Adyen Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adyen Bundle

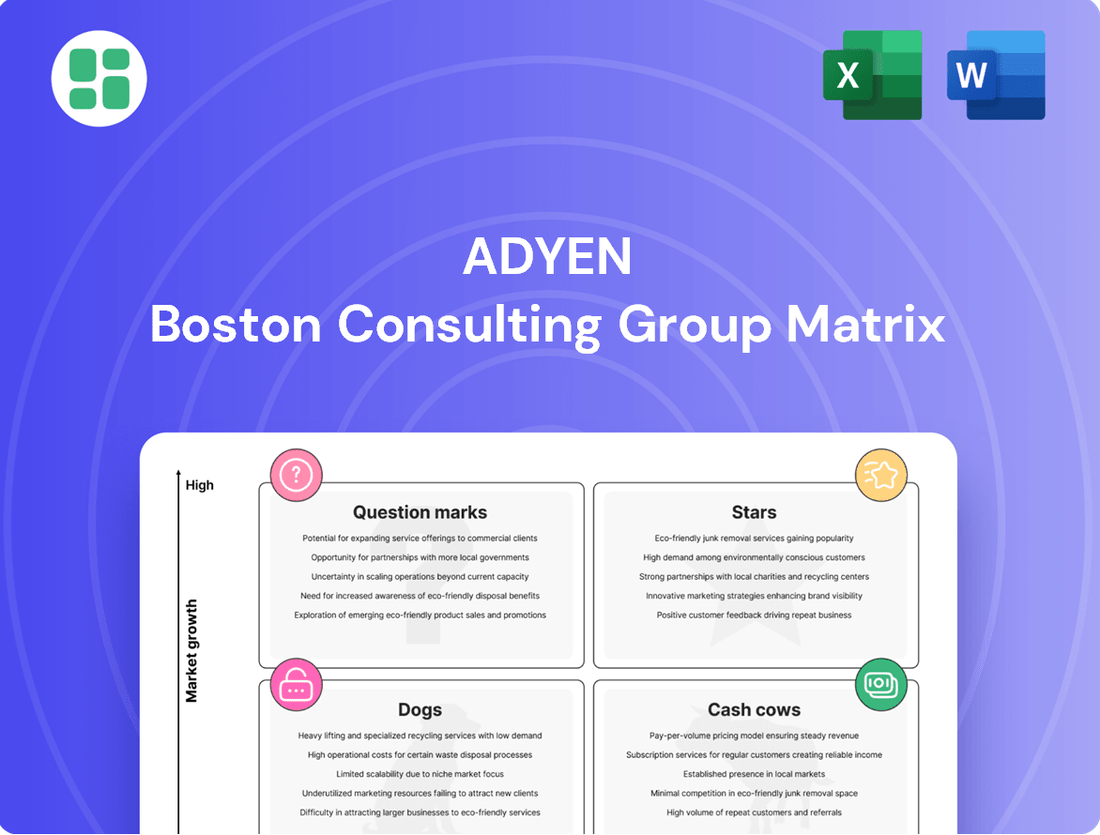

Explore Adyen's strategic positioning with our insightful BCG Matrix preview, highlighting its potential Stars, Cash Cows, Dogs, and Question Marks. Understand where Adyen's offerings fit within the market landscape and identify key areas for growth and optimization. Purchase the full BCG Matrix for a comprehensive breakdown, actionable insights, and a clear roadmap to capitalize on Adyen's market opportunities.

Stars

Adyen's Unified Commerce platform is a clear star in its portfolio, seamlessly blending online, in-app, and in-store payment experiences for businesses. This integrated approach is a major draw for retailers navigating the complexities of modern customer journeys. The platform's success is evident in Adyen's financial performance, with net revenue climbing an impressive 31% year-over-year in Q1 2025 and a strong 35% in the second half of 2024.

North America represents a significant opportunity for Adyen, characterized by robust growth and increasing market penetration. The company's strategic investments in the region are paying off, as evidenced by a 21% rise in North America-related revenues during the second half of 2024.

