Addus Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Addus Bundle

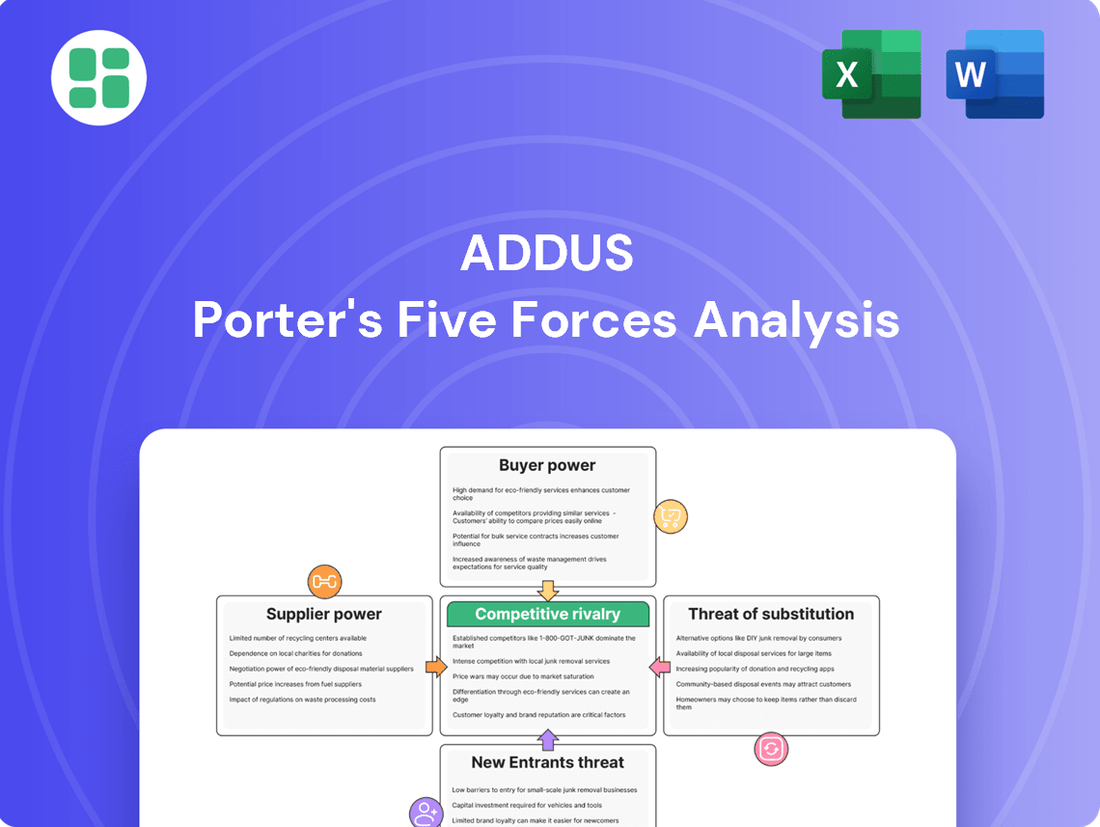

Porter's Five Forces Analysis for Addus reveals the intense competitive landscape they navigate, from the bargaining power of buyers to the threat of new entrants. Understanding these forces is crucial for any stakeholder looking to grasp Addus's strategic positioning and market vulnerabilities.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Addus’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The home care sector, including companies like Addus HomeCare, is grappling with a severe caregiver labor shortage. Projections indicate a substantial 21% job growth for home health and personal care aides from 2023 to 2033, highlighting the escalating demand for these essential services.

This ongoing scarcity, exacerbated by a national caregiver turnover rate of 77% in 2024, significantly bolsters the bargaining power of individual caregivers. They can now demand higher wages and more favorable working conditions, directly impacting labor costs for providers.

Consequently, Addus HomeCare faces the continuous necessity of investing heavily in recruitment and retention initiatives. Securing a stable and sufficient workforce is paramount to maintaining operational capacity and meeting the growing demand for their services.

