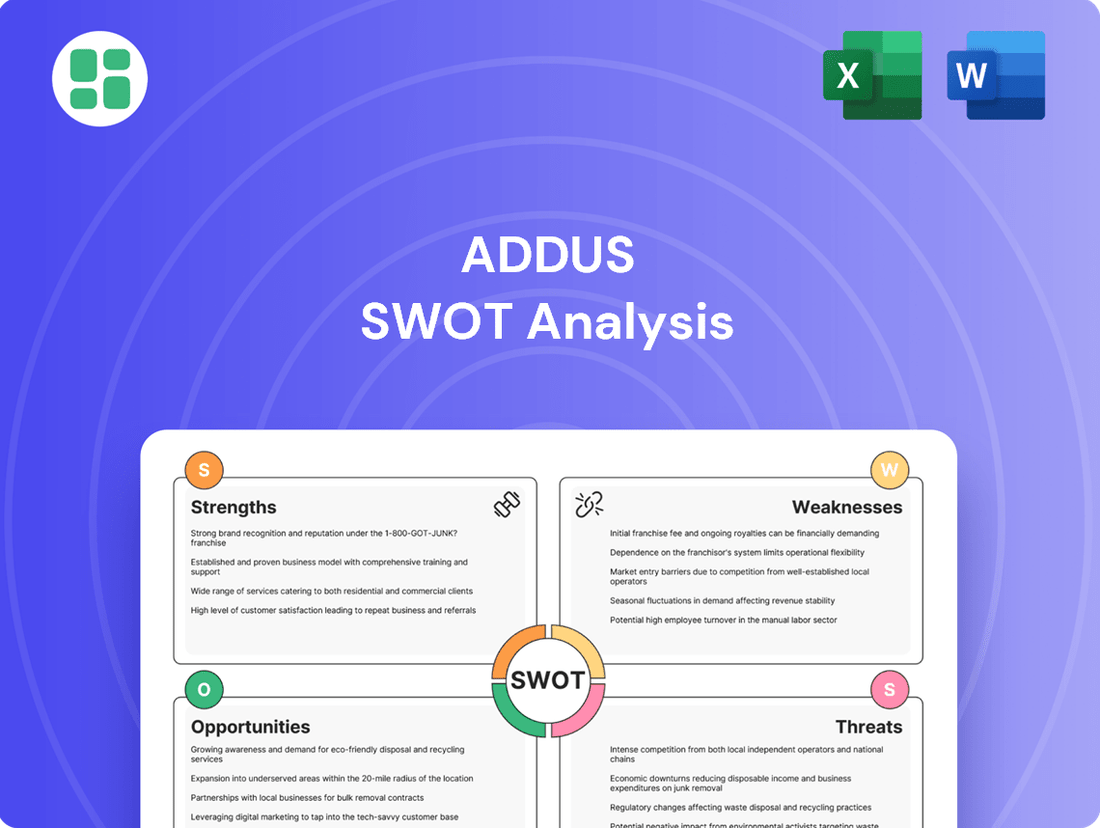

Addus SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Addus Bundle

Addus HomeCare's strengths lie in its established network and growing demand for in-home care, while its weaknesses might include operational complexities. Understanding these dynamics is crucial for navigating the competitive landscape.

Want the full story behind Addus's market position, potential challenges, and future opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Addus HomeCare boasts a diverse service portfolio, encompassing personal care, skilled nursing, and hospice care. This broad offering allows them to serve a wider spectrum of patient needs within the in-home care sector.

This diversification is a significant strength, creating multiple revenue streams and mitigating risks associated with reliance on a single service. For instance, in the first quarter of 2024, Addus reported a 10.3% increase in revenue, partly driven by the continued growth across its various service lines, demonstrating the effectiveness of this strategy.

Addus Homecare's reliance on government-funded programs like Medicaid and Medicare provides a bedrock of stability. These programs, which accounted for a significant portion of their revenue in recent years, offer a consistent payer base less impacted by economic downturns compared to private pay services. This dependable revenue stream is a key strength, ensuring operational continuity and predictable cash flow.

Addus HomeCare is strategically aligned with the strong societal shift towards aging in place, a trend that gained significant momentum through 2024 and is projected to continue its upward trajectory into 2025. This focus directly addresses the increasing desire of seniors and individuals with disabilities to remain in their homes, fostering independence and comfort.

