Adyen Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adyen Bundle

Adyen's product strategy focuses on unified commerce, offering a single platform for online, mobile, and in-store payments. This comprehensive approach simplifies complex payment ecosystems for businesses, driving efficiency and customer experience.

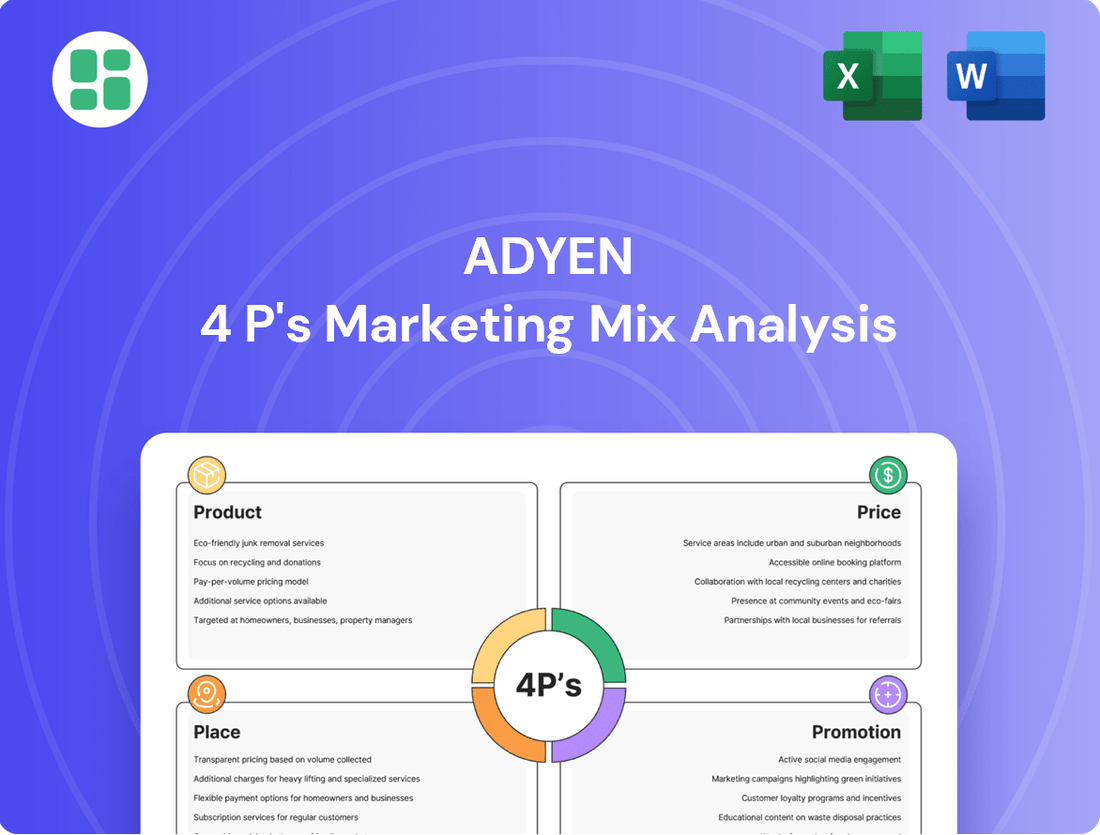

Unlock the full picture of Adyen's marketing success. Get instant access to a detailed, editable 4Ps Marketing Mix Analysis covering their innovative product suite, competitive pricing, strategic distribution, and impactful promotion.

Product

Adyen's End-to-End Payment Solutions represent its Product in the 4Ps marketing mix. This offering is a unified financial technology platform designed to streamline payment processing, risk management, and acquiring for businesses worldwide. It simplifies intricate payment infrastructures, allowing merchants to manage all their transactions through a single, integrated system.

This comprehensive approach supports a variety of payment channels, encompassing online, in-app, and physical store transactions. This ensures a seamless, unified commerce experience for customers, regardless of how they choose to pay. In 2024, Adyen reported processing a substantial volume of transactions, demonstrating the scale and adoption of its integrated payment solutions.

Adyen's unified commerce offering is a standout product, bringing together online, app, and in-store payment data into a single, cohesive platform. This integration provides businesses with a complete picture of customer interactions and payment streams, significantly boosting operational efficiency and customer satisfaction.

