1&1 Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

1&1 Bundle

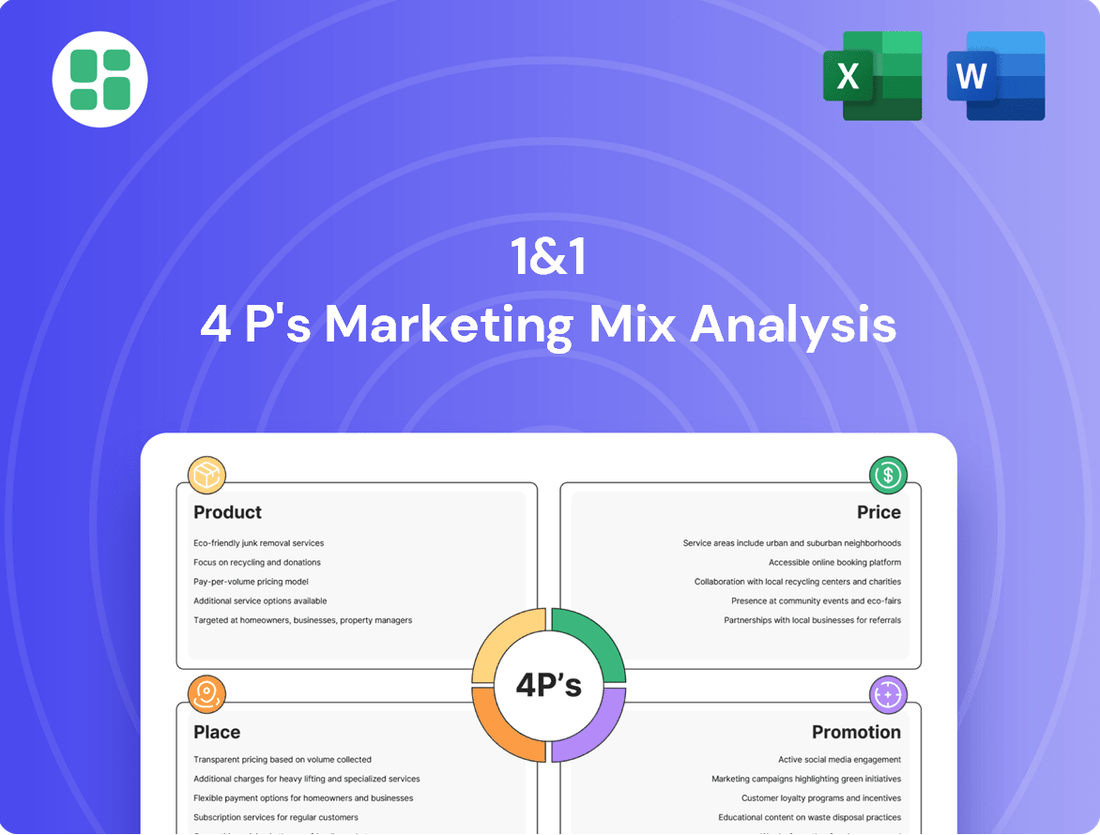

Discover how 1&1 leverages its Product, Price, Place, and Promotion strategies to dominate the web hosting market. This analysis reveals the core elements of their success, offering valuable insights for anyone looking to understand or replicate their approach.

Dive deeper into the intricacies of 1&1's marketing mix. Our comprehensive report dissects their product offerings, competitive pricing, strategic distribution, and impactful promotions, providing a clear roadmap to their market leadership.

Unlock the secrets behind 1&1's marketing prowess with our complete 4Ps analysis. This ready-to-use, editable document is your key to understanding their strategic advantage and applying similar principles to your own business endeavors.

Product

1&1 offers a range of high-speed broadband internet options, including DSL and fiber optic, catering to both individual users and businesses. These plans are built for dependable, fast connections, supporting everything from entertainment like streaming and gaming to essential business functions such as cloud access and online operations.

