Afarak Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Afarak Bundle

Afarak operates in a competitive landscape shaped by powerful buyer and supplier forces, alongside the constant threat of substitutes. Understanding these dynamics is crucial for navigating its market. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Afarak’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Afarak Group's control over its own chrome ore sources, specifically its mines in South Africa and Turkey, significantly diminishes the bargaining power of external suppliers. This vertical integration means Afarak is less dependent on the open market for its primary raw material, chrome ore. For instance, in 2023, Afarak's South African operations produced approximately 260,000 tonnes of chrome ore, showcasing a substantial internal supply.

While Afarak divested its Zeerust chrome mine in 2023, the company still possesses considerable chrome ore reserves in its remaining operational mines. This continued ownership of substantial reserves ensures a degree of self-sufficiency, further mitigating the influence that external chrome ore suppliers could exert on Afarak's operations and cost structure.

Energy, especially electricity and coal, is a major expense for making ferroalloys, making Afarak sensitive to energy price swings. For 2025, while coal prices are expected to stay steady, electricity costs are unlikely to drop significantly, which will affect how profitable the company is.

High energy expenses, particularly in Europe, can really squeeze producers like Afarak, directly impacting their profit margins. For instance, in 2024, electricity prices in many European countries remained elevated, with some industrial consumers facing increases of over 10% compared to the previous year, directly adding to production costs.

While chrome ore is a critical input for Afarak's ferrochrome production, the availability of alternative raw materials, such as manganese ore, can impact the broader ferroalloy market. For instance, manganese ore prices saw a notable decline in early 2024, but major producers initiated production cuts to support pricing, demonstrating a degree of supplier leverage.

Switching Costs for Afarak

Afarak faces significant switching costs related to its core raw material suppliers and energy sources. Reconfiguring mining operations or processing plants to accommodate new input providers would require substantial capital expenditure and extensive downtime, impacting production efficiency. For instance, the specialized nature of ferrochrome production means that sourcing alternative raw materials like chromite ore often necessitates adjustments to smelting processes and equipment, which are not easily or cheaply changed.

The company’s investments in integrated mining and processing infrastructure create high barriers to quickly switching key input providers. These assets, designed for specific operational workflows, make it economically unfeasible to pivot to different suppliers without considerable reinvestment. This lock-in effect strengthens the bargaining power of existing suppliers who understand the cost and complexity of Afarak finding alternatives.

While long-term contracts for essential inputs like electricity or specialized alloys can offer price stability, they simultaneously reduce Afarak’s agility. These agreements, though beneficial in hedging against short-term market fluctuations, can limit the company's ability to capitalize on more favorable pricing from new suppliers should they emerge. This contractual rigidity further entrenches the bargaining power of current suppliers.

- High Capital Investment: Reconfiguring mining and processing facilities for new raw materials or energy sources represents a significant capital outlay for Afarak, making supplier switching costly.

- Operational Disruption: Changes in core input suppliers would likely lead to temporary shutdowns or reduced operational efficiency during the transition period.

- Specialized Infrastructure: Afarak's specialized ferrochrome production facilities are designed for specific raw material inputs, increasing the difficulty and expense of sourcing alternatives.

- Long-Term Contracts: Existing long-term supply agreements, while providing stability, limit Afarak's flexibility to switch suppliers even if more cost-effective options become available.

Supplier Forward Integration Potential

The potential for suppliers to integrate forward into Afarak's business, specifically ferroalloy production, presents a theoretical challenge to its bargaining power. Large mining operations supplying raw materials possess the capital and scale to consider such a move. For instance, in 2023, global commodity prices saw significant fluctuations, making diversification attractive for some large players.

However, this forward integration is fraught with practical difficulties. It demands substantial capital investment, often in the billions, for specialized metallurgical plants and advanced processing technologies. Furthermore, navigating established market channels and building brand recognition in the ferroalloy sector requires considerable time and expertise, creating a high barrier to entry. For example, establishing a new ferroalloy smelter can cost upwards of $500 million to $1 billion.

- High Capital Requirements: Building ferroalloy production facilities necessitates massive upfront investment, often exceeding $500 million.

- Specialized Expertise Needed: Metallurgical knowledge and operational experience are crucial for successful ferroalloy manufacturing.

- Market Access Challenges: Gaining traction in established markets with existing players requires significant effort and resources.

