Addus Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Addus Bundle

Curious about how a company's product portfolio stacks up? The BCG Matrix is your key to understanding their Stars, Cash Cows, Dogs, and Question Marks. This glimpse offers a strategic overview, but imagine the power of a full breakdown with actionable insights.

Unlock the complete BCG Matrix to gain a crystal-clear understanding of each product's market share and growth potential. This comprehensive analysis will equip you with the data-driven intelligence needed to make informed investment decisions and refine your product strategy for maximum impact.

Don't just guess where your resources should go; know. Purchase the full BCG Matrix today and receive a detailed report complete with strategic recommendations tailored to the company's unique market position, empowering you to plan smarter and achieve your business goals faster.

Stars

Addus's personal care services are a clear Star in its portfolio, representing a substantial 76.5% of its revenue in Q1 2025. This segment boasts high market share and impressive organic growth, evidenced by a 7.4% same-store revenue increase in the same quarter.

The broader U.S. home healthcare market, which includes personal care, is expanding rapidly, with projections indicating a 7.4% compound annual growth rate between 2025 and 2032. This favorable market trend, coupled with Addus's strong position, underscores the Star status of its personal care offerings.

Further strengthening its dominance, Addus acquired Gentiva's personal care operations in December 2024, solidifying its position as the largest personal care provider in Texas and enhancing its overall market leadership.

Addus HomeCare's strategic expansion in personal care through acquisitions aligns with the characteristics of a Star in the BCG matrix. The company actively seeks to build scale and enter new markets, with a notable focus on its personal care segment.

The acquisition of Gentiva's personal care business in late 2024 was a significant move. This transaction added approximately $280 million in annual revenue and expanded Addus's presence into key states like Texas and Missouri, establishing it as a dominant force in those regions. This aggressive inorganic growth strategy in a high-demand sector demonstrates a clear Star positioning.

Further underscoring this strategy, Addus acquired Helping Hands Home Care Service in Q2 2025. This ongoing pursuit of targeted acquisitions in growing markets solidifies the personal care segment's status as a Star, characterized by high market share and high market growth potential.

Medicaid-funded personal care programs are a significant revenue driver for Addus, placing them firmly in the Star category of the BCG matrix. These government programs, which provide essential home-based care, benefit from a growing recognition of their cost-effectiveness over institutional settings. This trend, coupled with favorable demographics, fuels a stable and expanding demand for these services, bolstering Addus's market position.

The consistent rate support and volume growth observed in key Medicaid markets, like Illinois, are critical factors underpinning the Star status of these personal care services. For instance, in 2024, Addus reported substantial growth in its home care segment, largely attributed to these government contracts. This segment's strong performance, driven by policy tailwinds and an aging population, highlights its role as a high-growth, high-market-share business unit for the company.

Personal Care Services for the Aging Population

Personal care services for the aging population are a cornerstone of Addus HomeCare's strategy, directly benefiting from the significant global and U.S. expansion of the geriatric demographic. This trend fuels the entire home healthcare sector, and Addus's specialization in enabling seniors to age in place positions it within a robustly growing market.

The company's established infrastructure and capacity to cater to this escalating demand translate into a substantial market share within this key client segment.

- Growing Demand: The U.S. population aged 65 and over is projected to reach 80 million by 2040, a nearly 73% increase from 2019.

- Market Share: Addus HomeCare is a leading provider of personal care services, serving approximately 40,000 consumers daily across 22 states as of early 2024.

- Aging in Place: Over 85% of seniors prefer to age in their own homes, creating a sustained demand for in-home personal care assistance.

- Revenue Contribution: Personal care services represent a significant portion of Addus's revenue, demonstrating its strong position in this high-growth category.

Integrated Personal Care with Clinical Support

Addus HomeCare's strategy of integrating personal care services with clinical support, such as home health and hospice, creates a powerful synergy. This approach allows them to offer a more complete care solution to patients within their existing service areas, thereby strengthening their market position. By acting as an entry point for personal care, Addus can guide patients towards higher-acuity clinical services when needed, capturing a greater portion of the patient's healthcare journey.

