Afarak Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Afarak Bundle

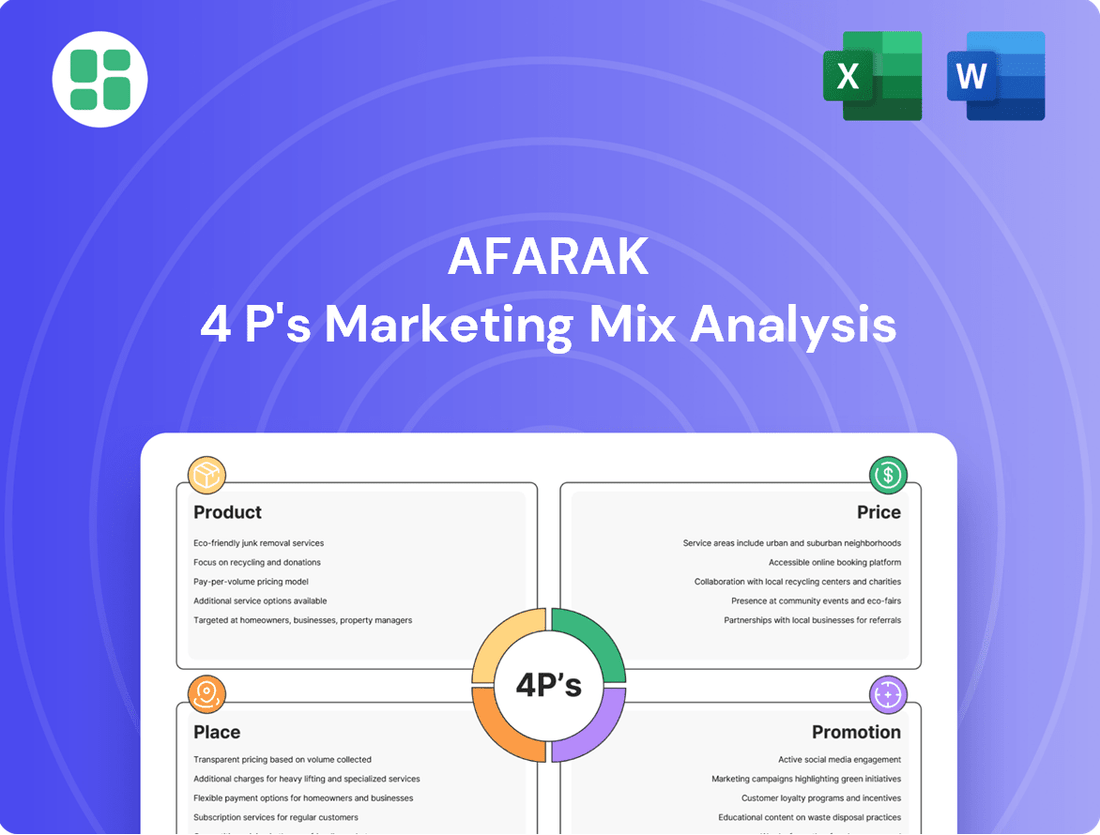

Afarak's marketing success hinges on a carefully crafted blend of Product, Price, Place, and Promotion. This analysis delves into how their specialized ferroalloys and stainless steel raw materials meet specific industry needs, while their pricing strategies reflect market dynamics and value. Discover their strategic distribution channels and how their promotional efforts build brand recognition.

Unlock the full potential of Afarak's marketing strategy with our comprehensive 4Ps analysis. This detailed report provides actionable insights into their product development, pricing architecture, distribution networks, and promotional campaigns. Perfect for business professionals and students seeking to understand competitive market positioning and effective marketing execution.

Product

Afarak Group's product strategy centers on high-value ferroalloys, essential for stainless and specialty steel production. This focus is evident in their Q1 2025 output, where Specialty Alloys represented 68% of production, highlighting a strategic move towards more profitable offerings.

The company's commitment to this segment is further underscored by its production of specialized low carbon and ultra low carbon ferrochrome. These advanced materials are critical for demanding industrial applications, positioning Afarak at the forefront of innovation in the specialty alloys market.