To fuel this expansion, Adyen has bolstered its North American infrastructure, notably with a new 150,000-square-foot office in San Francisco. This investment underscores Adyen's commitment to capturing the vast potential within North America's e-commerce landscape and its high propensity for digital payments.

Adyen for Platforms is Adyen's newest and most rapidly expanding business segment. This specialized offering caters to online platforms and marketplaces, demonstrating impressive growth trajectories. In the first quarter of 2025, net revenue for this pillar surged by 63% year-over-year.

This robust performance is further underscored by a 44% increase in volumes during the second half of 2024. Such growth highlights the strong underlying momentum within the Software-as-a-Service (SaaS) sector that Adyen for Platforms serves.

The critical role of this segment lies in its ability to generate new revenue streams for platform clients. This capability is significantly enhanced by Adyen's Embedded Financial Product (EFP) suite, which provides integrated financial solutions.

AI-powered Payment Optimization (Adyen Uplift)

Adyen Uplift, introduced in January 2025, is an AI-driven payment solution aimed at fine-tuning transactions, boosting authorization success, and lowering expenses for merchants. This advanced offering underscores Adyen's dedication to utilizing artificial intelligence to strengthen its market position and stand out in a crowded landscape.

Early pilot programs for Adyen Uplift have showcased impressive results, with participating businesses reporting substantial cost reductions and notable increases in conversion rates. For instance, one pilot merchant saw a 5% uplift in authorization rates, directly translating to increased revenue. Another observed a 3% decrease in processing fees through intelligent routing and fraud prevention.

- Adyen Uplift's AI capabilities focus on real-time transaction analysis.

- Pilot programs have demonstrated significant improvements in authorization rates, with some clients seeing up to a 5% increase.

- Cost savings are achieved through optimized payment routing and enhanced fraud detection.

- The product aims to directly impact conversion rates, with early tests showing a 3% boost for some users.

Global Enterprise Client Base

Adyen's robust global enterprise client base, featuring giants like Meta, Uber, H&M, eBay, and Microsoft, firmly places this segment as a Star in the BCG Matrix.

These partnerships are crucial, driving substantial transaction volumes and offering a solid foundation for increasing wallet share. This expansion is a primary engine for Adyen's consistent revenue growth and its leading position in sophisticated payment solutions.

For instance, in 2024, Adyen continued to secure and deepen relationships with major global brands, contributing to a significant portion of its overall payment processing volume.

- Global Enterprise Clients: Key partners include Meta, Uber, H&M, eBay, and Microsoft.

- Revenue Driver: These relationships generate substantial transaction volumes, fueling revenue growth.

- Market Position: Stable client base supports wallet share expansion and market leadership.

- 2024 Performance: Continued acquisition and deepening of major global brand partnerships.

Adyen for Platforms stands out as a high-growth Star, capturing significant market share within the rapidly expanding marketplace and platform economy. Its impressive revenue surge of 63% year-over-year in Q1 2025 and a 44% volume increase in the latter half of 2024 highlight its strong momentum. This segment empowers platform clients by enabling new revenue streams through integrated financial solutions like the Embedded Financial Product suite.

Adyen Uplift, an AI-driven payment solution launched in January 2025, is rapidly emerging as a Star by enhancing transaction success rates and reducing merchant costs. Pilot programs have shown promising results, with some merchants experiencing up to a 5% increase in authorization rates and a 3% reduction in processing fees. This innovation positions Adyen at the forefront of AI-powered payment optimization.

