Xeris Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Xeris Bundle

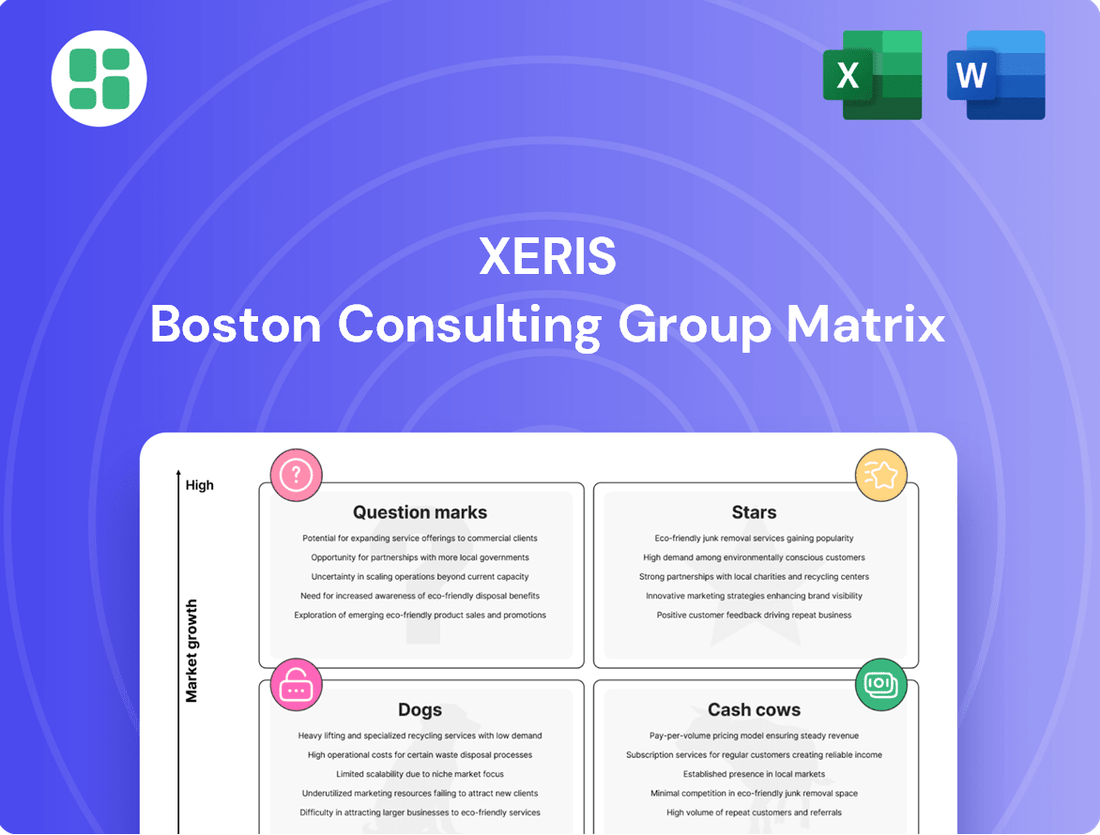

Unlock the strategic potential of your product portfolio with the Xeris BCG Matrix. This powerful tool visually categorizes your offerings into Stars, Cash Cows, Question Marks, and Dogs, providing a clear roadmap for resource allocation and future growth. Don't just guess where your business is headed; know it with precision.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Recorlev, Xeris Biopharma's innovative treatment for Cushing's syndrome, has experienced remarkable growth. Its revenue more than doubled in the full year of 2024, a testament to its market penetration and efficacy.

This upward trajectory continued into the first quarter of 2025, with Recorlev sales jumping an impressive 141% compared to the same period in the prior year. This surge is largely attributed to a substantial 124% increase in the average number of patients utilizing the therapy in Q1 2025.

The Cushing's syndrome market is also a high-growth area, with forecasts indicating a compound annual growth rate of approximately 23.3% between 2024 and 2029. This robust market expansion further solidifies Recorlev's position as a leading therapy in a rapidly developing therapeutic landscape.

