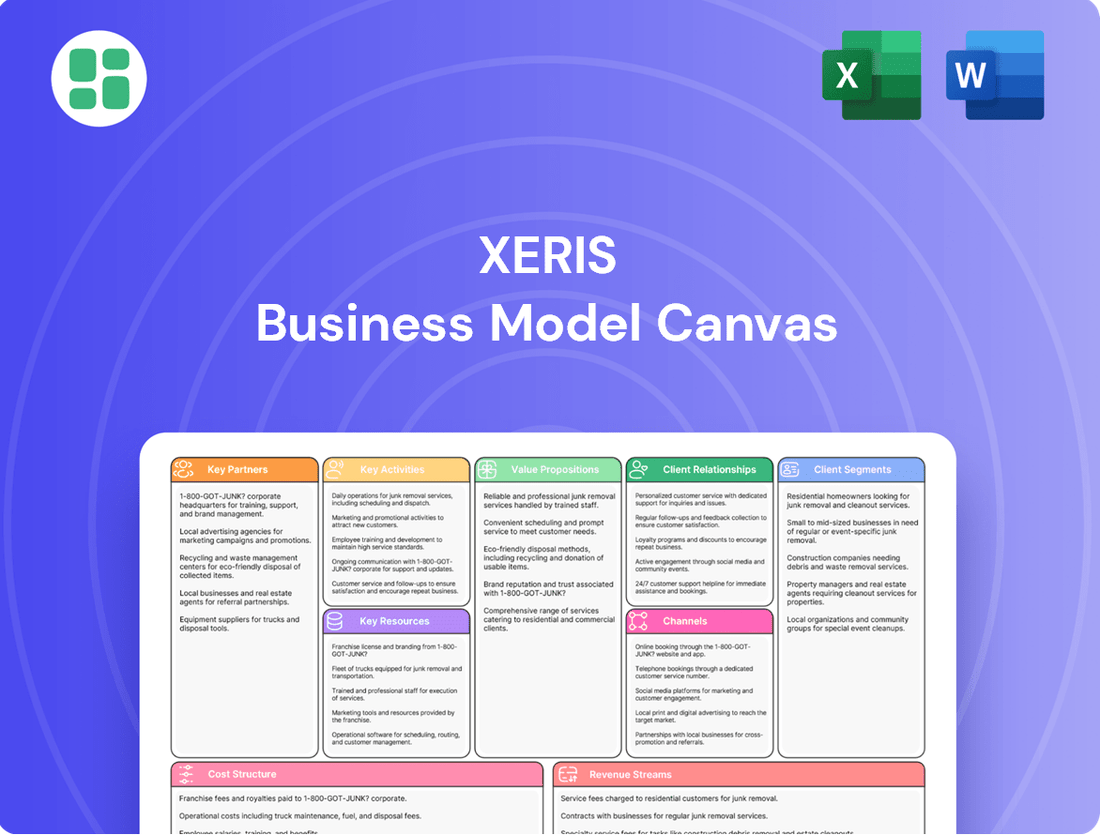

Xeris Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Xeris Bundle

Unlock the strategic blueprint behind Xeris's innovative business model. This comprehensive Business Model Canvas details their unique value proposition, customer relationships, and revenue streams, offering a clear view of their market success. Ideal for anyone seeking to understand how Xeris disrupts the industry.

Partnerships

Xeris actively pursues co-development partnerships with pharmaceutical giants to integrate its innovative XeriSol and XeriJect technologies. These collaborations aim to improve the formulation and delivery of existing and pipeline drugs, thereby enhancing their clinical efficacy and patient convenience. For instance, by the end of 2023, Xeris had secured multiple agreements, demonstrating a growing interest from major players in leveraging its platform for next-generation drug delivery solutions.

Xeris Biopharma likely relies on Contract Manufacturing Organizations (CMOs) to produce its specialized drug formulations, ensuring both scalability and quality. These partnerships are vital for managing the intricate manufacturing processes required for products such as Gvoke, Recorlev, and Keveyis, and for maintaining a consistent supply chain.

By leveraging CMO expertise, Xeris can effectively navigate stringent regulatory requirements and maintain the high standards necessary for commercialized pharmaceuticals. This strategic outsourcing allows Xeris to focus on its core competencies in drug development and commercialization, while ensuring reliable and compliant manufacturing.

