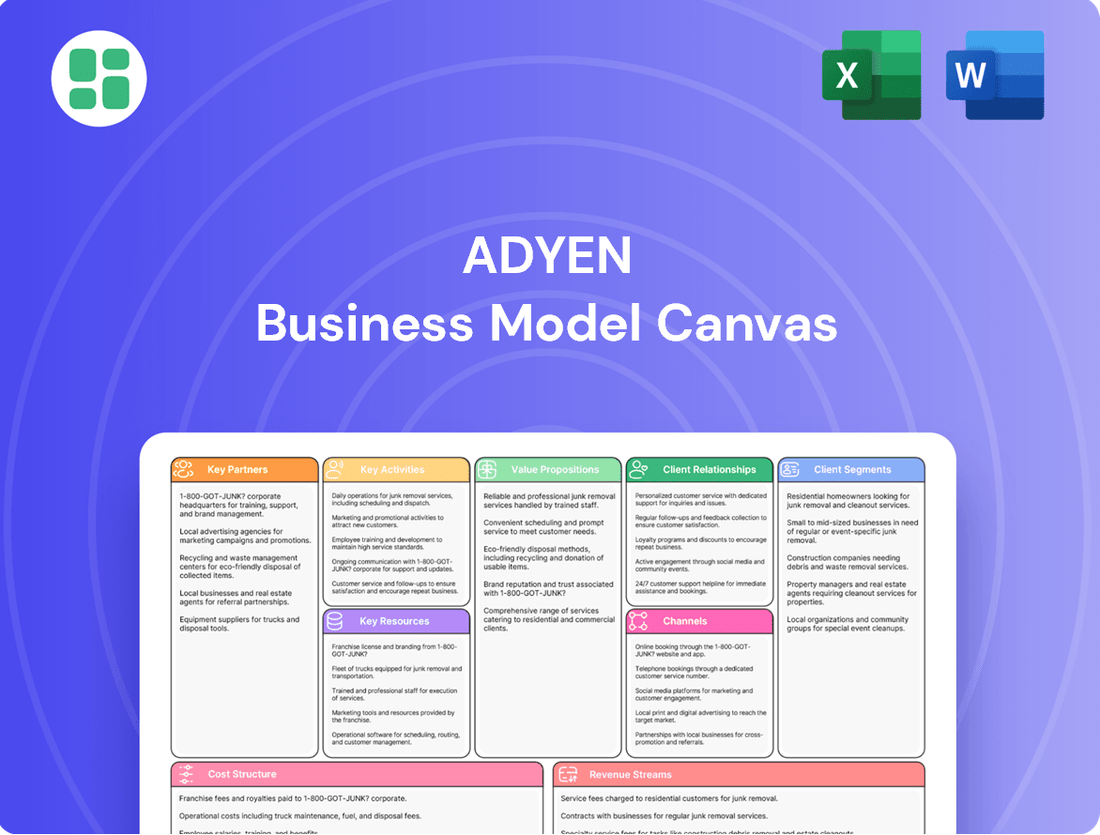

Adyen Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adyen Bundle

Uncover the strategic core of Adyen's success with our comprehensive Business Model Canvas. This in-depth analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market dominance. Gain actionable insights into how Adyen orchestrates its operations and partnerships to deliver seamless payment solutions.

Ready to dissect Adyen's winning formula? Our full Business Model Canvas provides a detailed, section-by-section breakdown of their key partners, cost structure, and competitive advantages. Download the complete template to benchmark your own strategies and accelerate your business planning.

Partnerships

Adyen's direct relationships with global payment networks, including Visa, Mastercard, and American Express, are crucial. These are the arteries through which transactions flow, allowing Adyen to process a vast spectrum of payment methods for its merchants worldwide.

These vital partnerships are the bedrock for Adyen's ability to facilitate international commerce. By maintaining these connections, Adyen ensures that its merchants can accept payments from virtually anywhere, a significant advantage in today's global marketplace.

The direct integration with these networks translates into tangible benefits for Adyen's clients. Merchants experience higher authorization rates, meaning more transactions are successfully approved, and they gain access to an exceptionally broad global reach, essential for expanding their customer base.

Adyen collaborates with a wide array of financial institutions and providers of local payment methods globally. For instance, their partnerships include SEPA Direct Debit for European transactions and Alipay, a dominant player in China. These alliances are fundamental to providing payment solutions that resonate with local consumer habits and comply with regional regulations.

These strategic partnerships are vital for Adyen's ability to offer comprehensive, localized payment options. By integrating with established regional banks and popular local payment systems, Adyen significantly broadens its market access and enhances the likelihood of successful transactions for its merchants.

In 2023, Adyen reported processing a substantial €737 billion in total payment volume, a testament to the effectiveness of its extensive network of financial partners. This growth underscores the importance of these key relationships in facilitating seamless cross-border commerce.

Adyen strategically partners with major e-commerce platforms like Shopify and marketplaces such as Airbnb. These collaborations are crucial as they enable Adyen to integrate its payment technology directly, offering smooth transaction experiences for millions of businesses and consumers on these sites.

This deep integration is a primary engine for Adyen's growth, particularly for its Adyen for Platforms offering, which simplifies payment management for businesses operating within larger ecosystems. For instance, Shopify’s extensive merchant base represents a significant opportunity for Adyen to expand its reach.

Technology and Software Providers

Adyen's strategic alliances with technology and software providers are fundamental to its business model. Collaborations with firms such as Intuit, known for QuickBooks and Mailchimp, are particularly significant. These partnerships allow Adyen to embed its payment processing capabilities directly into widely used business management platforms.

These integrations are crucial for providing businesses with a seamless and secure financial operation. By working with established software providers, Adyen enhances its service offering with improved security protocols, regulatory compliance, and guaranteed uptime for essential financial transactions. This ensures that businesses can manage their payments efficiently and reliably as part of their broader operational suite.

The benefits of these key partnerships are multifaceted:

- Enhanced Integration: Payments become a natural extension of existing accounting and CRM systems, simplifying workflows for merchants.

