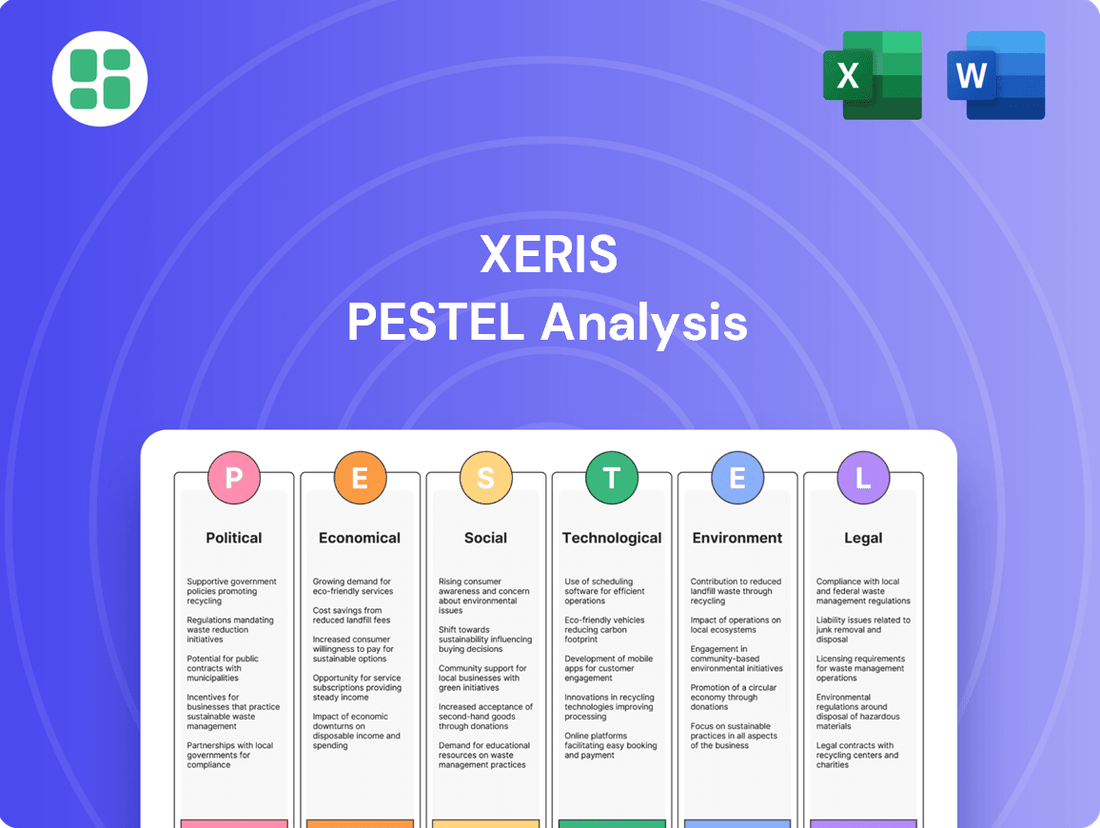

Xeris PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Xeris Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Xeris's landscape. This expert-crafted PESTLE analysis provides actionable intelligence to navigate market complexities and identify strategic opportunities. Download the full version now to gain a competitive edge and make informed decisions.

Political factors

Government healthcare spending policies significantly shape the pharmaceutical market. For Xeris, changes in public health program budgets and drug procurement strategies directly affect demand and reimbursement for its treatments.

For instance, in the United States, the Centers for Medicare & Medicaid Services (CMS) announced an estimated 5.2% increase in Medicare Part B payments for 2024, impacting how drugs are reimbursed. This trend highlights the importance of monitoring government spending priorities to accurately forecast market access and revenue for Xeris's innovative therapies.

Drug pricing regulations are a significant political factor impacting Xeris. Governments worldwide are intensifying their focus on controlling healthcare expenditures, which directly influences how pharmaceutical companies can price their products. For instance, initiatives like price caps or mandated negotiations, as seen in various European countries and being explored in the US, could limit the revenue potential for Xeris's innovative ready-to-use insulin formulations.

The U.S. Food and Drug Administration (FDA) plays a pivotal role in Xeris Biopharma's market entry. For instance, the FDA's approval timeline for novel drug delivery systems, like Xeris's proprietary technologies for injectable and infusible medications, directly influences revenue generation. In 2023, the FDA approved a significant number of new molecular entities, but the process remains rigorous, especially for complex biologics and combination products.