Addus HomeCare's reliance on specialized medical equipment providers for items like mobility aids and monitoring devices, particularly for its skilled nursing and hospice services, means these suppliers can hold moderate bargaining power. The home healthcare equipment market is growing, with some reports indicating a compound annual growth rate of over 7% in recent years, but the niche nature of certain advanced equipment can limit alternatives for Addus.

This means specialized suppliers can influence pricing due to the unique, often patented, technology or specific certifications required for their products. For instance, advanced patient monitoring systems or highly specialized durable medical equipment might only have a few qualified manufacturers. This situation necessitates Addus exploring strategies like long-term contracts or bulk purchasing agreements to secure favorable pricing and ensure consistent availability of critical supplies.

As the home care sector, including Addus, embraces digital tools like telehealth and remote patient monitoring, its reliance on technology and software providers grows. The specialized and fast-evolving nature of these solutions can give suppliers leverage, especially when they offer clear gains in efficiency or a competitive edge. For instance, the home healthcare technology market was valued at approximately $29.5 billion in 2023 and is projected to grow significantly, indicating a strong demand for these services.

Training and Certification Organizations

The quality of care provided by Addus HomeCare hinges on the proficiency of its caregivers, which in turn depends heavily on specialized training and certifications. The availability of accredited training programs for home health aides and certified nursing assistants (CNAs) is a critical factor. In 2024, the landscape of these programs remains somewhat constrained, with a limited number of institutions offering the necessary accreditations nationwide.

This scarcity can translate into increased costs for Addus. When fewer training providers exist, they gain leverage to potentially increase tuition fees or program costs. For instance, average CNA training program costs can range from $800 to $1,500, and this figure can be higher for specialized home health aide certifications. This dynamic directly impacts Addus's operational expenses as they strive to maintain a highly skilled and certified workforce, influencing their ability to attract and retain qualified personnel.

- Limited Accredited Programs: The number of recognized institutions offering comprehensive training for home health aides and CNAs remains relatively low across the United States.

- Increased Training Costs: This scarcity of training providers allows them to command higher prices for their programs, directly impacting Addus's recruitment and retention expenses.

- Impact on Workforce Quality: Higher training costs can create a barrier, potentially affecting Addus's ability to consistently onboard a large number of highly skilled caregivers.

Real Estate and Facility Lessors

Addus HomeCare's extensive network of operational sites across numerous states means it leases a significant amount of real estate. This reliance on leased facilities can give lessors some leverage, particularly in markets with high demand or for specialized properties. However, Addus's decentralized operational strategy, spread across many locations, likely dilutes the bargaining power of any single real estate lessor.

The fragmentation of the real estate market generally limits the power of individual property owners. For instance, as of late 2024, the U.S. commercial real estate vacancy rate hovered around 12-13%, indicating a supply that can often meet demand, thereby reducing lessor leverage. Addus's ability to secure multiple locations across different regions further spreads its dependency, diminishing the impact of any one lessor.

- Fragmented Market: The broad availability of commercial properties generally limits the power of individual lessors.

- Geographic Dispersion: Addus's presence in multiple states reduces reliance on any single property or lessor.

- Lease Terms: The ability to negotiate favorable lease terms or find alternative locations can mitigate lessor power.

Suppliers of specialized medical equipment and technology providers hold moderate bargaining power over Addus HomeCare. This is due to the niche nature and advanced technology of certain products, limiting alternatives and allowing suppliers to influence pricing. For example, the home healthcare technology market, valued at approximately $29.5 billion in 2023, demonstrates a strong demand for specialized solutions, potentially giving tech suppliers leverage.

The bargaining power of training program providers is significant due to a limited number of accredited institutions nationwide. This scarcity allows them to increase program costs, with average CNA training ranging from $800 to $1,500 in 2024, impacting Addus's workforce development expenses.