- Limited Immediate Threat: The practical hurdles mean that significant forward integration by Afarak's non-captive suppliers is unlikely in the short to medium term.

Afarak's vertical integration into chrome ore mining significantly reduces the bargaining power of external chrome ore suppliers. For instance, in 2023, Afarak's South African operations produced approximately 260,000 tonnes of chrome ore, demonstrating a strong internal supply base.

While Afarak divested its Zeerust mine in 2023, its remaining reserves provide a buffer against external supply pressures. However, energy costs, particularly electricity, remain a significant factor, with European industrial electricity prices in 2024 showing increases of over 10% for some consumers, impacting Afarak's production costs.

High switching costs for raw materials and energy sources, coupled with specialized infrastructure, lock Afarak into existing supplier relationships. Long-term contracts, while offering stability, also limit flexibility, effectively strengthening the bargaining power of current suppliers.

The threat of suppliers integrating forward into ferroalloy production is mitigated by the substantial capital investment, estimated at over $500 million, and specialized expertise required, making this an unlikely short-to-medium term scenario for Afarak's suppliers.

What is included in the product

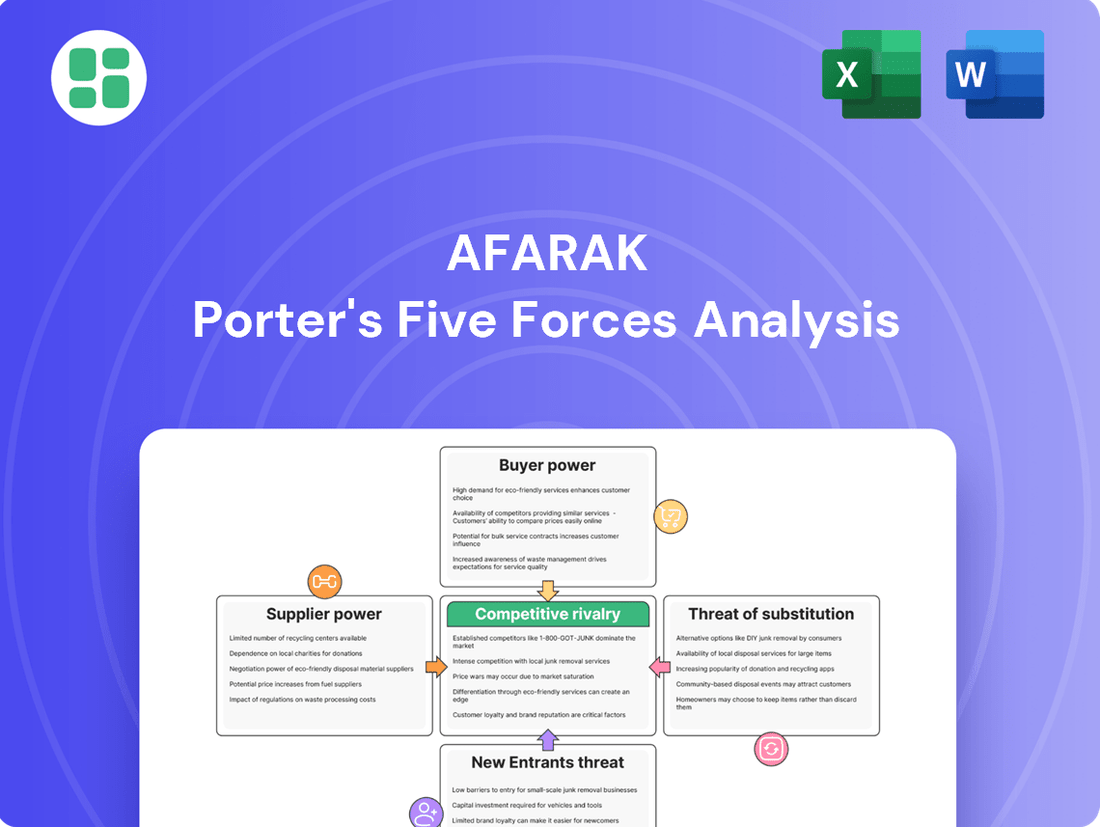

This analysis unpacks the competitive forces impacting Afarak, assessing the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry within the ferroalloy industry.

Quickly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces impacting Afarak.