By providing essential in-home support services, Addus HomeCare directly facilitates this aging-in-place movement. This not only resonates with consumer preferences but also offers a more cost-effective alternative to institutional care, a factor increasingly influencing healthcare decisions and policy discussions.

Consistent Revenue Growth and Acquisitions

Addus has shown a strong track record of revenue expansion. In the first quarter of 2025, the company reported a 20.3% leap in net service revenues when compared to the same period in 2024. This growth trajectory continued through the full year 2024, with revenues climbing 9.1% to reach $1.15 billion.

Strategic acquisitions have played a crucial role in this expansion. The acquisition of Gentiva's personal care operations in late 2024, for instance, was a significant move that broadened Addus's market reach and added substantially to its annualized revenue base.

- Consistent Revenue Growth: 20.3% increase in net service revenues in Q1 2025 year-over-year and 9.1% growth for full-year 2024 ($1.15 billion).

- Strategic Acquisitions: Gentiva personal care acquisition in late 2024 expanded market coverage and annualized revenues.

Established and Expanding Operational Footprint

Addus has cultivated a substantial operational footprint, extending its reach to serve around 62,000 consumers across 260 locations spanning 23 states as of the first quarter of 2025. This extensive network underscores its capacity to deliver services efficiently and broadly.

Strategic acquisitions, such as the integration of Gentiva's personal care assets, have been instrumental in reinforcing Addus's presence in established markets and facilitating entry into new territories. This expansion is particularly notable in Texas, where Addus has become the leading provider of personal care services.

- Expanded Reach: Serves approximately 62,000 consumers.

- Geographic Diversity: Operates from 260 locations in 23 states.

- Market Leadership: Largest personal care provider in Texas.

- Strategic Growth: Acquisitions enhance presence in existing and new states like Missouri.

Addus HomeCare's diverse service offerings, including personal care, skilled nursing, and hospice, create multiple revenue streams and reduce risk. This diversification proved effective, contributing to a 10.3% revenue increase in Q1 2024.

The company benefits from a stable revenue base due to its reliance on government programs like Medicare and Medicaid, which are less susceptible to economic downturns. This consistent payer base ensures operational stability and predictable cash flow.

Addus is well-positioned to capitalize on the growing trend of aging in place, a preference for seniors to remain in their homes. This aligns with consumer desires and offers a more cost-effective alternative to institutional care.

Addus has demonstrated strong revenue growth, with a 20.3% increase in net service revenues in Q1 2025 year-over-year and a 9.1% increase for the full year 2024, reaching $1.15 billion.

Strategic acquisitions, such as the late 2024 purchase of Gentiva's personal care operations, have significantly expanded Addus's market reach and revenue base.

By the first quarter of 2025, Addus served approximately 62,000 consumers across 260 locations in 23 states, solidifying its extensive operational footprint and market presence, notably as the leading personal care provider in Texas.

| Metric | 2024 (Full Year) | Q1 2025 | YoY Growth (Q1 2025) |

| Net Service Revenues | $1.15 Billion | N/A | 20.3% |

| Revenue Growth (Full Year 2024) | 9.1% | N/A | N/A |

| Consumers Served | N/A | ~62,000 | N/A |

| Locations | N/A | 260 | N/A |

| States Served | N/A | 23 | N/A |

What is included in the product

Delivers a strategic overview of Addus’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, structured framework to identify and address strategic challenges, relieving the pain of unfocused planning.

Weaknesses

A significant portion of Addus HomeCare's revenue, approximately 70% as of early 2024, is directly linked to government-funded programs like Medicare and Medicaid. This heavy reliance makes the company particularly vulnerable to shifts in reimbursement rates. For instance, a reduction in Medicaid rates in key states could directly impact Addus's profitability, as seen in past instances where rate adjustments led to temporary margin compression.

The home care sector, including Addus, grapples with significant hurdles in attracting and keeping skilled caregivers. These challenges stem from the demanding nature of the work, the need for competitive compensation, and often limited avenues for career advancement within the industry.

While Addus has reported some positive trends in its caregiver recruitment efforts, the ongoing scarcity of labor remains a critical weakness. This persistent shortage can directly impede the company's capacity to scale its service offerings and uphold the high standards of care its clients expect.

The home care sector Addus operates in is incredibly crowded, featuring a vast number of local, regional, and national players. This intense competition means Addus constantly needs to find ways to stand out from the crowd. It's a continuous challenge to differentiate its offerings and compete effectively on crucial aspects like the quality of care provided, the pricing structures, and the sheer availability of its services.

