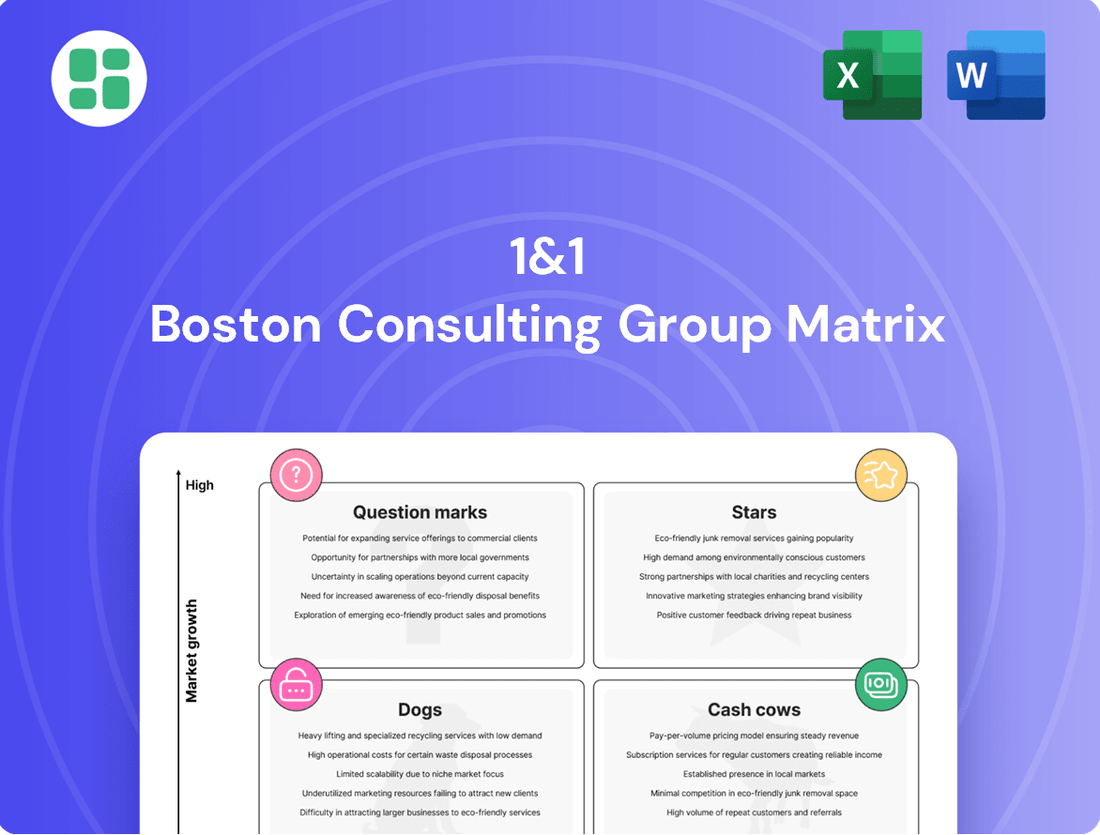

1&1 Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

1&1 Bundle

Understanding the 1&1 BCG Matrix is crucial for navigating market dynamics and optimizing your product portfolio. This snapshot reveals the current standing of key products, highlighting their potential for growth and profitability.

However, to truly unlock strategic advantage, you need the full picture. Purchase the complete BCG Matrix for a detailed quadrant-by-quadrant analysis, actionable insights, and a clear roadmap for investment and resource allocation.

Don't miss out on the opportunity to transform your business strategy. Get the full BCG Matrix today and gain the competitive edge you need to succeed!

Stars

1&1's Open RAN 5G mobile network is a clear Star in the BCG Matrix, showcasing significant growth potential and market leadership. This venture represents their primary growth engine, distinguishing them as Europe's first fully virtualized 5G network utilizing Open RAN technology.

Despite considerable initial investment and some earlier deployment hurdles, the network is experiencing rapid user adoption. Notably, it attracted 10 million subscribers to its O-RAN 5G network within just 18 months of its debut, demonstrating strong market traction.