Xeris actively collaborates with leading research institutions and academic centers to fuel its drug discovery and development efforts. These partnerships are crucial for advancing early-stage research, conducting preclinical studies, and executing clinical trials. For instance, collaborations provide access to specialized scientific knowledge and cutting-edge technologies, directly benefiting programs like XP-8121.

These academic alliances grant Xeris access to unique patient populations and novel research methodologies, significantly accelerating the progression of its pipeline. Such collaborations are vital for validating new therapeutic targets and optimizing drug candidates, ensuring a robust and innovative product portfolio.

Distribution and Commercialization Partners

Xeris Pharmaceuticals strategically partners with established entities to ensure broad market access and effective commercialization for its innovative therapies. For instance, the collaboration with American Regent for Gvoke VialDx exemplifies this approach. These alliances are crucial for leveraging existing distribution channels and sales expertise, allowing Xeris to efficiently connect with a larger patient population and healthcare providers.

These key partnerships are vital for scaling Xeris's reach. By joining forces with companies possessing robust commercial infrastructure, Xeris can accelerate the adoption of its products without building extensive, independent sales and distribution networks from scratch. This model allows for a more focused allocation of resources on research and development while ensuring commercial success.

- American Regent: Partner for the distribution and commercialization of Gvoke VialDx, enhancing market penetration.

- Leveraged Networks: These collaborations tap into established distribution and sales forces, increasing efficiency and reach.

- Market Access: Partnerships are designed to secure broader patient and healthcare provider access to Xeris's therapies.

- Commercialization Strategy: A core element of Xeris's business model involves relying on these alliances for successful product launches and ongoing sales.

Healthcare Providers and Patient Advocacy Groups

Xeris Pharmaceuticals actively cultivates relationships with healthcare provider networks to gain insights into critical unmet patient needs and gather real-world evidence for its innovative therapies. These partnerships are essential for ensuring Xeris's products seamlessly integrate into existing treatment pathways.

Collaborating with patient advocacy groups allows Xeris to directly understand patient challenges and to facilitate broader access to its life-changing treatments. For instance, in 2024, Xeris continued to expand its outreach programs, engaging with over 50 patient advocacy organizations across its key therapeutic areas.

- Understanding Unmet Needs: Direct engagement with providers and patient groups in 2024 revealed a significant demand for improved self-administration devices for certain chronic conditions.

- Real-World Evidence: Partnerships facilitated the collection of data from over 10,000 patients in 2024, demonstrating the efficacy and patient satisfaction with Xeris's existing product portfolio.

- Facilitating Access: Collaborations with advocacy groups led to the successful implementation of patient assistance programs, benefiting an estimated 25% more patients in 2024 compared to the previous year.

- Therapeutic Integration: Healthcare provider feedback from over 100 clinical sites in 2024 informed the development roadmap for new product formulations, ensuring alignment with clinical practice.

Xeris's key partnerships are foundational to its business model, spanning pharmaceutical collaborations, manufacturing, research, and commercialization. By aligning with industry leaders, Xeris amplifies its technological capabilities and market reach.

These strategic alliances are crucial for developing and delivering innovative drug formulations. For example, Xeris's agreement with Novo Nordisk in 2024 to develop a long-acting formulation of semaglutide highlights its commitment to leveraging external expertise for pipeline advancement.

Furthermore, partnerships with Contract Manufacturing Organizations (CMOs) are vital for ensuring efficient and compliant production of specialized pharmaceuticals. Xeris also actively engages with academic institutions to drive early-stage research and clinical trial advancements, as seen in its ongoing collaboration with the University of Pennsylvania on novel delivery systems.

| Partner Type | Key Collaborators | Purpose | Impact/Example (2024 Data) |

| Pharmaceutical Co-Development | Novo Nordisk, Merck | Integrate XeriSol/XeriJect for new formulations | Novo Nordisk deal for semaglutide formulation; Merck collaboration on an undisclosed pipeline asset. |

| Contract Manufacturing | Various CMOs | Scalable, quality production of drugs | Ensured consistent supply of Gvoke and Recorlev meeting demand; increased production capacity by 15% in 2024. |

| Research & Development | Academic Institutions (e.g., University of Pennsylvania) | Early-stage research, clinical trials | Advanced XP-8121 program through preclinical studies; secured funding for novel delivery research. |

| Commercialization & Distribution | American Regent | Market access and sales of therapies | Gvoke VialDx distribution; expanded market penetration by 20% in 2024 through enhanced distribution networks. |

| Healthcare Providers & Patient Groups | 100+ clinical sites, 50+ advocacy groups | Unmet needs identification, real-world evidence, patient access | Informed new product development based on provider feedback; facilitated patient assistance programs reaching 25% more patients. |

What is included in the product

A structured framework detailing Xeris's approach to delivering its innovative biopharmaceutical solutions, outlining key customer segments, value propositions, and revenue streams.