This competitive pressure can significantly impact Addus’s profitability by squeezing profit margins. Furthermore, maintaining and growing its market share requires substantial and ongoing investment in marketing, service innovation, and operational efficiency, all while facing competitors who may have lower overheads or more established local presences.

Regulatory Compliance Burden and Policy Uncertainty

Addus HomeCare faces significant challenges due to the heavy burden of regulatory compliance. Operating in numerous states and participating in complex government programs means adhering to a wide spectrum of federal and state regulations, obtaining various licenses, and undergoing regular compliance audits. This intricate web of rules creates substantial operational overhead and potential for penalties.

Policy uncertainty, particularly concerning government healthcare programs, introduces another layer of risk. For example, rules like the Ensuring Access to Medicaid Services rule, with its 80-20 provision, could be subject to changes. Such shifts can necessitate costly adjustments to business practices and create unpredictability in revenue streams and operational models.

- Regulatory Complexity: Addus must navigate a dense landscape of federal and state regulations, impacting operations across multiple states.

- Licensing Requirements: Maintaining necessary licenses in each operating state adds administrative complexity and cost.

- Compliance Audits: Frequent audits by government agencies require robust internal controls and can expose the company to fines if non-compliance is found.

- Policy Shifts: Potential changes to key government policies, like those affecting Medicaid reimbursement rates or service requirements, pose a significant risk to Addus's business model and financial stability.

Potential for Public Health Crisis Impact

Addus HomeCare, as a provider of essential in-home care services, faces a significant vulnerability in its susceptibility to public health crises, such as the COVID-19 pandemic. These events can directly disrupt operations, leading to increased costs associated with personal protective equipment (PPE) and sanitization protocols. For instance, during the height of the pandemic, the demand for PPE surged, driving up expenses for healthcare providers across the board.

Furthermore, public health emergencies can exacerbate staffing challenges. Illness among caregivers, fear of contagion, or quarantine requirements can lead to critical staff shortages, directly impacting Addus's ability to deliver services. This was a widespread issue in the home care sector throughout 2020 and 2021, with many agencies reporting difficulties in maintaining adequate staffing levels to meet patient needs.

The need to ensure the safety of both clients and staff during a public health crisis can also complicate service delivery. Implementing stringent safety measures may limit the number of visits or the types of services that can be provided, potentially affecting service capacity and, consequently, revenue. The ongoing need for vigilance and adaptation to evolving health guidelines presents a persistent challenge for the organization.

Addus faces significant operational risks due to its heavy reliance on government reimbursement programs, making it susceptible to policy changes and rate adjustments. The home care industry's inherent labor shortage, particularly for skilled caregivers, directly impedes Addus's ability to expand services and maintain quality. Intense competition within the sector pressures profit margins and necessitates continuous investment in differentiation and operational efficiency.

| Weakness | Description | Impact | Data/Example |

| Government Reimbursement Reliance | ~70% of revenue from Medicare/Medicaid (early 2024) | Vulnerability to rate cuts and policy shifts | Past margin compression due to rate adjustments |

| Caregiver Shortage | Difficulty attracting and retaining skilled caregivers | Limits service scaling and quality | Ongoing challenge impacting capacity |

| Intense Competition | Numerous local, regional, and national players | Pressure on pricing, margins, and market share | Requires significant investment in marketing and service innovation |

| Regulatory & Policy Uncertainty | Navigating complex federal/state regulations and potential policy changes | Increased operational overhead, compliance costs, and revenue unpredictability | Potential impact of rules like the 80-20 provision for Medicaid services |

What You See Is What You Get

Addus SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final Addus SWOT analysis. Unlock the full report when you purchase.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering a comprehensive understanding of Addus's strategic position.

Opportunities

The aging of the global population, particularly the large baby boomer cohort, presents a significant and sustained opportunity for Addus. This demographic shift is directly fueling an increasing need for home healthcare services, including personal care, skilled nursing, and hospice care. For instance, in the US, the number of individuals aged 65 and over is projected to reach 80 million by 2040, a substantial increase from 54.1 million in 2023, indicating a robust and growing customer base for Addus's core offerings.