Customers Bargaining Power

Afarak's core customers are major stainless steel and specialty steel producers, a sector dominated by a few large global entities. Companies such as Outokumpu, Tata Steel, and Nippon Steel represent significant buyers, possessing considerable leverage due to their substantial order volumes and market importance.

This concentration of powerful buyers means that Afarak faces customers who can exert substantial influence over pricing and contract terms. For instance, in 2024, the top five stainless steel producers globally accounted for a significant portion of the market share, underscoring the concentrated nature of Afarak's customer base and their inherent bargaining power.

Customers' price sensitivity is notably elevated, especially considering the subdued demand for stainless steel throughout 2024. This environment, coupled with significant price pressure from imported ferroalloys, grants buyers considerable leverage.

Afarak's own financial reporting for 2024 underscored this, revealing how weak stainless steel demand, particularly within the European market, directly eroded its profit margins.

The overcapacity prevalent in the global ferroalloy market further amplifies this customer bargaining power, enabling them to more effectively negotiate for reduced prices.

Ferroalloys, particularly ferrochrome, are vital for stainless steel, providing essential corrosion resistance and strength. Customers rely on these alloys for product integrity, ensuring consistent demand. However, the largely standardized nature of these materials means buyers focus heavily on competitive pricing to manage their own production costs.

Customer Switching Costs

Customer switching costs in the ferroalloy market are a key factor influencing the bargaining power of buyers. For many standard ferroalloy products, these costs are typically moderate. This means that if a customer can find better pricing or more favorable terms from another supplier, they can often switch without incurring significant expenses or operational disruptions.

This moderate switching cost environment is further amplified by common customer practices. Many buyers actively source from multiple suppliers to guarantee supply chain resilience and to maintain leverage in price negotiations. For instance, a large steel producer might have contracts with three or four different ferrochrome suppliers, allowing them to shift volumes based on prevailing market conditions.

However, the situation can change for more specialized or custom ferroalloy products. In these cases, switching suppliers can become more complex and costly. Customers might face higher qualification expenses, needing to re-certify new materials and potentially adjust their own manufacturing processes to accommodate the new alloy specifications.

These varying switching costs directly impact customer bargaining power:

- Moderate switching costs for standard alloys empower customers to seek better deals.

- Sourcing from multiple suppliers enhances customer leverage.

- Higher qualification and process adjustment costs for specialized alloys can reduce customer switching flexibility.

- In 2024, the global ferroalloys market, valued at approximately $120 billion, saw intense competition, further empowering buyers with choices.

Customer Backward Integration Potential

Large steel manufacturers, a key customer segment for ferroalloy producers like Afarak, possess significant financial muscle and the technical know-how to potentially produce their own ferroalloys. This capability, known as backward integration, means they could bypass current suppliers if they deem it advantageous.

Indeed, some integrated steel producers already have the infrastructure and expertise to engage in ferroalloy production, making this a very real and present threat. For instance, in 2024, global steel production reached approximately 1.9 billion tonnes, highlighting the sheer scale of these potential customers.

The mere existence of this backward integration potential significantly constrains the pricing power of ferroalloy producers. Customers know they have an alternative, which inherently limits how much ferroalloy suppliers can charge for their products.

- Customer Financial Capacity: Major steel companies often have annual revenues in the tens of billions of dollars, providing ample capital for backward integration projects.

- Technical Expertise: Steel manufacturing involves complex metallurgical processes, meaning the technical skills required for ferroalloy production are often already present within these organizations.

- Existing Capabilities: Some steel giants already operate their own mining or processing facilities, making the leap to ferroalloy production a logical, albeit significant, extension.

- Market Influence: The substantial volume of ferroalloys consumed by these large customers gives them considerable leverage in negotiations, further amplified by their integration potential.

Afarak's customers, primarily large stainless steel producers, wield substantial bargaining power. Their significant order volumes and the concentrated nature of the steel industry, where a few global players dominate, allow them to exert considerable influence over pricing and terms. This leverage is amplified by subdued demand for stainless steel in 2024 and overcapacity in the ferroalloy market, forcing suppliers to compete aggressively on price.