Real estate lessors have limited bargaining power due to the fragmented nature of the market and Addus's geographically dispersed operations. With a U.S. commercial real estate vacancy rate around 12-13% in late 2024, Addus can often secure favorable lease terms or alternative locations, diminishing individual lessor leverage.

What is included in the product

This analysis dissects the five competitive forces impacting Addus, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and ultimately, Addus's strategic positioning.

Quickly identify and address the root causes of competitive pressure with a structured framework that highlights your industry's key profit-draining forces.

Customers Bargaining Power

Government programs like Medicaid and Medicare are major customers for Addus HomeCare, giving them significant leverage. These agencies set the reimbursement rates, meaning they have a direct say in how much Addus earns. For instance, Medicare payment rate updates, which are announced annually, can substantially alter the financial outlook for home care providers.

Managed Care Organizations (MCOs) hold substantial bargaining power over Addus, particularly as they increasingly manage the healthcare needs and costs of consumers. The growth of Medicare Advantage plans, which often include home-based benefits, amplifies this influence. For instance, in 2024, Medicare Advantage enrollment continued its upward trend, with projections indicating further expansion, meaning more of Addus's potential clients are covered by MCOs.

MCOs leverage their large member bases and their financial incentive to control healthcare spending and improve patient outcomes. This economic pressure allows them to negotiate aggressively on reimbursement rates for services like personal care, skilled nursing, and hospice care, which are core to Addus's business. Addus's strategy to diversify its service offerings is a direct response, aiming to present a more comprehensive and valuable partnership that strengthens its negotiating position.

Individual clients and families paying privately for home care services hold significant bargaining power. This stems from their direct ability to select from a wide array of competing providers, making service quality, perceived value, and personalized care crucial differentiators for Addus. As the overall cost of home care continues to rise, these consumers are becoming increasingly price-sensitive, demanding clear evidence of the benefits and value their spending provides.

Referral Sources (Hospitals, Physicians)

Hospitals and physicians are vital referral sources for Addus HomeCare, especially for their skilled nursing and hospice segments. These healthcare providers can significantly influence patient choice, often favoring home care agencies with established ties, proven quality, and smooth patient transition processes. In 2024, the healthcare landscape continued to emphasize integrated care models, making these referral relationships even more critical for patient acquisition and service delivery.

The bargaining power of these referral sources stems from their ability to direct substantial patient volume. For instance, a hospital system's decision to partner with or consistently refer to a particular home care provider can directly impact that provider's revenue. Addus HomeCare's success hinges on its capacity to maintain robust relationships and consistently deliver high-quality care that aligns with the expectations of these medical professionals.

- Referral Dependency: Addus HomeCare relies heavily on local hospitals and physician groups for patient referrals, particularly for specialized services like skilled nursing and hospice care.

- Relationship Influence: The strength of existing relationships and the perceived quality of care directly impact the flow of referrals from these sources.

- Competitive Advantage: Demonstrating superior patient outcomes and seamless integration with hospital discharge processes are key to securing consistent referrals in a competitive market.

Preference for Aging in Place

The strong preference of approximately 90% of seniors to age in place significantly bolsters customer bargaining power. This means clients and their families actively seek home-based care, driving demand for services that enable independent living over institutional settings. This trend is a boon for companies like Addus, but it also translates into heightened customer expectations for tailored, high-quality, and comprehensive care solutions that prioritize comfort and safety within the home environment.

- Preference for Aging in Place: Around 90% of seniors wish to remain in their own homes.

- Increased Demand for Home Care: This preference fuels demand for alternatives to nursing homes and assisted living facilities.

- Customer Expectations: Clients expect personalized, high-quality services that support independent living.

- Addus's Market Position: The company's diverse service offerings align directly with this strong consumer preference.

Customers, especially those paying privately, have significant leverage due to the availability of numerous competing home care providers. This forces Addus to focus on service quality and value to stand out. The increasing price sensitivity of these clients, driven by rising care costs, means Addus must clearly demonstrate the benefits of its services.