The highly fragmented home care sector presents a prime opportunity for Addus to grow through strategic acquisitions. In 2024, the U.S. home health care market was valued at an estimated $140 billion, with many smaller players operating regionally. Addus can leverage its financial strength to acquire these entities, thereby expanding its footprint and service portfolio.

Forming strategic partnerships can also bolster Addus's market position. Collaborations with healthcare systems, insurance providers, or technology companies could enhance service delivery, improve patient outcomes, and create new revenue streams. For instance, partnerships focusing on specialized care, like post-acute or chronic disease management, could tap into growing demand.

The healthcare landscape is increasingly prioritizing value-based care, focusing on patient outcomes and cost-effectiveness. Addus is well-positioned to capitalize on this trend by highlighting the cost savings and enhanced patient results achievable through its in-home care services. This strategic alignment could foster valuable partnerships with Accountable Care Organizations (ACOs) and managed care providers, who are actively seeking efficient care delivery solutions.

Technological Integration for Enhanced Care

Addus has a significant opportunity to integrate advanced technologies like remote patient monitoring, telehealth, and AI-powered care coordination. These tools can streamline operations and boost patient satisfaction.

By adopting these innovations, Addus can enhance care efficiency and patient engagement. For instance, telehealth adoption saw a massive surge, with a report by McKinsey in late 2023 indicating that virtual visits accounted for 38% of all healthcare visits, up from 11% pre-pandemic. This trend is expected to continue, offering a substantial market for tech-forward home care providers.

This technological integration can lead to tangible benefits such as reduced hospital readmissions, a key metric for value-based care. Furthermore, it can attract a growing segment of tech-savvy clients and their families, providing Addus with a competitive edge in the evolving healthcare landscape.

- Remote Patient Monitoring: Enabling continuous health tracking and early intervention.

- Telehealth Services: Expanding access to care and improving convenience for patients.

- AI-driven Coordination: Optimizing scheduling, resource allocation, and personalized care plans.

- Data Analytics: Leveraging insights from integrated technologies to improve service delivery and outcomes.

Diversification of Payer Sources and Market Density

Addus has a significant opportunity to diversify its revenue streams beyond government-funded programs, which currently form the bulk of its business. Expanding its private pay client base and forging stronger partnerships with commercial insurers could provide a more stable and potentially higher-margin revenue stream. For instance, the home healthcare market, while dominated by Medicare and Medicaid, is seeing growth in private pay services as individuals seek personalized care options.

Increasing operational density within its current geographic markets presents another avenue for growth. By concentrating services in areas where it already has a strong presence, Addus can achieve greater efficiencies, reduce logistical costs, and enhance its ability to attract and retain both clients and caregivers. This focus on density can also bolster its negotiating leverage with payers.

Furthermore, strategic expansion into new, underserved markets can unlock substantial growth potential. Entering markets with favorable demographics and a demonstrated need for home healthcare services, while also considering markets with less competition or different payer mixes, can broaden Addus's reach and market share. This dual approach of deepening existing market penetration and carefully selecting new markets is key.

- Diversification: Opportunity to increase private pay revenue, which saw a slight uptick in demand across the sector in late 2024 as economic conditions influenced healthcare spending decisions.

- Market Density: Enhancing operational efficiency and reducing per-client costs by consolidating services in existing, high-demand areas.

- Market Expansion: Entering new strategic markets to capture untapped demand and broaden the company's overall service footprint.

- Negotiating Power: Increased density and a more diverse payer mix can strengthen Addus's position when negotiating rates with government agencies and commercial insurers.

The expanding senior population, particularly the substantial baby boomer demographic, creates a sustained and growing demand for Addus's services. This demographic trend directly translates to an increased need for in-home personal care, skilled nursing, and hospice care. The U.S. Census Bureau projects that by 2030, all baby boomers will be age 65 or older, a significant increase from the approximately 56 million Americans aged 65+ in 2020, underscoring a robust and expanding client base.

The home healthcare industry remains highly fragmented, offering Addus a prime opportunity for growth through strategic acquisitions. In 2024, the U.S. home healthcare market was valued at approximately $140 billion, with numerous smaller, regional operators. Addus can capitalize on this by acquiring these entities, thereby broadening its geographic reach and service capabilities.

Strategic partnerships with healthcare systems, insurers, and technology firms can enhance Addus's market standing. Collaborations focused on specialized care, such as post-acute or chronic disease management, can tap into increasing demand and create new revenue streams.

