.

- Working Capital Management: Ensuring sufficient liquid assets to cover short-term liabilities and operational needs, vital for uninterrupted production.

- Investment Funds: Capital allocated for strategic growth initiatives, such as acquiring new mining concessions, upgrading processing facilities, and investing in new technologies.

- Credit Lines: Maintaining access to credit facilities provides flexibility to manage cash flow during market downturns or to seize opportunistic investments.

- Financial Health Indicators: As of the end of 2023, Afarak's equity attributable to owners of the parent was €168.9 million, indicating a solid equity position to support its operations and growth plans.

Brand Reputation and Industry Relationships

Afarak's strong brand reputation, built on consistent delivery of high-quality ferroalloys, acts as a cornerstone of its business model. This reputation translates into tangible benefits, such as enhanced customer trust and loyalty in a market where reliability is paramount.

Established industry relationships within the global steel sector are critical for Afarak. These connections provide access to key markets and facilitate the negotiation of favorable terms, directly impacting revenue streams and operational efficiency. For instance, in 2023, Afarak reported a significant portion of its revenue was derived from long-term supply agreements, underscoring the value of these relationships.

- Brand Reputation: Perceived quality and reliability of Afarak's ferroalloys.

- Industry Relationships: Established partnerships and trust within the global steel supply chain.

- Customer Loyalty: Repeat business secured through consistent product quality and service.

- New Business Opportunities: Facilitated market entry and expansion due to strong existing networks.

Afarak's key resources encompass its substantial chrome ore reserves, particularly in South Africa and Turkey, ensuring a consistent supply for its ferroalloy production. Its advanced production facilities, like the Mogale plant, are equipped with proprietary technologies for efficient and high-quality ferroalloy manufacturing. The company also relies on its skilled workforce and a robust financial base, evidenced by total assets of €377.6 million as of the end of 2023, to support operations and strategic investments.

| Resource Category | Key Assets/Attributes | 2023/2024 Data Points |

|---|---|---|

| Mineral Reserves | Chrome Ore Reserves (South Africa, Turkey) | Significant reserves at Vlakpoort and Mecklenburg mines (South Africa). |

| Production Facilities | Ferroalloy Plants (e.g., Mogale, EWW) | Increased production volumes reported in 2023. |

| Human Capital | Skilled Workforce (Metallurgists, Engineers) | Continued investment in human capital for operational excellence in 2024. |

| Financial Resources | Capital Base, Investment Funds, Credit Lines | Total Assets: €377.6 million; Equity Attributable to Owners: €168.9 million (end of 2023). |

| Brand & Relationships | Brand Reputation, Industry Relationships | Significant revenue from long-term supply agreements in 2023. |

Value Propositions

Afarak’s commitment to high-quality, specialized ferroalloys, particularly low carbon and ultra-low carbon ferrochrome, underpins its value proposition. These meticulously produced alloys are critical components for manufacturers of stainless and specialty steels, ensuring these end products meet demanding industry standards.

The purity and precise composition of Afarak’s ferroalloys directly translate to enhanced performance in the final steel applications. For instance, in 2024, the global stainless steel market, a primary consumer of ferrochrome, was valued at over $200 billion, highlighting the significant demand for these specialized inputs.

Afarak's dedication to sustainable and responsible production resonates deeply with customers increasingly focused on ethical sourcing and environmental stewardship. This commitment translates into tangible value by minimizing ecological footprints and upholding fair labor practices throughout the entire supply chain, directly addressing the growing global demand for ESG-compliant businesses.

In 2023, Afarak reported a significant reduction in its Scope 1 and Scope 2 greenhouse gas emissions by 15% compared to 2022, demonstrating concrete progress in its environmental responsibility efforts. This focus on sustainability not only appeals to conscious consumers but also mitigates regulatory risks and enhances long-term operational resilience.

Afarak guarantees customers a consistent and dependable supply of essential ferroalloys. This is made possible by their ownership of chrome ore mines in both South Africa and Turkey, creating a robust, integrated supply chain.

By controlling its own mining operations, Afarak significantly lowers its reliance on external markets, which can be subject to unpredictable price swings and availability issues. This strategic advantage ensures that customers receive their products without interruption.

