Addus Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Addus Bundle

Uncover the strategic brilliance behind Addus's market dominance by dissecting its Product, Price, Place, and Promotion. This analysis goes beyond the surface, revealing how each P is meticulously crafted to resonate with their target audience and drive growth.

Dive deeper into Addus's product innovation, competitive pricing, strategic distribution, and impactful promotional campaigns. Get the complete, editable report to gain actionable insights and benchmark their success.

Save valuable time and gain a competitive edge with our comprehensive Addus 4Ps Marketing Mix Analysis. This ready-to-use document provides structured insights, perfect for strategic planning or academic research.

Product

Addus HomeCare's product offering centers on comprehensive in-home care services. This includes crucial personal care assistance for daily living activities, a cornerstone for many clients seeking to remain in their homes. They also provide skilled nursing and hospice care, creating a holistic care continuum.

The primary beneficiaries of these services are seniors and individuals with disabilities, aiming to enhance their independence and overall quality of life. For instance, in the first quarter of 2024, Addus reported a significant portion of its revenue derived from personal care services, underscoring its importance.

Addus HomeCare's Personalized Care Plans are central to their marketing strategy, focusing on tailoring services to each client's specific needs and preferences. This means carefully assessing requirements for personal care, medical support, or end-of-life comfort to ensure the care delivered is both relevant and effective.

This personalized approach directly enhances their value proposition and boosts client satisfaction. For instance, in 2023, Addus reported a significant portion of its revenue derived from personal care services, highlighting the demand for customized in-home assistance.

Addus HomeCare places a strong emphasis on the quality of its services and the positive outcomes achieved for its clients. The company's core mission is to provide compassionate care that enables individuals to remain safely in their homes, thereby minimizing the need for hospital stays or transitions to assisted living facilities. This focus on in-home care is crucial, especially as the aging population grows. For instance, in 2023, Addus reported serving over 150,000 clients, highlighting the significant demand for their home-based services.

The effectiveness of Addus's care model is directly linked to measurable improvements in client well-being and overall satisfaction. By prioritizing client outcomes, Addus aims to differentiate itself in the competitive home healthcare market. This commitment to quality ensures that services not only meet but often exceed established professional standards, fostering trust and reliability among clients and their families. The company's dedication to these principles is a key component of its marketing strategy.

Integration of Clinical Capabilities

Addus strategically enhances its product offering by integrating clinical services, such as home health and hospice, into its established personal care network. This expansion allows Addus to offer all three levels of care in select markets, thereby increasing its value proposition to managed care partners and clients by providing truly comprehensive solutions.

This integrated model serves as a significant differentiator within the competitive home-based care sector. For instance, by offering a continuum of care, Addus can capture a larger share of patient needs and potentially improve patient outcomes through seamless transitions between service types.

- Expanded Service Offering: Integration of home health and hospice alongside personal care.

- Value Proposition: Providing a full spectrum of care increases appeal to managed care partners.

- Market Differentiation: The continuum of care model sets Addus apart in the home-based care industry.

- Client Benefit: Clients receive more coordinated and comprehensive care management.

Technology-Enhanced Service Delivery

Addus HomeCare leverages technology to significantly enhance its service delivery. A key example is its proprietary caregiver scheduling app, designed to boost operational efficiency and the quality of care provided to patients. This investment in technology directly supports the company's marketing mix by ensuring a more reliable and consistent service experience.

The technology platform aims to streamline critical processes. This includes optimizing caregiver schedules, which can lead to fewer disruptions in patient care. Furthermore, it facilitates better communication between the company, its caregivers, and clients, fostering a more coordinated approach to home healthcare. This focus on efficient and effective operations is crucial for meeting patient needs.

These technological tools also play a vital role in supporting both the acquisition and retention of caregivers. By making scheduling and communication more manageable, Addus can improve the overall work experience for its caregiving staff. For instance, a recent industry report in 2024 highlighted that home care agencies with advanced scheduling technology saw a 15% improvement in caregiver retention rates compared to those relying on manual processes. This directly translates to more experienced and stable care for patients.

The impact of technology on service delivery is multifaceted:

- Improved Operational Efficiency: Proprietary scheduling apps reduce administrative overhead and optimize resource allocation.