The moderate switching costs for standard ferroalloys enable customers to easily shift between suppliers if better deals are available, further empowering their negotiation position. Additionally, the potential for backward integration, where large steel manufacturers could produce their own ferroalloys, acts as a constant constraint on pricing for companies like Afarak.

| Customer Leverage Factor | Description | Impact on Afarak |

| Customer Concentration | Domination by a few large global steel producers | High pressure on pricing and terms |

| Demand Conditions | Subdued stainless steel demand in 2024 | Weakened supplier pricing power |

| Market Overcapacity | Overcapacity in the global ferroalloy market | Intensified price competition |

| Switching Costs (Standard Alloys) | Moderate costs for standard ferroalloys | Facilitates customer supplier switching |

| Backward Integration Potential | Ability of large steel producers to produce own ferroalloys | Limits ferroalloy supplier pricing power |

Preview the Actual Deliverable

Afarak Porter's Five Forces Analysis

This preview showcases the complete Afarak Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. The document you see is precisely what you will receive immediately after purchase, ensuring no surprises or missing information. You'll gain instant access to this professionally formatted analysis, ready for immediate use and strategic decision-making.

Rivalry Among Competitors

The global ferroalloy market, particularly for ferrochrome, is characterized by a significant number of competitors, creating a fragmented landscape. Afarak faces competition from large, integrated producers and smaller, specialized firms alike.

Key global players like Glencore, Tata Steel, Samancor, and Sinosteel are direct rivals. This broad competitive base intensifies rivalry, especially in periods of market oversupply, which can pressure pricing and margins.

The ferroalloy industry, particularly for products like silicomanganese and ferrosilicon, is grappling with significant excess production capacity. This oversupply situation directly impacts operating rates for manufacturers, forcing them to run at lower utilization levels. Consequently, this imbalance between available supply and market demand puts considerable pressure on the profitability of alloy producers.

This excess capacity intensifies competitive rivalry as companies are compelled to compete more aggressively for a limited customer base. Manufacturers often resort to price reductions to move inventory, further eroding profit margins. For instance, in early 2024, reports indicated that certain ferroalloy markets were operating at utilization rates below 70% due to this capacity overhang.

Afarak contends with substantial price pressure stemming from the influx of low-cost ferroalloy imports. Key originating regions include India, Kazakhstan, Russia, and China, whose competitive pricing strategies directly impact Afarak's profit margins.

This global pricing dynamic compels domestic producers, including Afarak, to relentlessly pursue operational cost reductions to maintain competitiveness. For instance, in 2024, the global average price for ferrochrome, a key product for many in the industry, saw fluctuations influenced by these import pressures, with some benchmarks indicating year-on-year decreases in certain periods.

The intense competition from these lower-cost international suppliers significantly heightens rivalry within the ferroalloy market. Consequently, Afarak's ability to exert pricing power is considerably diminished, forcing a strategic focus on efficiency and value-added offerings to differentiate itself.

Weak Stainless Steel Demand

The demand for stainless steel, a key consumer of ferroalloys, remained sluggish in Europe throughout 2024, impacting the entire supply chain. Global stainless steel demand also faced headwinds during the year.

This weak underlying demand forces ferroalloy producers to compete aggressively on price to maintain sales volumes, intensifying rivalry. For instance, European ferrochrome prices saw significant downward pressure in early 2024 due to these market conditions.

- Weak European Stainless Steel Demand: Continued low demand from Europe's stainless steel sector in 2024 directly curtails orders for ferroalloys.

- Global Market Challenges: Broader global economic factors also contributed to subdued stainless steel consumption in 2024.

- Aggressive Pricing Strategies: Competitors are compelled to offer lower prices to secure limited sales, increasing competitive intensity.

- Anticipated Slow Recovery: The forecast for a gradual recovery in steel demand in 2025 suggests that competitive pricing pressures will likely persist.

Capital-Intensive Nature and High Exit Barriers

The ferroalloy industry demands massive upfront investment in mining, smelting, and refining facilities, making it inherently capital-intensive. For instance, establishing a new ferrochrome plant can cost hundreds of millions of dollars.

These substantial fixed costs translate into high exit barriers. Companies often continue to operate, even at reduced capacity, to cover ongoing expenses and avoid the significant losses associated with shutting down and liquidating assets.

This dynamic can lead to persistent oversupply in the market as producers struggle to leave, intensifying competitive rivalry among existing players. In 2024, many ferroalloy producers faced this challenge, with fluctuating demand and volatile raw material prices exacerbating the pressure to maintain production levels.