The company is making significant investments in expanding its fiber optic infrastructure. This strategic move aims to provide customers with increasingly rapid and robust internet connectivity, a crucial factor in today's digital landscape. For instance, as of early 2024, 1&1 reported significant progress in its fiber rollout, with a substantial portion of its network now capable of delivering gigabit speeds.

1&1's mobile product portfolio offers a comprehensive suite of postpaid and prepaid plans, catering to diverse data needs with integrated 5G access. This flexibility ensures customers can select services precisely matching their usage patterns, whether for personal or business communication.

A key differentiator is 1&1's investment in its own mobile network, Europe's first fully virtualized Open RAN network. This cutting-edge infrastructure is complemented by strategic national roaming agreements, notably with Vodafone, guaranteeing extensive coverage throughout Germany and enhancing customer reliability.

1&1 offers a robust suite of cloud-based applications and hosting solutions, primarily targeting small to medium-sized businesses and individual users. These services, often delivered through its sister company IONOS, encompass web hosting, domain registration, email, and cloud storage, designed to establish and manage an online presence. For instance, IONOS reported a significant increase in its cloud infrastructure services in 2024, reflecting growing demand for reliable online operations.

A key differentiator for 1&1's cloud offerings is the emphasis on secure data storage within German data centers. This commitment ensures adherence to stringent European data protection regulations, a crucial factor for businesses handling sensitive information. The company's focus on compliance and security contributes to its appeal for users prioritizing data privacy and regulatory adherence in their digital operations.

Integrated Service Bundles

1&1 actively promotes integrated service bundles, combining broadband, mobile, and often TV services into single packages. This strategy simplifies choices and offers potential cost savings for customers. For instance, in late 2024, 1&1 reported a significant portion of its customer base utilizing these bundled offerings, contributing to a higher average revenue per user (ARPU).

The focus on bundled services aims to enhance customer loyalty by providing a comprehensive solution from a single provider. This approach helps reduce churn and encourages customers to consolidate their telecommunications needs with 1&1. By offering convenience and potential savings, 1&1 positions itself as a one-stop shop for essential digital services.

- Increased ARPU: Bundles often lead to higher average revenue per user compared to single-service customers.

- Customer Loyalty: Integrated offerings foster stickiness and reduce the likelihood of customers switching providers.

- Simplified Customer Experience: Customers benefit from managing multiple services under one bill and provider.

- Competitive Advantage: Bundling is a key strategy to differentiate from competitors offering standalone services.

Customer Service and Technical Support

1&1 places significant emphasis on customer service and technical support, viewing it as a core component of its product. This commitment is demonstrated through their provision of 24/7 assistance, specifically in German, to help customers with setup, troubleshooting, and any other queries they might have.

The company actively cultivates a high degree of customer orientation and prioritizes service quality. These elements are presented as key factors that distinguish 1&1 from competitors, ultimately strengthening the overall value proposition of their offerings.

- 24/7 Support Availability: Customers can access assistance around the clock.

- Multilingual Support: German language support is a primary focus.

- Key Differentiator: High customer orientation and service quality set 1&1 apart.

- Value Enhancement: Superior support bolsters the perceived value of 1&1's products.

1&1's product strategy centers on delivering high-speed broadband, including DSL and fiber, alongside comprehensive mobile plans with 5G. They also offer robust cloud services and domain registration, often through IONOS, focusing on secure German data centers. The company actively bundles these services to enhance customer value and loyalty.

| Product Category | Key Features | Target Audience | 2024/2025 Data Point |

|---|---|---|---|

| Broadband Internet | DSL, Fiber Optic, Gigabit Speeds | Residential & Business | Significant fiber rollout progress, with substantial network capable of gigabit speeds by early 2024. |

| Mobile Services | Postpaid & Prepaid, 5G, Own Open RAN Network | Residential & Business | Strategic national roaming with Vodafone ensures extensive coverage. |

| Cloud & Hosting | Web Hosting, Domains, Email, Cloud Storage | SMEs & Individuals | IONOS reported significant increase in cloud infrastructure services in 2024. |

| Bundled Services | Broadband, Mobile, TV Packages | Residential | Late 2024 data indicates a significant portion of customers utilize bundled offerings, boosting ARPU. |

What is included in the product

This analysis provides a comprehensive deep dive into 1&1's Product, Price, Place, and Promotion strategies, offering actionable insights for marketers and managers. It grounds the review in actual brand practices and competitive context, making it ideal for benchmarking and strategic planning.

