1&1 PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

1&1 Bundle

Navigate the complex external forces impacting 1&1's digital landscape with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping the company's strategic direction and market opportunities. Equip yourself with actionable intelligence to anticipate challenges and capitalize on emerging trends. Purchase the full PESTLE analysis today and gain a critical competitive advantage.

Political factors

The German government is actively pursuing extensive broadband expansion, aiming for nationwide fiber network coverage by 2030. A key milestone is the target of achieving 50% fiber-to-the-home (FTTH) or fiber-to-the-building (FTTB) coverage by the end of 2025.

Significant financial backing is being channeled into these efforts, with a notable €1.2 billion allocated in January 2025 specifically to accelerate fiber network deployment, especially in rural and underserved regions.

These government-backed initiatives create a highly conducive market for companies like 1&1, which depend on robust fiber-optic infrastructure. The expansion directly translates to increased market penetration and a higher demand for high-speed internet services, benefiting 1&1's business model.

The Bundesnetzagentur (BNetzA) is a key player in Germany's 5G rollout, recently extending mobile spectrum licenses for 800MHz, 1800MHz, and 2.6GHz bands until 2030. These extensions come with updated coverage obligations, pushing for better mobile network availability across the country.

For 1&1, this means a more stable foundation for its 5G network construction, as access to these crucial frequencies is secured for the long term. The updated obligations are designed to stimulate competition and enhance overall mobile coverage, directly influencing 1&1's strategic planning and network deployment timelines.

Recent amendments to Germany's Telecommunications Act (TKG), with a draft adopted in May 2025, are set to significantly impact network expansion. These changes designate telecommunications infrastructure expansion as an 'overriding public interest,' a crucial legal shift designed to accelerate the rollout of fiber optic and mobile networks.

This reclassification aims to cut through bureaucratic red tape, a persistent hurdle for network operators like 1&1. By streamlining approval processes, the amendments are expected to facilitate faster deployment, directly supporting 1&1's strategic goals for physical infrastructure growth and meeting its ambitious rollout timelines.

Data Protection Regulations (GDPR and TDDDG)

Germany's stringent data protection laws, including the General Data Protection Regulation (GDPR) and the Telecommunications-Digital-Services-Data Protection Act (TDDDG), which saw updates in May 2024, directly impact 1&1's operations. These regulations impose strict requirements on how 1&1 collects, processes, and secures customer data, demanding robust consent mechanisms and transparent data handling practices. Failure to comply with these evolving legal frameworks can result in substantial fines, with GDPR penalties reaching up to €20 million or 4% of global annual turnover.

The TDDDG, particularly its 2024 revisions, reinforces the need for explicit user consent for data processing in telecommunications and digital services. For 1&1, this means investing in secure data management systems and ensuring clear communication with customers regarding data usage. Building and maintaining consumer trust through diligent adherence to these data protection standards is paramount for 1&1's long-term viability and market reputation.

- GDPR Fines: Potential penalties up to €20 million or 4% of global annual turnover.

- TDDDG Updates: May 2024 revisions emphasize explicit consent for data processing.

- Compliance Costs: Significant investment required in data security and privacy infrastructure.

- Consumer Trust: Adherence to regulations is key to maintaining customer confidence.

Competition Policy and Market Regulation

The German government, through agencies such as the Bundesnetzagentur, actively shapes the telecommunications landscape by enforcing competition policy. This regulatory focus is crucial for emerging players like 1&1, aiming to prevent anti-competitive practices by incumbent operators.

Policies designed to foster fair competition can include mandates for existing frequency owners to allow co-use by newer entrants. This approach directly impacts 1&1's ability to access essential infrastructure, thereby influencing its market entry and competitive strategies against established mobile network operators.

- Bundesnetzagentur's Role: The agency monitors and regulates the telecommunications market to ensure fair competition.

- Frequency Allocation: Regulations may include provisions for co-use of spectrum to benefit new operators like 1&1.

- Market Impact: These policies can significantly affect 1&1's pricing, infrastructure access, and overall competitive standing.