Adyen's global enterprise client base, including major players like Meta, Uber, and Microsoft, solidifies its Star status. These partnerships are critical revenue drivers, contributing significantly to Adyen's overall payment processing volumes and supporting expansion of wallet share. The continued deepening of these relationships in 2024 underscores Adyen's market leadership and its ability to serve complex, high-volume businesses.

| Product/Segment | BCG Category | Key Performance Indicators | Supporting Data |

| Adyen for Platforms | Star | Rapid revenue growth, high volume increase, enabling new revenue streams for clients. | Q1 2025: 63% YoY net revenue growth. H2 2024: 44% volume increase. |

| Adyen Uplift | Star | AI-driven optimization, improved authorization rates, cost reduction. | Pilot: Up to 5% authorization rate uplift, 3% processing fee reduction. Launched Jan 2025. |

| Global Enterprise Clients | Star | Significant transaction volumes, strong revenue contribution, market leadership. | Key clients: Meta, Uber, Microsoft. Continued deepening of partnerships in 2024. |

What is included in the product

Adyen's BCG Matrix offers a strategic overview of its product portfolio, identifying growth opportunities and resource allocation.

Adyen BCG Matrix: A visual tool to quickly identify underperforming products, freeing up resources for innovation.

Cash Cows

Adyen's core digital payment processing in EMEA is a prime example of a cash cow within its business. This segment, while experiencing a moderate 13% year-over-year growth in Q1 2025, still represents the bedrock of Adyen's operations.

It contributed the largest portion of processed volumes, at 58% in the second half of 2024, underscoring its dominance and consistent revenue generation. The EMEA region itself demonstrated robust performance, with revenue climbing 27% in H2 2024, showcasing its status as a mature yet highly profitable market for Adyen.

Adyen's traditional point-of-sale (POS) solutions are a cornerstone of its Unified Commerce offering, acting as a significant cash cow. These systems are well-established and reliably generate substantial revenue by facilitating in-person transactions for a vast merchant base.

The strength of these offerings is evident in their performance metrics. For the entirety of 2024, POS volumes experienced a robust 46% year-over-year increase, reaching an impressive €232.7 billion. This substantial growth underscores the continued demand and dependable performance of these solutions in the physical retail space.

Adyen's established risk management services act as a significant cash cow within its business model. These mature offerings, deeply integrated into the platform, generate consistent revenue by helping merchants combat fraud and improve transaction approval rates. For instance, in 2023, Adyen reported a significant increase in transaction volumes, underscoring the ongoing demand for effective risk mitigation solutions.

Global Payment Acquiring Services

Adyen's global payment acquiring services are a cornerstone of its business, acting as a mature Cash Cow. This segment connects merchants directly to card networks and a wide array of local payment methods, ensuring smooth transactions worldwide. In 2023, Adyen reported a significant increase in total processed volume, reaching €737.5 billion, a testament to the consistent demand for its acquiring capabilities.

These services generate reliable, transaction-based revenue from Adyen's extensive merchant network. Unlike newer, high-growth ventures, the acquiring business requires minimal new investment for upkeep, allowing it to generate substantial profits. This steady income stream fuels further innovation and expansion into other business areas.

- Mature Offering: Global payment acquiring is a well-established service, vital for merchants.

- Steady Revenue: Generates consistent income through transaction fees across a large customer base.

- Low Investment Needs: Requires relatively little new capital for maintenance compared to growth-focused segments.

- Profitability Driver: Its stable earnings support Adyen's overall financial health and strategic investments.

Data & Insights Offering

Adyen's data and insights offering represents a mature capability, honed through years of innovation and a commitment to data-driven strategies. This sophisticated service primarily benefits Adyen's existing large client base, providing them with deeper understanding and actionable intelligence.

While not a standalone high-growth product, this offering plays a crucial role in bolstering customer loyalty and operational efficiency. It indirectly contributes to Adyen's cash generation by improving merchant performance and increasing retention rates.

In 2023, Adyen reported a 23% increase in total revenue, reaching €1.7 billion. This growth underscores the effectiveness of their integrated offerings, including the value derived from their data and insights capabilities which enhance merchant success.

- Mature Offering: Adyen's data and insights are a well-developed capability, not a nascent product.

- Client Value: Primarily benefits existing large clients by providing them with valuable analytics.

- Indirect Cash Generation: Enhances merchant performance and loyalty, leading to increased retention and revenue.

- Strategic Importance: Supports overall business efficiency and customer stickiness within Adyen's ecosystem.

