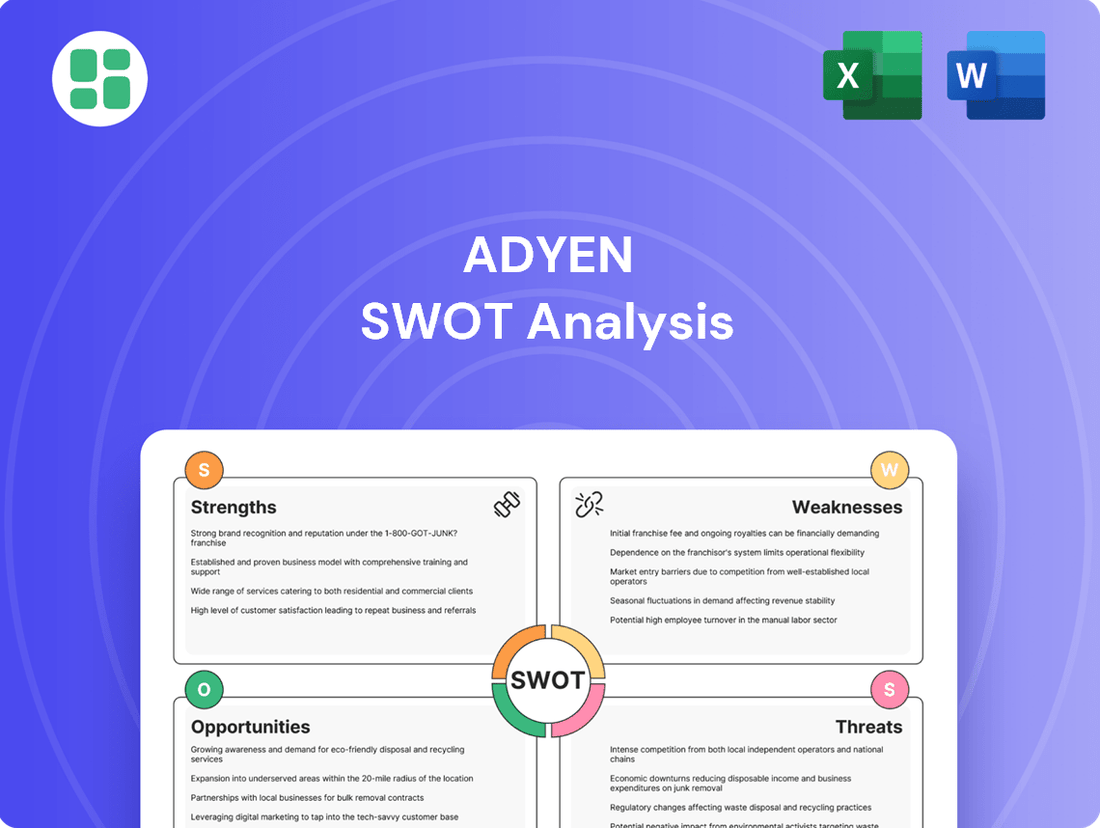

Adyen SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adyen Bundle

Adyen's robust technology platform and global reach are clear strengths, but they also face intense competition and evolving regulatory landscapes. Understanding the nuances of these factors is crucial for anyone looking to capitalize on Adyen's market position or mitigate potential risks.

Want the full story behind Adyen's strengths, opportunities, weaknesses, and threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning, pitches, and research.

Strengths

Adyen's unified global platform is a significant strength, offering a single, end-to-end solution that directly connects to card networks and local payment methods across the globe. This integration streamlines everything from payment processing to risk management and acquiring services, simplifying operations for merchants. For instance, Adyen reported processing €607.5 billion in total payment volume in 2023, a testament to the scale and efficiency of its unified system.

Adyen's financial performance is a significant strength, marked by consistent and impressive growth. In the second half of 2024, the company achieved a net revenue of €1.08 billion, a 22% increase compared to the same period in the previous year. This upward trend continued throughout the full year 2024, with net revenue climbing to €1.99 billion, reflecting a solid 23% year-on-year expansion.

