Adyen PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adyen Bundle

Navigate the complex external forces shaping Adyen's trajectory with our meticulously crafted PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both opportunities and challenges for this payments giant. Equip yourself with actionable intelligence to refine your market strategy and gain a competitive edge. Download the full analysis now for a comprehensive understanding.

Political factors

The global regulatory landscape for fintechs like Adyen is a dynamic and ever-changing terrain. New regulations are frequently introduced to govern digital payments, bolster data privacy, and combat financial crime. For instance, the European Union's PSD2 (Payment Services Directive 2) has significantly reshaped payment processing, requiring strong customer authentication and opening up new avenues for payment initiation services.

Adyen's ability to successfully expand and maintain compliance hinges on its capacity to navigate these diverse and often intricate regulations across the numerous countries it operates in. This includes adhering to varying data protection laws, such as GDPR in Europe and similar frameworks emerging globally, which impact how customer data is handled.

Shifts in governmental priorities concerning financial innovation can profoundly influence Adyen's market entry and product development strategies. For example, a government's push for open banking can create opportunities for Adyen to integrate new services, while a more protectionist stance might introduce barriers to entry or necessitate product adjustments.

Adyen's extensive global operations mean its revenue streams are directly influenced by geopolitical stability and evolving international trade policies. For instance, the ongoing trade tensions between major economic blocs, while not directly targeting payment processors, create an environment of uncertainty that can slow cross-border commerce, impacting Adyen's transaction volumes.

The imposition of sanctions or the formation of new trade alliances can significantly alter payment flows and the operational landscape for businesses using Adyen's services. For example, a sudden shift in trade agreements could necessitate adjustments to how Adyen facilitates payments in affected regions, potentially impacting its merchant acquisition and retention strategies.

To navigate these complexities, Adyen actively monitors geopolitical shifts and trade policy changes. In 2024, the world saw continued focus on supply chain resilience and digital trade agreements, which could present both opportunities and challenges for payment facilitators like Adyen by either streamlining or complicating international transactions.

Governments worldwide are increasingly championing digital economies, recognizing their potential to enhance efficiency and broaden financial access. This political push translates into a more receptive landscape for digital payment providers like Adyen. For instance, in 2024, the European Union continued its commitment to the Digital Single Market, which includes initiatives aimed at harmonizing payment services and encouraging digital innovation, directly benefiting companies operating within this framework.

This active governmental support often manifests as direct investment in digital infrastructure or the creation of regulatory frameworks that favor digital transactions. Such policies can significantly reduce barriers to entry and adoption for businesses and consumers alike, accelerating the move away from traditional cash-based systems. By 2025, many nations are expected to have updated or implemented new legislation specifically designed to foster digital payment growth, potentially offering Adyen new avenues for expansion and partnership.

Data Localization and Sovereignty Laws

Governments worldwide are increasingly implementing data localization and sovereignty laws, mandating that financial data be stored and processed within their national borders. For a global payment processor like Adyen, this means adapting its infrastructure and compliance strategies to navigate a patchwork of national regulations.

This trend presents significant operational challenges and can increase costs. For instance, the European Union's General Data Protection Regulation (GDPR) has set a precedent, influencing similar legislation in other regions, requiring robust data handling protocols. By mid-2024, numerous countries, including India and Vietnam, have strengthened their data localization requirements, impacting how international payment providers manage customer information.

- Increased Compliance Burden: Adyen must invest in local data centers or partner with local providers in various jurisdictions to comply with these laws.

- Operational Complexity: Managing data across multiple, geographically dispersed locations adds layers of complexity to Adyen's IT operations and data governance.

- Potential Cost Increases: Establishing and maintaining localized data infrastructure can lead to higher operational expenses, potentially impacting service pricing.

- Market Access Implications: Failure to comply with data localization mandates can restrict Adyen's ability to operate in key growth markets.

Central Bank Digital Currency (CBDC) Initiatives

The global exploration of Central Bank Digital Currencies (CBDCs) presents a significant political and economic shift. As of early 2024, over 130 countries are exploring or developing CBDCs, with several pilot programs underway, including China's digital yuan and potential launches in Europe and the United States.

Adyen must closely monitor these developments, as the widespread adoption of CBDCs could fundamentally reshape payment infrastructures.

- Impact on Existing Payment Rails: CBDCs could offer a direct, digital alternative to traditional payment systems, potentially reducing reliance on intermediaries like Adyen for certain transactions.

- Regulatory Landscape Shifts: Governments implementing CBDCs will likely introduce new regulations governing digital currency transactions, impacting compliance requirements for payment processors.