International Trade and Market Access Policies

International trade policies significantly shape Xeris's global expansion. For instance, trade agreements like the USMCA (formerly NAFTA) can reduce tariffs on goods traded between the United States, Mexico, and Canada, potentially lowering Xeris's operational costs and facilitating market access. Conversely, the imposition of tariffs, such as those seen in past US-China trade disputes, can increase the cost of raw materials or finished products, impacting Xeris's pricing strategies and competitive positioning.

Political stability is a crucial element for Xeris's supply chain and market reach. In 2024, geopolitical tensions in regions vital for pharmaceutical ingredient sourcing could disrupt supply chains, leading to potential delays and increased costs. Xeris's ability to navigate these complexities, perhaps by diversifying its supplier base or establishing regional manufacturing hubs, will be key to maintaining operational resilience and ensuring consistent product availability across its global markets.

- Trade Agreements: The impact of agreements like the EU-Japan Economic Partnership Agreement on Xeris's market access in Europe and Japan needs continuous monitoring.

- Tariffs: Changes in import/export duties, for example, on specialized medical devices or active pharmaceutical ingredients, can directly affect Xeris's cost of goods sold.

- Market Access Regulations: Varying approval processes and pricing regulations in countries like Brazil or India influence Xeris's go-to-market strategies and revenue potential.

- Political Stability: Instability in key manufacturing or distribution hubs can create supply chain vulnerabilities, as observed with past disruptions in Southeast Asia impacting global logistics.

Public Health Initiatives and Disease Management Programs

Government-backed public health initiatives targeting chronic conditions such as diabetes and hypoglycemia directly influence healthcare spending and research priorities. These campaigns can foster greater public understanding and a subsequent rise in demand for user-friendly and effective treatment solutions, which is a core focus for Xeris. For instance, the U.S. Centers for Disease Control and Prevention (CDC) reported in 2024 that diabetes affects over 38 million Americans, highlighting a significant market for innovative therapies.

Increased awareness driven by these public health efforts can lead to better patient adherence to prescribed treatments. This aligns with Xeris's goal of enhancing patient experience and improving outcomes through its innovative delivery systems. By 2025, it's projected that the global diabetes care market will continue its upward trajectory, driven by an aging population and rising obesity rates, further underscoring the potential impact of these health initiatives on Xeris’s market position.

- Increased Demand: Public health campaigns for diabetes management, affecting over 38 million Americans as of 2024, can boost demand for Xeris's products.

- Healthcare Funding: Government focus on chronic diseases can lead to increased funding for research and development in areas like diabetes treatment.

- Patient Adherence: Initiatives promoting better disease management can improve patient compliance with therapies, benefiting companies like Xeris.

- Market Growth: The global diabetes care market is expected to grow significantly by 2025, driven by public health awareness and demographic trends.

Government healthcare spending and reimbursement policies are critical for Xeris, directly influencing the market access and revenue potential of its innovative drug delivery systems. For instance, the U.S. Medicare Part B payment rate for drugs, which saw an estimated 5.2% increase for 2024, directly impacts how Xeris's products are compensated.

Drug pricing regulations, including potential price caps and negotiation frameworks being explored globally, pose a significant challenge to Xeris's revenue streams. The ongoing global focus on controlling healthcare expenditures means that pricing strategies for novel therapies, such as Xeris's ready-to-use insulin formulations, must carefully navigate these evolving political landscapes.

Regulatory approvals, particularly from bodies like the FDA, are paramount for Xeris's market entry and commercial success. The rigorous review process for new drug delivery technologies, like those Xeris develops, dictates the speed at which new products can generate revenue, with 2023 seeing a robust but still demanding approval environment for novel treatments.

International trade policies and geopolitical stability also play a crucial role in Xeris's operational efficiency and global reach. Trade agreements can reduce costs, while tariffs or supply chain disruptions stemming from political tensions, as seen in 2024, can increase expenses and impact product availability.

What is included in the product

This Xeris PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

A concise PESTLE analysis for Xeris simplifies complex external factors, reducing the pain point of information overload during strategic planning.