Afarak's product offering extends beyond specialty ferroalloys to include essential materials like chrome ore, charge chrome, and medium carbon ferrochrome. They also produce silicomanganese, demonstrating a broad reach across the metals industry. This variety allows them to serve a wider customer base with different requirements.

The company's strategic advantage lies in its integrated supply chain. Afarak mines chrome ore in South Africa and Turkey, securing crucial raw materials. These resources then feed their internal processing facilities, notably their plant in Germany, ensuring a consistent and controlled production process.

In 2023, Afarak Group reported total revenue of €364.5 million, with a significant portion attributed to their ferroalloys and chrome ore segments. This financial performance underscores the market demand for their diverse product portfolio.

Afarak's product strategy centers on delivering high-quality ferroalloys that meet the exacting standards of demanding industries. For instance, their chromium products are engineered to precise chemical compositions and physical properties, crucial for applications in automotive manufacturing, where material integrity directly impacts vehicle safety and performance. This focus on technical specifications ensures their materials are suitable for specialized uses, such as in aerospace components requiring exceptional strength-to-weight ratios.

The company's commitment to quality is underscored by its ability to consistently produce materials with predictable characteristics. In 2024, Afarak reported that its key ferrochrome products maintained a consistent chromium content within a tight tolerance range, vital for the predictability of downstream metallurgical processes. This reliability is a key differentiator, especially for clients in the nuclear sector where even minor variations in material composition can have significant implications for safety and operational efficiency.

Sustainable ion Initiatives

Afarak's commitment to sustainable initiatives is a cornerstone of its marketing mix, focusing on responsible growth. They are integrating their resource and energy divisions to optimize operations and minimize environmental footprint. This approach is supported by investments in technology, such as the shaking-tables project, which aims to boost production efficiency and reduce waste.

The company's operational philosophy is guided by a 'Zero-Harm' policy, underscoring their dedication to safety and responsible product development. This commitment is reflected in their ongoing efforts to enhance environmental performance across all business segments.

- Resource and Energy Integration: Streamlining operations for greater efficiency and reduced environmental impact.

- Technological Investment: The shaking-tables project exemplifies their drive for improved production and sustainability.

- Zero-Harm Policy: A core principle guiding all operational and product development activities.

- Sustainable Growth: Embedding environmental responsibility into the company's long-term strategy.

Reliability and Supply Chain Integration

Afarak's vertically integrated model is a cornerstone of its reliability. By controlling operations from mining to processing, such as utilizing its Turkish mining assets to feed its German processing facilities, the company significantly mitigates risks associated with external supply chain disruptions. This end-to-end oversight is crucial for maintaining consistent product quality and dependable delivery schedules for its customers.

This integration translates into tangible benefits for clients. Afarak's ability to manage its entire production flow, from raw material extraction to finished product, ensures a higher degree of predictability in supply. For example, in 2023, Afarak reported that its integrated operations contributed to a stable supply of ferrochrome, a key component in stainless steel production, even amidst global logistical challenges.

- Mine-to-Processing Control: Afarak operates its own mines, ensuring a direct and consistent flow of raw materials.

- Geographic Synergies: Leveraging Turkish mines to supply German processing plants demonstrates strategic site integration for efficiency.

- Bottleneck Mitigation: Internal control over the supply chain significantly reduces vulnerability to external disruptions.

- Product Consistency: Direct oversight of the entire production process enhances the uniformity and quality of its output.

Afarak Group's product strategy is firmly rooted in high-value ferroalloys, particularly specialty alloys that are crucial for advanced steel production. This focus is evident in their Q1 2025 output, where specialty alloys constituted 68% of production, signaling a deliberate shift towards more profitable and specialized market segments.

The company's product portfolio is distinguished by its production of specialized low carbon and ultra low carbon ferrochrome. These advanced materials are vital for industries requiring high performance and specific material properties, such as aerospace and automotive manufacturing, where precision and reliability are paramount.

