1&1 SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

1&1 Bundle

1&1's robust infrastructure and extensive product portfolio represent significant strengths, while their brand recognition in certain markets offers a competitive edge. However, understanding the nuances of their market challenges and potential threats is crucial for strategic planning.

Want the full story behind 1&1's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

1&1's pioneering Open RAN 5G network, the first fully virtualized of its kind in Europe, represents a significant strength. This innovative architecture promises lower latency and enhanced flexibility, setting it apart from competitors relying on traditional, proprietary systems.

This technological leadership positions 1&1 to capitalize on future advancements in telecommunications, such as edge computing and massive IoT deployments, offering a distinct competitive advantage in the evolving 5G landscape.

1&1 boasts an extensive service catalog, encompassing high-speed internet via DSL and fiber, along with mobile services including 5G. This broad spectrum of offerings extends to cloud solutions managed by its IONOS subsidiary, effectively serving both individual consumers and businesses.

This comprehensive portfolio creates multiple avenues for revenue generation. For instance, in 2023, 1&1 reported a significant increase in its customer base, with broadband connections growing by 5.7% year-over-year to 4.2 million. This demonstrates the broad appeal and market penetration of their diverse services.

1&1 AG boasts a substantial customer base exceeding 16 million contracts, solidifying its position as a dominant telecommunications player in Germany for over three decades. This extensive reach is a testament to its enduring market presence and customer loyalty.

The company effectively leverages its strong brand recognition through a multi-brand strategy, encompassing popular discount providers like WinSIM and PremiumSIM. This approach allows 1&1 to cater to a diverse range of consumer needs and preferences, further deepening its market penetration.

Strategic Fiber Optic Network (1&1 Versatel)

1&1's strategic advantage is significantly bolstered by its sister company, 1&1 Versatel's, extensive fiber-optic transport network. This owned infrastructure serves as a critical backbone for its broadband services and is instrumental in the company's ambitious 5G network expansion. By controlling this core connectivity, 1&1 reduces its reliance on external providers, a move that translates into greater operational efficiency and a distinct competitive edge in the telecommunications market.

This owned network is not just about current operations; it's a foundational asset for future growth. For instance, 1&1 Versatel's investment in expanding its fiber network is a key enabler for its broadband and mobile strategies. By the end of 2024, 1&1 Versatel aimed to connect approximately 4 million households to its fiber network, a substantial increase from previous years, underscoring the scale of this strategic strength.

- Nationwide Fiber Backbone: 1&1 Versatel's owned fiber-optic network provides a reliable and high-capacity foundation for 1&1's broadband and mobile services.

- Reduced Third-Party Dependence: Owning the network infrastructure minimizes reliance on external providers, leading to cost control and service quality assurance.

- Support for 5G Rollout: The robust fiber network is essential for the high-speed data transmission required for 1&1's ongoing 5G network deployment.

- Competitive Differentiation: This integrated infrastructure offers a significant advantage over competitors who may lease network capacity.

National Roaming Agreements for Coverage

1&1's strategic national roaming agreements, particularly with Vodafone, are a significant strength during its 5G network build-out. These partnerships provide immediate, nationwide coverage for its mobile subscribers, mitigating the impact of its ongoing proprietary network development.

This ensures a seamless customer experience and supports retention efforts as 1&1 expands its own infrastructure. For instance, by leveraging existing networks, 1&1 can offer competitive service levels from day one, a crucial factor in the highly competitive German mobile market.

- Vodafone Roaming Partnership: Secures extensive national coverage while 1&1 builds its own 5G network.

- Customer Retention: Guarantees service continuity, preventing customer churn during network expansion phases.

- Market Entry Advantage: Allows 1&1 to compete effectively from launch by offering immediate nationwide availability.

1&1's pioneering Open RAN 5G network is a significant strength, offering enhanced flexibility and lower latency compared to traditional systems. This technological leadership positions them well for future advancements like edge computing and massive IoT deployments.