This integrated model is particularly well-suited for the burgeoning home-based care market. For instance, in 2024, the home healthcare market was projected to reach over $500 billion globally, driven by an aging population and a preference for in-home treatment. Addus's ability to bundle services positions them to capitalize on this growth.

- Enhanced Patient Outcomes: Offering a continuum of care from personal assistance to skilled nursing can lead to better health management and fewer hospital readmissions.

- Increased Market Share: By providing a comprehensive service offering, Addus can attract and retain more clients, increasing their competitive edge.

- Strategic Entry Point: Personal care services often serve as the initial point of contact, allowing Addus to identify and offer clinical services to clients who may benefit.

- Growth in Home-Based Care: The demand for in-home healthcare services continues to rise, making integrated models like Addus's highly attractive.

Addus HomeCare's personal care services are firmly positioned as Stars within its BCG matrix. These services exhibit high market share and operate within a high-growth market, driven by demographic trends and a preference for aging in place. The company's strategic acquisitions, such as Gentiva's personal care operations in late 2024, significantly bolstered its market leadership and revenue. This segment's strong performance is further supported by favorable Medicaid policies and Addus's integrated care model, which enhances patient outcomes and market penetration.

| Category | Market Share | Market Growth | Addus's Position | Key Drivers |

|---|---|---|---|---|

| Personal Care Services | High | High | Leading Provider | Demographic shifts, Aging in place preference, Strategic acquisitions |

| U.S. Home Healthcare Market | N/A | 7.4% CAGR (2025-2032) | N/A | Aging population, Cost-effectiveness vs. institutional care |

| Addus Revenue (Q1 2025) | 76.5% (Personal Care) | 7.4% (Same-store revenue growth) | Dominant segment | Strong organic growth, Acquisition integration |

