Addus PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Addus Bundle

Navigate the complex external forces shaping Addus with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing their operations and strategic direction. Gain a critical advantage by leveraging these expert insights to inform your own business decisions. Download the full PESTLE analysis now and equip yourself with actionable intelligence.

Political factors

Addus HomeCare's financial health is significantly tied to government funding, particularly Medicare and Medicaid. Changes in reimbursement policies from agencies like the Centers for Medicare & Medicaid Services (CMS) directly influence its revenue streams.

For 2025, CMS announced a 0.5% increase in Medicare payments for Home Health Agencies, but this is coupled with a 1.975% permanent adjustment to rebalance the Patient-Driven Groupings Model (PDGM), a move that could affect Addus's earnings.

Additionally, a 2024 rule mandates that states allocate at least 80% of Medicaid payments for personal care services to direct care worker compensation, with extended compliance timelines, a policy Addus is navigating despite initial concerns.

Broader healthcare reform efforts, particularly those focusing on value-based care and expanding home and community-based services (HCBS), significantly shape Addus's strategic path. The trend towards shifting care from traditional institutions to home settings directly complements Addus's core business model, presenting clear avenues for expansion and increased service utilization.

For instance, the Biden-Harris administration's focus on strengthening HCBS, including a proposed $400 billion investment in the 2024 fiscal year, underscores this shift. This initiative aims to improve access and quality of care within home environments, directly benefiting companies like Addus that specialize in these services.

However, potential reforms introducing more stringent cost controls or altering reimbursement structures could necessitate significant operational adjustments for Addus. For example, changes in Medicare or Medicaid payment rates for home health services, which represent a substantial portion of revenue for many home care providers, could impact profitability and require careful financial management.

State-level budget decisions are a critical political factor for Addus, given its extensive operations across 23 states. Allocations for Medicaid and other home care programs directly influence the company's revenue streams and overall profitability. These decisions can lead to significant shifts in reimbursement rates, impacting Addus's financial performance.

For instance, Illinois's fiscal 2026 budget included a 3.9% increase in the base hourly reimbursement rate for home care services. Similarly, Texas implemented a substantial 9.9% increase in its reimbursement rates. These positive adjustments are projected to provide a notable boost to Addus's annual revenue, demonstrating the direct financial impact of state budget outcomes.

Regulatory Oversight and Compliance

The home care sector operates under a stringent regulatory framework, demanding constant adherence to federal and state laws. These laws cover everything from how services are delivered and the quality of care provided, to the intricacies of billing practices. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to emphasize enhanced oversight of home health agencies, with proposed rule changes impacting payment models and quality reporting.

Staying compliant means adapting to evolving regulations, which can require significant investment in compliance infrastructure and staff training. For example, updates to the Conditions of Participation (CoPs) for home health agencies, such as those related to infection control or patient rights, necessitate immediate operational adjustments. The increasing focus on data security and privacy, driven by regulations like HIPAA, also adds another layer of complexity and cost.

- Federal Oversight: CMS sets national standards for Medicare-certified home health agencies.

- State Licensing: Each state has its own licensing and operational requirements for home care providers.

- Compliance Costs: Investments in compliance software, training, and audits are ongoing necessities.

- Impact of Changes: Regulatory shifts can directly affect reimbursement rates and operational procedures.

Political Stability and Elections

The political landscape significantly influences Addus HomeCare's operational environment. Uncertainty surrounding election outcomes can affect future healthcare policies and funding streams, which are critical for the home care sector. For example, shifts in government could lead to reviews or potential changes in regulations like the Medicaid Access Rule, impacting how providers like Addus operate and are reimbursed.

- Political Uncertainty: Upcoming elections can introduce volatility in healthcare policy, potentially affecting reimbursement rates and regulatory compliance for home care services.

- Policy Shifts: Changes in administration may lead to the re-evaluation or repeal of existing healthcare regulations, such as the Medicaid Access Rule, creating an unpredictable operating environment.

- Government Funding: The level of government funding allocated to home and community-based services is directly tied to political priorities and budget decisions made by elected officials.

- Regulatory Environment: Political decisions shape the broader regulatory framework, influencing licensing, operational standards, and the scope of services offered by companies like Addus.

Government funding, particularly through Medicare and Medicaid, forms the bedrock of Addus HomeCare's revenue. Shifts in reimbursement policies from entities like CMS directly dictate financial performance, as seen with the 2025 Medicare payment increase of 0.5% for home health agencies, balanced by a 1.975% PDGM adjustment.

State-level budget decisions significantly impact Addus, operating in 23 states, with reimbursement rate changes directly affecting profitability. For instance, Illinois's fiscal 2026 budget included a 3.9% increase in home care rates, while Texas implemented a 9.9% rise, both positively impacting Addus's revenue projections.