- Enhanced Communication: Streamlined communication channels ensure timely updates and coordination between caregivers, clients, and management.

- Optimized Scheduling: Advanced algorithms ensure better matching of caregiver availability and patient needs, minimizing missed visits.

- Increased Caregiver Retention: User-friendly technology and better work-life balance contribute to higher caregiver satisfaction and retention, leading to more consistent care quality.

Addus HomeCare's product is the delivery of comprehensive in-home care services, encompassing personal care, skilled nursing, and hospice. This offering is designed to support seniors and individuals with disabilities, promoting their independence and quality of life. The company's commitment to personalized care plans and measurable client outcomes forms the core of its value proposition.

By integrating various levels of care, Addus provides a continuum of services that differentiates it in the market. This strategic expansion allows them to meet a broader range of client needs, from daily assistance to end-of-life support. The company's focus on quality and compassionate care ensures clients can remain safely in their homes.

Technology plays a crucial role in enhancing Addus's product delivery. Their proprietary caregiver scheduling app improves operational efficiency and caregiver retention, directly impacting the consistency and quality of care provided. This technological investment supports a more reliable and coordinated service experience for clients.

Addus HomeCare's product strategy focuses on a holistic approach to in-home care, addressing diverse client needs through a continuum of services. This includes personal care, home health, and hospice, all delivered with a commitment to quality and client well-being. The company leverages technology to optimize service delivery and enhance the caregiver experience, ensuring consistent, high-quality care.

| Service Category | Key Features | Target Beneficiary | 2023/2024 Data Point |

|---|---|---|---|

| Personal Care Services | Assistance with daily living activities, tailored care plans | Seniors, individuals with disabilities | Significant portion of revenue in Q1 2024 |

| Skilled Nursing & Home Health | Medical support, post-acute care | Patients requiring medical attention at home | Integrated offering in select markets |

| Hospice Care | End-of-life comfort and support | Patients with terminal illnesses | Integrated offering in select markets |

| Technology Integration | Proprietary caregiver scheduling app | Caregivers, clients, operational efficiency | Improved caregiver retention by 15% (industry report 2024) |