- Cross-Border Payment Opportunities: Some CBDC designs aim to facilitate faster and cheaper cross-border payments, which could present new integration opportunities for Adyen if designed with interoperability in mind.

- Competitive Pressures: The emergence of state-backed digital currencies might intensify competition from central banks themselves or new entities operating within CBDC frameworks.

Governmental support for digital economies is a significant tailwind for Adyen. Initiatives like the EU's Digital Single Market, actively promoted in 2024, aim to harmonize payment services and foster digital innovation, creating a more favorable operating environment. By 2025, many countries are expected to have updated or introduced new legislation specifically designed to accelerate digital payment growth, opening new avenues for Adyen.

Data localization laws are a growing concern, with countries like India and Vietnam strengthening requirements by mid-2024. This forces global payment processors like Adyen to adapt infrastructure and compliance strategies to a complex web of national regulations, potentially increasing operational costs.

The global exploration of Central Bank Digital Currencies (CBDCs) presents a transformative political and economic shift, with over 130 countries exploring them as of early 2024. Adyen must closely monitor these developments, as CBDCs could fundamentally reshape payment infrastructures and introduce new regulatory frameworks.

Geopolitical stability and evolving international trade policies directly impact Adyen's revenue streams. Trade tensions in 2024 created an environment of uncertainty that could slow cross-border commerce, affecting Adyen's transaction volumes and necessitating careful navigation of international trade agreements.

What is included in the product

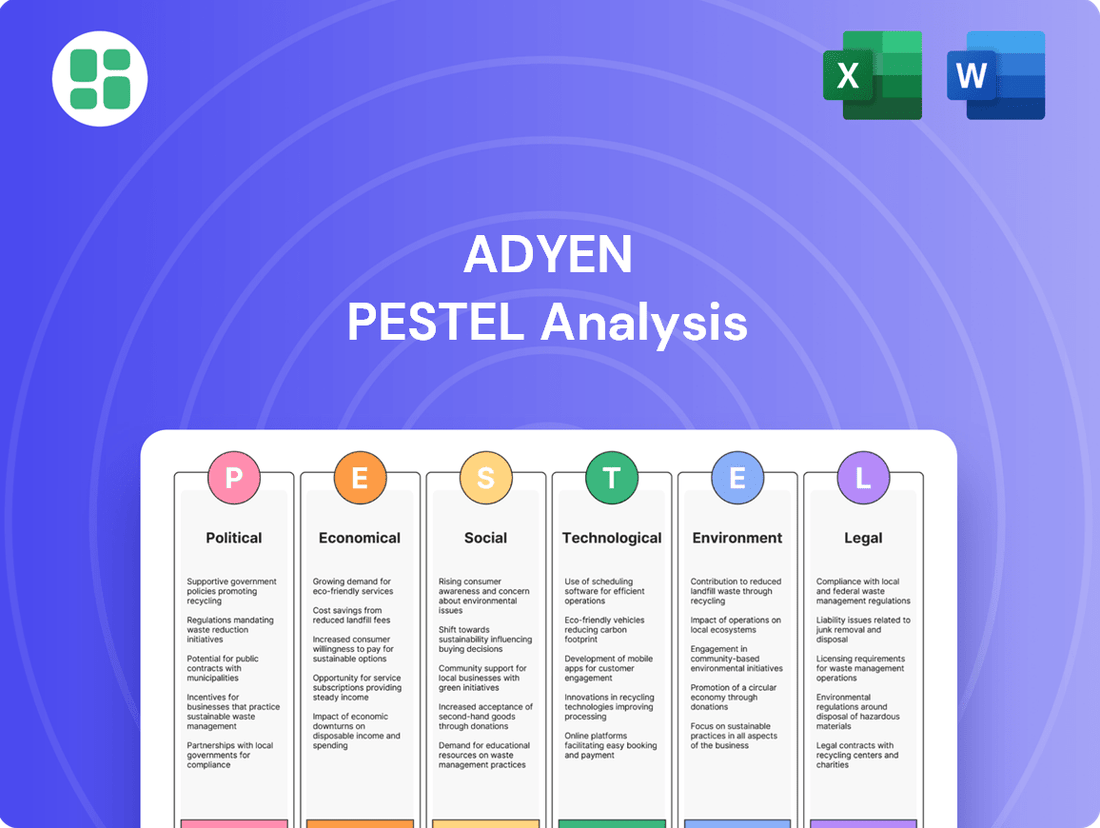

This Adyen PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategy.

It provides actionable insights for stakeholders to navigate the complex external landscape and capitalize on emerging opportunities.

