1&1 Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

1&1 Bundle

Unlock the strategic blueprint behind 1&1's success with our comprehensive Business Model Canvas. Discover how they effectively serve their customer segments and build key partnerships to deliver their value propositions. This detailed analysis is perfect for anyone looking to understand the core drivers of 1&1's thriving business.

Partnerships

1&1's 5G network expansion heavily depends on securing crucial infrastructure through key partnerships. They collaborate with companies like Vantage Towers and American Tower, who provide essential antenna sites and passive infrastructure necessary for building out their 5G capabilities.

Further strengthening their network, 1&1 leverages its sister company, 1&1 Versatel, for vital fiber optic connectivity to their mast sites. This integration is fundamental to the successful and efficient rollout of their 5G services.

The company also engages partners such as Eubanet and GfTD to facilitate site acquisition and provide construction support. These collaborations are critical for the physical deployment and expansion of 1&1's network infrastructure.

1&1 leverages national roaming agreements to provide comprehensive mobile coverage while its own network is under development. This strategy ensures customers maintain connectivity across Germany, even in areas not yet covered by 1&1's proprietary infrastructure.

Historically, Telefónica (O2) served as 1&1's primary national roaming partner. This partnership was crucial for offering a complete service offering to their growing customer base.

As of 2024, 1&1 is actively transitioning its national roaming services to Vodafone Germany. This strategic shift is designed to enhance network quality and expand coverage capabilities.

The migration of existing 1&1 customers to the Vodafone Germany network for national roaming is slated for completion by autumn 2025, ensuring a seamless experience and continued nationwide connectivity.

1&1's strategic reliance on technology and equipment suppliers is paramount, particularly with its fully virtualized 5G network built on Open RAN. Rakuten Symphony serves as a critical general contractor, supplying active network equipment and ensuring mobile performance, underpinning the network's innovative architecture.

Content and Application Providers

1&1 likely collaborates with a diverse range of content and application providers to enhance its broadband and mobile service packages. These partnerships are crucial for delivering a compelling value proposition to customers, moving beyond basic connectivity to offer integrated digital experiences. For instance, partnerships could bring popular streaming services, advanced cloud storage solutions, or innovative smart home technologies directly to 1&1 subscribers.

While specific details on these content partnerships are not always publicly disclosed in financial reports, the telecommunications sector widely recognizes their importance. By integrating third-party applications and content, 1&1 can differentiate its offerings and capture a larger share of the digital services market. This strategy allows them to cater to a broader customer base with varied digital needs and preferences.

Consider the following potential areas of partnership:

- Streaming Services: Bundling access to video-on-demand or live TV platforms to complement broadband offerings.

- Cloud & Productivity Tools: Integrating services like cloud storage, online office suites, or cybersecurity applications.

- Smart Home & IoT: Partnering with providers of connected devices and platforms to enable seamless smart home integration.

Retail and Distribution Partners

Beyond its direct online sales channels, 1&1 actively cultivates relationships with retail partners to broaden its market penetration for mobile and broadband services. These collaborations are crucial for reaching customer segments that may be less inclined towards digital engagement or who value the personalized assistance offered in physical retail environments.

In 2024, 1&1 continued to leverage its retail network to drive customer acquisition. For instance, its partnerships with electronics retailers and independent telecommunications dealers allowed it to tap into a wider customer base. This strategy proved effective, especially in acquiring customers for its mobile offerings, where in-person consultations can significantly influence purchasing decisions.

- Retail Network Expansion: 1&1 collaborates with major electronics chains and independent dealers to offer its mobile and broadband contracts, extending its physical presence.

- Customer Acquisition for Specific Segments: These partnerships are vital for capturing customers who prefer in-person sales interactions or are less comfortable with online purchasing.

- Brand Portfolio Diversification: The company's varied brand portfolio, including 1&1, Drillisch, and United Internet, allows for tailored distribution strategies across different retail partner types.

- Market Penetration: In 2024, these retail collaborations contributed significantly to 1&1's overall market share growth in the competitive German telecommunications landscape.

1&1's strategic partnerships are foundational to its 5G network build-out and service delivery. Collaborations with infrastructure providers like Vantage Towers and American Tower are essential for securing antenna sites. Furthermore, its relationship with sister company 1&1 Versatel ensures vital fiber optic connectivity, a critical component for 5G deployment.

The company also relies on partners such as Eubanet and GfTD for site acquisition and construction, facilitating the physical expansion of its network infrastructure. These alliances are key to efficiently establishing the physical backbone of their 5G services.

1&1's network development is further supported by its strategic shift in national roaming agreements. While Telefónica (O2) was a historical partner, 1&1 is actively transitioning its national roaming services to Vodafone Germany as of 2024, aiming to enhance coverage and quality. This migration is expected to be completed by autumn 2025, ensuring continued nationwide connectivity for its customers.

In terms of technology, 1&1's fully virtualized 5G network, built on Open RAN, heavily depends on suppliers like Rakuten Symphony, which acts as a general contractor providing active network equipment. This partnership is crucial for the operational performance and innovative architecture of their 5G infrastructure.

Beyond infrastructure and technology, 1&1 actively partners with content and application providers to enrich its service bundles. These collaborations, though not always detailed publicly, are vital for differentiating its offerings and capturing a broader market share by integrating services like streaming, cloud solutions, and smart home technologies.