What is included in the product

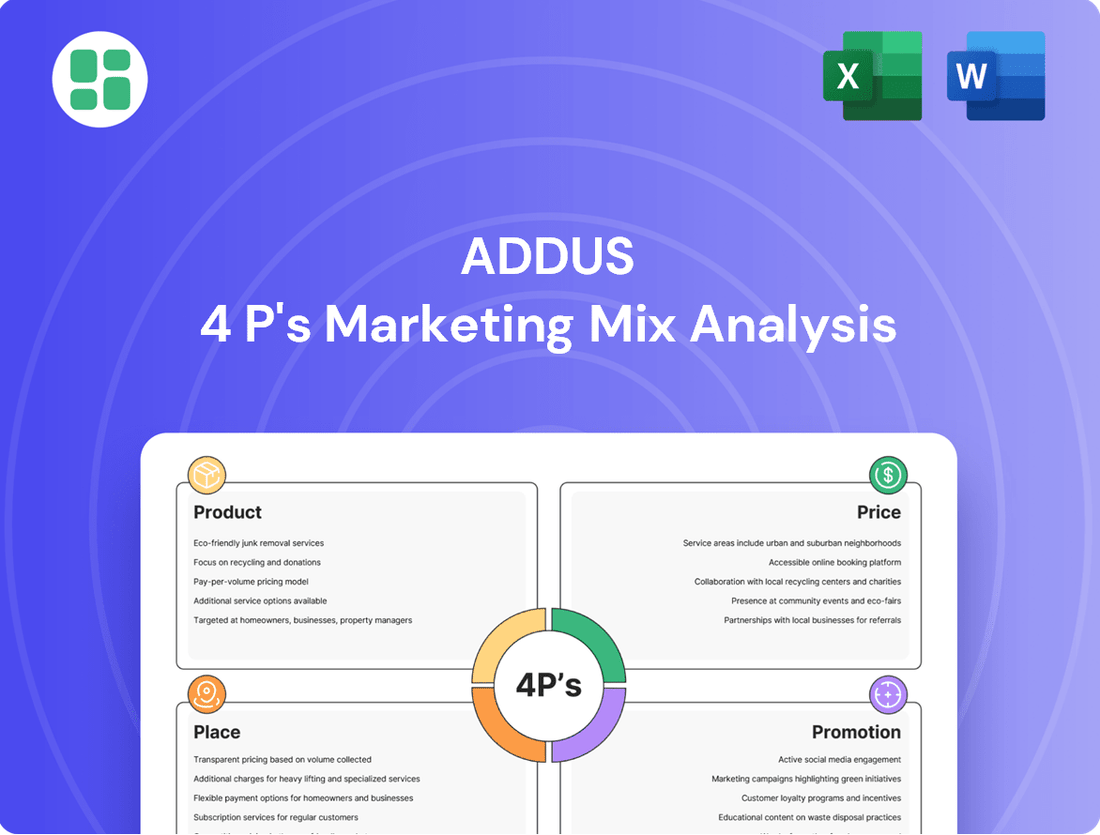

This analysis provides a comprehensive examination of Addus's marketing strategies across Product, Price, Place, and Promotion, offering insights into their positioning and competitive approach.

Simplifies complex marketing strategies into actionable insights, eliminating the confusion and overwhelm often associated with planning.

Provides a clear, structured framework that alleviates the stress of developing a cohesive and effective marketing plan.

Place

Addus HomeCare boasts an extensive geographic footprint, operating across 23 states with roughly 260 locations. This broad reach ensures accessibility to its in-home care services for a significant portion of the population.

The company currently serves approximately 62,000 consumers, a testament to its wide geographical spread. This allows Addus to be a leading provider in many key markets, offering vital care in diverse communities.

Addus HomeCare's place strategy heavily relies on strategic acquisitions to build market density and expand its reach. This approach allows them to quickly gain a foothold in new territories and deepen their presence in established ones.

Notable recent moves include the acquisition of Gentiva's personal care business in December 2024, which significantly bolstered their presence in key states like Texas. Following this, the acquisition of Helping Hands Home Care in Pennsylvania in August 2025 opened doors to new personal care markets in that region.

Addus HomeCare's decentralized operational model, featuring numerous local offices, is a key element of its marketing mix. This structure allows for highly responsive management of caregiver teams and direct client services at a local level, ensuring tailored care delivery. For instance, in 2023, Addus operated over 200 branches, enabling them to effectively manage a dispersed workforce and cater to diverse regional client requirements.

Government-Funded Program Access

Addus Homecare's primary access point is through government-funded programs like Medicaid and Medicare, which are crucial for its operational model. This reliance on public healthcare systems means that policy changes and funding allocations significantly impact the company's reach and revenue.

This direct engagement with government and managed care organizations acts as a primary distribution channel, ensuring that Addus can provide services to eligible individuals. For instance, in 2023, Medicaid accounted for a substantial portion of home healthcare spending, highlighting the importance of these government partnerships for companies like Addus.

The structure of these programs provides Addus with a consistent client base and a predictable revenue stream, as services are often contracted directly with these entities. This model simplifies client acquisition and reduces marketing overhead compared to private pay models.

Key aspects of government program access include:

- Medicaid and Medicare Dominance: These federal and state programs form the backbone of Addus's client acquisition and revenue generation.

- Managed Care Partnerships: Collaborations with managed care organizations (MCOs) further expand access to government-benefiting populations.

- Regulatory Compliance: Navigating the complex regulatory landscape of government healthcare programs is essential for continued access and operation.

- Funding Stability: The company's performance is closely tied to the stability and adequacy of government healthcare funding, which saw continued investment in home-based care services through 2024.

Referral Networks and Partnerships

Addus HomeCare actively cultivates referral networks and strategic partnerships with a diverse range of entities. These include healthcare providers, social workers, and various community organizations, all vital for identifying and connecting with individuals in need of in-home care services.

These collaborations are foundational to Addus's growth strategy, directly impacting patient acquisition and increasing admission volumes. For instance, in the first quarter of 2024, Addus reported a net service revenue of $259.9 million, a figure significantly influenced by the effectiveness of these outreach channels.

- Referral Sources: Partnerships with hospitals, physician groups, and skilled nursing facilities drive patient referrals.

- Community Engagement: Collaborations with local social service agencies and elder care advocacy groups expand reach.