A concise PESTLE analysis for Adyen that can be easily integrated into strategic discussions, simplifying complex external factors for quick understanding and actionable planning.

Economic factors

Adyen's financial performance is intrinsically linked to the health of the global economy and the spending habits of consumers. When economies are robust and confidence is high, people tend to spend more, directly boosting the transaction volumes Adyen processes for its clients. For instance, the IMF projected global growth to reach 3.2% in 2024, indicating a generally supportive environment for increased consumer activity.

Conversely, a slowdown in economic growth or a recessionary environment can significantly dampen consumer spending. This directly translates to fewer transactions for Adyen's merchants, impacting the company's revenue. For example, if consumer confidence dips, as seen in some regions during periods of inflation in 2023 and early 2024, it can lead to a noticeable deceleration in payment processing volumes.

Rising inflation, particularly in major economies like the US and Eurozone, directly impacts consumer spending. For instance, if inflation remains elevated in 2024, it could dampen discretionary spending, leading to lower transaction volumes for merchants, which in turn affects payment processors like Adyen.

Interest rate hikes, such as those implemented by the European Central Bank and the US Federal Reserve throughout 2023 and potentially continuing into 2024, increase the cost of capital for businesses. This can influence merchant adoption of new payment solutions and potentially affect Adyen's own borrowing costs and investment strategies.

Adyen's revenue is closely tied to the total value of transactions processed. Therefore, fluctuations in inflation and interest rates create a dynamic environment where changes in consumer behavior and merchant operational costs can significantly sway Adyen's financial performance.

Adyen's global operations mean it's directly impacted by currency exchange rate volatility. As a payment processor handling transactions across numerous countries, fluctuations in currency values can significantly alter the profitability of cross-border sales. For instance, if the Euro weakens against the US Dollar, Adyen's Euro-denominated revenues from US sales would translate to fewer Euros when converted, potentially impacting its reported earnings.

This volatility also presents a challenge for Adyen's merchant clients. Businesses selling goods or services internationally must contend with unpredictable shifts in the value of their foreign earnings. For example, a merchant based in the UK selling to customers in Japan might see their Yen revenue yield fewer Pounds Sterling due to adverse exchange rate movements, affecting their financial planning and pricing strategies.

In 2024, the Euro experienced notable fluctuations against major currencies. For example, the EUR/USD pair saw considerable movement, influenced by differing monetary policies and economic outlooks between the Eurozone and the United States. This environment underscores the ongoing need for Adyen to manage its currency exposures effectively to maintain stable financial performance and support its global clientele.

Competitive Landscape and Pricing Pressure

The payment processing sector is incredibly crowded, with giants like Stripe and PayPal alongside agile fintech startups constantly competing for merchant business. This fierce rivalry directly translates into significant pricing pressure for companies like Adyen. To stay ahead, Adyen must constantly refine its offerings and maintain competitive transaction fees, a challenge underscored by the industry's typical fee structures, which can range from 1.5% to 3.5% per transaction depending on the payment method and region.

Adyen's strategy to counter this pressure hinges on its ability to offer a unified platform that simplifies complex global payments, reducing operational costs for merchants. For instance, Adyen reported facilitating €737.5 billion in total payment volume in 2023, a testament to its scale and ability to attract large clients seeking efficiency. This differentiation, moving beyond just processing to providing a comprehensive solution, is key to maintaining market position.

- Intense Competition: The payment processing market features a high density of providers, including global leaders and specialized fintechs.

- Pricing Sensitivity: Merchants are often price-sensitive, leading to constant pressure on transaction fees across the industry.

- Adyen's Differentiation: Adyen focuses on offering integrated, global payment solutions to add value beyond basic processing.

- Market Dynamics: The need for continuous innovation and cost-effectiveness is paramount for retaining and acquiring customers in this competitive space.

E-commerce and Digital Economy Expansion

The ongoing surge in e-commerce and the digital economy is a powerful driver for Adyen. As more transactions move online, the need for seamless and secure digital payment processing escalates, directly benefiting companies like Adyen that specialize in these solutions.

This expansion is not slowing down. Global e-commerce sales are projected to reach $7.5 trillion by 2025, up from an estimated $5.7 trillion in 2023, according to Statista. This growth underscores the vast market opportunity for payment providers adept at handling the complexities of digital commerce.

- Digital Payment Growth: The digital payments market is expected to grow significantly, with transaction values projected to reach $15.5 trillion by 2027.