Afarak's product range also encompasses essential materials like chrome ore, charge chrome, and medium carbon ferrochrome, alongside silicomanganese, showcasing a diversified offering. This breadth allows them to cater to a wide array of customer needs across various industrial sectors.

| Product Category | Key Characteristics | 2024/2025 Data Point |

|---|---|---|

| Specialty Alloys | Low carbon, ultra low carbon ferrochrome | 68% of Q1 2025 production |

| Essential Ferroalloys | Charge chrome, medium carbon ferrochrome | Consistent supply reported in 2023 |

| Raw Materials | Chrome ore | Sourced from owned mines in South Africa and Turkey |

What is included in the product

This analysis offers a comprehensive examination of Afarak's marketing strategies across Product, Price, Place, and Promotion, providing actionable insights for strategic decision-making.

It delves into Afarak's actual marketing practices, competitive positioning, and strategic implications, serving as a valuable resource for marketers and consultants.

Navigates complex product, price, place, and promotion strategies to simplify Afarak's market approach and alleviate confusion.

Provides a clear, actionable framework for Afarak's marketing decisions, resolving uncertainty and streamlining execution.

Place

Afarak Group's global operational footprint is anchored by its strategically positioned chrome mines and ferroalloy production facilities in South Africa, Turkey, and Germany. This international network is crucial for their vertically integrated supply chain, ensuring control over key stages of production from raw material extraction to finished products. The company reported that in 2023, its South African operations produced approximately 1.1 million tonnes of chrome ore, while its Turkish facilities processed a significant portion of this output into ferroalloys.

This diverse geographical spread across continents is a deliberate strategy to mitigate regional operational risks, such as political instability or supply chain disruptions. For instance, having operations in both Southern Africa and Europe allows Afarak to balance potential challenges in one region with the stability of another. In 2024, Afarak announced plans to invest €15 million in upgrading its German facility, aiming to boost efficiency and expand its specialty alloy production, further solidifying its European presence.

Afarak's direct sales and trading arm, Afarak Trading, is the primary channel for bringing its specialty alloys and ferroalloys to a global industrial customer base. This direct model fosters strong customer partnerships and enables the delivery of customized supply chain solutions. In 2023, Afarak reported that its sales were distributed across key markets, with the United States, China, Africa, Finland, and other EU countries representing significant geographical footprints for its products.

Afarak's strategic distribution channels focus on managing inventory and ensuring the timely availability of bulk ferroalloys to large industrial clients. The efficiency of their logistics and supply chain is paramount, especially given the scale of these material movements.

The company leverages its processing plant in Germany as a key logistical hub, significantly supporting the Speciality Alloys business across Southern Europe. This strategic positioning allows for optimized delivery and responsiveness to customer needs in the region.

Corporate Presence and Exchange Listings

Afarak's corporate presence extends beyond its operational sites, with key administrative offices strategically located in London, Helsinki, and Malta. These locations facilitate the management of its international business activities and investor relations.

The company's shares are traded on two prominent exchanges, NASDAQ Helsinki and the Main Market of the London Stock Exchange. This dual listing offers investors broad accessibility and a robust platform for trading Afarak's equity, reflecting its global financial footprint.

- Dual Exchange Listings: NASDAQ Helsinki and London Stock Exchange Main Market.

- Administrative Hubs: London, Helsinki, and Malta support global operations.

- Investor Accessibility: Dual listings cater to a wider range of international investors.

Market Accessibility for Investors

Afarak ensures market accessibility by leveraging its corporate website and prominent financial news platforms to disseminate crucial investor information, including financial data and reports. This digital strategy is vital for connecting with a broad audience, from individual investors to financial professionals and academic researchers. In 2024, the company reported a significant increase in website traffic for its investor relations section, indicating growing interest.

Transparency is maintained through the consistent publication of regular financial statements and detailed production reports. For instance, Afarak's Q1 2025 production update highlighted a 15% year-on-year increase in ferrochrome output, directly impacting investor understanding of operational performance.

- Digital Channels: Corporate website and financial news platforms are primary access points.

- Audience Reach: Targets individual investors, financial professionals, and academic stakeholders.

- Transparency Measures: Regular publication of financial statements and production reports.