Adyen's established global payment acquiring services are a prime example of a cash cow, generating consistent, transaction-based revenue. This segment, which connects merchants to card networks and local payment methods, saw total processed volume reach €737.5 billion in 2023, a significant increase that highlights its dependable performance.

These services require minimal new investment for maintenance, allowing them to generate substantial profits that fuel other areas of Adyen's business. The continued demand for these core capabilities ensures a stable income stream, supporting Adyen's overall financial health and strategic growth initiatives.

| Business Segment | BCG Category | Key Characteristics | 2023 Data Point |

| Global Payment Acquiring | Cash Cow | Mature, stable revenue, low investment needs | €737.5 billion processed volume |

| EMEA Digital Payments | Cash Cow | Dominant market share, consistent revenue generation | 58% of processed volumes (H2 2024) |

| Traditional POS Solutions | Cash Cow | Well-established, reliable revenue from in-person transactions | €232.7 billion POS volumes (2024) |

What You See Is What You Get

Adyen BCG Matrix

The Adyen BCG Matrix preview you are currently viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no placeholder text, and no alterations – just the complete strategic analysis ready for your business planning. You can confidently use this preview as a direct representation of the professional, actionable document that will be yours to download and implement. It's designed for immediate use in understanding Adyen's product portfolio and market positioning.

Dogs

Certain older or highly niche local payment methods that Adyen supports might fall into the Dogs category. These are payment options with very low transaction volumes or declining usage, potentially requiring ongoing maintenance and integration efforts without generating substantial revenue or growth for Adyen. For instance, while Adyen supports a vast array of payment methods globally, a small percentage might represent less than 0.01% of total transaction value, making them candidates for re-evaluation.

While Adyen's core strength lies in serving large enterprises with substantial transaction volumes, certain very small merchant segments can present challenges. These segments, if they demand a disproportionately high level of customer support or specialized integration efforts relative to their revenue contribution, can become costly to service effectively. For instance, a niche market with unique, low-volume payment needs might require extensive custom development, increasing servicing expenses.

These pockets of small merchants could potentially act as cash traps for payment processors. By consuming significant operational resources and personnel time without generating commensurate revenue, they can divert attention and investment away from Adyen's more lucrative enterprise client base. Adyen's strategic focus, as evidenced by its emphasis on securing major global brands, is on achieving economies of scale through high-volume partnerships.

Underperforming regional markets, often characterized by significant macroeconomic headwinds or intense competitive pressures, represent the 'Dogs' in Adyen's BCG Matrix. These are areas where Adyen holds a low market share and experiences stagnant or declining growth, despite efforts to invest and expand.

While Adyen generally demonstrates robust growth globally, specific sub-regions or countries can consistently underperform. For example, Latin America experienced an outsized foreign exchange (FX) impact in the latter half of 2024, which negatively affected reported growth figures in that market.

Outdated Integrations or Modules

Outdated integrations or modules within Adyen's platform could be classified as Dogs. These are components that are no longer actively developed, have waning utility, or are being retired due to technological shifts or reduced customer interest. Such elements can drain resources on maintenance without fueling strategic expansion.

Adyen's commitment to innovation means they are likely phasing out older, less efficient solutions in favor of cutting-edge technologies. For example, if a specific payment gateway integration developed years ago is no longer supported by major card networks or has been superseded by more advanced APIs, it would fit the Dog category. This is common in the fast-evolving payments industry, where staying current is paramount.

- Obsolescence: Integrations that rely on outdated protocols or are not compatible with newer payment methods.

- Low Adoption: Modules with minimal customer usage, indicating a lack of perceived value or market fit.

- Maintenance Burden: Older systems requiring significant resources for upkeep without offering significant business benefits.

- Strategic Shift: Components that no longer align with Adyen's forward-looking product roadmap and investment priorities.

Services impacted by large customer exits

The exit of a major digital client in late 2024 significantly impacted Adyen's processed volume growth. Excluding this client, growth fell from an expected 25% to a mere 6% in Q1 2025, highlighting a key vulnerability.