What is included in the product

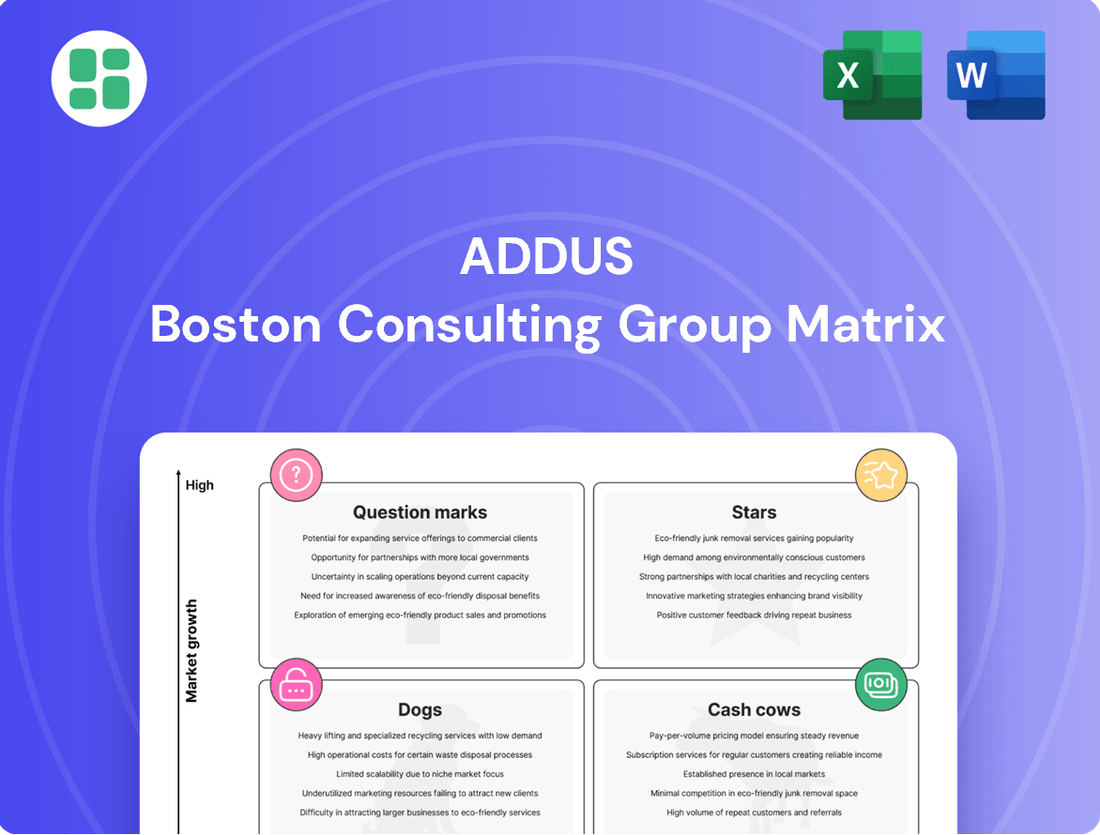

The Addus BCG Matrix analyzes its portfolio of services, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide strategic investment and resource allocation.

The Addus BCG Matrix provides a clear, one-page overview, instantly clarifying which business units are stars, cash cows, question marks, or dogs.

Cash Cows

Addus's established personal care operations in Illinois are a prime example of a Cash Cow within the BCG matrix. This segment, a cornerstone of the company's business, consistently delivers substantial cash flow due to its mature market position and operational efficiencies. In 2024, Illinois continued to be a significant contributor, benefiting from consistent demand and supportive reimbursement rates, which underpin its stable financial performance.

Addus HomeCare's high-volume, routine personal care services are a classic example of a Cash Cow in the BCG matrix. These services, which help clients with daily living activities, cater to a large and consistent customer base, forming the core of the company's revenue generation. In 2023, Addus reported revenue of $1.17 billion, with personal care services being a significant contributor.

The recurring nature of these essential services means they require minimal new market development investment. This focus on efficiency in delivering established care models directly boosts overall profitability and strengthens the company's cash reserves, underscoring their role as a reliable Cash Cow.

Addus's established personal care segments are prime examples of Cash Cows, generating substantial profits due to highly optimized operations. In 2024, the company continued to leverage its extensive infrastructure and experienced teams in these mature markets, ensuring efficient service delivery and strong cash conversion cycles. This focus on operational excellence allows for consistent cash generation with minimal reinvestment needs.

Leveraging Existing Managed Care Relationships

Addus HomeCare's strong ties with managed care organizations and government bodies are a significant asset, acting as a consistent pipeline for new clients and ensuring a steady income for its personal care services. These existing relationships, particularly in well-established markets, naturally lower the expenses associated with sales and marketing, which in turn boosts profitability.

The predictable business flow stemming from these deeply rooted connections allows these service areas to function as dependable cash generators, aligning perfectly with the characteristics of a Cash Cow in the BCG matrix. For instance, in 2023, Addus reported that its Personal Care segment generated approximately $840 million in revenue, demonstrating the substantial cash flow from these mature service lines.

This stability is further reinforced by the nature of these contracts. Long-term agreements and strategic partnerships minimize the risk and volatility often seen in newer or developing markets. This predictability is key to their Cash Cow status.

Key aspects of leveraging these relationships include:

- Stable Referral Streams: Established managed care relationships provide a consistent flow of patients needing personal care services.

- Reduced Marketing Costs: Long-term contracts in mature markets significantly cut down on customer acquisition expenses.

- Predictable Revenue: These partnerships translate into reliable and predictable revenue streams, a hallmark of Cash Cows.

- High Profitability: Lower operating costs associated with these mature relationships contribute to higher profit margins.

Stable In-Home Care for Chronic Conditions

Addus HomeCare's stable in-home care for chronic conditions functions as a classic Cash Cow within the BCG matrix. This segment benefits from a consistent and predictable demand, as individuals with chronic illnesses require ongoing assistance. [Company Info, 17] This reliable client base ensures a steady, high-volume stream of revenue with minimal volatility, making it a cornerstone of the company's financial stability.