Gvoke's position as a Star in Xeris's BCG Matrix is solidified by its impressive financial performance and market dominance. The company reported a significant 24% revenue increase for the full year 2024, followed by a robust 26% rise in the first quarter of 2025, showcasing consistent growth.

This strong financial trajectory is underpinned by Gvoke's substantial market share, capturing approximately 35% of the retail glucagon market. This indicates a clear leadership position and strong customer adoption for Xeris's ready-to-use liquid glucagon.

The overall market for severe hypoglycemia treatments is also expanding, with projections showing an 8.5% compound annual growth rate between 2026 and 2033. This favorable market environment further supports Gvoke's status as a high-growth, high-share product within Xeris's portfolio.

The patient base for Xeris' key products is steadily growing, a positive sign for their market position. Recorlev, in particular, demonstrated impressive growth, with its patient numbers soaring by 124% year-over-year in the first quarter of 2025. This significant expansion highlights strong demand and effective commercial strategies.

Gvoke also contributed to this positive trend, experiencing an 8% increase in total prescriptions during the same Q1 2025 period. Such consistent patient acquisition is vital for maintaining market share and driving revenue growth. It also reflects growing physician confidence in these therapeutic solutions.

Strategic Market Penetration

Xeris is doubling down on its Star products, aiming for deeper market penetration by investing heavily in patient access programs and engaging more directly with healthcare providers. This push is all about boosting brand performance and grabbing an even bigger slice of rapidly expanding markets. The company’s efforts are geared towards cementing its leading spot and ensuring continued revenue growth.

For instance, Xeris’s glucagon for injection, Gvoke HypoPen, saw significant uptake in 2024, with net sales reaching $180 million, a 25% increase year-over-year. This growth highlights the success of their penetration strategies in the severe hypoglycemia market.

- Targeted Patient Access: Xeris is enhancing patient access to its Star products through co-pay assistance programs and patient support services, aiming to reduce out-of-pocket costs and improve adherence.

- Healthcare Provider Engagement: Increased field force engagement and educational initiatives are being deployed to ensure healthcare providers are well-informed about the benefits and appropriate use of Xeris’s Star offerings.

- Market Share Expansion: The company’s strategic focus is on capturing a larger share within high-growth therapeutic areas, leveraging product differentiation and strong clinical data.

- Revenue Growth Acceleration: These penetration efforts are directly contributing to accelerated brand performance and sustained revenue expansion for Xeris’s key Star products.

Overall Commercial Portfolio Momentum

Xeris's overall commercial portfolio is exhibiting strong upward trajectory, primarily fueled by the exceptional performance of its key products, Recorlev and Gvoke. This robust growth is clearly reflected in the company's financial results.

- Total revenue surged by an impressive 48% year-over-year in the first quarter of 2025.

- The company has provided optimistic guidance for 2025, projecting total revenue to fall between $260 million and $275 million.

- This guidance represents a significant growth rate of over 30% at the midpoint.

- This collective momentum highlights Xeris's established leadership and solid standing within its core therapeutic markets.

Stars, representing Xeris's high-growth, high-market-share products, are the engine of the company's current success. Recorlev and Gvoke exemplify this category, demonstrating significant revenue increases and expanding patient bases. Xeris is actively investing in these products to further solidify their market leadership and capitalize on favorable market trends.

| Product | 2024 Revenue (Est.) | Q1 2025 Revenue Growth | Market Share (Est.) | Market Growth (CAGR) |

|---|---|---|---|---|

| Recorlev | N/A (High Growth) | 141% | Growing | ~23.3% (2024-2029) |

| Gvoke | $180 Million | 26% | ~35% (Retail Glucagon) | ~8.5% (2026-2033) |

What is included in the product

The Xeris BCG Matrix provides a strategic overview of its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

The Xeris BCG Matrix offers a clear, visual pain point reliever by instantly categorizing business units, simplifying strategic decision-making.

