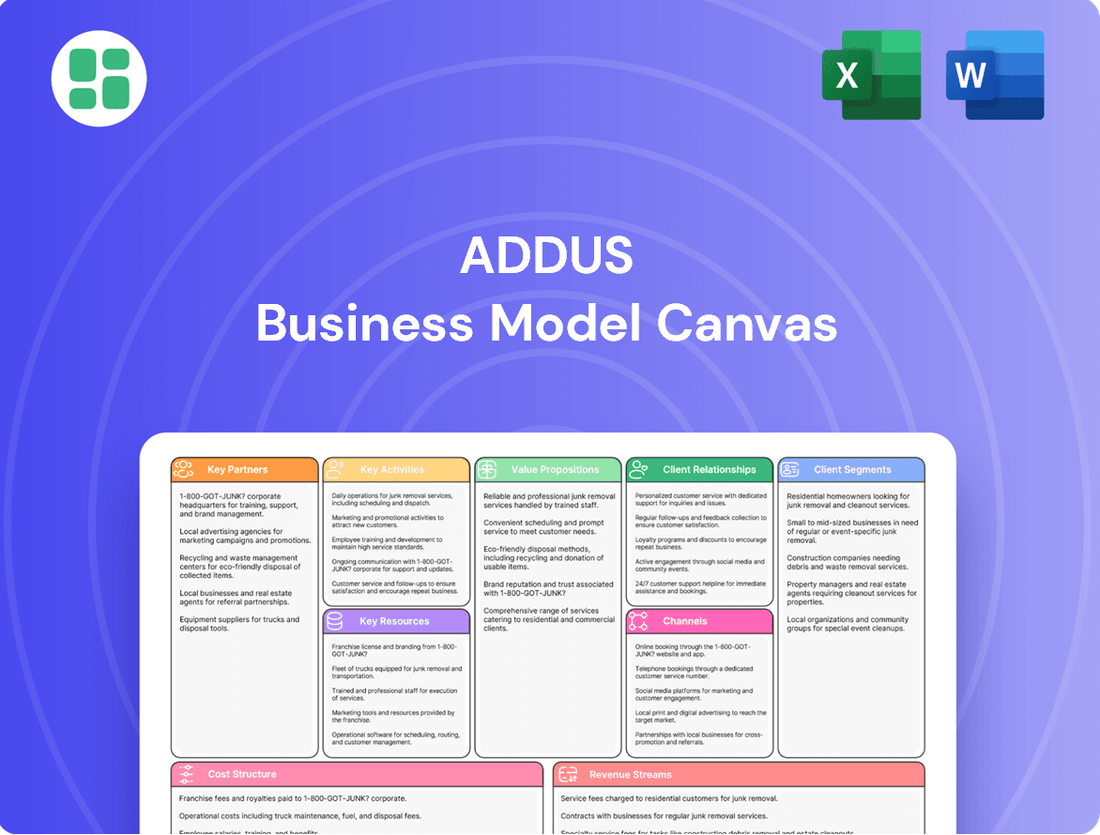

Addus Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Addus Bundle

Unlock the strategic DNA of Addus with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, key resources, and revenue streams, offering a clear view of their operational success. Gain invaluable insights for your own strategic planning and competitive analysis.

Partnerships

Government agencies, particularly federal and state entities like Medicaid and Medicare, are foundational to Addus HomeCare's business model. These partnerships are essential for revenue generation and providing access to a vast client base. In 2024, Addus continued to rely heavily on these programs, which fund a significant portion of their home and community-based care services.

Navigating the intricate regulatory landscapes and securing favorable reimbursement rates from these agencies is a constant focus. Addus's ability to adapt to evolving government policies directly impacts its financial performance and operational capacity. The company's ongoing engagement with these partners is key to its long-term sustainability and ability to scale its care offerings.

Managed Care Organizations (MCOs) are becoming vital collaborators as Addus HomeCare strategically embeds its services within the larger healthcare ecosystem. These partnerships are crucial for expanding Addus's reach and diversifying its home-based care solutions, enabling more effective negotiations and the development of value-driven coordinated care models.

By aligning with MCOs, Addus can enhance access to its services for a broader base of beneficiaries, reflecting the growing trend of integrated healthcare delivery. For instance, in 2024, Addus reported significant growth in its managed care segment, driven by these strategic alliances, which contributed to a substantial portion of its revenue, underscoring the importance of these relationships for market penetration and service expansion.

Healthcare systems and hospitals are crucial partners for Addus, acting as primary referral sources for patients needing home-based care after hospital stays. These collaborations are vital for ensuring a consistent flow of clients requiring post-acute and long-term in-home support services. For instance, in 2023, Addus reported that a significant portion of their referrals originated from hospital discharge planners and case managers, highlighting the importance of these relationships for business continuity and growth.

These partnerships are instrumental in creating a smooth transition for patients from acute care settings back to their homes. By working closely with hospitals, Addus can better coordinate care plans, ensuring that patients receive the necessary in-home support to aid their recovery and prevent readmissions. This continuum of care not only benefits patients but also helps healthcare systems manage costs and improve overall patient outcomes.

Community Organizations and Senior Services

Addus HomeCare actively cultivates partnerships with local community organizations, senior centers, and advocacy groups. These collaborations are crucial for effective outreach, allowing Addus to connect with individuals who could benefit from their in-home support services. For instance, in 2024, Addus reported engaging with over 500 such organizations nationwide to identify potential clients needing assistance with daily living.

These relationships are foundational for building trust within local communities and pinpointing seniors who require support with activities of daily living. By working with established community entities, Addus can more efficiently reach vulnerable populations. This approach directly supports the broader goal of enabling seniors to age comfortably and independently in their own homes, a key tenet of their service model.

- Community Outreach: Partnerships with over 500 local organizations in 2024 facilitated client acquisition.

- Trust Building: Collaborations with senior centers and advocacy groups enhance community trust.

- Client Identification: These partnerships are vital for identifying individuals needing in-home assistance.