This unified approach is crucial for creating smooth, consistent payment experiences for customers, no matter how they choose to shop. For instance, Adyen reported processing €737.6 billion in total payment volume in 2023, a 23% increase year-over-year, underscoring the demand for such integrated solutions.

Adyen's AI-powered optimization tools, such as Intelligent Payment Routing and Adyen Uplift, are key to their product offering. These solutions leverage artificial intelligence and machine learning to dynamically manage transactions.

By intelligently routing payments and employing uplift strategies, Adyen aims to significantly increase authorization rates and reduce instances of fraud. This directly translates to a smoother checkout experience for customers.

These advanced capabilities provide merchants with critical, data-driven insights. This allows businesses to refine their payment strategies and boost overall operational performance, a crucial factor in today's competitive landscape.

Global Payment Acceptance

Adyen's global payment acceptance capability is a cornerstone of its offering, allowing businesses to seamlessly receive payments from customers across the globe. This platform supports an impressive array of over 250 local payment methods and more than 150 currencies, which is vital for companies targeting international expansion. By integrating popular credit and debit cards, regional payment preferences, and mobile wallets, Adyen caters to a broad spectrum of customer transaction habits, thereby reducing friction in cross-border commerce.

The sheer breadth of payment options available through Adyen directly addresses the diverse needs of an international customer base. For instance, in 2024, emerging markets saw a significant uptick in mobile wallet usage for online transactions, a trend Adyen's platform is well-equipped to handle. This extensive reach not only simplifies international sales but also enhances the customer experience by offering familiar and convenient payment methods, which can translate to higher conversion rates for merchants.

- Global Reach: Supports over 250 local payment methods and 150+ currencies.

- Customer Convenience: Integrates popular cards, local options, and mobile wallets.

- Market Expansion: Crucial for businesses looking to grow internationally.

- Increased Conversions: Facilitates preferred payment methods, boosting sales.

Embedded Financial s for Platforms

Adyen's 'Adyen for Platforms' offering is a strategic move to capture the growing marketplace economy. This product allows platforms to seamlessly manage payments for their sub-merchants, streamlining onboarding and settlement processes. For instance, in 2024, the global marketplace GMV is projected to exceed $7 trillion, highlighting the immense opportunity for platforms to leverage integrated payment solutions.

Embedded financial products, such as Adyen's branded payout cards, represent a key element of their product strategy for platforms. These offerings not only simplify financial operations for sub-merchants but also create new revenue opportunities for the platform itself. By embedding these services, platforms can foster greater customer loyalty and reduce churn.

- Streamlined Sub-Merchant Onboarding: Platforms can offer a frictionless payment setup for their sellers.

- Enhanced Revenue Streams: Embedded financial products like branded cards create new income for platforms.

- Increased Customer Stickiness: Integrated financial services deepen platform relationships and reduce churn.

- Marketplace Growth Support: Adyen for Platforms caters to the rapidly expanding global marketplace sector, which saw significant growth in 2023 and is projected to continue this trend through 2025.

Adyen's product suite is characterized by its unified, end-to-end payment solutions designed for global commerce. This platform simplifies complex payment infrastructures, consolidating online, in-app, and physical transactions into a single, integrated system. The company's focus on a unified commerce experience ensures seamless customer interactions across all touchpoints.

Key product features include AI-powered optimization tools like Intelligent Payment Routing and Adyen Uplift, which aim to boost authorization rates and reduce fraud. The platform's global reach is extensive, supporting over 250 local payment methods and more than 150 currencies, facilitating international expansion for businesses.