Retail partnerships are also a significant channel for 1&1's customer acquisition. In 2024, collaborations with electronics retailers and independent dealers helped extend its market penetration, particularly for mobile services, where in-person engagement remains influential.

| Partnership Type | Key Partners | Role/Contribution | 2024 Impact/Focus |

|---|---|---|---|

| Infrastructure | Vantage Towers, American Tower | Antenna sites, passive infrastructure | Securing sites for 5G expansion |

| Connectivity | 1&1 Versatel | Fiber optic connectivity to mast sites | Enabling efficient 5G rollout |

| Site Acquisition & Construction | Eubanet, GfTD | Site acquisition, construction support | Physical deployment of network |

| National Roaming | Vodafone Germany (transitioning from Telefónica) | Mobile coverage in non-1&1 areas | Enhancing network quality and coverage |

| Technology & Equipment | Rakuten Symphony | Active network equipment, general contractor | Underpinning Open RAN 5G architecture |

| Content & Applications | (Various undisclosed) | Bundled services (streaming, cloud, IoT) | Differentiating service offerings |

| Retail Distribution | Electronics retailers, independent dealers | Market penetration, customer acquisition | Expanding reach for mobile and broadband |

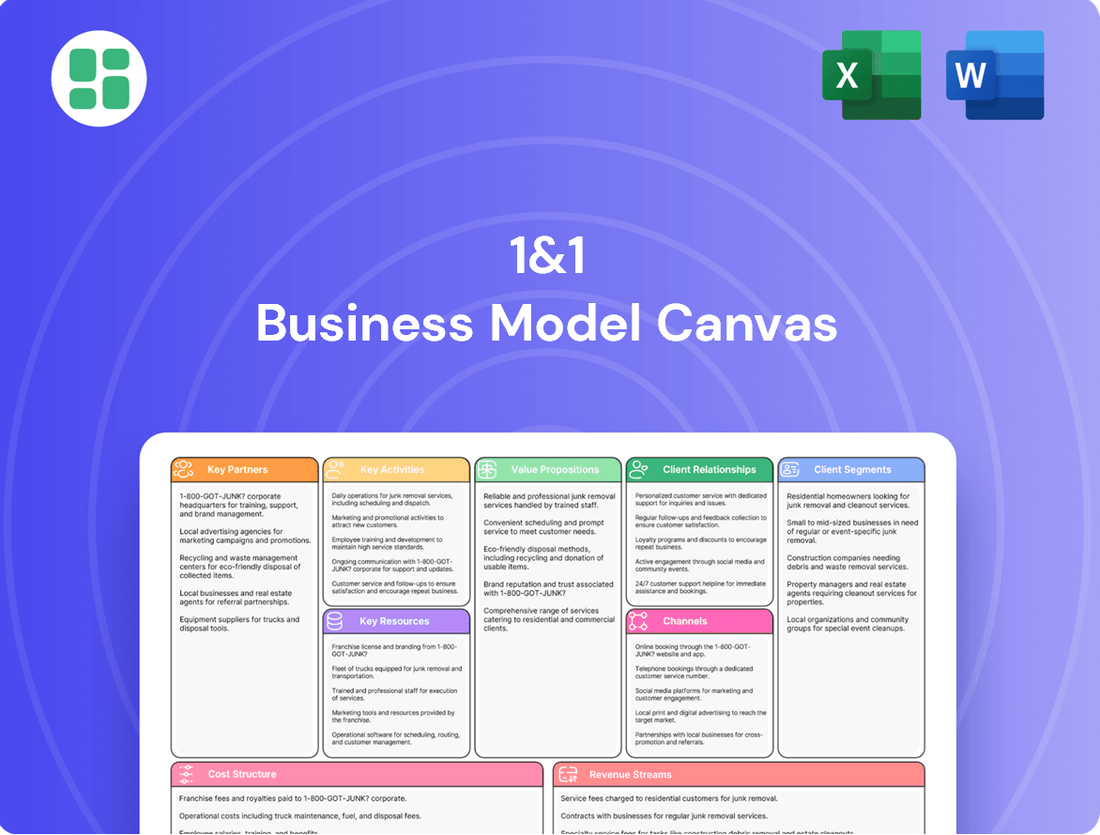

What is included in the product

A detailed Business Model Canvas for 1&1, outlining its customer segments, value propositions, and revenue streams in the web hosting and cloud services market.

This canvas provides a strategic overview of 1&1's operations, channels, and key resources for delivering digital solutions to businesses and individuals.

Simplifies complex business strategy into a clear, actionable framework.

Helps teams align on key business drivers and identify areas for improvement.

Activities

1&1's core activity involves building and running its own 5G mobile network using Open RAN technology. This means setting up antenna sites, installing base stations, and linking them via fiber optics. These efforts have ramped up significantly since 2024.

The company is pushing to cover 25% of German households with its 5G network by the close of 2025. The long-term goal is to reach 50% household coverage by 2030, demonstrating a strong commitment to network expansion despite inherent complexities.

1&1 prioritizes growing its customer base and keeping current subscribers happy in both mobile and broadband services. This involves targeted marketing, attractive pricing, and smooth transitions for customers moving to newer networks.

In fiscal year 2024, 1&1 saw a notable increase in its total customer contracts, with mobile internet subscriptions showing particularly strong growth.

1&1 actively develops and innovates its service portfolio, which is a core activity. This includes a wide range of offerings such as high-speed broadband internet, various mobile communication plans for both postpaid and prepaid customers, and a suite of cloud-based applications designed for businesses and individuals.

A significant part of this innovation involves leveraging their Open RAN network infrastructure. This allows 1&1 to pioneer and roll out new 5G services, with Fixed Wireless Access being a prime example, offering a competitive alternative to traditional fixed-line broadband. They are also continuously working to improve and expand their existing services to meet evolving customer demands.

For instance, in 2024, 1&1 continued its network expansion and optimization efforts, aiming to provide enhanced speeds and reliability. Their investment in Open RAN technology is a strategic move to foster greater flexibility and cost-efficiency in their network development, which directly feeds into their product innovation pipeline.

Billing and Customer Service Management

1&1's key activities heavily rely on the efficient management of billing and customer service. This encompasses everything from activating new contracts and processing changes to handling terminations. A significant focus in 2024 has been on supporting customers through a large-scale mobile customer migration, ensuring a smooth transition and addressing any arising technical issues.