Government payers like Medicare and Medicaid, along with Managed Care Organizations (MCOs), wield substantial bargaining power. They dictate reimbursement rates, directly impacting Addus's revenue. For example, Medicare payment rate adjustments, a yearly event, can significantly alter the financial landscape for home care providers like Addus.

Hospitals and physicians act as crucial referral sources, influencing patient choices and driving volume for Addus's skilled nursing and hospice segments. Integrated care models, a growing trend in 2024, further emphasize the importance of these referral relationships for patient acquisition.

The strong preference of about 90% of seniors to age in place empowers customers, increasing demand for home-based care and raising expectations for personalized, high-quality services. This trend directly benefits Addus by fueling demand but also necessitates a focus on delivering exceptional value.

| Customer Type | Bargaining Power Source | Impact on Addus | 2024 Trend/Data |

|---|---|---|---|

| Private Pay Clients | Provider choice, price sensitivity | Need for competitive pricing and superior service | Rising care costs increase price sensitivity |

| Government Payers (Medicare/Medicaid) | Reimbursement rate setting | Direct impact on revenue | Annual payment rate updates are critical |

| Managed Care Organizations (MCOs) | Large member bases, cost control incentives | Aggressive rate negotiation | Growth in Medicare Advantage amplifies influence |

| Hospitals & Physicians | Referral control, integrated care models | Crucial for patient volume and service delivery | Emphasis on seamless patient transitions |

Same Document Delivered

Addus Porter's Five Forces Analysis

This preview shows the exact Addus Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of competitive forces within the healthcare industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. This document is fully formatted and ready for your strategic planning needs.

Rivalry Among Competitors

The home care market is incredibly fragmented, meaning there are many players, big and small, all competing for the same customers. This intense rivalry means Addus HomeCare is up against a wide range of competitors, from other large public companies to smaller, local agencies, and even programs run by hospitals or non-profits.

This competitive landscape means Addus needs to constantly find new ways to stand out and keep both clients and caregivers happy. For instance, in 2023, the U.S. home healthcare market was valued at approximately $145 billion, with projections indicating steady growth, underscoring the high stakes and the need for differentiation in such a crowded space.

In the home care sector, competitive rivalry often hinges on service differentiation and quality. Companies like Addus HomeCare are acutely aware of this, focusing on robust caregiver training and the strategic integration of technology to elevate their offerings. This emphasis on quality care aims to build trust and loyalty among clients.

Addus HomeCare, for instance, leverages its established brand and a broad spectrum of services to differentiate itself. Their commitment to superior care is a significant factor in attracting and retaining clients in a crowded market. By prioritizing client satisfaction, they aim to set themselves apart from competitors.

Key performance indicators such as high client satisfaction scores and reduced hospital readmission rates are vital differentiators. For example, a lower readmission rate signifies effective post-care management, directly impacting client well-being and demonstrating the value of their services. This focus on outcomes is crucial for competitive advantage.

Addus HomeCare has strategically grown by acquiring other companies, which broadens its reach and service capabilities. This approach is quite common in the home care industry as it consolidates, allowing bigger companies to become dominant players. For instance, their acquisition of Gentiva's personal care division greatly expanded their presence, making them a top provider in several states.

Caregiver Recruitment and Retention

The intense competition for caregivers significantly heightens rivalry within the home healthcare sector. This shortage, a persistent issue, means agencies are constantly vying for a limited number of qualified professionals, leading to increased labor costs and operational hurdles. For Addus HomeCare, effectively recruiting, training, and retaining these essential workers is paramount to sustaining service quality and meeting demand in a challenging labor environment.

The caregiver shortage is a critical factor impacting Addus HomeCare. For instance, in 2023, the U.S. Bureau of Labor Statistics projected a need for 774,000 new home health aides and personal care aides by 2032, reflecting a significant demand that outstrips supply. This dynamic directly fuels competitive rivalry, forcing companies like Addus to invest more in compensation and benefits to attract and keep staff.