The German government's commitment to nationwide broadband expansion, targeting 50% fiber coverage by the end of 2025 and allocating €1.2 billion in early 2025 for this purpose, creates a favorable environment for 1&1. Furthermore, the Bundesnetzagentur's extension of mobile spectrum licenses until 2030 and recent TKG amendments designating network expansion as an 'overriding public interest' streamline deployment for companies like 1&1.

| Government Initiative | Target/Allocation | Impact on 1&1 |

| Broadband Expansion | 50% FTTH/FTTB by end of 2025; €1.2bn allocated Jan 2025 | Increased market demand for high-speed internet |

| Mobile Spectrum Licenses | Extended to 2030 (800, 1800, 2.6GHz bands) | Stable foundation for 5G network construction |

| Telecommunications Act (TKG) Amendments | Network expansion as 'overriding public interest' (May 2025 draft) | Streamlined approval processes, faster deployment |

What is included in the product

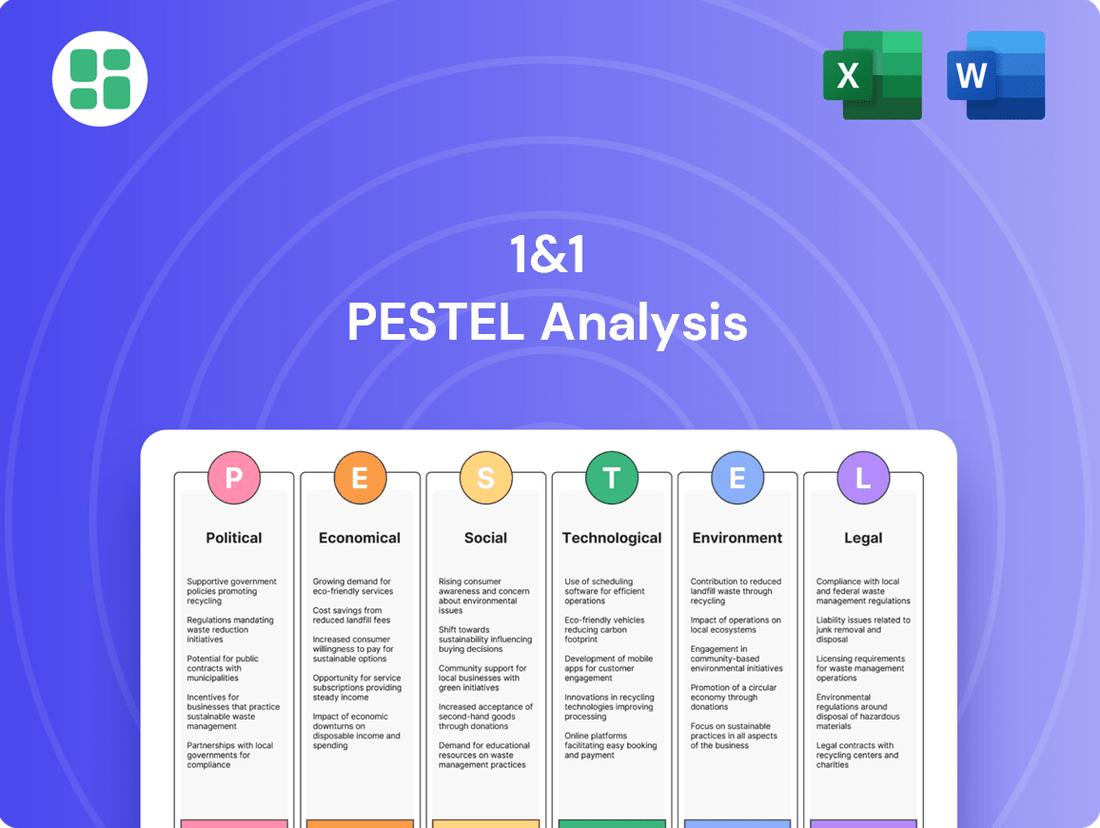

This PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting 1&1's operations and strategic positioning.

It provides actionable insights into market dynamics and regulatory landscapes, empowering stakeholders to navigate external influences and capitalize on emerging opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering immediate insights into external factors impacting 1&1's strategy.

Economic factors

Germany's economic growth is expected to be flat in 2025, with a projected 0% expansion. This stagnation, a downward revision from earlier forecasts, is largely due to ongoing trade tensions impacting the country's crucial export sector.

Despite the broader economic headwinds, private consumption is anticipated to see a modest uptick. This is supported by an increase in real disposable incomes and a more favorable interest rate environment, which could encourage consumer spending.

This mixed economic picture presents a nuanced outlook for 1&1. While increased purchasing power might boost demand for telecommunication services, the overall economic slowdown could temper spending from both private households and small and medium-sized businesses, potentially influencing 1&1's revenue streams.

Inflation continues to be a significant concern for German consumers, directly impacting their spending habits, particularly on non-essential services like telecommunications. While purchasing power is anticipated to see a modest rise in 2025, ongoing inflation means consumers are increasingly looking for ways to save money.