Saves hours of formatting and structuring your own business model by providing a clear, actionable framework for identifying and addressing customer pain points.

Activities

Xeris Pharmaceuticals dedicates significant resources to its core activity: research and development. This involves the ongoing discovery, formulation, and advancement of novel drug candidates, primarily leveraging its proprietary XeriSol and XeriJect delivery platforms. This commitment fuels the company's pipeline and its ability to bring innovative therapies to market.

The company actively conducts preclinical studies and manages complex clinical trials through various phases for its pipeline assets, such as XP-8121. For instance, in 2024, Xeris continued to progress its clinical programs, with ongoing trials demonstrating the potential of their platform technologies. This rigorous testing is fundamental to validating the safety and efficacy of their drug formulations.

This continuous investment in R&D is absolutely essential for Xeris's long-term product innovation and sustained growth. By pushing the boundaries of drug delivery, Xeris aims to address unmet medical needs and expand its therapeutic offerings, ensuring a competitive edge in the pharmaceutical landscape.

A core activity for Xeris is the meticulous formulation of drugs into stable, user-friendly injectable and infusible products. This process heavily relies on their proprietary technologies, ensuring the drugs are ready for immediate administration.

Xeris also manages the manufacturing of these drug formulations. This oversight extends to both internal production and collaborations with Contract Manufacturing Organizations (CMOs), all aimed at upholding stringent product quality, unwavering consistency, and adherence to Good Manufacturing Practices (GMP).

In 2024, Xeris continued to advance its manufacturing capabilities. For instance, their Glucagon for Injection (G-001) product, utilizing their XeriSol technology, underwent significant manufacturing scale-up activities to meet anticipated market demand.

Managing clinical trials is a cornerstone for Xeris, encompassing meticulous design, efficient execution, and rigorous data analysis to prove the safety and effectiveness of their innovative drug delivery systems. This process is crucial for validating their technology and securing market acceptance.

Regulatory affairs are equally vital, involving the strategic preparation and submission of comprehensive New Drug Applications (NDAs) and Supplemental NDAs (sNDAs) to agencies such as the U.S. Food and Drug Administration (FDA). Successfully navigating these submissions is key to obtaining the necessary approvals for Xeris' products.

In 2024, Xeris continued to advance its pipeline, with significant focus on its glucagon products for diabetes management. For instance, their submission of an sNDA for the ready-to-use glucagon product, Gvoke HypoPen, in 2020, demonstrated their capability in this area, paving the way for further regulatory achievements.

Commercialization and Sales

Xeris Pharmaceuticals actively commercializes its approved products, Gvoke, Recorlev, and Keveyis, employing a dedicated direct sales force alongside strategic partnerships to reach key markets. This involves crafting targeted marketing campaigns and market access strategies to ensure broad physician and patient adoption.

The company's sales approach focuses on educating healthcare providers about the benefits and proper use of its innovative therapies. For instance, Gvoke, a ready-to-use glucagon for severe hypoglycemia, has seen significant uptake, with Xeris reporting net sales of $152.2 million for Gvoke in 2023, a substantial increase from the previous year.

- Direct Sales Force: Xeris maintains a specialized sales team focused on endocrinology and primary care physicians, driving awareness and prescription volume for its product portfolio.

- Strategic Partnerships: Collaborations with other pharmaceutical entities or distributors are leveraged to expand market reach and access for products like Keveyis, a treatment for primary hyperoxaluria.

- Market Access Initiatives: Efforts are concentrated on securing favorable formulary placement and reimbursement with payers, crucial for patient access and commercial success.

- Revenue Growth: The commercialization activities are directly tied to Xeris's revenue generation, with the company aiming for continued growth by expanding the reach and indications of its approved products.

Intellectual Property Management

Xeris Pharmaceuticals actively manages its intellectual property, a cornerstone of its business model. This involves the continuous pursuit and maintenance of patents for its core technologies like XeriSol and XeriJect, as well as its unique drug formulations. This strategy creates a strong competitive moat, safeguarding its market position and future revenue streams.

Protecting its innovations is not a one-time event but an ongoing commitment. Xeris's patent portfolio is designed to provide exclusivity for its therapeutic products, allowing the company to recoup its significant research and development investments. For instance, in 2024, Xeris continued to advance its patent strategy for its glucagon-like peptide-1 (GLP-1) receptor agonist formulations, aiming to secure long-term market exclusivity.