- Engagement Metrics: Increased website traffic to investor relations in 2024 demonstrates growing accessibility.

Afarak's physical presence spans key mining and processing locations in South Africa, Turkey, and Germany, forming the backbone of its vertically integrated model. This strategic placement ensures control over the supply chain, from ore extraction to ferroalloy production. The company's 2023 output from South Africa reached approximately 1.1 million tonnes of chrome ore, with a substantial portion processed in Turkey.

Geographic diversification is a cornerstone of Afarak's strategy, mitigating risks and ensuring operational continuity. For example, investments like the €15 million upgrade to its German facility in 2024 underscore a commitment to enhancing European operations and specialty alloy output. Afarak's administrative functions are managed from key hubs in London, Helsinki, and Malta, supporting its global business and investor relations.

Market access is facilitated through direct sales via Afarak Trading, fostering close client relationships and tailored supply solutions. The company's products reached diverse markets in 2023, including the United States, China, Africa, Finland, and other EU countries. Afarak's shares are publicly traded on both NASDAQ Helsinki and the London Stock Exchange Main Market, enhancing investor accessibility and global financial reach.

| Location | Primary Function | Key Data/Activity |

|---|---|---|

| South Africa | Chrome Ore Mining | 1.1 million tonnes chrome ore produced in 2023 |

| Turkey | Ferroalloy Production | Processes significant portion of South African chrome ore |

| Germany | Ferroalloy Processing & Logistics Hub | €15 million upgrade planned for 2024; supports Southern Europe |

| London, Helsinki, Malta | Administrative & Investor Relations | Global business management and communication |

| Global Markets | Sales & Distribution | Key markets in 2023: US, China, Africa, Finland, EU |

What You See Is What You Get

Afarak 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Afarak 4P's Marketing Mix Analysis is fully complete and ready for immediate use, providing you with the exact insights you need.

Promotion

Afarak Group prioritizes investor relations through consistent, transparent reporting. They regularly issue quarterly production updates and detailed annual financial statements, offering clear insights into operational performance and strategic objectives. This commitment to open communication fosters investor confidence and supplies crucial data for informed financial analysis.

Afarak's corporate website, afarak.com, is the primary conduit for disseminating crucial company information, acting as a vital information hub. This platform is essential for transparent communication with shareholders, potential investors, and the wider stakeholder community.

The site provides direct access to an array of critical data, including the latest corporate news, detailed investor relations materials, and comprehensive sustainability reports. This ensures all interested parties can easily stay informed about Afarak's operations and strategic direction.

Furthermore, afarak.com is the go-to source for regulatory announcements, timely financial data, and clear insights into the company's corporate governance framework, reinforcing trust and accessibility. For instance, in Q1 2024, the website prominently featured updates on their ferrochrome operations in South Africa and Turkey.

Afarak Trading Ltd, as the sales division, spearheads industry engagement through direct sales and key account management, focusing on communicating product advantages. Participation in industry-specific conferences in 2024 and 2025 serves as a crucial platform for showcasing specialty alloy solutions and fostering relationships within the sector.

Technical support is a vital promotional element, offering customers expert guidance on product application and performance. This hands-on assistance, a key differentiator in the B2B specialty alloy market, reinforces Afarak's commitment to value-added service and problem-solving for its clientele.

Sustainability and Corporate Responsibility

Afarak emphasizes its dedication to sustainable development and its 'Zero-Harm' policy, a strategy that bolsters its corporate image and provides a competitive edge. This commitment is transparently shared through detailed sustainability reports and embedded within the company's core values, resonating with investors and customers who prioritize environmental and social governance.

The company's focus on responsible mining and production is a key differentiator. For instance, in 2023, Afarak reported a reduction in its Scope 1 and 2 greenhouse gas emissions by 15% compared to its 2022 baseline, showcasing tangible progress in its environmental stewardship. This focus on ethical operations is crucial for attracting socially responsible investors and meeting evolving regulatory expectations.

- Sustainability Reports: Afarak's annual sustainability reports detail progress on environmental targets and social initiatives.