Providing robust customer support is paramount. This includes addressing a wide range of customer inquiries, from billing discrepancies to technical support for their various services. In 2024, 1&1 has invested in improving its customer service infrastructure to handle increased contact volumes, especially during the mobile migration phase.

- Billing Operations: Streamlining contract activation, modification, and termination processes to minimize errors and customer friction.

- Customer Support: Offering multi-channel support (phone, email, chat) to resolve inquiries and technical issues promptly.

- Migration Support: Providing dedicated assistance to mobile customers during the ongoing large-scale migration in 2024.

- Self-Service Portals: Enhancing online tools for customers to manage their accounts and find answers independently.

Sales and Marketing

1&1 engages in extensive sales and marketing to reach both individual consumers and small to medium-sized businesses with its wide range of services. These efforts are crucial for communicating the value of their offerings and attracting new customers.

The company's marketing strategy utilizes a variety of channels to effectively promote its products and services. This includes digital advertising, content marketing, and direct outreach to target audiences.

- Digital Presence: 1&1 heavily invests in online advertising and search engine optimization to ensure visibility and attract potential customers searching for web hosting, cloud services, and other digital solutions.

- Customer Acquisition: A significant portion of 1&1's budget is allocated to customer acquisition through various campaigns designed to highlight competitive pricing and feature sets.

- Brand Building: Marketing activities also focus on building brand awareness and trust within the target markets, emphasizing reliability and customer support.

- Promotional Offers: 1&1 frequently offers special promotions and discounts to incentivize new sign-ups and encourage upgrades, a common tactic in the competitive tech service industry.

1&1's key activities revolve around building and operating its 5G mobile network using Open RAN technology, aiming for 25% German household coverage by the end of 2025. They also focus on customer acquisition and retention across mobile and broadband services, evidenced by strong growth in mobile internet subscriptions in 2024. Innovation is central, with the development of new 5G services like Fixed Wireless Access, supported by ongoing network optimization.

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a complete and unedited view of its structure and content. This ensures you know precisely what you are acquiring, with no discrepancies between the preview and the final deliverable. You'll gain immediate access to this comprehensive tool, ready for your strategic planning needs.

Resources

1&1's burgeoning mobile network infrastructure, encompassing antenna sites, base stations, and data centers, is a cornerstone of its operations. This physical network is further strengthened by its extensive fiber optic transport network, operated by 1&1 Versatel, ensuring robust connectivity.

The company's strategic acquisition and holding of valuable spectrum licenses are paramount. These licenses are the fundamental enablers for 1&1 to provide its mobile communications services, directly impacting its competitive edge and service delivery capabilities.

1&1 benefits immensely from a robust brand reputation and a large, loyal customer base, particularly within Germany's telecommunications sector. This strong market standing, bolstered by the integration of Drillisch's brand equity, translates into significant trust and recognition among consumers, offering a distinct competitive edge.

As of the first quarter of 2025, 1&1 reported an impressive 16.35 million customer contracts. This substantial customer base is a critical asset, providing a stable revenue stream and a platform for cross-selling various services, from mobile and internet to cloud solutions.

Skilled employees, especially engineers for network development and IT specialists for virtualized operations, are fundamental to 1&1's Open RAN strategy. Their deep knowledge is essential for constructing and managing this advanced infrastructure.

Customer service personnel are equally critical, ensuring the delivery of high-quality services to end-users. The expertise of these teams directly impacts the reliability and performance of 1&1's network offerings.

In 2024, the demand for specialized telecom talent, particularly in areas like Open RAN and cloud-native network functions, has intensified. Companies like 1&1 are investing heavily in attracting and retaining these professionals to maintain a competitive edge.

IT Systems and Software

1&1 heavily relies on advanced IT systems and software to manage its entire operation, from its fully virtualized network to customer data and billing. This robust digital infrastructure is the backbone of their service delivery, enabling efficient operations and customer management.

The Open RAN architecture, a key component of 1&1's network strategy, inherently requires sophisticated software and a network of decentralized data centers. This technological foundation allows for greater flexibility and innovation in mobile network deployment.

In 2024, 1&1 continued to invest significantly in its IT infrastructure. For instance, their cloud services, a major area of their business, saw continued expansion, with over 4 million hosted websites managed on their platforms. This growth necessitates ongoing upgrades and maintenance of their underlying IT systems and software.

- Network Virtualization: Software-defined networking (SDN) and network functions virtualization (NFV) are critical for managing 1&1's dynamic and flexible network infrastructure.

- Customer Relationship Management (CRM): Sophisticated CRM software is essential for managing millions of customer accounts, billing, and support interactions.

- Cloud Platform Management: Advanced software suites are used to manage and scale their extensive cloud hosting services, ensuring reliability and performance for their clients.

- Open RAN Software: The implementation of Open RAN relies on specialized software for managing distributed radio units and baseband processing, fostering an open ecosystem.

Financial Capital and Funding

1&1's ambitious network expansion necessitates substantial financial backing. This capital is sourced through a combination of internal cash flow, equity, and debt financing. For instance, in 2024, 1&1 secured a development loan from the Japan Bank for International Cooperation (JBIC) channeled through United Internet AG, specifically earmarked for mobile network construction.

The company's financial strategy is crucial for its growth, particularly in the capital-intensive telecommunications sector. This involves managing various funding streams to support infrastructure development and operational expenses. The JBIC loan underscores the reliance on external financing for major projects.

- Internal Cash Flow: Generated from ongoing business operations.

- Equity Financing: Raising capital by selling shares.

- Debt Financing: Utilizing loans and credit facilities, such as the JBIC development loan.

- Strategic Partnerships: Potential collaborations to share infrastructure costs.

1&1's core strength lies in its extensive physical network infrastructure, including antenna sites and data centers, complemented by a robust fiber optic transport network. This is underpinned by crucial spectrum licenses essential for mobile service delivery.

The company leverages a strong brand reputation and a significant customer base of 16.35 million contracts as of Q1 2025, providing a stable revenue foundation.