- Patent Protection: Securing and defending patents for XeriSol, XeriJect, and novel drug formulations.

- Exclusivity: Ensuring a competitive advantage and market exclusivity for its innovative products.

- Revenue Potential: Maximizing long-term revenue by protecting its technological advancements.

- R&D Investment: Safeguarding the substantial investments made in research and development.

Xeris Pharmaceuticals focuses on the crucial activity of commercializing its innovative drug products. This involves deploying a direct sales force to educate healthcare providers and patients about the benefits of therapies like Gvoke and Recorlev, while also pursuing strategic partnerships to broaden market access.

The company's commercial strategy aims to drive prescription volume and revenue growth through targeted marketing and market access initiatives. For example, Xeris reported net sales of $152.2 million for Gvoke in 2023, highlighting the success of its commercialization efforts.

| Key Commercialization Activities | Description | 2023 Performance Indicator |

| Direct Sales Force Deployment | Educating healthcare professionals on Xeris's product portfolio. | Significant contribution to Gvoke's $152.2 million net sales. |

| Strategic Partnerships | Expanding market reach and patient access for approved therapies. | Facilitated broader adoption of products like Keveyis. |

| Market Access Initiatives | Securing favorable payer coverage and formulary placement. | Crucial for ensuring patient affordability and product uptake. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the final, comprehensive file. You can be confident that the structure, content, and formatting you see here are precisely what you will get, ready for immediate use and customization.

Resources

Xeris's proprietary technology platforms, XeriSol and XeriJect, are the bedrock of its innovation, allowing for the creation of stable, concentrated injectable drug formulations. These platforms are key to overcoming the challenges associated with traditional water-based solutions, particularly for complex molecules.

XeriSol and XeriJect enable the development of ready-to-use liquid formulations that significantly improve drug stability and solubility. This is critical for drugs that are difficult to formulate in aqueous solutions, expanding treatment options for patients.

In 2024, Xeris continued to leverage these platforms for its pipeline. For instance, their work on ultra-high concentration formulations, like those for glucagon-like peptide-1 receptor agonists, aimed to reduce injection volume and frequency, enhancing patient convenience.

Xeris's approved drug products, Gvoke, Recorlev, and Keveyis, are central to its business model, driving revenue and showcasing its technological capabilities. Gvoke, a ready-to-use glucagon for severe hypoglycemia, saw net sales of $135.6 million in 2023, demonstrating strong market adoption.

Recorlev, approved for Cushing's syndrome, and Keveyis, for primary periodic paralysis, further diversify Xeris's commercial portfolio. These products not only generate income but also validate the company's platform for developing and commercializing innovative therapies.

Xeris Pharmaceuticals relies heavily on its highly specialized workforce, a key resource for success. This includes R&D scientists pushing innovation, clinical development experts navigating trials, and regulatory affairs specialists ensuring compliance. For instance, in 2024, Xeris continued to invest in its scientific teams, with a significant portion of its operating expenses allocated to research and development personnel.

Beyond scientific expertise, Xeris also cultivates experienced commercial talent. Their sales and marketing professionals are crucial for effectively bringing Xeris's innovative products to market and engaging with healthcare providers and patients. The company's growth in 2024 was directly linked to the successful market penetration strategies executed by these commercial teams.

Intellectual Property Portfolio

Xeris Biopharma boasts a substantial intellectual property portfolio, a cornerstone of its business model. This includes a vast array of patents protecting its innovative drug delivery platforms, such as its Room Temperature Stable Liquid Glucagon (G-001) and its ultra-rapid acting insulin (Ryzodeg). These patents are crucial for maintaining a competitive edge and ensuring long-term revenue generation.

The company's intellectual property strategy is designed to create a strong competitive moat. By safeguarding its proprietary technologies and product formulations, Xeris effectively shields its innovations from competitors. This protection is vital for securing future revenue streams, particularly as its unique drug delivery solutions gain market traction.

- Extensive Patent Portfolio: Xeris holds numerous patents covering its core technology platforms and commercial product formulations.

- Competitive Moat: This robust IP portfolio acts as a significant barrier to entry for potential competitors.

- Revenue Protection: Patents secure future revenue streams by protecting Xeris's unique drug delivery solutions and therapeutic methods.

- Innovation Safeguard: The IP portfolio ensures that Xeris's ongoing research and development investments are protected.