- Caregiver Shortage Impact: High turnover rates and a scarcity of qualified caregivers intensify competition among home healthcare agencies.

- Cost Implications: Fierce competition drives up wages and benefits, increasing operational expenses for providers like Addus.

- Operational Challenges: Maintaining consistent service quality and sufficient capacity becomes difficult when competing for a limited workforce.

- Strategic Imperative: Addus's success hinges on its ability to develop robust strategies for caregiver recruitment, training, and long-term retention.

Payer Relationships and Reimbursement Models

Competitive rivalry in the home healthcare sector is significantly shaped by relationships with government payers like Medicare and Medicaid, as well as managed care organizations (MCOs). Favorable contracts and reimbursement rates are absolutely critical for maintaining profitability. For instance, in 2023, Medicare and Medicaid combined represented a substantial portion of healthcare spending in the US, underscoring the importance of these relationships.

Addus HealthCare's integrated care model, which spans personal care, home health, and hospice services, is strategically designed to appeal to MCOs. This comprehensive approach allows Addus to potentially negotiate more advantageous reimbursement terms by offering a continuum of care, which can lead to better patient outcomes and reduced overall healthcare costs for payers.

The broader industry trend towards value-based care models also plays a crucial role. These models incentivize providers like Addus to demonstrate superior quality outcomes and cost efficiency, rather than simply billing for services rendered. This shift further strengthens the bargaining power of providers who can effectively showcase their ability to manage patient populations and achieve desired health results, potentially leading to more competitive reimbursement structures.

- Payer Relationships: Government payers (Medicare, Medicaid) and MCOs are key determinants of profitability through contract negotiation.

- Addus's Strategy: Integrated care model (personal care, home health, hospice) aims to enhance attractiveness to MCOs for better contract terms.

- Value-Based Care Impact: Industry shift incentivizes providers to prove quality outcomes, influencing competitive dynamics and reimbursement levels.

The home care market is highly competitive, with numerous providers vying for clients. Addus HomeCare faces rivalry from large public companies, smaller local agencies, and even hospital-based programs. This intense competition necessitates continuous innovation in service delivery and caregiver satisfaction to maintain market share.

In 2023, the U.S. home healthcare market was valued at around $145 billion, highlighting the significant opportunities but also the fierce competition. Addus differentiates itself through its broad service offerings and commitment to quality, aiming to build client loyalty.

A critical factor intensifying rivalry is the persistent shortage of qualified caregivers. In 2023, the U.S. Bureau of Labor Statistics projected a need for 774,000 new home health and personal care aides by 2032. This demand-supply gap forces companies like Addus to increase wages and benefits, driving up operational costs.

| Factor | Impact on Addus | 2023/2024 Data Point |

| Market Fragmentation | Intensifies competition for clients and caregivers | U.S. home healthcare market valued at ~$145 billion |

| Caregiver Shortage | Drives up labor costs and impacts service capacity | Projected need for 774,000 new aides by 2032 |

| Payer Relationships | Reimbursement rates from Medicare, Medicaid, and MCOs are crucial for profitability | Medicare and Medicaid are substantial payers in US healthcare spending |

SSubstitutes Threaten

Traditional institutional care settings like nursing homes and assisted living facilities pose a notable substitute threat to in-home care services. These facilities provide a full suite of services, including meals, medication oversight, and organized social events, which can attract families seeking comprehensive support for their loved ones. For instance, in 2023, the average monthly cost for assisted living in the U.S. ranged from $4,000 to $6,000, potentially higher than in-home care.

Despite these offerings, the persistent desire among seniors to age in their own homes, often referred to as 'aging in place,' generally tips the scales in favor of in-home care. Furthermore, the cost-effectiveness of receiving care at home compared to the often higher expenses associated with residential facilities makes in-home services a more financially viable option for many families. This preference for familiar surroundings and potentially lower costs helps mitigate the threat from these institutional alternatives.

