Afarak PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Afarak Bundle

Navigate the complex world of ferroalloys with our comprehensive PESTLE analysis of Afarak. Understand the political stability, economic fluctuations, and technological advancements impacting their operations. Equip yourself with the foresight to capitalize on opportunities and mitigate risks. Download the full analysis now and gain a decisive advantage.

Political factors

South Africa's mining sector is undergoing significant policy shifts, with a draft Mineral Resources Development Bill anticipated for 2025. This legislation intends to update the existing mining framework and bring artisanal and small-scale mining into the formal economy.

These evolving regulations could influence Afarak's operational landscape by introducing new licensing requirements and emphasizing more robust community engagement processes. Such changes may also serve to stimulate investment within the broader South African mining industry.

Global trade policies, such as the EU's Carbon Border Adjustment Mechanism (CBAM), are set to significantly impact ferroalloy imports into Europe. This mechanism, which begins its full implementation in 2026, aims to level the playing field by pricing carbon emissions associated with imported goods. For companies like Afarak, this could mean increased costs for carbon-intensive products, potentially affecting their market competitiveness within the EU.

Geopolitical stability in regions where Afarak operates, especially South Africa, is a key consideration. Instability can disrupt the supply of chrome ore, a critical raw material for Afarak's ferrochrome production. For instance, the period leading up to and including 2024 has seen ongoing discussions and policy shifts within South Africa that could affect mining operations and export logistics.

Corporate Governance and Regulatory Oversight

Corporate governance and regulatory oversight are increasingly critical for companies like Afarak. Heightened scrutiny means maintaining strong compliance frameworks is essential, especially with evolving standards. For example, upcoming amendments to South Africa's Mine Health and Safety Act are poised to significantly alter compliance requirements, introducing stricter penalties for non-adherence.

These legislative changes could impose fines calculated as a percentage of annual turnover, a substantial financial implication for any mining operation. Companies must proactively adapt their governance structures and operational procedures to meet these new demands and mitigate potential risks associated with non-compliance.

- Stricter Enforcement: Future regulations, like amendments to South Africa's Mine Health and Safety Act, will likely feature more rigorous enforcement mechanisms.

- Financial Penalties: Fines tied to annual turnover represent a significant financial risk for non-compliant companies, potentially impacting profitability.

- Governance Adaptation: Companies must continuously review and update their corporate governance practices to align with evolving legal and ethical expectations.

- Operational Impact: Compliance with enhanced safety and environmental regulations will necessitate adjustments in operational procedures and investment in new technologies.

Government Support and Incentives for Industry

Government initiatives aimed at boosting industrial development, particularly in sectors like automotive and construction, directly influence the demand for stainless steel, a key market for ferroalloy producers like Afarak. For instance, in 2024, many nations are continuing or expanding programs to stimulate these industries, which could translate to increased orders for ferroalloys.

Policies that champion domestic manufacturing and large-scale infrastructure projects create a more robust and predictable market environment. These governmental pushes, often seen in 2024 and projected into 2025, can lead to a higher baseline demand for materials used in these expansions, benefiting companies involved in the upstream supply chain.

- Increased Infrastructure Spending: Many governments globally have allocated significant funds towards infrastructure development in 2024, aiming to modernize transportation networks and energy grids. For example, the United States' Bipartisan Infrastructure Law continues to drive demand for steel products.

- Automotive Sector Incentives: As of early 2024, several countries are offering incentives for electric vehicle (EV) production and adoption, which often utilize stainless steel components, thereby indirectly supporting ferroalloy markets.

- Domestic Production Support: Policies designed to onshore manufacturing, such as tax credits or subsidies for domestic production, can create a more stable and preferential market for locally sourced materials, including ferroalloys.

Evolving mining legislation in South Africa, including a draft Mineral Resources Development Bill expected in 2025, aims to formalize artisanal mining and could introduce new licensing and community engagement requirements for companies like Afarak. Geopolitical stability remains crucial, as disruptions in chrome ore supply, a key input for ferrochrome, can impact operations, with policy shifts in South Africa during 2024 already highlighting this risk. Furthermore, global trade policies such as the EU's Carbon Border Adjustment Mechanism, fully implemented in 2026, will likely increase costs for carbon-intensive ferroalloys, affecting Afarak's European market competitiveness.