Cash Cows

Gvoke has solidified its position as a robust revenue stream for Xeris, bringing in $82.8 million in 2024. This established product now acts as a dependable cash cow, underpinning the company's financial stability.

With a commanding 35% share of the retail glucagon market, Gvoke’s consistent performance ensures a reliable inflow of cash. This financial strength allows Xeris to allocate resources strategically to other growth initiatives.

Xeris's XeriSol and XeriJect platforms are foundational cash cows, driving revenue through licensing and collaborations. These proprietary technologies allow Xeris to partner with other companies, generating income streams such as milestone payments and royalties.

A prime example is the $3 million milestone payment Xeris received in Q4 2024 from Beta Bionics for a glucagon formulation. This highlights the recurring and predictable nature of revenue generated from these licensing agreements.

Once the technology platforms are established and licensed, the need for significant additional investment from Xeris is minimal. This low reinvestment requirement ensures that these licensing deals provide a stable and consistent financial contribution to the company.

Keveyis, Xeris's product for primary periodic paralysis, demonstrates a classic Cash Cow profile. Despite a revenue dip to $49.5 million in 2024 and $11.4 million in Q1 2025, largely due to increased competition, it remains a consistent contributor to Xeris's overall revenue.

While not a growth engine, Keveyis's stable, albeit declining, revenue stream is crucial. It reliably generates cash, likely covering its own operational expenses and providing a steady financial foundation for Xeris. This stability allows Xeris to allocate resources to other areas of its business.

Optimized Manufacturing and Operational Efficiency

Xeris Pharmaceuticals actively optimizes its manufacturing and operational efficiency, a key driver for its Cash Cow products. Investments like the Gvoke capacity expansion are designed to boost profit margins and cash flow from established revenue streams.

This focus on operational excellence directly translates into stronger financial performance. By reducing costs and enhancing the profitability of existing products, Xeris solidifies its position in the market.

- Gvoke Capacity Expansion: This initiative directly supports increased production and efficiency for a core product.

- Reduced Operating Costs: Investments in infrastructure aim to lower the cost of goods sold, thereby increasing profit margins.

- Disciplined Capital Allocation: Xeris's strategic approach to deploying capital further enhances its ability to generate consistent cash flow from its mature products.

Consistent Positive Adjusted EBITDA

Xeris Pharmaceuticals demonstrated strong operational performance, achieving positive Adjusted EBITDA in both the fourth quarter of 2024 and the first quarter of 2025. This consistent profitability indicates that the company's core commercial activities are effectively generating enough cash to meet operational costs.

This financial discipline is crucial, as it confirms that Xeris's established products are not only self-sustaining but also contributing positively to the company's overall financial well-being. Such operational profitability provides a solid foundation for funding future growth and pipeline expansion efforts.

- Q4 2024 Positive Adjusted EBITDA: Xeris reported positive Adjusted EBITDA, highlighting operational cash generation.

- Q1 2025 Positive Adjusted EBITDA: Continued positive Adjusted EBITDA in the subsequent quarter reinforces financial stability.

- Core Business Profitability: Established products are generating sufficient cash to cover operating expenses.

- Reinvestment Capacity: Consistent operational profitability enables reinvestment in growth and pipeline development.

Cash Cows within Xeris's portfolio represent established products and technologies that generate substantial, consistent revenue with minimal need for further investment. These are the financial workhorses, providing a stable cash flow that supports the company's overall operations and strategic initiatives.

Gvoke, with $82.8 million in 2024 revenue and a 35% market share, exemplifies a strong Cash Cow. Similarly, the XeriSol and XeriJect platforms, through licensing and milestone payments like the $3 million from Beta Bionics in Q4 2024, offer predictable income streams.

Keveyis, despite facing competition and a revenue dip to $49.5 million in 2024, still fits the Cash Cow profile by consistently covering its operational costs and contributing to Xeris's financial stability.