- Expanded Reach: Access to Intuit's extensive user base, for example, allows Adyen to connect with a vast number of small and medium-sized businesses.

- Streamlined Compliance: Partnerships help ensure that integrated payment solutions meet evolving financial regulations and security standards.

- Improved Operational Efficiency: Businesses benefit from a unified platform, reducing the complexity of managing separate payment and business management software.

Strategic Acquirers and Issuers

Adyen strategically partners with other acquiring banks and card issuers, even while holding its own licenses in key regions. This dual approach strengthens its comprehensive payment processing capabilities, allowing it to offer a truly end-to-end solution for merchants. These collaborations are vital for expanding its global reach and ensuring seamless transactions across diverse payment networks.

These partnerships are crucial for Adyen's ability to offer embedded financial products, such as lending or issuing services, directly within its clients' platforms. By integrating with other financial institutions, Adyen can broaden its product suite and provide more value-added services. For instance, in 2024, Adyen continued to expand its acquiring capabilities in new markets, often leveraging existing banking infrastructure through these strategic alliances.

- Enhanced Cross-Border Capabilities: Partnerships with international acquiring banks facilitate smoother and more cost-effective cross-border payments for Adyen's clients.

- Embedded Finance Expansion: Collaborations enable Adyen to embed financial services, like working capital solutions, directly into merchant workflows.

- Regulatory Compliance: Working with licensed partners helps Adyen navigate complex local regulations in various jurisdictions.

- Scalability and Reach: These relationships allow Adyen to scale its operations rapidly and extend its payment processing services to a wider array of businesses globally.

Adyen's key partnerships are the backbone of its ability to offer a comprehensive, global payment solution. These alliances span direct relationships with major card networks like Visa and Mastercard, ensuring high authorization rates and broad acceptance. Furthermore, Adyen collaborates with numerous financial institutions and providers of local payment methods worldwide, such as SEPA Direct Debit and Alipay, to cater to diverse consumer preferences and regulatory landscapes.

What is included in the product

A detailed breakdown of Adyen's payment processing and financial technology services, focusing on its platform-as-a-service model, key partnerships, and revenue streams from transaction fees and value-added services.

Adyen's Business Model Canvas effectively addresses the pain point of fragmented payment processing by clearly outlining its integrated platform, simplifying complex financial operations for businesses.

It serves as a powerful tool to visualize Adyen's value proposition, highlighting how it alleviates the burden of managing multiple payment providers and their associated complexities.

Activities

Adyen's key activity revolves around processing vast amounts of global payments across online, mobile, and physical retail environments. This encompasses acquiring, where Adyen directly interfaces with card networks and various local payment methods to boost successful transaction rates and simplify the payment journey for businesses and consumers alike.

In 2024 alone, Adyen facilitated a staggering €1.2 trillion in payment volume, underscoring its significant role in the global transaction ecosystem and its ability to handle immense scale.

Adyen's core activities include offering sophisticated risk management and AI-driven fraud prevention. Services like Adyen Uplift and Protect utilize machine learning to scrutinize transaction data instantly, flagging suspicious patterns and curbing fraudulent activities. This approach not only bolsters security but also helps merchants improve their conversion rates by reducing legitimate transactions mistakenly blocked.

In 2024, Adyen continued to enhance its fraud detection capabilities, a crucial element given the increasing sophistication of online fraud. While specific figures for fraud reduction are proprietary, the company's consistent investment in AI and machine learning for its risk management tools underscores their importance in maintaining trust and operational efficiency for its vast merchant network.

Adyen's core activity involves the ongoing development and refinement of its unified commerce platform. This platform is designed to seamlessly integrate payment data from online, in-store, and mobile channels into one cohesive system.

This continuous development effort directly addresses the need for merchants to simplify their payment operations. By offering a single view of transactions, Adyen empowers businesses to gain deeper insights into customer behavior and streamline their financial management.

The ultimate goal is to enable businesses to deliver a consistent and enhanced customer experience, regardless of how a customer chooses to interact and pay. For instance, Adyen reported a significant increase in transaction volumes, handling €609.2 billion in total payment volume in 2023, underscoring the platform's growing adoption and the importance of its unified approach.

Product Innovation and AI Integration

Adyen's core activities revolve around continuous product innovation, with a significant focus on integrating Artificial Intelligence. This includes developing sophisticated features such as intelligent payment routing, which optimizes transaction pathways for speed and cost-efficiency. They are also pioneering AI-driven payment optimization to enhance approval rates and reduce declines for their merchants.

The company is actively expanding its financial product offerings, notably through Embedded Financial Products (EFP) and Issuing services. These innovations are designed to provide merchants with more integrated and powerful financial tools directly within their existing platforms. This strategic push aims to not only streamline operations but also to create new avenues for revenue growth for Adyen's clientele.

- AI-Powered Payment Optimization Adyen's investment in AI directly impacts merchant success by improving transaction outcomes.

- Embedded Financial Products (EFP) Development This signifies a move towards offering more comprehensive financial solutions integrated into merchant workflows.

- Issuing Services Expansion Adyen is building out its capacity to offer card issuing capabilities, further deepening its financial service ecosystem.

Global Market Expansion and Compliance

Adyen's global market expansion is a cornerstone of its strategy, involving the acquisition of new operating licenses and significant investment in regional infrastructure. For instance, in 2024, Adyen continued to bolster its presence in key growth areas like North America and the Asia-Pacific region, aiming to capture a larger share of the burgeoning e-commerce and omnichannel payment markets. This expansion necessitates a deep understanding and proactive adaptation to evolving local regulatory landscapes.

Building a robust legal and compliance framework is paramount to Adyen's international operations. This includes navigating complex financial regulations, data privacy laws, and anti-money laundering requirements across dozens of jurisdictions. By prioritizing compliance, Adyen ensures its ability to operate seamlessly and securely in diverse markets, fostering trust with both merchants and consumers. This commitment to regulatory adherence is crucial for sustainable growth.