What is included in the product

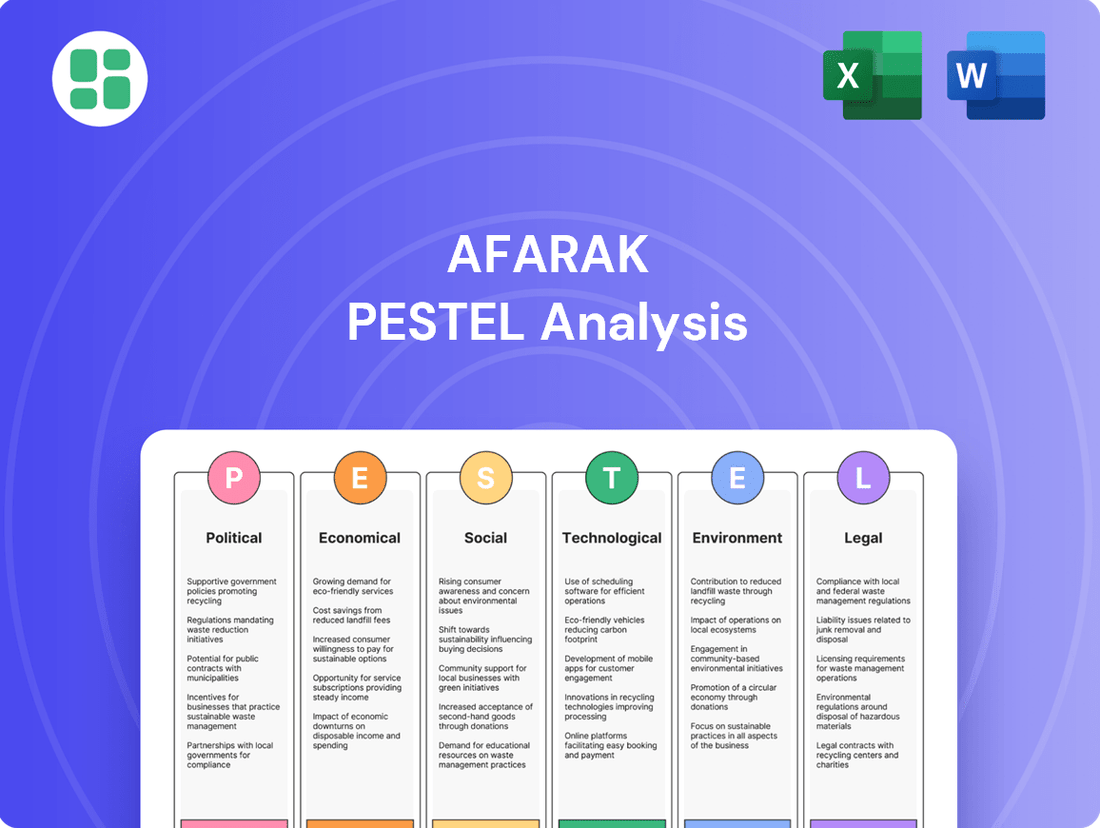

This PESTLE analysis of Afarak examines the impact of external macro-environmental factors on its operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Afarak PESTLE Analysis offers a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thus alleviating the pain point of information overload.

Economic factors

Global stainless steel production saw a year-on-year increase in the first quarter of 2025, a positive sign for ferroalloy demand, as stainless steel accounts for over 81% of global ferroalloy consumption. This growth, however, is tempered by persistent challenges such as market oversupply and volatile demand patterns, especially noticeable in key regions like Europe and China.

Prices for essential raw materials such as chrome ore and ferrochrome can be quite unpredictable, directly influencing Afarak's expenses and overall financial success. For instance, in the first half of 2025, chrome ore prices began to climb after reaching a low point, signaling a potential shift in market dynamics.