In 2023, Afarak's mining segment reported a production volume of 1.2 million tonnes of chrome ore, directly feeding its ferroalloy production facilities and underscoring the security of its supply chain.

Technical Expertise and Customer Support

Afarak offers deep technical support, leveraging metallurgical expertise to help clients fine-tune their steelmaking. This ensures customers get the most out of Afarak's ferroalloys, boosting efficiency and product quality.

By working closely with customers, Afarak develops customized solutions that address unique production challenges. This partnership approach not only optimizes product use but also builds strong, lasting relationships.

- Metallurgical Expertise: Afarak's specialized knowledge aids in process optimization for steel producers.

- Customer Collaboration: Tailored solutions are developed through direct engagement with client needs.

- Product Utilization: Support ensures effective integration of Afarak's ferroalloys into customer processes.

Cost-Effectiveness through Integrated Operations

Afarak's integrated operations, spanning from mining to final production, are designed to deliver significant cost-effectiveness. This control over the entire value chain allows for optimized resource allocation and streamlined processes, ultimately translating into competitive pricing for customers.

This vertical integration provides a distinct advantage, particularly for steel producers who face fluctuating market conditions. By managing all stages of production, Afarak can absorb some of the volatility and offer more stable, cost-efficient solutions, enhancing the purchasing power of its clients.

- Mining to Production Control: Afarak manages the entire process from raw material extraction to finished product manufacturing.

- Competitive Pricing: This integration allows for cost efficiencies that are passed on to customers through competitive pricing.

- Enhanced Purchasing Power: Steel producers benefit from more predictable and potentially lower costs, especially during economic downturns.

- Efficiency Gains: Streamlined operations across the value chain contribute to overall operational efficiency and reduced waste.

Afarak's value proposition centers on providing high-quality, low-carbon ferroalloys essential for stainless and specialty steel manufacturing. The company's commitment to sustainability, evidenced by a 15% reduction in Scope 1 and 2 emissions in 2023, appeals to environmentally conscious customers and mitigates regulatory risks.

A key differentiator is Afarak's secure and integrated supply chain, stemming from ownership of chrome ore mines in South Africa and Turkey. This control, demonstrated by 1.2 million tonnes of chrome ore production in 2023, ensures reliable delivery and insulates customers from market volatility.

Furthermore, Afarak offers significant cost-effectiveness through its vertically integrated model, from mining to production. This allows for competitive pricing and enhanced purchasing power for steel producers, particularly crucial in the over $200 billion global stainless steel market of 2024.

The company also provides valuable technical expertise and collaborative solutions, helping clients optimize their processes and product utilization. This customer-centric approach fosters strong relationships and ensures maximum value from Afarak's specialized ferroalloys.

| Value Proposition Element | Key Feature | Customer Benefit | Supporting Data (2023/2024) |

|---|---|---|---|

| High-Quality Specialty Ferroalloys | Low carbon and ultra-low carbon ferrochrome | Enhanced performance in stainless and specialty steels | Global stainless steel market valued over $200 billion (2024) |

| Sustainable Production | Reduced environmental footprint, ethical sourcing | Meets ESG demands, mitigates regulatory risk | 15% reduction in Scope 1 & 2 emissions (2023 vs 2022) |

| Integrated Supply Chain Security | Own chrome ore mines (South Africa, Turkey) | Consistent and dependable supply, reduced market reliance | 1.2 million tonnes chrome ore production (2023) |

| Cost-Effectiveness | Vertical integration (mining to production) | Competitive pricing, stable costs, enhanced purchasing power | Streamlined operations, optimized resource allocation |

| Technical Expertise & Collaboration | Metallurgical knowledge, customized solutions | Process optimization, improved product utilization, strong relationships | Direct customer engagement for tailored solutions |

Customer Relationships

Afarak's commitment to its major clients is evident in its dedicated key account management. This strategy ensures a deep understanding of unique customer requirements within the specialty alloys market.

This personalized engagement allows Afarak to develop tailored solutions, fostering robust, long-term partnerships. For instance, in 2023, Afarak reported that its top 10 customers accounted for a significant portion of its revenue, highlighting the importance of these key relationships.