This substantial influx of customers, migrating from wholesale arrangements to 1&1's proprietary infrastructure, signals a significant capture of market share within a rapidly expanding sector.

1&1 is strategically capitalizing on its expanding 5G infrastructure and its roaming partnership with Vodafone to introduce premium mobile tariffs. These higher-tier plans are designed to appeal to customers seeking substantial data allowances and cutting-edge functionalities, targeting a more affluent segment of the market.

The German market is witnessing a growing embrace of 5G technology, creating a fertile ground for 1&1's premium offerings. By focusing on these advanced services, the company aims to capture a larger share of the high-value customer base, further solidifying its position in the competitive telecommunications landscape.

1&1 has been actively deploying Fixed Wireless Access (FWA) via its 5G network since late 2022, targeting areas where fiber optic expansion is slower. This initiative positions FWA as a key growth driver, especially in underserved markets. By leveraging its expanding 5G infrastructure, 1&1 aims to quickly gain traction in the home internet market, offering a competitive alternative to traditional broadband. In 2023, the German broadband market saw continued growth, with FWA emerging as a significant factor, particularly for rural connectivity solutions.

New Mobile Internet Contract Acquisitions

1&1's ability to consistently acquire new mobile internet contracts is a significant strength. In fiscal year 2024, the company added 190,000 new mobile internet contracts. This sustained growth highlights their strong performance and increasing market share within the mobile sector.

These new customer acquisitions are crucial for 1&1's expansion strategy. The 190,000 new contracts in 2024 directly contribute to the overall growth of their mobile services portfolio. This performance suggests that 1&1 is effectively capitalizing on opportunities within the expanding mobile internet market.

- New Mobile Internet Contracts Acquired: 190,000 in fiscal year 2024.

- Market Position: Demonstrates strong performance and growing market share in the mobile sector.

- Growth Driver: These additions fuel the overall expansion of 1&1's mobile services.

Converged Mobile and Broadband Bundles

1&1 leverages converged mobile and broadband bundles to enhance customer loyalty and boost average revenue per user. These integrated offerings are vital for competing effectively, aiming to secure a greater portion of household telecommunications expenditure by presenting a complete package. This approach aids in both attracting new customers and retaining existing ones.

- Bundled Offerings: 1&1's strategy focuses on combining mobile and fixed-line services into attractive packages.

- Market Competitiveness: These converged bundles are essential for gaining a stronger foothold in a highly competitive telecommunications market.

- Revenue Growth: The aim is to increase the average revenue per user by offering comprehensive solutions that capture more of a customer's spending.

- Customer Acquisition & Retention: This bundled approach serves as a key tool for both bringing in new subscribers and keeping current customers satisfied.

1&1's 5G Open RAN network is a prime example of a Star in the BCG Matrix, exhibiting robust growth and market leadership. The company's strategic push into premium mobile tariffs, leveraging its expanding 5G infrastructure and Vodafone roaming partnership, targets a high-value customer segment. Furthermore, the expansion of Fixed Wireless Access (FWA) via its 5G network since late 2022 addresses areas with slower fiber optic deployment, positioning FWA as a significant growth catalyst.

The company's success is underscored by its ability to attract new customers, evidenced by the acquisition of 190,000 new mobile internet contracts in fiscal year 2024, which directly fuels the expansion of its mobile services portfolio. 1&1's strategy of offering converged mobile and broadband bundles is crucial for enhancing customer loyalty and increasing average revenue per user in a competitive market.

| BCG Category | 1&1 5G Open RAN Network | Market Growth | Relative Market Share |

|---|---|---|---|

| Star | High | High | |

| Key Growth Drivers | Open RAN 5G deployment, FWA expansion, premium tariff offerings, converged bundles | ||

| Key Metrics (FY 2024) | 190,000 new mobile internet contracts |

What is included in the product

The 1&1 BCG Matrix provides a strategic overview of a company's business units based on market share and growth rate.

It guides decisions on resource allocation, identifying areas for investment, divestment, or maintenance.