The company's comprehensive service catalog, including DSL, fiber, and mobile (5G), alongside cloud solutions via IONOS, diversifies revenue streams. In 2023, 1&1 saw broadband connections grow 5.7% year-over-year to 4.2 million, highlighting broad appeal.

With over 16 million contracts, 1&1 has a substantial and loyal customer base in Germany, reinforced by a multi-brand strategy including discount providers like WinSIM and PremiumSIM.

1&1 Versatel's owned fiber-optic transport network is a critical backbone for both broadband and 5G expansion, reducing third-party reliance and improving efficiency. By the end of 2024, 1&1 Versatel aimed to connect approximately 4 million households to its fiber network.

Strategic national roaming agreements, particularly with Vodafone, provide immediate nationwide coverage for mobile subscribers during the 5G network build-out, ensuring customer retention and a competitive market entry.

| Strength Area | Key Aspect | Supporting Data/Fact |

|---|---|---|

| Network Technology | Open RAN 5G Network | First fully virtualized of its kind in Europe. |

| Service Portfolio | Diversified Offerings | Broadband (DSL/Fiber), Mobile (5G), Cloud (IONOS). Broadband connections grew 5.7% YoY to 4.2M in 2023. |

| Customer Base & Brand | Extensive Reach & Multi-Brand Strategy | Over 16 million contracts; utilizes brands like WinSIM and PremiumSIM. |

| Infrastructure Ownership | Owned Fiber-Optic Network | 1&1 Versatel's network supports broadband and 5G; ~4M households targeted for fiber connection by end of 2024. |

| Strategic Partnerships | National Roaming Agreements | Vodafone partnership ensures immediate nationwide coverage for mobile services. |

What is included in the product

Delivers a strategic overview of 1&1’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

1&1 has grappled with significant hurdles in its 5G network expansion, notably experiencing persistent problems with antenna site deployment and various technical malfunctions. These setbacks have not only caused the company to miss crucial regulatory deadlines but also forced increased capital expenditure, thereby hindering overall operational efficiency.

For instance, by the end of 2023, 1&1 had only managed to activate approximately 3,700 of its planned 5G base stations, a figure considerably lower than its initial targets. This slow pace directly impacts its ability to compete effectively in the German mobile market, where rivals like Deutsche Telekom and Vodafone have established more extensive 5G coverage.

The ambitious rollout of 1&1's new mobile network has encountered significant headwinds, leading to start-up costs that have outpaced initial projections. These extensive investments, coupled with unforeseen operational challenges, have placed a strain on the company's financial performance.

Consequently, 1&1's EBITDA for fiscal year 2024 experienced a negative impact, and forecasts for 2025 indicate a continued downward trend, falling short of market expectations. This financial pressure directly affects the company's ability to achieve its planned profitability targets in the near term.

Network instability has proven a significant weakness for 1&1. A temporary outage of their new mobile network in May 2024, stemming from issues with undersized network components, resulted in an unexpected surge in customer churn. This instability also forced a temporary halt on migrating existing customers to the new network, directly impacting growth and highlighting critical vulnerabilities.

Declining Broadband Customer Base

1&1 has faced a shrinking broadband customer base, a significant weakness. While mobile contracts show promise, the fixed-line segment is proving challenging. This decline in broadband connections was observed throughout 2024 and continued into the first half of 2025, highlighting difficulties in the German market.

This trend suggests that 1&1 may be struggling to compete effectively in the German fixed-line broadband sector. The company's ability to attract and retain customers in this core area is crucial for its overall financial health and market position.

- Broadband customer decline: 1&1 reported a decrease in its broadband customer numbers during 2024.

- First-half 2025 trend: This negative trend persisted into the initial six months of 2025.

- Competitive pressure: The German fixed-line market is highly competitive, impacting 1&1's ability to grow this segment.

Reliance on External Partners for Network Expansion

Despite significant investment in its own fiber optic network, 1&1's expansion strategy is hampered by its ongoing reliance on external partners for antenna site deployment. This dependence was evident in 2023 when a dispute with Vantage Towers, a key infrastructure provider, led to delays in activating new sites, directly impacting 1&1's ambitious rollout plans. The company's ability to scale its mobile network is therefore constrained by the operational efficiency and cooperative spirit of these third-party collaborators.