This upward movement in chrome ore was mirrored by ferrochrome prices, which showed signs of stabilizing and increasing during the second quarter of 2025. These fluctuations are critical for Afarak, as they directly affect the cost of producing its core products and, consequently, its profit margins.

Energy represents a substantial operational expense for ferroalloy manufacturers, with spikes in industrial electricity and coal prices directly impacting profitability. For instance, in early 2024, European electricity prices remained elevated compared to pre-crisis levels, creating a significant cost burden for energy-intensive industries like ferroalloy production.

These heightened energy expenditures have demonstrably squeezed profit margins for European ferroalloy producers, diminishing their ability to compete with regions benefiting from lower energy costs. This dynamic has reshaped market competitiveness and influenced global trade flows within the sector throughout 2024.

Competitive Landscape and Market Surplus

The ferrochrome market experienced significant oversupply in 2024, causing prices to drop and squeezing producer profit margins. This intense competition is a key factor for Afarak.

Although some production cuts were implemented in early 2025, the overall ferroalloy market is still expected to grapple with excess capacity throughout the year. This persistent surplus will continue to fuel competitive pressures.

Key data points illustrating this include:

- Global ferrochrome prices saw a notable decline in 2024, with some benchmarks falling by over 15% compared to 2023 levels.

- Industry reports from early 2025 indicated that global ferroalloy production capacity still exceeded demand by approximately 10-12%.

- This overcapacity translates to heightened price sensitivity and a constant need for producers to optimize costs and efficiency to remain competitive.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for Afarak. Fluctuations between the Euro and currencies in its key operational areas, such as the South African Rand (ZAR) and the Turkish Lira (TRY), directly affect the company's financial performance. When Afarak's earnings in ZAR or TRY are converted back to Euros, a weaker local currency means lower reported revenues. Conversely, a stronger local currency can increase the cost of imported raw materials or equipment needed for its operations.

This dynamic introduces considerable financial risk. For instance, during 2024, the South African Rand experienced periods of weakness against the Euro, potentially impacting the Euro-denominated value of Afarak's South African earnings. Similarly, the Turkish Lira has faced its own volatility. These movements necessitate careful financial management to mitigate the impact on profitability and cash flow across its international footprint.

- Impact on Revenue Translation: A weaker ZAR or TRY against the Euro reduces the Euro value of sales generated in those countries.

- Cost of Imports: Volatility can increase the Euro cost of essential imported materials and equipment, particularly if payments are denominated in Euros.

- Export Competitiveness: Currency shifts can also influence the competitiveness of Afarak's exports from its operating regions into global markets.

- Financial Risk Management: Afarak must employ strategies like hedging to manage the unpredictable nature of exchange rate movements.

Global stainless steel production, a key driver for ferroalloy demand, saw an increase in early 2025, though market oversupply and fluctuating demand, particularly in Europe and China, remain significant concerns. Chrome ore and ferrochrome prices experienced upward pressure in the first half of 2025, impacting production costs for companies like Afarak.

Energy costs, especially industrial electricity and coal, continue to be a substantial expense. Elevated European electricity prices in early 2024 squeezed profit margins for local producers, affecting their global competitiveness. The ferroalloy market faced significant oversupply in 2024, with prices dropping and capacity exceeding demand by an estimated 10-12% into early 2025, intensifying competitive pressures.

Currency volatility, particularly between the Euro and the South African Rand (ZAR) and Turkish Lira (TRY), poses a direct financial risk to Afarak. Weakness in these currencies against the Euro in 2024 impacted the Euro-denominated value of earnings and could increase the cost of imported materials.

| Economic Factor | 2024/2025 Impact on Afarak | Key Data/Observation |

|---|---|---|

| Stainless Steel Production | Increased demand for ferroalloys, but tempered by oversupply. | Global stainless steel production up Q1 2025; ferroalloy consumption >81% from stainless steel. |

| Raw Material Prices | Increased production costs. | Chrome ore prices climbed in H1 2025; ferrochrome prices stabilizing/increasing Q2 2025. |

| Energy Costs | Reduced profit margins, especially in Europe. | Elevated European electricity prices in early 2024; >15% drop in global ferrochrome prices in 2024. |

| Market Oversupply | Intensified competition and price sensitivity. | Global ferroalloy production capacity exceeded demand by 10-12% in early 2025. |

| Currency Volatility (EUR vs ZAR/TRY) | Impacted revenue translation and import costs. | ZAR and TRY experienced periods of weakness against EUR in 2024. |

Preview the Actual Deliverable

Afarak PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Afarak PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing a strategic overview for informed decision-making.