Key intellectual property includes their Open RAN strategy, advanced IT systems, and specialized software for network virtualization and cloud platform management.

Financial resources are vital, with 1&1 securing funding through internal cash flow, equity, and debt, exemplified by a 2024 development loan from JBIC for network construction.

| Key Resource Category | Specific Assets/Capabilities | 2024/2025 Data Point |

|---|---|---|

| Physical Infrastructure | Mobile Network Infrastructure (Antenna sites, Base stations, Data Centers) | Ongoing expansion and deployment |

| Intellectual Property | Spectrum Licenses | Essential for mobile service operation |

| Brand & Customer Base | Brand Reputation, Customer Contracts | 16.35 million customer contracts (Q1 2025) |

| Financial Resources | Internal Cash Flow, Equity, Debt Financing | JBIC development loan secured in 2024 for network construction |

Value Propositions

1&1 provides dependable, high-speed broadband internet, utilizing its extensive fiber-optic network and partnerships with regional city carriers. This ensures robust connectivity for both homes and businesses.

In 2023, 1&1 reported a significant increase in its broadband customer base, reaching over 4 million connections, highlighting the strong demand for its reliable internet services.

This high-speed offering is crucial for modern households and businesses that rely on fast, stable internet for everything from remote work and online education to streaming and cloud-based operations.

1&1 offers a complete suite of mobile services, encompassing both postpaid and prepaid options. This broad offering caters to diverse customer needs for mobile connectivity.

The company is actively deploying its own 5G network, aiming to provide customers with cutting-edge mobile technology. By focusing on 5G expansion, 1&1 ensures access to faster speeds and improved performance for its users.

In 2024, 1&1 continued its strategic build-out of its 5G infrastructure, with a target to cover a significant portion of German households with its high-speed network by the end of the year.

Beyond just providing internet and mobile services, 1&1 offers a suite of integrated cloud-based applications. These include services like online storage, cloud telephony, and even smart home solutions, adding significant value for their customers.

These additional services are particularly beneficial for small to medium-sized businesses, offering them a convenient, all-in-one digital ecosystem. For instance, their cloud telephony solutions can streamline communication, a critical aspect for many businesses, especially as remote work continues to be prevalent.

In 2024, the demand for integrated cloud solutions continued to grow, with businesses increasingly looking for ways to enhance productivity and collaboration. 1&1's strategy to bundle these applications with their core connectivity offerings positions them to capitalize on this trend, making their internet and mobile packages more attractive and versatile.

Competitive Pricing and Value for Money

1&1 strategically targets a broad customer base by offering competitive pricing, ensuring value for money. This approach allows them to attract both budget-conscious individuals and those seeking premium services, effectively covering diverse market segments.

The company leverages its discount brands to further enhance its appeal to price-sensitive consumers. This multi-brand strategy is a cornerstone of their business model, enabling them to capture market share across different price points.

- Competitive Tariffs: 1&1 consistently offers attractive pricing for its telecommunications and hosting services.

- Value Proposition: The core of their strategy is delivering strong value, meaning customers receive high-quality services at competitive rates.

- Market Reach: By catering to both value and premium segments, 1&1 broadens its customer reach and revenue potential.

- Brand Differentiation: Discount brands allow for targeted marketing and service packages, appealing to specific consumer needs without diluting the premium brand image.

Reliable and Seamless Connectivity

1&1 is focused on delivering dependable and smooth connectivity for its business clients throughout Germany. This is being achieved through the development of its own mobile network and smart national roaming partnerships.

The company is actively moving its existing customer base onto this new network infrastructure. This migration is designed to elevate the overall user experience, though some temporary disruptions might occur during the transition phase.

- Network Investment: 1&1 reported significant investments in its network infrastructure throughout 2023 and into 2024, aiming to solidify its position as a reliable provider.

- Customer Migration: As of early 2024, 1&1 continued its strategic customer migration to its proprietary network, with a target of onboarding a substantial portion of its user base by the end of the year.

- Roaming Agreements: National roaming agreements are crucial for ensuring coverage gaps are filled, particularly during the network build-out phase, providing a seamless experience even in areas not yet fully covered by 1&1's own infrastructure.

1&1 offers robust, high-speed broadband internet powered by an extensive fiber-optic network and strategic collaborations with regional carriers, ensuring reliable connectivity for homes and businesses. The company reported over 4 million broadband connections in 2023, demonstrating strong customer adoption.

1&1 provides a comprehensive mobile service portfolio, including both postpaid and prepaid plans, while actively expanding its 5G network. By the close of 2024, 1&1 aimed to cover a significant percentage of German households with its advanced 5G infrastructure.

The company enhances its offerings with integrated cloud services such as online storage and cloud telephony, creating a valuable all-in-one digital ecosystem, particularly beneficial for small to medium-sized businesses seeking to boost productivity and collaboration.

1&1 employs a competitive pricing strategy, augmented by discount brands, to appeal to a wide range of consumers and capture diverse market segments. This approach ensures they deliver strong value, offering high-quality services at attractive rates.

1&1 is committed to providing dependable connectivity for its business clients through its own mobile network development and national roaming partnerships. The company continued its strategic customer migration to its proprietary network throughout early 2024, aiming for substantial onboarding by year-end.

| Value Proposition | Description | Key Data/Facts |

|---|---|---|

| Dependable High-Speed Connectivity | Utilizing extensive fiber-optic network and partnerships for robust home and business internet. | Over 4 million broadband connections reported in 2023. |

| Comprehensive Mobile Services & 5G Expansion | Offering a full suite of mobile plans and actively deploying own 5G network. | Targeted significant German household coverage with 5G by end of 2024. |

| Integrated Cloud Solutions | Bundling cloud-based applications like storage and telephony for added value. | Growing demand for integrated cloud solutions in 2024, enhancing business productivity. |

| Competitive Pricing & Value | Attracting broad customer base through competitive tariffs and discount brands. | Multi-brand strategy to capture market share across different price points. |

| Reliable Business Connectivity & Network Migration | Developing own mobile network and national roaming for business clients. | Strategic customer migration to proprietary network ongoing in early 2024. |

Customer Relationships

1&1 heavily relies on its extensive online portals and self-service options, enabling customers to independently manage accounts, review bills, adjust tariffs, and access support. This digital-first approach caters to the convenience of digitally adept users, streamlining their interaction with the company.