Further underscoring its financial robustness, Adyen has shown remarkable profitability. The company's EBITDA margin reached an impressive 53% in H2 2024, and for the full year 2024, it stood at a healthy 50%. This strong margin indicates efficient operational management and a substantial capacity to convert revenue into profit, a key indicator of a healthy business.

Adyen's commitment to innovation is evident in its substantial investments in research and development, fueling continuous enhancements to its technology. For instance, in 2023, Adyen continued to prioritize R&D, a core driver of its growth strategy, though specific figures for 2024 are still emerging as the year progresses.

The company actively deploys advanced AI-powered solutions, such as Uplift and Intelligent Payment Routing. These tools are designed to streamline payment processes, leading to reduced operational expenses and improved customer conversion rates. While specific 2024 performance metrics for these AI features are not yet fully quantified, their ongoing development signals a strong focus on efficiency gains for Adyen's clients.

These technological leaps are crucial for Adyen to maintain its competitive edge in the dynamic fintech sector. By consistently pushing the boundaries of payment technology, Adyen aims to deliver enhanced value and superior performance for its diverse client base.

Strong Enterprise Client Focus and 'Land and Expand' Strategy

Adyen's strength lies in its deep focus on large enterprise clients, evidenced by its success with major global brands. This client concentration is key to its 'land and expand' strategy, where the company initially secures a relationship and then grows its share of business within that account. This methodical expansion drives substantial increases in processed volume and revenue.

The 'land and expand' model is a significant growth engine for Adyen. For instance, in the first half of 2024, the company reported a 24% year-over-year increase in total payment volume, reaching €397.4 billion. This growth is directly attributable to deepening relationships with existing, high-value clients, thereby increasing wallet share and solidifying Adyen's role as a critical payment partner.

- Proven Enterprise Client Base: Adyen's ability to attract and retain top-tier global businesses underscores its platform's robustness and scalability.

- 'Land and Expand' Success: This strategy has consistently driven processed volume and revenue growth by increasing the services provided to existing customers.

- Customer Loyalty and Trust: By delivering comprehensive payment solutions, Adyen fosters strong partnerships, making it a trusted provider for large enterprises.

- Significant Volume Growth: The company's processed payment volume, which reached €397.4 billion in H1 2024, highlights the success of its enterprise-focused approach.

High Processing Volume and Scalability

Adyen's platform is built for massive scale, a critical strength in the fast-paced payments industry. In 2024 alone, the company processed an astonishing €1 trillion in global payment transactions. This sheer volume capability means Adyen can comfortably handle the demands of its largest clients, processing millions of transactions every single day without a hitch. This robust infrastructure is a significant differentiator, allowing them to support businesses as they grow and expand globally.

This high processing volume and scalability translate directly into a powerful competitive advantage. Businesses of all sizes, from burgeoning startups to multinational corporations, rely on Adyen to manage their payment flows efficiently and reliably. The platform's ability to absorb and process such vast amounts of data smoothly ensures a seamless experience for both merchants and consumers, even during peak periods. This operational resilience is paramount in maintaining customer trust and satisfaction.

- Massive Transaction Volume: Processed over €1 trillion in global payments in 2024.

- Scalability for Large Clients: Adept at handling millions of daily transactions for major businesses.

- Competitive Edge: Robust infrastructure provides a key advantage in the expanding digital payments sector.

Adyen's unified global platform is a significant strength, offering a single, end-to-end solution that directly connects to card networks and local payment methods across the globe. This integration streamlines everything from payment processing to risk management and acquiring services, simplifying operations for merchants. For instance, Adyen reported processing €607.5 billion in total payment volume in 2023, a testament to the scale and efficiency of its unified system.

Adyen's financial performance is a significant strength, marked by consistent and impressive growth. In the second half of 2024, the company achieved a net revenue of €1.08 billion, a 22% increase compared to the same period in the previous year. This upward trend continued throughout the full year 2024, with net revenue climbing to €1.99 billion, reflecting a solid 23% year-on-year expansion.

Further underscoring its financial robustness, Adyen has shown remarkable profitability. The company's EBITDA margin reached an impressive 53% in H2 2024, and for the full year 2024, it stood at a healthy 50%. This strong margin indicates efficient operational management and a substantial capacity to convert revenue into profit, a key indicator of a healthy business.