This reliance creates a critical weakness, as evidenced by the fact that as of early 2024, 1&1 had activated fewer than 1,000 of its planned 10,000 antenna sites, a pace significantly slower than initially projected. The company's financial performance is directly tied to its ability to quickly expand its network coverage, making these external dependencies a substantial risk. Failure to secure timely access to and deployment at these sites can lead to:

- Delayed Market Penetration: Slower network build-out directly translates to a delayed ability to attract and retain customers in new geographic areas.

- Increased Operational Costs: Contractual disputes or renegotiations with partners can lead to unforeseen cost escalations, impacting profitability.

- Competitive Disadvantage: Rivals with more control over their infrastructure deployment may gain a significant advantage in market share and customer acquisition.

1&1's ambitious 5G rollout has been significantly hampered by persistent issues with antenna site deployment and technical problems, causing missed deadlines and increased capital expenditure. By the end of 2023, only about 3,700 of its planned 5G base stations were active, a stark contrast to competitors' coverage. This slow pace, coupled with start-up costs exceeding projections, has strained finances, leading to negative EBITDA in 2024 and forecasts below market expectations for 2025.

Network instability, exemplified by a May 2024 outage due to undersized components, resulted in customer churn and a halt in customer migration. Furthermore, 1&1 is experiencing a shrinking broadband customer base, a trend observed throughout 2024 and into the first half of 2025, indicating struggles in the competitive German fixed-line market.

The company's reliance on external partners for antenna site deployment, as highlighted by a 2023 dispute with Vantage Towers, creates a critical weakness. As of early 2024, fewer than 1,000 of 10,000 planned antenna sites were active, impacting market penetration, increasing costs, and creating a competitive disadvantage.

| Weakness | Description | Impact | Data Point |

| 5G Rollout Delays | Antenna site deployment issues and technical malfunctions | Missed regulatory deadlines, increased capital expenditure | ~3,700 active 5G base stations by end of 2023 (vs. planned) |

| Financial Strain | Start-up costs exceeding projections, negative EBITDA | Hinders profitability targets, below market expectations | Negative EBITDA forecast for 2024 and 2025 |

| Network Instability | Outages due to component issues | Customer churn, halted customer migration | May 2024 network outage |

| Broadband Customer Decline | Shrinking fixed-line customer base | Challenges in competitive German market | Decline observed throughout 2024 and H1 2025 |

| External Dependency | Reliance on partners for antenna site deployment | Slow site activation, delayed market entry | <1,000 active sites of 10,000 planned by early 2024 |