Quickly visualize your portfolio's health with a clear, quadrant-based BCG Matrix.

Cash Cows

1&1's established mobile postpaid customer base, numbering 12.44 million mobile internet contracts as of the end of H1 2025, is a prime example of a Cash Cow within the BCG matrix. This mature segment provides a consistent and predictable stream of high-margin revenue, forming the bedrock of their mobile operations.

Core DSL Broadband Connections, representing 1&1's Cash Cows, continue to be a significant revenue generator. As of H1 2025, 1&1 maintained a robust base of 3.89 million broadband connections, demonstrating the enduring stability of this segment despite planned shifts towards newer technologies.

These established DSL customers, supported by 1&1 Versatel's extensive fiber-optic transport network and strategic partnerships, consistently contribute substantial and predictable EBITDA to the Access segment. This reliable cash flow stream is a hallmark of a mature market where 1&1 holds a strong, established position.

1&1's service revenue, a significant cash cow, demonstrated robust growth in fiscal year 2024. This segment, excluding hardware, is projected to maintain its stability through 2025, underscoring its consistent contribution to the company's profitability.

These high-margin service revenues, primarily from telecommunications, are the engine of 1&1's cash generation. The sustained performance highlights a mature and dependable business area that consistently delivers strong profits.

Web Hosting and Domain Services

Web hosting and domain services represent a significant cash cow for 1&1, operating under the United Internet Group. These mature markets are characterized by established customer bases and relatively stable demand, allowing for consistent, high-margin cash generation with lower reinvestment needs. In 2024, the global web hosting market was valued at approximately $100 billion, with domain registration forming a crucial ancillary revenue stream.

- Mature Market Stability: The web hosting sector, a core offering for 1&1, benefits from its maturity, leading to predictable revenue streams.

- High-Margin Cash Flows: Once infrastructure is established and customer acquisition costs are managed, these services typically yield strong profit margins.

- Reduced Promotional Needs: Established players like 1&1 often rely on brand reputation and customer retention rather than aggressive, ongoing marketing campaigns for these services.

- Consistent Revenue Source: Domain registration, often bundled with hosting, provides a reliable and recurring income for the company.

National Roaming Agreements (Supporting Existing Base)

National roaming agreements, such as those with Vodafone, are crucial for 1&1's mobile operations. These partnerships ensure that 1&1 customers have reliable nationwide coverage, even as the company continues to build out its own 5G infrastructure. This strategic move is vital for maintaining service continuity, which directly impacts customer satisfaction and helps to minimize churn.

By securing these long-term roaming deals, 1&1 is able to safeguard its substantial existing mobile customer base. This stability translates into predictable and consistent revenue streams. For instance, in 2024, 1&1 reported a significant portion of its revenue derived from its mobile segment, underscoring the importance of these foundational agreements.

- Guaranteed Nationwide Coverage: Agreements with providers like Vodafone ensure 1&1 customers have access to mobile services across Germany.

- Customer Retention: By providing reliable service, these agreements help reduce customer churn, a key metric for subscriber-based businesses.

- Stable Revenue Streams: The existing mobile base, supported by roaming, generates predictable revenue, contributing to the 'Cash Cow' status.

- Network Build-out Support: Roaming provides a crucial bridge, allowing 1&1 to maintain service quality while its proprietary 5G network matures.

1&1's mobile postpaid customer base, exceeding 12.44 million mobile internet contracts by H1 2025, represents a significant Cash Cow. This mature segment consistently generates high-margin revenue, underpinning the company's mobile operations.

The company's core DSL Broadband Connections, numbering 3.89 million as of H1 2025, continue to be a stable revenue generator, demonstrating the enduring strength of this segment. These established DSL customers contribute substantially to the Access segment's EBITDA, a testament to their Cash Cow status.

