Afarak Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Afarak Bundle

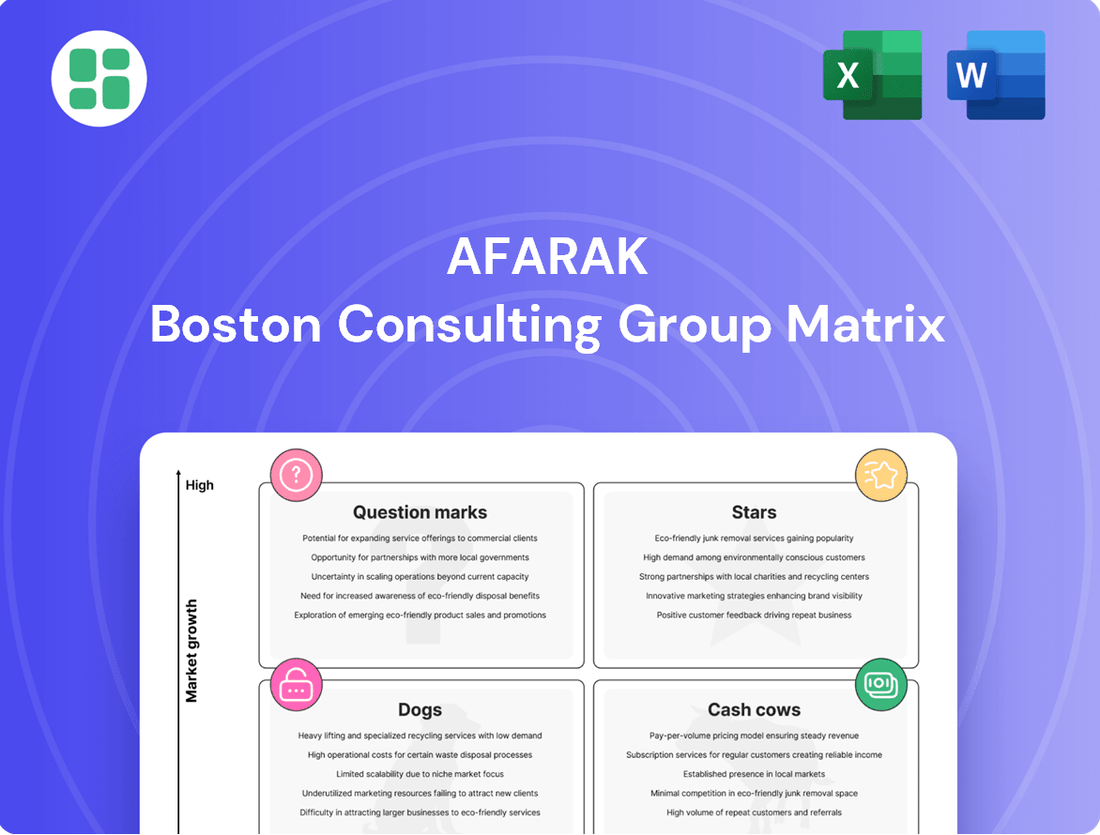

Uncover Afarak's strategic positioning with a glimpse into its BCG Matrix. See where its diverse product portfolio falls – are they market-leading Stars, stable Cash Cows, underperforming Dogs, or promising Question Marks?

This preview only scratches the surface of Afarak's potential. Purchase the full BCG Matrix report to gain a comprehensive understanding of each product's market share and growth rate, arming you with the data to make informed investment decisions and optimize your resource allocation.

Don't miss out on the complete strategic blueprint. Invest in the full Afarak BCG Matrix and unlock detailed quadrant analysis, actionable insights, and a clear path to maximizing profitability and driving future growth.

Stars

Afarak Group's speciality alloys production experienced a robust 15.2% increase in Q1 2025 when compared to the same quarter in 2024. This surge highlights a substantial uptick in market demand for these specialized materials.

This growth trajectory firmly places speciality alloys as a star performer within Afarak's business portfolio. The company's capacity to meet this escalating demand is a testament to its operational efficiency and strategic market positioning.

Afarak's Turkish mining operations are a significant driver of its success, particularly within the context of the BCG matrix. The mining activity at Afarak's Turkish mines surged by an impressive 18.4% in Q1 2025, a vital increase that ensures a steady supply of crucial feedstock for its processing plants. This substantial growth underscores the high potential and strategic importance of these operations in a market segment experiencing robust expansion.