Key activities supporting global expansion and compliance include:

- Securing New Licenses: Obtaining necessary payment processing and financial services licenses in target countries, a process that can be lengthy and resource-intensive.

- Investing in Regional Infrastructure: Establishing and upgrading data centers, local offices, and support teams to ensure efficient and localized service delivery.

- Adapting to Local Regulations: Continuously monitoring and implementing changes required by diverse regulatory bodies, such as PSD2 in Europe or specific state regulations in the US.

- Building a Compliance Framework: Developing and maintaining comprehensive policies, procedures, and technology to meet global compliance standards, including KYC/AML and data protection.

Adyen's key activities are centered on its unified payments platform, enabling seamless transactions across all channels. This involves continuous innovation in AI-driven fraud prevention and payment optimization to boost merchant success rates. The company also focuses on expanding its financial product suite, including Embedded Financial Products and Issuing services, to offer more integrated solutions.

Global expansion and robust compliance are also critical activities. Adyen actively secures new operating licenses and invests in regional infrastructure to serve diverse markets effectively. Simultaneously, it maintains a strong focus on adapting to and adhering to complex international financial regulations, ensuring secure and compliant operations worldwide.

| Key Activity Area | Description | 2024/Recent Data Point |

|---|---|---|

| Platform Development & Innovation | Enhancing the unified commerce platform with AI for fraud prevention and payment optimization. | Facilitated €1.2 trillion in payment volume in 2024. |

| Financial Product Expansion | Developing and offering Embedded Financial Products (EFP) and Issuing services. | Continued investment in AI for risk management and fraud detection. |

| Global Market Expansion | Acquiring new licenses and investing in regional infrastructure. | Bolstered presence in North America and Asia-Pacific. |

| Regulatory Compliance | Navigating and adhering to diverse international financial regulations. | Ensuring adherence to global compliance standards like KYC/AML. |

Full Document Unlocks After Purchase

Business Model Canvas

The Adyen Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you can confidently assess the structure, content, and quality, knowing it's not a mockup but a direct representation of the final deliverable. Once your order is complete, you'll gain full access to this exact, ready-to-use Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

Adyen's proprietary technology platform, built entirely in-house, is its most critical asset. This single, unified system manages everything from payment processing and fraud detection to data insights, offering merchants a seamless and efficient global solution.

This integrated platform allows Adyen to process a vast volume of transactions, handling €603 billion in total payment volume in 2023. Its continuous evolution ensures merchants benefit from the latest innovations in payment technology and risk management.

Adyen's global network, featuring direct connections to over 250 payment methods and card schemes, is a cornerstone of its business. This extensive reach allows businesses to process payments seamlessly across borders.

Crucially, Adyen holds banking and acquiring licenses in numerous key regions, including Europe, North America, and Asia. These licenses are vital for its end-to-end payment processing capabilities, enabling it to manage transactions directly without relying on third-party acquirers.

In 2024, Adyen continued to expand its licensing footprint, securing new authorizations that bolster its ability to serve a wider range of global clients. This strategic expansion underpins its capacity to offer a unified platform for diverse payment needs.

Adyen's core strength lies in its sophisticated data and AI capabilities, fueled by the immense volume of transactions processed globally. By leveraging advanced machine learning algorithms, Adyen transforms raw transaction data into actionable intelligence.

This data-driven approach is crucial for optimizing payment processing, leading to higher authorization rates and reduced friction for merchants. For instance, in 2023, Adyen reported processing a substantial €606.2 billion in total payment volume, a significant increase from previous years, showcasing the scale of data they manage.

Furthermore, Adyen's AI powers robust fraud detection systems, protecting both merchants and consumers. The company continuously refines these models using real-time data, ensuring a secure payment environment. This intelligence also translates into valuable insights for merchants, helping them understand customer behavior and tailor their offerings.

Skilled Human Capital

Adyen's global team, comprising engineers, product developers, sales, and support staff, is a cornerstone of its business model. This skilled human capital is crucial for innovation and operational excellence.

The company strategically invests in talent acquisition, prioritizing hires that align with its growth objectives and technological advancements. This intentional approach ensures Adyen maintains a competitive advantage in the fast-paced payments industry.

As of early 2024, Adyen's workforce exceeded 4,000 employees globally, a testament to its continuous expansion and commitment to building a robust team. This human capital is directly linked to their ability to develop and deploy sophisticated payment solutions.

- Global Talent Pool: Adyen's strength lies in its diverse, international workforce of over 4,000 professionals as of early 2024, fostering a rich environment for innovation.

- Strategic Hiring: The company's deliberate hiring strategy focuses on securing top-tier engineers and product specialists to drive technological leadership.

- Innovation Engine: Skilled human capital is Adyen's primary resource for developing cutting-edge payment technologies and maintaining its competitive edge.

Brand Reputation and Customer Base

Adyen’s brand reputation as a reliable financial technology partner for major global companies is a cornerstone of its business model. This trust is built on consistent performance and security, making it a go-to solution for businesses like Meta, Uber, and H&M.

The company’s ability to attract and keep these high-profile clients speaks volumes about its value proposition. A strong customer retention rate, consistently above 90% in recent years, directly translates into predictable revenue streams and a solid foundation for continued growth.

- Trusted Partner: Adyen serves a significant portion of the world's largest businesses, indicating a high level of confidence in its platform.

- High Retention: Over 90% of Adyen's customers renew their contracts, showcasing strong client satisfaction and loyalty.

- Market Validation: The adoption of Adyen by industry leaders validates its technological capabilities and service quality.

- Growth Driver: A loyal and expanding customer base is a primary engine for Adyen's ongoing revenue and market share expansion.

Adyen's proprietary technology platform, built entirely in-house, is its most critical asset, enabling seamless global payment processing. This unified system handles everything from transaction processing to fraud detection, supporting a total payment volume of €603 billion in 2023.

The company's extensive global network, with direct connections to over 250 payment methods and card schemes, is a key resource. Furthermore, Adyen's banking and acquiring licenses across major regions like Europe and North America are vital for its end-to-end processing capabilities.