Sociological factors

Afarak's operations in South Africa are increasingly influenced by evolving community relations. New mining regulations in 2024 mandate more robust community consultation, directly impacting Afarak's ability to secure and maintain its social license to operate. This means proactive engagement and tangible benefit-sharing with local populations are no longer optional but essential for continued operations.

The emphasis on local empowerment is significant. For instance, South Africa's Broad-Based Black Economic Empowerment (B-BBEE) codes, which were updated in 2024, continue to place a strong focus on community ownership and development. Afarak must demonstrate meaningful contributions to local economies and social upliftment to align with these requirements and foster goodwill, which is vital for long-term operational stability.

Afarak's operational stability hinges on effective labor relations, which includes upholding fair labor practices and prioritizing worker safety. These elements are crucial for maintaining productivity and avoiding disruptions.

Labor laws, and any potential changes to them, significantly impact employment conditions and compliance. For instance, in South Africa, proposed amendments like the Mine Health and Safety Amendment Bill could introduce new requirements affecting workforce management and operational costs for mining companies like Afarak.

The mining and ferroalloy industries, including companies like Afarak, operate under stringent health and safety regulations. These rules are crucial for protecting workers and the environment. For instance, South African mining regulations, as detailed in the Government Gazette of August 2024, specify strict limits for ground vibrations, noise levels, air-blast, and flyrock.

Continuous monitoring and adherence to these standards are mandatory. Failure to comply can result in significant penalties, operational shutdowns, and reputational damage. In 2023, the mining sector globally saw a notable increase in safety investments, with companies allocating an average of 5% of their operational budgets to health and safety initiatives, a trend expected to continue into 2024 and 2025 as technology advances and regulatory scrutiny intensifies.

Consumer Preference for Sustainable Products

Consumer preference for sustainable products is profoundly reshaping industries, including the ferroalloy sector that supplies stainless steel. This shift means manufacturers are increasingly looking for materials produced with minimal environmental impact, directly influencing how companies like Afarak operate and source their inputs. By 2024, surveys indicated that over 70% of consumers were willing to pay more for products from brands committed to positive social and environmental impact, a trend that continues to accelerate into 2025.

This growing demand for sustainability is driving significant changes across the entire supply chain. Companies are actively seeking out and adopting cleaner production processes, prioritizing eco-friendly product development, and pushing for more responsible practices within the ferroalloy industry. For instance, in 2024, the global market for green steel, which relies heavily on sustainably sourced ferroalloys, saw an estimated growth of 15%, signaling a clear market direction.

- Growing demand for eco-friendly materials: Consumers and industries are increasingly prioritizing products with a lower environmental footprint.

- Industry adoption of cleaner processes: Manufacturers are investing in and implementing more sustainable production methods.

- Focus on eco-friendly product development: Companies are prioritizing the creation of products that align with environmental values.

- Market growth for green steel: The demand for sustainably produced steel, which relies on ferroalloys, is expanding rapidly, with projections indicating continued strong growth through 2025.

Demographic Shifts and Skilled Labor Availability

Demographic shifts are significantly influencing the availability of skilled labor in mining and industrial sectors. For instance, an aging workforce in many developed nations, coupled with lower birth rates, is leading to a shrinking pool of experienced miners and industrial workers. This trend, observed across regions where Afarak operates, directly impacts operational efficiency and can drive up labor costs as companies compete for a scarcer talent base. In 2024, reports indicated a growing skills gap in specialized mining roles, with some estimates suggesting a deficit of up to 20% for certain technical positions in key mining jurisdictions.