Xeris's focus on optimizing manufacturing and achieving positive Adjusted EBITDA in Q4 2024 and Q1 2025 underscores the profitability and cash-generating capacity of these mature assets.

| Product/Platform | 2024 Revenue | Key Contribution | Investment Need |

|---|---|---|---|

| Gvoke | $82.8 million | Dominant market share, stable revenue | Low (capacity expansion ongoing) |

| XeriSol/XeriJect Platforms | Licensing & Royalties | Recurring income, milestone payments | Minimal |

| Keveyis | $49.5 million | Consistent operational cash flow | Low |

What You’re Viewing Is Included

Xeris BCG Matrix

The Xeris BCG Matrix preview you're seeing is the exact, fully formatted document you will receive upon purchase. This means no watermarks or demo content, just a professionally designed strategic tool ready for your immediate use. You can confidently download this file knowing it's the complete, analysis-ready Xeris BCG Matrix, perfect for informing your business strategy and decision-making.

Dogs

Keveyis has seen a significant revenue drop, with net revenue falling by about 13% in both the full year of 2024 and the first quarter of 2025. This consistent decline points to a weakening market position and lower customer interest.

The product is facing increased competition from generics, making it difficult to sustain its earlier sales figures. This performance aligns with a product in a market segment that is either experiencing slow growth or is in decline.

The rise of generic competitors has significantly hampered Keveyis's sales, leading to a noticeable decline in patient demand. This external competitive pressure makes it an uphill battle for Keveyis to reclaim lost market share or even achieve modest growth in the current landscape.

Products that are highly vulnerable to generic erosion, like Keveyis appears to be, often become what are termed cash cows. This designation reflects their diminishing profitability and shrinking market viability, making them less attractive for further investment or innovation.

The termination of Xeris's exclusive worldwide license agreement with Amgen in Q4 2024, while not significantly impacting the company's overall financial outlook, clearly marks a discontinued partnership as a 'Dog' within its strategic portfolio. This venture, though not a product itself, represents an effort that failed to generate the anticipated sustained revenue streams, effectively becoming a divested initiative.

Underperforming Niche Segments

Underperforming niche segments within Xeris's portfolio, particularly older formulations, could be categorized as Dogs in the BCG Matrix. These areas might consume significant resources for maintenance without contributing meaningfully to revenue growth. For instance, if a specific formulation launched years ago, like a less popular GLP-1 delivery system, is only generating a few million dollars in annual sales but requires substantial R&D and manufacturing oversight, it would fit this description. Companies often have such legacy products that become cash drains.

These segments are prime candidates for strategic evaluation, often leading to decisions about reduced investment or outright divestiture. Consider a scenario where Xeris has a niche product that accounted for less than 1% of its total revenue in 2024, yet its operational costs, including specialized manufacturing and regulatory compliance, represent a disproportionate percentage of its overall expenses. Such a product would be a classic example of a Dog, hindering resource allocation for more promising ventures.

The rationale for such classification is straightforward: resources are better deployed towards products with higher growth potential or market share. Xeris’s focus in 2024 has been on expanding its key products, such as those utilizing its proprietary XeriSol™ technology for subcutaneous delivery of biologics. Segments not aligning with this growth strategy and showing minimal market traction would fall into the Dog category.

- Niche Formulations: Older or less adopted formulations within Xeris's product pipeline that exhibit low sales and high maintenance costs.

- Resource Drain: Segments requiring disproportionate financial and operational resources for upkeep rather than expansion or innovation.

- Strategic Review: Areas typically considered for reduced investment, discontinuation, or divestiture to reallocate capital to growth-oriented products.

- 2024 Context: Products contributing less than 1% of total revenue while consuming significant operational resources would be prime candidates for this classification.

Sunk Costs in Deprioritized R&D

Deprioritized research and development programs, like those that might not yield future returns for Xeris, represent sunk costs. These are investments already made that cannot be recovered, especially if the project is terminated due to poor trial results or a change in company strategy. They no longer offer future economic value.