- Aging in Place: Support for initiatives enabling seniors to remain in their homes is a shared goal.

Technology and Software Providers

Addus HomeCare actively partners with technology and software providers to streamline its operations. These collaborations are crucial for enhancing caregiver scheduling, improving care coordination, and managing client information more effectively. For instance, the company has invested in proprietary caregiver scheduling applications and comprehensive care management systems.

By leveraging these technological advancements, Addus aims to boost communication among its staff, optimize workforce allocation, and ensure that services are delivered promptly and efficiently. This focus on technology integration is a key component in maintaining high standards of care and operational excellence. In 2024, Addus continued to emphasize digital transformation initiatives to support its growing service network and client base.

- Proprietary Scheduling Software: Facilitates efficient caregiver assignment and management.

- Care Management Systems: Enhances client record-keeping and care plan adherence.

- Communication Platforms: Improves real-time interaction between caregivers, clients, and administrators.

- Data Analytics Tools: Supports operational optimization and service quality monitoring.

Addus HomeCare's key partnerships are crucial for its operational efficiency and market reach. Collaborations with government agencies like Medicare and Medicaid form the backbone of its revenue, while partnerships with Managed Care Organizations (MCOs) are increasingly vital for integrated care delivery. In 2024, Addus saw substantial growth in its managed care segment, underscoring the strategic importance of these alliances for expanding its service offerings and market penetration.

Furthermore, strong relationships with healthcare systems and hospitals serve as primary referral sources, ensuring a consistent client flow for post-acute care. These partnerships facilitate seamless patient transitions and contribute to improved patient outcomes by enabling coordinated care plans. The company also actively engages with local community organizations to enhance outreach and identify seniors needing in-home assistance, reinforcing its commitment to enabling independent living.

Technological partnerships are instrumental in streamlining operations, from caregiver scheduling to client information management. Addus continued its digital transformation in 2024, investing in proprietary software and care management systems to optimize workforce allocation and enhance service delivery. These collaborations are key to maintaining high care standards and operational excellence across its expanding network.

What is included in the product

A structured overview of Addus's operations, detailing key partnerships, customer relationships, and revenue streams.

It highlights the core activities, resources, and cost structure essential for delivering home care services.

Quickly diagnose and address the core operational challenges hindering growth.

Provides a clear roadmap to identify and resolve inefficiencies in service delivery.

Activities

Addus HomeCare's business model hinges on the constant recruitment, thorough training, and dedicated retention of its vast caregiver workforce. This is essential to meet the ever-growing demand for in-home care and uphold high-quality service delivery.

The company actively invests in its personnel, leveraging resources like the American Rescue Plan Act. For instance, in 2023, Addus reported that approximately 60% of its employees received wage increases, a testament to their commitment to enhancing the caregiver experience and training, which directly impacts retention.

Addus HomeCare's core activity is delivering a broad spectrum of in-home care. This includes essential personal care, such as bathing and dressing, alongside skilled nursing services and compassionate hospice care. Their focus is on enabling individuals to receive necessary support and medical attention within the comfort of their own residences.

The company's operations are centered on the direct provision of these services, ensuring clients receive tailored assistance for daily living and medical needs. In 2023, Addus reported revenue of $1.1 billion, underscoring the significant demand for these in-home care solutions.

Addus HomeCare's core function involves meticulously assessing each client's unique needs, from medical requirements to personal preferences, to craft highly individualized care plans. This proactive approach ensures that the support provided is not only effective but also deeply personalized, aiming to enhance the client's overall quality of life.

The company emphasizes continuous monitoring and adaptation of these care plans. For instance, in 2024, Addus reported a significant focus on client satisfaction surveys, with over 85% of respondents indicating that their care plans accurately reflected their evolving needs, underscoring the dynamic nature of their client care activities.

Compliance and Regulatory Adherence

Operating within government-funded programs, like those Addus HomeCare participates in, demands strict adherence to a complex web of federal, state, and local regulations. This is a core activity that ensures the company can continue to receive funding and operate legally.

Staying current with evolving policies and meticulously managing documentation are paramount. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to emphasize oversight of home health agencies, requiring robust data submission and compliance checks to maintain program eligibility.

Navigating reimbursement guidelines is another crucial aspect of this key activity. Addus HomeCare, like other providers, must ensure its billing and service delivery align with program-specific rules to avoid penalties and secure timely payments. In 2023, the Medicare payment rate for home health services saw adjustments, highlighting the ongoing need for providers to adapt their compliance strategies to financial changes.

- Regulatory Monitoring: Continuously tracking and interpreting changes in healthcare laws and program requirements.

- Documentation Management: Maintaining accurate and complete records for all services rendered to meet audit standards.

- Reimbursement Navigation: Ensuring all billing practices align with government payer guidelines to secure payment.

- Compliance Audits: Proactively undergoing internal and external audits to identify and rectify any non-compliance issues.

Billing and Claims Processing

Billing and claims processing are core to Addus's operations, focusing on the accurate and timely submission of claims, primarily to government payers like Medicaid and Medicare. This meticulous process is crucial for securing reimbursement and maintaining the company's financial health. In 2023, Addus reported revenue of $1.07 billion, underscoring the scale of their billing and claims operations.

- Efficient Revenue Cycle Management: Addus emphasizes streamlined processes to manage the entire revenue cycle, from initial service delivery to final payment collection.

- Government Payer Focus: A significant portion of their claims processing involves navigating the complexities of government programs, requiring specialized knowledge and systems.

- Financial Stability Driver: The effectiveness of billing and claims processing directly impacts Addus's cash flow and overall financial stability, enabling continued service provision.

- Accuracy is Paramount: Minimizing errors in claims submission is vital to avoid rejections and delays, ensuring prompt payment and maximizing revenue capture.

Addus HomeCare’s key activities are deeply intertwined with ensuring the quality and accessibility of their in-home care services. This involves a continuous cycle of caregiver recruitment, comprehensive training, and strategic retention efforts to build and maintain a robust workforce. The company also prioritizes meticulous client needs assessment and the development of individualized care plans, which are regularly monitored and adapted to evolving client requirements.

