Adyen Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adyen Bundle

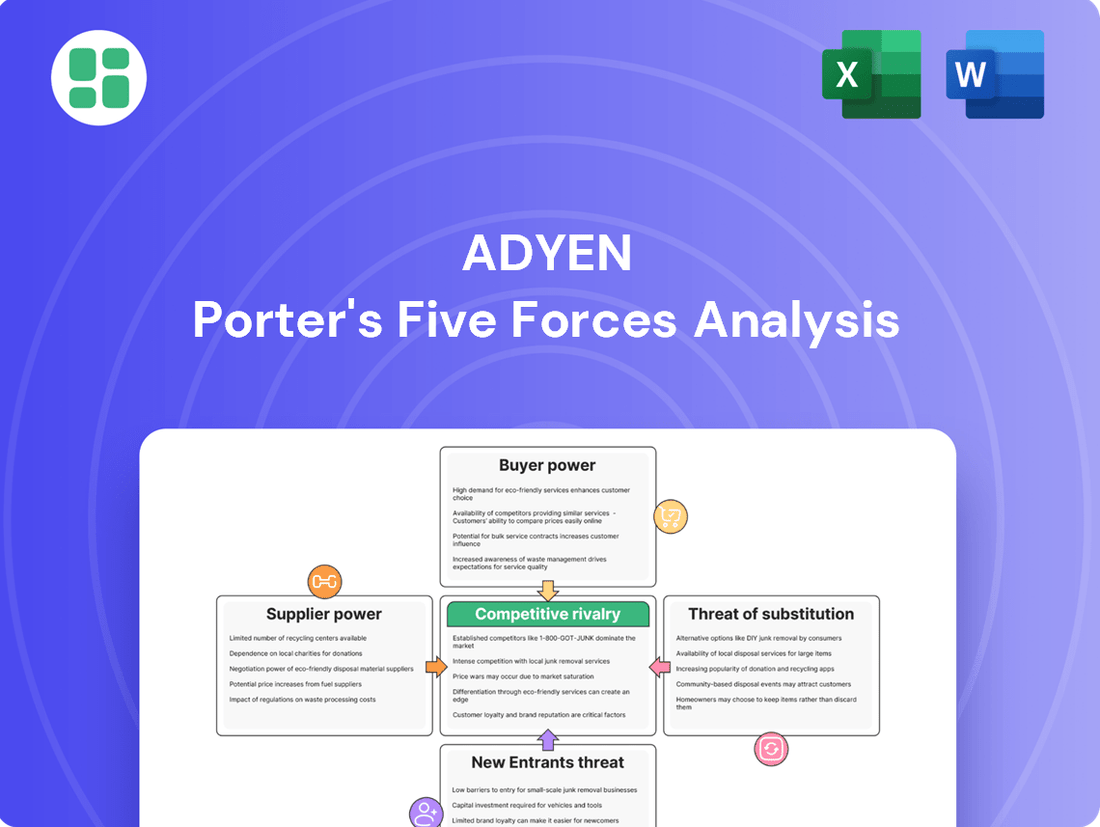

Adyen navigates a dynamic payments landscape, where intense rivalry and the threat of new entrants significantly shape its competitive environment. Understanding the bargaining power of buyers and suppliers is crucial for Adyen's continued success.

The complete report reveals the real forces shaping Adyen’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Adyen's reliance on a small number of major global card networks, such as Visa and Mastercard, and critical banking partners for its acquiring licenses and settlement processes significantly concentrates supplier power. This limited pool of essential service providers means these entities hold substantial sway over Adyen's operational costs and terms, as Adyen has few viable alternatives for processing transactions worldwide.

The limited number of global card networks and banking partners that Adyen must work with gives these suppliers considerable bargaining power. For instance, Visa and Mastercard are dominant players in the payment processing landscape, and their terms can heavily influence Adyen's profitability. In 2023, Visa and Mastercard continued to hold substantial market share in global card transactions, underscoring their leverage.