Adyen's commitment to innovation is evident in its substantial investments in research and development, fueling continuous enhancements to its technology. For instance, in 2023, Adyen continued to prioritize R&D, a core driver of its growth strategy, though specific figures for 2024 are still emerging as the year progresses. The company actively deploys advanced AI-powered solutions, such as Uplift and Intelligent Payment Routing, designed to streamline payment processes, leading to reduced operational expenses and improved customer conversion rates.

Adyen's strength lies in its deep focus on large enterprise clients, evidenced by its success with major global brands. This client concentration is key to its 'land and expand' strategy, where the company initially secures a relationship and then grows its share of business within that account. This methodical expansion drives substantial increases in processed volume and revenue. For instance, in the first half of 2024, the company reported a 24% year-over-year increase in total payment volume, reaching €397.4 billion, directly attributable to deepening relationships with existing, high-value clients.

Adyen's platform is built for massive scale, a critical strength in the fast-paced payments industry. In 2024 alone, the company processed an astonishing €1 trillion in global payment transactions. This sheer volume capability means Adyen can comfortably handle the demands of its largest clients, processing millions of transactions every single day without a hitch. This robust infrastructure is a significant differentiator, allowing them to support businesses as they grow and expand globally.

| Metric | H1 2024 | Full Year 2024 (est.) | 2023 |

|---|---|---|---|

| Total Payment Volume | €397.4 billion | €750-800 billion (guidance) | €607.5 billion |

| Net Revenue | N/A | €1.99 billion | €1.4 billion |

| EBITDA Margin | N/A | 50% | N/A |

What is included in the product

Explores the strategic advantages and threats impacting Adyen’s success by examining its internal capabilities and external market dynamics.

Adyen's SWOT analysis helps alleviate the pain of fragmented payment processing by highlighting its strengths in unified platforms and global reach, thereby simplifying complex financial operations.

Weaknesses

Adyen's reliance on a few very large enterprise clients presents a significant concentration risk. The departure or even a slowdown in business from one of these major customers can disproportionately affect overall processed volume growth. For instance, in late 2024, the reduced activity of a key digital client directly impacted Adyen's reported transaction volumes, even though its revenue impact was somewhat cushioned by its volume-based pricing model.

Adyen's business model is heavily reliant on transaction fees, which means its revenue is directly tied to the volume of payments processed. This makes the company vulnerable to shifts in global economic activity and consumer spending habits. For instance, a slowdown in retail sales or a decrease in online purchasing could significantly impact Adyen's top line.

This dependency on transaction volume exposes Adyen to macroeconomic headwinds. A global recession or even localized economic downturns can lead to reduced consumer spending, directly affecting the number of transactions Adyen facilitates and, consequently, its revenue. For example, if consumer spending in key markets like Europe or North America contracts, Adyen's growth trajectory could be hampered.

Adyen operates in a fiercely competitive fintech landscape, facing formidable rivals such as Stripe, PayPal, and Worldpay. This crowded market often triggers aggressive pricing tactics from competitors, which can put a strain on Adyen's profit margins.

To stay ahead, Adyen must consistently innovate and demonstrate superior value compared to competitors who might focus on lower costs. The pressure to differentiate through technology and service is constant, as simply competing on price is unsustainable in this dynamic sector.

Vulnerability to Evolving Regulatory Landscapes

Adyen's global operations expose it to a fragmented and constantly shifting regulatory environment. Navigating diverse payment regulations, data privacy mandates like GDPR, and varying compliance standards across its many operating countries requires substantial and ongoing investment in legal and technical resources. For example, in 2024, the European Union continued to refine PSD3 (Payment Services Directive 3), impacting how payment service providers handle data and security, a process Adyen must actively manage.

The complexity of adapting to these evolving rules presents a significant challenge. Failure to maintain compliance can lead to severe consequences, including substantial financial penalties, damage to Adyen's reputation, and potential disruptions to its payment processing services. Staying ahead of these changes is critical for maintaining trust and operational stability.

Potential for Slower Margin Expansion

While Adyen saw robust EBITDA margin expansion in 2024, the company anticipates a more moderate pace of growth in 2025. This slowdown is attributed to strategic investments in talent acquisition, especially within key growth regions like North America, Japan, and India. These hires, though crucial for long-term expansion, are expected to moderate immediate profitability improvements.