- High Capital Investment: Ferroalloy production requires significant capital for mining, processing plants, and specialized equipment.

- Exit Barriers: Substantial fixed costs and specialized assets make it difficult and costly for companies to leave the market.

- Operational Continuation: Companies may continue production at lower rates to cover fixed costs, contributing to market oversupply.

- Intensified Rivalry: The difficulty in exiting the market fuels intense competition among remaining players, especially during downturns.

Competitive rivalry in the ferroalloy sector is fierce, driven by numerous global players and significant excess production capacity. This oversupply, exacerbated by weak demand for key downstream products like stainless steel in 2024, forces producers into aggressive price competition, squeezing profit margins. High capital requirements and exit barriers mean companies often continue operating even at low utilization, further intensifying this rivalry.

| Competitor Type | Key Players | Impact on Rivalry |

|---|---|---|

| Integrated Producers | Glencore, Tata Steel, Samancor, Sinosteel | Intensify competition through scale and market share. |

| Specialized Firms | Various regional players | Add to market fragmentation and niche competition. |

| Low-Cost Importers | India, Kazakhstan, Russia, China | Exert significant price pressure on domestic producers. |

SSubstitutes Threaten

Afarak's primary products, ferroalloys like ferrochrome and ferrosilicon, are fundamental to stainless steel manufacturing. These materials impart crucial qualities such as durability and resistance to rust, which are hard to achieve with alternative substances. For instance, ferrochrome is essential for providing stainless steel's signature corrosion resistance.

The market for stainless steel relies heavily on these specific ferroalloys, and there aren't many direct material replacements that can match their performance and cost-effectiveness. This makes it challenging for industries to switch away from them easily. In 2023, global stainless steel production reached approximately 57 million metric tons, underscoring the scale of demand for these core inputs.

Consequently, the threat of direct material substitutes for Afarak's core ferroalloy products remains relatively low. The inherent technical requirements and economic viability of using ferroalloys in steel production create a strong barrier against easy substitution, securing their position in the supply chain.

While direct substitutes for ferroalloys in steel production are scarce, a notable indirect threat emerges from end-user industries exploring alternative materials. For instance, the automotive sector, a major consumer of steel, is increasingly adopting lightweight materials like aluminum and advanced composites to improve fuel efficiency. This trend, if it accelerates, could significantly reduce the demand for steel and, consequently, ferroalloys.

Similarly, the construction industry is experimenting with engineered plastics and advanced polymers for certain applications, potentially lessening its reliance on steel. A widespread shift towards these substitutes in key sectors could directly impact the market for ferroalloys. For example, global aluminum consumption reached approximately 69 million metric tons in 2023, highlighting its growing presence as an alternative material.

Technological advancements in steel production, particularly the rise of 'green steel' and novel alloying methods, pose a potential threat of substitutes. These innovations could impact the demand for traditional ferroalloys used in steelmaking. For instance, advancements in direct reduced iron (DRI) processes, often powered by hydrogen, might reduce the reliance on traditional blast furnace routes that heavily utilize ferroalloys.

While these technological shifts may not entirely eliminate the need for ferroalloys, they could significantly alter the types and volumes required. For example, the development of advanced high-strength steels (AHSS) with specific microstructures might necessitate different alloying elements or concentrations compared to conventional grades. The global steel industry is increasingly focused on sustainability; by 2024, the European Union's Carbon Border Adjustment Mechanism (CBAM) is already influencing production methods, pushing for lower-carbon steel, which indirectly affects the inputs like ferroalloys.

Price-Performance Trade-off of Alternatives

The threat of substitutes for ferroalloys in steel production hinges on the price-performance trade-off. Any alternative material or technology must offer a significantly better value proposition to displace the entrenched use of ferroalloys.

Ferroalloys have a long history of providing cost-effective solutions for imparting specific properties to steel, such as strength, hardness, and corrosion resistance. For a substitute to gain traction, it would need to match or exceed this efficiency without a substantial cost increase.

Customers in the steel industry face considerable costs associated with retooling manufacturing processes and re-engineering their products to accommodate new materials. This significant investment barrier makes the adoption of substitutes challenging unless the benefits are overwhelmingly clear.

- Price-Performance Imperative: Substitutes must offer a superior price-performance ratio to displace ferroalloys.