This trend puts pressure on companies like 1&1, which serves a diverse customer base. For instance, Germany's inflation rate was 2.2% in April 2024, a slight decrease from previous months but still a factor in consumer decision-making. 1&1 must carefully consider how its pricing across both its value and premium offerings aligns with consumers' reduced real income and their search for more affordable telecom options.

Germany's telecommunications sector is experiencing significant investment, with projections showing a 3.5% increase to €8 billion in 2025. This surge is driven by companies like 1&1, prioritizing expansion in fiber optic and mobile network infrastructure.

This robust investment climate, while favorable for network growth, also presents substantial capital expenditure demands for 1&1 as it competes in this dynamic market.

Competitive Intensity and Pricing Pressure

The German telecommunications sector is a battleground, with giants like Deutsche Telekom and Vodafone duking it out with Telefónica Deutschland and emerging players like 1&1. This fierce rivalry directly translates into significant pricing pressure. Companies are constantly adjusting their offerings to attract and retain customers, which can squeeze profit margins and drive up the cost of acquiring each new subscriber. For 1&1, navigating this landscape means finding unique ways to stand out and keeping a tight rein on expenses.

In 2024, the average revenue per user (ARPU) in the German mobile market remained under pressure due to intense competition, with major operators reporting ARPU figures generally in the €10-€15 range. This highlights the challenge for new entrants like 1&1 to achieve profitability amidst aggressive pricing strategies from established players. The ongoing build-out of 5G infrastructure also adds to the capital expenditure burden, further intensifying the need for efficient cost management and service differentiation.

- Market Share Dynamics: Deutsche Telekom held a leading position in the German mobile market in early 2024, with a subscriber base exceeding 40 million, while Vodafone and Telefónica Deutschland followed closely, each with over 30 million customers.

- Pricing Strategies: Average monthly mobile contract prices in Germany in mid-2024 ranged from approximately €15 for basic plans to €40+ for premium unlimited data packages, demonstrating the broad spectrum of pricing driven by competitive pressures.

- Subscriber Acquisition Costs (SAC): Industry reports from late 2023 and early 2024 indicated that SAC for major German telecom operators could range from €50 to over €100 per new subscriber, a figure directly impacted by promotional activities and competitive offers.

- Impact on Margins: The intense competition and associated pricing pressure contributed to a tightening of EBITDA margins for some German telecom operators, with reported margins often falling between 35% and 45% in the mobile segment during the 2023-2024 period.

Cloud Services Market Growth

The German cloud services market is experiencing robust expansion, with forecasts indicating a compound annual growth rate (CAGR) of 17.48% between 2025 and 2032. This upward trend is fueled by a strong demand for scalable and cost-efficient cloud solutions across various industries.

This burgeoning market presents a significant growth avenue for 1&1, given its portfolio of cloud-based applications tailored for small and medium-sized businesses. The increasing reliance on digital transformation initiatives by these businesses directly translates into greater adoption of cloud services.

Furthermore, the market's growth is bolstered by the widespread adoption of hybrid and multi-cloud strategies among German enterprises. This strategic shift by larger organizations creates a more dynamic and diverse cloud ecosystem, offering 1&1 opportunities to cater to evolving client needs.

- Projected German Cloud Services Market CAGR (2025-2032): 17.48%

- Key Market Drivers: Demand for scalability, cost-efficiency, and digital transformation.

- Strategic Trends: Increasing adoption of hybrid and multi-cloud strategies by German enterprises.

- Opportunity for 1&1: Significant growth potential due to its cloud-based offerings for SMEs.

Germany's economic outlook for 2025 is characterized by flatness, with a projected 0% growth, a revision from earlier, more optimistic forecasts. This stagnation is largely attributed to ongoing global trade tensions that are impacting the nation's vital export sector.

Despite the broader economic slowdown, private consumption is expected to see a modest increase, supported by rising real disposable incomes and a more favorable interest rate environment. However, persistent inflation, at 2.2% in April 2024, continues to dampen consumer spending power, particularly on non-essential services like telecommunications, pressuring companies like 1&1 to balance pricing strategies.

The German telecommunications sector is a highly competitive arena, with significant investments in infrastructure, projected to reach €8 billion in 2025, a 3.5% increase. This intense rivalry, evident in average mobile ARPU figures generally between €10-€15 in 2024, necessitates efficient cost management and service differentiation for players like 1&1, especially given subscriber acquisition costs that can range from €50 to over €100.

| Economic Indicator | 2024 Projection/Data | 2025 Projection | Impact on 1&1 |

|---|---|---|---|

| GDP Growth | Slightly positive (e.g., 0.3%) | 0% (flat) | Reduced overall market demand, potential pressure on revenue growth. |

| Inflation Rate | ~2.2% (April 2024) | Expected to moderate but remain a factor | Consumer price sensitivity, demand for value-oriented services. |

| Private Consumption | Modest uptick expected | Continued modest growth | Potential for increased demand for telecom services, but price sensitive. |

| Telecom Infrastructure Investment | High | €8 billion (3.5% increase) | Opportunity for network expansion, but high CAPEX requirements. |

What You See Is What You Get

1&1 PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive 1&1 PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a thorough understanding of the external forces shaping 1&1's strategic landscape.