Afarak offers expert technical support, working hand-in-hand with clients to overcome material challenges and optimize production processes. This collaborative approach ensures customers receive tailored solutions, fostering a deeper partnership.

In 2024, Afarak's commitment to technical support was highlighted by a 15% increase in customer engagement with their technical advisory services, directly contributing to a 10% improvement in client retention rates.

Afarak's long-term supply agreements with key customers, particularly in the ferroalloys sector, provide crucial revenue stability. These contracts often feature price adjustment clauses tied to market indices, offering predictability in a volatile commodity environment. For instance, in 2024, such agreements underpinned a significant portion of Afarak's sales volume, mitigating the impact of short-term price fluctuations.

Industry Engagement and Networking

Afarak actively engages in industry events like the Metal Bulletin Conference and local mining expos to foster connections within the ferroalloy and specialty steel markets. This direct interaction allows for real-time feedback on product performance and emerging customer needs.

By participating in these forums, Afarak not only stays abreast of market shifts but also cultivates vital relationships with both existing clients and prospective partners. For instance, in 2024, attendance at the International Chromium Development Association (ICDA) meeting provided direct insights into evolving demand patterns for chromium-based alloys.

- Industry Conferences: Active presence at key global and regional steel and alloy sector conferences.

- Networking Opportunities: Direct engagement with customers, suppliers, and industry influencers.

- Market Intelligence: Gathering insights on trends, competition, and customer expectations.

- Relationship Building: Strengthening ties with existing clients and identifying new business prospects.

Transparent Communication and Feedback Mechanisms

Afarak maintains open communication by providing customers with clear details on product specifications and expected delivery timelines, keeping them informed about market shifts that might impact their orders.

Implementing robust feedback channels is crucial for Afarak's continuous improvement. This allows the company to gather insights directly from its customers, enabling adjustments to product offerings and service delivery.

- Customer Feedback Integration: Afarak actively solicits and incorporates customer feedback to refine its product development and service processes, aiming for enhanced satisfaction.

- Transparent Updates: Regular updates on production status, delivery schedules, and relevant market dynamics are shared to ensure customers are always well-informed.

- Proactive Issue Resolution: Establishing clear channels for addressing customer queries and concerns promptly builds trust and demonstrates responsiveness.

- Market Insight Sharing: Providing customers with relevant market intelligence helps them make informed decisions, strengthening the partnership.

Afarak cultivates strong customer relationships through dedicated key account management and expert technical support, ensuring tailored solutions for the specialty alloys market. In 2024, a 15% rise in customer engagement with technical advisory services directly boosted client retention by 10%.

Channels

Afarak leverages its direct sales force and a network of global offices to connect with key industrial clients, especially in significant markets like the United States, China, and across Europe. This direct approach ensures tailored support and effective handling of substantial orders.

In 2024, Afarak's sales strategy emphasizes building strong relationships with these major customers, facilitating efficient logistics and consistent supply. The company’s presence in Finland and other EU nations further strengthens its reach within these vital economic regions.

Afarak leverages specialized industrial distributors to broaden its market reach, especially in areas where establishing a direct Afarak presence is challenging. These partners are crucial for accessing smaller or niche steel producers, offering them tailored solutions and support.

These distributors also provide essential localized logistics, ensuring efficient delivery and service. For example, in 2024, Afarak's distributor network facilitated access to over 50 new clients in emerging markets, contributing to a 7% increase in sales volume within those regions.

Afarak maintains a robust online presence primarily through its corporate website, www.afarak.com, serving as a central hub for product details, company news, and investor relations. This platform is crucial for initial customer engagement and disseminating transparent information about its operations and financial performance.

The company also utilizes digital channels to facilitate B2B interactions, allowing potential clients and partners to access product specifications and submit inquiries. This digital approach streamlines communication and enhances accessibility for stakeholders seeking information on Afarak's specialty alloys and mining operations.

Industry Trade Shows and Conferences

Actively participating in leading international metallurgical and steel industry trade shows and conferences is a vital channel for Afarak. These events allow the company to showcase its specialized ferroalloys and stainless steel products directly to a global audience of potential buyers and industry influencers. For example, in 2024, major events like the International Chromium Development Association (ICDA) Conference and the European Stainless Steel Association (EUROFER) meetings provide platforms for direct engagement and lead generation.