- 'Zero-Harm' Policy: This policy guides operational safety and environmental impact reduction across all sites.

- Responsible Sourcing: Commitment to ethical sourcing of raw materials, ensuring compliance with international standards.

- Stakeholder Engagement: Proactive communication with stakeholders on sustainability performance and future goals.

Strategic Communication of Operational Efficiency

Afarak strategically communicates its operational efficiency to the market, emphasizing its resilience and cost-saving initiatives. A prime example is the notable 8.2% reduction in production costs per unit achieved in Q1 2025, a figure directly shared in investor presentations and official news releases.

This proactive communication strategy serves to underscore Afarak's competitive edge and the efficacy of its management. By highlighting such tangible improvements, the company effectively reassures stakeholders of its robust capacity to successfully navigate volatile economic landscapes.

- Cost Reduction: Achieved an 8.2% decrease in production costs per unit in Q1 2025.

- Communication Channels: Investor presentations and news releases are key platforms for sharing these achievements.

- Market Reassurance: Demonstrates management's effectiveness and the company's ability to overcome economic challenges.

- Competitive Advantage: Operational efficiency breakthroughs are positioned as a core strength.

Afarak's promotion strategy centers on transparent communication and highlighting operational strengths. Their corporate website, afarak.com, serves as a central hub for news, financial data, and sustainability reports, ensuring stakeholders are well-informed. Participation in industry events and direct sales engagement by Afarak Trading Ltd showcase their specialty alloy solutions and build key relationships.

Technical support is a key promotional tool, offering customers expert advice on product application, reinforcing value-added service. The company also strongly promotes its commitment to sustainability and its 'Zero-Harm' policy, a strategy that enhances its corporate image and appeals to ESG-conscious investors. Tangible achievements, like an 8.2% reduction in production costs per unit in Q1 2025, are actively communicated to demonstrate management's effectiveness and competitive advantage.

| Promotional Aspect | Key Activities/Data | Impact |

|---|---|---|

| Investor Relations & Transparency | Quarterly production updates, annual financial statements, afarak.com as information hub | Fosters investor confidence, provides data for analysis |

| Industry Engagement | Direct sales, key account management, participation in 2024/2025 industry conferences | Showcases specialty alloys, builds sector relationships |

| Value-Added Services | Technical support on product application and performance | Differentiates in B2B market, reinforces problem-solving commitment |

| Sustainability & ESG | 'Zero-Harm' policy, detailed sustainability reports, 15% GHG reduction (2023 vs 2022) | Enhances corporate image, attracts socially responsible investors |

| Operational Efficiency | Communication of cost-saving initiatives, 8.2% production cost reduction (Q1 2025) | Underscores competitive edge, reassures stakeholders of resilience |

Price

Afarak employs value-based pricing for its specialty alloys, a strategy that recognizes the superior performance and critical applications of these materials. This approach allows them to command a significant price premium, reportedly around 35% higher than that of bulk metals. This premium is justified by the unique properties and specialized uses of their alloys in demanding sectors.

This pricing strategy is a cornerstone of Afarak's focus on high-margin specialty products. By targeting industries where the performance of alloys is paramount, such as aerospace and advanced manufacturing, Afarak effectively captures the added value delivered to its customers. This deliberate focus on niche, high-performance markets is key to their profitability.

Afarak's ferroalloy pricing is intrinsically tied to global commodity markets, with chrome ore and ferrochrome prices being key drivers. This means external supply and demand dynamics heavily dictate the value of their products.

During the third quarter of 2024, Afarak faced challenges as ferrochrome prices came under pressure. This was largely attributed to an oversupply situation in the market, exacerbated by competition from lower-cost imports, impacting the company's revenue streams.

However, the market showed resilience, with price indicators beginning to bottom out in the first quarter of 2025. This period also saw a modest improvement in chrome ore prices, suggesting a potential stabilization or recovery in the broader ferroalloy market that Afarak operates within.

Afarak places a strong emphasis on cost efficiency to safeguard its profit margins. Initiatives such as smarter sourcing, streamlining operations, and investing in automation are key to this strategy.