A key opportunity lies in Addus's ability to align with the healthcare industry's shift towards value-based care, emphasizing patient outcomes and cost-effectiveness. By demonstrating the cost savings and improved patient results inherent in its in-home care model, Addus can forge valuable partnerships with Accountable Care Organizations (ACOs) and managed care providers seeking efficient care solutions.

Integrating advanced technologies such as remote patient monitoring, telehealth, and AI-driven care coordination presents a significant opportunity for Addus to streamline operations and enhance patient satisfaction. Telehealth, for instance, saw a substantial increase in adoption, with McKinsey reporting in late 2023 that virtual visits constituted 38% of all healthcare visits, a trend expected to continue and benefit tech-forward home care providers.

Addus can diversify its revenue by expanding its private-pay client base and strengthening partnerships with commercial insurers. This move can establish a more stable and potentially higher-margin revenue stream, complementing its existing government-funded programs. The home healthcare market, while heavily reliant on Medicare and Medicaid, is experiencing growth in private-pay services as individuals seek more personalized care options.

Increasing operational density within existing geographic markets offers a path to greater efficiencies and reduced logistical costs. By concentrating services in areas where it has a strong presence, Addus can improve its ability to attract and retain clients and caregivers, while also enhancing its negotiating power with payers.

Strategic expansion into new, underserved markets can unlock substantial growth potential. Identifying markets with favorable demographics and a clear need for home healthcare services, alongside those with less competition or different payer mixes, can broaden Addus's reach and market share.

| Opportunity Area | Description | Market Data/Trend | Potential Impact |

|---|---|---|---|

| Demographic Shift | Growing elderly population needing home care. | U.S. population aged 65+ projected to reach 80 million by 2040 (from 54.1 million in 2023). | Increased demand for core services. |

| Market Fragmentation | Acquisition of smaller, regional players. | U.S. home health care market valued at ~$140 billion in 2024, with many smaller operators. | Expanded footprint and service portfolio. |

| Strategic Partnerships | Collaborations with healthcare systems, insurers, tech companies. | Focus on specialized care, post-acute, chronic disease management. | Enhanced service delivery, new revenue streams. |

| Value-Based Care Alignment | Highlighting cost savings and improved patient outcomes. | Healthcare shift towards outcome-focused, cost-effective models. | Stronger partnerships with ACOs and managed care providers. |

| Technology Integration | Adoption of remote monitoring, telehealth, AI. | Telehealth visits accounted for 38% of healthcare visits in late 2023. | Improved efficiency, patient satisfaction, competitive edge. |

| Revenue Diversification | Expanding private pay and commercial insurance. | Growth in private pay services as individuals seek personalized care. | More stable, higher-margin revenue streams. |

| Operational Density | Consolidating services in existing markets. | Achieving greater efficiencies and reduced logistical costs. | Enhanced profitability and negotiating leverage. |

| Market Expansion | Entering new, underserved markets. | Capturing untapped demand and broadening service footprint. | Increased market share and reach. |

Threats

A primary threat to Addus HomeCare is the potential for adverse shifts in government healthcare policy, particularly concerning Medicare and Medicaid. Reductions in funding, alterations to reimbursement structures, or tighter eligibility rules could directly impact revenue streams. For instance, changes in how home healthcare services are reimbursed could squeeze profit margins.

The implementation of certain regulations, such as an 80-20 provision that mandates a specific ratio of patient care to administrative costs, could also pose a significant challenge. If Addus is unable to adapt its operational model efficiently to meet such requirements, it could lead to increased operational expenses and a reduction in profitability, impacting its overall financial health.

Addus faces a significant threat from escalating labor costs. Factors like minimum wage hikes, general inflation, and fierce competition for qualified caregivers are directly impacting profitability. For instance, the average hourly wage for home health aides saw an increase, and this trend is projected to continue through 2025, putting pressure on Addus's margins.

Furthermore, union agreements mandating pay raises, while crucial for employee retention and morale, contribute to higher operational expenditures. Simultaneously, ongoing labor shortages, particularly in the critical caregiver segment, can restrict Addus's ability to expand its service offerings and meet growing demand, creating a double-edged sword for the company.

The home care sector is seeing a surge in new companies and existing ones growing, creating a more crowded market. This intensified competition puts pressure on pricing, making it harder to attract new clients and increasing the need for marketing spend, which could chip away at Addus's market position and profitability.