Furthermore, Adyen's 'Adyen for Platforms' offering caters to the growing marketplace economy by enabling platforms to manage payments for sub-merchants, including embedded financial products like branded payout cards. This strategic product development supports marketplace growth and enhances platform revenue streams.

| Product Feature | Description | Key Benefit | 2023/2024 Data Point |

|---|---|---|---|

| Unified Commerce Platform | Integrates online, in-app, and in-store payments. | Streamlined operations, unified customer view. | €737.6 billion Total Payment Volume processed in 2023 (23% YoY growth). |

| AI-Powered Optimization | Intelligent Payment Routing, Adyen Uplift. | Increased authorization rates, reduced fraud. | Enhanced authorization rates for merchants using AI tools. |

| Global Payment Acceptance | 250+ local payment methods, 150+ currencies. | Facilitates international sales, customer convenience. | Significant uptick in mobile wallet usage in emerging markets in 2024. |

| Adyen for Platforms | Payment management for marketplaces and sub-merchants. | Streamlined onboarding, new revenue streams. | Global marketplace GMV projected to exceed $7 trillion in 2024. |

What is included in the product

This analysis delves into Adyen's marketing mix, examining its comprehensive product offerings, competitive pricing strategies, global place of operations, and multi-faceted promotional activities.

Simplifies complex marketing strategy into actionable insights, alleviating the pain of understanding Adyen's competitive positioning and core value proposition.

Provides a clear, concise overview of Adyen's marketing approach, easing the burden of strategic planning and communication for diverse teams.

Place

Adyen's direct sales strategy is laser-focused on securing large enterprise clients and major platform businesses. This approach is essential because these clients demand highly integrated and complex payment solutions, often needing bespoke configurations. Adyen's sales teams engage directly with the 'buying committees' within these organizations, understanding their intricate requirements.

This direct engagement allows Adyen to develop deeply customized payment infrastructures for high-volume merchants. For instance, in 2023, Adyen reported a significant portion of its revenue growth came from its largest clients, underscoring the effectiveness of this direct sales model in capturing substantial market share within the enterprise segment.

Adyen's global infrastructure is a cornerstone of its marketing mix, enabling it to serve a diverse clientele across continents. With offices strategically positioned in key financial hubs, Adyen ensures localized support and a robust payment network for its merchants. This physical presence is crucial for facilitating seamless cross-border transactions, a vital component for businesses operating in today's interconnected economy.

The company's commitment to expanding its global footprint is evident in its continued investment in new office locations. As of early 2024, Adyen operates in over 30 countries, underscoring its dedication to being close to its customers and understanding regional market nuances. This expansion strategy directly supports its ability to offer tailored payment solutions and maintain high service levels worldwide.

Adyen's omnichannel distribution capabilities are central to its offering, connecting online, in-app, and in-store sales data for a unified merchant view. This integrated approach empowers businesses to create seamless customer journeys across all touchpoints. For instance, Adyen's platform facilitates consistent loyalty programs and personalized offers whether a customer shops online or in a physical store.

The platform supports a wide array of hardware for in-person transactions, from traditional point-of-sale terminals to modern mobile POS devices. This flexibility ensures merchants can adapt their physical retail presence to match the digital experience. In 2024, Adyen reported a significant increase in its in-store processing volumes, reflecting the growing adoption of its unified commerce solutions by retailers seeking to bridge their online and offline operations.

Strategic Partnerships and Ecosystem

Adyen strategically cultivates partnerships with key players across the digital commerce landscape, including e-commerce platforms like Shopify and BigCommerce, and enterprise resource planning (ERP) systems such as SAP and Oracle. These alliances are crucial for embedding Adyen's payment processing capabilities directly into the operational workflows of businesses, thereby expanding its market penetration and simplifying adoption for merchants. By integrating with these established ecosystems, Adyen enhances its value proposition, offering a more seamless and comprehensive solution.

These collaborations enable Adyen to reach a broader customer base and offer enhanced functionalities. For instance, Adyen's integration with platforms allows merchants to easily manage payments alongside their sales and inventory, streamlining operations. The company's commitment to building a robust ecosystem is evident in its ongoing efforts to connect with a diverse range of technology providers, ensuring its payment solutions are adaptable and accessible to businesses of all sizes and across various industries.

- E-commerce Platform Integration: Adyen partners with leading platforms to offer embedded payment solutions, simplifying checkout for online retailers.

- ERP System Connectivity: Collaborations with ERP providers allow for seamless reconciliation of payments with financial records, improving back-office efficiency.

- Technology Provider Alliances: Adyen works with various tech companies to enhance its offering, such as fraud prevention tools or customer data platforms.

- Market Reach Expansion: These strategic partnerships are instrumental in increasing Adyen's visibility and accessibility to new merchant segments globally.