While not a traditional product, a heavy reliance on a few large clients can cause a revenue stream to resemble a 'Dog' in the BCG Matrix. This occurs when their departure temporarily stunts growth, diverting resources towards client retention rather than new business development.

- Client Dependency: A substantial portion of processed volume growth was tied to a few key clients.

- Impacted Growth: The departure of a major digital client in late 2024 reduced Q1 2025 processed volume growth from 25% to 6% (excluding the client).

- Resource Allocation: This situation can tie up resources in recovery efforts, hindering proactive growth initiatives.

- 'Dog' Behavior: Revenue streams heavily dependent on a few large clients can exhibit 'Dog' characteristics when those clients exit.

Dogs in Adyen's BCG Matrix represent underperforming segments, such as niche payment methods with low transaction volumes or outdated platform integrations requiring significant maintenance. These areas consume resources without substantial revenue generation, mirroring the characteristics of a 'Dog' in strategic portfolio analysis. For example, a specific regional market experiencing economic headwinds might see stagnant or declining growth, even with investment, indicating a low market share and minimal expansion potential.

Adyen's focus on large enterprises means that very small merchant segments demanding disproportionate support can become costly to service, acting as cash traps. The departure of a major client in late 2024, for instance, significantly impacted Adyen's processed volume growth, reducing it from an expected 25% to 6% in Q1 2025 when excluding that client. This client dependency can lead to revenue streams exhibiting 'Dog' behavior if clients exit, diverting resources from new business.

| Category | Characteristics | Adyen Example |

|---|---|---|

| Dogs | Low market share, low growth, high maintenance | Niche payment methods, outdated integrations, underperforming regional markets |

| Impact | Resource drain, potential cash trap | High servicing costs for small merchants, client departure impacting growth |

| Strategic Implication | Divestment or minimal investment | Focus on high-volume enterprise clients, phasing out less efficient solutions |

Question Marks

Adyen's foray into embedded finance products beyond traditional payments, such as card issuing and banking infrastructure for platforms, represents a significant strategic expansion. These offerings are positioned as question marks within the BCG matrix due to their nascent stage and substantial investment requirements for scaling.

The growth trajectory is promising, with issuing volumes experiencing a remarkable 258% year-over-year surge to nearly €1 billion annually by Q1 2025. This rapid increase highlights the high growth potential of these new revenue streams, indicating strong market interest and adoption.

However, the early adoption phases necessitate continued investment to capture substantial market share and solidify their position. The success of these embedded finance products hinges on Adyen's ability to effectively scale these innovative solutions and navigate the competitive landscape.

Adyen's strategic push into India, with operations commencing in August 2024, and Mexico, where it has secured acquiring licenses, highlights its pursuit of high-growth markets. These regions, despite their significant potential, currently represent low market share for Adyen, positioning them as Stars within the BCG matrix.

Successfully capturing market share in India and Mexico necessitates considerable investment. Adyen must allocate resources towards deep localization, robust infrastructure development, and expanding its local teams to build a strong operational presence and capitalize on these emerging opportunities.

Adyen's expansion into advanced AI-driven financial services, moving beyond payment optimization, positions it for significant future growth. Offerings like Adyen Uplift, which leverages AI for insights like customer lifetime value and churn prediction, represent a strategic push into higher-value services.

These sophisticated AI capabilities are currently in their nascent stages of market penetration, meaning Adyen likely holds a relatively low market share in this specific advanced financial services segment. Significant investment in research and development, alongside dedicated market education, will be crucial for these offerings to gain broader adoption and become substantial contributors to Adyen's revenue streams.

Specific Industry Vertical Deep-Dives

Adyen's strategic push into new industry verticals, like healthcare and niche B2B marketplaces, signifies a move towards high-potential, albeit investment-intensive, growth areas. These specialized segments demand bespoke payment solutions, posing a challenge in terms of initial setup costs and the need to compete with established incumbents.

The company's focus on verticals like healthcare, which saw global digital health spending reach an estimated $211 billion in 2024, highlights the significant revenue potential. However, navigating the complex regulatory and security requirements of such sectors necessitates substantial upfront investment in tailored technology and compliance infrastructure.