The political climate introduces inherent volatility, with election outcomes potentially reshaping healthcare policies and funding for home care services. Changes in administration could lead to reviews of regulations like the Medicaid Access Rule, creating an unpredictable operating environment for companies like Addus.

| Political Factor | Impact on Addus | 2024/2025 Data/Trend |

| Government Reimbursement Rates | Directly impacts revenue and profitability. | CMS announced a 0.5% Medicare payment increase for HHAs in 2025, with a 1.975% PDGM adjustment. Illinois increased rates by 3.9% for FY26; Texas by 9.9%. |

| Healthcare Reform & Policy | Shapes strategic direction and expansion opportunities. | Biden-Harris administration proposed $400 billion investment in HCBS for FY24, favoring home-based care models. |

| Regulatory Compliance | Requires ongoing investment and adaptation to evolving laws. | CMS continues enhanced oversight; proposed rule changes impact payment models and quality reporting in 2024. |

| Political Uncertainty | Creates volatility in policy and funding streams. | Upcoming elections could lead to re-evaluation of regulations like the Medicaid Access Rule. |

What is included in the product

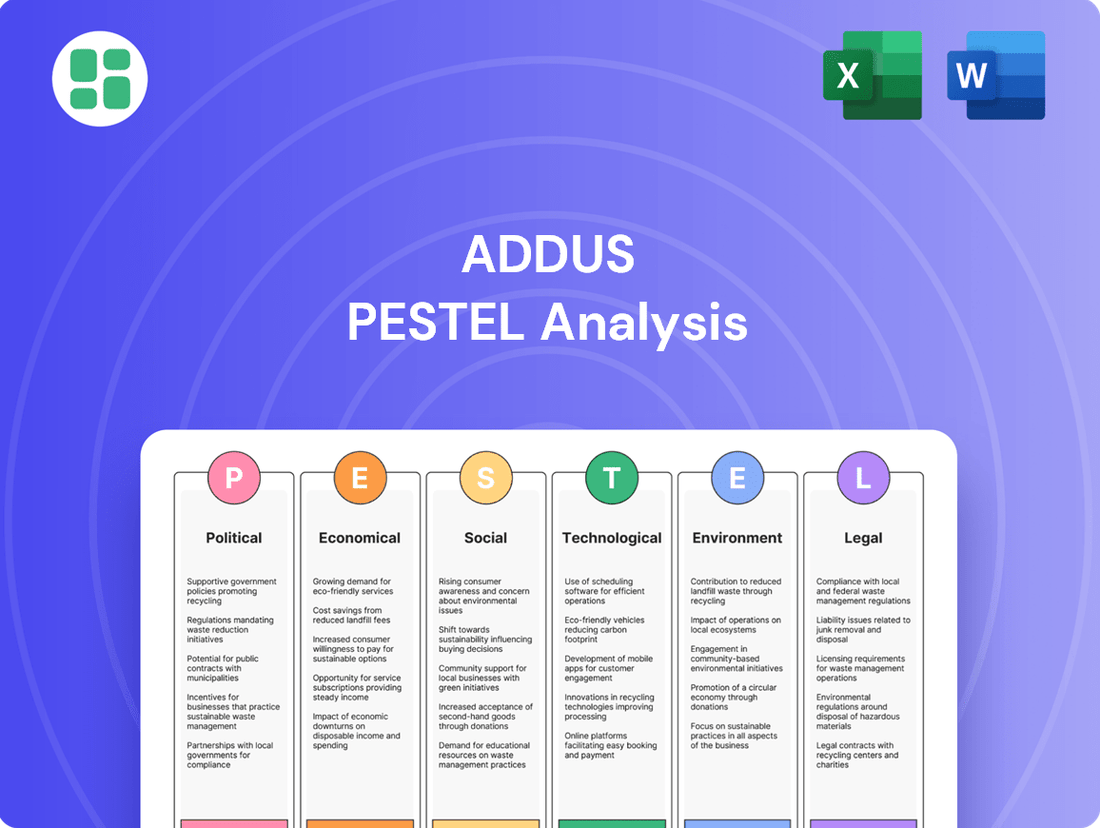

This Addus PESTLE analysis dissects the critical external macro-environmental forces shaping its operational landscape across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategy.

Economic factors

Reimbursement rate adjustments significantly impact Addus HomeCare's revenue, as its services are largely funded by government and managed care programs. For calendar year 2025, the Centers for Medicare & Medicaid Services (CMS) has signaled a modest aggregate increase for Medicare home health payments, which provides a baseline for the industry.

However, the company's financial performance is heavily influenced by state-specific rate adjustments. For instance, recent historical data shows that changes in Illinois and Texas, key operational states for Addus, have had a direct correlation with the company's revenue streams. These state-level decisions are crucial for Addus's profitability.