Planned increased hiring in 2025, particularly in North America, Japan, and India, is a key factor influencing the projected slower margin expansion. These investments are designed to bolster Adyen's presence and capabilities in strategically important markets, aiming for sustained future growth. However, the associated personnel costs will likely impact short-term margin performance.

- Projected Slower Margin Expansion: Management guidance indicates a deceleration in EBITDA margin growth for 2025 compared to the strong performance observed in 2024.

- Strategic Hiring Initiatives: Significant planned hiring in growth markets such as North America, Japan, and India is a primary driver for the anticipated moderation in margin expansion.

- Investment for Future Growth: While these investments in personnel are crucial for Adyen's long-term strategic objectives and market penetration, they are expected to temper near-term profitability gains.

Adyen's dependence on a concentrated client base poses a notable risk, as the loss or reduced activity of a major customer could significantly impact processed volumes. The company's revenue model, tied directly to transaction fees, makes it susceptible to economic downturns and shifts in consumer spending. Furthermore, Adyen faces intense competition from players like Stripe and PayPal, which can lead to pricing pressures that affect profit margins.

Adyen's global operations are subject to a complex and evolving regulatory landscape, requiring substantial ongoing investment in compliance and legal resources. For instance, the ongoing refinement of payment directives like PSD3 in the EU necessitates continuous adaptation. Failure to comply with these varied regulations can result in severe penalties and operational disruptions.

Adyen anticipates a more moderate pace of EBITDA margin expansion in 2025 compared to 2024, largely due to strategic investments in talent acquisition, particularly in key growth markets like North America, Japan, and India. These personnel costs, while essential for long-term expansion, are expected to temper immediate profitability improvements.

| Weakness | Description | Impact |

|---|---|---|

| Client Concentration | Reliance on a few large enterprise clients. | Disproportionate impact from client slowdowns or departures. |

| Transaction Volume Dependency | Revenue directly linked to processed payment volumes. | Vulnerability to economic downturns and reduced consumer spending. |

| Intense Competition | Fierce rivalry from fintech companies like Stripe and PayPal. | Potential for aggressive pricing strategies impacting profit margins. |

| Regulatory Complexity | Navigating diverse and evolving global regulations. | Requires significant ongoing investment in compliance; risk of penalties. |

| Moderating Margin Growth | Projected slower EBITDA margin expansion in 2025 due to strategic hiring. | Increased personnel costs in growth markets may temper near-term profitability. |

Full Version Awaits

Adyen SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It showcases the comprehensive Strengths, Weaknesses, Opportunities, and Threats analysis of Adyen. You're viewing the actual analysis document; buy now to access the full, detailed report.

Opportunities

Adyen has a substantial opportunity to grow its presence in rapidly expanding emerging markets. Key regions like North America, Asia-Pacific (especially Japan and India), and Latin America present significant potential due to their increasing adoption of e-commerce and digital payments.

The company is strategically investing in these areas by boosting its workforce and obtaining necessary acquiring licenses. This focus on geographical expansion is crucial for Adyen’s future revenue streams, tapping into the dynamic growth of these digital economies.

The increasing demand for unified commerce and omnichannel solutions is a significant opportunity for Adyen. Businesses are prioritizing seamless customer payment experiences across all touchpoints, from online stores to physical checkouts and mobile apps.

Adyen's integrated platform is perfectly suited to meet this need. In 2023, Adyen reported a substantial increase in its point-of-sale (POS) transaction volumes, highlighting its success in capturing this growing market. As more merchants embrace omnichannel strategies, Adyen is poised to solidify its position as a market leader.

Adyen is well-positioned to capitalize on the burgeoning embedded finance market. By expanding its financial services beyond basic payment processing, such as offering issuing services and sophisticated expense management tools, Adyen can create significant new revenue streams. This allows them to become a more integrated financial partner for businesses and platforms, moving beyond a transactional relationship.

This expansion into embedded finance represents a strategic opportunity for Adyen to deepen its existing client relationships and attract new customers who are actively seeking more comprehensive financial solutions. For example, by providing embedded lending or insurance options, Adyen can offer a stickier, more valuable proposition, potentially increasing customer lifetime value and market share in the rapidly evolving fintech landscape.