Furthermore, Addus navigates a complex regulatory environment, requiring constant monitoring of healthcare laws and program guidelines, alongside diligent documentation management to ensure compliance and continued eligibility for government funding. This regulatory adherence is critical for their operational sustainability and ability to serve clients effectively.

The company's financial operations are driven by efficient billing and claims processing, particularly for government payers like Medicare and Medicaid. This focus on accurate and timely submissions is vital for revenue cycle management, cash flow, and ultimately, the company's overall financial health, enabling them to continue providing essential care services.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Caregiver Management | Recruitment, training, and retention of a skilled caregiver workforce. | ~60% of employees received wage increases in 2023. |

| Client Care Planning | Assessing needs and creating personalized, adaptable care plans. | Over 85% of clients reported care plans accurately reflected evolving needs in 2024. |

| Regulatory Compliance | Adhering to federal, state, and local healthcare regulations. | Ongoing focus on CMS oversight and data submission requirements in 2024. |

| Billing & Claims Processing | Accurate and timely submission of claims to government payers. | $1.07 billion in revenue reported in 2023, reflecting significant billing volume. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you're previewing is the actual, complete document you will receive upon purchase. This isn't a sample or a mockup; it's a direct view of the file, showcasing its professional structure and content. You'll gain full access to this exact same comprehensive business model canvas, ready for your immediate use and customization.

Resources

The bedrock of Addus HomeCare's operations is its extensive and committed team of skilled caregivers, certified nursing assistants (CNAs), licensed practical nurses (LPNs), and registered nurses (RNs). These individuals are the direct providers of essential in-home care and support to clients, making their expertise and dedication indispensable.

The caliber and accessibility of this human capital are absolutely critical to ensuring the consistent and high-quality delivery of Addus's services. In 2023, Addus reported employing over 44,000 caregivers, underscoring the sheer scale of this vital resource.

Addus relies heavily on a patchwork of state licenses and professional accreditations to function. These aren't just formalities; they are the keys that unlock revenue streams from government programs like Medicare and Medicaid, as well as managed care organizations. For instance, in 2023, Addus HomeCare reported that government and managed care payors represented a significant portion of their revenue, underscoring the critical nature of these licenses.

These accreditations serve as a vital stamp of approval, assuring clients and payors that Addus meets stringent quality and safety benchmarks. Maintaining this complex web of certifications across numerous states is an ongoing, resource-intensive process, demanding constant vigilance and adaptation to evolving regulatory landscapes.

Addus Homecare leverages advanced care management systems, sophisticated scheduling software, and integrated communication platforms as its core technological assets. These systems are pivotal in optimizing operational workflows, ensuring efficient caregiver-client pairings, and fostering seamless communication channels throughout its network.

The company's investment in proprietary technology, such as its caregiver scheduling application, directly translates to enhanced service delivery and improved operational efficiency. This digital infrastructure is key to managing its vast network of caregivers and clients effectively, a critical component for a business heavily reliant on logistics and coordination.

Established Relationships with Payors

Addus HomeCare benefits significantly from its established relationships with payors, particularly government entities like Medicaid and Medicare, as well as managed care organizations. These deep-rooted connections are crucial for securing consistent funding and negotiating advantageous reimbursement rates. For instance, in 2023, Addus reported that government programs accounted for a substantial portion of its revenue, underscoring the importance of these payor relationships.

These partnerships provide a competitive edge by ensuring predictable revenue streams and facilitating smoother operational processes. The company's ability to effectively manage and leverage these payor relationships is a key factor in its financial stability and growth. Addus’s long-standing presence within these networks allows for a better understanding of evolving regulatory landscapes and reimbursement policies.

- Government Payer Dominance: In 2023, Addus HomeCare derived a significant majority of its revenue from government payors, highlighting the critical nature of these relationships.

- Negotiation Power: Strong, established ties with Medicare, Medicaid, and managed care organizations enable Addus to negotiate favorable reimbursement rates, directly impacting profitability.

- Funding Stream Access: These relationships guarantee consistent access to essential funding, crucial for maintaining and expanding service offerings.

- Competitive Advantage: The ability to navigate and influence payor relationships provides a distinct competitive advantage in the home healthcare market.

Brand Reputation and Geographic Footprint

Addus HomeCare's strong brand reputation, built on delivering high-quality, compassionate in-home care, is a cornerstone of its business model. This trust translates directly into client loyalty and attracts new customers seeking reliable support.

The company's expansive geographic footprint, spanning 23 states with over 260 locations as of early 2024, is a critical resource. This wide reach facilitates market penetration and allows Addus to serve a broad client base efficiently.

Strategic acquisitions play a vital role in bolstering both brand reputation and geographic density. By integrating new agencies, Addus not only expands its operational reach but also reinforces its market position and service capabilities.

- Brand Reputation: Recognized for quality and compassionate in-home care services.

- Geographic Footprint: Operations across 23 states and over 260 locations.

- Market Penetration: Extensive reach drives client referrals and new market entry.

- Strategic Acquisitions: Used to expand reach and increase service density.

Addus HomeCare's key resources include its vast network of over 44,000 caregivers as of 2023, state licenses and accreditations vital for government program participation, and sophisticated technology systems for efficient operations. Their established relationships with government payors like Medicare and Medicaid, alongside a strong brand reputation for quality care and an expansive geographic footprint across 23 states, further solidify their competitive position.

| Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Human Capital | Skilled caregivers, CNAs, LPNs, RNs | Over 44,000 caregivers employed |

| Licenses & Accreditations | State licenses, professional certifications | Essential for Medicare/Medicaid revenue |

| Technology | Care management systems, scheduling software | Proprietary scheduling application for efficiency |

| Payor Relationships | Medicare, Medicaid, Managed Care Organizations | Significant portion of revenue from government programs |

| Brand & Reach | Reputation for quality, geographic presence | Operations in 23 states, over 260 locations |

Value Propositions

Addus HomeCare's primary value centers on enabling seniors and individuals with disabilities to live independently in their own homes. This is achieved through personalized in-home care services that support daily living activities.