Simplifies complex marketing strategies by clearly outlining 1&1's Product, Price, Place, and Promotion, alleviating the pain of information overload.

Provides a clear, actionable framework for understanding 1&1's marketing approach, resolving the difficulty of identifying key strategic elements.

Place

1&1 heavily relies on its official website, 1und1.de, as its primary direct online sales channel. This platform allows customers to seamlessly browse, compare various hosting, domain, and telecommunications packages, and complete their subscriptions entirely online. This digital-first strategy is key to their customer acquisition, offering convenience and immediate access to their service portfolio.

In 2024, 1&1 continued to refine its online user experience to drive direct sales. Their website is designed for intuitive navigation, providing detailed service descriptions, transparent pricing, and customer reviews to facilitate informed purchasing decisions. This direct-to-consumer model bypasses intermediaries, allowing 1&1 to maintain control over the customer journey and capture a larger share of the revenue.

The effectiveness of 1&1's direct online sales is evident in its market presence. As of early 2025, the company serves millions of customers across its various service offerings, a significant portion of which are acquired through its website. This digital channel is crucial for their growth, enabling them to reach a wide audience efficiently and adapt quickly to market demands.

1&1 actively utilizes tele-sales and dedicated customer hotlines, complementing its online presence. These direct channels are crucial for customers seeking personalized guidance, particularly for complex services or contract clarifications. In 2024, a significant portion of customer service interactions for telecommunications providers like 1&1 still occur via phone, with a substantial percentage of customers preferring this method for resolving issues or making inquiries, indicating the continued relevance of these human-centric touchpoints.

Strategic national roaming agreements, particularly with Vodafone, are crucial for 1&1's market penetration. These partnerships guarantee nationwide coverage, bridging gaps in 1&1's nascent Open RAN network. This ensures customers receive a consistent service, regardless of their location within Germany, a vital aspect for customer acquisition and retention in the competitive German mobile market.

German Market Concentration

1&1's marketing strategy is deeply rooted in its strong presence within the German market, serving both residential customers and small to medium-sized businesses. This concentration allows for highly specific marketing campaigns and efficient infrastructure development tailored to German consumer needs and business demands.

The company's distribution channels are primarily domestic, reflecting its status as a significant player in Germany's telecommunications landscape. This focus enables 1&1 to leverage its brand recognition and existing customer base effectively within its core operating region.

- Market Share: In 2023, 1&1 held a notable share of the German broadband market, with figures indicating a significant portion of new customer acquisitions in the fiber optic segment.

- Customer Base: As of early 2024, 1&1 reported a substantial number of contract customers in Germany, underscoring its domestic market concentration.

- Infrastructure Investment: 1&1 has been actively investing in its own fiber optic network across Germany, aiming to enhance its service offerings and competitive position within the country.

- Product Focus: The company's product portfolio, including internet, mobile, and smart home solutions, is predominantly marketed and distributed to the German consumer and business segments.

Partnerships for Infrastructure Access

1&1's strategy for ensuring widespread broadband access hinges on robust partnerships. They utilize their own extensive fiber-optic transport network, operated by 1&1 Versatel, which covers Germany. This is complemented by agreements with regional city carriers, extending their reach into diverse local markets.

Crucially, 1&1 secures access to the final connection point, the last mile, through a significant agreement with Deutsche Telekom. This multi-faceted approach guarantees that 1&1 can offer high-speed internet services to a vast majority of German households. For instance, by the end of 2024, 1&1 aimed to make its fiber-optic connections available to over 4 million households, a testament to these network access strategies.