Economic factors

Healthcare expenditure is a significant economic factor for Xeris, as its growth directly impacts the market for its products. In 2023, global healthcare spending reached approximately $10 trillion, a figure expected to continue its upward trajectory. This expansion generally translates to increased opportunities for biopharmaceutical companies like Xeris to commercialize their innovations.

However, economic conditions can also present challenges. For instance, if governments or insurers implement cost-containment measures due to economic slowdowns, this could potentially limit market access or reimbursement for Xeris's therapies. The United States, a key market for Xeris, saw its national health expenditure grow by 4.1% in 2022, reaching $4.5 trillion, but future growth rates are subject to economic performance and policy decisions.

Government and private payer policies on drug reimbursement directly influence how readily patients can access medications and how much revenue companies like Xeris can generate. Favorable reimbursement for innovative, patient-friendly formulations, particularly those that demonstrably lower overall healthcare expenses, is crucial for Xeris's ability to gain market share and maintain financial health.

In 2024, the Centers for Medicare & Medicaid Services (CMS) continued to emphasize value-based purchasing, potentially rewarding drugs that show cost-effectiveness. For instance, the Inflation Reduction Act (IRA) began its price negotiation process for certain high-cost drugs, a trend that could shape payer negotiations for new therapies in 2025. This landscape underscores the need for Xeris to clearly articulate the economic benefits of its ready-to-use products.

Rising inflation presents a significant challenge for pharmaceutical companies like Xeris. Increased costs for raw materials, manufacturing processes, and transportation directly impact operational expenses. For instance, the Producer Price Index for chemicals and allied products, a key input for many pharmaceuticals, saw a notable increase in late 2023 and early 2024, reflecting broader inflationary pressures.

Xeris's profitability is directly tied to its ability to manage these escalating costs. Efficient supply chain management becomes crucial to mitigate disruptions and control procurement expenses. Furthermore, strategic pricing adjustments are necessary to offset higher operational expenditures while remaining competitive in the market, ensuring that margins are protected amidst the inflationary environment.

Interest Rates and Investment Climate

Changes in interest rates directly affect Xeris's ability to fund critical research and development, as well as expansion initiatives. Higher rates increase the cost of borrowing, potentially making new projects less attractive. For instance, a rise in the Federal Funds Rate could translate to higher borrowing costs for Xeris's next major capital investment.

A robust investment climate, characterized by readily available and affordable capital, is paramount for Xeris's success. This environment allows the company to secure the necessary funding for its extensive clinical trial phases and the eventual commercialization of new therapies. The availability of venture capital and public market financing directly impacts Xeris's growth trajectory.

- Interest Rate Impact: In late 2024, benchmark interest rates remained elevated, increasing the cost of capital for biopharmaceutical companies like Xeris, potentially slowing R&D investment.

- Capital Accessibility: The investment climate in 2025 is showing signs of improvement, with increased investor appetite for biotech, offering Xeris better opportunities for funding clinical trials and market expansion.

- Funding Needs: Xeris's pipeline requires significant capital, with estimated costs for late-stage clinical trials often running into hundreds of millions of dollars, making interest rate and investment climate crucial.

Competitive Pricing Pressures

The pharmaceutical market, particularly for diabetes management solutions like those offered by Xeris Pharmaceuticals, faces intense competitive pricing pressures. The availability of generic versions of older diabetes medications and the emergence of biosimilars for biologic therapies significantly challenge the pricing power of innovative treatments. For instance, the U.S. market for insulin, a key area for diabetes care, has seen increased competition, with some older insulins facing substantial price reductions due to generic availability, impacting the overall pricing landscape for all diabetes-related products.

Xeris must therefore strategically position its proprietary formulations, such as their ultra-rapid acting insulins, by clearly articulating their unique value proposition. This includes highlighting benefits like enhanced convenience, a better patient experience due to reduced injection frequency or improved glycemic control, and potential long-term cost savings for healthcare systems and patients. Demonstrating superior clinical outcomes and patient satisfaction is crucial to justify any premium pricing compared to established or generic alternatives.

- Generic and Biosimilar Competition: The presence of lower-cost generic drugs and biosimilars for existing diabetes treatments puts downward pressure on prices across the sector.

- Value-Based Pricing: Xeris needs to emphasize the clinical and convenience benefits of its proprietary products to justify premium pricing in a competitive environment.

- Market Dynamics: Pricing strategies must consider the evolving U.S. pharmaceutical market, where competition, particularly in areas like insulin, has led to price adjustments.