The home care sector, including companies like Addus, is fundamentally built on its workforce. This means that when there aren't enough caregivers or when their wages go up significantly, it directly affects how much it costs to run the business and how much profit they can make. For instance, in 2023, the U.S. Bureau of Labor Statistics reported that the median hourly wage for home health and personal care aides was $15.03, a figure that has seen consistent upward pressure.

Demand for these essential services is consistently higher than the available supply of qualified professionals. This imbalance forces companies to compete more fiercely for staff, often by offering higher wages and better benefits. This trend is expected to continue, with the Bureau of Labor Statistics projecting a 22% growth for home health and personal care aides from 2022 to 2032, much faster than the average for all occupations.

While Addus primarily serves government-funded programs, overall economic growth is crucial. A robust economy in 2024 and projections for 2025 can lead to healthier state budgets, potentially increasing funding for home care services. Conversely, economic slowdowns might tighten government purse strings, impacting program allocations.

Consumer spending patterns also play a role. Even with government funding, increased disposable income during economic expansions might encourage private payers or families to supplement services not fully covered by public programs, boosting demand.

For instance, the U.S. Bureau of Economic Analysis reported a 1.3% increase in real GDP in the first quarter of 2024, indicating continued economic expansion. This growth environment is generally favorable for sectors reliant on government and private spending, including home healthcare.

Interest Rates and Access to Capital

Fluctuations in interest rates directly impact Addus's cost of capital, influencing the feasibility and expense of its growth strategies, particularly acquisitions. For instance, if the Federal Reserve maintains a higher interest rate environment, the cost of borrowing for Addus to fund new ventures or purchase other home care providers will increase.

Addus's strategic focus on targeted acquisitions to broaden its geographic reach and enhance service capabilities means that access to capital under favorable financing conditions is paramount. For example, in early 2024, the Federal Funds Rate remained elevated, impacting borrowing costs for companies like Addus.

- Impact on Acquisition Financing: Higher interest rates increase the debt servicing costs for acquisitions, potentially reducing the attractiveness of potential targets or requiring higher projected returns to justify the investment.

- Cost of Capital: Changes in benchmark interest rates, such as the Secured Overnight Financing Rate (SOFR), directly affect the interest Addus pays on its variable-rate debt and the cost of issuing new debt.

- Investor Sentiment: A rising interest rate environment can also make fixed-income investments more appealing relative to equities, potentially impacting Addus's stock valuation and its ability to raise capital through equity offerings.

- Expansion Projects: Beyond acquisitions, interest rates influence the cost of financing new facilities or technology investments necessary for expanding service offerings.

Inflationary Pressures on Operational Costs

Inflation significantly impacts Addus's operational costs beyond just labor. Rising prices for administrative supplies, fuel for transportation, and essential equipment directly squeeze profit margins. This is particularly challenging when reimbursement rates from government programs or insurance providers don't keep pace with these escalating expenses.

For instance, the Consumer Price Index (CPI) for services, a key indicator of inflation in sectors where Addus operates, saw a notable increase. In the first half of 2024, various service categories experienced price hikes that could translate to higher costs for Addus. This dynamic forces the company to find efficiencies elsewhere to offset these inflationary pressures.

- Administrative Expenses: Increased costs for office supplies, technology, and professional services add to overhead.

- Transportation: Fluctuations in fuel prices directly impact the cost of delivering home healthcare services.

- Supplies and Equipment: Rising prices for medical supplies, personal protective equipment (PPE), and durable medical equipment affect overall expenditure.

- Reimbursement Rate Challenges: Addus often operates with reimbursement rates that are fixed or increase at a slower pace than inflation, creating a profitability squeeze.

Economic factors significantly shape Addus HomeCare's operational landscape. Reimbursement rate adjustments, particularly from government programs like Medicare and Medicaid, directly influence revenue. For 2025, while Medicare home health payments are expected to see a modest increase, state-specific rate changes remain critical, as seen in historical impacts from Illinois and Texas.

Labor costs, driven by wage pressures and caregiver shortages, are a primary economic concern. The Bureau of Labor Statistics reported a median hourly wage of $15.03 for home health aides in 2023, a figure expected to rise with a projected 22% job growth for this sector by 2032.

Broader economic conditions also play a vital role. Robust GDP growth, such as the 1.3% increase in Q1 2024 reported by the BEA, can bolster state budgets and potentially increase funding for home care services. Conversely, economic downturns may lead to tighter government spending.