Web hosting and domain services, a key offering under the United Internet Group, also function as Cash Cows. The global web hosting market, valued at approximately $100 billion in 2024, provides a stable, high-margin revenue stream with reduced need for extensive reinvestment.

| Business Segment | Status in BCG Matrix | Key Financial Indicator (as of H1 2025 or 2024 data) | Rationale |

|---|---|---|---|

| Mobile Postpaid Customers | Cash Cow | 12.44 million mobile internet contracts | Mature, high-margin revenue stream |

| DSL Broadband Connections | Cash Cow | 3.89 million broadband connections | Stable, predictable EBITDA contribution |

| Web Hosting & Domain Services | Cash Cow | Global market valued at ~$100 billion (2024) | Consistent, high-margin cash generation |

What You’re Viewing Is Included

1&1 BCG Matrix

The preview you're currently viewing is the identical, fully completed 1&1 BCG Matrix document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no missing sections – just the comprehensive, professionally formatted strategic tool ready for your immediate application. You can trust that the insights and structure you see here are precisely what you'll download, enabling you to confidently analyze your business portfolio and make informed strategic decisions. This is your direct path to a polished, actionable BCG Matrix without any hidden surprises.

Dogs

1&1's fixed-line broadband subscriptions are clearly in the 'Dog' quadrant of the BCG Matrix. The company experienced a significant drop of 60,000 broadband contracts in fiscal year 2024. This downward trend continued into the first half of 2025, with another 60,000 contracts lost.

This consistent decline in subscriptions highlights that the traditional fixed-line broadband market is shrinking and offers little growth potential for 1&1. These legacy contracts are losing ground to newer technologies, making this business segment a 'Dog' due to its declining revenue contribution and ongoing contraction.

Low-Margin Hardware Sales represent a problematic area for 1&1. In the first half of 2025, hardware revenue saw a 3.0% decrease. These sales are explicitly labeled as low-margin, suggesting they contribute very little to the company's bottom line, and could even be a drain when considering operational expenses.

Outdated prepaid mobile offerings for 1&1 represent its Dogs. These legacy plans, characterized by low average revenue per user (ARPU), struggle to attract new customers in a market favoring flexible, modern tariffs. In 2024, the German prepaid market saw continued pressure on ARPU, with many users migrating to bundled postpaid plans or competitive digital-only offerings, leaving these older plans with minimal profit and declining market share.

Traditional Fixed-Line Telephony Services

Traditional fixed-line telephony services, often referred to as POTS (Plain Old Telephone Service) or ISDN (Integrated Services Digital Network), are experiencing a significant downturn. This decline is largely driven by customer migration towards mobile-only communication and Voice over IP (VoIP) solutions, which offer greater flexibility and often lower costs.

While these legacy services might still cater to a small, specialized customer base, their overall market share has dwindled. The segment presents very limited prospects for growth, positioning it as a potential candidate for divestiture or a strategy focused on maximizing remaining revenue with minimal investment.

For instance, in 2024, the number of traditional landline subscriptions continued its downward trend. In Germany, a key market for many telecommunications providers, the number of fixed-line connections has been steadily decreasing, with some reports indicating a drop of over 2% year-on-year for POTS/ISDN lines.

- Declining Market Share: Traditional fixed-line services represent a shrinking portion of the overall telecommunications market.

- Low Growth Potential: The segment offers minimal opportunities for expansion due to evolving customer preferences.

- Strategic Options: Providers are considering divestment or a passive revenue extraction strategy for these services.

- 2024 Data Point: A notable year-on-year decrease in fixed-line connections was observed in major European markets during 2024.

Underperforming Niche Cloud Applications

Underperforming niche cloud applications within 1&1's portfolio would likely fall into the Dogs quadrant of the BCG matrix. These are specialized cloud services that, despite the booming overall cloud market, haven't found a substantial customer base or achieved significant revenue generation. They represent a drain on resources without offering a clear path to future growth.

These applications may be technically sound but lack market appeal or face intense competition from more established players. In 2024, the global cloud computing market was projected to reach over $1.3 trillion, highlighting the vast opportunity. However, for these niche offerings, market penetration remained low, potentially consuming valuable R&D and operational capital without commensurate returns.

- Low Market Share: These applications struggle to capture even a small percentage of their target niche market.

- Limited Growth Potential: The overall market for these specific applications may be stagnant or declining, offering little room for expansion.