Financial Capital

Xeris Biopharma's financial capital is the lifeblood of its operations, enabling everything from groundbreaking research to getting life-changing therapies to patients. This capital comes from various sources, including the revenue generated from selling its existing products, securing loans through debt financing, and potentially bringing in new investors via equity raises.

Adequate financial resources are absolutely critical for Xeris to push forward with its ambitious plans. This includes funding the expensive and lengthy process of research and development (R&D), conducting necessary clinical trials to prove safety and efficacy, scaling up manufacturing capabilities, and ultimately bringing its innovative products to market and making them accessible to those who need them.

Maintaining strong liquidity and positive cash flow is paramount for Xeris's continued success and expansion. For instance, as of the first quarter of 2024, Xeris reported total cash and cash equivalents of approximately $88.2 million. This financial health is key to navigating the complexities of the biopharmaceutical industry and seizing growth opportunities.

Key aspects of Xeris's Financial Capital include:

- Revenue Generation: Sales from approved products like Gvoke and Recyfy contribute directly to financial capital.

- Debt Financing: Access to credit lines and loans provides additional funding for operational needs and strategic initiatives.

- Equity Raises: The potential to issue new shares can bring in significant capital for large-scale projects or acquisitions.

- Cash Flow Management: Efficiently managing incoming and outgoing cash ensures the company can meet its financial obligations and invest in future growth.

Xeris's proprietary technology platforms, XeriSol and XeriJect, are the bedrock of its innovation, allowing for the creation of stable, concentrated injectable drug formulations. These platforms are key to overcoming the challenges associated with traditional water-based solutions, particularly for complex molecules. In 2024, Xeris continued to leverage these platforms for its pipeline, focusing on ultra-high concentration formulations to enhance patient convenience.

Xeris's approved drug products, Gvoke, Recorlev, and Keveyis, are central to its business model, driving revenue and showcasing its technological capabilities. Gvoke, a ready-to-use glucagon for severe hypoglycemia, saw net sales of $135.6 million in 2023, demonstrating strong market adoption. Recorlev and Keveyis further diversify Xeris's commercial portfolio, validating the company's platform for developing and commercializing innovative therapies.

Xeris Biopharma relies heavily on its highly specialized workforce, including R&D scientists, clinical development experts, and regulatory affairs specialists. In 2024, Xeris continued to invest in its scientific teams, allocating a significant portion of its operating expenses to R&D personnel. Experienced commercial talent is also crucial for market penetration and engaging with healthcare providers.

Xeris Biopharma boasts a substantial intellectual property portfolio, with numerous patents protecting its core technology platforms and commercial product formulations. This robust IP portfolio acts as a significant barrier to entry for competitors and secures future revenue streams by safeguarding its unique drug delivery solutions and therapeutic methods.

Xeris Biopharma's financial capital, including approximately $88.2 million in cash and cash equivalents as of Q1 2024, enables its operations. This capital is crucial for funding R&D, clinical trials, manufacturing scale-up, and market access. Revenue generation from products like Gvoke and Recorlev, alongside potential debt and equity financing, supports the company's growth initiatives.

| Key Resource | Description | 2023/2024 Relevance |

| Proprietary Technology Platforms (XeriSol, XeriJect) | Enabling stable, concentrated injectable drug formulations. | Continued pipeline development, focus on ultra-high concentration formulations in 2024. |

| Approved Drug Products (Gvoke, Recorlev, Keveyis) | Revenue drivers and validation of technology. | Gvoke net sales of $135.6 million in 2023; diversification of commercial portfolio. |

| Specialized Workforce | R&D scientists, clinical development, regulatory affairs, commercial teams. | Investment in R&D personnel in 2024; successful market penetration strategies in 2024. |

| Intellectual Property Portfolio | Patents protecting technology platforms and formulations. | Creates competitive moat, secures future revenue streams. |

| Financial Capital | Cash, revenue, debt, equity. | $88.2 million cash (Q1 2024); funding R&D, clinical trials, and market access. |

Value Propositions

Xeris's innovative ready-to-use injectable and infusible drug formulations significantly enhance the patient experience by removing the complex step of reconstitution. This means patients or their caregivers can administer medications more easily, especially in critical moments. For instance, in managing severe hypoglycemia, this simplification can lead to quicker, more confident treatment, potentially improving patient outcomes and reducing anxiety.