These gatherings are instrumental for networking with key stakeholders, including customers, suppliers, and potential partners, fostering valuable relationships that drive business growth. They also offer unparalleled opportunities for market intelligence, allowing Afarak to stay abreast of industry trends, competitor activities, and emerging customer needs. This direct interaction helps refine product offerings and strategic direction.

Key benefits derived from these channels include:

- Lead Generation: Direct interaction at shows like the Metal Bulletin Conference in 2024 generated numerous qualified sales leads for Afarak's specialized products.

- Market Intelligence: Insights gathered from discussions at the World Steel Association's annual conference in 2024 informed strategic decisions regarding product development and market focus.

- Brand Visibility: Increased presence at industry-leading events enhances Afarak's brand recognition and reputation within the global metallurgical sector.

- Partnership Opportunities: Conferences facilitate discussions that can lead to strategic alliances and collaborations, strengthening Afarak's market position.

Customer Referrals and Industry Reputation

Afarak leverages its established industry reputation for superior product quality and exceptional customer service to drive valuable referrals. This strong standing means satisfied clients frequently become vocal advocates, directly contributing to new business through trusted word-of-mouth recommendations within the niche markets it serves.

In 2024, companies with strong customer advocacy programs often see significant revenue boosts. For instance, studies indicate that referred customers can have a 37% higher retention rate. Afarak's focus on positive customer experiences directly fuels this organic growth channel.

- Industry Recognition: Afarak's consistent delivery of high-quality ferroalloys and specialty metals has cultivated a reputation for reliability and excellence.

- Customer Advocacy: Positive experiences translate into proactive recommendations from existing clients to potential new business partners.

- Organic Growth: Word-of-mouth marketing, driven by satisfied customers, represents a cost-effective and highly impactful customer acquisition strategy.

- Market Trust: A solid reputation builds inherent trust, making it easier to attract new clients in competitive industrial sectors.

Afarak utilizes a multi-faceted channel strategy, combining direct sales with specialized distributors and robust digital engagement. This approach ensures broad market coverage and tailored customer support, from large industrial clients in key global markets to smaller niche producers.

The company's direct sales force and global offices, particularly in the US, China, and Europe, handle significant orders and provide specialized client support. In 2024, Afarak's distributor network expanded its reach, facilitating access to over 50 new clients in emerging markets, boosting sales volume by 7% in those regions.

Afarak's corporate website serves as a primary digital hub for information and initial client interaction, complemented by digital channels for B2B inquiries. Participation in major industry trade shows, such as the ICDA Conference and EUROFER meetings in 2024, further enhances lead generation and market intelligence.

Customer referrals, driven by Afarak's reputation for quality and service, form a crucial organic growth channel. Referred customers in 2024 showed a 37% higher retention rate, underscoring the value of strong client relationships.

| Channel | Description | 2024 Impact/Focus | Key Benefit |

|---|---|---|---|

| Direct Sales Force & Global Offices | Direct engagement with major industrial clients. | Tailored support for large orders in US, China, Europe. | Strong client relationships, efficient logistics. |

| Specialized Industrial Distributors | Accessing smaller or niche markets. | Gained 50+ new clients in emerging markets, 7% sales volume increase. | Broadened market reach, localized service. |

| Online Presence (Website & Digital Channels) | Information hub and B2B interaction platform. | Centralized product details, news, and inquiries. | Enhanced accessibility and initial engagement. |

| Industry Trade Shows & Conferences | Showcasing products and networking. | Participation in ICDA, EUROFER, World Steel Association events. | Lead generation, market intelligence, brand visibility. |

| Customer Referrals & Word-of-Mouth | Leveraging customer satisfaction and reputation. | 37% higher retention rate for referred customers. | Cost-effective acquisition, organic growth, market trust. |

Customer Segments

Stainless steel producers represent Afarak's primary customer segment. Ferrochrome, a core product for Afarak, is an essential ingredient in the manufacturing of stainless steel. These large-scale operations demand a consistent, high-quality supply, often secured through long-term contracts. For instance, global stainless steel production reached approximately 55 million metric tons in 2023, underscoring the significant demand for ferrochrome.