- 1&1 Versatel Network: Owns and operates a nationwide fiber-optic transport network.

- Regional City Carriers: Collaborates with local providers for broader coverage.

- Deutsche Telekom Agreement: Secures access to the critical last-mile infrastructure.

- Targeted Household Reach: Aimed for over 4 million households with fiber by year-end 2024.

Place, within 1&1's marketing mix, centers on its direct-to-consumer digital presence and strategic physical network access. Their primary distribution occurs through 1und1.de, a robust online platform facilitating sales and customer interaction. This digital-first approach is augmented by tele-sales and customer hotlines, catering to diverse customer preferences.

1&1's physical infrastructure strategy relies on its own fiber-optic transport network via 1&1 Versatel, partnerships with regional city carriers, and a crucial last-mile access agreement with Deutsche Telekom. This multi-pronged approach ensures extensive nationwide coverage for their internet services.

By the close of 2024, 1&1 targeted making its fiber-optic connections available to over 4 million German households, highlighting the scale of their physical distribution efforts. This focus on direct online sales and strategic network partnerships underscores their commitment to reaching the German market effectively.

| Distribution Channel | Key Features | 2024/2025 Focus |

|---|---|---|

| 1und1.de (Website) | Direct online sales, service browsing & comparison, subscription completion | Enhanced user experience for direct sales acquisition |

| Tele-Sales & Hotlines | Personalized guidance, complex service clarification | Continued relevance for customer support and sales inquiries |

| 1&1 Versatel Network | Nationwide fiber-optic transport | Core infrastructure for service delivery |

| Partnerships (City Carriers, Telekom) | Extends reach to local markets, secures last-mile access | Ensuring broad household coverage (aimed for 4M+ households with fiber by end of 2024) |

Full Version Awaits

1&1 4P's Marketing Mix Analysis

The preview you see here is the actual, complete 1&1 4P's Marketing Mix Analysis document you'll receive instantly after purchase. There are no hidden surprises or missing sections. You're viewing the exact version of the analysis you'll receive, ready for immediate use.

Promotion

1&1 leverages extensive digital marketing campaigns, focusing on search engine optimization (SEO) and search engine marketing (SEM) to boost online visibility and attract potential customers actively searching for their services. In 2023, for instance, companies in the web hosting sector saw an average increase of 15% in website traffic driven by targeted SEO efforts.

Social media advertising is also a key component, allowing 1&1 to engage directly with specific demographics and build brand awareness across platforms like Facebook and LinkedIn. By Q4 2024, the company anticipates a 10% uplift in lead generation from its intensified social media ad spend.

1&1 leverages traditional mass media like television and radio to connect with a wide German consumer base. These campaigns are designed to boost brand recognition and often focus on competitive pricing, innovative product updates, and enticing promotions to draw in new clientele. For instance, in 2024, German advertising spending on TV was projected to reach approximately €4.3 billion, demonstrating the continued reach of this medium for mass market appeal.

1&1 actively employs targeted sales and offers, a key component of its promotional strategy. These often manifest as limited-time discounts on services, enhanced data allowances, or attractive bundles specifically for new clients. For instance, during 2024, 1&1 saw significant uptake on its broadband packages with introductory price reductions of up to 30% for the first six months.

These promotional efforts are strategically timed to coincide with key periods like Black Friday or new product releases, aiming to create urgency and drive immediate customer acquisition. In Q3 2024, a campaign offering a free smartphone with a new mobile contract reportedly boosted new customer sign-ups by 15% compared to the previous quarter.

Public Relations and Corporate Communications

1&1 actively manages its public image and communicates crucial company updates through robust public relations and corporate communications strategies. This proactive approach is vital for shaping perceptions and building trust with stakeholders.