1&1 offers dedicated customer support through various channels, including phone and online chat, to address inquiries and technical issues. This commitment to support is vital for customer retention, particularly during critical service transitions like migrating to new network infrastructure.

1&1 likely focuses on building strong customer bonds through tailored offers and rewards. This strategy aims to increase customer lifetime value and minimize the likelihood of customers switching to competitors. For instance, in 2024, telecommunications companies reported that personalized promotions can boost customer retention by up to 15%.

These personalized offers could include exclusive discounts on new services or bundled packages for long-standing clients. Loyalty programs might provide tiered benefits, such as faster customer support or early access to new features, fostering a sense of appreciation and encouraging continued engagement with 1&1's offerings.

Community Building and Engagement

While specific details on community building for 1&1 are not always prominent in public disclosures, a robust strategy likely involves fostering user interaction. This could manifest through dedicated online forums or active social media channels where customers can share tips, troubleshoot issues, and connect with one another. Such engagement enhances the customer experience beyond basic service provision.

This approach to customer relationships can significantly boost loyalty and reduce churn. For instance, a study by Bain & Company found that companies with strong community engagement see a 20-30% increase in customer lifetime value. By facilitating peer-to-peer support, 1&1 can effectively scale its customer service efforts and create a more valuable ecosystem for its users.

- Community Forums: Dedicated platforms for users to share knowledge and solutions.

- Social Media Engagement: Active presence on platforms to interact with customers and build brand advocacy.

- Customer Feedback Loops: Mechanisms for gathering and acting upon user suggestions to improve services.

- Exclusive Content/Events: Offering value-added resources or opportunities for community members.

Contractual Relationships (Long-term)

1&1 heavily relies on contractual relationships, particularly long-term agreements for its broadband and mobile offerings. These contracts are fundamental to its business model, creating predictable, recurring revenue. For instance, many customers sign up for 24-month broadband contracts, locking in their service and providing 1&1 with a stable income base.

This contractual foundation is crucial for financial planning and investment. By securing customers for extended periods, 1&1 can forecast revenue with greater accuracy, which is vital for managing operational costs and investing in network infrastructure. In 2023, 1&1 reported a significant portion of its revenue was derived from its existing customer base, underscoring the importance of these long-term contracts.

- Long-term contracts: The backbone of 1&1's customer acquisition strategy, ensuring sustained revenue.

- Recurring revenue: Contracts for broadband and mobile services generate predictable income streams.

- Customer stability: Long-term commitments reduce churn and foster a loyal customer base.

- Financial predictability: Contracts allow for more reliable revenue forecasting and business planning.

1&1 cultivates customer relationships through a blend of digital self-service, direct support, and loyalty initiatives. Their online portals empower customers to manage accounts independently, while phone and chat support address specific needs, especially during crucial service changes. Personalized offers and loyalty programs are key to boosting customer lifetime value and retention, with tailored promotions potentially increasing retention by up to 15% in 2024.

Community building, through forums and social media, further enhances the customer experience by enabling peer-to-peer support and feedback. This engagement can significantly boost customer loyalty and lifetime value, with studies showing a 20-30% increase in lifetime value for companies with strong community engagement.

Contractual relationships, particularly long-term agreements for broadband and mobile services, form the core of 1&1's customer base, ensuring predictable recurring revenue. These contracts are vital for financial planning, allowing for accurate revenue forecasting and investment in infrastructure, as evidenced by a significant portion of 1&1's revenue in 2023 stemming from its existing customer base.

| Relationship Aspect | Description | Impact | Example Data (2024/2025) |

|---|---|---|---|

| Digital Self-Service | Online portals for account management, billing, and support. | Customer convenience, operational efficiency. | High adoption rates for online service management. |

| Direct Customer Support | Phone and online chat for inquiries and issue resolution. | Customer retention, problem-solving. | Focus on reducing average handling time for support calls. |

| Loyalty Programs & Personalization | Tailored offers, discounts, and tiered benefits. | Increased customer lifetime value, reduced churn. | Personalized promotions can boost retention by up to 15%. |

| Community Engagement | Forums, social media interaction, and feedback loops. | Enhanced customer experience, brand advocacy. | Community engagement can increase customer lifetime value by 20-30%. |

| Contractual Agreements | Long-term contracts for broadband and mobile services. | Predictable recurring revenue, financial stability. | Majority of revenue derived from long-term contracts. |

Channels

1&1 leverages its proprietary websites and robust e-commerce infrastructure as a core channel for directly selling its broadband, mobile, and cloud services. This direct-to-consumer approach is a significant driver of customer acquisition, offering efficiency and broad market penetration.

In 2024, the e-commerce sector continued its upward trajectory, with global online retail sales projected to reach trillions of dollars. For companies like 1&1, this signifies a massive opportunity to capture market share through optimized online sales funnels and a seamless digital customer experience.

1&1 leverages direct sales teams and dedicated call centers as crucial customer interaction channels. These channels facilitate personalized consultations, enabling the company to effectively upsell and cross-sell services, thereby maximizing customer lifetime value. In 2024, a significant portion of 1&1's customer acquisition and retention efforts are channeled through these direct touchpoints, reflecting their importance in building strong customer relationships and driving revenue growth.

While 1&1 is predominantly an online business, it strategically utilizes a network of physical retail stores. These stores, whether company-owned or operated through partnerships, serve a crucial role in catering to customers who value face-to-face interactions for product exploration and customer service. This hybrid approach expands 1&1's reach beyond digital channels.