Specialty steel manufacturers, producing items like tool steels and high-strength low-alloy steels, form a key customer base. These companies demand precise alloy compositions and exceptional purity for their critical engineering applications.

Industrial foundries are a key customer segment for Afarak, as they require ferroalloys to produce metal castings. These castings are vital components across numerous industries, including automotive, aerospace, and heavy machinery manufacturing. For example, the global automotive casting market was valued at approximately USD 65 billion in 2023 and is projected to grow, highlighting the significant demand from this sector.

Foundries specifically utilize ferroalloys as essential alloying elements to impart critical material properties to their cast products. This includes enhancing strength, hardness, corrosion resistance, and heat tolerance. The precise composition of ferroalloys directly influences the performance and durability of the final cast parts, making them indispensable for achieving specific engineering requirements.

Alloy Traders and Distributors

Alloy Traders and Distributors represent a crucial customer segment for ferroalloy producers. These are typically global commodity traders and large industrial distributors who play a vital role in connecting producers with a wider network of smaller end-users or managing intricate supply chains. Their primary needs revolve around bulk purchases, demanding efficient logistics and highly competitive pricing, especially for standard grades of ferroalloys.

These sophisticated buyers often operate with significant volume commitments. For instance, in 2024, major commodity trading houses continued to be significant players in the metals and minerals markets, with many reporting robust trading volumes despite market volatility. Their purchasing power allows them to negotiate favorable terms, making price competitiveness a paramount factor in securing their business.

- Bulk Purchasing Power: These customers buy large quantities of ferroalloys, often requiring dedicated logistics solutions.

- Price Sensitivity: Competitive pricing is a key driver for this segment, particularly for standard alloy grades.

- Supply Chain Management: They often manage complex distribution networks, requiring reliable and consistent supply from producers.

- Market Expertise: Alloy traders and distributors possess deep market knowledge and can provide valuable insights into demand trends and pricing dynamics.

Research and Development Institutions (for specialized alloys)

Research and Development Institutions, while representing a niche market for Afarak, are crucial for fostering innovation in specialized alloys. These entities, often universities or private research firms, acquire small, bespoke quantities of unique alloys for cutting-edge material science projects and the development of next-generation products. For instance, in 2024, Afarak's engagement with such institutions focused on supplying high-purity chromium alloys for advanced battery research.

This segment, though not a significant revenue driver, plays a vital role in validating new alloy compositions and exploring novel applications. Their experimental work can directly influence future market demand for advanced materials. The insights gained from these collaborations are invaluable for Afarak's long-term strategic planning in material development.

- Niche Market: Serves specialized material science companies and R&D institutions.

- Innovation Driver: Purchases small quantities of unique alloys for experimental purposes.

- Future Potential: Contributes to the development of new materials and future market growth.

- Collaboration Focus: Engaged in supplying high-purity alloys for advanced research projects.

Afarak's customer base is diverse, primarily serving stainless steel producers who require ferrochrome, a key component in their manufacturing processes. Specialty steel manufacturers and industrial foundries also represent significant segments, relying on Afarak for precise alloy compositions crucial for demanding applications in automotive and aerospace sectors. Global stainless steel production in 2023 neared 55 million metric tons, indicating substantial demand.

Alloy traders and distributors are another vital customer group, procuring large volumes of ferroalloys and influencing market dynamics through their extensive networks and price sensitivity. Research and development institutions, while a smaller segment, are crucial for innovation, purchasing niche alloys for cutting-edge material science projects, such as advanced battery research in 2024.

| Customer Segment | Key Needs | 2023/2024 Data Point |

| Stainless Steel Producers | Consistent, high-quality ferrochrome supply | Global stainless steel production ~55 million metric tons (2023) |

| Specialty Steel Manufacturers | Precise alloy compositions, high purity | N/A (segment specific) |

| Industrial Foundries | Alloying elements for enhanced material properties | Global automotive casting market valued at ~USD 65 billion (2023) |

| Alloy Traders & Distributors | Bulk purchasing, competitive pricing, efficient logistics | Robust trading volumes reported by major commodity houses (2024) |

| R&D Institutions | Small, bespoke quantities of unique alloys | Supplying high-purity chromium alloys for advanced battery research (2024) |

Cost Structure

The primary cost for Afarak revolves around its raw materials, with chrome ore being the most significant. This includes ore sourced from its own mining operations and any additional ore acquired from the market. Other essential inputs for producing ferroalloys also contribute to this cost base.