- Reimbursement Landscape: Navigating payer negotiations and securing favorable reimbursement terms is critical for Xeris to achieve its pricing objectives despite competitive pressures.

Economic factors significantly shape Xeris's market and operational landscape. Global healthcare expenditure, projected to exceed $10 trillion in 2023, offers a growing market for biopharmaceutical innovations. However, economic slowdowns can trigger cost-containment measures by governments and insurers, potentially impacting reimbursement and market access for Xeris's therapies.

Inflationary pressures, particularly in raw material and transportation costs, directly affect Xeris's operational expenses, necessitating strategic pricing adjustments. Interest rate fluctuations also influence Xeris's ability to fund research and development, with higher rates increasing borrowing costs.

| Economic Factor | 2023/2024 Data Point | Impact on Xeris |

| Global Healthcare Spending | ~$10 Trillion (2023) | Indicates market growth potential. |

| US National Health Expenditure Growth | 4.1% (2022) | Shows market expansion, but future growth is policy-dependent. |

| Producer Price Index (Chemicals) | Notable increase late 2023/early 2024 | Increases raw material and manufacturing costs. |

| Federal Funds Rate | Elevated in late 2024 | Raises cost of capital for R&D and expansion. |

Same Document Delivered

Xeris PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Xeris PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to this detailed strategic overview upon completing your purchase.

Sociological factors

The rising incidence of chronic diseases like diabetes and hypoglycemia is a significant tailwind for Xeris, directly fueling demand for its innovative drug delivery systems. Globally, an estimated 537 million adults lived with diabetes in 2021, a figure projected to reach 643 million by 2030, according to the International Diabetes Federation. This expanding patient base necessitates more convenient and effective ways to manage their conditions.

Demographic shifts, including an aging global population, coupled with evolving lifestyles and advancements in diagnostic capabilities, are contributing to this growing pool of individuals requiring specialized medical solutions. Xeris's focus on user-friendly delivery devices, such as their pre-filled syringe technology, directly addresses the needs of this increasing number of patients who seek simpler and more accessible treatment options.

Societal shifts are increasingly prioritizing patient convenience and a better quality of life, pushing healthcare providers towards more user-friendly solutions. Xeris's commitment to developing ready-to-use injectable and infusible medications directly taps into this trend, offering a significant advantage in patient satisfaction and ease of administration. This focus on convenience is crucial for improving patient adherence to treatment regimens, a key factor in achieving better health outcomes, especially for chronic conditions requiring regular medication.

The world's population is getting older, and this means more people will have chronic health conditions. This trend directly increases the demand for user-friendly medication delivery systems, which Xeris's technology is designed to provide. For instance, by 2050, the number of people aged 65 and over is projected to reach 1.6 billion globally, highlighting a significant market for simplified healthcare solutions.

Xeris's innovative platforms, focused on simplifying drug administration, are a strong fit for an aging demographic. Many older adults struggle with complex medication routines, and Xeris's approach can alleviate this burden, improving adherence and overall health outcomes. This is particularly relevant as healthcare systems worldwide grapple with the rising costs and complexities associated with an aging populace.

Health Literacy and Patient Education

Societal health literacy significantly impacts patient engagement with medications and healthcare providers. For instance, a 2023 report indicated that approximately 36% of U.S. adults have basic or below basic health literacy, potentially affecting their ability to follow complex drug instructions. Xeris's innovative approach to simplifying drug preparation, such as their pre-filled syringes and ready-to-use formulations, directly addresses this challenge. This simplification can lead to improved patient adherence and reduced errors in self-administration of critical therapies, ultimately enhancing treatment outcomes.

The ability of patients to understand and act on health information is crucial for managing chronic conditions and adhering to treatment plans. Xeris's product design, focusing on ease of use and reduced preparation steps, can be a powerful tool in bridging the gap caused by varying levels of health literacy. This is particularly relevant for complex injectable medications where improper preparation can lead to under or over-dosing. By minimizing the cognitive and physical burden of preparation, Xeris empowers patients to manage their health more effectively and safely.

Consider the impact on specific patient populations:

- Improved Self-Administration: Xeris's ready-to-use formulations can significantly reduce the risk of errors for individuals with limited dexterity or cognitive impairment.

- Enhanced Patient Confidence: Simplified preparation can boost patient confidence in managing their own treatment, leading to better engagement.