Interest rates directly affect Addus's cost of capital for growth initiatives like acquisitions. Elevated Federal Funds Rates in early 2024 increased borrowing costs, impacting the financial viability of expansion strategies.

| Economic Factor | Impact on Addus | Relevant Data/Trend |

|---|---|---|

| Reimbursement Rates | Directly affects revenue; state-level variations are crucial. | CMS signaled modest Medicare home health payment increase for 2025. |

| Labor Costs | Influences operational expenses and profitability due to caregiver shortages. | Median hourly wage for home health aides was $15.03 in 2023. |

| Economic Growth (GDP) | Impacts government funding availability and potential for private pay growth. | U.S. real GDP increased by 1.3% in Q1 2024. |

| Interest Rates | Affects cost of capital for acquisitions and expansion projects. | Federal Funds Rate remained elevated in early 2024, increasing borrowing costs. |

What You See Is What You Get

Addus PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Addus PESTLE analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain valuable insights into the external forces shaping Addus's strategic landscape.

Sociological factors

The increasing number of individuals aged 65 and older is a significant factor boosting demand for Addus HomeCare's services. This demographic trend directly translates into a larger potential customer base for home-based healthcare and personal assistance.

By 2034, it's projected that older adults will surpass children in the United States population. This demographic shift underscores a long-term, growing requirement for the types of services Addus provides, ensuring sustained market opportunity.

A significant societal shift is underway, with a strong preference among older adults to age in place, meaning they wish to remain in their own homes for as long as possible. This desire directly translates into increased demand for home-based care services, a core offering for companies like Addus. In 2024, surveys indicated that over 75% of individuals aged 65 and older expressed a desire to stay in their current homes.

This trend perfectly aligns with Addus HomeCare’s mission to deliver essential services such as assistance with daily living activities, skilled nursing, and hospice care within the familiar comfort of a client’s home. The company's strategic focus on in-home care positions it to capitalize on this growing demographic preference. By 2025, the home healthcare market is projected to reach over $500 billion globally, underscoring the robust growth driven by this aging-in-place phenomenon.

The availability of family caregivers is a significant sociological factor impacting the demand for professional home care services. As of 2023, the U.S. Census Bureau data indicates a growing aging population, with approximately 56 million Americans aged 65 and older. This demographic shift means more individuals will require care, and the capacity of informal family support networks is increasingly strained.

Families are becoming more geographically dispersed, with a higher percentage of adult children living more than an hour away from their aging parents. This distance, coupled with increased workforce participation and dual-income households, limits the time and ability of family members to provide consistent care. Consequently, the need for paid professional assistance, whether for respite care to give family caregivers a break or for comprehensive, ongoing support, is on the rise.

Awareness and Acceptance of Home Care

Growing awareness of home care's advantages is significantly boosting its adoption. People increasingly recognize that receiving care at home can lead to a better quality of life, lower risks of hospital readmission, and often prove more economical than traditional nursing homes or assisted living facilities. This shift in perception directly benefits companies like Addus, which specialize in providing these in-home services.

Several factors are driving this increased acceptance:

- Favorable Demographics: The aging population, with an estimated 10,000 Americans turning 65 each day in 2024, creates a larger pool of potential clients seeking home-based care solutions.

- Patient Preference: Surveys consistently show a strong preference among seniors to age in place, with a significant majority preferring to remain in their own homes rather than move to an institutional setting.

- Cost-Effectiveness: Home care can be 20-30% less expensive than assisted living or skilled nursing facilities, making it an attractive option for individuals and families managing healthcare budgets.

- Technological Advancements: Innovations in telehealth and remote monitoring further support the viability and safety of home care, increasing confidence in its efficacy.

Health Disparities and Access to Care

Health disparities, particularly those affecting vulnerable populations, are a significant sociological factor influencing healthcare policy and service delivery in 2024 and 2025. These disparities highlight the ongoing need for equitable access to care, a core tenet for organizations like Addus. The company's strategic focus on government-funded programs directly addresses this by aiming to provide essential services to eligible individuals, including those with disabilities or chronic illnesses, thereby meeting critical societal needs.

In the United States, for instance, data from the Centers for Disease Control and Prevention (CDC) in late 2023 indicated persistent disparities in health outcomes based on race, ethnicity, socioeconomic status, and geographic location. These ongoing trends underscore the importance of Addus's business model, which relies heavily on reimbursement from programs like Medicare and Medicaid. These programs are designed to broaden access for populations that might otherwise face significant barriers to receiving necessary home care and support services.

- Health Disparities: Persistent gaps in health outcomes exist across various demographic groups in the US, impacting access to quality care.

- Equitable Access: Societal demand for fair and just healthcare access drives policy decisions and shapes service provider strategies.

- Government Programs: Addus's reliance on Medicare and Medicaid reimbursement reflects the critical role of public funding in ensuring care for underserved populations.