Geographical Expansion Initiatives

Adyen is actively pursuing geographical expansion, with a strategic focus on high-growth markets like North America, India, and Japan. This expansion involves significant investment in local infrastructure, building dedicated commercial and engineering teams, and tailoring its payment platform to suit unique regional market demands. By doing so, Adyen ensures its comprehensive payment solutions are readily accessible and finely tuned for a diverse global customer base.

In 2024, Adyen continued to bolster its presence in key regions. For instance, its North American operations have seen substantial growth, driven by increasing demand for unified commerce solutions. The company's commitment to localization is evident in its hiring efforts, with a notable increase in local talent acquisition in India and Japan throughout 2024 and early 2025, aiming to better serve the specific needs of businesses in these dynamic economies.

- North America: Continued investment in expanding its merchant services and platform capabilities to capture a larger share of the US and Canadian markets.

- India: Focus on building out a robust local team and adapting its payment gateway to cater to India's rapidly growing digital economy and diverse payment preferences.

- Japan: Strategic efforts to enhance its offering for Japanese businesses, including support for local payment methods and compliance with regulatory requirements.

Adyen's physical presence is deeply intertwined with its global infrastructure, enabling localized support and a robust payment network. With offices in over 30 countries as of early 2024, Adyen prioritizes being close to its customers. This strategic placement facilitates seamless cross-border transactions and allows for a nuanced understanding of regional market demands, crucial for tailoring its payment solutions.

What You See Is What You Get

Adyen 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Adyen 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You're viewing the exact version of the analysis you'll receive, fully complete and ready to use for your strategic planning.

Promotion

Adyen's promotion strategies are laser-focused on a Business-to-Business (B2B) audience, specifically engaging financially-literate decision-makers within large enterprises and digital platforms. Their core messaging highlights the sophisticated, end-to-end capabilities of their payment solutions, underscoring their proficiency in tackling complex financial challenges.

Key communication channels employed by Adyen include direct sales engagements, where tailored solutions are presented. Furthermore, they leverage industry publications to reach their target demographic and utilize digital content, such as white papers and case studies, to showcase their expertise and value proposition. For instance, Adyen's 2024 investor relations reports consistently emphasize their growth in enterprise clients, indicating the effectiveness of their B2B-centric promotional efforts.

Adyen's promotional efforts consistently emphasize its core value propositions: boosting authorization rates, mitigating fraud, and delivering robust data analytics. The company effectively communicates how its integrated payment platform drives business efficiency and growth.

This focus on tangible business outcomes, such as increasing sales through higher approval rates and reducing chargebacks via advanced fraud detection, directly addresses the needs of strategic decision-makers. For instance, Adyen's technology aims to improve authorization rates, which can directly impact a merchant's revenue; a 1% increase in authorization rates can translate to millions in additional revenue for larger businesses.

Adyen actively cultivates thought leadership through its consistent publication of annual reports, business updates, and insightful industry analyses. For instance, their 2024 Annual Report and the Q1 2025 Business Update offer stakeholders a transparent view into their financial performance, strategic direction, and prevailing market dynamics.

These valuable resources, like the recently released 2024 Annual Report detailing their performance and strategic initiatives, position Adyen as a knowledgeable and reliable authority within the competitive fintech landscape, fostering trust and credibility among its audience.

Showcasing Product Innovation

Adyen consistently emphasizes its commitment to product innovation, a key element in showcasing its market leadership. This focus is evident in the regular introduction of advanced solutions designed to meet evolving merchant demands.

The company actively publicizes new AI-powered features, such as Adyen Uplift, which aims to boost conversion rates for businesses. Furthermore, Adyen has launched updated physical hardware, like the SFO1 terminal, enhancing the in-store payment experience. These developments are communicated through various channels, including press releases and detailed website content.

- AI-Powered Solutions: Adyen Uplift is a prime example of their AI integration, designed to optimize customer journeys and increase sales.

- Hardware Advancements: The SFO1 terminal represents their commitment to providing robust and user-friendly physical payment devices.

- Communication Strategy: Product innovations are strategically announced via press releases and detailed explanations on their official website, reinforcing their technological edge.

- Merchant Value Proposition: By highlighting these advancements, Adyen underscores its dedication to providing merchants with cutting-edge tools that drive growth and efficiency.