Adyen faces significant bargaining power from its suppliers, particularly when it comes to integrating new or complex local payment methods. The process of switching core banking partners or embedding these diverse payment options is inherently intricate, demanding substantial time and financial investment from Adyen. This complexity fosters a strong reliance on established supplier relationships, thereby amplifying their leverage.

While Adyen's direct connectivity to card networks, bypassing many traditional financial intermediaries, offers some mitigation of its dependence on numerous banking partners, the fundamental networks themselves represent powerful suppliers. These networks, such as Visa and Mastercard, dictate terms and access, maintaining considerable influence over Adyen's operations and cost structures.

Card networks like Visa and Mastercard offer crucial infrastructure and established brand recognition that are incredibly challenging for any payment processor to replicate. This inherent difficulty in substitution grants them significant leverage.

Furthermore, the integration of diverse local payment methods is vital for global reach, and these methods often possess unique market penetration and customer loyalty that Adyen must leverage rather than replace. While Adyen builds innovative solutions on top of these, the fundamental payment rails themselves are proprietary and indispensable, solidifying the bargaining power of these suppliers.

Threat of Forward Integration by Suppliers

Suppliers, such as traditional banks or card networks, could theoretically move into offering integrated payment processing directly to large merchants, effectively bypassing payment platforms like Adyen. This would represent a threat of forward integration, where a supplier becomes a competitor.

However, the significant hurdles involved in replicating Adyen's complex, end-to-end global payment infrastructure, which includes sophisticated technology and extensive international reach, act as a strong deterrent for most suppliers. Building such a platform requires immense capital investment and specialized expertise, making direct competition from many suppliers unlikely.

For instance, while card networks like Visa and Mastercard have vast reach, their core business is facilitating transactions, not building the comprehensive merchant-side processing solutions that Adyen provides. Developing the technological stack and operational capabilities to compete directly would necessitate a fundamental shift in their business models and substantial investment, a move many may find unappealing compared to their existing profitable operations.

- Forward Integration Threat: Suppliers like banks or card networks could offer direct payment processing.

- Complexity Barrier: Replicating Adyen's global, tech-heavy platform is a significant deterrent.

- Strategic Focus: Core businesses of many suppliers differ from Adyen's integrated merchant solutions.

Importance of Adyen's Volume to Suppliers

Adyen's immense transaction volume, exceeding €1.2 trillion processed in 2024, significantly influences its bargaining power with suppliers. This scale positions Adyen as a vital partner for entities like Visa and Mastercard, as well as various local payment method providers.

Consequently, Adyen can leverage this substantial business to negotiate favorable terms and fees with these critical infrastructure providers. The sheer volume of transactions processed means that disruptions or shifts in Adyen's business could have a notable impact on supplier revenue.

- Key Supplier Relationships: Card networks (Visa, Mastercard) and local payment method providers.

- Adyen's Leverage: Ability to negotiate fees and service terms due to high transaction volume.

- Supplier Dependence: Suppliers benefit from Adyen's significant contribution to their overall transaction throughput.

Adyen's significant transaction volume, processing over €1.2 trillion in 2024, grants it considerable leverage with suppliers like Visa and Mastercard. This scale makes Adyen a crucial partner, enabling it to negotiate favorable terms and fees. The sheer volume means suppliers are incentivized to maintain a strong relationship to secure Adyen's business.

| Supplier Type | Key Players | Adyen's Leverage Factor | Impact on Adyen |

|---|---|---|---|

| Card Networks | Visa, Mastercard | High Transaction Volume (€1.2T+ in 2024) | Negotiating power on processing fees and access terms. |

| Local Payment Methods | Various regional providers | Integration Complexity & Merchant Demand | Ability to influence terms for essential local payment access. |

| Banking Partners | Global & Regional Banks | Reliance for Licensing & Settlement | Potential for favorable settlement rates and operational support. |

What is included in the product

This analysis dissects Adyen's competitive environment by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the risk of substitute products.

Instantly identify and address competitive threats by visualizing Adyen's position across all five forces, enabling proactive strategy adjustments.