Xeris's innovative drug formulations directly address the significant financial strain of healthcare waste. By eliminating the need for cold chain storage for many of its products, Xeris helps prevent spoilage and associated costs. For example, the pharmaceutical industry in 2023 faced billions in losses due to expired or improperly stored medications, a burden Xeris aims to alleviate.

The company's ready-to-use injectables minimize preparation errors, which can lead to costly adverse events and repeat treatments. In 2024, medication errors remain a substantial concern, contributing to extended hospital stays and increased patient care expenses. Xeris's technology offers a tangible solution to reduce these preventable costs.

Furthermore, Xeris's efficient delivery systems streamline patient treatment, potentially reducing the overall burden on healthcare providers and facilities. This efficiency can translate to lower administrative costs and improved resource allocation within hospitals and clinics, ultimately contributing to a more cost-effective healthcare system.

Xeris's proprietary XeriSol and XeriJect technologies significantly enhance drug stability, allowing for room-temperature storage and extended shelf-life. This is a major advantage, as it reduces the reliance on expensive and complex cold chain logistics.

For instance, their formulation for glucagon, G-PEN, offers a two-year shelf life at room temperature, a stark contrast to traditional glucagon products requiring refrigeration. This stability directly translates into simplified supply chains for pharmacies and greater convenience and accessibility for patients, ensuring the medication remains effective when needed.

Addressing Unmet Medical Needs

Xeris Pharmaceuticals is dedicated to tackling significant unmet medical needs, particularly within chronic endocrine and neurological diseases. Their innovative product pipeline, including Recorlev for Cushing's syndrome and XP-8121 for hypothyroidism, offers crucial therapeutic options for patients facing challenging conditions.

This strategic focus on underserved patient populations creates substantial value by providing access to treatments where few or no alternatives exist. For instance, Cushing's syndrome affects an estimated 1 in 50,000 people annually, and effective management remains a critical challenge.

- Targeting Rare and Complex Diseases: Xeris develops therapies for conditions like Cushing's syndrome and hypothyroidism, where patient populations often have limited treatment options.

- Innovative Delivery Systems: The company's proprietary technology platforms enhance the delivery and efficacy of these vital treatments.

- Addressing Patient Burden: By focusing on chronic diseases, Xeris aims to improve the quality of life and reduce the long-term management burden for patients.

Flexible and Concentrated Drug Delivery

Xeris's XeriSol and XeriJect platforms are designed to create highly concentrated drug formulations. This concentration allows for smaller injection volumes, which can lead to less frequent dosing for patients. This innovation significantly enhances patient comfort and opens up new avenues for administering various molecules via subcutaneous and intramuscular routes.

The flexibility offered by these platforms is a key value proposition. For example, a concentrated formulation could mean a patient needing a biologic treatment might only require an injection once a month instead of weekly, a substantial improvement in adherence and quality of life. This concentration capability is crucial for making complex therapies more manageable.

- Concentrated Formulations: Enables smaller injection volumes, improving patient experience.

- Flexible Administration: Supports both subcutaneous and intramuscular delivery methods.

- Reduced Dosing Frequency: Potentially allows for less frequent injections, enhancing patient compliance.

- Broad Molecule Compatibility: Applicable to a wide range of therapeutic molecules.

Xeris's value proposition centers on simplifying drug administration, reducing healthcare waste, and improving patient outcomes through innovative formulation and delivery technologies.

Their ready-to-use injectables and room-temperature stable formulations directly combat medication errors and spoilage, which cost the pharmaceutical industry billions annually, as seen in 2023 losses.

By concentrating drug formulations and offering flexible administration routes, Xeris enhances patient convenience and compliance, potentially reducing dosing frequency for complex therapies.

The company targets unmet medical needs in chronic diseases, providing crucial treatment options for underserved patient populations, such as those with Cushing's syndrome, where effective management remains a challenge.

| Value Proposition Area | Description | Example/Data Point |

|---|---|---|

| Simplified Drug Administration | Ready-to-use, no reconstitution needed | G-PEN offers a two-year shelf life at room temperature. |

| Reduced Healthcare Waste | Eliminates cold chain requirements for many products | Addresses billions in pharmaceutical losses due to spoilage (2023). |

| Minimized Preparation Errors | Reduces costly adverse events and repeat treatments | Medication errors remain a significant concern in 2024, impacting healthcare costs. |

| Enhanced Patient Experience | Concentrated formulations, smaller volumes, less frequent dosing | Potential for monthly injections instead of weekly for certain biologics. |

| Addressing Unmet Medical Needs | Focus on chronic endocrine and neurological diseases | Recorlev for Cushing's syndrome, affecting 1 in 50,000 annually. |

Customer Relationships

Xeris cultivates direct connections with healthcare providers, such as endocrinologists and neurologists, via its specialized sales teams and medical science liaisons. This direct engagement facilitates comprehensive education on product advantages, clinical findings, and patient assistance initiatives.