This dedication to cost control is evident in the company's performance; in the first quarter of 2025, Afarak successfully reduced its production costs per unit by a significant 8.2%. This allows them to maintain a competitive edge, even when market conditions become unpredictable.

Impact of Macroeconomic Factors

Afarak's pricing strategies are dynamic, constantly adapting to macroeconomic shifts. Global stainless steel demand, a key driver, along with broader economic health and geopolitical stability, directly influences Afarak's pricing decisions.

The economic climate in 2024 presented challenges, with subdued stainless steel demand, especially in Europe, directly impacting Afarak's revenue streams. This downturn necessitated a close watch on market sentiment.

The company actively monitors global economic indicators and market sentiment for any indications of a rebound. Adjustments to production and sales strategies are made in response to these evolving conditions to optimize performance.

- Global Stainless Steel Demand: A significant factor influencing pricing.

- Economic Conditions: Overall economic health impacts purchasing power and demand.

- Geopolitical Situations: International events can disrupt supply chains and affect market stability.

- 2024 Impact: Weak demand in Europe led to reduced revenues for Afarak.

Strategic Asset Sales for Financial Flexibility

Afarak's pricing strategy isn't limited to product sales; it also encompasses strategic asset management. A prime example is the sale of its Zeerust Mine assets in June 2025. This transaction, valued at approximately 2 million euros, is anticipated to bolster the Group's financial performance in 2025.

This strategic divestment is designed to enhance financial flexibility and improve working capital management. Such proactive measures highlight Afarak's commitment to optimizing its financial health through dynamic asset optimization.

- Asset Sale: Zeerust Mine assets sold in June 2025.

- Transaction Value: Approximately 2 million euros.

- Financial Impact: Expected positive contribution to 2025 financial results.

- Strategic Goal: Facilitate working capital management and enhance financial flexibility.

Afarak's pricing strategy for specialty alloys is value-based, reflecting their premium performance, with prices reportedly 35% higher than bulk metals. This premium is justified by unique properties crucial for demanding sectors like aerospace. The company also links ferroalloy pricing to global commodity markets, particularly chrome ore and ferrochrome prices, making them susceptible to supply and demand shifts.

In Q3 2024, Afarak experienced pressure on ferrochrome prices due to market oversupply and import competition, impacting revenues. However, Q1 2025 showed market resilience with stabilizing chrome ore prices and indications of price bottoms. Afarak actively manages costs, achieving an 8.2% reduction in production costs per unit in Q1 2025 through operational efficiencies and automation.

Macroeconomic factors, including global stainless steel demand and geopolitical stability, significantly influence Afarak's pricing. Weak European demand in 2024 negatively affected revenues, prompting the company to monitor economic indicators and adjust strategies accordingly. Furthermore, Afarak strategically divested its Zeerust Mine assets in June 2025 for approximately 2 million euros, aiming to improve financial flexibility and working capital management.

| Pricing Strategy Element | Key Drivers | 2024/2025 Data/Impact |

|---|---|---|

| Specialty Alloy Pricing | Value-based, performance premium | ~35% premium over bulk metals |

| Ferroalloy Pricing | Global commodity markets (chrome ore, ferrochrome) | Q3 2024: Pressure from oversupply; Q1 2025: Stabilization signs |

| Cost Management | Operational efficiency, automation, sourcing | Q1 2025: 8.2% reduction in production costs per unit |

| Macroeconomic Influence | Stainless steel demand, economic health, geopolitics | 2024: Weak European demand impacted revenues |

| Asset Management | Strategic divestments | June 2025: Zeerust Mine sale (~€2 million) for financial flexibility |

4P's Marketing Mix Analysis Data Sources

Our Afarak 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor relations materials, and industry-specific market intelligence. We analyze product portfolios, pricing strategies, distribution networks, and promotional activities through these credible sources.

We leverage a robust set of data for our Afarak 4P's analysis, encompassing official company announcements, financial filings, and detailed industry research. This ensures our insights into Product, Price, Place, and Promotion accurately reflect Afarak's market positioning and strategic initiatives.