Partner Networks and Affiliates

1&1 leverages a robust network of partners and affiliates to broaden its market presence. These collaborations often involve online comparison platforms, independent sales representatives, and complementary service providers who endorse 1&1's offerings to their customer bases.

For instance, in 2023, affiliate marketing accounted for a significant portion of customer acquisition for many digital service providers, with some reporting over 20% of new sign-ups originating from these channels. This strategy allows 1&1 to tap into established audiences without the direct overhead of extensive marketing campaigns.

- Affiliate Marketing: Utilizes a commission-based model where partners earn a fee for directing customers to 1&1.

- Reseller Programs: Enables other businesses to sell 1&1 products and services under their own brand or as an add-on.

- Strategic Partnerships: Collaborates with hardware providers or software developers to offer bundled solutions, increasing value for customers.

Advertising and Marketing Campaigns

1&1 leverages extensive advertising campaigns across TV, online platforms, and print media. These campaigns are vital for building brand recognition and clearly communicating the value of their services, ultimately driving potential customers towards their sales channels.

Customer acquisition costs are a significant factor in 1&1's marketing strategy. In 2023, for instance, the company reported substantial marketing expenditures aimed at attracting new subscribers to its diverse range of digital products and services.

- Brand Awareness: 1&1's advertising aims to keep its brand top-of-mind for consumers seeking internet, cloud, or hosting solutions.

- Value Proposition Communication: Campaigns highlight key benefits such as speed, reliability, and customer support to differentiate from competitors.

- Traffic Generation: Advertising efforts are directly linked to driving traffic to their website and sales teams, converting interest into customer sign-ups.

- Customer Acquisition Costs (CAC): Significant investment is allocated to marketing, reflecting the competitive nature of the digital services market. For example, in 2023, marketing and sales expenses represented a notable portion of their operating costs.

1&1's channel strategy is multifaceted, encompassing direct online sales, a dedicated sales force, call centers, and a select network of physical stores. These channels are designed to reach a broad customer base and cater to diverse purchasing preferences.

In 2024, the digital landscape continues to emphasize seamless online experiences, making 1&1's e-commerce platform a critical revenue driver. This focus is supported by the ongoing growth in global online retail, projected to exceed trillions of dollars, underscoring the importance of efficient digital sales funnels.

The company also relies on strategic partnerships and affiliate marketing to expand its reach. These collaborations allow 1&1 to tap into new customer segments by leveraging the established audiences of partners, a strategy that proved effective in 2023 with affiliate marketing contributing significantly to customer acquisition for many digital service providers.

1&1's advertising efforts across various media are crucial for brand building and driving traffic to its sales channels. In 2023, the company's marketing and sales expenses reflected a considerable investment in customer acquisition within the competitive digital services market.

| Channel | Description | Key Role | 2023/2024 Relevance |

|---|---|---|---|

| E-commerce | Proprietary websites and online infrastructure | Direct sales, customer acquisition | Continued growth in online retail, essential for market penetration |

| Direct Sales & Call Centers | In-house sales teams and customer support | Personalized service, upselling/cross-selling | Crucial for customer relationships and revenue growth |

| Physical Retail Stores | Company-owned or partnered locations | Face-to-face interaction, customer service | Complements digital channels, caters to specific customer needs |

| Partnerships & Affiliates | Collaborations with other businesses and individuals | Market expansion, audience access | Significant contributor to customer acquisition, cost-effective reach |

| Advertising | TV, online, print media campaigns | Brand awareness, value communication | Drives traffic and customer sign-ups; significant marketing spend in 2023 |

Customer Segments

Private households, representing a core customer segment for telecommunications providers like 1&1, are primarily seeking reliable and fast internet access for their homes. This includes families needing connectivity for remote work, online education, and entertainment streaming. In 2024, the demand for fiber optic broadband continued to grow, with many households prioritizing speeds exceeding 100 Mbps.

Beyond home internet, this segment also encompasses individuals and families looking for mobile communication plans. These plans are essential for personal smartphones and tablets, with a strong emphasis on data allowances and competitive monthly pricing. The average monthly mobile data consumption per user in many developed markets is projected to exceed 20 GB by the end of 2024, highlighting the need for robust data packages.

Furthermore, private households are increasingly interested in value-added services that enhance their digital lifestyle. This can include cloud storage solutions for photos and documents, smart home integration services, or bundled entertainment packages. Providers offering attractive bundles that combine internet, mobile, and these additional services often see higher customer loyalty and average revenue per user.

Small to Medium-Sized Businesses (SMBs) represent a core customer segment for 1&1, seeking dependable broadband, flexible mobile plans for their teams, and essential cloud services to streamline operations. In 2024, the demand for reliable digital infrastructure among SMBs continued to grow, with many actively upgrading their connectivity to support remote work and digital transformation initiatives.

SMBs prioritize solutions that are not only reliable and scalable but also come with accessible business support. This means they are looking for partners who can grow with them and offer assistance when needed, ensuring minimal disruption to their business activities. For instance, a significant portion of SMBs in Germany, where 1&1 has a strong presence, reported increased investment in IT infrastructure in 2024 to enhance operational efficiency.

Mobile internet users represent a substantial segment for 1&1, encompassing both postpaid and prepaid subscribers. The demand in this area is heavily influenced by competitive pricing on data allowances, the perceived quality and reach of network coverage, and attractive smartphone bundling deals. In 2024, the German mobile market saw continued growth, with a significant portion of the population relying on mobile data for daily communication and access to online services.

Broadband Internet Users

Broadband Internet Users are 1&1's core customer base, demanding reliable, high-speed internet for both residential and business needs. This segment spans from basic DSL users to those requiring advanced fiber optic connections, with a strong emphasis on performance and consistent service. In 2024, Germany's broadband penetration continued to rise, with over 90% of households having access to speeds of at least 30 Mbps, indicating a robust market for 1&1's offerings.