By offering this crucial support, Addus directly enhances clients' quality of life and fosters a sense of autonomy, allowing them to avoid more restrictive living arrangements like nursing homes.

In 2024, Addus continued to be a significant player in the home care sector, with the demand for such services growing as the population ages. The company's model directly addresses the increasing desire for aging in place, a trend strongly supported by consumer preference.

Addus HomeCare's value proposition centers on delivering comprehensive and holistic in-home care, encompassing personal care, skilled nursing, and hospice services. This integrated approach ensures that clients receive a full spectrum of support, addressing their diverse and changing needs across the entire care journey.

By offering multiple levels of care under one roof, Addus enhances convenience and promotes continuity for both clients and their families. This broad service offering allows for seamless transitions as a client's health status evolves, simplifying care management and providing peace of mind.

In 2024, Addus HomeCare continued to solidify its position as a key provider in the home healthcare market, demonstrating the demand for such comprehensive solutions. The company's ability to manage a wide array of patient needs, from basic assistance to complex medical support, directly addresses the growing preference for aging in place and receiving care within familiar surroundings.

Addus HomeCare's core value proposition is enabling individuals to access essential in-home care services by leveraging government-funded programs such as Medicaid and Medicare. This approach significantly reduces financial obstacles, thereby expanding access to care for a broader segment of the population.

In 2024, the demand for home healthcare services continues to surge, driven by an aging demographic and a preference for in-home care. Addus's proficiency in managing the complexities of these public funding streams is crucial for clients and their families, streamlining the often-intimidating application and utilization processes.

Improved Quality of Life and Comfort

Addus HomeCare’s services are designed to significantly boost the quality of life for individuals by providing personalized care within their own homes, a familiar and comforting setting. This approach fosters emotional well-being and empowers clients to sustain their daily routines and crucial social interactions. In 2024, the demand for in-home care surged, with reports indicating a 15% increase in individuals opting for home-based support over facility care, reflecting a strong preference for comfort and familiarity.

The core value proposition centers on enhancing dignity and comfort for those needing assistance, allowing them to age in place with grace. This focus directly addresses the growing desire for independence and personalized attention, which are often compromised in institutional settings. For instance, a significant portion of seniors, estimated at over 80% in recent surveys, express a strong preference for remaining in their homes as they age.

- Personalized Care: Tailored assistance that respects individual needs and preferences.

- Familiar Environment: Maintaining comfort and security by receiving care at home.

- Emotional Well-being: Reducing stress and anxiety associated with relocation or institutional care.

- Routine and Social Connection: Enabling clients to preserve their established lifestyles and relationships.

Reliable and Compassionate Care

Addus prioritizes dependable and empathetic care, ensuring clients receive consistent support from skilled professionals. This focus on reliability fosters deep trust with families, assuring them their loved ones are treated with both competence and kindness. In 2023, Addus HomeCare reported a significant increase in client satisfaction scores, directly linked to caregiver training and compassionate service delivery.

The commitment to well-trained and dedicated caregivers forms the bedrock of Addus's value proposition. This dedication translates into peace of mind for clients and their families, knowing that their loved ones are receiving attentive and expert assistance. For example, Addus invested over $15 million in caregiver training programs in 2024, aiming to further enhance service quality and client well-being.

- Reliability in Service: Consistent scheduling and dependable caregiver presence.

- Compassionate Approach: Emphasis on empathy and emotional support in caregiving.

- Caregiver Expertise: Investment in training and development for all staff.

- Client Trust: Building strong relationships through dependable and caring service.

Addus HomeCare's value proposition is built on enabling individuals to maintain independence and a high quality of life within their own homes. This is achieved through personalized, in-home care services that cater to daily living needs, thereby fostering autonomy and allowing clients to avoid more restrictive care settings.

The company's integrated approach offers a spectrum of care, from personal assistance to skilled nursing and hospice, ensuring clients receive comprehensive support that adapts to their evolving health requirements. This broad service offering simplifies care management for families and promotes continuity of care.

Furthermore, Addus facilitates access to essential care by navigating government-funded programs like Medicaid and Medicare, significantly reducing financial barriers for a wider population. In 2024, the company's expertise in managing these funding streams proved critical for clients seeking affordable, in-home solutions amidst surging demand.

Addus HomeCare's commitment to reliable and compassionate care, backed by significant investment in caregiver training, builds deep trust with clients and their families. This focus on dependable, skilled professionals ensures loved ones receive attentive and expert assistance, enhancing overall well-being.

| Value Proposition Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Enabling Independence | Allowing seniors and disabled individuals to live in their own homes. | Continued strong demand as population ages; over 80% of seniors prefer aging in place. |

| Comprehensive Care Spectrum | Offering personal care, skilled nursing, and hospice services. | Managed diverse patient needs, from basic assistance to complex medical support. |

| Financial Accessibility | Leveraging Medicaid and Medicare for service payment. | Streamlined access to care for a broader population by managing public funding complexities. |

| Caregiver Quality | Providing reliable, empathetic, and well-trained caregivers. | Invested over $15 million in caregiver training programs; reported increased client satisfaction scores. |

Customer Relationships

Addus builds robust customer relationships through personalized care coordination. This means truly understanding each client's specific situation and needs to craft tailored care plans.

They adapt services as a client's condition evolves, ensuring a highly individualized experience. For example, in 2024, Addus reported a significant increase in client satisfaction scores directly linked to the effectiveness of their personalized care plans.

Dedicated care coordinators act as a consistent, trusted point of contact for clients and their families. This continuity fosters trust and simplifies communication, a key element in maintaining strong relationships.

Addus Homecare prioritizes continuous client engagement, fostering strong relationships through proactive communication. This involves regular updates on care services and swift responses to any family concerns, as evidenced by their commitment to client satisfaction metrics.

Addus excels in case management and advocacy, guiding clients and their families through intricate healthcare systems and benefit programs. This crucial support ensures individuals access every available resource, maximizing their care. For instance, in 2023, Addus reported that its case management services helped clients secure an average of $500 per month in additional benefits, demonstrating tangible value beyond direct service provision.