Unpaid care from family and friends is a significant substitute for professional home care. Many individuals prefer this informal arrangement due to personal connections. However, the growing complexity of care needs and financial strain on family caregivers can make this option less sustainable over time.

The viability of informal care as a substitute is influenced by support systems. For instance, in 2024, many organizations are expanding programs offering respite care and training for family caregivers. These initiatives aim to alleviate caregiver burden, potentially strengthening this substitute's appeal against professional services.

For individuals with minimal care needs, the option to manage their daily lives independently, without formal assistance, acts as a significant substitute. This is particularly true for those who are largely self-sufficient but might require occasional help.

The growing sophistication of assistive technologies and smart home solutions is further bolstering this trend. These innovations empower individuals to maintain their independence for extended periods by facilitating daily activities, from medication reminders to mobility assistance. For instance, the global market for assistive technology was projected to reach over $29 billion in 2024, highlighting its increasing accessibility and adoption.

Addus HomeCare's strategic focus on individuals requiring assistance with activities of daily living (ADLs) inherently mitigates the direct threat from those fully capable of self-care. By concentrating on a segment where formal support is a necessity, the company positions itself to serve a market less susceptible to substitution by independent living solutions.

Hospital Stays and Acute Care Facilities

Hospital stays and acute care facilities face a threat from substitutes, primarily through the increasing adoption of 'Hospital-at-Home' programs. While traditional hospitalization is an option for acute medical needs, it often comes at a higher cost compared to home-based care. These evolving programs blur the lines, offering acute care in a patient's residence.

This shift directly impacts the demand for traditional inpatient services. For instance, by mid-2024, a significant number of healthcare systems were expanding their Hospital-at-Home offerings, with some reporting a reduction in traditional bed days for eligible patients. This trend represents a direct substitute for extended inpatient stays, potentially altering competitive dynamics within the acute care sector.

- Hospital-at-Home programs are gaining traction, offering acute care outside traditional facilities.

- This trend can lead to reduced demand for inpatient hospital beds, impacting revenue for acute care facilities.

- By 2024, numerous healthcare providers were investing in and scaling these home-based acute care models.

Telehealth and Remote Monitoring Technologies

Telehealth and remote monitoring technologies present a growing threat of substitution for traditional in-home care services. These advancements allow for virtual consultations and continuous patient data collection, potentially reducing the need for frequent in-person visits, especially for routine care and managing chronic conditions. For instance, a 2024 report indicated that over 50% of consumers expressed willingness to use telehealth for non-emergency medical needs, highlighting a significant shift in patient preferences.

However, the widespread adoption of these substitutes is currently tempered by several factors. Reimbursement policies for telehealth services can vary significantly, impacting the financial viability for both providers and patients. Furthermore, the initial cost of implementing and maintaining remote monitoring equipment remains a barrier for some healthcare systems and individuals. Despite these challenges, the trend toward digital health solutions is undeniable, with investments in health tech projected to reach hundreds of billions globally by 2025.

For Addus HomeCare, these technologies are more accurately viewed as complements rather than direct substitutes. Telehealth can enhance the efficiency of their existing service model by streamlining certain aspects of patient interaction and data gathering. This allows Addus to potentially expand their service offerings and focus in-person resources on more complex care needs that cannot be addressed remotely, thereby strengthening their overall value proposition.

- Telehealth adoption: Over 50% of consumers willing to use telehealth for non-emergency needs in 2024.

- Market growth: Global health tech investments expected to reach hundreds of billions by 2025.

- Complementary role: Technologies can enhance efficiency and expand service capabilities for in-home care providers.

The threat of substitutes for in-home care services is multifaceted, encompassing traditional institutional care, informal caregiving, independent living aided by technology, and evolving acute care models like Hospital-at-Home. While institutional care offers comprehensive services, the preference for aging in place and potential cost savings often favor in-home care. Informal care, though personal, faces sustainability challenges with increasing care complexity.