Sociological factors

Germany's accelerating digital transformation is fueling a significant demand for robust internet and mobile services. With approximately 90% of the German population now online, the need for faster, more dependable connectivity is paramount for both consumers and enterprises alike.

This societal shift directly supports 1&1's growth trajectory by broadening its addressable market and driving higher data usage per customer. As more aspects of daily life and business operations move online, the reliance on seamless digital communication intensifies, presenting a clear opportunity for telecommunications providers.

The surge in remote and hybrid work models, a trend significantly amplified in 2024 and continuing into 2025, has fundamentally altered household connectivity needs. This shift means reliable, high-speed broadband is no longer a convenience but a critical utility for millions, impacting everything from work productivity to education and social interaction.

This increased reliance on home internet directly benefits companies like 1&1, whose broadband services are essential for supporting this new normal. With more people working and spending leisure time at home, the demand for robust internet infrastructure and increased data traffic is a key market driver.

German consumers are highly attuned to data privacy and security. A significant 61% of them believe using the internet has become more dangerous, highlighting a deep-seated concern. This sentiment directly impacts how they interact with digital services, making trust a paramount factor.

For telecommunication companies like 1&1, this translates into a critical need for strong cybersecurity protocols and clear communication about data handling. Investing in these areas isn't just a compliance issue; it's a strategic imperative for attracting and retaining customers in a privacy-conscious market.

Maintaining consumer trust in data protection is essential for 1&1's long-term success. A proactive approach to security and transparency can differentiate the company and foster loyalty among its customer base, particularly in the competitive German telecommunications landscape.

Aging Population and Digital Inclusion

Germany's demographic landscape is shifting significantly, with an aging population presenting both challenges and opportunities for digital inclusion. By 2024, it's projected that over 22 million people in Germany will be aged 65 and over, a substantial segment of the population. While younger generations are generally adept with digital technologies, ensuring that older citizens can access and effectively use digital services is crucial for companies like 1&1.

This demographic trend necessitates a strategic approach to service design and customer support. 1&1 must consider the varying levels of digital literacy among different age groups when developing its offerings. For instance, user-friendly interfaces and accessible customer support channels are vital to bridge the digital divide for seniors.

- Demographic Shift: Germany's population is aging, with the proportion of individuals aged 65+ increasing.

- Digital Literacy Gap: A notable difference exists in digital proficiency between younger and older demographics.

- Market Opportunity: Catering to the needs of an aging population can unlock a significant market segment for digital services.

- Service Adaptation: 1&1 should focus on intuitive design and robust support to ensure digital inclusion for all age groups.

Demand for Personalized and Integrated Services

Consumers are increasingly demanding tailored experiences and connected digital services, a trend amplified by younger demographics. This means telecom providers are expected to offer more than just basic internet and phone plans. For instance, a 2024 study indicated that 65% of consumers aged 18-34 prefer brands that offer personalized recommendations.

This shift directly impacts how companies like 1&1 must operate. The expectation is for seamless integration across all touchpoints, whether online or in-store, and for services to adapt to individual needs. This includes everything from customized data plans to AI-driven support.

- Personalization is Key: A significant portion of consumers, especially younger ones, actively seek personalized service offerings.

- Integrated Experiences: The demand is for a unified digital ecosystem, not siloed services.

- 1&1's Advantage: 1&1's existing portfolio of mobile, broadband, and cloud services provides a strong foundation to build these integrated, user-centric solutions.

Societal trends are significantly shaping the demand for digital services in Germany, with a growing online population and increased reliance on home internet due to hybrid work models. For instance, by the end of 2024, over 90% of Germans are online, driving demand for faster connectivity. This societal shift directly supports 1&1's growth by expanding its customer base and increasing data consumption.

Consumer concerns about data privacy are paramount, with 61% of Germans perceiving internet use as more dangerous, making trust and robust cybersecurity essential for 1&1. Furthermore, Germany's aging demographic, with over 22 million people aged 65+ by 2024, presents an opportunity for 1&1 to cater to varying digital literacy levels through user-friendly services and accessible support.