Key characteristics and preferences within this segment include:

- Demand for Speed and Stability: Customers expect uninterrupted, fast internet crucial for remote work, streaming, and online gaming.

- Bundled Services: Many users prefer integrated packages that combine internet, telephony, and sometimes mobile services for convenience and cost savings.

- Value for Money: Price competitiveness remains a significant factor, alongside the quality of service provided.

- Customer Support: Responsive and effective customer service is highly valued, particularly when technical issues arise.

Value and Premium Segments

1&1 effectively segments its customer base by offering distinct value propositions. For budget-conscious users, it leverages discount brands to provide essential services at competitive prices. This strategy appeals to a broad market seeking affordability.

Conversely, the main 1&1 brand caters to customers prioritizing enhanced features, superior customer support, and premium service levels. This dual approach allows 1&1 to capture different market segments with tailored offerings.

- Value Segment: Focuses on cost-effective solutions, attracting a large volume of price-sensitive customers.

- Premium Segment: Targets users willing to invest more for advanced functionalities and dedicated support.

- Market Reach: This segmentation strategy enables 1&1 to maximize its market penetration and revenue streams.

1&1 serves a diverse customer base, primarily focusing on private households and small to medium-sized businesses (SMBs). For households, the emphasis is on reliable, high-speed internet, including fiber optic connections, and mobile plans with ample data. SMBs seek dependable digital infrastructure, scalable solutions, and accessible support to facilitate their operations and digital transformation efforts.

The company also targets mobile internet users, offering both postpaid and prepaid options, with competitive pricing and strong network coverage being key attractors. Broadband internet users, a foundational segment, require consistent performance for both personal and professional use, with many upgrading to faster fiber connections.

1&1 employs a dual-brand strategy to cater to different market needs. Discount brands appeal to cost-conscious consumers, while the main 1&1 brand targets those seeking enhanced features and premium support, maximizing market penetration and revenue.

| Customer Segment | Key Needs | 2024 Market Trend/Data Point |

|---|---|---|

| Private Households | Reliable, high-speed internet (fiber optic), mobile plans with data | Demand for speeds >100 Mbps continued to grow; average mobile data consumption projected to exceed 20 GB/user. |

| Small to Medium-Sized Businesses (SMBs) | Dependable broadband, flexible mobile, cloud services, scalable IT | Increased investment in IT infrastructure for remote work and digital transformation. |

| Mobile Internet Users | Competitive pricing, data allowances, network coverage, smartphone bundles | Significant reliance on mobile data for daily communication and online services in key markets. |

| Broadband Internet Users | Speed, stability, bundled services, value for money, customer support | Over 90% of households had access to speeds of at least 30 Mbps in Germany. |

Cost Structure

Building and keeping 1&1's own 5G mobile network running is a big expense. This includes setting up new antenna sites, expanding existing ones, and making sure the fiber optic connections are solid. These costs cover both the initial investment in infrastructure (capex) and the day-to-day running costs (opex).

In 2024, 1&1 continued its aggressive network expansion, with significant capital expenditures dedicated to 5G rollout. For instance, the company announced plans to invest several hundred million euros in network infrastructure development throughout the year, aiming to cover a substantial portion of the German population with its 5G services.

1&1's cost structure is significantly impacted by national roaming and wholesale network fees. Despite building its own infrastructure, the company relies on partners like Vodafone for nationwide mobile coverage, incurring substantial wholesale costs. These payments are a crucial part of their cost of sales, reflecting the ongoing need to access established network infrastructure to complement their own build-out.

Marketing and sales expenses are crucial for customer acquisition and building brand awareness. In 2024, companies are allocating significant portions of their budgets to digital advertising, content marketing, and sales team commissions to reach target audiences effectively.

These costs directly impact the overall cost of distribution, as they cover the efforts to get the product or service in front of potential buyers. For instance, many SaaS companies in 2024 are seeing customer acquisition costs (CAC) rise, with some reporting CAC exceeding $1,000 for certain market segments, underscoring the heavy investment required.

Personnel Costs

Personnel costs are a substantial component of 1&1's operational expenses. These costs encompass salaries, benefits, and all other employee-related expenditures for their diverse workforce. This includes vital roles such as network engineers who maintain their infrastructure, customer service representatives who support their user base, sales teams driving revenue, and essential administrative staff.

In 2024, the telecommunications and IT services sector, where 1&1 operates, saw continued investment in skilled personnel. For instance, the average salary for a network engineer in Germany, a key market for 1&1, was reported to be around €65,000 annually, with benefits adding a significant percentage on top of this. Similarly, customer service roles often come with competitive compensation packages to ensure high-quality support.

- Salaries: Base pay for all employees across technical, sales, support, and administrative functions.

- Benefits: Health insurance, retirement contributions, paid time off, and other employee perks.

- Training and Development: Costs associated with upskilling staff, particularly in rapidly evolving tech fields.

- Payroll Taxes and Social Contributions: Employer-side contributions mandated by labor laws.

IT and Software Costs

1&1's commitment to a fully virtualized, Open RAN-based network and cloud services translates into significant IT and software expenditures. These costs encompass everything from the initial acquisition and ongoing maintenance of sophisticated IT systems to the licensing of essential software that powers their operations.

The company's investment in data centers, crucial for housing and managing their digital infrastructure, represents another substantial component of their cost structure. Furthermore, continuous technological development and robust support are vital to staying competitive in the fast-evolving telecommunications and cloud services landscape, adding to these IT and software expenses.

- IT Infrastructure: Significant investment in servers, networking equipment, and storage solutions for their virtualized network.

- Software Licenses: Costs associated with operating systems, virtualization software, cloud management platforms, and security solutions.

- Data Center Operations: Expenses related to power, cooling, physical security, and maintenance of their data center facilities.

- Research & Development: Ongoing spending on developing and refining their Open RAN technology and cloud service offerings.