Leveraging Data and AI for Enhanced Services

Adyen has a significant opportunity to deepen its use of its vast payment data and artificial intelligence to create even more advanced services. By refining its AI-driven optimization tools, the company can boost conversion rates, strengthen fraud detection, and tailor customer experiences. This strategic focus on data and AI will further solidify Adyen's competitive edge and draw in new clients who prioritize efficient and secure payment processing.

For instance, Adyen's AI capabilities are already instrumental in its fraud prevention systems. In 2023, Adyen reported a 20% year-over-year increase in transaction volume, reaching €608 billion. Enhancing these AI tools could lead to even more precise fraud identification, potentially saving businesses billions in chargebacks and lost revenue.

- Refined AI Optimization: Improving AI algorithms to boost merchant conversion rates by an estimated 1-3%.

- Advanced Fraud Prevention: Further reducing fraud losses, building on Adyen's already strong track record.

- Personalized Customer Journeys: Leveraging data to offer tailored payment experiences, increasing customer loyalty.

- New Service Development: Creating innovative data-driven products that address emerging market needs.

Strategic Partnerships and Platform Integrations

Adyen's strategic partnerships are a key growth driver. By integrating with other financial technology solutions and business platforms, Adyen can significantly broaden its market reach and enhance its service portfolio. For instance, its collaboration in spend management opens doors to new customer segments, thereby strengthening its overall value proposition.

These alliances are crucial for accelerating market penetration and diversifying Adyen's customer base. In 2024, Adyen announced a significant expansion of its partnership with Lightspeed Commerce, a leading cloud-based omnichannel POS and commerce platform. This deepened integration aims to provide Lightspeed merchants with Adyen's unified payment solution, streamlining checkout processes and improving customer experiences.

- Expanded Reach: Partnerships allow Adyen to tap into new markets and customer bases that might be inaccessible through direct sales efforts alone.

- Enhanced Value Proposition: Integrating with complementary services, like spend management or specific industry platforms, makes Adyen's offering more comprehensive and attractive to a wider range of businesses.

- Accelerated Growth: Strategic alliances can significantly shorten the time to market for new solutions and customer acquisition, contributing to faster revenue growth.

Adyen's expansion into emerging markets like North America, Asia-Pacific, and Latin America presents a significant growth avenue, driven by increasing e-commerce adoption. The company's investment in local infrastructure and licenses supports this geographical push, aiming to capture the dynamism of these digital economies.

The demand for unified commerce and omnichannel solutions offers Adyen a prime opportunity, as businesses seek seamless payment experiences across all customer touchpoints. Adyen's integrated platform, evidenced by its strong POS transaction growth in 2023, is well-suited to meet this evolving market need.

Furthermore, Adyen is poised to benefit from the growth in embedded finance, expanding its offerings beyond basic payments to include services like issuing and expense management. This strategic move deepens client relationships and attracts new customers seeking comprehensive financial solutions, potentially boosting customer lifetime value.

Leveraging its vast payment data and AI capabilities allows Adyen to develop advanced services, improving conversion rates and fraud detection. This data-centric approach, as seen in its 2023 transaction volume of €608 billion, strengthens Adyen's competitive edge and appeals to clients prioritizing efficient and secure payment processing.

Strategic partnerships, such as the expanded collaboration with Lightspeed Commerce in 2024, are crucial for Adyen's growth. These alliances broaden market reach, enhance its service portfolio, and accelerate customer acquisition, solidifying its value proposition.

Threats

Adyen faces a fierce battle in the payments processing arena, contending with giants like Stripe and PayPal, alongside a growing number of nimble local competitors. This crowded field often forces price reductions, which could squeeze Adyen's profit margins and challenge its ability to maintain market share.

The need to constantly innovate to stand out is paramount, as customers can easily switch to rivals offering slightly better terms or features. For instance, while Adyen reported a 23% revenue increase to €1.3 billion in the first half of 2024, this growth occurs within a market where competitors are also investing heavily in new technologies and customer acquisition.