The demand for personalized and integrated digital experiences is also rising, with 65% of 18-34 year olds preferring brands that offer tailored recommendations. 1&1's existing diverse service portfolio positions it well to meet these evolving consumer expectations for seamless, user-centric solutions.

Technological factors

Germany's 5G network expansion is accelerating, with a goal to cover a substantial portion of the population by 2025. This rapid deployment is crucial for economic growth and digital transformation.

1&1 stands out as a pioneer in Europe, constructing its entire 5G network using Open RAN technology. This virtualized approach promises greater agility and potential cost savings by allowing for a mix of hardware and software vendors.

While Open RAN offers advantages like vendor diversification and increased flexibility, it also introduces challenges in integration and requires 1&1 to meet aggressive network build-out timelines to capitalize on its innovative strategy.

Germany is aggressively expanding its fiber optic infrastructure, with ambitious goals to reach near-universal coverage by 2030. This technological push, often referred to as Fiber to the Home (FTTH) and Fiber to the Building (FTTB), is foundational for delivering the high-speed internet required for modern digital life and is also essential for the robust backhaul needed to support 5G mobile networks.

For 1&1, this fiber expansion is not just a trend but a strategic imperative. The company's significant investments in its own 1&1 Versatel fiber network, alongside its access to other extensive fiber networks, directly impacts its ability to offer competitive broadband speeds and maintain service reliability. By 2025, Germany aims to have at least 50% of all households connected to fiber, a target that underscores the importance of this infrastructure for 1&1's market position.

The German cloud services market is projected to reach approximately €35 billion in 2024, demonstrating robust expansion as businesses prioritize scalability and operational efficiency. This growth is further fueled by a significant uptick in demand for sovereign cloud solutions, ensuring data residency and compliance, alongside the burgeoning integration of edge computing for applications requiring minimal latency. 1&1's strategic focus on cloud-based business applications positions it to directly leverage this market momentum. Furthermore, its innovative Open RAN network architecture inherently supports edge computing principles by enabling data processing to occur closer to the end-user, enhancing performance for latency-sensitive services.

Artificial Intelligence (AI) Integration

Artificial Intelligence (AI) is rapidly transforming the telecommunications landscape, with 1&1 poised to benefit significantly. AI integration is key for optimizing network performance, streamlining customer service through advanced chatbots, and delivering highly personalized user experiences. German businesses are demonstrating a strong and growing commitment to AI adoption, with projections indicating substantial market expansion in the coming years.

By strategically implementing AI, 1&1 can achieve notable improvements in operational efficiency and elevate customer satisfaction. This aligns with trends observed among leading telecommunications providers who are already leveraging AI to offer more intelligent and responsive services, thereby gaining a competitive edge.

- Network Optimization: AI algorithms can predict and prevent network issues, ensuring seamless connectivity for 1&1 customers.

- Enhanced Customer Service: AI-powered chatbots offer 24/7 support, resolving queries faster and improving user satisfaction.

- Personalized Offerings: AI enables 1&1 to analyze customer data and provide tailored product and service recommendations.

- Market Growth: The German AI market is expected to grow substantially, presenting a fertile ground for 1&1's AI initiatives.

Cybersecurity and Network Resilience

The increasing reliance on digital services underscores the critical need for robust cybersecurity and resilient networks. Telecom providers, including 1&1, are continuous targets for sophisticated cyberattacks, necessitating substantial investments in defense mechanisms to safeguard service continuity and data integrity.

For 1&1, a secure and resilient network is not just a preference but a fundamental requirement, especially given the intricate nature of Open RAN deployments. Protecting customer data and ensuring uninterrupted service delivery are paramount to maintaining trust and operational stability.

The global cybersecurity market is projected to reach $366 billion in 2028, highlighting the significant financial commitment required. In 2023, the average cost of a data breach globally was $4.45 million, a figure that underscores the financial imperative for proactive security measures.

- Increased Investment in Security: 1&1 must allocate significant resources to advanced threat detection, prevention, and response systems to counter evolving cyber threats.

- Open RAN Vulnerabilities: The distributed nature of Open RAN introduces new potential attack vectors that require specialized security protocols and continuous monitoring.

- Regulatory Compliance: Adhering to stringent data protection regulations, such as GDPR, necessitates a strong cybersecurity posture to avoid substantial penalties.

- Customer Trust: Demonstrating a commitment to network resilience and data security is vital for retaining customers and attracting new ones in a competitive market.

Technological advancements are reshaping the telecommunications sector, with Germany's 5G network expansion and fiber optic build-out being central to this evolution. 1&1's pioneering use of Open RAN technology positions it to leverage these developments, aiming for agility and cost-efficiency in its network infrastructure.