Key cost drivers for 1&1 include significant capital expenditure on building its 5G network, estimated in the hundreds of millions of euros for 2024, alongside substantial operational expenses for national roaming and wholesale network access. Marketing and sales efforts to acquire customers also represent a considerable outlay, with customer acquisition costs in the tech sector often exceeding €1,000 per customer in 2024.

Personnel costs, including competitive salaries for specialized roles like network engineers (averaging around €65,000 annually in Germany in 2024), are a major operational expense. Furthermore, substantial investments in IT infrastructure, software licenses, data center operations, and ongoing research and development are critical for maintaining their virtualized, Open RAN-based network and cloud services.

| Cost Category | Description | 2024 Focus/Data Point |

|---|---|---|

| Network Infrastructure | Building and expanding 5G mobile network, fiber optic connections. | Hundreds of millions of euros invested in 5G rollout. |

| Wholesale Network Fees | National roaming and access to partner networks. | Significant part of cost of sales due to reliance on established infrastructure. |

| Marketing & Sales | Customer acquisition, brand awareness, digital advertising. | Customer Acquisition Costs (CAC) in tech sectors can exceed €1,000. |

| Personnel Costs | Salaries, benefits, training for engineers, support, sales staff. | Network engineer salaries in Germany average ~€65,000 annually. |

| IT & Software | Virtualized network, Open RAN, cloud services, data centers. | Ongoing investment in servers, software licenses, and data center operations. |

Revenue Streams

Monthly subscription fees are the bedrock of 1&1's mobile business, generating consistent, high-margin revenue from both postpaid and prepaid customers. In 2024, the telecommunications sector saw continued growth in mobile service revenue, with many providers reporting increases driven by data consumption and premium plan uptake.

Monthly subscription fees for broadband internet are a cornerstone revenue for 1&1, providing a consistent and predictable income. This stream serves a broad customer base, encompassing both individual consumers and business clients who rely on reliable, high-speed connectivity.

These broadband subscriptions represent a high-margin service revenue, contributing significantly to the company's overall profitability. For instance, in 2023, 1&1 reported that its broadband and cloud business segment saw revenue growth, underscoring the strength of these recurring service fees.

1&1 generates revenue through hardware sales, offering devices like smartphones and routers. These sales are often tied to their mobile or broadband service contracts, providing a bundled value proposition for customers.

While these hardware sales contribute to overall revenue, they are generally considered low-margin streams for the company. For instance, in 2023, 1&1 reported a significant portion of its revenue from services, with hardware sales playing a supplementary role in customer acquisition and retention.

Value-Added Services and Applications

1&1 generates additional revenue through a suite of value-added services and cloud-based applications. These offerings, which include online storage solutions, IP telephony, and smart home integrations, can be purchased as standalone products or bundled with core internet and hosting packages, providing customers with enhanced functionality and convenience.

In 2024, the demand for integrated cloud services continued to grow, with companies increasingly looking for comprehensive solutions. 1&1's strategy to offer these services as upsells directly contributes to increasing the average revenue per user (ARPU). For instance, the adoption of cloud-based productivity tools and enhanced security features often comes with a premium subscription, boosting the company's service revenue.

- Online Storage: Offering secure and scalable cloud storage solutions for businesses and individuals.

- IP Telephony: Providing advanced voice communication services over the internet, often with features like virtual numbers and call management.

- Smart Home Solutions: Integrating internet connectivity with home automation devices, offering convenience and control.

- Bundled Services: Packaging these applications with core offerings to create attractive, feature-rich deals.

Interconnection and Wholesale Services

1&1, as a telecommunications player, leverages interconnection fees, charging other carriers for calls and data routed through its network. This is a standard practice in the industry, contributing to revenue stability.

Looking ahead, 1&1 is positioned to generate revenue from wholesale services. As its own network infrastructure matures, it can offer access to other service providers, creating a new income stream.

For context, the global wholesale carrier market was valued at approximately USD 670 billion in 2023 and is projected to grow. 1&1's participation in this market, particularly with its expanding fiber optic network, is a key strategic move.

- Interconnection Fees: Revenue generated from allowing other telecom operators to use 1&1's network for calls and data.

- Wholesale Network Access: Future revenue from leasing its network infrastructure to other service providers.

- Market Growth: The wholesale carrier market is expanding, presenting opportunities for providers like 1&1.

Beyond core subscriptions, 1&1 diversifies revenue through hardware sales, primarily smartphones and routers, often bundled with service plans. While these sales are crucial for customer acquisition and retention, they typically represent lower-margin contributions compared to service-based income.

1&1 also taps into value-added services and cloud solutions, including online storage, IP telephony, and smart home integrations. These offerings are sold as standalone products or bundled with existing packages, aiming to increase average revenue per user (ARPU).

The company also earns revenue through interconnection fees, charging other carriers for network usage, and anticipates future income from wholesale network access as its infrastructure develops.

| Revenue Stream | Description | 2023/2024 Context |

|---|---|---|

| Mobile Subscriptions | Recurring fees from postpaid and prepaid mobile plans. | Continued growth in mobile service revenue driven by data consumption. |

| Broadband Subscriptions | Consistent income from home and business internet services. | Broadband and cloud segment revenue showed growth in 2023. |

| Hardware Sales | Revenue from selling devices like smartphones and routers. | Supplementary role in customer acquisition; lower margin than services. |

| Value-Added Services | Income from cloud storage, IP telephony, smart home, etc. | Growing demand for integrated cloud services boosts ARPU. |

| Interconnection Fees | Charges to other carriers for network usage. | Standard industry revenue stream contributing to stability. |

| Wholesale Network Access | Future revenue from leasing network infrastructure. | Opportunity from expanding fiber optic network in a growing market. |

Business Model Canvas Data Sources

The Business Model Canvas is informed by a blend of primary customer feedback, internal sales data, and competitive landscape analysis. These sources provide a comprehensive view of market needs and operational realities.