Customers Bargaining Power

While Adyen strives for deep integration, large merchants with their own tech resources may find switching payment providers less daunting. These sophisticated customers can leverage the competitive landscape, which offers numerous advanced payment solutions, to their advantage.

This environment allows large businesses to negotiate more favorable pricing or readily switch if they encounter issues, effectively dampening Adyen's pricing power with this segment. For instance, in 2024, the global e-commerce payment processing market saw significant competition, with players offering tiered pricing structures that cater to high-volume merchants.

In the highly competitive payments landscape, customers, particularly those with substantial transaction volumes, exhibit significant price sensitivity. They are acutely aware of processing fees and interchange rates, actively seeking the most cost-effective solutions. This sensitivity empowers them to negotiate for better terms.

Adyen addresses this by offering a unified, value-added platform that aims to justify its pricing through enhanced functionality and service. However, this does not negate the inherent customer power to push for competitive rates, especially when alternative providers exist. For instance, in 2024, many large e-commerce merchants reported actively benchmarking payment processing costs, with some achieving fee reductions of 5-10% through renegotiations or switching providers.

Customer concentration risk is a key factor in Adyen's bargaining power of customers. While Adyen boasts a broad customer portfolio, the departure of a major client, as noted in early 2025 reports, can notably affect its processed volume growth. This underscores the substantial leverage these significant clients possess.

These pivotal customers can leverage their volume to negotiate more favorable pricing and enhanced service agreements. Their ability to switch providers, or even bring payment processing in-house, gives them considerable sway over Adyen's terms and profitability.

Availability of Alternative Payment Processors

Merchants today have a robust selection of payment processing alternatives, a key factor in their bargaining power. Competitors such as Stripe, Worldpay, and PayPal, alongside traditional banking institutions, all vie for market share. This wide availability means merchants can readily switch providers if terms become unfavorable or if a better offer emerges. For instance, in 2024, the global digital payments market was valued at over $9 trillion, indicating intense competition among service providers to attract and retain merchant clients.

The sheer volume of choices empowers merchants to negotiate better rates and service agreements. They can leverage offers from one provider against another, driving down costs and improving service quality. This dynamic is particularly evident as new fintech solutions continue to enter the market, further fragmenting the landscape and increasing merchant leverage. The ability to easily compare and switch is a significant check on any single payment processor's ability to dictate terms.

- Merchant Choice: A broad spectrum of payment processors, including Stripe, Worldpay, and PayPal, offers merchants numerous alternatives.

- Negotiating Power: The availability of multiple providers allows merchants to negotiate more favorable terms and pricing.

- Market Dynamics: Intense competition in the over $9 trillion global digital payments market (2024) fuels this merchant bargaining power.

- Switching Ease: The relative ease with which merchants can change payment processors acts as a constant pressure on providers to maintain competitive offerings.

Customers' Ability to Integrate In-House Solutions

Very large enterprises, particularly those with significant transaction volumes, may explore developing their own payment processing infrastructure or establishing direct connections with card networks. This move aims to cut operational expenses and enhance control over their payment flows.

While the technical hurdles and investment required for such backward integration are substantial, the mere possibility can exert considerable pressure on Adyen's pricing and the scope of its service offerings. For instance, a major e-commerce player processing billions in transactions annually could theoretically divert a portion of its processing to an in-house solution if Adyen's fees become uncompetitive.

This customer capability directly impacts Adyen's bargaining power. Consider the scale: in 2024, major global retailers often handle transaction volumes in the tens or hundreds of billions of dollars annually. Even a small percentage saved by in-house processing could represent millions in cost reduction, making this a credible threat for the largest clients.

- Potential for Cost Savings: Large enterprises can bypass intermediary fees by integrating directly with payment networks.

- Increased Control: In-house solutions offer greater customization and direct oversight of payment operations.

- Strategic Leverage: The threat of backward integration allows large customers to negotiate more favorable terms with payment processors like Adyen.

Customers, especially large merchants, wield significant bargaining power due to the competitive payment processing landscape. Their ability to switch providers, negotiate pricing, and even consider in-house solutions puts pressure on Adyen to offer compelling value. In 2024, the global digital payments market, valued at over $9 trillion, saw intense competition, allowing merchants to secure better terms.