- Cross-Border E-commerce: Cross-border e-commerce is a key component, with its value anticipated to hit $2.1 trillion by 2027, presenting Adyen with opportunities to facilitate international transactions.

- Mobile Commerce Dominance: Mobile commerce is increasingly important, accounting for a substantial portion of online sales, which requires payment solutions optimized for mobile devices.

Economic growth directly fuels Adyen's transaction volumes. With the IMF projecting 3.2% global growth for 2024, this provides a generally favorable backdrop for increased consumer and business spending. However, persistent inflation, as seen in major economies, can dampen discretionary spending, impacting the number and value of transactions processed by Adyen. Similarly, interest rate hikes, such as those by the ECB and US Federal Reserve throughout 2023 and into 2024, increase borrowing costs for merchants and can influence their investment in new payment technologies.

Currency fluctuations also play a significant role. For instance, the Euro's movements against the US Dollar in 2024, influenced by differing monetary policies, directly affect Adyen's reported earnings from cross-border transactions. Merchants also face challenges managing foreign earnings, as seen with UK businesses selling to Japan where Yen-to-Pound Sterling conversions can be unpredictable.

Full Version Awaits

Adyen PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive Adyen PESTLE Analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Adyen.

The content and structure shown in the preview is the same document you’ll download after payment, providing a thorough examination of Adyen's strategic landscape.

Sociological factors

Consumers increasingly favor digital and mobile payment methods. In 2024, mobile payment adoption continued its upward trajectory, with a significant portion of global transactions occurring via smartphones, including mobile wallets and contactless options. This shift is driven by convenience and the integration of payments into daily digital routines.

The rise of Buy Now, Pay Later (BNPL) services is another key trend, offering consumers flexible payment solutions. By late 2024 and into early 2025, BNPL providers reported substantial growth in transaction volumes, particularly among younger demographics. Adyen's ability to integrate these diverse payment preferences directly impacts its value proposition for merchants seeking to capture this evolving consumer base.

The world is increasingly going digital, with more people than ever before using smartphones and the internet. This surge in digital literacy, especially in developing nations, is a game-changer for financial inclusion. It means millions are moving away from cash and embracing digital payments, opening up vast new opportunities.

This growing digital embrace directly benefits companies like Adyen. As more consumers adopt online and mobile transactions, Adyen's ability to process these payments becomes even more valuable. For instance, reports indicate that by 2025, over 80% of the global population is expected to have internet access, a significant jump from just a few years ago.

Adyen's platform is perfectly positioned to capitalize on this shift, enabling businesses to seamlessly connect with this expanding base of digitally-enabled consumers. This trend is particularly evident in regions like Southeast Asia, where mobile payment adoption is soaring, with some countries seeing growth rates exceeding 30% year-over-year in digital transaction volumes.

Consumers today demand payment experiences that are not only fast and secure but also completely seamless, regardless of how they shop. This societal shift means payment providers must deliver highly optimized flows that reduce friction at every touchpoint, from online checkout to in-app purchases.

This expectation puts significant pressure on companies like Adyen to ensure high authorization rates and intuitive interfaces. For instance, a study in late 2024 indicated that over 60% of consumers are likely to abandon a purchase if the checkout process is too complicated, highlighting the direct link between user experience and sales.

Trust and Security Concerns in Digital Payments

Public trust is paramount for digital payment adoption. Concerns about data breaches and fraud can deter both consumers and businesses from using new payment methods. For Adyen, maintaining a strong reputation for security is non-negotiable. A significant security incident could erode confidence and lead to substantial financial losses.

Adyen's commitment to robust security, including advanced fraud detection and transparent data handling, is crucial for building and sustaining trust. In 2024, the global digital payments market is projected to reach over $2.5 trillion, highlighting the immense opportunity, but also the significant risk associated with security failures.

- Consumer Trust: A 2024 survey indicated that over 60% of consumers cite security as their primary concern when choosing a payment method.

- Merchant Reliance: Businesses depend on secure payment gateways to protect their revenue and customer data, making trust a key factor in Adyen's merchant acquisition strategy.

- Reputational Risk: A single major data breach could cost Adyen millions in remediation, regulatory fines, and lost business, impacting its market position.

Changing Workforce Demographics and Skills

The global workforce is increasingly digital-native, with a significant demand for specialized skills in areas like cybersecurity, artificial intelligence, data science, and cloud computing. For Adyen, a payments technology company, attracting and retaining talent with these proficiencies is paramount to maintaining its competitive edge. For instance, a 2024 report indicated a global shortage of cybersecurity professionals, with millions of unfilled positions, highlighting the competitive landscape for Adyen.