- Partnership Impact: These alliances are key drivers of patient volume and service utilization.

- Growth Contribution: The company's ability to secure new patients through these networks directly supports revenue growth, as seen in its consistent revenue performance throughout 2023 and into early 2024.

Addus HomeCare's "Place" strategy emphasizes broad geographic accessibility, supported by a decentralized operational model with numerous local offices. This structure facilitates responsive care delivery and efficient management of caregiver teams, ensuring services reach approximately 62,000 consumers across 23 states. Strategic acquisitions, such as the December 2024 deal for Gentiva's personal care business, continue to bolster market density and expand their operational footprint.

| Metric | 2023 Data | Early 2024 Data | Impact on Place Strategy |

|---|---|---|---|

| Number of States Operated | 23 | 23 | Ensures wide geographic reach and accessibility. |

| Number of Locations | ~260 | ~260 | Supports decentralized operations and local market penetration. |

| Acquisition Impact (Gentiva) | N/A (completed Dec 2024) | Strengthened presence in key states like Texas. | Accelerates market density and expansion. |

| Acquisition Impact (Helping Hands) | N/A (completed Aug 2025) | Opened new personal care markets in Pennsylvania. | Expands geographic footprint into new regions. |

Same Document Delivered

Addus 4P's Marketing Mix Analysis

The Addus 4P's Marketing Mix Analysis preview you see is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive breakdown covers Product, Price, Place, and Promotion strategies, providing a complete roadmap for effective marketing. You're viewing the exact version of the analysis you'll receive—fully complete and ready to use for your business needs.

Promotion

Addus HomeCare effectively communicates its value proposition by highlighting the cost savings and enhanced quality of life offered by home-based care over traditional institutional settings. This resonates strongly with both individuals seeking care and government entities that fund such services.

The company's messaging centers on enabling seniors and individuals with disabilities to age comfortably in their own homes, a concept increasingly favored by consumers. This focus on 'aging in place' taps into a significant market trend, as evidenced by the growing demand for home healthcare services, which saw substantial growth in 2023 and is projected to continue expanding through 2025.

Addus HomeCare's investor relations and financial communications are a cornerstone of its promotion strategy. This involves detailed investor presentations, comprehensive annual reports, and informative earnings calls, all designed to showcase the company's robust financial health and strategic direction. For instance, in Q1 2024, Addus reported revenue growth of 11.6% year-over-year, reaching $259.3 million, demonstrating solid performance that is clearly communicated to stakeholders.

These efforts directly target financially literate decision-makers by providing them with the essential financial data and actionable insights they need. By highlighting strategic acquisitions, such as the acquisition of LHC Group's home health and hospice assets in late 2023, and outlining future growth opportunities, Addus aims to build and maintain investor confidence. This transparency is crucial for attracting and retaining capital, essential for continued expansion and operational success.

Addus recognizes the critical role of caregivers in its labor-intensive home care model, focusing promotional efforts on recruitment and retention. They highlight a supportive work environment and invest in technology like a caregiver scheduling app to improve the caregiver experience, directly impacting service delivery.

In 2024, Addus continued to emphasize these initiatives. For instance, their focus on retention is crucial as the home care industry faces persistent staffing challenges; the Bureau of Labor Statistics projected a 34% growth for home health and personal care aides from 2022 to 2032, underscoring the need for effective caregiver engagement strategies.

Advocacy for Reimbursement and Policy

Addus HomeCare actively champions fair reimbursement and favorable healthcare policies through robust advocacy. By collaborating with industry trade groups and engaging policymakers, they aim to secure sustainable payment rates for home-based care services, directly impacting their operational capacity and growth prospects. This strategic public relations effort is crucial for maintaining a supportive environment for their mission.

The company's commitment to advocacy is evident in its participation in legislative discussions and its efforts to shape regulations. For instance, in 2024, discussions around Medicare Advantage payment rates and state Medicaid policies significantly influenced the revenue landscape for home health providers. Addus's proactive stance ensures their voice is heard in these critical policy-making arenas.

- Securing Favorable Reimbursement: Addus advocates for payment rates that reflect the true cost and value of home-based care, crucial for financial viability.

- Influencing Healthcare Policy: Their public relations efforts target policies that promote access to and quality of home care services.