Adyen's sophisticated data and AI capabilities, fueled by vast transaction volumes, are central to its operations. In 2023, Adyen processed €606.2 billion in total payment volume, using this data to optimize payment processing and enhance fraud detection.

Adyen's brand reputation as a reliable financial technology partner for major global companies is a cornerstone of its business model, built on consistent performance and security. This trust is reflected in a customer retention rate consistently above 90% in recent years.

| Key Resource | Description | Supporting Data/Fact |

| Proprietary Technology Platform | Single, unified system for payments, fraud, and data insights. | Processed €603 billion in total payment volume in 2023. |

| Global Network & Licenses | Direct connections to 250+ payment methods; banking/acquiring licenses in key regions. | Licenses secured in Europe, North America, and Asia; expanding in 2024. |

| Data & AI Capabilities | Leverages transaction data for optimization and fraud detection. | Managed €606.2 billion in total payment volume in 2023. |

| Brand Reputation & Customer Loyalty | Trusted partner for major global businesses. | Customer retention rate consistently above 90%. |

Value Propositions

Adyen's single global platform streamlines the entire payment lifecycle, from processing and acquiring to robust risk management. This unified approach works seamlessly across online, in-app, and in-store environments, significantly simplifying operations for businesses with a global footprint.

By consolidating these critical functions, Adyen eliminates the need for multiple vendors, reducing complexity and offering a singular, consolidated view of all payment data. This is particularly impactful for businesses aiming for efficient international expansion.

In 2024, Adyen continued to process substantial transaction volumes, with its platform supporting merchants in over 150 countries. This extensive reach underscores the value of their end-to-end solution for global commerce.

Adyen's direct card network connections and intelligent routing are key to boosting authorization rates. This means more approved transactions for merchants. In 2024, Adyen's platform processed over $900 billion in total payment volume, reflecting its significant impact on global commerce.

The company's AI-powered fraud prevention tools, like Adyen Uplift and Protect, are designed to catch fraudulent activity before it impacts revenue. By minimizing false positives, these tools ensure legitimate customers can complete purchases smoothly, contributing to higher conversion rates and a better customer experience.

These optimized authorization rates and reduced fraud directly translate into increased revenue for merchants and lower operational costs. Businesses using Adyen benefit from fewer chargebacks and a more streamlined payment process, allowing them to focus on growth.

Adyen offers merchants unparalleled, real-time access to their payment data across every sales channel. This deep dive into analytics allows businesses to truly understand customer purchasing habits and identify trends.

With these comprehensive insights, businesses can refine their strategies, optimize operations, and make informed, data-backed decisions. For instance, in 2023, Adyen reported a 23% increase in total payment volume, demonstrating the scale of data they process and the potential for insights derived from it.

Global Reach and Local Payment Acceptance

Adyen's global reach and local payment acceptance are crucial for businesses looking to expand internationally. They allow merchants to connect with customers by offering a vast selection of payment methods and currencies, making transactions smooth across borders.

This capability directly addresses diverse consumer preferences worldwide, opening up new markets and revenue streams for businesses. For instance, in 2024, Adyen reported processing transactions in over 150 currencies, highlighting their extensive network.

- Global Payment Network: Adyen provides access to over 250 payment methods, including popular local options and global card schemes.

- Currency Conversion: Facilitates seamless transactions by supporting a wide range of currencies, simplifying cross-border payments for both merchants and consumers.

- Market Expansion: Enables businesses to cater to local payment habits, increasing conversion rates and customer satisfaction in new territories.

Innovation and Future-Proofing

Adyen's dedication to innovation is a cornerstone of its value proposition, evident in its substantial investments in research and development. For instance, in 2023, Adyen reported a significant increase in its operating expenses, with a notable portion allocated to product development and technology, reflecting its commitment to pushing the boundaries of payment technology.

This continuous investment allows Adyen to introduce groundbreaking features, such as embedded financial products that seamlessly integrate into merchant platforms and AI-driven optimization tools designed to enhance transaction success rates and reduce fraud. These advancements empower merchants with cutting-edge payment solutions, ensuring they remain competitive in a rapidly changing digital landscape.

- R&D Investment: Adyen’s consistent focus on R&D fuels the development of next-generation payment solutions.

- Embedded Finance: Offering integrated financial products simplifies payment processes for merchants and their customers.

- AI Optimization: Leveraging artificial intelligence improves transaction efficiency and security.

- Market Competitiveness: These innovations help merchants adapt to evolving consumer expectations and market trends.

Adyen's unified platform simplifies global payments, offering a single solution for online, in-app, and in-store transactions. This streamlined approach reduces complexity and provides consolidated data, crucial for international expansion.

By boosting authorization rates through direct card connections and intelligent routing, Adyen ensures more approved transactions. In 2024, Adyen processed over $900 billion in total payment volume, highlighting its effectiveness.

Adyen's AI-powered fraud prevention minimizes false positives, enhancing conversion rates and customer experience. This focus on security and efficiency directly increases merchant revenue and lowers operational costs.

The company provides real-time access to comprehensive payment data, enabling businesses to understand customer behavior and refine strategies. Adyen's 2023 total payment volume increase of 23% underscores the depth of insights available.

| Value Proposition | Description | 2024 Data/Impact |

| Unified Global Platform | Single platform for all payment channels, simplifying operations. | Supports merchants in over 150 countries. |

| Increased Authorization Rates | Direct connections and intelligent routing boost transaction approvals. | Processed over $900 billion in total payment volume. |

| AI-Powered Fraud Prevention | Minimizes fraud and false positives for better customer experience. | Enhances conversion rates and reduces chargebacks. |

| Data & Insights | Real-time access to payment data for strategic decision-making. | 23% increase in total payment volume in 2023. |

Customer Relationships

Adyen offers dedicated account managers and specialized support, particularly for its enterprise clients. This high-touch approach ensures that complex payment needs are addressed effectively, fostering smooth integrations and ongoing optimization. For instance, their focus on partnership means dedicated teams help businesses navigate the intricacies of global payments, a critical factor for companies like Uber, a major Adyen client.