Furthermore, the rise of remote and hybrid work models necessitates an organizational adaptation to new work structures. Adyen must foster an inclusive culture that supports diverse work arrangements to attract a broader talent pool. By 2025, it’s projected that over 30% of the global workforce will be working remotely at least part-time, a trend Adyen needs to strategically leverage.

- Digital Skills Gap: A growing demand for AI, data science, and cybersecurity experts puts pressure on tech companies like Adyen to secure specialized talent.

- Remote Work Adoption: The increasing prevalence of remote and hybrid work models requires Adyen to adapt its HR strategies for talent acquisition and retention.

- Talent Competition: Adyen faces intense competition for skilled tech professionals, necessitating competitive compensation and a strong employer brand.

Societal expectations around convenience and speed are transforming payment landscapes, pushing for frictionless experiences. Consumers in 2024 and early 2025 increasingly expect instant transactions, whether online or in-store, leading to a demand for integrated, one-click payment solutions. This societal pressure directly influences Adyen's product development, requiring constant innovation in user interface and processing efficiency to meet these elevated consumer demands.

The growing emphasis on ethical consumption and data privacy is also a significant sociological factor. By 2025, consumer awareness regarding how their data is used by payment providers is expected to be higher than ever. Adyen must navigate these evolving ethical considerations, ensuring transparency and robust data protection to maintain consumer trust and brand reputation, especially as digital payment volumes continue to surge globally.

| Sociological Factor | 2024/2025 Trend | Impact on Adyen |

|---|---|---|

| Demand for Convenience | Continued rise in mobile payments and BNPL adoption. | Adyen must offer seamless integration of diverse payment methods. |

| Digital Literacy & Inclusion | Expansion of internet access, especially in emerging markets. | Opens new customer segments for Adyen's services. |

| User Experience Expectations | High abandonment rates for complex checkouts. | Adyen needs to optimize transaction flows for speed and simplicity. |

| Consumer Trust & Security | Heightened concerns over data breaches and fraud. | Adyen's investment in security is critical for market confidence. |

Technological factors

Adyen significantly bolsters its fraud prevention through sophisticated AI and machine learning. These technologies are not static; they are constantly evolving, allowing Adyen to stay ahead of emerging fraud tactics.

By continuously refining its AI models, Adyen can detect and block fraudulent transactions with greater accuracy. This not only minimizes financial losses for its merchant clients but also contributes to higher approval rates for legitimate transactions, a crucial metric in the payments sector.

This commitment to cutting-edge technology in risk management serves as a significant competitive advantage for Adyen in the dynamic payments landscape, differentiating it from competitors who may not invest as heavily in these advanced capabilities.

Adyen's technological backbone, an API-first and cloud-native architecture, is a significant advantage. This design facilitates swift integration with merchant platforms, ensuring seamless payment processing. For instance, their ability to handle complex integrations quickly is a key differentiator in the fast-paced e-commerce sector.

This modern architecture underpins Adyen's agility, allowing for rapid deployment of new functionalities and robust scalability. In 2024, Adyen continued to emphasize its platform's ability to support growing transaction volumes, a critical factor for merchants expanding globally. The cloud-native approach ensures high availability across its extensive network, minimizing downtime for businesses.

While blockchain and Distributed Ledger Technologies (DLT) are not yet dominant in mainstream payment processing, their potential to reshape payment infrastructure is significant. Adyen actively tracks these advancements, considering their future application for streamlining cross-border transactions, boosting transparency, and creating novel payment pathways.

Cybersecurity Threats and Data Protection

Adyen, as a processor of significant financial data, is a prime target for increasingly sophisticated cyber threats. The company's commitment to robust security measures, including advanced encryption and real-time threat monitoring, is crucial. For instance, in 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, highlighting the immense financial risk involved in data breaches.

Protecting customer data integrity and preventing unauthorized access are paramount for Adyen. This necessitates continuous investment in cutting-edge security technologies and protocols. A 2024 report indicated that the average cost of a data breach in the financial sector reached $5.9 million, underscoring the financial imperative for strong cybersecurity.

Beyond the technological necessity, maintaining strong cybersecurity is vital for regulatory compliance and Adyen's reputation. Failure to protect sensitive information can lead to severe penalties and loss of customer trust. For example, the GDPR fines can reach up to 4% of annual global turnover, a significant deterrent for non-compliance.

- Constant Evolution of Threats: Cybercriminals continuously develop new attack vectors targeting financial data processors.

- Investment in Security Infrastructure: Adyen must allocate substantial resources to state-of-the-art encryption, threat detection, and incident response capabilities.