- Targeted Support: The company's services are crucial for individuals with disabilities and chronic illnesses, addressing a significant societal need for long-term care solutions.

Societal shifts, including the increasing preference for aging in place, directly fuel demand for Addus HomeCare's services. By 2034, older adults are projected to outnumber children in the US, highlighting a sustained need for in-home care. This trend aligns with Addus's mission to provide essential services within clients' homes, a market expected to exceed $500 billion globally by 2025.

The strain on informal family caregiving networks, due to geographic dispersion and busy lifestyles, increases reliance on professional home care. As of 2023, approximately 56 million Americans were aged 65 and older, a number that continues to grow. This demographic reality underscores the increasing need for paid assistance to supplement family support.

Growing awareness of home care's benefits, including improved quality of life and cost-effectiveness compared to institutional settings, is a key driver. In 2024, an estimated 10,000 Americans turned 65 daily, further expanding the client pool. Home care is often 20-30% less expensive than assisted living, making it an attractive option.

Health disparities and the demand for equitable access to care are critical sociological factors. Addus's reliance on Medicare and Medicaid reimbursement addresses this by providing essential services to underserved populations, including those with disabilities and chronic illnesses.

| Sociological Factor | Description | Impact on Addus | Supporting Data (2024/2025 Projections) |

|---|---|---|---|

| Aging Population | Increasing number of individuals 65+ | Directly increases potential client base | 10,000 Americans turn 65 daily (2024); Older adults to outnumber children by 2034 |

| Aging in Place Preference | Desire to remain in own homes | Drives demand for in-home services | Over 75% of individuals 65+ prefer to stay home (2024 survey) |

| Family Caregiver Strain | Geographic dispersion, busy lifestyles | Increases need for professional support | 56 million Americans aged 65+ (2023); Limited time/ability for distant family caregivers |

| Awareness of Home Care Benefits | Perceived quality of life, cost savings | Boosts adoption of home-based services | Home care 20-30% cheaper than assisted living; Global home healthcare market projected >$500 billion by 2025 |

| Health Disparities & Equity | Need for accessible care for vulnerable groups | Supports reliance on government programs | Persistent disparities in health outcomes (CDC, late 2023); Medicare/Medicaid crucial for access |

Technological factors

Telehealth and remote patient monitoring (RPM) are significantly reshaping home care, allowing Addus to offer virtual consultations and continuously track patient vital signs. This technological shift enhances care delivery by providing real-time health updates, which can lead to better patient outcomes and a potential decrease in hospital readmissions.

The increasing digitalization of administrative and care processes is a significant technological factor for Addus. By adopting digital platforms for patient records, care coordination, and scheduling, Addus can streamline its operations. This move towards digital solutions, including electronic visit verification (EVV), not only enhances efficiency but also ensures better compliance with regulations.

This technological shift allows caregivers to dedicate more time to direct patient interaction, improving the quality of care. For instance, the widespread adoption of EVV systems, which Addus utilizes, has been shown to improve data accuracy and reduce administrative burdens, freeing up valuable resources. In 2024, the home healthcare industry continued to see a strong push towards digital transformation, with companies investing heavily in technology to manage their workforce and patient data more effectively.

Artificial intelligence and big data analytics are transforming the home care sector. These technologies are vital for creating personalized care plans, predicting potential health issues, and boosting how efficiently home care providers like Addus operate. For instance, in 2024, the global AI in healthcare market was valued at over $15 billion and is projected to grow significantly, indicating strong adoption trends.

Addus can harness AI-powered tools to offer real-time support for decision-making, pinpointing patients at higher risk and enhancing caregiver efficiency and job satisfaction. By analyzing vast datasets, AI can identify patterns that lead to better patient outcomes and more streamlined workflows, potentially reducing operational costs by up to 20% in some healthcare applications.

Wearable Technology and Smart Home Systems

The proliferation of wearable health devices and smart home systems presents a significant technological advantage for companies like Addus, enhancing senior care. These innovations directly support independent living by providing continuous monitoring and immediate alerts in case of emergencies.

Wearable tech, such as smartwatches and health trackers, can meticulously monitor vital signs like heart rate and activity levels. This data offers valuable insights for caregivers and healthcare providers, allowing for proactive interventions. For instance, a sudden drop in activity could signal a fall, prompting a swift response. The global wearable technology market was valued at approximately $116 billion in 2023 and is projected to grow substantially, indicating widespread adoption.

Smart home systems, including voice-activated assistants and automated safety features, further bolster senior independence and safety. These systems can manage lighting, temperature, and even medication reminders, simplifying daily routines. The smart home market is also experiencing robust growth, with an estimated market size of over $100 billion in 2023, demonstrating a strong consumer interest in connected living environments.