What You See Is What You Get

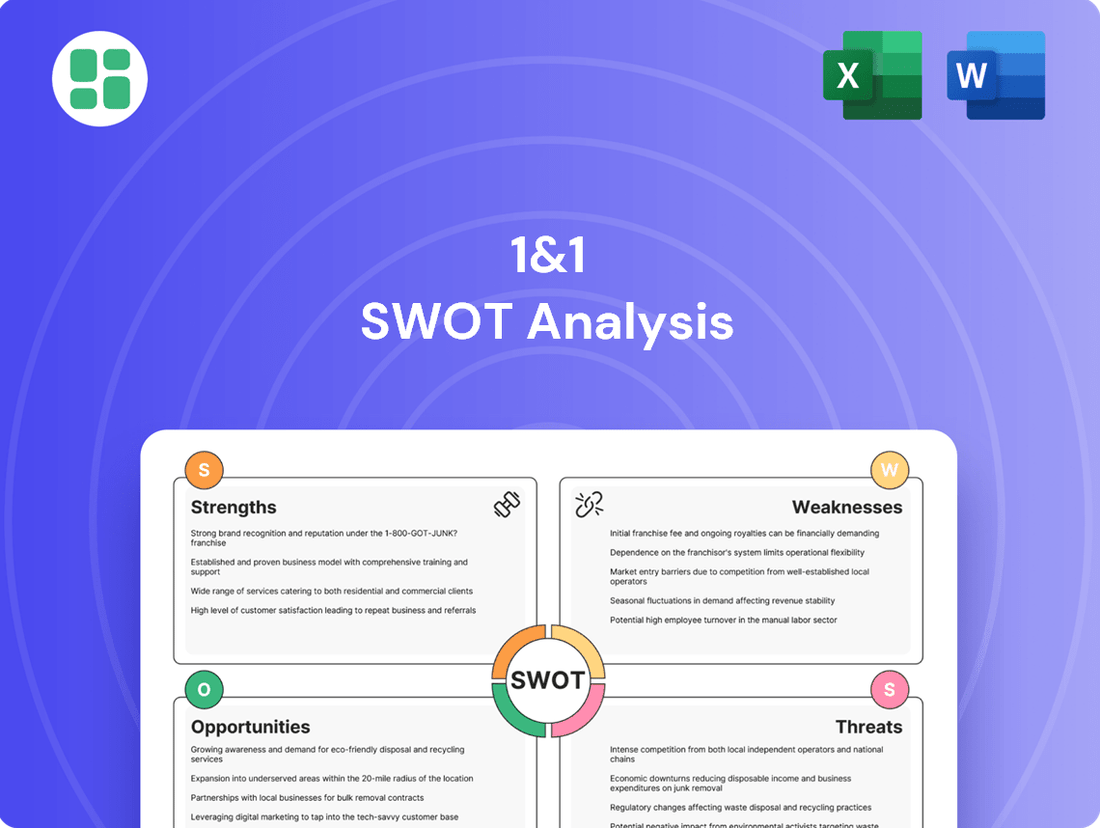

1&1 SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The German telecom market is booming, fueled by a strong desire for faster internet and the widespread rollout of 5G technology. This trend is creating a substantial opportunity for 1&1 to grow its customer base and service offerings.

The increasing number of Internet of Things (IoT) devices and the general push towards digitalization across all sectors of the German economy further expand the market potential for 1&1's telecommunications services.

As the trailblazer of Europe's inaugural Open RAN 5G network, 1&1 stands to gain significantly from this forward-thinking technology. This early adoption positions them to leverage Open RAN's inherent flexibility and cost-saving potential, creating a durable competitive edge in the evolving telecommunications landscape. By 2025, the global Open RAN market is projected to reach $7.2 billion, a testament to its growing importance.

The German government's commitment to enhancing digital infrastructure, particularly fiber network expansion and 5G deployment, presents a significant opportunity for 1&1. Public funding and supportive legislation, like the Telecommunications Network Expansion Acceleration Act, directly reduce the financial strain on companies like 1&1 undertaking extensive network build-outs. This policy environment is designed to accelerate the rollout of high-speed internet, a core component of 1&1's strategy.

Expansion into Cloud and Hosting Services

Leveraging the robust cloud and hosting capabilities of its parent company, IONOS, 1&1 can tap into significant cross-selling opportunities. This integration allows for the creation of a more cohesive digital offering for customers, potentially increasing customer retention and average revenue per user.

The burgeoning global cloud computing market, projected to reach over $1.3 trillion by 2024, provides a fertile ground for expansion. Furthermore, the escalating demand for AI-driven applications necessitates scalable cloud infrastructure, positioning 1&1 to capitalize on this trend.

- Cross-selling Synergy: Integrate IONOS's cloud and hosting solutions with 1&1's existing product suite to offer bundled digital services.

- Market Growth: Capitalize on the projected 20% year-over-year growth in the global cloud infrastructure market in 2024-2025.

- AI Demand: Address the increasing need for scalable cloud resources driven by the widespread adoption of AI technologies.

- Revenue Diversification: Expand revenue streams beyond traditional web hosting and domain registration into higher-margin cloud services.

Potential for Improved Operating Leverage Post-Migration

Upon the nearing completion of its large-scale mobile customer migration to its new internal network, a process anticipated to conclude by late 2025 or early 2026, 1&1 is positioned for significant operating leverage improvements. This strategic shift is expected to drastically reduce the company's ongoing wholesale network access costs, a major operational expenditure.