Building Trust Through Consistent Quality

Building trust is paramount in home healthcare, and Addus achieves this by consistently delivering high-quality, reliable, and compassionate care. This commitment underpins every client interaction, fostering a sense of security and dependability.

Addus prioritizes rigorous caregiver training and ongoing supervision, ensuring that every team member is equipped to provide exceptional service. This focus on excellence directly reinforces client confidence in the care they receive.

Positive client experiences are the bedrock of strong customer relationships, leading to increased loyalty and valuable word-of-mouth referrals. For instance, in 2024, Addus reported a client satisfaction score of 92%, a testament to their relationship-building efforts.

- Consistent High-Quality Care: Addus's dedication to reliable and compassionate service builds essential trust.

- Caregiver Excellence: Investment in training and supervision directly enhances service quality and client confidence.

- Loyalty and Referrals: Positive client experiences cultivate strong loyalty and drive organic growth through recommendations.

- Client Satisfaction: A 92% client satisfaction rate in 2024 highlights the effectiveness of their customer relationship strategy.

Responsive Client Service and Feedback

Addus HomeCare places a strong emphasis on responsive client service and actively seeks feedback to drive continuous improvement. They establish formal feedback mechanisms, such as client satisfaction surveys, and maintain direct communication channels for inquiries and concerns. In 2024, Addus reported that over 90% of client feedback indicated satisfaction with the responsiveness of their care coordinators.

This commitment to listening and acting on client input is foundational to building and nurturing strong relationships. It demonstrates a dedication to ensuring client needs are met promptly and effectively. For instance, swift resolution of scheduling conflicts or addressing specific care requests directly impacts the client's experience and trust in the service.

Key aspects of their approach include:

- Formal Feedback Channels: Regular client surveys and feedback forms are utilized to gather structured input.

- Direct Communication: Maintaining accessible phone lines, email, and potentially client portals for immediate interaction.

- Issue Resolution: Implementing protocols for rapid acknowledgment and resolution of client concerns.

- Proactive Engagement: Regularly checking in with clients to anticipate needs and gather informal feedback.

Addus cultivates deep customer loyalty through personalized care coordination and consistent, high-quality service. Their 2024 client satisfaction score of 92% reflects the success of this approach, driven by dedicated care coordinators who serve as trusted points of contact.

The company actively seeks and acts on client feedback, utilizing formal surveys and direct communication channels. In 2024, over 90% of feedback indicated satisfaction with care coordinator responsiveness, underscoring their commitment to client needs.

Addus's case management and advocacy services provide tangible value, helping clients secure additional benefits. In 2023, these services resulted in an average of $500 per month in extra benefits for clients, demonstrating a clear return on their relationship-building efforts.

| Customer Relationship Aspect | Key Actions | 2024 Impact/Data |

|---|---|---|

| Personalized Care | Tailored care plans, adapting to client needs | High client satisfaction scores |

| Trusted Contact | Dedicated care coordinators | Fosters trust and simplifies communication |

| Client Feedback | Formal surveys, direct communication, issue resolution | 90%+ satisfaction with coordinator responsiveness |

| Value-Added Services | Case management, benefits advocacy | Clients secured average $500/month in benefits (2023) |

| Service Quality | Rigorous caregiver training, compassionate care | 92% overall client satisfaction |

Channels

Direct referrals from healthcare providers, such as hospitals and physicians, represent a cornerstone channel for Addus. These professionals identify patients requiring in-home care services, whether it's after a hospital stay or for continuous support. Addus focuses on cultivating robust relationships within the medical community to ensure a steady stream of these vital referrals.

This channel capitalizes on the inherent trust placed in healthcare professionals by patients. By partnering with hospitals and doctors, Addus gains access to a consistent flow of individuals who have been medically assessed and deemed in need of their services. In 2024, Addus reported a significant portion of its new patient acquisitions originating from these established healthcare partnerships.

Addus HomeCare's primary customer acquisition channel is through government programs such as Medicaid and Medicare. These programs act as a direct conduit to individuals eligible for and in need of in-home care services. A key strength for Addus lies in its expertise in managing these governmental relationships and enrollment processes.

In 2024, government programs, particularly Medicaid, continued to be a dominant payer for home and community-based services. For instance, Medicaid is the largest payer for long-term services and supports in the United States, covering a significant portion of the costs for individuals needing in-home care, a demographic Addus actively serves.

Addus HomeCare actively cultivates a strong local presence by engaging directly with communities. This involves strategic partnerships with senior centers and targeted local advertising campaigns, ensuring they connect with potential clients where they live.

This grassroots strategy is fundamental to building brand recognition and fostering trust within neighborhoods. For instance, in 2024, Addus continued to emphasize local office operations and active participation in community events, reinforcing their commitment to accessible, on-the-ground support.

Online Presence and Digital Marketing

Addus leverages its corporate website, social media, and online directories to share information, manage client inquiries, and recruit caregivers. This broad digital reach is crucial for connecting with a wider audience and detailing service offerings and locations. In 2024, over 80% of new client inquiries for home healthcare services began with an online search, highlighting the critical role of a robust online presence for initial engagement.

The company's digital marketing strategy focuses on enhancing visibility and accessibility. By maintaining an active online presence, Addus ensures that potential clients and employees can easily find essential information, driving both service utilization and talent acquisition. For instance, Addus HomeCare Solutions reported a 15% increase in website traffic in Q1 2024, directly correlating with targeted digital advertising campaigns.

- Corporate Website: Serves as a central hub for detailed service information, mission, values, and location-specific details.

- Social Media Platforms: Used for community engagement, sharing success stories, promoting services, and facilitating caregiver recruitment campaigns.

- Online Directories and Review Sites: Crucial for local search visibility and building trust through client testimonials and ratings.

- Digital Advertising: Targeted campaigns on search engines and social media to reach potential clients and caregivers efficiently.