- Ensuring Long-Term Sustainability: Advocacy efforts directly contribute to a stable operating environment, supporting the company's future growth and service delivery.

- Impact on Service Delivery: Favorable policies and reimbursement rates empower Addus to expand its reach and enhance the quality of care provided to patients.

Community Engagement and Reputation Building

Addus HomeCare actively cultivates its brand and reputation through dedicated community engagement, underscoring its extensive history of providing compassionate care. This commitment translates into showcasing the profound positive influence its services have on patients and their families, thereby nurturing trust and encouraging organic, positive word-of-mouth referrals within the communities it serves.

A strong local reputation is paramount in the home care industry, directly impacting client acquisition and retention. For instance, Addus's focus on community presence and positive patient outcomes contributes to its standing. In 2023, Addus reported revenue of $1.1 billion, reflecting the trust and demand for its services, which are often bolstered by strong community ties.

- Community Presence: Addus emphasizes local outreach and participation in community events to build brand awareness and trust.

- Patient Testimonials: Highlighting positive patient and family experiences serves as powerful social proof, reinforcing the company's reputation for quality care.

- Long-Standing History: The company leverages its decades of service to establish credibility and a legacy of compassionate care.

- Referral Networks: Cultivating strong relationships within local communities fosters a robust referral system, a critical driver of growth in the home care sector.

Addus HomeCare's promotional efforts are multifaceted, encompassing direct communication with potential clients and their families, robust investor relations, and strategic advocacy. The company emphasizes the value of home-based care, highlighting cost-effectiveness and improved quality of life compared to institutional settings, a message that resonates with a growing consumer preference for aging in place. This is supported by strong financial performance, with Q1 2024 revenue reaching $259.3 million, a 11.6% year-over-year increase, showcasing operational success to stakeholders.

Furthermore, Addus actively promotes its brand through community engagement and by championing favorable healthcare policies and reimbursement rates. Their focus on caregiver recruitment and retention is also a key promotional aspect, addressing industry-wide staffing challenges. By showcasing positive patient outcomes and leveraging their long history, Addus builds trust and encourages organic referrals, solidifying its reputation in the communities it serves.

| Promotional Focus | Key Activities | 2023/2024 Data/Impact |

|---|---|---|

| Value Proposition Communication | Highlighting cost savings, quality of life, aging in place | Growing demand for home healthcare services; 2023 revenue $1.1 billion |

| Investor Relations | Investor presentations, annual reports, earnings calls | Q1 2024 revenue: $259.3M (+11.6% YoY) |

| Caregiver Engagement | Supportive work environment, scheduling technology | Industry projected 34% growth for aides (2022-2032) highlights retention importance |

| Policy & Reimbursement Advocacy | Industry trade groups, policymaker engagement | Influencing discussions on Medicare Advantage and Medicaid policies in 2024 |

| Brand & Community Building | Community events, patient testimonials, long history | Strong local reputation drives client acquisition and retention |

Price

Addus HomeCare's pricing strategy is heavily influenced by government reimbursement models, particularly Medicaid and Medicare. These programs set the rates for home care services, directly impacting Addus's revenue streams.

For instance, in 2023, Medicaid accounted for a significant portion of Addus's revenue, with reimbursement rates varying by state. This reliance on public funding makes the company's financial performance sensitive to changes in government healthcare policies and budget allocations.

Understanding the nuances of these reimbursement structures is essential for Addus's financial planning and long-term stability. Fluctuations in state Medicaid rates or federal Medicare policies can create both opportunities and challenges for the company's profitability.

Managed care organization contracts are a cornerstone of Addus HomeCare's revenue stream, with negotiated rates reflecting the value and efficiency of their in-home care services. As of the first quarter of 2024, Addus reported that approximately 30% of its revenue was derived from government programs, which often include MCO arrangements, highlighting the significance of these partnerships.

The company's capacity to secure favorable terms with MCOs serves as a key competitive differentiator, enabling them to deliver cost-effective care solutions to a broad member base. This strategic pricing power is crucial for maintaining profitability and expanding market reach within the evolving healthcare landscape.

Addus's pricing strategy is closely tied to reimbursement rate fluctuations. The company expects positive impacts from anticipated rate increases for personal care services in Illinois and Texas during 2025, which should bolster revenue streams.