The anticipated reduction in these wholesale fees is projected to directly translate into enhanced profitability. Specifically, 1&1 forecasts a notable uplift in its Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) margins. This operational efficiency gain is a key driver for future financial performance.

Furthermore, the cost savings realized from the network migration are expected to bolster the company's free cash flow generation in the years following the transition. This improved cash flow provides greater financial flexibility for reinvestment, debt reduction, or shareholder returns.

The potential for improved operating leverage is a critical opportunity for 1&1, driven by:

- Reduced Wholesale Costs: Significant savings are expected as the company relies less on external network providers post-migration.

- Enhanced EBITDA Margins: Lower operating expenses directly contribute to a higher percentage of revenue converting to EBITDA.

- Increased Free Cash Flow: Improved profitability and efficient operations are set to boost the cash available for strategic initiatives.

The ongoing expansion of 5G networks across Germany presents a substantial opportunity for 1&1 to acquire new customers and broaden its service portfolio. This trend is further amplified by the increasing adoption of IoT devices and the broader digitalization efforts within the German economy.

As a pioneer in Europe's first Open RAN 5G network, 1&1 is strategically positioned to benefit from this innovative technology. The global Open RAN market is expected to reach $7.2 billion by 2025, highlighting the significant growth potential and competitive advantage this offers.

Government support for digital infrastructure, including fiber optic expansion and 5G deployment, directly aids 1&1's network build-out efforts. This favorable policy environment, coupled with the synergy from IONOS's cloud services, creates avenues for cross-selling and revenue diversification.

The projected completion of 1&1's mobile customer migration to its internal network by late 2025 or early 2026 is a key opportunity for improved operating leverage. This transition is anticipated to significantly reduce wholesale network access costs, leading to enhanced EBITDA margins and increased free cash flow.

| Opportunity Area | Description | Key Data/Projection |

|---|---|---|

| 5G Network Expansion | Growing demand for faster internet and 5G rollout in Germany. | Continued strong demand for high-speed connectivity. |

| Open RAN Leadership | Pioneering Europe's first Open RAN 5G network. | Global Open RAN market projected to reach $7.2 billion by 2025. |

| Digitalization & IoT | Increased adoption of IoT devices and digitalization across industries. | Broadening market potential for telecom services. |

| Government Support | German government's commitment to digital infrastructure enhancement. | Supportive policies and potential public funding for network expansion. |

| IONOS Synergy | Cross-selling opportunities with IONOS's cloud and hosting services. | Global cloud computing market exceeding $1.3 trillion by 2024; AI-driven application demand. |

| Network Migration Savings | Reduced wholesale network access costs post-customer migration. | Anticipated significant reduction in operating expenses, boosting EBITDA margins and free cash flow. |

Threats

The German telecommunications landscape is a battleground dominated by giants like Deutsche Telekom, Vodafone, and Telefónica. These established players are not standing still; they are pouring significant capital into expanding their 5G and fiber optic networks, intensifying the competitive pressure on 1&1.

This aggressive infrastructure investment by market leaders directly translates into challenges for 1&1, potentially impacting its ability to gain market share and maintain profitability. For instance, in late 2023, Deutsche Telekom announced plans to accelerate its fiber rollout, aiming for 10 million households connected by the end of 2024, a move that directly competes with 1&1's own expansion efforts.

1&1 faces significant threats from stringent regulatory requirements, particularly concerning its 5G network expansion. The Bundesnetzagentur mandates specific rollout deadlines and coverage targets, and failure to meet these obligations can result in substantial penalties. For instance, in 2023, telecommunications companies in Germany faced increased scrutiny over network build-out progress.

Non-compliance with spectrum usage rights or missed 5G site deployment targets could trigger financial repercussions for 1&1. These could include fines, additional regulatory oversight, or even legal challenges, all of which could negatively impact the company's financial health and strategic flexibility in the competitive German market.