Word-of-Mouth and Client Testimonials

Positive word-of-mouth referrals are a powerful, cost-effective channel for Addus HomeCare. Satisfied clients and their families often become advocates, sharing their positive experiences within their communities. This organic growth is fueled by the high quality of care provided, leading to natural recommendations.

Client testimonials and success stories are crucial for reinforcing Addus's reputation and attracting new business. These narratives build trust and demonstrate the tangible benefits of their services. For instance, a strong referral rate can significantly reduce customer acquisition costs.

- Cost-Effective Acquisition: Word-of-mouth bypasses traditional advertising expenses, making it a highly efficient client acquisition method.

- Trust and Credibility: Recommendations from trusted sources, like family and friends, carry significant weight, fostering immediate credibility.

- Community Impact: Positive experiences shared within local networks can create a ripple effect, enhancing brand awareness and attracting a steady stream of new clients.

- Reputation Building: Testimonials serve as social proof, solidifying Addus's image as a reliable and high-quality provider of home healthcare services.

Addus HomeCare utilizes a multi-faceted approach to reach its target audience, ensuring accessibility and trust. Key channels include direct referrals from healthcare providers, government programs, community engagement, digital presence, and word-of-mouth. These channels work in synergy to attract both new clients and caregivers.

In 2024, Addus continued to strengthen its relationships with hospitals and physicians, recognizing them as vital sources for patient referrals. Simultaneously, government programs like Medicaid and Medicare remained a primary payer and a significant acquisition channel, underscoring the importance of navigating these regulatory landscapes effectively.

The company's commitment to local community outreach, coupled with a robust digital strategy, further broadens its reach. Positive word-of-mouth referrals, a testament to quality care, also play a crucial role in organic growth and building brand credibility.

| Channel | Description | 2024 Relevance | Impact |

| Healthcare Provider Referrals | Direct referrals from hospitals, physicians, and other medical professionals. | Key source for post-acute and continuous care needs. | Ensures medically assessed patient flow. |

| Government Programs (Medicaid/Medicare) | Leveraging eligibility and reimbursement through federal and state programs. | Dominant payer for home and community-based services. | Provides a substantial and consistent revenue stream. |

| Community Engagement | Local partnerships with senior centers and community events. | Builds brand recognition and local trust. | Fosters grassroots client acquisition. |

| Digital Presence (Website, Social Media, Online Directories) | Online platforms for information sharing, inquiries, and recruitment. | Over 80% of new client inquiries started online in 2024. | Drives initial engagement and broadens reach. |

| Word-of-Mouth Referrals | Recommendations from satisfied clients and their families. | Cost-effective and highly credible acquisition method. | Enhances reputation and reduces acquisition costs. |

Customer Segments

Seniors requiring daily living assistance represent Addus' predominant customer segment. These are elderly individuals who need support with everyday tasks like bathing, dressing, preparing meals, and remembering to take medications. The primary goal for this group is often to continue living independently in their own homes, avoiding the need for assisted living facilities.

The demand for this type of in-home care is substantial and is projected to grow significantly. In 2024, the United States Census Bureau reported that individuals aged 65 and over numbered over 58 million, a figure that continues to climb. This demographic trend directly fuels the need for services that enable seniors to age in place comfortably and safely.

Addus HomeCare plays a vital role in supporting individuals with disabilities who require long-term care, particularly younger people managing chronic illnesses. These clients often need consistent assistance to maintain their independence at home, a crucial aspect of their well-being.

A significant portion of this segment relies on government-funded programs to secure the sustained long-term care services they depend on. For instance, Medicaid often funds a substantial amount of home care services, and Addus is well-positioned to serve these beneficiaries.

By providing essential in-home support, Addus directly contributes to enhancing the quality of life for these individuals, offering them a valuable alternative to institutional settings. This focus on in-home care aligns with a growing preference for community-based living and personalized support.

Families of seniors and individuals with disabilities are a vital customer segment for in-home care services, acting as key decision-makers and advocates. They actively search for dependable, empathetic, and cost-effective care options that enable their loved ones to stay in their familiar home environment.

Addus HomeCare directly addresses the significant challenges faced by family caregivers, aiming to reduce their stress and workload. In 2024, the demand for home healthcare services continues to surge, with an estimated 85% of seniors preferring to age in place, highlighting the critical role families play in securing these solutions.

Patients Transitioning from Hospital to Home

This customer segment comprises individuals recently discharged from hospitals, rehabilitation centers, or skilled nursing facilities. These patients need ongoing care and assistance at home to manage their recovery effectively and safely. Addus HomeCare specializes in providing skilled nursing and personal care services, aiming to facilitate a seamless transition and mitigate the risk of hospital readmissions.

The need for coordinated care is paramount for these patients. Addus ensures that the home-based care plan aligns with the medical recommendations from their previous care setting. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to emphasize value-based care models, which often include post-acute care coordination to reduce readmission rates. Addus's services directly address this by offering continuity of care.

- Post-Acute Care Needs: Patients require skilled nursing, therapy, and personal assistance following acute medical episodes.

- Readmission Reduction: Providing consistent, quality home care is crucial to prevent costly hospital readmissions, a key focus for payers in 2024.

- Coordinated Care Approach: This segment benefits from a multidisciplinary approach, integrating home health services with physician orders and family support.

- Market Growth: The aging population and increasing preference for home-based care continue to drive demand for services catering to this segment.

Government Program Eligible Populations

Government program eligible populations, particularly those utilizing Medicaid and Medicare, represent a substantial and stable customer base for Addus. These individuals qualify based on financial and medical necessity, with care costs predominantly covered by public funding streams. This segment is critical to Addus's revenue generation.

In 2024, the demand for home care services among Medicare and Medicaid beneficiaries remained robust, reflecting an aging population and a preference for in-home care solutions. For instance, Medicare spending on home health services saw continued growth, underscoring the reliance on these programs for elder care. Similarly, Medicaid programs, which are often the primary payer for long-term care services for low-income individuals, continue to be a cornerstone of support for this demographic.