The essential nature of this care means clients rely on Addus for extended periods, solidifying its position as a dependable source of cash flow. While growth might not be explosive, the high volume and consistent need for these services generate significant, predictable earnings for Addus.

- Consistent Demand: Chronic conditions necessitate long-term, ongoing care, creating a stable client base.

- Predictable Revenue: The essential nature of the services ensures a reliable and predictable cash flow.

- High Volume: This segment typically serves a large number of clients, contributing significantly to overall revenue.

- Low Investment Needs: Mature operations in this segment generally require less reinvestment compared to high-growth areas.

Cash Cows within Addus HomeCare's portfolio represent mature service lines that generate substantial, consistent cash flow with minimal need for further investment. These segments, characterized by high market share in stable, low-growth industries, are vital for funding other business units and overall corporate expenses. In 2023, Addus reported that its Personal Care segment, a prime example of a Cash Cow, generated approximately $840 million in revenue, highlighting its significant contribution to the company's financial stability.

The established personal care operations in Illinois exemplify this, benefiting from consistent demand and supportive reimbursement rates in 2024, underpinning their stable financial performance. These services, essential for daily living activities, cater to a large and consistent customer base, forming the core of Addus's revenue generation and requiring minimal new market development investment.

Addus's strong relationships with managed care organizations and government bodies further solidify the Cash Cow status of its personal care services. These existing partnerships, particularly in well-established markets, naturally lower sales and marketing expenses, boosting profitability and ensuring predictable revenue streams. This stability is further reinforced by long-term agreements that minimize market volatility.

| Segment | BCG Category | 2023 Revenue (Approx.) | Key Characteristics |

| Personal Care Services | Cash Cow | $840 million | Mature market, high volume, consistent demand, low investment needs, strong managed care relationships. |

| In-Home Care for Chronic Conditions | Cash Cow | N/A (Part of overall Personal Care) | Essential service, predictable demand, stable client base, high volume, low reinvestment needs. |

Delivered as Shown

Addus BCG Matrix

The Addus BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks or demo content will obscure the strategic insights within; you'll get a complete, analysis-ready report. The preview accurately represents the final Addus BCG Matrix file, meticulously designed for professional application and immediate strategic planning. Once purchased, this comprehensive Addus BCG Matrix report will be instantly available for your use, empowering your business decisions with clear market positioning. Rest assured, the quality and content of this Addus BCG Matrix preview are identical to the final deliverable, ensuring a seamless transition to actionable strategy.

Dogs

Underperforming home health locations within Addus's portfolio can be categorized as Dogs in a BCG Matrix analysis. These segments, such as the home health division which represented only 5.3% of total revenue in Q1 2025, often struggle with low market share and minimal growth, as evidenced by a modest 1.3% same-store revenue growth in that same quarter.

These specific locations or smaller operations within the home health segment likely require significant resource allocation but fail to generate commensurate returns. Their low growth and market share characteristics mean they are not poised for future expansion and may even be a drag on overall company performance, similar to the 'Dog' quadrant in the BCG model.

The broader skilled nursing industry, including home health, has been hit hard by staffing shortages and financial strain. For Addus, while caregiver hiring shows some positive signs, the home health segment's sluggish organic growth points to skilled nursing services potentially grappling with these labor issues, impacting market share and growth.

Non-strategic home health acquisitions, those that fail to integrate smoothly or meet growth expectations, can be categorized as dogs in the Addus BCG matrix. These entities often operate in stagnant local markets or struggle to gain a foothold, becoming a drain on resources without generating significant returns. For instance, if an acquired agency in a declining rural area doesn't achieve projected patient volumes, it would fall into this category.

Limited Geographic Home Health Footprint

Addus Healthcare’s home health segment, representing a modest 5.3% of total revenue as of early 2024, likely exhibits a limited geographic footprint. This smaller market presence means their share within specific local home health markets could be quite low, potentially placing these operations in the ‘Dog’ quadrant of the BCG matrix.