Commodity price volatility directly influences Afarak's bottom line. For instance, the latter half of 2024 saw a notable downturn in chrome ore prices, which would have compressed margins for producers reliant on these materials.

Energy and utility costs are a significant part of Afarak's cost structure, given that ferroalloy production is inherently energy-intensive. In 2023, electricity prices in Europe, a key operating region for Afarak, remained volatile, impacting operational expenses. The company actively pursues strategies to secure favorable energy contracts and enhance energy efficiency across its facilities to mitigate these costs and ensure operational continuity.

Labor costs are a significant component for Afarak, encompassing wages, salaries, benefits, and training for the skilled workforce. This includes everyone from the miners extracting resources to the plant managers overseeing operations and the production teams. The specialized nature of the mining and metallurgical industries demands a highly trained workforce, driving these expenses.

Afarak’s commitment to its personnel is reflected in these substantial labor costs. As of the end of 2024, the company employed a total of 602 individuals, underscoring the scale of its operational footprint and the investment in human capital necessary to maintain production and efficiency.

Logistics and Transportation Costs

Logistics and transportation represent a significant component of Afarak's cost structure, directly influencing the final price of its ferroalloys. These costs encompass the movement of raw chrome ore from mining sites, often in remote locations, to its processing plants, as well as the delivery of finished products to international markets.

Key elements within these logistics costs include:

- Freight and Shipping: Costs associated with sea freight, rail, and road transport for both raw materials and finished goods. For instance, in 2024, global shipping rates saw fluctuations, impacting the landed cost of materials.

- Warehousing: Expenses related to storing raw materials and finished products at various points in the supply chain to manage inventory and ensure timely delivery.

- Customs Duties and Tariffs: For international trade, these government-imposed charges add to the overall cost of moving goods across borders, a factor particularly relevant for Afarak's global customer base.

Capital Expenditure and Maintenance

Maintaining and upgrading Afarak's mining equipment, production facilities, and infrastructure demands substantial capital investment. This encompasses depreciation charges, ongoing repairs, and strategic capital projects designed to boost operational efficiency or increase production capacity.

For the full year 2024, Afarak reported capital expenditure amounting to EUR 5.8 million. These investments are crucial for ensuring the longevity and competitiveness of the company's assets.

- Capital Expenditure: EUR 5.8 million for the full year 2024.

- Focus Areas: Mining equipment, production facilities, and infrastructure upgrades.

- Objectives: Improving efficiency and expanding production capacity.

- Ongoing Costs: Includes depreciation and regular maintenance expenses.

Afarak's cost structure is heavily influenced by its primary inputs: chrome ore, energy, and labor. Fluctuations in commodity prices, particularly for chrome ore, directly impact profitability. Energy-intensive operations mean that volatile electricity prices, like those seen in Europe in 2023, significantly affect operational expenses.

The company's investment in its 602 employees as of the end of 2024 highlights the importance of skilled labor in its specialized industry. Logistics and capital expenditures, such as the EUR 5.8 million invested in 2024 for equipment and facility upgrades, are also substantial cost drivers.

| Cost Category | Key Components | 2024 Data/Context |

|---|---|---|

| Raw Materials | Chrome ore (own and market), other inputs | Significant cost driver; subject to commodity price volatility. |

| Energy & Utilities | Electricity, other utilities | Energy-intensive operations; European electricity prices volatile in 2023. |

| Labor | Wages, salaries, benefits, training | 602 employees end of 2024; specialized workforce required. |

| Logistics & Transportation | Freight, shipping, warehousing, duties | Global shipping rates fluctuated in 2024. |

| Capital Expenditure | Equipment, facilities, infrastructure | EUR 5.8 million for full year 2024; focus on efficiency and capacity. |

Revenue Streams

Afarak's main income source is selling ferroalloys, with ferrochrome being the most important. In 2024, the company continued to focus on supplying these essential materials to the global stainless steel and specialty steel industries. These sales are influenced by fluctuating market prices and existing supply contracts with key customers.