- Established Efficiency: Ferroalloys are proven, cost-effective for achieving desired steel properties.

- Customer Investment Barrier: Significant costs for retooling and re-engineering hinder substitute adoption.

Recycling and Circular Economy Impact

The growing emphasis on ferrochrome recycling and incorporating recycled materials into steelmaking processes presents a significant threat of substitutes for primary ferroalloy production. For instance, by 2024, the European Union's circular economy action plan aims to boost recycling rates across various sectors, potentially impacting demand for virgin materials like ferrochrome.

This shift towards a circular economy means that a portion of the demand for newly mined or processed ferrochrome could be satisfied by recycled sources. This trend could gradually reduce market volumes for new ferrochrome production as more industries adopt recycling initiatives.

- Ferrochrome Recycling: Increasing adoption of ferrochrome recycling in steel production acts as a direct substitute for primary ferrochrome.

- Circular Economy Initiatives: Global and regional policies promoting circular economies, like those in the EU, are driving the use of recycled materials, thereby substituting primary resources.

- Market Volume Impact: The integration of recycled ferrochrome can lead to a reduction in the demand for newly produced ferrochrome, affecting market share for primary producers.

- Sustainability Drivers: Environmental regulations and corporate sustainability goals are accelerating the adoption of recycled ferrochrome, further intensifying the substitution threat.

While direct material substitutes for Afarak's core ferroalloys are limited due to their essential role in stainless steel, indirect threats are growing. End-user industries are exploring alternatives like aluminum and composites to reduce steel usage, potentially impacting ferroalloy demand. For example, global aluminum consumption was around 69 million metric tons in 2023.

Technological advancements, such as green steel production and new alloying methods, also pose a threat by potentially altering the types and volumes of ferroalloys needed. The EU's Carbon Border Adjustment Mechanism (CBAM) in 2024 is already pushing for lower-carbon steel, indirectly affecting ferroalloy inputs.

Furthermore, the increasing focus on ferrochrome recycling, driven by circular economy initiatives, directly substitutes primary ferrochrome production. The EU's circular economy action plan, active by 2024, aims to boost recycling rates, potentially reducing demand for virgin materials.

| Threat Type | Description | Example/Data Point |

|---|---|---|

| Indirect Material Substitution | End-user industries adopting lighter materials like aluminum and composites. | Global aluminum consumption reached ~69 million metric tons in 2023. |

| Technological Substitution | Advancements in steelmaking reducing reliance on traditional ferroalloys. | EU's CBAM (2024) influencing production towards lower-carbon steel. |

| Recycling Substitution | Increased use of recycled ferrochrome replacing primary production. | EU circular economy initiatives boosting recycling rates. |

Entrants Threaten

The ferroalloy industry, especially for companies like Afarak with integrated mining and processing operations, necessitates immense capital investment. Building and equipping chrome mines, alongside establishing or purchasing ferroalloy smelters and associated infrastructure, requires billions of dollars. This substantial financial commitment serves as a significant deterrent for new companies looking to enter the market.

The threat of new entrants in the ferrochrome market, particularly concerning access to raw material reserves, is significantly mitigated by the high cost and difficulty of securing economically viable chrome ore. Control over these reserves is paramount for efficient ferrochrome production, and the limited availability of high-quality, accessible ore bodies presents a substantial natural barrier to entry.

Afarak's strategic advantage lies in its ownership of mines in South Africa and Turkey, which ensures a secure and consistent supply chain. This direct control over essential raw materials makes it exceedingly challenging for potential new competitors to establish a comparable footing without similar upstream integration, a feat that requires substantial capital investment and time.

Established players like Afarak leverage significant economies of scale in mining and ferroalloy processing. For instance, in 2024, Afarak's production capacity in its key operations allowed for substantial cost efficiencies, making it challenging for new, smaller entrants to match their per-unit pricing. This scale translates directly into lower operational costs, a critical barrier for newcomers.

The experience curve also plays a crucial role. Afarak has decades of accumulated knowledge in optimizing mining extraction, smelting, and ferroalloy production. This deep understanding of operational nuances, supply chain management, and quality control, honed over years, provides a distinct competitive edge that is difficult and time-consuming for new entrants to replicate, impacting their ability to achieve comparable efficiency and profitability.