Assistive technologies and independent living solutions empower individuals to manage with less formal support, a trend bolstered by a projected global assistive technology market exceeding $29 billion in 2024. Hospital-at-Home programs directly substitute for traditional inpatient stays, with many healthcare systems expanding these models by mid-2024. Telehealth, while a growing substitute for routine in-person visits, is often complementary to in-home care, enhancing efficiency.

| Substitute Category | Key Characteristics | 2024 Data/Projections | Impact on In-Home Care |

|---|---|---|---|

| Institutional Care | Comprehensive services, structured environment | Assisted living costs: $4,000-$6,000/month (US average) | Moderate threat, often higher cost than in-home care |

| Informal Care | Family/friend support, personal connection | Growing respite care programs for caregivers | Significant substitute, but sustainability can be an issue |

| Independent Living + Tech | Self-sufficiency aided by technology | Assistive technology market: >$29 billion (global projection) | Growing threat for those with minimal care needs |

| Hospital-at-Home | Acute care in patient's residence | Expansion by numerous healthcare systems | Direct substitute for extended inpatient care |

| Telehealth/Remote Monitoring | Virtual consultations, data collection | >50% consumer willingness for non-emergency telehealth (2024) | Potential substitute for routine visits, often complementary |

Entrants Threaten

The home care sector presents a mixed bag of entry barriers. While basic personal care services often have minimal licensing requirements in many states, the more specialized areas like home health and hospice demand specific state licenses and, in some cases, Certificates of Need (CON). These intricate regulatory landscapes, varying significantly from state to state, can act as a substantial deterrent for new companies looking to enter the market.

For instance, in 2024, the process of obtaining a CON for a new home health agency could take upwards of 12-18 months and involve extensive documentation and public hearings, adding significant time and cost. This complexity naturally favors established players who have already navigated these processes and built robust compliance systems.

Addus HomeCare, operating across multiple states, already possesses the necessary licenses and the established infrastructure to manage compliance. This existing foundation provides a significant competitive advantage, making it more challenging for new entrants to match their operational readiness and market penetration from day one.

Launching a home care agency akin to Addus, which provides a spectrum of services from personal care to skilled nursing and hospice, demands considerable upfront capital. This investment is crucial for securing qualified staff, implementing necessary technology, and building a robust operational framework. For instance, in 2024, the average startup cost for a home health agency can range from $50,000 to over $200,000, depending on licensing and service offerings.

New entrants face a significant hurdle in achieving economies of scale and broad geographic coverage, areas where Addus has strategically expanded through organic growth and acquisitions. The home care industry saw significant consolidation in 2023, with several mid-sized agencies being acquired, indicating a trend that further elevates the barriers to entry for smaller, independent operators seeking to compete on a national or even regional level.

New companies entering the home care sector face a significant hurdle in replicating the deep-rooted relationships Addus HomeCare and similar established providers have cultivated with government programs like Medicare and Medicaid, as well as managed care organizations. These contracts are the lifeblood of the industry, and securing them requires a proven history of reliable service and financial stability that new entrants simply haven't built yet.

Addus HomeCare’s reputation, built over years of delivering quality care and achieving positive patient outcomes, acts as a powerful deterrent. This established trust with both patients and referring entities makes it challenging for newcomers to gain the necessary traction and payer confidence. For instance, in 2023, Addus HomeCare reported revenue of $1.06 billion, a testament to its established market position and payer network.

Caregiver Recruitment and Retention Challenges

The pervasive caregiver shortage and high turnover rates significantly deter new entrants, forcing them to vie with established agencies for scarce talent. In 2024, the demand for home health aides continued to outstrip supply, with projections indicating a need for over 1.1 million new home health and personal care aides by 2030, according to the Bureau of Labor Statistics. This creates a substantial hurdle for newcomers aiming to build a reliable workforce.

New companies face the daunting task of recruiting and training a dependable caregiver team from the ground up, a process that is both expensive and time-consuming. The average cost to recruit and onboard a new caregiver can range from $2,000 to $5,000, factoring in background checks, training, and initial wages. This capital investment and operational lag can be prohibitive for emerging businesses.