In 2024, Xeris reported a significant portion of its revenue derived from direct sales channels, underscoring the effectiveness of this customer relationship strategy. For instance, their sales force actively engages with over 5,000 healthcare professionals annually, ensuring deep product understanding and adoption.

Xeris Pharmaceuticals leverages patient support programs like XerisCareConnection and PPP MentorConnect to ensure patients can access and consistently use their prescribed therapies. These initiatives are crucial for building strong, lasting relationships with patients, demonstrating a commitment beyond just the product itself.

These programs provide vital resources, including financial assistance to offset treatment costs and educational materials to empower patients with knowledge about their condition and medication. This comprehensive approach not only fosters trust but also cultivates significant patient loyalty, a cornerstone of sustainable customer relationships in the healthcare sector.

Xeris actively engages Key Opinion Leaders (KOLs) within its therapeutic fields. This engagement is multifaceted, involving scientific collaborations, participation in advisory boards, and presence at major medical conferences. For instance, in 2024, Xeris highlighted its ongoing research partnerships with leading endocrinologists and diabetes educators, many of whom are recognized KOLs.

These KOLs are crucial for Xeris's strategy. They offer invaluable insights into clinical needs and emerging trends, directly informing product development. Furthermore, their influence helps shape clinical practice and effectively communicate the benefits of Xeris's innovative delivery systems, such as the XERISCOPE platform.

Pharmacist and Distributor Engagement

Xeris Pharmaceuticals prioritizes strong connections with pharmacists and drug distributors to guarantee its innovative products, like its ready-to-use insulin formulations, reach patients seamlessly. This engagement is crucial for maintaining a consistent supply chain. In 2023, Xeris reported net sales of $108.4 million, with a significant portion driven by these distribution channels.

Key aspects of Xeris's customer relationship strategy include:

- Streamlined Ordering and Inventory Management: Ensuring pharmacies and distributors have easy access to product information and efficient systems for placing and fulfilling orders, which is vital for managing inventory levels and preventing stockouts.

- Reliable Delivery and Logistics: Partnering with distributors to ensure timely and temperature-controlled delivery of products, a critical factor for biopharmaceuticals.

- Educational Support and Training: Providing pharmacists with the necessary training and information on Xeris's products, such as their unique delivery devices, to ensure proper patient use and satisfaction.

- Responsive Communication Channels: Maintaining open lines of communication to address any concerns or feedback from pharmacy and distribution partners promptly.

Investor Relations and Shareholder Communication

For Xeris, maintaining robust investor relations and transparent shareholder communication is paramount. This involves consistently sharing detailed financial performance, strategic advancements, and forward-looking insights through channels like earnings calls and annual reports. For instance, in 2024, Xeris's investor communications would have focused on the progress of their key products, such as glucagon for severe hypoglycemia, and their pipeline developments.

These interactions are crucial for fostering investor confidence and providing clarity on the company's trajectory. Investor days and regular updates offer a platform to discuss market positioning, regulatory milestones, and the commercialization strategy for their innovative drug delivery systems.

- Transparent Financial Reporting: Regular dissemination of quarterly and annual financial results, adhering to all regulatory standards.

- Strategic Updates: Sharing progress on clinical trials, new product development, and market expansion initiatives.

- Investor Engagement: Hosting earnings calls, investor days, and responding to shareholder inquiries to build trust and understanding.

- Future Outlook: Providing clear guidance on anticipated performance, market opportunities, and potential challenges.

Xeris cultivates deep relationships with healthcare providers through dedicated sales teams and medical liaisons, focusing on education and support for their innovative delivery systems. The company also prioritizes patient access and adherence via programs like XerisCareConnection, fostering loyalty and trust.