Industry Recognition and Case Studies

Adyen strategically uses industry accolades to bolster its market position. For instance, being recognized as a Leader in IDC MarketScapes for payment platform software in both 2024 and 2025 underscores their technological prowess and market leadership. This recognition directly translates into enhanced trust among potential clients.

Furthermore, Adyen prominently features case studies detailing successful partnerships with globally recognized brands. These include collaborations with companies like Meta, Uber, H&M, and eBay, showcasing tangible results and the effective deployment of Adyen's payment solutions. Such real-world examples serve as powerful endorsements of their capabilities.

The inclusion of these case studies allows prospective clients to see direct evidence of Adyen's impact on businesses similar to their own. This approach effectively demonstrates:

- Proven success stories with major global enterprises.

- Tangible benefits derived from Adyen's integrated payment platform.

- Enhanced credibility through third-party validation and client testimonials.

Adyen's promotional strategy centers on demonstrating tangible business value to its B2B clientele. They highlight how their platform directly contributes to increased revenue and operational efficiency through features like enhanced authorization rates and robust fraud mitigation. For example, Adyen's 2024 investor reports consistently point to strong growth in enterprise adoption, a testament to their effective B2B outreach.

The company leverages thought leadership and product innovation as key promotional tools. Their 2024 Annual Report and Q1 2025 updates showcase advancements like Adyen Uplift, an AI-powered solution aimed at boosting conversion rates. This focus on cutting-edge technology, coupled with industry accolades like being named a Leader in IDC MarketScapes for payment platform software in 2024 and 2025, builds significant credibility.

Case studies featuring global brands such as Meta, Uber, and H&M serve as powerful endorsements, illustrating the real-world impact of Adyen's solutions. These examples provide prospective clients with concrete evidence of improved sales and reduced risk, reinforcing Adyen's position as a trusted partner for businesses seeking to optimize their payment operations.

| Promotional Focus | Key Initiatives | Demonstrated Value | Supporting Data (2024/2025) |

|---|---|---|---|

| B2B Value Proposition | Direct Sales, Industry Publications, Digital Content | Increased Authorization Rates, Fraud Mitigation, Data Analytics | Growth in Enterprise Clients (Investor Reports) |

| Thought Leadership & Innovation | Annual Reports, Business Updates, Press Releases | AI-Powered Solutions (Adyen Uplift), Hardware Advancements (SFO1 Terminal) | IDC Marketscape Leader (2024, 2025) |

| Credibility & Trust | Case Studies, Client Testimonials | Proven Success with Global Brands | Partnerships with Meta, Uber, H&M, eBay |

Price

Adyen employs an Interchange++ pricing model, offering a clear view of each transaction's fees. This model separates interchange fees, set by card issuers, from scheme fees charged by card networks, and Adyen's own processing fee. For instance, in 2024, interchange fees can range from 0.2% to over 2% depending on card type and transaction, while scheme fees might add another 0.1% to 0.5%, with Adyen's markup being competitive.

Adyen's pricing structure is built around transaction-based fees, a core component of its 'Price' strategy within the 4Ps. This means customers primarily pay for each transaction processed through the platform. This model directly links Adyen's revenue to the volume and value of payments handled.

The typical Adyen fee consists of a small fixed amount per transaction plus a percentage of the transaction value, which varies depending on the payment method. For instance, a common structure might be a small fixed fee like $0.10 plus a percentage that could range from around 0.5% for debit cards to over 2% for certain credit cards or alternative payment methods. This pay-as-you-go approach is a significant differentiator.

Crucially, Adyen generally avoids the recurring charges common with other payment processors. This means no monthly account fees, no setup costs, and no charges for integration or account closure. This transparent, volume-driven pricing makes costs predictable and directly tied to business activity, appealing to businesses of all sizes looking for straightforward payment processing costs.

For businesses processing substantial transaction volumes or requiring highly specialized payment solutions, Adyen provides bespoke pricing structures. These custom agreements often incorporate tiered volume discounts, making Adyen a compelling choice for large enterprises seeking cost-efficiency. For instance, in 2024, Adyen's ability to negotiate rates allows them to accommodate a wide array of business models, from rapidly scaling startups to established global corporations.