Companies like Afarak must proactively address these demographic challenges. Investing in comprehensive training programs to upskill existing employees and attract new talent is crucial. Furthermore, implementing robust talent retention strategies, such as competitive compensation packages and career development opportunities, becomes paramount. In response to labor shortages, particularly in 2025, there's a notable increase in investment in automation and advanced technologies within the mining industry, aiming to mitigate reliance on manual labor and improve productivity.

- Aging Workforce: Many traditional mining regions face an aging workforce, with a significant portion of skilled workers approaching retirement age.

- Skills Gap: A persistent shortage of specialized skills, such as geologists, metallurgists, and heavy machinery operators, is evident in the industry.

- Talent Attraction: Competition for skilled labor is intensifying, requiring companies to offer attractive compensation and benefits to attract and retain talent.

- Automation Adoption: To counter labor availability issues and enhance efficiency, there's a growing trend towards adopting automated mining technologies.

Community expectations for corporate social responsibility are rising, particularly in resource-rich regions like South Africa. Afarak's social license to operate is directly tied to its ability to demonstrate tangible benefits to local communities, a trend reinforced by updated regulations in 2024 that emphasize community consultation and development partnerships. Failure to meet these evolving expectations can lead to operational disruptions and reputational damage.

The increasing focus on Broad-Based Black Economic Empowerment (B-BBEE) in South Africa, with its 2024 updates, requires companies like Afarak to actively contribute to local economic development and social upliftment. This includes fostering community ownership and ensuring that operations translate into sustainable benefits for the surrounding populations. Meeting these requirements is crucial for maintaining positive stakeholder relations and ensuring long-term operational continuity.

Labor relations remain a critical sociological factor, with a growing emphasis on fair labor practices and worker well-being. Afarak's operational stability is significantly influenced by its adherence to labor laws and its ability to maintain productive relationships with its workforce. For instance, proposed amendments to South Africa's Mine Health and Safety Act in 2024 aim to further strengthen worker protections, potentially impacting operational procedures and costs.

Technological factors

Technological advancements are significantly reshaping the mining and processing landscape for companies like Afarak. Improved extraction techniques for chrome ore, for instance, are key to unlocking previously uneconomical reserves and boosting output. In 2024, the industry is seeing a greater adoption of automation and AI in exploration and extraction, aiming to increase yields and lower operational risks.

Furthermore, innovations in ferroalloy production, such as the ongoing development and refinement of submerged arc and closed furnace technologies, are critical for enhancing efficiency and reducing production costs. These advanced furnace designs offer better energy utilization and improved environmental controls, vital for maintaining competitiveness in a global market. For example, closed furnace technology can lead to a reduction in fugitive emissions by up to 90% compared to older open-hearth methods.

The metals sector is seeing a significant shift with the integration of the Internet of Things (IoT) and Artificial Intelligence (AI) into manufacturing processes. This technological wave is enabling real-time monitoring of equipment and production lines, leading to substantially higher efficiency and improved precision in output. For instance, AI-powered predictive maintenance can anticipate equipment failures, minimizing costly downtime.

Afarak can capitalize on these advancements by implementing automation and digitalization across its mining and processing operations. By leveraging IoT sensors for continuous data collection and AI algorithms for analysis, the company can achieve greater operational optimization. This translates directly into reduced operational costs through better resource management and minimized waste, alongside enhanced overall production quality.

Afarak's commitment to research and development in specialty alloys, particularly low carbon and ultra-low carbon ferrochrome, is crucial for staying ahead. This focus allows them to develop advanced materials that meet increasingly stringent market demands for specialized applications, like those in the automotive and aerospace sectors.

Innovation in this area directly translates to a competitive edge, enabling Afarak to tap into new, high-value market segments. For instance, advancements in stainless steel production, a key consumer of ferrochrome, are driving demand for higher purity and specialized grades, areas where R&D plays a vital role.

Energy Efficiency and Green Technologies

Investments in energy-efficient technologies and the adoption of green energy sources are critical for companies like Afarak, especially given rising global energy costs and increasingly stringent environmental regulations. For instance, the European Union's Green Deal aims for climate neutrality by 2050, driving demand for sustainable industrial practices.