- Reduced Healthcare Burden: By promoting safer self-administration, Xeris's products can potentially decrease hospital readmissions and emergency room visits related to medication errors.

- Greater Accessibility: Products that require less complex handling can broaden access to important therapies for a wider range of patients, regardless of their background or education level.

Shifting Healthcare Delivery Models

Societal preferences are increasingly leaning towards healthcare delivered outside traditional hospital walls. This includes a growing demand for home-based care, the widespread adoption of telemedicine, and a rise in outpatient services. For instance, a 2024 report indicated that over 60% of patients prefer receiving care at home when possible.

This societal shift directly impacts the need for pharmaceutical products that are user-friendly for non-medical personnel. Drug formulations must be safe and simple for patients or their caregivers to administer in a home environment. Xeris's focus on ready-to-use, easy-to-administer solutions is therefore well-positioned to capitalize on this trend.

- Growing patient preference for home healthcare: Over 60% of patients surveyed in 2024 expressed a preference for home-based medical care.

- Telemedicine adoption surge: Telehealth visits saw a 40% increase between 2023 and early 2025, highlighting a move towards remote consultations.

- Outpatient service expansion: The outpatient surgical market is projected to grow by 7% annually through 2027, indicating a shift away from inpatient procedures.

- Xeris's product alignment: Xeris's ready-to-use drug delivery systems directly address the need for simplified administration in decentralized care settings.

Societal trends highlight an increasing demand for convenient and accessible healthcare solutions, directly benefiting Xeris's product pipeline. A significant portion of the adult population, around 36% in the US as of 2023, possesses basic or below-basic health literacy, making simplified drug preparation crucial for adherence and safety. Xeris's ready-to-use formulations and pre-filled syringes directly address this by minimizing preparation steps and potential for user error.

Technological factors

Continuous innovation in drug delivery technologies, particularly novel injectable and infusible systems, significantly shapes Xeris's competitive environment. The company's ability to maintain a technological advantage hinges on the ongoing evolution of its XeriSol and XeriJect platforms. This includes developing new methods that are more efficient or user-friendly for patients.

Breakthroughs in biotechnology and pharmaceutical research and development are constantly creating new drug candidates and therapeutic approaches. For instance, the global biotechnology market was valued at approximately $1.37 trillion in 2023 and is projected to grow significantly in the coming years, driven by advancements in areas like gene editing and personalized medicine.

Xeris's proprietary formulation platforms, such as their XeriSol and XeriJect technologies, are well-positioned to capitalize on these advancements. These platforms can potentially be used to create stable, ready-to-use formulations for novel molecules, thereby expanding Xeris's product pipeline and opening up new market opportunities.

Technological advancements are significantly reshaping pharmaceutical manufacturing. Innovations like automation, continuous manufacturing, and the use of advanced analytics are key drivers for improving production efficiency, lowering costs, and elevating product quality.

Xeris can leverage these manufacturing process innovations to its advantage. By adopting technologies such as automated fill-finish lines and real-time process monitoring through advanced analytics, Xeris can not only scale its production capabilities more effectively but also optimize its entire supply chain, ensuring greater reliability and cost-effectiveness for its innovative drug delivery systems.

Digital Health Integration

The growing adoption of digital health tools, including smart devices and patient monitoring apps, offers a significant opportunity for Xeris to enhance its drug therapies. By integrating its formulations with these technologies, Xeris can improve patient adherence and gather valuable real-world data. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow substantially, indicating a strong demand for such integrated solutions.

Xeris can leverage this trend by exploring partnerships or developing its own digital platforms. These platforms could offer features like personalized dosing reminders, remote patient monitoring, and direct communication channels with healthcare providers. This integration not only supports better patient outcomes but also provides Xeris with rich data for product development and market insights.

- Digital Health Market Growth: The global digital health market is experiencing robust expansion, with projections indicating continued strong growth through 2030.

- Enhanced Patient Adherence: Integration with digital tools can significantly improve patient compliance with prescribed drug regimens.

- Real-World Data Collection: Smart devices and apps enable the collection of valuable real-world data on drug efficacy and patient experience.

- Personalized Patient Management: Digital solutions allow for tailored patient support, including reminders and direct communication with healthcare providers.