- Regulatory and Reputational Stakes: Robust cybersecurity is essential for meeting compliance obligations and maintaining customer confidence in data handling.

Innovation in Payment Methods and Devices

The payment landscape is evolving at an unprecedented speed, with innovations like biometric authentication, wearable payment devices, and transactions initiated by the Internet of Things (IoT) becoming increasingly common. Adyen must remain at the forefront of these advancements, continuously updating its platform to seamlessly integrate these new payment methods. This ensures merchants can offer a wide array of payment options to their customers, a crucial factor in today's diverse consumer market.

Adyen's commitment to supporting a broad spectrum of payment devices and form factors is paramount. This includes ensuring compatibility with everything from traditional card readers to the latest contactless and mobile payment solutions. For instance, the global contactless payment market was valued at approximately $2.0 trillion in 2023 and is projected to grow significantly, highlighting the importance of Adyen's adaptability to meet merchant needs across various channels and technologies.

- Biometric Authentication: Fingerprint and facial recognition are becoming standard security features, requiring Adyen's systems to support these methods.

- Wearable Payments: Smartwatches and fitness trackers capable of payments necessitate integration with Adyen's processing capabilities.

- IoT Transactions: Devices like smart refrigerators ordering groceries automatically demand secure, embedded payment solutions.

- Device Compatibility: Adyen must ensure its platform works with a vast and growing array of consumer electronic devices used for payments.

Adyen's technological prowess is central to its competitive edge, especially in fraud prevention. Leveraging AI and machine learning, Adyen continuously refines its ability to detect and block fraudulent transactions, a critical function given the projected $10.5 trillion global cost of cybercrime in 2024.

The company's API-first, cloud-native architecture facilitates rapid integration and scalability, essential for supporting the growing transaction volumes anticipated in 2024. This robust infrastructure ensures high availability, minimizing downtime for merchants.

Adyen actively monitors emerging technologies like blockchain and DLT, recognizing their potential to revolutionize payment infrastructure and streamline cross-border transactions.

Adyen's investment in advanced cybersecurity is paramount, especially considering the average data breach cost in the financial sector reached $5.9 million in 2024. This focus is vital for regulatory compliance, such as GDPR, where fines can reach 4% of global turnover.

| Technology Area | Adyen's Approach | Impact/Data Point |

| Fraud Prevention | AI & Machine Learning | Minimizes financial losses, improves approval rates. Global cybercrime cost projected at $10.5 trillion annually (2024). |

| Platform Architecture | API-first, Cloud-native | Enables swift integration, scalability, and high availability. Supports growing transaction volumes. |

| Emerging Tech | Monitoring (Blockchain, DLT) | Potential for cross-border transaction efficiency and transparency. |

| Cybersecurity | Advanced Encryption, Threat Monitoring | Protects data integrity, meets regulatory compliance. Average data breach cost in finance: $5.9 million (2024). |

Legal factors

Adyen's global operations necessitate strict adherence to a complex landscape of data privacy laws, including the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), alongside evolving regulations in other jurisdictions. These legal frameworks govern every aspect of personal and financial data handling, from collection and storage to processing and sharing. Failure to comply can result in substantial financial penalties; for instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher, underscoring the critical importance of robust data governance for Adyen's legal standing and reputation.

As a financial technology platform, Adyen operates under strict Anti-Money Laundering (AML) and Know Your Customer (KYC) laws designed to combat financial crime. These regulations require Adyen to implement comprehensive due diligence, monitor transactions, and report suspicious activities to maintain financial system integrity.

In the European Union, Payment Services Directives, particularly PSD2 and the forthcoming PSD3, are pivotal in defining the operational environment for payment providers like Adyen. These regulations aim to boost market competition, encourage technological advancements, and strengthen safeguards for consumers. For instance, PSD2's mandate for Strong Customer Authentication (SCA) has already reshaped transaction security protocols across the EU, impacting billions of transactions annually.

Adyen must remain agile, continually updating its services and internal processes to adhere to these evolving legal frameworks. This includes adapting to open banking requirements, which allow third-party providers secure access to customer financial data with consent, fostering new payment solutions and business models. The compliance journey presents both hurdles, such as the cost of implementing new security measures, and significant opportunities for innovation and market expansion.