While Adyen focuses on direct relationships, it also provides robust self-service tools. These include extensive documentation, developer portals, and client dashboards. This empowers businesses to manage their payment operations, access real-time data, and integrate Adyen's solutions independently, which is crucial for companies with strong in-house technical teams.

Adyen cultivates partnership-oriented growth by deepening relationships with existing clients, aiming to increase their share of wallet. This involves proactively offering new functionalities and integrated financial products that align with client expansion. In 2024, Adyen continued to emphasize this strategy, seeing significant revenue growth from its established customer base.

Customer-Focused Platform Development

Adyen's platform development is deeply rooted in understanding and addressing merchant needs. By actively seeking and integrating feedback, they ensure their offerings remain relevant and competitive, directly impacting customer satisfaction and loyalty.

This commitment to a customer-centric approach has yielded impressive results, with Adyen consistently achieving high Net Promoter Scores (NPS). For instance, in 2023, Adyen reported an NPS of 67, a testament to the positive experiences their merchants have with the platform and services.

- Merchant-Driven Innovation: Adyen's product roadmap is shaped by direct input from its diverse merchant base, ensuring new features and improvements align with real-world business challenges.

- High Merchant Satisfaction: The company's focus on seamless integration, robust features, and responsive support contributes to strong merchant retention and positive word-of-mouth referrals.

- Industry-Leading NPS: Adyen's consistent high Net Promoter Score, often cited as a key performance indicator, highlights the success of its customer-focused development strategy.

Community and Ecosystem Engagement

Adyen cultivates strong customer relationships by actively engaging with the fintech ecosystem. This includes fostering a vibrant developer community and participating in industry events. Such engagement promotes knowledge sharing and drives innovation, indirectly strengthening loyalty among its diverse clientele.

For technology-centric firms like Adyen, community and ecosystem involvement are crucial. By hosting developer forums and contributing thought leadership, they build brand loyalty and facilitate valuable knowledge exchange. This approach supports clients in their own innovation journeys.

- Developer Community: Adyen's commitment to its developer community is evident through resources and platforms that foster collaboration and problem-solving, leading to enhanced product adoption and satisfaction.

- Industry Events and Thought Leadership: Participation in key fintech conferences and publishing insightful content positions Adyen as a leader, building trust and attracting new clients by demonstrating expertise and forward-thinking.

- Ecosystem Partnerships: Collaborating with other players in the fintech space broadens Adyen's reach and offers integrated solutions, creating a more robust value proposition for its customers.

Adyen prioritizes direct, high-touch relationships, especially with enterprise clients, offering dedicated account managers to navigate complex payment needs and foster integrations. This partnership approach, exemplified by their work with major clients like Uber, ensures tailored support and ongoing optimization. In 2024, Adyen continued to deepen these relationships, driving significant revenue growth from its existing customer base through proactive offering of new functionalities and integrated financial products.

Complementing direct engagement, Adyen provides extensive self-service tools, including detailed documentation and developer portals. These resources empower businesses to independently manage payment operations, access real-time data, and integrate solutions efficiently, catering to clients with strong in-house technical capabilities.

Adyen's commitment to customer satisfaction is reflected in its high Net Promoter Score (NPS). In 2023, Adyen achieved an NPS of 67, underscoring the positive merchant experiences driven by their seamless integration, robust features, and responsive support, which also contributes to strong retention and positive word-of-mouth referrals.

The company actively cultivates its developer community and participates in industry events, fostering knowledge sharing and driving innovation. This ecosystem engagement builds brand loyalty and indirectly strengthens client relationships by supporting their own innovation journeys.

| Customer Relationship Aspect | Description | Supporting Data/Example |

|---|---|---|

| Dedicated Support | High-touch account management for enterprise clients. | Partnership with Uber for global payment solutions. |

| Self-Service Tools | Comprehensive documentation and developer portals. | Empowers businesses with strong technical teams. |

| Partnership Growth | Deepening relationships to increase share of wallet. | Significant revenue growth from established clients in 2024. |

| Customer Feedback Integration | Shaping product roadmap based on merchant needs. | Ensures relevance and competitiveness of offerings. |

| Merchant Satisfaction | Focus on seamless integration and responsive support. | NPS of 67 reported in 2023. |

| Ecosystem Engagement | Fostering developer communities and industry participation. | Builds brand loyalty and supports client innovation. |

Channels

Adyen leverages a direct sales force to engage enterprise clients, offering tailored payment solutions for sectors like e-commerce and retail. This approach allows for in-depth consultation to address complex business requirements.

In 2024, Adyen continued to build on its enterprise relationships, with a significant portion of its revenue stemming from these direct engagements. The company reported strong growth in transaction volumes from its larger clients, underscoring the effectiveness of its direct sales strategy in securing and expanding business with major players.

Adyen utilizes its official website, a robust content marketing strategy including case studies, and targeted digital advertising to draw in prospective clients and highlight its payment processing prowess. This digital outreach is a primary driver for new business, especially for companies in search of sophisticated, global payment infrastructure.

In 2024, Adyen's continued investment in digital channels is evident as they aim to capture a larger share of the cross-border e-commerce market, which is projected to reach trillions of dollars. Their online presence serves as a critical touchpoint for businesses evaluating payment partners, emphasizing efficiency and scalability.

Adyen leverages partnerships and referral programs as key channels to expand its reach. Collaborations with e-commerce platforms, technology providers, and system integrators are crucial for acquiring new merchants.

These strategic alliances enable Adyen to tap into existing customer bases of partners, reaching merchants already integrated with popular business solutions. For instance, in 2024, Adyen continued to deepen its relationships with major e-commerce enablers, facilitating access to a wider pool of businesses seeking streamlined payment processing.

Industry Events and Conferences

Adyen actively participates in key industry events like Money 20/20 and Shoptalk. These gatherings are crucial for showcasing their unified payment platform and engaging with a broad audience of merchants and partners. In 2024, Adyen continued to emphasize its role in enabling seamless global commerce.