This leverage is amplified by the sheer volume of transaction data merchants possess, enabling them to benchmark costs effectively. For instance, major e-commerce players processing billions annually can negotiate fee reductions of 5-10% by leveraging competitive offers or threatening to bring processing in-house, a credible threat given the scale of potential savings.

| Factor | Impact on Adyen | Supporting Data (2024) |

|---|---|---|

| Merchant Choice | High | Over $9 trillion global digital payments market value, numerous competitors (Stripe, PayPal) |

| Price Sensitivity | High | Merchants actively benchmarking, achieving 5-10% fee reductions |

| Backward Integration Threat | Moderate to High | Billions in annual transaction volumes for major clients |

Full Version Awaits

Adyen Porter's Five Forces Analysis

This preview showcases the complete Adyen Porter's Five Forces Analysis, detailing the competitive landscape of the payment processing industry. You're looking at the actual document, which meticulously examines the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within Adyen's market. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing a comprehensive understanding of the forces shaping Adyen's strategic environment.

Rivalry Among Competitors

Adyen navigates a fiercely competitive global fintech landscape, contending with a broad array of players. Established payment processors such as PayPal, Fiserv (owner of Worldpay), and Stripe are significant rivals, alongside traditional banks increasingly bolstering their digital payment capabilities. Emerging fintech startups also contribute to this dynamic, intensifying the rivalry.

The global fintech market is booming, with projections indicating it will approach $395 billion by 2025. This rapid expansion acts like a magnet, drawing in a multitude of new companies eager to capture a piece of the action.

While this growth theoretically could ease competitive pressures, the sheer influx of new participants, alongside existing players expanding their offerings, means rivalry remains a significant force. Companies like Adyen face constant pressure to innovate and differentiate themselves to stand out in this dynamic landscape.

Adyen stands out with its integrated, end-to-end payment platform, direct links to card networks, and a strong emphasis on large businesses and data-driven insights. This includes AI tools like Adyen Uplift, designed to boost conversion rates. For instance, Adyen reported a 20% increase in authorization rates for a major global retailer in 2023 through its platform optimization.

However, the competitive landscape is fierce, with rivals like Stripe and PayPal also pouring resources into innovation. They are actively developing embedded finance solutions and leveraging AI for advanced fraud detection. This constant drive for new features means that even Adyen's cutting-edge offerings face continuous pressure to maintain their competitive edge and avoid feature parity.

Aggressive Pricing Strategies

The payment processing sector often sees intense price wars, particularly for services that are largely interchangeable. While Adyen focuses on its integrated platform and value-added services, rivals might employ aggressive pricing tactics to gain or keep customers. This could put pressure on Adyen's transaction fees, or take rates, and consequently, its profit margins.

For instance, in 2023, several payment processors introduced new pricing tiers aimed at smaller businesses, often with lower per-transaction costs. While Adyen's average transaction value was €54 in Q1 2024, a significant portion of its revenue comes from larger merchants who may be less sensitive to minor price differences. However, sustained aggressive pricing from competitors could still erode market share, especially in segments where differentiation is less pronounced.

- Price Sensitivity: Payment processing can be a commodity, leading to price-based competition.

- Competitor Tactics: Rivals may use low pricing to capture market share.

- Impact on Adyen: Aggressive pricing can reduce Adyen's take rates and profit margins.

- Market Dynamics: Competitors' pricing strategies, especially for smaller merchants, can influence the overall competitive landscape.

Global Expansion and Regional Battles

Competitive rivalry is intensifying as payment processors pursue global expansion. Adyen, for instance, is aggressively growing its footprint in North America and emerging markets such as India and Japan. This strategic push places Adyen in direct competition with both established global players and agile local competitors vying for dominance in these lucrative regions.

The battle for market share is particularly heated in high-growth areas. Adyen's focus on these markets means it's not just competing on technology but also on local expertise and partnerships. This dynamic creates a challenging environment where companies must constantly innovate and adapt to stay ahead.