Consumer Protection and Disclosure Laws

Adyen operates within a complex web of consumer protection and disclosure laws, which are crucial for maintaining trust and avoiding penalties. These regulations mandate transparency in pricing, clear dispute resolution processes, and equitable treatment for all consumers involved in financial transactions. For instance, in the European Union, the Payment Services Directive 2 (PSD2) enforces strong customer authentication and transparency requirements, impacting how Adyen handles payments and customer data. Failure to comply can lead to significant fines; in 2023, the European Data Protection Board reported a total of €1.5 billion in fines issued under GDPR, a framework that heavily influences disclosure practices.

Key legal factors impacting Adyen include:

- Transparency in Fees and Terms: Adyen must clearly communicate all charges, interest rates, and contract terms to its users, aligning with regulations like the Consumer Credit Protection Act in the United States.

- Data Privacy and Security: Compliance with data protection laws such as GDPR in Europe and CCPA in California is paramount, requiring robust measures for handling sensitive customer information. As of early 2024, data privacy breaches remain a significant concern, with regulatory bodies actively pursuing enforcement actions.

- Dispute Resolution: Adyen needs to provide accessible and fair mechanisms for consumers to resolve disputes, as stipulated by consumer rights legislation globally.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Adherence to stringent AML and KYC regulations is essential to prevent financial crime, involving thorough identity verification and transaction monitoring.

Licensing and Regulatory Approvals

Adyen operates in the highly regulated financial technology sector, necessitating a robust framework of licenses and approvals across its global operations. For instance, in the European Union, Adyen holds an Electronic Money Institution (EMI) license issued by the Dutch Central Bank (DNB), allowing it to provide payment services across the Single Euro Payments Area (SEPA). Maintaining these authorizations is critical; in 2024, Adyen continued its proactive engagement with regulatory bodies worldwide to ensure ongoing compliance, which is paramount for market access and service continuity.

The complexity of global financial regulations means Adyen must navigate diverse compliance landscapes, from the Payment Services Directive (PSD2) in Europe to various state-level money transmitter licenses in the United States. Failure to secure or renew these vital permits can lead to significant operational disruptions and penalties. Adyen’s 2024 strategy included significant investment in its compliance infrastructure to manage this intricate web of legal requirements, ensuring uninterrupted service for its merchants.

Key legal factors impacting Adyen include:

- Global Licensing Requirements: Adyen must secure and maintain specific payment processing and acquiring licenses in each jurisdiction it operates, a process that is both resource-intensive and subject to evolving legal standards.

- Regulatory Compliance Burden: Ongoing adherence to directives like PSD2 and various national financial regulations requires continuous monitoring and adaptation of Adyen's systems and processes.

- Market Access Restrictions: Non-compliance or failure to obtain necessary licenses directly impedes Adyen's ability to offer its services in specific countries or regions, impacting growth potential.

Adyen's legal obligations are extensive, covering data privacy, financial crime prevention, and consumer protection across its global operations. Adherence to regulations like GDPR and CCPA is critical, with GDPR fines potentially reaching 4% of global annual turnover. The company must also comply with stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) laws to prevent financial crime.

Payment Services Directives, such as PSD2 and the upcoming PSD3 in the EU, significantly shape Adyen's operational environment, mandating strong customer authentication and fostering competition. Adyen's commitment to compliance is demonstrated by its proactive engagement with regulatory bodies and investment in compliance infrastructure, ensuring continued market access and service continuity.

Navigating global licensing requirements, including Electronic Money Institution (EMI) licenses, is vital for Adyen's operations. For instance, its EMI license from the Dutch Central Bank allows service across the SEPA region. Failure to maintain these licenses can restrict market access and lead to penalties, highlighting the importance of continuous adaptation to evolving legal standards.

Environmental factors

Adyen's digital infrastructure, like all payment processors, is powered by data centers that consume substantial amounts of electricity. This energy demand is a critical environmental consideration, especially as the world pushes for greater sustainability. For instance, the global data center market was valued at over $200 billion in 2023 and is projected to grow, highlighting the scale of energy usage involved.

Growing awareness of climate change intensifies scrutiny on technology firms to minimize their environmental impact, including energy consumption. This translates into pressure on companies like Adyen to adopt more energy-efficient technologies and operational practices. The European Union, for example, aims for a 20% reduction in energy consumption by 2030, influencing how businesses manage their data infrastructure.

To address this, Adyen must prioritize energy efficiency in its data center choices and explore investments in renewable energy sources. This proactive approach not only mitigates environmental risk but can also lead to cost savings and enhanced brand reputation in an increasingly eco-conscious market. Many major tech companies are already committing to 100% renewable energy for their operations, setting a precedent for the industry.

Investors and regulators are pushing for greater transparency in sustainability, with a significant uptick in ESG reporting demands. For instance, in 2024, over 80% of S&P 500 companies published sustainability reports, a substantial increase from previous years, highlighting this critical trend.