- Networking and Lead Generation: Events provide a direct channel to meet prospective clients, understand their payment challenges, and generate qualified leads.

- Product Demonstration and Innovation Showcase: Adyen uses these platforms to unveil new features and technologies, highlighting their competitive edge in areas like data analytics and fraud prevention.

- Thought Leadership: Speaking engagements and panel discussions at these conferences allow Adyen to share insights on industry trends, positioning them as experts in the payments ecosystem.

- Brand Building and Market Presence: Consistent visibility at major events reinforces Adyen's brand recognition and strengthens its position in the competitive fintech landscape.

Investor Relations and Public Relations

Adyen’s investor relations and public relations function as crucial, albeit indirect, channels. These activities, including the release of their 2023 annual report and regular earnings calls, bolster the company’s reputation and transparency. This enhanced visibility and credibility are vital for attracting significant enterprise clients and top-tier talent, reinforcing Adyen's standing in the competitive payments landscape.

These efforts directly contribute to building stakeholder trust. For instance, Adyen’s consistent communication around its financial performance, such as reporting a 23% revenue growth to €1.3 billion in the first half of 2024, solidifies its market position. This transparency helps to attract and retain investors, further strengthening the company’s ability to invest in innovation and expansion.

- Enhanced Credibility: Regular financial reporting and transparent communication build trust with investors and potential clients.

- Talent Acquisition: A strong public image and positive investor sentiment make Adyen an attractive employer.

- Market Positioning: Consistent PR efforts reinforce Adyen's brand as a leading global payments platform.

- Stakeholder Engagement: Annual reports and earnings calls provide key insights, fostering strong relationships with all stakeholders.

Adyen utilizes a multi-pronged channel strategy, combining direct sales for enterprise clients with robust digital outreach. Partnerships and industry events further amplify its market presence, while investor and public relations build crucial credibility.

In 2024, Adyen's direct sales force remained a cornerstone, securing significant deals with large merchants. The company's digital channels, including its website and content marketing, attracted a growing number of businesses seeking scalable payment solutions, especially in the cross-border e-commerce space which continues its upward trajectory.

Strategic partnerships with e-commerce platforms and technology providers proved vital in 2024 for expanding Adyen's reach. Participation in key fintech events like Money 20/20 provided platforms for product showcases and lead generation, reinforcing Adyen's position as a leader in global payments.

Adyen's commitment to transparency through investor relations, highlighted by its first-half 2024 revenue growth of 23% to €1.3 billion, bolstered its reputation. This focus on clear communication and financial performance is instrumental in attracting both clients and investors.

| Channel | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Sales | Engaging enterprise clients with tailored solutions. | Secured major deals, driving significant revenue from large merchants. |

| Digital Outreach | Website, content marketing, digital advertising. | Attracted new businesses, particularly in cross-border e-commerce. |

| Partnerships | Collaborations with e-commerce platforms, tech providers. | Expanded reach by tapping into partner customer bases. |

| Industry Events | Participation in Money 20/20, Shoptalk, etc. | Showcased innovation, generated leads, and built brand presence. |

| Investor/Public Relations | Financial reporting, earnings calls, PR activities. | Enhanced credibility and transparency, fostering stakeholder trust. |

Customer Segments

Adyen's core customer base is comprised of large, global enterprises that need comprehensive payment processing capabilities spanning various sales channels and international markets. These are typically well-established, high-volume businesses seeking a unified platform to manage their diverse payment needs.

Prominent examples of these large global enterprises include industry leaders such as Meta, Uber, H&M, and eBay, all of whom rely on Adyen for their complex payment infrastructures. In 2024, Adyen reported processing a significant volume of transactions for these types of clients, demonstrating their capacity to handle the scale and complexity required by multinational corporations.

Platform businesses and marketplaces represent a significant and expanding area for Adyen. These entities often require sophisticated solutions to manage payments for their own users or sub-merchants, a task Adyen is well-equipped to handle.

Adyen for Platforms directly addresses the intricate payment processing and regulatory compliance demands inherent in these business models. This specialized offering streamlines operations for platforms, enabling them to onboard and pay out their sellers efficiently.

In 2023, Adyen reported a substantial increase in transaction volumes from its platform clients, underscoring the segment's growth. The company's ability to offer a unified platform for managing diverse payment flows makes it an attractive partner for businesses operating in the gig economy, e-commerce marketplaces, and software-as-a-service (SaaS) providers.

Omnichannel retailers, those businesses seamlessly blending online, in-store, and app-based sales, represent a crucial customer segment for Adyen. These businesses are actively seeking unified payment solutions to provide a consistent and frictionless customer journey across all touchpoints.

Adyen's platform is a perfect fit, enabling these retailers to manage transactions, data, and customer interactions from a single source. For instance, in 2024, many large fashion retailers reported significant growth in their omnichannel sales, with some seeing over 40% of their revenue generated through integrated online and physical store experiences, highlighting the demand for Adyen's capabilities.

High-Growth Tech Companies

Adyen focuses on high-growth technology firms that need adaptable, worldwide payment solutions to fuel their rapid scaling. Companies like Netflix and Spotify are prime examples, relying on Adyen for seamless transaction processing that can handle massive user bases and diverse revenue streams.

These tech giants often experience unpredictable transaction volumes and require sophisticated fraud management tools. Adyen's platform is built to accommodate this volatility, ensuring smooth operations even during peak periods. For instance, Adyen processed over $900 billion in total payment volume in 2023, a significant portion of which came from these large, dynamic tech clients.

- Scalability: Adyen's infrastructure supports exponential growth, crucial for tech companies expanding into new markets or launching new services.

- Flexibility: The platform allows for customization to match unique business models and evolving payment needs.

- Global Reach: High-growth tech firms often operate internationally, and Adyen provides unified access to global payment methods and acquiring.

- Innovation: Adyen's continuous development in payment technology, including AI-driven fraud detection, benefits these forward-thinking companies.