The burgeoning cloud services market, projected to reach €35 billion in Germany in 2024, presents significant opportunities for 1&1, particularly with its focus on cloud-based business applications and edge computing capabilities inherent in its Open RAN architecture. Furthermore, the increasing integration of Artificial Intelligence (AI) across industries, including telecom, offers 1&1 avenues to optimize network performance, enhance customer service, and personalize offerings.

However, these technological shifts also bring challenges, notably the need for robust cybersecurity measures to protect against evolving threats and ensure network resilience. The global cybersecurity market's significant growth, reaching an estimated $366 billion by 2028, underscores the critical investment required to safeguard operations and customer data.

| Technological Factor | Description | 1&1 Relevance/Impact | Key Data/Projections (2024/2025) |

| 5G Network Expansion | Widespread deployment of 5G infrastructure. | Enables higher speeds and lower latency, crucial for new services. | Germany targeting substantial population coverage by 2025. |

| Fiber Optic Infrastructure | Expansion of high-speed fiber connections. | Foundation for reliable broadband and 5G backhaul. | Germany aiming for 50% household fiber penetration by 2025. |

| Open RAN Technology | Virtualizing and opening up mobile network components. | Offers flexibility, vendor diversification, and potential cost savings for 1&1. | 1&1 is a pioneer in Europe with a fully Open RAN network strategy. |

| Cloud Services | Growth in cloud computing adoption and solutions. | 1&1 can leverage this for its business applications and edge computing. | German cloud market projected at €35 billion in 2024. |

| Artificial Intelligence (AI) | Integration of AI for network optimization and customer service. | Improves operational efficiency and customer experience for 1&1. | Strong growth projected for AI adoption in German businesses. |

| Cybersecurity | Measures to protect against digital threats. | Essential for network resilience, data integrity, and customer trust for 1&1. | Global cybersecurity market projected at $366 billion by 2028; average data breach cost $4.45 million in 2023. |

Legal factors

The German Telecommunications Act (TKG) and its upcoming 2025 amendments are central to 1&1's operations, dictating licensing, network access, and consumer protections. These regulations are dynamic, requiring constant adaptation from telecom providers.

The Bundesnetzagentur's role is critical, with its decisions on spectrum allocation and access rules directly influencing 1&1's strategic investments and business model. For instance, recent spectrum auctions in 2024 have set new parameters for network build-out.

Navigating this evolving legal landscape is paramount for 1&1's continued market presence and operational success. Adherence to these regulatory shifts ensures legal standing and competitive positioning.

The General Data Protection Regulation (GDPR) and the updated Telecommunications-Digital-Services-Data Protection Act (TDDDG), effective May 2024, significantly shape 1&1's operations by mandating rigorous data protection standards. These regulations require 1&1 to implement advanced data security protocols, maintain transparent privacy notices, and facilitate data subject access requests, impacting how customer information is handled.

Failure to adhere to these stringent legal frameworks, which include potential fines up to 4% of global annual turnover or €20 million for GDPR violations, poses a substantial risk to 1&1. The TDDDG further refines these requirements for the telecommunications sector, emphasizing the need for secure data handling and clear consent mechanisms, with breaches potentially leading to significant financial penalties and erosion of customer trust.

German consumer protection laws, such as those within the Telecommunications Act (TKG), significantly shape 1&1's operations regarding marketing, contract management, billing, and complaint resolution. These regulations ensure fair practices and safeguard customer rights.

The upcoming discontinuation of the European Online Dispute Resolution Platform in July 2025 will necessitate adjustments in how 1&1 handles cross-border consumer disputes, potentially requiring new avenues for resolution. This change highlights the dynamic nature of consumer protection frameworks.

Compliance with these evolving consumer protection mandates is not just a legal necessity but a cornerstone for fostering customer loyalty and mitigating the risk of costly legal challenges. For instance, in 2023, German consumer protection agencies reported a 15% increase in complaints related to digital services, underscoring the importance of robust compliance.

Competition Law and Anti-Monopoly Regulations

Germany's competition authorities actively oversee the telecommunications sector, aiming to curb anti-competitive behavior and foster a level playing field. This includes rigorous examination of spectrum allocation, mandates for dominant operators to grant network access, and close scrutiny of any proposed mergers or acquisitions.

These legal frameworks directly impact 1&1's strategic options, influencing its capacity to compete effectively and grow its market presence against established market leaders. For instance, the Bundeskartellamt's decisions on wholesale access terms can significantly shape 1&1's cost structure and its ability to offer competitive retail services.