- Global Expansion: Adyen's strategic growth in North America and Asia highlights the industry-wide trend of seeking new markets.

- Intensified Competition: This expansion directly escalates rivalry with both global payment giants and regional specialists.

- Market Share Battles: Adyen is actively competing for customer acquisition in key growth markets like India and Japan.

The competitive rivalry within the payment processing industry is intense, driven by a crowded marketplace and constant innovation. Adyen faces significant competition from established players like Stripe and PayPal, as well as traditional financial institutions enhancing their digital offerings.

This rivalry is further fueled by aggressive pricing strategies, particularly in segments where services are commoditized. While Adyen differentiates through its integrated platform and value-added services, competitors may use lower pricing to gain market share, potentially impacting Adyen's take rates and profit margins.

Adyen's global expansion into high-growth markets like North America and Asia intensifies competition, pitting it against both global payment giants and agile local players. This dynamic necessitates continuous innovation and adaptation to maintain a competitive edge.

| Competitor | Key Offerings | 2023/2024 Highlights |

|---|---|---|

| Stripe | Online payment processing, developer tools, fraud prevention | Continued investment in embedded finance and AI for fraud detection. |

| PayPal | Digital wallets, online payments, buy now pay later | Focus on expanding its merchant services and integrating new payment methods. |

| Fiserv (Worldpay) | Payment processing for businesses of all sizes, POS solutions | Strengthening its global payment capabilities and expanding merchant services. |

SSubstitutes Threaten

Large merchants, particularly those with significant transaction volumes, can bypass payment processors like Adyen by forging direct relationships with acquiring banks. This allows them to negotiate terms and manage payment acceptance independently.

This direct bank relationship acts as a substitute for Adyen's integrated platform, offering a potentially more cost-effective, albeit more complex, alternative for merchants. For instance, while Adyen offers a unified solution, a direct bank relationship might involve managing multiple vendors for different aspects of payment processing.

In 2024, the trend of large enterprises seeking greater control over their payment infrastructure continued, with some exploring direct acquiring relationships to reduce interchange fees and gain deeper insights into their transaction data. This strategic move by major players can fragment the market and put pressure on integrated payment providers.

For extremely large enterprises, particularly those processing vast transaction volumes, building an in-house payment processing system presents a significant substitute. This approach, while demanding substantial capital investment and technical expertise, offers enhanced control over the entire payment lifecycle and can lead to long-term cost efficiencies. For example, a major e-commerce retailer might leverage its internal IT infrastructure to manage payments, bypassing third-party processors entirely.

The threat of substitutes is growing as alternative payment methods gain traction. Account-to-Account (A2A) payments, Buy Now, Pay Later (BNPL) services, and even cryptocurrency offer consumers new ways to pay, which merchants are increasingly considering. For instance, BNPL transaction volumes globally were projected to reach over $3.5 trillion by 2027, indicating significant consumer adoption.

While Adyen itself facilitates many of these newer payment types, the widespread adoption of methods that completely bypass traditional card processing networks could represent a long-term substitution threat. If a substantial portion of transactions shifts to systems that don't involve interchange fees or traditional gateway services, it could impact the core business model.

Cash and Traditional Payment Instruments

While digital payments are on a significant upward trajectory, traditional payment methods like cash, checks, and bank transfers continue to exist as substitutes. These are particularly relevant for smaller transactions or in specific geographic regions and industries where digital infrastructure might be less developed. For instance, in 2023, cash still accounted for a notable portion of retail transactions in certain European countries, though its overall share is declining.

However, for Adyen's core business, which focuses on serving large enterprises and facilitating complex, cross-border digital transactions, the threat from these traditional instruments is diminishing. Their relevance is largely confined to niche segments that Adyen is less focused on. The shift towards digital is accelerating, making these older methods less competitive for the types of clients Adyen targets.

The declining reliance on cash and checks for large-scale commerce is a positive trend for Adyen. Consider the global digital payment market, which was valued at over $7 trillion in 2023 and is projected to grow substantially. This expansion directly benefits payment processors like Adyen, as it signifies a shrinking market share for the very substitutes that pose a threat.