The increasing chrome ore prices further bolster the attractiveness of these Turkish assets. This combination of increased production volume and favorable market pricing positions the Turkish mining segment as a strong performer, likely contributing positively to Afarak's overall financial health and strategic positioning.

The Elektrowerk Weisweiler GmbH (EWW) plant in Germany plays a crucial role in Afarak's specialty alloys segment. Its performance is directly linked to the consistent supply of high-quality ferrochrome, largely sourced from Afarak's Turkish mining operations. This synergy allows EWW to produce specialized ferrochrome grades essential for high-value applications.

In 2024, Afarak reported that its specialty alloys segment, heavily reliant on EWW's processing, continued to be a strong revenue generator. The demand for these specialized materials, driven by industries like aerospace and automotive, supported premium pricing for EWW's output. For instance, in the first half of 2024, the specialty alloys segment contributed a substantial portion to Afarak's overall EBITDA, underscoring EWW's strategic importance.

High-Margin Specialised Ferrochrome Grades

Afarak's strategic emphasis on producing specialized Low Carbon (LC) and Ultra Low Carbon (ULC) ferrochrome grades positions it advantageously in the market. These niche products command a significant price premium, with Afarak securing approximately a 35% uplift compared to standard ferrochrome. This focus on high-value output is instrumental in driving profitability and solidifying its market leadership within the demanding high-performance steel sector.

- Specialized Production: Afarak concentrates on LC and ULC ferrochrome.

- Price Premium: These grades achieve a 35% price advantage over bulk ferrochrome.

- Profitability Driver: High-margin products are key to Afarak's financial success.

- Market Niche: Focus on high-performance steel industry enhances market standing.

Innovation in Alloy Development

Afarak's commitment to innovation in alloy development is a key differentiator, particularly within the context of a BCG Matrix analysis. The company's investment in state-of-the-art R&D facilities in Germany is a strategic move to foster the creation and rigorous testing of specialized alloys. These alloys are meticulously designed to meet precise customer specifications, a crucial factor for success in demanding industries.

This dedication to continuous innovation is not merely about creating new products; it's fundamental to maintaining Afarak's competitive position. By staying ahead of the curve in material science, Afarak can effectively address the dynamic and often rapidly changing requirements of high-growth sectors such as aerospace and the automotive industry. For instance, advancements in lightweight, high-strength alloys are critical for improving fuel efficiency in vehicles and aircraft.

- R&D Investment: Afarak operates modern R&D laboratories in Germany, facilitating the development of unique specialty alloys.

- Customer-Centric Innovation: Alloys are tailored to specific customer needs, ensuring high performance and application suitability.

- Market Responsiveness: Continuous innovation allows Afarak to meet evolving demands in sectors like aviation and automotive.

- Competitive Advantage: Advanced alloy development is crucial for maintaining a leading edge in technologically driven markets.

Afarak's specialty alloys, particularly its Low Carbon (LC) and Ultra Low Carbon (ULC) ferrochrome, are clearly positioned as Stars in its BCG matrix. These products command a significant price premium, approximately 35% higher than standard ferrochrome, directly contributing to Afarak's profitability. The company's dedicated R&D efforts in Germany ensure these alloys meet stringent customer specifications for high-performance industries like aerospace and automotive, solidifying their market leadership.

| Product Segment | Growth Rate (Q1 2025 vs Q1 2024) | Market Share/Position | Profitability |

|---|---|---|---|

| Specialty Alloys (LC/ULC Ferrochrome) | 15.2% increase in production | Market Leader in niche segments | High, driven by 35% price premium |

| Turkish Mining Operations | 18.4% production surge (Q1 2025) | Key feedstock supplier, strong growth | Favorable, boosted by rising chrome ore prices |

What is included in the product

The Afarak BCG Matrix provides a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

This analysis highlights which units Afarak should invest in, hold, or divest to optimize its portfolio.

The Afarak BCG Matrix provides a clear, one-page overview, immediately highlighting strategic priorities and alleviating the pain of unclear business unit performance.

Cash Cows

The Vlakpoort Chrome Mine in South Africa is a cornerstone of Afarak's FerroAlloys segment, consistently supplying chrome ore to international markets. Its established operations and long-standing presence signal a dependable source of cash flow for the company, even amidst market volatility.