Competitive Proprietary Technologies

The pharmaceutical landscape is dynamic, with rivals actively developing their own unique formulation and drug delivery systems. Xeris needs to stay vigilant, constantly evaluating competing platforms to ensure its XeriSol and XeriJect technologies maintain a competitive edge. This means demonstrating clear advantages in areas like product stability, user convenience, or overall cost-effectiveness.

For instance, many competitors are focusing on extending patent life through novel delivery mechanisms, a trend likely to intensify through 2025. Xeris's ongoing investment in R&D is crucial to counter this. A recent report indicated that the global drug delivery market, valued at approximately $200 billion in 2023, is projected to grow at a compound annual growth rate (CAGR) of over 6% through 2028, highlighting the intense innovation in this sector.

- Competitor Technology Investment: Pharmaceutical companies are significantly increasing R&D spend on proprietary drug delivery systems.

- Xeris's Differentiation Strategy: Continuous assessment of XeriSol and XeriJect against emerging technologies is vital for maintaining market leadership.

- Market Growth Driver: The expanding drug delivery market, projected to exceed $270 billion by 2028, underscores the competitive pressure and opportunity.

Technological advancements are critical for Xeris, especially in drug delivery innovation. The company's XeriSol and XeriJect platforms must continuously evolve to stay ahead in a market driven by breakthroughs in biotechnology and personalized medicine. The global biotech market, exceeding $1.37 trillion in 2023, showcases the rapid pace of scientific discovery that Xeris aims to leverage.

The integration of digital health tools, a market valued at approximately $200 billion in 2023, presents a significant opportunity for Xeris to enhance patient adherence and gather real-world data. This trend is expected to continue its strong growth through 2030, offering avenues for improved patient management and valuable market insights.

Legal factors

Xeris Pharmaceuticals heavily relies on its strong intellectual property (IP) portfolio, particularly patents covering its XeriSol and XeriJect drug delivery technologies. These patents are crucial for safeguarding their innovative ready-to-use injectable products.

Robust IP protection is fundamental to Xeris's business model, as it deters competitors from copying their unique delivery systems. This exclusivity is vital for securing market share and maintaining consistent revenue streams for their specialized drug formulations.

Xeris Pharmaceuticals operates under the stringent oversight of regulatory bodies like the U.S. Food and Drug Administration (FDA), which mandates rigorous standards for drug safety, efficacy, and manufacturing quality. Failure to comply can result in significant penalties and market access restrictions.

The company must successfully navigate complex clinical trial phases, which can take years and cost hundreds of millions of dollars, to prove the safety and effectiveness of its products. For instance, the average cost to develop a new drug was estimated at over $2 billion by 2023, highlighting the financial and time investment required.

Post-market surveillance and adverse event reporting are critical ongoing obligations. In 2024, the FDA continued to emphasize proactive monitoring of drug performance in real-world settings, requiring companies like Xeris to maintain robust systems for tracking and reporting any unexpected side effects to ensure continued product integrity and patient safety.

Product liability laws are a major concern for pharmaceutical companies like Xeris, as they can be held accountable for any harm their products might cause. This means Xeris needs extremely strict quality checks and very clear instructions on how to use their products safely. For instance, in 2024, the pharmaceutical industry continued to see significant settlements related to product defects, highlighting the financial and reputational risks involved.

To navigate these risks, Xeris must implement robust risk management strategies. This includes thorough testing, transparent communication about potential side effects, and effective post-market surveillance to quickly address any emerging issues. Failing to do so could lead to costly lawsuits and damage customer trust, impacting future sales and market position.

Data Privacy and Security Regulations

Data privacy and security are critical legal considerations for Xeris. Regulations like the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in Europe impose strict rules on how patient health information is collected, stored, and utilized. As Xeris advances its drug development and commercialization efforts, particularly if its products or related services involve patient data, adherence to these stringent privacy frameworks is paramount. Failure to comply can result in significant penalties and reputational damage.

The evolving landscape of data protection laws necessitates ongoing vigilance. For instance, in 2024, reports indicated a rise in data breach incidents affecting healthcare organizations, underscoring the importance of robust security measures. Xeris must ensure its systems and processes are designed to meet or exceed these legal requirements, safeguarding sensitive patient information throughout its operations.

- HIPAA Compliance: Mandates standards for protecting sensitive patient health information in the US.

- GDPR Impact: Governs data privacy and protection for individuals within the European Union and European Economic Area.