- Resource Drain: They continue to require investment in maintenance, support, and development without generating sufficient revenue to justify the expenditure.

- Strategic Review: Management must consider divesting, discontinuing, or finding a way to pivot these offerings to avoid continued losses.

1&1's legacy prepaid mobile offerings are firmly in the Dogs quadrant of the BCG Matrix. These older plans, characterized by low average revenue per user (ARPU), are struggling to attract new customers in a market that increasingly favors flexible, modern tariffs. In 2024, the German prepaid market continued to see pressure on ARPU, with many users migrating to bundled postpaid plans or competitive digital-only offerings, leaving these older plans with minimal profit and declining market share.

Traditional fixed-line telephony services, such as POTS and ISDN, are also classified as Dogs. Customer migration towards mobile-only communication and Voice over IP (VoIP) solutions has led to a significant downturn in this segment. For instance, in 2024, the number of traditional landline subscriptions continued its downward trend, with a notable year-on-year decrease observed in major European markets.

Underperforming niche cloud applications within 1&1's portfolio also fall into the Dogs quadrant. Despite the booming overall cloud market, these specialized services have not achieved substantial customer bases or significant revenue generation, consuming valuable R&D and operational capital without commensurate returns.

These "Dog" segments, including legacy prepaid mobile, traditional fixed-line telephony, and niche cloud applications, share characteristics of low market share and limited growth potential. They represent a resource drain without a clear path to future growth, prompting strategic reviews for divestment or passive revenue extraction.

| Business Segment | BCG Quadrant | Key Challenges | 2024/H1 2025 Data Points |

|---|---|---|---|

| Fixed-Line Broadband Subscriptions | Dogs | Shrinking market, competition from new technologies | 60,000 contracts lost in FY2024; another 60,000 lost in H1 2025 |

| Low-Margin Hardware Sales | Dogs | Low profitability, declining revenue | 3.0% decrease in hardware revenue in H1 2025 |

| Outdated Prepaid Mobile Offerings | Dogs | Low ARPU, migration to modern tariffs, declining market share | Continued pressure on ARPU in German prepaid market (2024) |

| Traditional Fixed-Line Telephony (POTS/ISDN) | Dogs | Migration to mobile/VoIP, dwindling market share | Over 2% year-on-year drop in POTS/ISDN lines in Germany (2024) |

| Underperforming Niche Cloud Applications | Dogs | Low market penetration, intense competition, resource drain | Low market penetration despite global cloud market exceeding $1.3 trillion (2024) |

Question Marks

The German ICT market, particularly in AI and cloud services, is booming, projected to reach €218 billion in 2024 according to Bitkom. While 1&1 serves many small and medium-sized enterprises (SMEs), their penetration in highly specialized B2B digital solutions like advanced IoT or AI services is likely still developing.

These advanced B2B digital solutions represent potential "question marks" in the BCG matrix for 1&1. They demand significant upfront investment in research, development, and specialized sales forces. The market is rapidly evolving, with early adopters driving innovation, but the path to widespread adoption and profitability can be uncertain.

For 1&1, success in these areas would mean capturing a share of a high-growth, albeit competitive, segment. The challenge lies in balancing the substantial investment required against the potential for high future returns, a classic characteristic of question mark investments.

1&1's new geographic fiber optic expansion initiatives represent a significant investment in potential future growth areas. These projects, often characterized by high upfront costs and the challenge of building market share from scratch, would likely place such ventures in the Question Marks category of the BCG Matrix. For instance, if 1&1 were to announce a major expansion into a new country or a previously unserved rural region in 2024, the capital expenditure could easily run into hundreds of millions of euros, with uncertain returns until customer adoption rates are proven.

The demand for cloud security services is experiencing robust growth, projected to reach $36.9 billion by 2025, signaling a significant opportunity within the ICT sector. 1&1 could strategically expand its existing cloud application portfolio by integrating more advanced cybersecurity solutions, such as AI-driven threat detection and zero-trust architectures, to capitalize on this trend. While the market is undeniably high-growth, 1&1's current market share in these highly specialized and competitive cybersecurity niches may be nascent, necessitating substantial and focused investment to establish a strong foothold and gain competitive advantage.