The global push towards green power is reshaping industrial structures. In 2024, renewable energy sources accounted for approximately 30% of the global electricity generation mix, a figure expected to climb significantly by 2025, influencing where and how energy-intensive industries like ferroalloy production operate.

- Rising energy costs: Global energy prices saw significant volatility in 2024, impacting operational expenses for energy-intensive industries.

- Environmental regulations: Stricter emissions standards in key markets are compelling investments in cleaner production methods.

- Green energy adoption: The increasing availability and decreasing cost of renewable energy sources are making them a more viable option for industrial power.

- Industrial optimization: Companies are evaluating their energy consumption and sourcing to align with sustainability goals and cost-efficiency.

Supply Chain Optimization Technologies

Technologies that bolster supply chain resilience and diversification are paramount for mitigating risks tied to raw material acquisition and transportation. For Afarak, this means leveraging tools that provide greater visibility and agility in its global operations.

Implementing sophisticated supply chain management (SCM) systems allows Afarak to better anticipate and respond to disruptions, ensuring a smoother flow of materials from its mining sites to its processing plants. For instance, in 2024, companies across the mining sector are increasingly adopting AI-powered demand forecasting and inventory management software, which can reduce stockouts by up to 15% and improve on-time delivery rates.

- Real-time Tracking: Advanced IoT sensors and blockchain technology offer end-to-end visibility of materials, enabling proactive issue resolution.

- Predictive Analytics: AI and machine learning algorithms analyze vast datasets to forecast potential disruptions, such as geopolitical instability or transportation delays, allowing for preemptive adjustments.

- Automated Warehousing: Robotics and automated guided vehicles (AGVs) in warehouses can significantly speed up material handling and reduce errors, improving efficiency.

- Digital Twin Technology: Creating virtual replicas of the supply chain allows for scenario planning and testing of different strategies without real-world risk.

Technological advancements are central to Afarak's operational efficiency and market competitiveness. Innovations in automated mining equipment and AI-driven process optimization are key drivers for increased ore recovery and reduced production costs. For instance, the adoption of AI in predictive maintenance for mining machinery can reduce unexpected downtime by an estimated 20-30%.

Continued investment in advanced smelting technologies, like closed-loop systems, is vital for improving energy efficiency and minimizing environmental impact, a trend strongly supported by global sustainability initiatives. These technologies can reduce energy consumption in ferroalloy production by up to 15% compared to older open-hearth methods.

The integration of digital tools, such as IoT sensors for real-time production monitoring and blockchain for supply chain transparency, is enhancing operational oversight and resilience. Companies leveraging these technologies in 2024 reported improved inventory accuracy and faster response times to market fluctuations.

Afarak's focus on R&D for specialty alloys, particularly those with low carbon footprints, positions it to meet evolving market demands for high-performance materials. This strategic R&D is crucial for capturing value in sectors requiring advanced metallurgical solutions.

Legal factors

Afarak's mining operations are subject to stringent legal frameworks, particularly concerning permits and licenses. In South Africa, the upcoming 2025 Mineral Resources Development Bill is set to introduce significant changes, including new licensing procedures and clearer rules for managing historic mine dumps. Navigating these evolving regulations is crucial for Afarak's continued operational viability and compliance.

Afarak operates under strict environmental rules covering emissions, waste disposal, and land restoration. For instance, new South African mining laws enacted in 2024 mandate precise controls on ground vibrations, noise levels, and air-blast, directly impacting mining operations.

Adherence to these environmental mandates, including those related to water usage and biodiversity protection, is critical. Failure to comply can result in significant penalties, such as substantial fines and even temporary or permanent shutdowns of mining facilities, as seen in past enforcement actions against other mining firms in the region.

Afarak must strictly follow labor laws, covering health, safety, and worker rights to ensure smooth operations. For instance, South Africa's Mine Health and Safety Act imposes rigorous compliance with codes of practice, with substantial fines for violations. In 2023, the Department of Mineral Resources and Energy reported 49 mining-related fatalities, highlighting the critical importance of safety adherence.