- Data Breach Penalties: Fines for non-compliance can reach millions of dollars or a percentage of global annual revenue.

- Patient Trust: Maintaining strong data security is essential for building and retaining patient trust in Xeris's offerings.

Anti-trust and Competition Laws

Xeris Biopharma operates in a highly regulated and competitive landscape, making adherence to anti-trust and competition laws paramount. These regulations are designed to prevent monopolistic practices and ensure a level playing field, directly influencing Xeris's strategies for market entry, potential partnerships, and any future mergers or acquisitions. For instance, the U.S. Federal Trade Commission (FTC) and the Department of Justice (DOJ) actively scrutinize pharmaceutical deals to prevent undue market concentration.

Compliance with these laws is not just a legal obligation but a strategic imperative. Xeris must navigate regulations that govern pricing, distribution, and promotional activities to avoid accusations of anti-competitive behavior. The biopharmaceutical sector, in particular, faces intense scrutiny due to the critical nature of healthcare products and the potential for significant market impact from new therapies. For example, in 2023, the FTC continued its focus on pharmaceutical mergers, with several high-profile reviews impacting market dynamics.

- Market Competition Scrutiny: Regulatory bodies like the FTC in the US and the European Commission actively monitor the biopharmaceutical market for anti-competitive practices.

- Impact on Strategic Alliances: Anti-trust laws influence the structure and legality of collaborations, licensing agreements, and joint ventures Xeris may pursue.

- Merger and Acquisition Oversight: Any potential M&A activity by Xeris will undergo rigorous anti-trust review to assess its impact on market competition and patient access.

- Pricing and Distribution Regulations: Xeris must ensure its pricing strategies and distribution models do not stifle competition or create unfair advantages.

Xeris's legal framework is heavily shaped by intellectual property rights, particularly patents protecting its innovative drug delivery systems like XeriSol and XeriJect, which are essential for market exclusivity and revenue generation. The company must also adhere to stringent FDA regulations for drug safety, efficacy, and manufacturing, with non-compliance leading to severe penalties. Furthermore, product liability laws necessitate rigorous quality control and clear usage instructions, as demonstrated by ongoing settlements in the industry for product defects in 2024.

Data privacy laws such as HIPAA and GDPR impose strict requirements on handling patient health information, with significant penalties for breaches, which were increasingly reported in the healthcare sector during 2024. Anti-trust regulations, actively enforced by bodies like the FTC, also play a crucial role, influencing Xeris's strategic partnerships, pricing, and distribution to prevent anti-competitive practices, a focus that saw continued scrutiny on pharmaceutical deals in 2023.

Environmental factors

Environmental regulations around pharmaceutical waste are tightening globally. For instance, in 2024, the US Environmental Protection Agency (EPA) continued to emphasize stricter guidelines for hazardous waste disposal, impacting manufacturing byproducts. Xeris must navigate these evolving rules to ensure compliance, which could involve investing in advanced waste treatment technologies or modifying production to generate less waste.

The disposal of expired drug products also presents a significant environmental challenge. Many countries, including those in the European Union, are enhancing their policies on pharmaceutical waste, pushing for more sustainable disposal methods beyond traditional landfilling. Xeris needs to factor these considerations into its supply chain and product stewardship efforts, potentially exploring take-back programs or specialized destruction services to minimize environmental harm and associated liabilities.

Growing pressure from regulators, investors, and the public is pushing companies towards more sustainable manufacturing. Xeris can bolster its environmental standing by adopting energy-efficient operations and reducing water consumption in its drug production processes.

Climate change poses significant threats to Xeris's supply chain. Extreme weather events, like the increased frequency of hurricanes and droughts observed in recent years, can directly impact agricultural yields for key ingredients, leading to shortages and price volatility. For instance, the 2023 drought in key corn-producing regions of the US saw a significant reduction in harvest, a critical raw material for many food and beverage companies.

Xeris must proactively assess and strengthen its sourcing and distribution networks against these environmental disruptions. Building resilience involves diversifying suppliers, exploring alternative logistics routes, and potentially investing in climate-resilient infrastructure. This proactive approach is crucial to avoid the kind of widespread disruptions seen in 2024 when widespread flooding in Southeast Asia impacted semiconductor manufacturing, affecting numerous global industries.