- Enhanced Safety: Wearables and smart home tech provide real-time alerts for falls or other emergencies, reducing response times.

- Health Monitoring: Continuous tracking of vital signs and activity levels offers crucial data for personalized care plans.

- Independent Living: These technologies empower seniors to maintain autonomy in their homes for longer periods.

- Complementary Services: The data and alerts generated by these devices directly support and enhance Addus's existing personal care offerings.

Enhanced Communication Platforms

Enhanced communication platforms are revolutionizing the healthcare sector, particularly for home care providers like Addus. Technology now allows for seamless, real-time interaction between caregivers, patients, and their families. This improved connectivity ensures that care plans are coordinated effectively and that responses to patient needs are swift and appropriate. For instance, a 2024 report indicated that 75% of home care agencies using integrated communication software saw a reduction in patient care gaps.

User-friendly applications and digital platforms are central to this transformation. These tools simplify the complexities of care management, offering features such as appointment scheduling, medication reminders, and direct messaging. This not only streamlines operations for Addus but also significantly enhances the overall care experience for patients and their loved ones. A survey from early 2025 found that 88% of patients reported higher satisfaction with home care services that utilized dedicated communication apps, citing the ease of receiving updates and communicating concerns.

The impact of these technological advancements is substantial, fostering better engagement and transparency. Key benefits include:

- Improved Care Coordination: Real-time updates allow for immediate adjustments to care plans based on patient status.

- Enhanced Patient and Family Engagement: Accessible platforms empower families with information and direct communication channels.

- Operational Efficiency: Streamlined communication reduces administrative burdens and improves caregiver scheduling.

- Data Accessibility: Digital records and communication logs provide valuable data for quality improvement and reporting.

Technological advancements are fundamentally reshaping home care delivery for Addus. Telehealth and remote patient monitoring (RPM) enable virtual consultations and continuous vital sign tracking, improving patient outcomes. The increasing digitalization of administrative tasks, including electronic visit verification (EVV), streamlines operations and ensures regulatory compliance, freeing caregivers for more direct patient interaction.

Artificial intelligence (AI) and big data analytics are crucial for developing personalized care plans and predicting health issues, enhancing operational efficiency. In 2024, the global AI in healthcare market exceeded $15 billion, highlighting significant industry adoption. AI can optimize workflows and potentially reduce operational costs by up to 20% in certain healthcare applications.

Wearable health devices and smart home systems significantly enhance senior care by supporting independent living through continuous monitoring and emergency alerts. The global wearable technology market reached approximately $116 billion in 2023, with smart home systems also exceeding $100 billion, indicating strong consumer interest in connected living environments.

Enhanced communication platforms facilitate seamless interaction between caregivers, patients, and families, improving care coordination and response times. A 2024 report showed 75% of home care agencies using integrated communication software experienced fewer patient care gaps, while early 2025 data indicated 88% of patients reported higher satisfaction with services utilizing dedicated communication apps.

| Technology | Impact on Addus | Market Data (2023-2024) |

| Telehealth & RPM | Improved patient monitoring, better outcomes | Growing adoption in home care |

| Digitalization (EVV) | Streamlined operations, regulatory compliance | Industry-wide push for digital transformation |

| AI & Big Data | Personalized care, predictive analytics, efficiency | AI in Healthcare Market > $15 billion (2024) |

| Wearables & Smart Homes | Enhanced safety, independent living, data insights | Wearables Market ~$116 billion (2023) |

| Communication Platforms | Better coordination, increased satisfaction | 75% reduction in care gaps with integrated software |

Legal factors

Addus HomeCare operates under stringent Medicaid and Medicare regulations, which are its main revenue streams. For instance, the 80% direct care compensation rule implemented for Medicaid services in 2024 significantly influences how Addus must allocate its spending to ensure compliance.

Furthermore, ongoing adjustments to Medicare payment systems, such as the proposed Medicare Physician Fee Schedule updates for 2025, directly affect Addus's reimbursement rates and necessitate continuous operational and financial adaptation to maintain compliance.

Addus HomeCare's operations are heavily influenced by legal factors, particularly concerning patient privacy and data security. Compliance with the Health Insurance Portability and Accountability Act (HIPAA) is not just a guideline but a critical legal mandate. This ensures the protection of Protected Health Information (PHI) handled by the company.

Maintaining robust cybersecurity measures and stringent internal policies is an ongoing legal obligation for Addus. This is crucial for the secure handling and electronic transmission of sensitive patient data. Failure to comply can result in significant penalties, impacting both reputation and financial standing.

Addus, as a major employer of caregivers, navigates a complex web of labor laws. This includes adhering to federal and state minimum wage standards, which saw the federal minimum wage remain at $7.25 per hour in 2024, though many states have higher rates. Overtime regulations and mandatory training for healthcare professionals also add to compliance burdens, impacting operational costs and scheduling.