Small and Medium-sized Businesses (SMEs) via Platforms

Adyen's strategic pivot to serve Small and Medium-sized Businesses (SMEs) is largely facilitated through platform partnerships. This indirect market penetration allows Adyen to tap into a vast ecosystem of businesses that might otherwise be too fragmented to approach directly.

By integrating Adyen's payment solutions into the offerings of larger platform businesses, SMEs gain access to sophisticated payment processing capabilities. This is particularly impactful as many SMEs operate within these digital marketplaces, relying on the platform's infrastructure for their sales and operations.

- Platform Integration: Adyen partners with platforms like Shopify, BigCommerce, and others, enabling their SME merchants to seamlessly adopt Adyen's payment services.

- Market Reach: This strategy significantly expands Adyen's serviceable addressable market, allowing it to engage with millions of SMEs globally without direct onboarding for each.

- Scalability: For platforms, offering Adyen as a payment option enhances their value proposition, attracting more SME users and fostering growth.

- Data Insights: Adyen gains valuable data across a diverse SME base, informing product development and service enhancements for this segment.

Adyen serves a diverse customer base, primarily targeting large global enterprises with complex, multi-channel payment needs. They also cater to platform businesses and marketplaces requiring sophisticated solutions for their own users, as well as omnichannel retailers seeking unified payment experiences. High-growth technology firms with volatile transaction volumes and a need for robust fraud management are another key segment, with Adyen also strategically reaching SMEs through platform partnerships.

| Customer Segment | Key Characteristics | Examples | 2023/2024 Data Point |

|---|---|---|---|

| Large Global Enterprises | High-volume, multi-channel, international payment needs. | Meta, Uber, H&M, eBay | Processed over $900 billion in Total Payment Volume (TPV) in 2023. |

| Platform Businesses & Marketplaces | Need to manage payments for sub-merchants, regulatory compliance. | E-commerce marketplaces, gig economy platforms | Reported substantial increase in transaction volumes from platform clients in 2023. |

| Omnichannel Retailers | Seamless online, in-store, and app integration; consistent customer journey. | Fashion retailers, electronics stores | In 2024, many reported over 40% of revenue from integrated online/physical sales. |

| High-Growth Technology Firms | Scalability, adaptability, global reach, robust fraud detection. | Netflix, Spotify | TPV growth driven by dynamic tech clients contributed significantly to overall volume. |

| Small and Medium-sized Businesses (SMEs) | Accessed indirectly through platform partnerships. | Merchants on Shopify, BigCommerce | Adyen's platform integration strategy expands reach to millions of SMEs globally. |

Cost Structure

Adyen dedicates a substantial portion of its expenses to its cutting-edge technology infrastructure and robust research and development efforts. This includes the upkeep of its global data centers, sophisticated network systems, and continuous innovation in areas like AI-driven fraud detection and new payment functionalities.

In 2023, Adyen reported capital expenditure of €237.3 million, which represented approximately 4.8% of its net revenue. This consistent investment underscores their commitment to maintaining a leading-edge technology platform that supports their diverse merchant base and evolving payment landscape.

Adyen's cost structure heavily features personnel and talent acquisition expenses. These encompass employee salaries, comprehensive benefits packages, and the significant costs involved in attracting and retaining skilled professionals, particularly in crucial areas like engineering, sales, and customer support. These investments are fundamental to maintaining Adyen's technological edge and market presence.

While the pace of hiring saw a moderation in 2024 compared to previous years, Adyen continued to prioritize strategic investments in its human capital. This focus on talent underscores the company's understanding that its people are a core driver of innovation and operational excellence. For instance, Adyen's commitment to its workforce is reflected in its ongoing efforts to build a strong engineering team, which is essential for developing and maintaining its complex payment processing platform.

Scheme fees and interchange fees are variable costs that Adyen passes on to its merchants. These fees are a significant part of Adyen's cost structure, directly tied to transaction volume. For instance, in 2024, Adyen's commitment to transparency is evident in its Interchange++ pricing model, which clearly delineates these charges for merchants, ensuring they understand the breakdown of costs associated with each transaction.

Sales, Marketing, and Customer Support Costs

Adyen's sales, marketing, and customer support expenses are significant drivers of its operational costs, reflecting its global reach and commitment to merchant success. These costs encompass direct sales teams focused on acquiring new merchants, extensive digital marketing campaigns to build brand awareness, and robust customer support infrastructure to assist a diverse international clientele. Investments in regional expansion, including setting up new offices and hiring local talent, also fall under this category, ensuring localized support and market penetration.

In 2023, Adyen reported €1.18 billion in operating expenses, with a substantial portion allocated to personnel costs, which would include sales, marketing, and support functions. The company's strategy of aggressive global growth, particularly in North America and Asia, necessitates continued investment in these areas. For instance, expanding its sales force in key markets directly impacts these costs, aiming to capture a larger share of the rapidly evolving payments landscape.

- Sales & Marketing: Direct sales teams, digital advertising, and partnership development are key expenditures.

- Customer Support: Maintaining a global, 24/7 support network for merchants incurs considerable operational costs.

- Regional Expansion: Investments in new market entry, including sales and support staff, contribute to overall expenses.

- Personnel Costs: A significant portion of operating expenses is tied to the compensation and benefits of employees in these crucial functions.

Regulatory and Compliance Costs

Operating as a global financial technology platform means Adyen must invest heavily in legal and compliance frameworks. This ensures adherence to financial regulations in every country they operate, a complex and ongoing task.

These costs are substantial, covering everything from obtaining and maintaining banking and acquiring licenses to ongoing monitoring and reporting. For instance, in 2024, the global fintech regulatory landscape continued to evolve, with increased scrutiny on data privacy and anti-money laundering (AML) measures, likely driving higher compliance expenditures for companies like Adyen.

- Licensing Fees: Costs associated with acquiring and renewing necessary financial licenses in various operating regions.

- Compliance Staffing: Salaries and training for legal, compliance, and risk management professionals.

- Technology Investments: Spending on systems to ensure data security, fraud prevention, and regulatory reporting.

- Audit and Legal Counsel: Fees for external audits and legal advice to navigate complex international regulations.