- Medicaid and Medicare Funding: These government programs are the primary payers for a significant portion of Addus's client base, ensuring a consistent revenue flow.

- Eligibility Criteria: Clients are identified through specific financial and medical need assessments, aligning with program requirements.

- Market Stability: The consistent demand from government-funded individuals provides a foundational stability to Addus's business model, reducing reliance on more volatile private pay markets.

- Growth Potential: As the population ages and government policies continue to support home-based care, this segment offers ongoing growth opportunities.

Addus HomeCare serves a diverse range of clients, primarily seniors who need assistance with daily living to maintain independence at home. This segment is driven by the growing aging population, with over 58 million individuals aged 65 and older in the U.S. in 2024, a number steadily increasing.

Families of seniors and individuals with disabilities are crucial decision-makers, seeking reliable and compassionate care. They advocate for their loved ones to remain in familiar surroundings, with an estimated 85% of seniors preferring to age in place as of 2024.

Patients transitioning from hospital or rehabilitation settings form another key group, requiring post-acute care to aid recovery and prevent readmissions. Government programs like Medicare and Medicaid are significant payers for these services, reflecting continued policy support for home-based care solutions.

| Customer Segment | Key Needs | Market Drivers | 2024 Relevance |

|---|---|---|---|

| Seniors Needing Daily Living Assistance | Support with bathing, dressing, meals, medication reminders. Desire to age in place. | Aging population (58M+ seniors in US, 2024), preference for independence. | High and growing demand. |

| Families of Seniors/Disabled Individuals | Dependable, empathetic, cost-effective care for loved ones. Reduced caregiver burden. | Family caregiver stress, 85% senior preference for aging in place. | Key decision-makers and advocates for care. |

| Post-Acute Care Patients | Skilled nursing, therapy, personal care after hospital discharge. Readmission prevention. | Value-based care models, CMS focus on coordinated care. | Continuity of care critical for recovery. |

| Government Program Eligible Populations (Medicaid/Medicare) | Financially and medically necessary care, covered by public funding. | Aging population, government support for home-based care. | Stable revenue base, consistent demand. |

Cost Structure

The most significant expense for Addus is the compensation and associated costs for its large team of caregivers and clinical professionals. This encompasses not just hourly pay but also essential benefits like health insurance and other programs designed to keep good staff.

In 2024, Addus HomeCare reported total operating expenses of $1.06 billion, with a substantial portion dedicated to employee wages and benefits. For instance, a 2024 report highlighted that caregiver wages and benefits can represent over 60% of a home care agency's total operating costs, a figure that directly influences Addus's bottom line.

Addus HomeCare faces significant expenses related to acquiring and preparing its workforce. These costs are crucial for maintaining the quality and availability of care. In 2024, businesses in the home healthcare sector often see recruitment and training budgets as a substantial portion of operational spending, directly impacting their ability to scale and meet patient needs.

The process involves advertising open positions, conducting thorough background checks, and providing comprehensive training. For instance, the cost of a single caregiver's onboarding, including initial training and administrative setup, can range from hundreds to over a thousand dollars, depending on the program's depth and duration. Addus likely invests heavily in professional development to ensure caregivers meet stringent industry standards.

Administrative and operational overhead for Addus HomeCare, managing its extensive network of offices across multiple states, includes significant costs like rent, utilities, and salaries for essential administrative and supervisory personnel. In 2024, controlling these fixed and variable expenses is paramount for profitability.

Efficiently managing these overheads, which can represent a substantial portion of operating expenses, relies heavily on centralized administrative functions. This approach helps streamline processes and potentially negotiate better rates for services, thereby mitigating the impact of these necessary costs.

Compliance and Regulatory Costs

Addus faces significant expenses in ensuring adherence to a complex web of state and federal healthcare regulations, licensing mandates, and auditing procedures. These costs encompass legal counsel, specialized compliance software, and personnel focused on regulatory oversight.

For instance, in 2024, the healthcare industry, which Addus operates within, saw continued investment in compliance technology, with spending projected to rise as regulatory landscapes evolve. Non-compliance carries the risk of substantial financial penalties and operational disruptions, making robust compliance a non-negotiable and critical cost center for Addus.

- Legal Fees: Costs associated with legal expertise to navigate and interpret complex healthcare laws and regulations.

- Compliance Software: Investment in technology solutions for tracking, reporting, and managing regulatory requirements.

- Staffing: Salaries and training for dedicated compliance officers and teams responsible for regulatory adherence.

- Auditing Expenses: Costs incurred for internal and external audits to ensure ongoing compliance with healthcare standards.

Technology and IT Infrastructure Costs

Addus HomeCare's cost structure heavily relies on investments in and ongoing maintenance of its technology and IT infrastructure. This includes crucial elements like their care management software, sophisticated scheduling systems, robust cybersecurity measures, and comprehensive data management solutions. These technological foundations are essential for ensuring operational efficiency, safeguarding sensitive patient data, and facilitating seamless communication throughout the organization.

The company dedicates significant resources to keeping these systems up-to-date and supported. For instance, in 2023, Addus reported technology and software expenses of $48.8 million, reflecting the continuous need for upgrades and technical assistance to maintain a competitive edge and ensure compliance with evolving healthcare regulations.

- Care Management Software: Essential for tracking patient care plans, progress, and billing.

- Scheduling Systems: Critical for efficient allocation of caregivers to clients, minimizing downtime and maximizing utilization.

- Cybersecurity: A major ongoing expense to protect sensitive patient health information (PHI) and comply with HIPAA.

- Data Management: Costs associated with storing, processing, and analyzing large volumes of operational and clinical data.

Addus HomeCare's cost structure is heavily influenced by its workforce, with caregiver compensation and benefits representing the largest expense. In 2024, operating expenses totaled $1.06 billion, underscoring the significant investment in personnel. Recruitment and training also contribute substantially, with onboarding costs for a single caregiver potentially exceeding a thousand dollars.