- Healthcare: Adyen's tailored solutions for healthcare providers aim to streamline patient payments and manage complex billing cycles, tapping into a sector projected for continued digital transformation.

- Specialized B2B Platforms: Expansion into platforms requiring intricate multi-party payment flows or specific industry compliance, such as those in the logistics or manufacturing sectors, offers a path to capture specialized market share.

- Investment vs. Reward: While these deep dives require considerable investment in R&D and market penetration, successful entry into lucrative verticals can yield substantial long-term revenue streams and solidify Adyen's position as a versatile payment partner.

Strategic Partnerships for New Offerings

New strategic partnerships focused on developing entirely new capabilities or accessing untapped customer segments would be classified under the Question Marks category. These alliances are in their early stages, with potential for significant future growth but also inherent risks.

For instance, a partnership aimed at co-developing a novel payment solution for the burgeoning metaverse market, or an alliance to penetrate a new geographic region with a highly localized offering, would fit this description. While existing partnerships, like those with e-commerce platforms, have proven successful, these nascent collaborations represent future bets.

Consider the potential impact of a partnership with a leading AI firm to integrate advanced fraud detection capabilities into Adyen's platform. If this collaboration is in its early development phase, it would represent a Question Mark. Adyen's 2023 revenue reached €1.3 billion, showing strong overall performance, but the success of such new ventures remains uncertain.

- Nascent Product Co-Development: Alliances focused on creating entirely new product features or services that are still in the research and development phase.

- Untapped Market Penetration: Partnerships designed to enter new geographic regions or customer segments where Adyen currently has minimal presence.

- Strategic Risk vs. Reward: These ventures carry higher risk due to their unproven nature but offer significant potential for future market leadership and revenue growth.

- Investment in Future Growth: Resources allocated to these partnerships are investments in Adyen's long-term competitive advantage and diversification.

Adyen's expansion into embedded finance, including card issuing and banking infrastructure, places these initiatives in the Question Marks category of the BCG matrix. These ventures require significant upfront investment to scale and capture market share, despite showing rapid growth, such as a 258% year-over-year surge in issuing volumes to nearly €1 billion annually by Q1 2025.

The company's strategic entry into high-growth markets like India, with operations beginning in August 2024, and Mexico, where it secured acquiring licenses, also positions these as Question Marks. While these regions offer substantial potential, Adyen's current market share is low, necessitating considerable investment in localization and infrastructure to compete effectively.

Furthermore, Adyen's development of advanced AI-driven financial services, such as Adyen Uplift for customer lifetime value prediction, represents another Question Mark. These sophisticated offerings are in their early stages, requiring substantial R&D and market education to achieve broader adoption and significant revenue contribution.

Adyen's strategic push into specialized industry verticals like healthcare, a sector where global digital health spending reached an estimated $211 billion in 2024, also falls into the Question Marks quadrant. These specialized segments demand bespoke solutions and face competition from incumbents, requiring significant investment in tailored technology and compliance.

New strategic partnerships aimed at co-developing novel capabilities or entering untapped customer segments are also classified as Question Marks. These alliances, such as potential collaborations for metaverse payment solutions or new geographic market penetration, carry inherent risks but offer significant future growth potential.

| Initiative | BCG Category | Market Share | Growth Rate | Investment Needs |

| Embedded Finance (Issuing, Banking) | Question Mark | Low | High | High |

| India Market Entry | Question Mark | Low | High | High |

| Mexico Market Entry | Question Mark | Low | High | High |

| Advanced AI Financial Services | Question Mark | Low | High | High |

| Specialized Vertical Expansion (e.g., Healthcare) | Question Mark | Low | High | High |

| New Strategic Partnerships | Question Mark | Low | High | High |

BCG Matrix Data Sources

Our Adyen BCG Matrix is built upon robust data, integrating Adyen's financial reports, market share analysis, and industry growth forecasts to provide strategic clarity.