- Bundesnetzagentur's Role: Germany's Federal Network Agency (Bundesnetzagentur) is central to regulating the telecommunications market, ensuring fair competition and consumer protection.

- Merger Control: Potential mergers or acquisitions involving major players, including those that could affect 1&1, undergo strict review to prevent undue market concentration.

- Network Access: Regulations often compel incumbent operators to provide access to their infrastructure, a crucial factor for 1&1's network expansion and service delivery.

Infrastructure Deployment Regulations and Permitting

The legal landscape for deploying telecommunications infrastructure, such as laying fiber optic cables and erecting mobile masts, presents a complex web of regulations and permitting requirements. These processes can be time-consuming and bureaucratic, directly impacting the speed and cost of network expansion for companies like 1&1.

Efforts to simplify these procedures are underway, with recent legislative changes in Germany, for instance, designating network expansion as an overriding public interest. This aims to expedite the approval process, though navigating specific local ordinances and securing timely permits remains a critical legal hurdle for 1&1's infrastructure deployment initiatives.

- Bureaucratic Hurdles: Permitting for new infrastructure, like fiber optic cable installation, often involves multiple local authorities, leading to potential delays and increased administrative costs.

- Overriding Public Interest: Legislation declaring network expansion a public interest aims to streamline approvals, but local implementation can vary significantly.

- Local Bylaws: Specific municipal regulations regarding mast heights, aesthetic considerations, and underground cable routing add layers of legal complexity to deployment plans.

- Environmental Impact Assessments: Depending on the scale and location of infrastructure projects, environmental reviews and approvals can add substantial time and legal scrutiny.

Legal factors significantly shape 1&1's operational environment. The German Telecommunications Act (TKG) and its 2025 amendments, alongside data protection laws like GDPR and the TDDDG (updated May 2024), mandate strict compliance regarding network access, consumer rights, and data handling, with potential fines for non-compliance. German competition authorities also play a crucial role, influencing market dynamics through spectrum allocation and merger reviews, directly impacting 1&1's competitive strategy and network expansion efforts.

| Legal Area | Key Regulations/Bodies | Impact on 1&1 | Relevant Data/Trends |

|---|---|---|---|

| Telecommunications Regulation | German Telecommunications Act (TKG), Bundesnetzagentur | Licensing, network access, spectrum allocation, consumer protection | Spectrum auctions in 2024 set new network build-out parameters. |

| Data Protection | GDPR, TDDDG (effective May 2024) | Data security, privacy notices, consent mechanisms | Fines up to 4% of global annual turnover or €20 million for GDPR violations. |

| Competition Law | Bundeskartellamt | Market oversight, merger control, network access mandates | Scrutiny of wholesale access terms affects 1&1's cost structure. |

| Consumer Protection | TKG, European ODR Platform (discontinuing July 2025) | Marketing, contracts, billing, dispute resolution | 15% increase in digital service complaints in Germany in 2023. |

Environmental factors

The extensive broadband and mobile networks operated by companies like 1&1, encompassing data centers and cell towers, are inherently energy-intensive. As 1&1 continues to build out its 5G and fiber optic infrastructure, its overall energy consumption and associated carbon footprint are expected to grow significantly.

In 2023, the telecommunications sector globally accounted for approximately 2-3% of total global electricity consumption. This figure is projected to rise as network traffic increases and more advanced technologies are deployed, placing direct operational cost and environmental pressure on companies like 1&1.

Consequently, 1&1 faces increasing pressure from regulators and stakeholders to invest in and adopt energy-efficient technologies, such as advanced cooling systems for data centers and more power-efficient base stations. Furthermore, a strategic shift towards sourcing renewable energy, like solar and wind power, is becoming crucial for reducing operational carbon emissions and meeting sustainability targets.

The telecommunications sector, including companies like 1&1, faces growing pressure regarding electronic waste (e-waste). Globally, e-waste generation is projected to reach 74 million metric tons by 2030, a significant increase from 53.6 million metric tons in 2019. This surge stems from the rapid obsolescence of devices and network infrastructure.

As a provider of mobile and broadband services, 1&1 must navigate evolving environmental regulations concerning the responsible disposal and recycling of its equipment. These regulations aim to minimize the environmental impact of discarded electronics, which often contain hazardous materials.

Adopting circular economy principles is crucial for 1&1's long-term sustainability and compliance. Initiatives like refurbishing used network hardware or implementing robust recycling programs for customer devices can reduce waste and create value from existing resources. For instance, some European countries have set ambitious e-waste collection targets, with Germany aiming for 65% of the average weight of placed on the market products by 2023.