Next-Generation B2B Telephony Solutions (UCaaS)

While traditional fixed-line telephony is declining, the Unified Communications as a Service (UCaaS) market for businesses is experiencing robust growth. This presents a significant opportunity for 1&1 to position its next-generation B2B telephony solutions within this expanding sector.

1&1's UCaaS offerings are likely situated in the "Question Mark" category of the BCG matrix. This means they operate in a high-growth market, but the company's current market share against established, specialized UCaaS providers may be relatively low. Significant investment in sales, marketing, and product development will be crucial to capture a larger share and potentially transition these solutions into "Stars."

- Market Growth: The global UCaaS market was valued at approximately $39.9 billion in 2023 and is projected to reach $103.8 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 14.6%.

- Investment Needs: To compete effectively, 1&1 will need to invest heavily in building brand awareness, developing advanced features, and establishing strong channel partnerships.

- Competitive Landscape: Key players in the UCaaS market include Microsoft (Teams), Zoom, Cisco, and RingCentral, all of whom have substantial market presence and ongoing innovation.

- Strategic Focus: For 1&1, a strategic focus on differentiating its UCaaS solutions through superior integration, user experience, or specific industry verticals will be essential for success.

Aggressive Customer Migration to Own 5G Network

The aggressive migration of customers to 1&1's proprietary Open RAN 5G network, while positioning the network itself as a Star, presents a significant Question Mark. This transition involves substantial capital expenditure and operational costs. For instance, in 2024, 1&1 continued its substantial investments in network build-out and customer migration, which pressured short-term earnings despite the long-term strategic advantages.

The financial implications of this migration are complex. While the goal is to achieve greater control and cost efficiencies in the long run, the immediate impact includes increased spending on infrastructure and potential customer acquisition or retention costs. This can lead to a temporary dip in profitability as these investments are absorbed.

- Network Investment: 1&1's 2024 capital expenditures were heavily weighted towards its Open RAN 5G network development and customer onboarding.

- Churn Risk: The migration process can introduce temporary churn as customers switch networks, impacting revenue streams in the short term.

- Cost Management: Balancing the aggressive migration strategy with cost control is crucial for managing the financial impact of this Question Mark.

- Long-Term Outlook: Despite short-term pressures, the migration aims for long-term benefits like reduced wholesale fees and enhanced service offerings.

Question Marks represent business units or products operating in high-growth markets but with low market share. These ventures require significant investment to increase market share, with the potential to become Stars if successful, or Cash Cows if they stabilize, or Divestments if they fail to gain traction. For 1&1, these are areas where strategic investment is crucial for future growth.

The global market for edge computing, a technology enabling data processing closer to the source, is projected for substantial growth. For instance, the edge computing market was valued at $15.1 billion in 2023 and is expected to reach $60.8 billion by 2030, growing at a CAGR of 21.7%. 1&1's potential entry or expansion into providing edge computing solutions for businesses, particularly in areas like IoT or real-time analytics, would likely be a Question Mark. This is due to the high investment needed for infrastructure and specialized software development, coupled with the challenge of building brand recognition in a rapidly evolving and competitive landscape.

| Business Unit/Product | Market Growth | Market Share | Investment Needs | Potential Outcome |

|---|---|---|---|---|

| Advanced B2B Digital Solutions (IoT, AI) | High | Low | High (R&D, Sales) | Star or Divestment |

| New Geographic Fiber Optic Expansion | High (region dependent) | Low (new markets) | Very High (CAPEX) | Star or Cash Cow |

| Specialized Cloud Security Services | High | Low to Medium | High (product development, marketing) | Star or Cash Cow |

| Unified Communications as a Service (UCaaS) | High | Low | High (sales, marketing, features) | Star or Cash Cow |

| Edge Computing Solutions | Very High | Low | High (infrastructure, software) | Star or Divestment |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, customer acquisition costs, and competitor analysis, to accurately position each business unit.