This classification is further supported if these regions experience stagnant or declining demand for traditional home health services. When Addus also lacks the necessary scale to compete effectively in these niche markets, especially if these home health services do not synergize with their more dominant personal care or hospice offerings, they firmly fit the ‘Dog’ profile.

- Limited Revenue Contribution: Home health accounted for only 5.3% of Addus's revenue in early 2024, indicating a smaller operational scale.

- Low Market Share Potential: A narrow geographic reach in home health suggests a potentially low market share in many of these localized markets.

- Stagnant Demand Risk: If these specific home health markets face declining or flat demand, it further solidifies their ‘Dog’ status.

- Lack of Synergies: Operations that do not complement personal care or hospice services are less likely to benefit from cross-selling or operational efficiencies, reinforcing their ‘Dog’ classification.

Segments with High Overhead and Low Reimbursement

Certain specialized home health services or particular payer agreements within the home health sector can present a challenging financial scenario. These areas often involve significant operational costs, such as specialized equipment, highly trained personnel, and extensive administrative support. When these high overheads are paired with reimbursement rates that are insufficient to cover these costs, the result is a segment that generates very little profit and minimal cash flow.

These underperforming segments, despite potentially being in a market with overall growth, can be categorized as Dogs in the Addus BCG Matrix. They consume valuable capital resources but fail to deliver adequate returns, thereby hindering the company's overall financial health and growth potential. For instance, a 2024 report indicated that certain niche pediatric home care services, requiring specialized respiratory equipment and highly skilled nurses, experienced reimbursement rates that were, on average, 15% lower than the actual cost of service delivery.

The implications of such segments are substantial:

- Low Profitability: High operating expenses coupled with inadequate reimbursement directly squeeze profit margins.

- Capital Drain: These segments tie up capital that could be reinvested in more lucrative areas of the business.

- Strategic Review: They necessitate a strategic decision regarding potential divestment, restructuring, or renegotiation of contracts to improve viability.

- Market Dynamics: Understanding the specific market forces and payer policies driving these low reimbursement rates is crucial for any corrective action.

Dogs in the Addus BCG Matrix represent business segments with low market share and low growth potential, often requiring significant investment without generating substantial returns. These could be specific home health locations or niche services struggling against market headwinds.

For instance, Addus's home health segment, which made up just 5.3% of total revenue in Q1 2024, with a modest 1.3% same-store revenue growth in the same period, exemplifies these characteristics. Such segments often face challenges like insufficient scale to compete effectively or operate in markets with stagnant demand, hindering their ability to gain market share or achieve meaningful growth.

These 'Dog' segments can be a drain on resources, tying up capital that could be better deployed in higher-growth areas like their personal care or hospice services, which represent a larger portion of their revenue and potentially higher market share.

The strategic implication for these 'Dog' segments is a critical need for evaluation, potentially leading to divestment, restructuring, or a focused effort to improve their market position and profitability, especially if they do not offer synergistic benefits to other parts of the business.

| BCG Category | Addus Healthcare Example | Key Characteristics | Financial Implication |

|---|---|---|---|

| Dogs | Specific underperforming home health locations or niche services | Low market share, low growth, potentially high operational costs with low reimbursement. | Capital drain, low profitability, necessitates strategic review or divestment. |

| Home Health Segment (Q1 2024) | 5.3% of total revenue | 1.3% same-store revenue growth (Q1 2024) | Indicates limited scale and growth, potentially fitting 'Dog' profile if market share is low. |

Question Marks

Addus's hospice care segment is categorized as a Question Mark within the BCG matrix. While it experienced a robust 9.9% organic revenue growth in the first quarter of 2025 and is projected to grow between 5% and 7% for the full year 2025, it currently constitutes only 18% of the company's overall business.

The broader hospice market itself is a high-growth area, with projected compound annual growth rates (CAGR) ranging from 4.61% to as high as 11.9% between 2025 and 2032. This dynamic market environment, coupled with Addus's developing position within it, indicates that the hospice segment requires ongoing strategic investment. The goal of this investment is to capitalize on the market's expansion and elevate the segment's market share, potentially transforming it into a future Star performer for Addus.