Societal and regulatory pressures are increasingly pushing telecommunications companies like 1&1 to establish and meet ambitious carbon footprint reduction goals. This necessitates a thorough evaluation of emissions throughout their entire value chain, encompassing everything from network infrastructure operations to their supply chain and the devices customers use.

In 2023, the European Union's emissions trading system saw carbon prices averaging around €90 per tonne, highlighting the financial implications of carbon emissions for businesses operating within the bloc. 1&1's sustainability reports likely detail specific strategies aimed at mitigating its environmental impact, potentially including investments in renewable energy sources for its data centers and network equipment, as well as initiatives to optimize energy efficiency.

Sustainable Infrastructure Development

The expansion of telecommunications infrastructure, especially fiber optic networks, inherently involves construction that can affect local environments and resource use. For 1&1, this means considering the ecological footprint of its network build-out. Sustainable construction methods, reducing environmental impact during deployment, and choosing eco-friendly materials are crucial. For instance, the EU's Green Deal aims to promote sustainable construction, with targets for reducing embodied carbon in buildings and infrastructure, which directly influences material sourcing and construction techniques relevant to 1&1's operations.

1&1's network expansion strategies must actively integrate these environmental considerations to align with growing regulatory and societal expectations for sustainability. This involves a proactive approach to minimizing disruption and optimizing resource efficiency throughout the infrastructure development lifecycle.

Key environmental considerations for 1&1's infrastructure development include:

- Minimizing habitat disruption: Careful planning to avoid sensitive ecosystems during cable laying and tower construction.

- Resource efficiency: Utilizing recycled materials and energy-efficient construction equipment.

- Waste reduction: Implementing strategies for managing and recycling construction waste generated during network rollouts.

- Embodied carbon reduction: Selecting materials with lower carbon footprints for infrastructure components.

Climate Change Adaptation and Network Resilience

Climate change presents tangible risks to 1&1's physical network infrastructure, particularly from extreme weather events like intensified storms and heatwaves. These events can disrupt service and damage critical assets, requiring significant investment in climate-resilient designs and robust disaster recovery protocols. For instance, the European Environment Agency reported a notable increase in weather-related damages across the EU in recent years, underscoring the growing need for proactive adaptation strategies.

The growing frequency and severity of climate-related disruptions directly influence network planning and ongoing maintenance for 1&1. Ensuring continuous service availability amidst unpredictable weather patterns necessitates forward-thinking infrastructure upgrades and contingency planning. This commitment to resilience also aligns with broader environmental responsibilities, showcasing a dedication to sustainable operations and minimizing the ecological footprint of their network services.

- Increased Investment: 1&1 may need to allocate a larger portion of its capital expenditure towards hardening network infrastructure against extreme weather, potentially impacting budget allocations for 2024-2025.

- Operational Adjustments: Proactive maintenance schedules and enhanced monitoring systems will be crucial to detect and mitigate potential climate-related disruptions before they affect service delivery.

- Regulatory Scrutiny: As environmental regulations evolve, 1&1 might face increased pressure to demonstrate its climate adaptation strategies and commitment to network resilience.

1&1's extensive network infrastructure, including data centers and mobile base stations, is a significant consumer of energy. As the company expands its 5G and fiber optic services, its energy usage and carbon footprint are expected to rise. The telecommunications sector globally consumed around 2-3% of global electricity in 2023, a figure projected to increase with network traffic growth.

The company faces mounting pressure from regulators and stakeholders to adopt energy-efficient technologies and source renewable energy. Furthermore, the growing volume of electronic waste (e-waste) presents a challenge, with global projections indicating 74 million metric tons by 2030. 1&1 must adhere to evolving regulations for responsible disposal and recycling, potentially adopting circular economy principles.

Climate change also poses risks, with extreme weather events capable of disrupting 1&1's physical network infrastructure. This necessitates investments in climate-resilient designs and disaster recovery plans, as evidenced by increasing weather-related damages reported across the EU.

| Environmental Factor | Impact on 1&1 | Data/Trend |

| Energy Consumption | Increased operational costs and carbon footprint due to network expansion. | Telecom sector: ~2-3% global electricity use (2023), projected to rise. |

| Electronic Waste (E-waste) | Compliance with disposal regulations, need for recycling programs. | Global e-waste projected to reach 74M metric tons by 2030. Germany's 2023 e-waste collection target: 65%. |

| Climate Change Risks | Infrastructure vulnerability to extreme weather, need for resilience investments. | Increased weather-related damages reported across the EU. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously crafted using a blend of public and proprietary data sources. We draw insights from official government reports, reputable market research firms, and leading economic indicators to ensure a comprehensive and accurate understanding of the macro-environment.