1&1 faced a significant network outage in May 2024, highlighting the technical hurdles in their new Open RAN deployment. This event, coupled with the discovery of undersized network components, points to the ongoing risks of instability in their infrastructure.

Such technical vulnerabilities can directly impact customer loyalty, potentially leading to higher churn rates as users seek more reliable services. Furthermore, these issues may force 1&1 into unexpected capital spending to address and fortify their network, impacting financial projections.

Dependency on National Roaming Agreements and Partner Reliability

1&1's network expansion is significantly tied to existing national roaming agreements with rivals such as Vodafone. This reliance creates a vulnerability, as any disruptions or disagreements with these partners could directly impact 1&1's service availability and rollout schedule.

Disputes concerning access to essential infrastructure, like the issues experienced with Vantage Towers, highlight the precariousness of these partnerships. Such conflicts can escalate, causing further delays in network deployment and inflating operational expenses for 1&1.

- Roaming Reliance: 1&1's ongoing network build-out phase necessitates continued reliance on national roaming agreements with competitors.

- Infrastructure Access: Past disputes, such as those involving Vantage Towers, demonstrate the potential for complications in accessing critical radio mast infrastructure.

- Cost and Delay Impact: Potential disagreements with roaming partners or infrastructure providers could lead to increased operational costs and further delays in 1&1's network rollout.

Adverse Macroeconomic Conditions and Inflationary Pressures

Persistent inflation in Germany, reaching 5.9% in 2023 according to Destatis, directly challenges 1&1's profitability by increasing operational expenses. This inflationary environment, coupled with ongoing geopolitical instability, erodes consumer discretionary spending, potentially dampening demand for 1&1's higher-tier service offerings.

The rising cost of essential inputs, from network hardware to skilled labor, puts significant pressure on 1&1's margins. For instance, component costs for 5G infrastructure have seen upward trends. This necessitates careful cost management and strategic pricing adjustments to maintain competitiveness.

- Inflationary Impact: German inflation averaged 5.9% in 2023, increasing operational costs for 1&1.

- Consumer Spending: Geopolitical tensions and inflation threaten to reduce consumer purchasing power, impacting demand for premium services.

- Operational Costs: Rising prices for network equipment and labor directly affect 1&1's cost structure and profitability.

Intensified competition from established players like Deutsche Telekom and Vodafone, who are aggressively expanding their 5G and fiber networks, presents a significant threat. Deutsche Telekom's accelerated fiber rollout, targeting 10 million households by the end of 2024, directly challenges 1&1's market share ambitions.

Stringent regulatory requirements, particularly regarding 5G network expansion deadlines and coverage targets set by the Bundesnetzagentur, pose a risk of substantial penalties for non-compliance. Technical vulnerabilities, as evidenced by the May 2024 network outage and undersized components in their Open RAN deployment, could lead to customer churn and unexpected capital expenditures.

Reliance on national roaming agreements with competitors, such as Vodafone, and potential complications in accessing critical infrastructure, like past disputes with Vantage Towers, create operational vulnerabilities. Persistent inflation in Germany, averaging 5.9% in 2023, increases operational expenses and could dampen consumer demand for premium services.

| Threat Category | Specific Threat | Impact on 1&1 | Relevant Data/Example |

|---|---|---|---|

| Market Competition | Aggressive network expansion by rivals | Loss of market share, pressure on profitability | Deutsche Telekom targeting 10M fiber households by end of 2024 |

| Regulatory Compliance | Strict 5G rollout deadlines and coverage targets | Risk of fines and penalties for non-compliance | Increased scrutiny on network build-out progress in 2023 |

| Technical Vulnerabilities | Open RAN deployment issues, network outages | Customer churn, unexpected capital spending | May 2024 outage, discovery of undersized network components |

| Infrastructure Reliance | Dependence on roaming partners and mast access | Service disruptions, delayed rollout, increased costs | Past disputes with Vantage Towers |

| Economic Factors | Inflation and geopolitical instability | Increased operational costs, reduced consumer spending | German inflation at 5.9% in 2023 |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, incorporating internal financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded perspective.