Addus HomeCare benefits from its established employee base and robust recruitment infrastructure, giving it a distinct competitive edge. With a workforce of over 40,000 caregivers as of late 2023, Addus has developed scalable processes for talent acquisition and retention, which are difficult for new entrants to replicate quickly. This existing network significantly lowers the barrier to entry for Addus itself, while simultaneously raising it for others.

- Caregiver Shortage Impact: High demand and limited supply of qualified caregivers in 2024.

- Recruitment Costs: New entrants face significant expenses in building a workforce.

- Turnover Rates: High caregiver turnover (often exceeding 40% annually) exacerbates recruitment challenges for new agencies.

- Addus's Advantage: Existing infrastructure and large employee base provide a competitive moat.

Brand Recognition and Trust

In the home care sector, where trust is everything, brand recognition acts as a significant barrier to entry. Potential new companies must overcome the challenge of establishing a reputation that rivals established players like Addus HomeCare, which has been serving clients since 1979. This long history allows Addus to leverage decades of experience and a proven track record, making it difficult for newcomers to gain immediate client and referral source confidence.

New entrants face a substantial hurdle in building brand recognition and trust comparable to Addus HomeCare. The company's operational history, dating back to 1979, and its current reach, serving tens of thousands of patients weekly, have cultivated a strong and reliable brand image. To effectively compete, new businesses would need to make considerable investments in marketing and consistently deliver high-quality services to earn the same level of trust.

- Brand Longevity: Addus HomeCare's operation since 1979 provides a significant advantage in established trust.

- Scale of Operations: Serving tens of thousands of patients weekly demonstrates widespread acceptance and operational capacity.

- Marketing Investment: New entrants must allocate substantial resources to build brand awareness and client confidence.

- Service Quality: Consistent delivery of high-quality care is essential for new companies to gain a competitive edge.

The threat of new entrants in the home care sector is moderately high, influenced by varying regulatory requirements and capital needs. While basic services have lower barriers, specialized care, like skilled nursing, demands licenses and can take over a year to obtain, as seen with Certificate of Need processes in 2024. This complexity, coupled with startup costs ranging from $50,000 to $200,000 for agencies in 2024, provides some protection for established players like Addus HomeCare.

However, the industry's fragmented nature and the ongoing caregiver shortage, projected to require over 1.1 million new aides by 2030, present significant challenges for newcomers. These factors, alongside the need to build brand trust and secure payer contracts, create substantial hurdles that established companies have already overcome.

Addus HomeCare's extensive experience since 1979, its scale serving tens of thousands weekly, and its $1.06 billion revenue in 2023 underscore its competitive advantages. These established strengths, including a workforce of over 40,000 caregivers by late 2023, make it difficult for new entrants to match its operational readiness and market penetration.

| Factor | Impact on New Entrants | Addus HomeCare's Position |

|---|---|---|

| Regulatory Complexity | High barrier, especially for skilled care (e.g., CON process taking 12-18 months in 2024) | Established licenses and compliance infrastructure |

| Capital Requirements | Significant upfront costs ($50k-$200k+ for agencies in 2024) | Existing financial resources and operational scale |

| Caregiver Shortage | Major challenge in recruitment and retention (need for 1.1M+ aides by 2030) | Large existing workforce (40k+ caregivers by late 2023) and recruitment infrastructure |

| Brand Recognition & Trust | Requires substantial marketing investment and time to build | Long-standing reputation since 1979, serving tens of thousands weekly |

| Payer Contracts | Difficult to secure without proven track record and financial stability | Established relationships with Medicare, Medicaid, and managed care organizations |

Porter's Five Forces Analysis Data Sources

Our Addus Porter's Five Forces analysis is built upon comprehensive data from company annual reports, investor presentations, and industry-specific market research reports. We also incorporate insights from regulatory filings and economic databases to provide a robust understanding of the competitive landscape.