Adyen faces mounting pressure to detail its environmental footprint, from carbon emissions to waste management. Stakeholders, including a growing number of ESG-focused funds, expect clear data on these metrics, influencing Adyen's strategic planning and how it communicates its commitment to environmental stewardship.

Consumers and businesses are increasingly prioritizing sustainability, leading to a growing demand for payment solutions that align with environmental values. While the carbon footprint of a single digital transaction is minimal, the broader perception of a payment provider's eco-friendliness can sway customer preference.

Adyen could tap into this trend by developing or partnering on initiatives that highlight its commitment to sustainability. For example, by investing in carbon offsetting programs for its data centers or offering payment options that support eco-conscious merchants, Adyen can appeal to this expanding market segment. In 2024, reports indicated a significant rise in consumer willingness to pay more for sustainable products, a sentiment likely to extend to financial services.

Waste Management and E-waste

The technology sector, including payment processors like Adyen, faces growing scrutiny over electronic waste (e-waste). As hardware is upgraded and devices are retired, this waste stream presents an environmental challenge. While Adyen's core operations are software-centric, its reliance on physical servers, data centers, and employee-issued equipment means it contributes to this issue.

Adyen can mitigate its environmental impact by adopting robust waste management strategies. This includes responsible disposal of outdated hardware and exploring partnerships for recycling or refurbishment. Promoting circular economy principles, such as extending the lifespan of equipment or sourcing refurbished components, further demonstrates environmental commitment.

For instance, the global e-waste generated in 2023 reached an estimated 62 million metric tons, according to the Global E-waste Monitor 2024. Companies are increasingly being held accountable for their role in this growing problem, making proactive waste management a crucial aspect of corporate social responsibility.

- E-waste Generation: The technology industry is a significant contributor to global e-waste, driven by rapid hardware obsolescence.

- Adyen's Footprint: Although software-focused, Adyen's physical infrastructure and employee devices contribute to e-waste.

- Circular Economy: Implementing circular economy principles for hardware, such as repair and reuse, can reduce environmental impact.

- Global E-waste Data: In 2023, global e-waste generation was estimated at 62 million metric tons, highlighting the scale of the issue.

Contribution to a Cashless Society

Adyen's facilitation of digital payments is a significant driver in the global move towards a cashless society. This shift reduces the environmental impact associated with the production, distribution, and disposal of physical cash, such as paper currency and metal coins. For instance, the U.S. Bureau of Engraving and Printing uses cotton and linen to print currency, a process that requires resources and energy.

The increasing reliance on digital transactions, supported by platforms like Adyen, inherently promotes a more resource-efficient payment ecosystem. This digital transformation can lead to a lower carbon footprint compared to the logistical demands of managing physical money. In 2023, global digital payment transaction volumes were projected to exceed 1.5 quadrillion USD, highlighting the scale of this transition.

- Reduced Resource Consumption: Less demand for paper, ink, and metal used in currency production.

- Lower Transportation Emissions: Decreased need for armored vehicles and logistics networks to move physical cash.

- Waste Reduction: Less physical currency ending up in landfills.

- Energy Efficiency: Digital systems, while energy-intensive, can be more efficient per transaction than the entire lifecycle of physical currency.

Adyen's operations, like many tech companies, rely on data centers which consume significant electricity, a key environmental concern. The global data center market's growth, valued over $200 billion in 2023, underscores the energy demands. With increasing climate change awareness, there's pressure on firms like Adyen to adopt energy-efficient practices, aligning with initiatives like the EU's 20% energy reduction goal by 2030.

The company faces growing demands for transparency in its environmental footprint, with a surge in ESG reporting, as evidenced by over 80% of S&P 500 companies publishing sustainability reports in 2024. Consumers and businesses are increasingly favoring sustainable options, making Adyen's eco-friendliness a potential differentiator, especially as consumer willingness to pay more for sustainable products rose significantly in 2024.

Adyen's digital payment facilitation contributes to a cashless society, reducing the environmental impact tied to physical currency production and logistics. The projected over 1.5 quadrillion USD in global digital payment transaction volumes for 2023 highlights this shift towards a more resource-efficient payment ecosystem compared to the lifecycle of physical money.

PESTLE Analysis Data Sources

Our PESTLE analysis for Adyen is built upon a robust foundation of data from reputable financial institutions, industry-specific market research, and official government publications. We meticulously gather insights on political stability, economic indicators, technological advancements, and evolving regulatory landscapes to ensure a comprehensive and accurate assessment.