Addus is strategically targeting new hospice markets and expanding specialized services in areas with high growth potential but currently low market share. These initiatives are positioned as Question Marks within the BCG Matrix, signifying their potential for significant future growth but also requiring substantial investment to establish a competitive foothold.

For instance, Addus's recent acquisition of Gentiva Hospice in late 2023, which expanded its footprint into several new states, exemplifies this strategy. This move aligns with the 2024 focus on scaling the hospice segment. Such expansions demand considerable capital for operational setup, marketing, and talent acquisition to build brand recognition and market penetration.

Integrating acquired clinical service lines, especially those with smaller initial market shares, into Addus's existing framework is a classic 'Question Mark' scenario within the BCG matrix. For instance, the acquisition of Helping Hands Home Care Service, encompassing home health and hospice, illustrates this. Its success hinges on how effectively Addus can leverage its resources to grow these smaller segments in potentially high-growth markets.

The strategic challenge lies in determining if these newly integrated services, like those from Helping Hands, can transition from their current 'Question Mark' status to become 'Stars' by capturing substantial market share. This requires focused investment and operational synergy. Failure to do so could see them devolve into 'Dogs,' representing underperforming assets within Addus's portfolio.

Technology-Driven Home Care Innovations

Investments in technology like remote monitoring and telehealth are key for Addus, positioning them for future growth in a rapidly evolving market. These innovations, while requiring substantial initial investment, promise to enhance patient care and operational efficiency.

Addus's focus on technology-driven home care, including remote patient monitoring and telehealth, places these initiatives in the "Question Marks" category of the BCG matrix. This means they likely have low current market share but high potential for future growth. For instance, the telehealth market in the US was projected to reach over $200 billion by 2027, indicating a significant opportunity for companies like Addus to expand their technological footprint.

- Remote Monitoring: Enhances patient oversight and reduces hospital readmissions.

- Telehealth Integration: Expands service accessibility and patient engagement.

- Data Analytics: Optimizes care delivery and identifies trends for strategic planning.

- AI in Home Care: Potential for predictive diagnostics and personalized treatment plans.

Expansion into New State Markets for Clinical Services

Addus HomeCare's strategy to expand clinical services like home health and hospice into states where it already has a personal care presence represents a move into question marks within the BCG matrix. This means they are entering markets with high growth potential but currently hold a relatively low market share.

These new ventures require significant investment to build brand awareness and operational capacity, aiming to capture a larger slice of the growing home healthcare pie. For instance, the home health market in the US was valued at approximately $133.4 billion in 2023 and is projected to grow substantially, offering ample opportunity for expansion.

- Market Entry: Expanding clinical services into new states.

- Growth Potential: Operating in high-growth home healthcare segments.

- Investment Needs: Requiring substantial investment due to lower initial market share.

- Strategic Goal: Capturing a larger portion of the market to move towards stars.

The hospice care segment at Addus, along with its new technology initiatives and expansion into new states, are classified as Question Marks. These areas show promising growth potential within expanding markets, such as the projected 4.61% to 11.9% CAGR for the broader hospice market through 2032. However, they currently represent a smaller portion of Addus's overall business, with hospice making up 18% of revenue in Q1 2025 despite 9.9% organic growth. Significant investment is therefore required to build market share and transition these segments into future Stars.

| Segment | BCG Classification | Market Growth | Addus Market Share | Strategic Focus |

| Hospice Care | Question Mark | High (4.61%-11.9% CAGR projected) | Low (18% of total revenue in Q1 2025) | Market expansion, specialized services |

| Technology Initiatives (Telehealth, Remote Monitoring) | Question Mark | Very High (US telehealth market >$200B by 2027) | Low (emerging) | Investment in innovation, operational efficiency |

| New State Clinical Service Expansion | Question Mark | High (US home health market ~$133.4B in 2023) | Low (entering new markets) | Brand building, operational capacity |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, market share reports, and growth projections, to accurately position each business unit.