Additional Service Fees

While Adyen's primary revenue comes from per-transaction fees, a closer look at their pricing reveals a layer of additional service fees that businesses must factor in. These charges, though often smaller individually, can significantly impact the overall cost of payment processing.

These supplementary fees are typically applied for specific functionalities and actions within the Adyen ecosystem. For instance, handling cross-border transactions often involves currency conversion fees, which vary based on the currencies involved. Similarly, processing refunds or managing customer disputes, such as chargebacks, can also incur separate charges.

For businesses evaluating Adyen, understanding these miscellaneous fees is crucial for accurate budgeting and cost-benefit analysis. These charges, while standard in the payment processing industry, contribute to the total expenditure and should be considered alongside the core transaction rates.

- Currency Conversion Fees: Applied to transactions involving different currencies, impacting international sales.

- Refund Processing Fees: Charges associated with issuing refunds to customers, a common operational cost.

- Dispute Management (Chargeback) Fees: Costs incurred when a customer disputes a transaction with their bank.

Cost Efficiency through Open Banking

Adyen's focus on cost efficiency is evident in its support for open banking payments. These direct account-to-account transactions bypass traditional card networks, which typically incur higher interchange and scheme fees. For instance, in Europe, where open banking adoption is growing, businesses can see significant savings by shifting transactions away from card rails.

This cost advantage is particularly impactful for businesses processing high volumes of transactions. By reducing per-transaction costs, Adyen's open banking solutions can directly contribute to improved profit margins. For example, a study by PwC in late 2023 indicated that account-to-account payments could offer savings of up to 50% compared to card payments for certain transaction types.

- Lower Transaction Fees: Open banking payments typically have lower processing fees than card payments, as they avoid card network charges.

- Reduced Chargebacks: Account-to-account payments often have a lower incidence of chargebacks, further reducing associated costs and administrative burden.

- Improved Cash Flow: Direct debits through open banking can offer more predictable settlement times, enhancing cash flow management for businesses.

- Competitive Advantage: Offering cost-effective payment options can provide a competitive edge, attracting and retaining customers who are price-sensitive.

Adyen's pricing strategy, centered on its Interchange++ model, offers transparency by itemizing interchange, scheme, and Adyen's own processing fees. This approach ensures businesses understand every cost component, with interchange fees in 2024 varying from 0.2% to over 2% based on card type, and scheme fees typically adding another 0.1% to 0.5%. Adyen's own markup remains competitive within this framework.

The core of Adyen's pricing is its transaction-based fee structure, typically a small fixed amount per transaction plus a percentage of the transaction value. For example, a common fee might be $0.10 plus 0.5% to 2% depending on the payment method, aligning revenue directly with payment volume and value.

Adyen generally avoids recurring charges like monthly account fees or setup costs, offering a pay-as-you-go model that appeals to businesses seeking predictable expenses. For high-volume clients or those needing specialized solutions, Adyen provides custom pricing with potential volume discounts, making it attractive for large enterprises in 2024.

Beyond core transaction fees, businesses should account for supplementary charges such as currency conversion fees for international sales and fees for refunds or dispute management (chargebacks). These ancillary costs, while standard, impact the total payment processing expenditure.

| Fee Type | Typical Range (2024) | Notes |

|---|---|---|

| Interchange Fees | 0.2% - 2%+ | Varies by card type, issuer, and transaction |

| Scheme Fees | 0.1% - 0.5% | Charged by card networks (Visa, Mastercard) |

| Adyen Processing Fee | Competitive Markup | Adyen's own service charge |

| Currency Conversion | Variable | Applied to cross-border transactions |

| Refund Processing | Per Refund | Cost for issuing refunds |

| Dispute Management | Per Dispute | Costs associated with chargebacks |

4P's Marketing Mix Analysis Data Sources

Our Adyen 4P's Marketing Mix Analysis is built upon a robust foundation of publicly available data. We meticulously examine Adyen's official press releases, investor relations materials, and their comprehensive website to understand their product offerings, pricing strategies, and distribution channels.

To ensure accuracy and relevance, we also incorporate insights from reputable industry reports and competitive analysis platforms. This allows us to benchmark Adyen's promotional activities and overall market positioning against key players in the payments industry.