Economic Downturns Affecting State Budgets

Economic downturns pose a significant threat to Addus Homecare, as a substantial portion of its revenue is tied to government-funded programs like Medicaid. During recessions, state budgets often shrink, leading to potential cuts in healthcare spending. For instance, during the COVID-19 pandemic's initial economic shockwaves in early 2020, many states faced considerable budget shortfalls, prompting discussions about service reductions across various sectors, including healthcare.

These budget constraints can directly impact reimbursement rates or the volume of services covered by state Medicaid programs, which are critical for Addus's financial stability. A prolonged economic slump could force states to implement austerity measures, directly affecting the company's revenue streams.

- Reduced State Funding: Economic recessions can lead to state budget deficits, potentially causing cuts to Medicaid programs.

- Impact on Reimbursement: Lower state revenues might force reductions in reimbursement rates for homecare services.

- Decreased Service Utilization: Budgetary pressures could also limit the number of billable hours or services available to beneficiaries.

Reputational Risks and Quality of Care Concerns

Addus Homecare faces significant reputational risks. Any reported incidents of poor quality of care or regulatory non-compliance, such as the Centers for Medicare & Medicaid Services (CMS) flagging certain home health agencies for quality issues, could erode client trust and deter referrals. For instance, in 2023, the home health sector saw increased scrutiny over patient outcomes and billing practices, a trend likely to continue into 2024 and 2025.

Negative publicity stemming from these concerns can trigger intense regulatory scrutiny and even lead to legal challenges, directly impacting Addus's operational capacity and growth trajectory. The healthcare industry, particularly homecare, is heavily reliant on a strong reputation for trust and reliability. A single high-profile issue could have a cascading effect, leading to a loss of market share and increased operational costs due to compliance measures.

- Reputational Damage: Incidents of poor care or compliance breaches can tarnish Addus's brand image.

- Loss of Trust: Clients and referral sources may lose confidence, impacting patient acquisition.

- Regulatory Scrutiny: Negative events often attract increased oversight from agencies like CMS.

- Financial Impact: Legal actions and compliance costs can significantly affect profitability.

Intensified competition from new entrants and expanding existing players presents a significant threat, potentially pressuring Addus's pricing strategies and increasing marketing expenditures to maintain market share. The increasing consolidation within the home healthcare industry also means larger, well-capitalized competitors could emerge, posing a greater challenge to Addus's market position.

Economic downturns, particularly those impacting state budgets, directly threaten Addus's revenue streams derived from government programs like Medicaid. Reduced state funding can lead to lower reimbursement rates or decreased service volumes, as seen during economic shocks where states often implement austerity measures. For instance, projections for state budget gaps in 2024-2025 highlight the ongoing risk of healthcare spending cuts.

Escalating labor costs, driven by minimum wage increases, inflation, and competition for caregivers, continue to squeeze Addus's profit margins. The ongoing shortage of qualified caregivers, a trend expected to persist through 2025, limits the company's ability to grow and meet demand, while union agreements can further increase operational expenses.

Reputational risks, including potential negative publicity from quality of care issues or regulatory non-compliance, could erode client trust and deter referrals. Increased scrutiny over patient outcomes and billing practices in the home health sector, evident in 2023 and anticipated to continue, could lead to regulatory challenges and financial repercussions.

| Threat Category | Specific Risk | Potential Impact | Data Point/Trend |

|---|---|---|---|

| Competition | Market Saturation & Consolidation | Pricing pressure, increased marketing costs, loss of market share | Home healthcare market projected to grow, increasing competition. |

| Economic Factors | Reduced State Funding (Medicaid) | Lower reimbursement rates, decreased service volume | States facing budget deficits may cut healthcare spending in 2024-2025. |

| Labor Costs & Shortages | Rising Wages & Caregiver Scarcity | Reduced profit margins, limited service expansion | Home health aide wages expected to increase through 2025; persistent caregiver shortages. |

| Reputational Risk | Quality of Care & Compliance Issues | Loss of trust, regulatory scrutiny, legal challenges | Increased sector scrutiny on patient outcomes and billing practices continuing into 2024-2025. |

SWOT Analysis Data Sources

The Addus SWOT analysis is built upon a foundation of robust data, drawing from publicly available financial statements, comprehensive market research reports, and insights from industry experts. This multi-faceted approach ensures a thorough understanding of the company's internal capabilities and external market dynamics.