While Xeris's R&D expenses saw an increase in 2024, signaling continued investment in innovation, it's important to recognize that not all these expenditures will translate into successful commercial products. Some portion of these 2024 R&D outlays could become sunk costs if projects are ultimately abandoned.

Consider the implications for Xeris's strategic resource allocation:

- Unrecoverable Investments: Past R&D spending on projects that are no longer pursued are sunk costs, meaning the money spent is gone and cannot be recouped.

- Impact on Future Returns: When R&D efforts are deprioritized, the potential future value these investments were meant to generate disappears, making them non-productive assets.

- 2024 R&D Spending: Xeris's increased R&D expenditure in 2024 highlights the company's commitment to developing new products, but also underscores the inherent risk of some of these investments becoming sunk costs.

Dogs in the BCG Matrix represent products or business units with low market share and low market growth. For Xeris, this could include older formulations or discontinued partnerships that consume resources without generating significant returns. These are often candidates for divestment or reduced investment.

The termination of Xeris's exclusive worldwide license agreement with Amgen in Q4 2024, while not a product, fits the Dog category as a divested initiative that failed to yield sustained revenue. Similarly, underperforming niche segments or legacy products that contribute minimally to revenue but require substantial upkeep would be classified as Dogs.

These segments, such as a less popular GLP-1 delivery system launched years ago, might generate only a few million dollars annually while demanding significant R&D and manufacturing oversight. Products contributing less than 1% of total revenue in 2024 but consuming disproportionate operational costs exemplify Dogs, hindering resource allocation to more promising ventures.

Deprioritized R&D programs also fall into this category. While Xeris increased R&D spending in 2024, some of these investments might become sunk costs if projects are abandoned due to poor trial results or strategic shifts, representing unrecoverable expenditures with no future economic value.

Question Marks

XP-8121, Xeris's innovative once-weekly subcutaneous injection for hypothyroidism, is positioned as a Question Mark in the BCG matrix. It has successfully completed Phase 2 trials and is ready for Phase 3, but it currently holds zero market share.

The hypothyroidism market is substantial, offering significant growth opportunities if XP-8121 demonstrates efficacy and gains market traction. However, its future commercial success is uncertain, necessitating considerable investment for the upcoming Phase 3 clinical trials and regulatory approvals.

Xeris Pharmaceuticals has several early-stage pipeline programs utilizing its proprietary XeriSol and XeriJect technologies. These initiatives are considered question marks in the BCG matrix because they are unproven and carry significant development risks. If these programs prove successful, they have the potential to unlock substantial new revenue streams for the company.

Currently, these early-stage programs represent an investment in research and development, consuming resources without generating any commercial sales. For instance, as of the first quarter of 2024, Xeris reported that its R&D expenses were $20.5 million, a portion of which is allocated to these nascent projects. The success of these ventures is crucial for future growth, but their early nature means they are high-risk, high-reward propositions.

Exploring new therapeutic indications for established products like Gvoke or Recorlev fits the Question Mark quadrant in the BCG Matrix. This strategy involves leveraging existing commercial successes to penetrate new market segments where Xeris currently holds minimal or no market share.

While these products are already on the market, a new indication represents an entirely new battleground. This means Xeris would be starting from scratch in terms of market share for that specific indication, despite the product's existing familiarity. For example, if Gvoke, currently approved for severe hypoglycemia, were to be explored for a new indication like managing allergic reactions, it would be a Question Mark.

This strategic move offers substantial growth potential by tapping into unmet needs or expanding the utility of their existing pipeline. However, it necessitates considerable investment in research and development, including extensive clinical trials to prove efficacy and safety for the new use. Xeris's 2023 financial report showed substantial R&D spending, indicating a commitment to such growth avenues.

International Market Expansion

Xeris's potential expansion into new international geographies or untapped regional markets represents its "Question Marks" in the BCG Matrix.