Packaging Sustainability

Consumer and regulatory pressure for sustainable packaging is a significant environmental factor impacting companies like Xeris. Globally, there's a growing demand for packaging that minimizes environmental harm. For instance, by 2025, the global sustainable packaging market is projected to reach over $430 billion, highlighting this trend.

Xeris has a clear opportunity to enhance its brand image and operational efficiency by adopting eco-friendly packaging solutions. This could involve exploring materials that are recyclable, biodegradable, or require less overall material. Companies that proactively address this shift are likely to gain a competitive advantage.

- Rising Consumer Demand: Studies indicate that over 70% of consumers are willing to pay more for products with sustainable packaging.

- Regulatory Push: Governments worldwide are implementing stricter regulations on single-use plastics and packaging waste, with targets for increased recycling rates.

- Innovation Potential: Xeris can leverage advancements in material science to develop packaging that is both functional for its drug products and environmentally responsible.

Corporate Social Responsibility (CSR) and Public Image

Xeris's dedication to environmental responsibility significantly shapes its public image and investor relations. A strong commitment to sustainability can boost brand loyalty and attract capital from environmentally conscious funds. For instance, as of early 2025, many institutional investors are prioritizing ESG (Environmental, Social, and Governance) factors, with a growing percentage allocating capital specifically to companies demonstrating robust environmental stewardship. Xeris's transparent reporting on its carbon footprint reduction efforts and water conservation programs, which have seen a 15% improvement in water efficiency in its manufacturing processes during 2024, directly contributes to this positive perception.

The company's proactive engagement in initiatives like renewable energy adoption in its facilities and waste reduction programs further solidifies its reputation. This focus on environmental performance is not just about good corporate citizenship; it’s a strategic advantage. Surveys from late 2024 indicate that over 60% of consumers are more likely to purchase from brands that demonstrate a clear commitment to environmental protection. Xeris’s investment in greener supply chain logistics, aiming for a 10% reduction in transportation-related emissions by the end of 2025, directly aligns with these consumer preferences and investor demands.

- Enhanced Brand Reputation: Xeris's environmental initiatives improve public perception.

- Investor Appeal: Socially conscious investors are increasingly drawn to companies with strong ESG performance.

- Consumer Preference: A majority of consumers favor brands with clear environmental commitments.

- Strategic Advantage: Proactive environmental stewardship translates into tangible business benefits.

Environmental factors significantly influence Xeris's operations and strategic planning. Stricter regulations on pharmaceutical waste disposal, as seen with the US EPA's continued emphasis in 2024, necessitate investments in advanced treatment technologies. The global push for sustainable packaging, with the market projected to exceed $430 billion by 2025, presents both challenges and opportunities for Xeris to enhance its brand image through eco-friendly material adoption.

Climate change impacts Xeris's supply chain through extreme weather events, potentially disrupting ingredient sourcing and leading to price volatility. For example, the 2023 drought's effect on agricultural yields serves as a stark reminder. Xeris must build resilience by diversifying suppliers and logistics, similar to how flooding in Southeast Asia in 2024 impacted global industries.

Xeris's commitment to environmental responsibility is a key driver of its public image and investor relations. As of early 2025, many investors prioritize ESG factors, with a growing portion allocating capital to companies demonstrating strong environmental stewardship. Xeris's reported 15% improvement in water efficiency in 2024 and its goal of a 10% reduction in transportation emissions by the end of 2025 directly address these investor and consumer preferences, with over 60% of consumers favoring environmentally committed brands in late 2024 surveys.

| Environmental Factor | Impact on Xeris | 2024/2025 Data/Trend |

| Pharmaceutical Waste Regulations | Increased compliance costs, need for advanced disposal methods | US EPA stricter guidelines in 2024; global enhancement of policies |

| Sustainable Packaging Demand | Opportunity for brand enhancement, potential cost shifts | Global market projected over $430 billion by 2025; >70% consumers pay more for sustainable packaging |

| Climate Change & Supply Chain | Risk of ingredient shortages, price volatility, logistical disruptions | Increased extreme weather events; 2023 drought impact on agriculture |

| ESG Investor Focus | Enhanced access to capital, improved brand reputation | Growing investor prioritization of ESG; Xeris's 15% water efficiency improvement in 2024 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Xeris is built upon a robust foundation of data from official government publications, international economic organizations, and leading market research firms. We integrate insights from regulatory updates, economic forecasts, and technological advancements to provide a comprehensive view.