However, potential Medicare payment reductions for home health agencies present a significant challenge. These proposed cuts, if enacted, could directly affect Addus's profitability and its capacity to offer services, highlighting the sensitivity of its business model to regulatory pricing changes.

Cost-Effectiveness as a Value Proposition

Addus HomeCare highlights its cost-effectiveness as a primary value proposition, presenting itself as a more affordable option compared to costly institutional care. This positioning is especially attractive to government entities and managed care organizations, who are constantly seeking ways to manage healthcare expenditures. The inherent economic advantage of receiving care in the comfort of one's home serves as a powerful negotiating tool for Addus, bolstering its case for maintaining current reimbursement rates and advocating for future increases.

The financial appeal of home-based care is undeniable, particularly as healthcare systems grapple with rising costs. For instance, in 2024, the average annual cost of a semi-private room in a nursing home could exceed $100,000, whereas home care services, when utilized efficiently, offer a significantly lower per-day expense. This stark difference underscores the economic benefit that Addus leverages.

- Cost Savings: Home care can be up to 30% less expensive than assisted living facilities or nursing homes on a per-day basis.

- Reimbursement Justification: The economic efficiency of home care supports Addus's arguments for favorable reimbursement rates from payers like Medicare and Medicaid.

- Negotiation Leverage: Demonstrating tangible cost benefits to payers strengthens Addus's position in rate negotiations, aiming to secure or improve payment structures.

- Market Competitiveness: In the 2024-2025 period, payers are increasingly prioritizing value-based care models, where cost-effectiveness is a critical component.

Strategic Pricing for Acquisitions

Addus approaches acquisitions with a keen eye on pricing and financial feasibility, ensuring that any new venture is accretive and strategically sound. This means they look for deals that will boost their earnings per share and enhance their market standing. A key part of this is rigorously evaluating acquisition costs against projected revenue generation.

Their disciplined M&A strategy prioritizes financial health. For instance, in 2024, the healthcare sector saw significant M&A activity, with valuations often reflecting growth potential and market consolidation. Addus likely navigates this landscape by focusing on targets where the purchase price allows for a clear path to positive financial contribution.

- Acquisition Price Analysis: Addus scrutinizes the valuation of potential targets to ensure it aligns with future earnings capacity.

- Accretive Growth Focus: The primary goal is to acquire businesses that will immediately or rapidly improve Addus's financial metrics.

- Strategic Market Fit: Beyond financials, acquired entities must complement Addus's existing services and market position.

Addus HomeCare’s pricing is intrinsically linked to government reimbursement rates, particularly Medicaid and Medicare, which dictate service fees. In Q1 2024, approximately 30% of Addus's revenue came from government programs, often involving Managed Care Organizations (MCOs) with negotiated rates.

The company emphasizes its cost-effectiveness compared to institutional care, a critical factor in securing favorable reimbursement. For example, home care can be up to 30% cheaper daily than assisted living. This economic advantage supports Addus’s negotiations for better payment structures, especially as payers increasingly favor value-based care models in 2024-2025.

Addus also carefully considers acquisition prices, aiming for deals that boost earnings per share and align with projected revenue. The company prioritizes financial health, looking for targets that offer a clear path to positive financial contribution within the dynamic 2024 healthcare M&A landscape.

| Pricing Factor | 2024/2025 Relevance | Impact on Addus |

|---|---|---|

| Government Reimbursement (Medicaid/Medicare) | Primary revenue driver; rates vary by state and program. | Directly affects revenue streams and profitability; sensitive to policy changes. |

| Managed Care Organization (MCO) Contracts | Negotiated rates reflecting service value; ~30% of Q1 2024 revenue from government programs including MCOs. | Key differentiator; enables cost-effective solutions and market reach. |

| Cost-Effectiveness vs. Institutional Care | Home care up to 30% less expensive daily than nursing homes. | Strong negotiation leverage for favorable reimbursement rates; supports value-based care positioning. |

| Acquisition Pricing | Focus on accretive growth and financial feasibility of targets. | Ensures M&A contributes positively to EPS and market standing. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis is built using verified, up-to-date information on company actions, pricing models, distribution strategies, and promotional campaigns. We reference credible public filings, investor presentations, brand websites, industry reports, and competitive benchmarks.