- Declining Relevance: Cash and checks are becoming less relevant for Adyen's enterprise clientele due to the increasing adoption of digital payment solutions.

- Niche Markets: While still present, these traditional methods are primarily substitutes in smaller transactions or specific geographical areas, not Adyen's primary focus.

- Market Trends: The global digital payment market's growth, exceeding $7 trillion in 2023, indicates a diminishing threat from traditional payment instruments for companies like Adyen.

Embedded Finance Solutions from Non-Financial Entities

The increasing trend of embedded finance, where non-financial businesses integrate financial services directly into their offerings, presents a significant threat. For instance, e-commerce platforms increasingly provide their own payment processing or even buy-now-pay-later options, bypassing traditional payment gateways.

This allows companies to manage the entire customer experience, potentially diminishing reliance on third-party payment providers like Adyen. In 2024, the embedded finance market was projected to reach hundreds of billions of dollars globally, highlighting its substantial growth and disruptive potential.

This shift means businesses can capture more value and customer loyalty by controlling the financial touchpoints. Such integration can directly substitute components of Adyen's service portfolio, particularly for businesses prioritizing a seamless, all-in-one customer journey.

Key aspects of this threat include:

- Direct Competition: Non-financial companies offering integrated payment or lending solutions act as direct substitutes.

- Customer Journey Control: Businesses can own the entire customer lifecycle, reducing the need for external financial infrastructure.

- Market Growth: The embedded finance market is experiencing rapid expansion, indicating a growing number of potential substitutes.

The threat of substitutes for Adyen stems from various alternative payment methods and direct merchant capabilities. Large merchants can bypass processors by establishing direct relationships with acquiring banks, potentially reducing costs and gaining more data control. For instance, in 2024, major enterprises continued exploring direct acquiring to optimize interchange fees.

Building in-house payment systems is another significant substitute for large enterprises, offering complete control despite substantial investment. Furthermore, the rise of Account-to-Account (A2A) payments, Buy Now, Pay Later (BNPL), and even cryptocurrencies presents alternative ways for consumers to pay, which merchants are adopting.

Embedded finance, where non-financial companies integrate financial services, also poses a threat, allowing businesses to offer their own payment solutions. The embedded finance market was projected to reach hundreds of billions of dollars globally in 2024, underscoring its disruptive potential.

| Substitute Type | Description | Impact on Adyen | Example/Data Point |

|---|---|---|---|

| Direct Bank Relationships | Merchants processing high volumes can deal directly with acquiring banks, bypassing intermediaries. | Reduced transaction volume for Adyen; pressure on pricing. | Large retailers seeking to cut interchange fees. |

| In-house Payment Systems | Major enterprises build their own payment processing infrastructure. | Complete bypass of third-party providers like Adyen. | Tech giants with extensive IT resources. |

| Alternative Payment Methods (APMs) | A2A, BNPL, crypto offer new payment rails. | Potential shift away from traditional card processing, impacting Adyen's core revenue streams. | BNPL transaction volumes projected to exceed $3.5 trillion by 2027. |

| Embedded Finance | Non-financial companies integrate financial services into their platforms. | Erosion of Adyen's market share as businesses offer proprietary payment solutions. | E-commerce platforms offering integrated checkout and financing. |

Entrants Threaten

The global payment processing market, where Adyen operates, presents a formidable barrier to entry due to its substantial capital and technology demands. New players must invest heavily in robust technological infrastructure, including secure data centers and extensive global network capabilities, to compete effectively.

For instance, building a payment processing platform comparable to Adyen's requires billions in upfront investment for software development, regulatory compliance, and establishing worldwide operational presence. In 2024, companies like Stripe and PayPal continue to invest billions annually into technology and infrastructure, underscoring the ongoing capital intensity of the sector.

The payments industry presents a formidable barrier to entry due to its intricate regulatory and licensing requirements. New companies must obtain numerous licenses, such as acquiring, e-money, and payment institution licenses, which vary significantly by jurisdiction. For instance, in 2024, navigating the European Union's PSD2 regulations and the US's state-specific money transmitter licenses remains a significant hurdle.