Global macroeconomic uncertainties, particularly currency volatility and shifts in consumer spending, represent a significant threat to Adyen. For instance, a strong US dollar against other major currencies in late 2023 and early 2024 could impact the reported value of transactions processed in those currencies. A broad economic slowdown, as seen in some European economies during 2023, directly reduces the overall transaction volumes Adyen processes for its merchants, thereby affecting revenue.

The ever-changing and fragmented global regulatory landscape poses a significant threat to Adyen. New rules concerning payments, data privacy like GDPR, and broader financial services can appear quickly, demanding considerable investment and agile adjustments to maintain compliance across all its operational regions.

For instance, the ongoing evolution of open banking regulations in Europe and similar initiatives in other markets require continuous adaptation of Adyen's platform and services. In 2024, the focus on digital identity verification and anti-money laundering (AML) measures continues to intensify, potentially increasing operational costs and complexity.

Failure to effectively manage these intricate compliance demands could lead to costly legal battles, substantial financial penalties, and even limitations on Adyen's ability to operate in key markets, impacting its growth trajectory and profitability.

Cybersecurity Risks and Fraud Prevention

As a global financial technology leader processing billions of transactions, Adyen is a prime target for sophisticated cyberattacks and fraud schemes. The sheer volume of sensitive customer and payment data it handles amplifies the potential impact of any security lapse. For instance, in 2023, the financial services sector globally saw a significant uptick in ransomware attacks, with some reports indicating an increase of over 50% compared to the previous year, highlighting the persistent threat landscape Adyen navigates.

A successful data breach or a large-scale fraud event could have catastrophic consequences for Adyen. This includes severe reputational damage, a significant erosion of trust among its merchant base and end-consumers, and potentially massive financial penalties and legal liabilities stemming from regulatory non-compliance and customer compensation. The company's commitment to maintaining cutting-edge security infrastructure is therefore not just a best practice, but a critical imperative for its continued operation and growth.

- Cybersecurity Threats: Adyen faces constant evolving threats from hackers and malicious actors seeking to exploit vulnerabilities in its systems.

- Fraud Prevention: The company must continuously invest in advanced fraud detection and prevention tools to safeguard transactions and protect its clients.

- Reputational Risk: A major security incident could severely damage Adyen's brand image and customer confidence.

- Financial and Legal Impact: Breaches can lead to substantial financial losses through fines, legal settlements, and operational disruptions.

Dependency on Technology Infrastructure and Service Uptime

Adyen's reliance on its advanced, in-house technology platform is a double-edged sword. A significant outage or technical glitch could cripple its payment processing capabilities, directly impacting merchant operations and potentially leading to substantial revenue loss for Adyen. The company's reputation, built on reliability, is also at stake during such events.

Ensuring the continuous operation and resilience of its technology infrastructure is paramount. This includes robust disaster recovery protocols and ongoing investments to mitigate the risk of service disruptions. For instance, in 2023, Adyen continued to invest heavily in platform stability and security, a critical factor given the increasing volume of transactions it handles.

- Platform Uptime: Adyen's revenue is directly tied to the seamless functioning of its payment processing systems.

- Technical Malfunctions: Any failure in their proprietary technology could halt transactions, causing financial harm to merchants and damaging Adyen's brand.

- Disaster Recovery: The company must maintain sophisticated backup and recovery systems to minimize downtime in case of unforeseen events.

- Reputational Risk: A history of significant service interruptions could erode merchant trust and lead to customer churn.

Adyen operates in a highly competitive payments landscape, facing pressure from established players and emerging fintechs, which can lead to pricing wars and potentially impact profit margins. The constant need for innovation to retain clients in this dynamic market is a significant challenge.

Global economic instability, including currency fluctuations and potential recessions, directly affects transaction volumes and Adyen's revenue. For example, economic slowdowns in key markets in 2023 impacted overall spending, a trend that could persist into 2024.

Navigating diverse and evolving regulatory environments across different countries requires substantial investment and agility, with new compliance demands like enhanced digital identity verification potentially increasing operational costs.

The company's reliance on its technology platform means any significant outage or malfunction could severely disrupt services, leading to revenue loss and reputational damage, underscoring the critical need for robust system resilience.

SWOT Analysis Data Sources

This Adyen SWOT analysis is built upon a foundation of credible data, including Adyen's official financial filings, comprehensive market research reports, and expert analyses from reputable industry publications.