The landscape is further complicated by state-specific labor laws and, where applicable, collective bargaining agreements. For instance, states like California have stringent rules regarding meal and rest breaks for employees, which directly affect how Addus manages its caregiver workforce. These variations require diligent attention to ensure consistent compliance across all operating regions.

Licensing and Accreditation Requirements

Addus operates in numerous states, and each jurisdiction imposes distinct licensing and accreditation mandates for home care agencies. Navigating and complying with these varying state-specific regulations is fundamental to Addus's legal standing and its capacity to provide services. For instance, as of early 2024, states like Texas and Florida have specific requirements regarding caregiver background checks and agency bonding, which Addus must meticulously manage across its operations.

Failure to maintain current licenses or adhere to state-defined operational standards can lead to significant penalties, including fines and suspension of services. These legal obligations directly impact Addus's operational continuity and its ability to expand into new markets. The company's commitment to compliance ensures its services meet the minimum legal thresholds for quality and safety.

- State Licensing: Addus must secure and renew licenses in every state it operates, a process that can involve extensive paperwork and fees.

- Accreditation Standards: While not always legally mandated, accreditation from bodies like The Joint Commission can be crucial for market access and demonstrating quality, often influencing payer contracts.

- Regulatory Changes: Addus must remain vigilant for changes in state healthcare laws, such as new background check protocols or updated staffing ratios, which can impact operational costs and procedures.

- Compliance Costs: The ongoing expense of meeting diverse state regulations, including legal counsel and administrative staff dedicated to compliance, represents a significant operational cost for Addus.

Fraud, Waste, and Abuse (FWA) Prevention

Addus Homecare, heavily reliant on government reimbursements, faces significant legal scrutiny regarding Fraud, Waste, and Abuse (FWA). The company must maintain robust internal controls to ensure accurate billing and service delivery, as non-compliance can lead to severe financial penalties and exclusion from vital programs like Medicare and Medicaid. For instance, in 2023, the Department of Justice reported recovering over $2.2 billion from healthcare fraud cases, highlighting the aggressive enforcement landscape.

Maintaining meticulous documentation and transparent reporting are paramount for Addus. This includes adhering to all federal and state FWA prevention guidelines, such as those mandated by the Centers for Medicare & Medicaid Services (CMS). Failure to do so can result in audits, recoupment of payments, and reputational damage. The Office of Inspector General (OIG) regularly publishes its work plan, detailing areas of focus for healthcare fraud investigations, which often include home health services.

Key legal considerations for Addus include:

- Compliance Programs: Implementing and regularly updating comprehensive compliance programs designed to detect and prevent FWA.

- Documentation Standards: Ensuring all services rendered are properly documented, medically necessary, and billed accurately according to payer requirements.

- Reporting Obligations: Establishing clear channels for reporting suspected FWA internally and complying with any mandatory reporting requirements.

- Training and Education: Providing ongoing FWA training to all employees, particularly those involved in billing, coding, and service delivery.

Addus HomeCare operates within a highly regulated environment, particularly concerning government healthcare programs like Medicare and Medicaid, which form its primary revenue sources. The company must adhere to evolving payment rules, such as the 2024 Medicaid direct care compensation rule, which mandates specific spending allocations. Furthermore, proposed changes to Medicare payment systems, like the 2025 Physician Fee Schedule, directly influence reimbursement rates and require constant operational adjustments.

Labor laws significantly impact Addus's operational costs and workforce management. This includes compliance with federal and state minimum wage laws, with the federal rate at $7.25 per hour in 2024, alongside overtime regulations and healthcare professional training mandates. State-specific labor laws, such as those concerning employee breaks in California, add further complexity to workforce management across different operating regions.

Navigating state-specific licensing and accreditation requirements is crucial for Addus's legal standing and service provision. For example, states like Texas and Florida have distinct mandates for caregiver background checks and agency bonding as of early 2024. Non-compliance with these regulations can result in penalties, impacting operational continuity and market expansion.

| Legal Factor | Impact on Addus | 2024/2025 Data/Examples |

|---|---|---|

| Government Reimbursement Regulations | Affects revenue streams and operational spending | 80% direct care compensation rule for Medicaid (2024); Proposed Medicare Physician Fee Schedule updates (2025) |

| Labor Laws | Impacts workforce management and operational costs | Federal minimum wage ($7.25/hr in 2024); State-specific break rules (e.g., California) |

| State Licensing & Accreditation | Essential for legal operation and market access | Specific background check and bonding requirements (e.g., Texas, Florida in early 2024) |

| Fraud, Waste, and Abuse (FWA) | Requires robust internal controls to avoid penalties | DOJ recovered over $2.2 billion from healthcare fraud cases (2023); OIG work plan focus on home health services |

Environmental factors

Climate change presents a significant challenge to Addus HomeCare's service delivery model. Increased frequency and intensity of extreme weather events, such as hurricanes and severe storms, directly impede caregivers' ability to reach clients' homes, disrupting essential care. For instance, in 2023, regions like Florida experienced prolonged power outages following Hurricane Idalia, impacting a substantial portion of Addus's client base and requiring adaptive service strategies.