The Mecklenburg Chrome Mine in South Africa operates as a classic Cash Cow for Afarak. This mature operation consistently extracts chrome ore, a vital raw material that fuels the company's ferroalloy manufacturing and also finds its way to direct sales markets. Its reliability makes it a cornerstone asset, generating predictable cash flow from a stable, albeit not rapidly expanding, sector.

Afarak's established chrome ore sales from its South African mines are a prime example of a Cash Cow in the BCG matrix. This segment consistently generates revenue, demonstrating resilience even when global market prices for chrome ore experience volatility. The company benefits from well-developed sales channels and enduring relationships with its clientele, ensuring a stable foundation for cash flow within this mature commodity sector.

Existing FerroAlloys Business (Stable Portions)

Even with broader market headwinds, Afarak's established ferroalloy operations, specifically those not burdened by underperforming segments, are likely acting as reliable cash generators. These segments benefit from existing infrastructure and a solid market footing, meaning they don't demand significant new capital for upkeep. For instance, in 2024, Afarak reported that its South African ferrochrome operations, a core part of its ferroalloys business, continued to be a significant contributor to revenue, demonstrating resilience despite challenging market conditions.

These stable portions are crucial for funding other areas of the business. Their consistent cash flow supports ongoing operations and potentially future investments.

- Stable Cash Generation: Established ferroalloy operations provide consistent revenue streams.

- Low Maintenance Capital: Existing infrastructure requires minimal new investment for continued operation.

- Market Presence: Benefits from an established customer base and distribution networks.

- Contribution to Group: These segments are vital for funding other business units or strategic initiatives.

Optimized Procurement and Operational Efficiency

Afarak’s focus on optimized procurement and operational efficiency directly bolsters its cash cow segments. The company achieved an impressive 8.2% reduction in production costs per unit during the first quarter of 2025. This significant cost saving directly translates into maximized cash flow from its established, mature operations.

By diligently streamlining its procurement processes and enhancing overall operational efficiency, Afarak is well-positioned to maintain strong profitability. This strategic approach ensures the company can sustain its financial performance even when market conditions present slower growth. This efficiency is key to the robust cash generation expected from its cash cow businesses.

- Cost Reduction: Achieved an 8.2% decrease in production costs per unit in Q1 2025.

- Profitability Sustainment: Streamlined operations support profitability in low-growth markets.

- Cash Flow Maximization: Efficiency initiatives directly enhance cash flow from mature operations.

Afarak's established chrome ore sales and ferroalloy operations, particularly from its South African mines like Vlakpoort and Mecklenburg, function as robust Cash Cows. These mature segments benefit from consistent demand and established market channels, generating predictable revenue streams with minimal need for extensive capital reinvestment. Their reliability provides a stable financial foundation for the company.

| Segment | BCG Classification | Key Characteristics | 2024/2025 Data Point |

| South African Chrome Ore Sales | Cash Cow | Established operations, consistent demand, predictable revenue | Significant contributor to revenue in 2024 despite market headwinds. |

| Ferroalloy Operations (South Africa) | Cash Cow | Mature, stable market presence, low maintenance capital | 8.2% reduction in production costs per unit in Q1 2025, enhancing profitability. |

What You’re Viewing Is Included

Afarak BCG Matrix

The Afarak BCG Matrix you are previewing is the precise, fully formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, offering you a ready-to-use tool for evaluating Afarak's business units.

Dogs

The divestment of the Zeerust chrome mine in June 2025 clearly marks it as a 'Dog' in Afarak's BCG matrix. This strategic move indicates the mine was likely a drain on resources, failing to generate adequate returns, thereby impacting overall profitability.

Afarak's decision to sell Zeerust highlights a commitment to optimizing its asset base and strengthening its financial position. Such divestments are crucial for shedding underperforming units and reallocating capital to more promising ventures, a common strategy for companies managing diverse portfolios.

Underperforming South African mining operations, like those impacted by a significant 26.8% drop in activity in Q1 2025 due to heavy rainfall, represent the Dogs in Afarak's portfolio. These segments struggle with low output and profitability, often hampered by external disruptions and internal inefficiencies.

Such operations tie up valuable capital without generating sufficient returns, creating a drag on overall company performance. For example, if a specific mine within Afarak's South African holdings experienced a 15% decrease in production volume in 2024 due to equipment failures, it would exemplify a Dog's characteristics.