Adyen's cost structure is heavily influenced by its investment in technology and talent. Significant expenses are allocated to maintaining and upgrading its global infrastructure, including data centers and network systems, alongside continuous R&D for payment innovations. Personnel costs, particularly for engineering and sales, represent a substantial portion of operating expenses, underscoring the value placed on skilled human capital.

Variable costs like scheme and interchange fees are directly tied to transaction volume, a core aspect of Adyen's revenue model. The company's commitment to global expansion also drives costs related to sales, marketing, and customer support in new and existing markets. Furthermore, Adyen incurs significant expenses to ensure compliance with diverse international financial regulations.

| Cost Category | Key Components | 2023 Impact/Focus |

| Technology & R&D | Data centers, network systems, AI development | €237.3 million capital expenditure (approx. 4.8% of net revenue) |

| Personnel | Salaries, benefits, talent acquisition (esp. engineering, sales) | Substantial portion of operating expenses; continued strategic hiring in 2024 |

| Transaction Fees | Scheme fees, interchange fees | Variable costs directly linked to transaction volume; Interchange++ pricing |

| Sales, Marketing & Support | Sales teams, digital marketing, global customer support | €1.18 billion operating expenses in 2023; investment in regional expansion |

| Legal & Compliance | Licensing, compliance staffing, regulatory reporting systems | Ongoing investment due to evolving global fintech regulations (e.g., data privacy, AML) |

Revenue Streams

Adyen's core revenue generation hinges on transaction processing fees. They typically charge a small fixed fee coupled with a percentage of the transaction value for each payment processed.

This fee structure, often referred to as Interchange Plus Plus (Interchange++), breaks down costs transparently. It accounts for the interchange fee charged by card networks, a scheme fee, and Adyen's own processing markup. This model allows for varied fees depending on factors like card type, transaction volume, and geographical location.

For instance, in 2024, Adyen's revenue from payment processing was a significant driver of their financial performance. Their ability to handle a vast array of payment methods globally allows them to capture a substantial share of e-commerce and point-of-sale transactions, translating directly into fee-based income.

Adyen generates significant revenue through its acquiring services, acting as a direct link between merchants, card networks, and various local payment methods. This direct connection allows Adyen to capture a portion of the transaction value.

A key component of this revenue is the markup Adyen applies over interchange and scheme fees. This markup is often a percentage of the transaction value and can be influenced by the volume of transactions a merchant processes, offering a tiered pricing structure.

For instance, in 2023, Adyen reported a substantial increase in its acquiring revenue, driven by higher transaction volumes and a growing merchant base. The company processed a record €735.6 billion in total payment volume in the first half of 2024, indicating strong performance in its core acquiring business.

Adyen supplements its core payment processing income with revenue from specialized, value-added services. These offerings cater to businesses seeking enhanced operational efficiency and security.

Key among these are its AI-driven fraud prevention tools, such as Revenue Protect and Uplift, which generate fees for merchants by reducing chargebacks and protecting against fraudulent transactions. In 2023, Adyen reported that its platforms processed €736 billion in total payment volume, a significant portion of which is facilitated by these advanced security features.

Furthermore, Adyen earns from services like account updater, ensuring payment details remain current, and from providing sophisticated reporting and analytics capabilities that offer deeper insights into transaction data, allowing businesses to optimize their strategies.

Embedded Financial Products (e.g., Issuing)

Adyen's Embedded Financial Products (EFP) represent a significant and expanding revenue source, particularly through their card issuing capabilities. This allows partner platforms to seamlessly integrate financial services, like virtual and physical cards, directly into their own user experiences.

By offering these embedded solutions, Adyen empowers businesses to create new revenue opportunities by acting as financial service providers to their customer base. For instance, platforms can earn interchange fees on transactions made with their branded cards.

- Embedded Financial Products (EFP) are a growing revenue stream for Adyen.

- This suite includes issuing virtual and physical cards.

- Platforms can unlock new revenue by offering financial services to their users.

- Adyen's EFP strategy allows businesses to monetize their customer relationships through financial products.

Point-of-Sale (POS) Hardware and Software

While Adyen's primary revenue comes from processing transactions, they also earn from selling their own point-of-sale (POS) hardware and software. This is crucial for businesses handling in-person payments.

The demand for these physical terminals and their accompanying software saw substantial growth in 2024. This hardware segment is a key component supporting Adyen's unified commerce strategy.

- Hardware Sales: Revenue generated from the sale of Adyen's proprietary POS terminals.

- Software Licensing: Income from the software that powers these in-person payment devices.

- 2024 Growth: The POS segment experienced significant volume increases throughout 2024, indicating strong adoption.

Adyen's revenue streams are diverse, primarily driven by transaction processing fees, which include interchange, scheme fees, and Adyen's markup. They also generate income from value-added services like fraud prevention and account updating, as well as from selling POS hardware and software.

A significant growth area is Embedded Financial Products (EFP), where Adyen enables platforms to offer financial services, such as card issuing, to their users, creating new revenue opportunities for both Adyen and its partners.

In the first half of 2024, Adyen processed €735.6 billion in total payment volume, highlighting the scale of their transaction-based revenue.

| Revenue Stream | Description | 2024 Data/Trend |

|---|---|---|

| Transaction Processing Fees | Interchange, scheme fees, and Adyen's markup on payments. | Core revenue driver, benefiting from high payment volumes. |

| Value-Added Services | Fraud prevention (e.g., Revenue Protect), account updater, analytics. | Enhances merchant operations and generates recurring fees. |

| Embedded Financial Products (EFP) | Card issuing and integration of financial services into partner platforms. | Rapidly growing segment, enabling partners to monetize customer relationships. |

| POS Hardware & Software | Sales of payment terminals and associated software. | Supports unified commerce strategy, saw significant volume increases in 2024. |

Business Model Canvas Data Sources

The Adyen Business Model Canvas is informed by a blend of internal financial data, extensive market research, and competitive analysis. These sources provide a comprehensive view of Adyen's operations, customer base, and strategic positioning.