Entering new markets would involve high initial investment in regulatory approvals, commercial infrastructure, and market education, with uncertain immediate returns. For instance, establishing a presence in a new European Union country could cost millions in compliance and market entry fees alone. However, successful entry could unlock significant new high-growth revenue streams, potentially diversifying Xeris's global footprint and reducing reliance on existing markets.

Considerations for Xeris's international expansion include:

- Market Attractiveness: Assessing the size, growth rate, and competitive landscape of potential new markets.

- Regulatory Environment: Navigating diverse healthcare and pharmaceutical regulations in each target country.

- Operational Feasibility: Evaluating the cost and complexity of setting up distribution networks and local commercial teams.

- Competitive Response: Anticipating how established local players and other international competitors might react to Xeris's entry.

Novel Technology Applications

Novel technology applications for Xeris represent the company's boldest moves into uncharted territories, pushing the boundaries of its proprietary XeriSol and XeriJect platforms. These initiatives are categorized as question marks in the BCG matrix because they involve significant investment in research and development for entirely new uses or drug classes, with uncertain future market positions. For instance, Xeris might explore applying its formulation technology to a completely different disease area, requiring substantial upfront capital and extended development timelines.

These ventures are inherently high-risk, high-reward, seeking to establish Xeris in potentially lucrative, high-growth sectors where the company currently has no established presence. Success here could unlock substantial new revenue streams and market share, but the path is fraught with challenges, including technical hurdles, regulatory approvals, and market acceptance. The financial commitment is considerable, with R&D expenses for such exploratory projects potentially running into tens of millions of dollars annually, without guaranteed commercial returns.

- Exploratory R&D: Xeris's commitment to exploring novel applications for its core technologies signifies a strategic focus on long-term innovation, even if immediate returns are not guaranteed.

- Market Potential: These ventures target potentially high-growth sectors, aiming to diversify Xeris's product portfolio and revenue base beyond its current therapeutic focuses.

- Investment & Risk: Substantial R&D investment is required, carrying significant risk due to uncertain timelines, technical challenges, and the possibility of no commercialization.

- Strategic Diversification: By venturing into new applications, Xeris aims to reduce reliance on existing markets and capitalize on emerging opportunities in the broader pharmaceutical and biotech landscape.

Question Marks in Xeris's BCG Matrix represent products or initiatives with low market share but in high-growth markets, demanding significant investment to capture potential. These are typically early-stage products or new market entries where success is uncertain but the upside is substantial.

XP-8121, a potential once-weekly subcutaneous injection for hypothyroidism, is a prime example. It has advanced to Phase 3 trials, indicating market potential, but currently holds no market share, requiring substantial funding for development and commercialization.

Xeris's exploration of new therapeutic indications for existing products, like Gvoke or Recorlev, also falls into this category. While the base products are established, entering a new indication means starting from zero market share in that specific segment, demanding new R&D investment.

The company's ventures into novel technology applications, such as using XeriSol or XeriJect for entirely new disease areas, are also Question Marks. These are high-risk, high-reward endeavors requiring significant capital for research and development with an uncertain path to market success.

| Initiative | Market Growth Potential | Current Market Share | Investment Needs | Strategic Rationale |

|---|---|---|---|---|

| XP-8121 (Hypothyroidism) | High | Zero | High (Phase 3, regulatory) | Tap into substantial unmet need with innovative delivery |

| New Indications for Existing Products | Varies by indication | Zero (for new indication) | Moderate to High (Clinical trials) | Leverage existing technology and brand familiarity |

| Novel Technology Applications | Potentially Very High | Zero | Very High (Exploratory R&D) | Establish leadership in new therapeutic areas |

| International Market Expansion | Varies by region | Zero to Low | High (Regulatory, infrastructure) | Diversify revenue streams and global footprint |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of financial disclosures, market research reports, and competitive benchmarking to provide a comprehensive view of product performance.