These environmental disruptions necessitate robust emergency response and contingency planning. Addus must invest in communication systems and alternative transportation solutions to ensure continuity of care during natural disasters. The growing unpredictability of weather patterns, as highlighted by NOAA's 2024 climate outlook predicting an active Atlantic hurricane season, underscores the need for proactive adaptation to maintain operational resilience and client well-being.

While Addus HomeCare's environmental footprint is relatively small compared to large hospitals, responsible waste management remains crucial. In 2024, the company's skilled nursing and hospice services generated waste streams that included used medical supplies and personal protective equipment (PPE). Proper disposal protocols are in place to mitigate any environmental impact, even at this scale.

Addus's operations, including administrative offices and vehicle fleets, contribute to energy consumption and associated carbon emissions. The company is actively working to mitigate this impact. For instance, their recent headquarters relocation to a mixed-use development was specifically chosen for its design aimed at reducing their environmental footprint.

Further efforts include encouraging employees to utilize mass transit options, which directly addresses reducing emissions from commuting. While specific 2024 or 2025 data on Addus's exact energy consumption or carbon footprint reduction targets isn't publicly detailed yet, these strategic moves signal a commitment to environmental responsibility in line with broader industry trends towards sustainability.

Sustainability Practices in Supply Chain

Addus HomeCare's commitment to sustainability in its supply chain for medical supplies in skilled nursing and hospice care is increasingly critical. As of early 2025, the healthcare industry is seeing a heightened focus on reducing waste and carbon footprints associated with medical consumables and equipment. This includes exploring options for biodegradable materials and more efficient logistics to minimize environmental impact.

The drive for sustainable sourcing aligns with growing investor and regulatory pressure. For instance, many publicly traded healthcare companies are now reporting on their Scope 3 emissions, which encompass supply chain activities. Addus's proactive approach to this can enhance its corporate social responsibility profile and potentially lead to cost savings through optimized resource utilization.

Key areas for Addus to consider regarding environmental sustainability in its supply chain include:

- Sustainable Sourcing: Prioritizing suppliers who utilize recycled materials or employ eco-friendly manufacturing processes for medical disposables and equipment.

- Waste Reduction: Implementing strategies to minimize packaging waste and explore reusable or recyclable alternatives for medical supplies.

- Logistics Optimization: Streamlining delivery routes and considering lower-emission transportation methods to reduce the carbon intensity of supply chain operations.

Focus on Community Health and Environmental Determinants of Health

Addus HomeCare's core mission to enhance quality of life and enable individuals to age in place directly supports community well-being. This focus on home-based care and community integration indirectly touches upon environmental determinants of health, as healthier living environments often correlate with better health outcomes for aging populations.

While Addus does not directly manage environmental resources, its commitment to health within homes and communities aligns with a broader understanding of environmental health. This includes factors like safe living spaces and access to supportive community networks, which are crucial for holistic well-being.

- Community Health Impact: Addus HomeCare's services contribute to reduced hospital readmissions, a key indicator of community health. In 2023, home health agencies like Addus reported an average readmission rate of 15.1%, significantly lower than inpatient settings.

- Environmental Determinants: By enabling aging in place, Addus supports the maintenance of familiar and often more comfortable living environments, reducing stress and promoting psychological well-being, which are recognized environmental determinants of health.

- Holistic Approach: The company's emphasis on personalized care plans fosters healthier home environments and strengthens community ties, indirectly promoting a positive relationship between individuals and their immediate surroundings.

Environmental factors pose direct operational risks to Addus HomeCare, particularly concerning extreme weather events that can disrupt service delivery. The company's efforts to mitigate its environmental footprint include optimizing energy consumption and waste management across its facilities and operations.

Addus is also increasingly focused on the environmental sustainability of its supply chain, recognizing the growing importance of eco-friendly medical supplies and efficient logistics. This proactive approach aims to align with investor expectations and reduce the company's overall environmental impact.

The company's core business of enabling aging in place indirectly supports community environmental health by promoting stable and supportive living environments. This focus on home-based care contributes to positive health outcomes, aligning with broader environmental determinants of health.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Addus HomeCare is built on a robust foundation of data from reputable sources including government health and labor statistics, industry-specific market research reports, and financial news outlets. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the home healthcare sector.