Strict Environmental and Regulatory Hurdles

The mining and metallurgical sectors are heavily regulated, demanding extensive environmental permits and social licenses to operate. New companies entering this space must navigate complex approval processes and adhere to continuously evolving environmental standards, significantly increasing both the cost and time to market. For instance, in 2024, the average time to secure mining permits in many jurisdictions exceeded 18 months, with compliance costs often representing 15-20% of initial capital expenditure.

These stringent regulatory frameworks create substantial barriers to entry, requiring new players to possess considerable financial resources and expertise to manage compliance. The ongoing investment needed to meet these standards, such as implementing advanced emission controls and waste management systems, further deters potential entrants. In 2023, companies investing in new mining operations reported that environmental compliance alone accounted for over $500 million in capital outlay for large-scale projects.

- Stringent Environmental Regulations: Compliance with air, water, and land protection laws is mandatory.

- Complex Permitting Processes: Obtaining necessary approvals can take years and involve multiple government agencies.

- Social License to Operate: Gaining community acceptance and support is crucial and often challenging.

- Evolving Standards: Keeping up with new environmental requirements adds ongoing costs and operational complexity.

Established Distribution Channels and Customer Relationships

Afarak benefits from deeply entrenched relationships with global stainless steel producers, a critical customer base for its ferroalloys. This mature distribution network is not easily replicated. For instance, in 2024, the global stainless steel market was valued at over $200 billion, with established players having long-standing supply agreements.

New entrants face significant hurdles in establishing their own sales and marketing infrastructure and must overcome customer loyalty. Convincing these established customers to switch from proven suppliers in such a vital input industry requires substantial investment and a compelling value proposition, acting as a strong deterrent.

- Established Global Network: Afarak's existing relationships with major stainless steel producers provide immediate market access.

- High Customer Switching Costs: Stainless steel manufacturers often prioritize reliability and proven quality, making it difficult for new suppliers to gain traction.

- Distribution Infrastructure: Building a comparable distribution network for ferroalloys demands considerable capital and time investment.

The threat of new entrants in the ferroalloy sector, particularly for integrated players like Afarak, is considerably low due to the massive capital expenditure required for mining and smelting operations. Securing access to quality chrome ore reserves, as Afarak has in South Africa and Turkey, is a significant natural barrier, demanding billions in investment and years to establish. In 2024, the cost of developing a new, medium-sized mine could easily exceed $1 billion, further limiting potential competition.

Existing players benefit from substantial economies of scale, with Afarak's 2024 production capacity enabling cost efficiencies that new, smaller operations cannot match. Decades of operational experience also provide a competitive edge, making it difficult for newcomers to achieve comparable efficiency and profitability. The global stainless steel market, a key customer base valued at over $200 billion in 2024, also presents high switching costs for customers, reinforcing the advantage of established suppliers.

| Barrier to Entry | Description | Impact on New Entrants | Example Data (2024 unless otherwise stated) |

|---|---|---|---|

| Capital Requirements | Establishing integrated mining and smelting facilities requires billions of dollars. | High barrier, limiting the number of potential entrants. | Estimated cost for a new medium-sized mine: >$1 billion. |

| Raw Material Access | Control over high-quality chrome ore reserves is crucial and limited. | Significant natural barrier; securing viable reserves is challenging and costly. | Afarak's ownership of mines in South Africa and Turkey provides a secure supply. |

| Economies of Scale | Larger operations achieve lower per-unit production costs. | New entrants struggle to compete on price with established, high-volume producers. | Afarak's production capacity in 2024 allowed for significant cost efficiencies. |

| Customer Relationships & Switching Costs | Deeply entrenched relationships with major customers (e.g., stainless steel producers) and high costs to switch suppliers. | Difficult for new entrants to gain market access and displace established players. | Global stainless steel market valued at >$200 billion in 2024. |

| Regulatory & Environmental Compliance | Complex permitting, stringent environmental standards, and social license requirements. | Increases cost and time to market; requires significant expertise and financial resources. | Average mining permit acquisition time: >18 months; compliance costs can be 15-20% of initial capex. |

Porter's Five Forces Analysis Data Sources

Our Afarak Porter's Five Forces analysis is built upon comprehensive data from Afarak's annual reports, investor presentations, and industry-specific market research reports. We also incorporate data from financial news outlets and competitor filings to provide a robust understanding of the competitive landscape.