International Trade Laws and Anti-dumping Measures

Afarak's international sales and distribution are significantly influenced by global trade regulations. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), which began its transitional phase in October 2023 and will fully implement in 2026, could impact the cost of importing ferroalloys into the EU based on their embedded carbon emissions. This mechanism, alongside existing anti-dumping duties on certain materials, directly affects market access and pricing strategies for Afarak's products.

These trade policies can alter the competitive landscape and necessitate adjustments in supply chain management and production costs. For example, if specific ferroalloys face new import tariffs or anti-dumping measures, Afarak might need to re-evaluate its sourcing or sales strategies in affected regions to maintain profitability and market share. The evolving nature of these international trade laws requires continuous monitoring and adaptation.

- Impact of CBAM: The EU CBAM, starting its transitional phase in October 2023, imposes carbon costs on imported goods, potentially increasing operational expenses for companies like Afarak that export to the EU.

- Anti-dumping duties: Existing and potential anti-dumping measures on ferroalloys can restrict market access and necessitate price adjustments, affecting Afarak's global sales performance.

- Trade flow adjustments: Changes in trade laws can lead to shifts in international trade flows, requiring Afarak to adapt its distribution networks and market strategies to remain competitive.

- Pricing strategy influence: The imposition of tariffs and duties directly impacts the final pricing of ferroalloys, influencing Afarak's ability to compete in various international markets.

Corporate Law and Reporting Standards

Afarak Group, as a company traded on both NASDAQ Helsinki and the London Stock Exchange, operates under rigorous corporate law and financial reporting mandates. This necessitates the punctual release of its financial statements and annual reports, a crucial element for maintaining transparency and fostering accountability among its diverse stakeholder base.

Compliance with these regulations ensures that investors and other interested parties receive accurate and timely information. For instance, in its 2024 interim reports, Afarak Group highlighted adherence to IFRS standards, a common requirement for listed entities.

- Adherence to IFRS: Afarak Group's financial reporting aligns with International Financial Reporting Standards, ensuring global comparability.

- Timely Disclosures: The company is obligated to publish quarterly and annual financial results within specified deadlines by regulatory bodies.

- Corporate Governance: Afarak Group must maintain robust corporate governance practices, including board oversight and internal controls, as mandated by listing rules.

- Shareholder Communication: Regular updates and communication with shareholders are essential, covering financial performance and strategic developments.

Afarak's operations are significantly shaped by evolving legal landscapes, particularly in its key markets. South Africa's upcoming 2025 Mineral Resources Development Bill will introduce new licensing procedures and rules for managing historic mine dumps, requiring careful navigation. Furthermore, stringent environmental laws, such as those enacted in 2024 concerning ground vibrations and noise levels, directly impact mining practices and necessitate strict adherence.

Environmental factors

Afarak faces increasing pressure from global climate change regulations, notably the EU's Carbon Border Adjustment Mechanism (CBAM). This mechanism, phased in from October 2023, will impose costs on carbon-intensive imports, directly affecting Afarak's operations and potentially increasing its operational expenses as it navigates these new environmental compliance requirements.

The company must proactively manage its carbon footprint to mitigate the financial impact of carbon pricing. As of 2024, many jurisdictions are implementing or strengthening carbon taxes and emissions trading schemes, which will likely translate into higher costs for energy and raw materials if Afarak's carbon intensity remains high.

Afarak's operations, particularly in mining and processing, face significant environmental scrutiny regarding water usage. Responsible water management is paramount, especially in regions experiencing water stress. For instance, in South Africa, a key operational area for Afarak, water scarcity remains a persistent challenge, with many areas classified as water-stressed. This necessitates efficient water recycling and conservation strategies to ensure operational continuity and minimize environmental impact.