Afarak's production of commodity-grade ferroalloys, such as ferrochrome and ferrosilicon, faces intense competition in global markets characterized by oversupply. Key producing regions like India, Kazakhstan, Russia, and China often leverage lower production costs, putting significant price pressure on producers like Afarak.

These commodity products typically generate very thin profit margins, and in periods of high supply and low demand, they can become cash traps. For instance, in 2024, the global ferrochrome market has seen fluctuating prices, with benchmarks for high-carbon ferrochrome hovering around $1.10-$1.30 per pound, reflecting the oversupply challenges.

High-Cost Production Lines

High-cost production lines within Afarak, such as certain ferrochrome operations, consistently demand significant capital and operational expenditure, often exceeding the revenue generated by their output. For instance, in 2023, Afarak reported that its South African ferrochrome operations faced elevated energy costs and raw material price volatility, contributing to a lower EBITDA margin for that segment compared to others.

These segments represent a drain on the company's resources, directly impacting overall profitability and requiring careful strategic consideration. The challenge lies in the fact that these high costs are often tied to the inherent nature of the production process or the market dynamics of the specific product.

- High Operating Expenses: Production lines with consistently high energy, labor, or raw material costs relative to their output value.

- Low Profitability Margins: Segments that generate minimal profit or even incur losses due to cost pressures and market pricing.

- Resource Drain: These operations consume capital and management attention without delivering commensurate returns, hindering investment in more promising areas.

- Strategic Review Necessity: Such lines necessitate a thorough evaluation for potential divestiture, restructuring, or significant technological upgrades to improve efficiency.

Non-Strategic or Legacy Assets

Non-strategic or legacy assets, within Afarak's framework, are those operations or product lines that don't fit with the company's core strategy of expanding in specialty alloys. These are often characterized by a low market share and limited growth potential.

These assets can be viewed as 'Dogs' in the BCG matrix. Their presence can divert management attention and financial resources away from more promising areas. For example, if a legacy mining operation within Afarak has declining ore grades and faces high extraction costs, it might fall into this category.

The continued investment in such 'Dog' assets can hinder Afarak's ability to capitalize on opportunities in the growing specialty alloys market. In 2024, companies like Afarak are under pressure to streamline operations and focus capital on high-return initiatives.

- Low Market Share: Assets with a minimal presence in their respective markets.

- Low Growth Prospects: Operations unlikely to see significant expansion in demand or revenue.

- Capital Drain: Resources tied up that could be reinvested in strategic growth areas.

- Strategic Misalignment: Operations that do not support the company's long-term vision, such as Afarak's focus on specialty alloys.

Dogs in Afarak's portfolio are business units or assets that have low market share and low growth potential, often characterized by high operating expenses and low profitability margins. These segments, such as the divested Zeerust chrome mine, represent a drain on resources, tying up capital without generating sufficient returns. For example, underperforming South African mining operations impacted by adverse weather or internal inefficiencies in 2025 exemplify these 'Dog' characteristics.

These underperforming assets require careful strategic consideration, potentially leading to divestment or significant restructuring to improve efficiency. The global ferrochrome market, facing intense competition and fluctuating prices around $1.10-$1.30 per pound for high-carbon ferrochrome in 2024, exemplifies the market pressures that can turn even core products into 'Dogs' if production costs are too high.

Afarak's strategic focus on specialty alloys means legacy assets or high-cost production lines that don't align with this vision are prime candidates for being classified as 'Dogs'. Companies like Afarak are under pressure in 2024 to streamline operations and reallocate capital to high-return initiatives, making the identification and management of 'Dogs' a critical aspect of portfolio optimization.

The challenge with 'Dogs' is their tendency to consume capital and management attention, hindering investment in more promising growth areas. For instance, a legacy mining operation with declining ore grades and escalating extraction costs would represent a significant 'Dog' within the company's structure, demanding a strategic review for potential divestiture or substantial operational improvements.

| Asset/Operation Example | Market Share | Growth Potential | Profitability | Strategic Fit |

|---|---|---|---|---|

| Zeerust Chrome Mine (Divested June 2025) | Low | Low | Negative | None |

| Underperforming SA Mining Operations (Q1 2025) | Low | Low | Low/Negative | Limited |

| High-Cost Ferrochrome Lines | Moderate | Low | Thin Margins | Questionable |

| Legacy Mining Operations (Declining Grades) | Low | Low | Low | None |

Question Marks

Afarak is currently assessing the feasibility of underground mining at its Mecklenburg operation. This represents a substantial capital commitment with inherent risks and an uncertain future return on investment.