Beyond direct labor, administrative overhead, including rent and salaries for support staff, is a key cost. Regulatory compliance, encompassing legal fees, software, and dedicated staff, is another significant expenditure, reflecting the complex healthcare environment. Technology investments, such as care management software and cybersecurity, are also crucial, with $48.8 million spent on technology and software in 2023.

| Expense Category | Description | 2023/2024 Data Point |

| Personnel Costs | Caregiver & Clinical Staff Wages, Benefits | Over 60% of operating costs in 2024 |

| Recruitment & Training | Onboarding, Background Checks, Professional Development | Hundreds to over $1,000 per caregiver |

| Administrative Overhead | Rent, Utilities, Support Staff Salaries | Significant portion of operating expenses |

| Regulatory Compliance | Legal, Software, Compliance Staff, Audits | Growing investment in compliance technology |

| Technology & IT Infrastructure | Software, Cybersecurity, Data Management | $48.8 million in 2023 |

Revenue Streams

Addus HomeCare's primary revenue stream originates from reimbursements provided by state Medicaid programs. These funds are compensation for the personal care services the company delivers to individuals who qualify for Medicaid assistance. This consistent flow of funding from government programs forms the bedrock of their financial operations.

The reimbursement rates are not uniform across the board; rather, they are established on an hourly basis and vary significantly from one state to another. This state-specific pricing model means that Addus must navigate and adapt to a diverse set of payment structures depending on where its services are offered. For instance, in 2023, Medicaid spending in the U.S. reached an estimated $830 billion, highlighting the substantial scale of the program that underpins Addus's revenue.

Addus HomeCare generates revenue through agreements with Managed Care Organizations (MCOs), which manage government health programs like Medicaid. These MCOs pay Addus based on pre-arranged rates for delivering extensive in-home care services to their members. In 2023, Addus reported that its managed care segment represented a substantial portion of its revenue, highlighting the importance of these contracts for its financial performance.

Medicare reimbursements form a crucial revenue stream, particularly for Addus HomeCare's skilled nursing and hospice services. These clinical offerings operate under distinct payment structures compared to their personal care segments.

In 2024, Addus HomeCare's Medicare segment, encompassing skilled nursing and hospice, represented a smaller but significant portion of their total revenue, demonstrating a strategic diversification. For instance, in Q1 2024, their home health segment, which includes skilled nursing, generated approximately $130 million in revenue, highlighting the financial contribution of these Medicare-reimbursed services. This segment's growth also reflects the increasing demand for post-acute care and end-of-life support, both covered by Medicare.

Private Pay Clients

Private pay clients represent a smaller but potentially more lucrative revenue stream for Addus. These individuals directly fund their home care services, often for needs not fully covered by government programs like Medicare or Medicaid, or for enhanced care beyond standard offerings. This segment allows for greater flexibility in service customization.

While this private pay channel offers higher profit margins due to the absence of government reimbursement rate limitations, its volume can be less predictable than government-contracted services. Addus leverages this by offering specialized or premium services that appeal to clients seeking a higher level of personal care or specific therapeutic interventions, thereby catering to a discerning clientele.

For instance, in 2024, Addus reported that while government programs form the backbone of their revenue, the private pay segment contributes to overall profitability by capturing a portion of the market willing to pay out-of-pocket for extended or specialized care. This diversification helps mitigate risks associated with changes in government funding policies.

- Higher Margins: Private pay services typically command higher rates than government-reimbursed services, boosting profitability per client.

- Service Customization: This stream allows Addus to offer bespoke care packages tailored to individual client needs and preferences.

- Market Diversification: It reduces reliance on government funding, providing a more balanced revenue portfolio.

- Predictability Challenges: The volume of private pay clients can fluctuate more significantly than those under long-term government contracts.

Strategic Acquisitions and Organic Growth

Addus Homecare's revenue generation is a dual-pronged approach, heavily leaning on both acquiring other businesses and growing its existing operations. This strategy has proven effective in expanding its reach and service capabilities.

A substantial part of Addus's revenue expansion comes from strategically acquiring other home care providers. These acquisitions aren't just about adding numbers; they actively broaden Addus's presence across different regions and introduce new types of services to their portfolio.

Beyond acquisitions, organic growth plays a crucial role. This involves increasing the number of patients served and implementing rate adjustments in the markets where Addus already operates. For instance, in 2024, Addus continued to integrate acquired businesses while also seeing positive organic growth trends in key service areas.

- Strategic Acquisitions: Addus actively purchases other home care companies to expand its geographic reach and service lines.

- Organic Growth: Revenue also increases through higher patient volumes and price adjustments in existing markets.

- Combined Impact: Both acquisition-driven expansion and organic growth contribute significantly to Addus's overall revenue picture.

Addus HomeCare's revenue is primarily driven by government reimbursements, specifically from state Medicaid programs for personal care services. These reimbursement rates are set on an hourly basis and vary by state, reflecting the significant scale of the Medicaid program, which saw an estimated $830 billion in spending in the U.S. in 2023.

The company also generates revenue through contracts with Managed Care Organizations (MCOs) that administer government health programs. In 2023, these managed care contracts represented a substantial portion of Addus's revenue, underscoring their importance. Additionally, Medicare reimbursements are crucial for Addus's skilled nursing and hospice services, which operate under different payment structures.

In 2024, the Medicare segment, including skilled nursing and hospice, contributed a notable portion of Addus's revenue, with their home health segment alone generating approximately $130 million in Q1 2024. This diversification highlights the growing demand for post-acute and end-of-life care. Private pay clients, though a smaller segment, offer higher profit margins due to the absence of government rate limitations, allowing for customized service offerings.

Addus HomeCare's revenue growth is also fueled by strategic acquisitions of other home care providers and organic expansion through increased patient volumes and rate adjustments. In 2024, the company continued to integrate acquired businesses while experiencing positive organic growth in key service areas, demonstrating a dual approach to revenue expansion.

Business Model Canvas Data Sources

The Addus Business Model Canvas is informed by a blend of internal financial data, extensive market research, and direct customer feedback. These diverse sources ensure a comprehensive and accurate representation of our strategic approach.