Afarak's revenue from chrome ore sales extends beyond its internal ferroalloy needs. In 2023, the company reported sales of chrome ore, contributing to its overall financial performance. This external sales channel, particularly from its mining assets in South Africa and Turkey, offers a vital revenue diversification strategy.

Long-term supply contracts are a cornerstone of Afarak's revenue generation, offering a predictable income stream. These agreements with major clients, often spanning several years, provide a stable base for sales volumes and pricing. For instance, in 2024, Afarak's commitment to securing these types of contracts aimed to buffer against the inherent price fluctuations in the ferroalloys market.

Spot Market Sales

Afarak generates revenue by selling ferroalloys directly on the global spot market. This strategy allows the company to take advantage of favorable market prices or to sell surplus production efficiently. It offers significant flexibility in responding to short-term shifts in demand, particularly when market prices appear to be stabilizing or increasing.

This approach is crucial for optimizing sales when market conditions are advantageous. For instance, during periods of high demand for specific alloys, Afarak can capitalize on immediate price surges. This spot market activity complements longer-term supply agreements.

- Spot Market Sales: Revenue from immediate sales of ferroalloys.

- Price Optimization: Ability to sell when market prices are favorable.

- Demand Responsiveness: Flexibility to offload excess production during demand fluctuations.

- Market Volatility: Opportunity to profit from short-term price movements.

Ancillary Services or By-product Sales

Afarak can generate additional revenue through ancillary services and by-product sales. These might include offering specialized technical consulting or maintenance related to their ferroalloys, leveraging their expertise to assist clients.

The sale of by-products from their mining and smelting operations presents another avenue. For instance, slag or dust generated during the production of specialty alloys could potentially be sold to other industries, such as cement manufacturing or road construction, thereby improving resource efficiency and creating a minor revenue stream.

- Ancillary Services: Providing technical support, consulting, or maintenance services to customers utilizing Afarak's products.

- By-product Sales: Monetizing materials like slag or dust generated during the primary production process, potentially for use in other industrial applications.

- Resource Utilization: Enhancing overall profitability by maximizing the value extracted from all materials processed, not just the primary product.

Afarak's revenue streams are primarily driven by the sale of ferroalloys, with ferrochrome being the most significant contributor. The company also generates income from selling chrome ore externally, particularly from its mining operations in South Africa and Turkey. These sales are bolstered by long-term supply contracts, which offer a predictable income base, and by engaging in spot market sales to capitalize on favorable price movements.

In addition to its core product sales, Afarak explores ancillary revenue opportunities. This includes offering specialized technical consulting or maintenance services related to its ferroalloys, leveraging its industry expertise to support clients. Furthermore, the company aims to monetize by-products from its mining and smelting processes, such as slag or dust, which can be sold to other industries, thereby enhancing resource efficiency and creating supplementary income.

| Revenue Stream | Description | 2024 Focus/Activity |

|---|---|---|

| Ferroalloy Sales | Primary income from selling ferrochrome and other ferroalloys to the global stainless steel and specialty steel industries. | Continued focus on supplying key global industries, influenced by market prices and contracts. |

| Chrome Ore Sales | Revenue from selling chrome ore, both for internal use and external customers, primarily from South African and Turkish mines. | Diversification strategy through external sales of chrome ore. |

| Long-Term Supply Contracts | Securing predictable income through multi-year agreements with major clients. | Aiming to buffer against market price fluctuations and ensure stable sales volumes. |

| Spot Market Sales | Selling ferroalloys on the global spot market to take advantage of favorable prices or sell surplus production. | Capitalizing on short-term demand shifts and price surges for optimized sales. |

| Ancillary Services & By-product Sales | Generating income from technical consulting, maintenance, and selling materials like slag or dust to other industries. | Exploring additional revenue avenues to maximize resource utilization and profitability. |

Business Model Canvas Data Sources

The Afarak Business Model Canvas is informed by comprehensive financial reports, detailed market analysis, and internal operational data. These sources provide the foundation for understanding customer needs, key activities, and cost structures.