Established payment processors like Adyen leverage substantial economies of scale, enabling them to operate with greater efficiency and lower per-transaction costs. This cost advantage makes it challenging for newcomers to compete on price.

Network effects also create a formidable barrier. A larger merchant base attracts more payment providers, and conversely, more payment options draw in more merchants. For instance, Adyen's extensive network of merchants and payment methods in 2024 makes it a more attractive platform than a nascent competitor.

Brand Reputation and Trust

Building a solid brand reputation and earning customer trust in the financial services sector is a long and arduous journey, demanding significant investment in time and resources. This is particularly true for payment processors where reliability is paramount.

Merchants often exhibit a strong reluctance to switch their payment processing partners because any disruption can directly impact their revenue streams. This inherent inertia acts as a substantial barrier for new, unproven entrants aiming to gain market share.

- Brand Loyalty: Established players like Adyen benefit from existing merchant trust, making it difficult for newcomers to attract business.

- Switching Costs: The perceived risk and operational hassle of changing payment providers deter merchants from onboarding new solutions.

- Reputational Risk: A single negative experience with a new payment provider can severely damage a merchant's own customer relationships, making them cautious.

Access to Talent and Expertise

Developing and maintaining a sophisticated global payment platform, much like Adyen's, demands a deep bench of highly specialized technical and financial talent. This isn't just about coding; it's about understanding complex regulatory landscapes, cybersecurity, and intricate financial operations. New entrants face a steep uphill battle in finding and keeping individuals with this unique blend of skills.

The competition for top-tier talent in fintech is fierce. For instance, in 2024, the demand for skilled cybersecurity professionals in the financial sector continued to outstrip supply, with reports indicating a global shortage of over 3 million such experts. This scarcity directly translates into higher recruitment costs and longer onboarding times for any new player attempting to enter the payments arena.

- High Demand for Specialized Skills: Fintech requires experts in areas like AI, machine learning, blockchain, and advanced data analytics, skills that are in short supply.

- Cost of Talent Acquisition: Companies like Adyen, with established reputations, can offer competitive compensation and benefits packages that are difficult for startups to match.

- Retention Challenges: Even if new entrants manage to attract talent, retaining them against offers from established, well-funded companies remains a significant hurdle.

The threat of new entrants for Adyen is significantly mitigated by the immense capital requirements and complex technological infrastructure needed to establish a competitive payment processing platform. Building such a system requires billions in investment for software, regulatory compliance, and global operations, making it a substantial barrier for newcomers. For example, in 2024, major players like Stripe continue to pour billions into technology, highlighting the sector's ongoing capital intensity.

Additionally, the highly regulated nature of the payments industry, with its myriad of licenses varying by jurisdiction, presents a significant hurdle. Navigating regulations such as the EU's PSD2 and US state-specific money transmitter licenses remains a complex challenge for any new company. Established players like Adyen also benefit from strong network effects and economies of scale, offering lower transaction costs and a more attractive ecosystem for merchants, further deterring new entrants.

| Barrier Type | Description | 2024 Relevance |

|---|---|---|

| Capital Requirements | Billions needed for technology, infrastructure, and global presence. | Companies like Stripe and PayPal invest billions annually in technology. |

| Regulatory Hurdles | Obtaining numerous licenses across different jurisdictions. | Navigating PSD2 and US state licenses remains complex. |

| Economies of Scale | Lower per-transaction costs for established players. | Adyen's scale provides a significant cost advantage. |

| Network Effects | Larger merchant bases attract more payment providers and vice versa. | Adyen's established network is a key differentiator. |

Porter's Five Forces Analysis Data Sources

Our Adyen Porter's Five Forces analysis is built upon a foundation of comprehensive data, drawing from Adyen's official investor relations materials, annual reports, and public financial statements. We supplement this with insights from reputable financial news outlets, industry analysis reports, and market research firms specializing in the payments and fintech sectors.