The Mecklenburg underground project offers potential for future growth, but it demands significant upfront investment. There's no guarantee of market demand or operational efficiency, placing it in a high-risk category.

In 2024, Afarak reported that the preliminary economic assessment for Mecklenburg's underground potential indicated a need for approximately €50 million in initial capital expenditure. The projected payback period was estimated at 7-10 years, contingent on achieving an average chromite concentrate price of $150 per tonne.

The Waylox mine development project in Zimbabwe is classified as a Question Mark within the Afarak BCG Matrix. This early-stage venture shows promise for future growth but currently demands significant investment without generating substantial returns. Its classification highlights the uncertainty surrounding its ability to capture market share and become a profitable operation.

The burgeoning 'green steel' market, driven by environmental regulations and consumer demand for lower-carbon products, signifies a substantial growth avenue for ferroalloy producers. This shift necessitates significant investment in sustainable production methods, impacting the strategic positioning of companies like Afarak within the BCG matrix.

Within the BCG framework, Afarak's current involvement in 'green steel' related ferroalloys likely places it in the Question Mark category. While the market is expanding rapidly, with projections indicating continued strong growth through 2025 and beyond, Afarak's existing market share in this specific niche is probably minimal. This requires substantial capital expenditure to develop and scale up production of ferroalloys manufactured using renewable energy and advanced, low-emission technologies.

New Product Development Initiatives

Afarak's new product development initiatives, focusing on novel alloys and expanded applications, represent its 'Question Marks' in the BCG matrix. These ventures are inherently risky, demanding substantial capital for research, development, and market penetration, with uncertain outcomes regarding profitability and market share.

These R&D efforts are crucial for future growth but carry significant upfront costs and a longer gestation period before generating returns. For instance, the company might allocate a portion of its capital expenditure towards exploring specialized ferroalloys for the burgeoning electric vehicle battery market, a sector projected to grow substantially by 2030.

- Exploration of advanced alloys for high-demand sectors like aerospace and renewable energy.

- Investment in pilot projects for new material applications, such as specialized coatings or additive manufacturing powders.

- Partnerships with research institutions to accelerate innovation and reduce development timelines.

- Market analysis to identify unmet needs and potential niches for novel alloy offerings.

Future Acquisitive Growth Targets

Afarak's strategic roadmap clearly outlines an acquisitive growth trajectory, focusing on identifying and integrating new businesses or assets to expand its market presence and capabilities. This approach is crucial for navigating the dynamic specialty alloys sector.

These potential acquisitions are considered Stars in the BCG Matrix context. They represent opportunities with high growth potential but also demand significant capital investment and carry inherent risks associated with integration challenges and market reception. For instance, in 2024, the company has been actively exploring opportunities in niche markets for high-purity ferroalloys, a segment projected to grow at a compound annual growth rate of approximately 6% through 2028.

- High Growth Potential: Target acquisitions are in segments with robust projected market growth, such as advanced materials for electric vehicles and renewable energy infrastructure.

- Significant Investment Required: Successful integration necessitates substantial capital outlay for operational upgrades, technology adoption, and market penetration strategies.

- Integration and Market Risks: Challenges include merging corporate cultures, aligning operational systems, and ensuring the acquired entity performs as expected in competitive markets.

- Strategic Importance: These acquisitions are key to diversifying Afarak's product portfolio and strengthening its competitive advantage in high-value specialty alloy markets.

Afarak's new product development and exploration into emerging markets, such as those driven by the green steel trend, are classified as Question Marks. These initiatives require substantial investment for research, development, and market entry, with uncertain returns.

The Waylox mine in Zimbabwe is also a Question Mark, representing an early-stage project with high growth potential but currently demanding significant capital without generating substantial profits. Its success hinges on market acceptance and operational efficiency.

Afarak's ventures into specialized ferroalloys for sectors like electric vehicle batteries are considered Question Marks. These areas offer future growth but involve considerable R&D costs and face market adoption risks.

Afarak is exploring the potential of underground mining at its Mecklenburg operation, a significant capital commitment with uncertain future returns. This project, along with new product development, represents its Question Marks.

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, including financial performance, industry growth rates, and competitive landscape analysis, to provide a clear strategic overview.