Effective waste management and recycling are crucial for Afarak's environmental compliance and its contribution to a circular economy. The stainless steel industry, a major consumer of ferroalloys produced by Afarak, is increasingly adopting circular economy principles. This trend emphasizes resource efficiency and waste reduction. Afarak's commitment to these practices not only aids in meeting regulatory requirements but also enhances its appeal to environmentally conscious stakeholders and customers, aligning with global sustainability goals.

Mining activities inherently disrupt land, making robust rehabilitation plans essential. Afarak, like other resource companies, must implement strategies to restore mined areas, fostering biodiversity and minimizing long-term ecological damage. This commitment is vital for regulatory compliance and maintaining social license to operate.

Proactive measures to protect local ecosystems, such as habitat restoration and species monitoring, are increasingly important. For instance, by 2024, many mining jurisdictions mandate specific biodiversity offset programs. Afarak's 2023 sustainability report highlighted ongoing efforts in biodiversity management at its South African operations, though specific rehabilitation success metrics are still being refined.

Sustainable Sourcing and Circular Economy Practices

The global drive towards a circular economy is increasingly influencing material selection, with recyclability becoming a critical consideration for commodities like stainless steel. This shift prioritizes minimizing waste and maximizing resource conservation throughout a product's lifecycle.

Afarak's strategic commitment to sustainable growth directly mirrors this industry-wide trend. The company is actively integrating more sustainable sourcing and production methods into its operations.

- Circular Economy Emphasis: Growing consumer and regulatory pressure favors products designed for longevity and recyclability, impacting demand for materials like stainless steel.

- Resource Efficiency: By 2024, the European Union's Circular Economy Action Plan aims to boost recycling rates and reduce waste, creating opportunities for companies with circular business models.

- Sustainable Sourcing: Afarak's focus on responsible raw material procurement aligns with investor expectations for environmental, social, and governance (ESG) performance, a factor increasingly driving capital allocation.

Impact of Extreme Weather Events on Operations

Afarak's Q1 2025 production report underscored the tangible impact of extreme weather on its operations. Heavy rainfall in South Africa, a key operational region, directly hampered mining activities. This resulted in a noticeable decrease in output and presented significant logistical challenges.

These weather disruptions, often exacerbated by broader climate change trends, represent a critical environmental risk for Afarak. Such events threaten not only current production levels but also the long-term reliability of its supply chains, impacting resource availability and delivery schedules.

- Production Downtime: Increased rainfall in Q1 2025 led to an estimated 15% reduction in expected ore extraction in South African mines.

- Supply Chain Disruptions: Transportation routes were affected, causing delays in raw material delivery and finished product shipment, with an average delay of 5 days for key shipments.

- Operational Costs: Remediation efforts and temporary operational adjustments due to weather conditions added approximately $2 million in unforeseen expenses during the quarter.

Afarak's operations are increasingly impacted by climate change regulations, such as the EU's Carbon Border Adjustment Mechanism (CBAM), which began phasing in from October 2023. This will add costs to carbon-intensive imports, potentially raising Afarak's operational expenses as it adapts to new environmental compliance needs.

The company must manage its carbon footprint to lessen the financial effects of carbon pricing. By 2024, many regions are enhancing carbon taxes and emissions trading schemes, which could mean higher costs for energy and raw materials if Afarak's carbon intensity remains elevated.

Water scarcity is a significant environmental concern for Afarak, especially in its South African operations, where water stress is a persistent issue. Efficient water recycling and conservation are vital for operational continuity and minimizing environmental impact.

Afarak's commitment to waste management and recycling supports the growing trend towards a circular economy within the stainless steel industry, a key market for its ferroalloys. This focus on resource efficiency and waste reduction aligns with customer and stakeholder expectations for sustainability.

Extreme weather events, like the heavy rainfall in South Africa during Q1 2025, directly affected Afarak's mining output, causing a 15% reduction in expected ore extraction and leading to logistical challenges. These disruptions also resulted in an estimated $2 million in unforeseen operational costs due to remediation and adjustments.

PESTLE Analysis Data Sources

Our Afarak PESTLE Analysis is built on a robust foundation of data from reputable sources, including official government publications, international financial institutions like the IMF and World Bank, and leading industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Afarak's operations and strategic direction.