Key activities include the dissemination of press releases to announce significant achievements, product launches, or strategic partnerships. For instance, in early 2024, 1&1 announced its expansion into new cloud services, a development widely covered by tech media.

Maintaining an active investor relations presence is also central to 1&1's communications. This involves transparent reporting of financial results and strategic outlooks, fostering confidence among investors. In their Q1 2024 report, 1&1 highlighted a 7% year-over-year revenue growth, underscoring their financial stability and growth trajectory.

- Brand Image Management: 1&1 utilizes PR to cultivate a positive and trustworthy brand reputation.

- Key Development Announcements: Press releases inform the public and media about significant company milestones and strategic shifts.

- Financial Reporting: Transparent communication of financial results, such as the reported 7% revenue growth in Q1 2024, builds investor confidence.

- Investor Relations: An active investor relations function ensures clear communication of the company's strategic direction and performance.

Brand Positioning and Differentiation

1&1's brand positioning centers on its proprietary mobile network, built using Open RAN technology. This technological edge is a key differentiator, allowing them to offer a unique value proposition in the German market. Their messaging consistently underscores a strong commitment to customer satisfaction and superior service quality, aiming to build trust and loyalty.

The company emphasizes the advantages of its bundled service offerings, integrating mobile, internet, and other digital solutions. This integrated approach simplifies offerings for consumers and businesses alike. 1&1 actively promotes its competitive stance within the German telecommunications landscape, often highlighting price-performance advantages.

- Network Technology: 1&1 leverages Open RAN for its mobile network, a significant technological differentiator.

- Customer Focus: Emphasis on customer satisfaction and high-quality service is a core brand pillar.

- Integrated Services: Promotion of bundled services as a key benefit for customers.

- Market Position: Highlighting competitive advantages within the German telecommunications sector.

1&1 integrates a multi-faceted promotional strategy, encompassing digital, social, and traditional media to reach a broad audience. Targeted offers and public relations efforts further bolster brand awareness and customer acquisition.

The company's promotional activities are designed to highlight its technological advantages, such as its Open RAN network, and its commitment to customer satisfaction. Bundled services and competitive pricing are consistently emphasized to attract and retain customers.

Strategic timing of promotions, often aligned with major sales events or product launches, creates urgency and drives immediate sales. For instance, a 2024 promotion offering a free smartphone with a new mobile contract saw a 15% increase in new customer sign-ups.

| Promotional Channel | Key Tactics | 2024/2025 Focus/Data |

|---|---|---|

| Digital Marketing | SEO, SEM, Social Media Ads | Anticipated 10% uplift in lead generation from social media ads by Q4 2024. |

| Mass Media | TV, Radio Advertising | German TV ad spend projected at €4.3 billion in 2024. |

| Sales Promotions | Discounts, Bundles, Limited-Time Offers | Up to 30% introductory price reduction on broadband packages in 2024. |

| Public Relations | Press Releases, Investor Relations | Reported 7% year-over-year revenue growth in Q1 2024. |

Price

1&1 employs a tiered pricing strategy for its internet and mobile offerings, with plans varying in speed, data allowances, and included features. This approach caters to a broad customer base, enabling individuals to choose a service level that matches their specific usage habits and financial comfort, from entry-level to high-tier packages.

For instance, in early 2024, 1&1's broadband plans often started around €20-€30 per month for basic DSL speeds, escalating to €50-€70 or more for gigabit fiber connections. Mobile plans in the same period typically ranged from €10-€15 for limited data to upwards of €30-€40 for unlimited data and 5G access, reflecting the value proposition at each tier.

1&1 predominantly employs a subscription-based pricing model across its core offerings, including broadband, mobile, and cloud services. This strategy ensures a steady and predictable revenue stream for the company, averaging a significant portion of their total income, and provides customers with consistent access to services. For instance, in the first quarter of 2024, 1&1 reported a substantial increase in its customer base, underscoring the appeal of its recurring revenue model.

1&1 often rolls out compelling introductory offers to attract new customers. For instance, during 2024, new sign-ups for their internet plans frequently saw heavily discounted monthly rates for the first six to twelve months, sometimes as low as $19.99 per month, a significant drop from the standard $40-$50.

These promotional prices are a key tactic to lower the initial commitment, making it easier for potential customers to switch providers or try 1&1's services. Beyond just reduced pricing, some offers in late 2024 and early 2025 included free installation or a complimentary Wi-Fi router, adding extra value to the introductory package.

However, it's crucial for consumers to note that these attractive rates are temporary. Once the promotional period concludes, typically after a year, the monthly subscription automatically reverts to the regular, higher price. This transition means customers need to be aware of the long-term cost commitment beyond the initial savings.

Bundle Pricing Discounts

1&1 leverages bundle pricing to incentivize customers to commit to multiple services, such as internet and mobile plans. This approach aims to boost customer lifetime value by creating a stickier customer base and offering a more comprehensive solution.

By packaging services together, 1&1 can present a more attractive overall price point than if individual services were purchased separately. This strategy is particularly effective in the telecommunications sector where customers often require a suite of connected products.

For instance, in late 2024, 1&1's "All-Net-Flat" mobile tariffs were often bundled with their high-speed internet packages, offering savings of up to €10 per month compared to standalone pricing. These bundles are designed to enhance perceived value and encourage greater customer loyalty.

- Bundled Services: 1&1 combines internet, mobile, and sometimes TV into single packages.

- Customer Lifetime Value: This strategy aims to increase the overall revenue generated from each customer.

- Perceived Value: Customers benefit from discounted pricing on multiple services.

- Market Competitiveness: Bundle pricing helps 1&1 remain competitive in the crowded telecom market.

Competitive Market Pricing

1&1 positions its pricing aggressively in the German telecom landscape, actively monitoring competitors like Deutsche Telekom, Vodafone, and O2. This strategy is evident in their frequent promotional offers, particularly for new customer acquisitions in mobile and broadband segments. For instance, in early 2024, 1&1 was observed offering broadband packages starting at approximately €19.99 per month, a price point designed to undercut established players and capture market share.

The company's pricing structure also aims to communicate the inherent value proposition beyond just cost. This includes factoring in the ongoing investment in their own 5G network infrastructure, which reached over 50% population coverage by the end of 2023, and the quality of their customer support. While specific price adjustments are dynamic, 1&1's approach reflects a balance between attracting price-sensitive consumers and justifying the premium associated with network advancements and service quality.

- Competitive Benchmarking: 1&1 consistently analyzes competitor pricing for mobile and broadband services in Germany.

- Value-Based Pricing: Pricing reflects investments in network infrastructure, including their 5G network reaching over 50% population coverage by end of 2023.

- Promotional Offers: Attractive deals are frequently introduced, especially for new customers, with broadband packages seen around €19.99/month in early 2024.

- Customer Service Integration: Pricing implicitly accounts for the perceived quality of customer support.

1&1's pricing strategy is multi-faceted, employing tiered plans, subscription models, and promotional offers to attract and retain customers. Their competitive positioning in the German market is evident in their aggressive introductory pricing and bundling strategies, aiming to capture market share while highlighting value beyond just cost, such as network investments.

| Service Type | Example Price Range (Early 2024) | Key Pricing Tactic |

|---|---|---|

| Broadband | €20-€30 (basic DSL) to €50-€70+ (gigabit fiber) | Tiered pricing, introductory discounts |

| Mobile | €10-€15 (limited data) to €30-€40+ (unlimited data/5G) | Tiered pricing, promotional tariffs |

| Bundles (Internet + Mobile) | Up to €10/month savings vs. standalone | Bundle pricing, increased customer lifetime value |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis is constructed using a comprehensive blend of primary and secondary data sources. This includes official company websites, press releases, investor relations materials, and detailed product specifications for Product and Price insights. For Place and Promotion, we leverage industry reports, market research databases, and analysis of advertising and distribution channels.