Engagement with Key Opinion Leaders (KOLs) is central to Xeris's strategy, informing product development and influencing clinical practice. Furthermore, strong partnerships with pharmacists and distributors are essential for seamless product delivery and market access, as evidenced by their 2023 net sales of $108.4 million.

| Customer Segment | Relationship Approach | Key Engagement Activities | 2024 Focus/Data Point |

|---|---|---|---|

| Healthcare Providers (Endocrinologists, Neurologists) | Direct Engagement & Education | Sales teams, Medical Science Liaisons, Clinical Data Sharing | Engaging over 5,000 healthcare professionals annually |

| Patients | Support Programs & Education | XerisCareConnection, PPP MentorConnect, Financial Assistance | Enhancing adherence and long-term therapy use |

| Key Opinion Leaders (KOLs) | Collaboration & Influence | Scientific Partnerships, Advisory Boards, Conference Presence | Partnerships with leading endocrinologists and diabetes educators |

| Pharmacists & Distributors | Supply Chain & Education | Streamlined Ordering, Reliable Delivery, Product Training | Supporting efficient distribution of ready-to-use insulin formulations |

| Investors | Transparency & Communication | Financial Reporting, Strategic Updates, Earnings Calls | Highlighting progress on glucagon and pipeline developments |

Channels

Xeris leverages established pharmaceutical distribution networks, primarily working with major wholesalers like McKesson, Cardinal Health, and AmerisourceBergen. These partnerships are crucial for reaching a wide array of healthcare providers, including hospitals, clinics, and retail pharmacies, ensuring efficient delivery of their ready-to-use medications.

The company also utilizes specialty pharmacies, which are vital for handling products requiring specific storage or administration protocols. This dual approach to distribution allows Xeris to effectively manage its supply chain and guarantee that its innovative therapies are accessible to patients when and where they are needed.

Xeris Pharmaceuticals employs a specialized direct sales force to engage healthcare providers, including physicians and nurses. This team educates medical professionals on the unique benefits and applications of their key products, such as Gvoke, Recorlev, and Keveyis. This direct interaction is crucial for driving product awareness and encouraging prescription uptake.

In 2024, Xeris continued to invest in its sales force to expand market reach for its established and pipeline products. The company's strategy relies on this direct channel to build strong relationships with prescribers, ensuring they understand the value proposition of Xeris's innovative therapies. This approach directly supports the generation of new prescriptions and market share growth.

Xeris Pharmaceuticals actively cultivates its online presence through its corporate website, serving as a vital conduit for product information, technological advancements, and investor relations. This digital platform is designed to be a comprehensive resource for a broad audience, encompassing patients seeking understanding, healthcare providers evaluating treatment options, and investors assessing growth potential.

Digital marketing initiatives further amplify Xeris's reach, ensuring key messages about their innovative drug delivery systems, like the XeriSol technology, are disseminated effectively. In 2024, companies across the pharmaceutical sector significantly increased their digital ad spend, with projections indicating continued growth, reflecting the channel's importance in patient and professional engagement.

This strategic online engagement is crucial for building brand awareness and fostering trust within the medical community and among potential shareholders. Xeris's commitment to transparency and education via its digital channels supports its mission to improve patient outcomes and drive business value.

Medical Conferences and Scientific Publications

Xeris Pharmaceuticals leverages medical conferences and scientific publications as key channels to communicate its research and product value. These avenues are vital for reaching healthcare professionals, the primary audience for their innovative therapies.

Participation in major conferences allows for direct engagement with physicians and researchers, fostering understanding of Xeris's technologies, such as their proprietary XeriSol platform. For instance, presenting data at the American Diabetes Association Scientific Sessions or the Endocrine Society's annual meeting directly informs endocrinologists and diabetologists about the benefits of products like Gvoke. In 2024, Xeris continued to present clinical data at these significant events, highlighting real-world evidence and patient outcomes.

- Dissemination of Clinical Data: Publishing trial results in high-impact journals like The Lancet Diabetes & Endocrinology or the Journal of Clinical Endocrinology & Metabolism validates Xeris's product efficacy and safety profiles.

- Key Opinion Leader Engagement: Presenting at conferences facilitates dialogue with leading endocrinologists, building advocacy and driving prescriber adoption.

- Brand Awareness and Credibility: Consistent presence and data sharing at scientific forums enhance Xeris's reputation as an innovator in endocrinology.

Strategic Partnerships for Expanded Reach

Xeris Pharmaceuticals leverages strategic partnerships as a key channel to amplify its market presence. These collaborations with other pharmaceutical entities and commercialization specialists are crucial for penetrating new markets and reaching broader patient populations with its innovative products.

A prime example of this strategy in action is the partnership with American Regent for Gvoke VialDx. This collaboration specifically aims to expand the diagnostic application reach of Gvoke, demonstrating how alliances can unlock new avenues for product utilization and revenue generation.

These types of channel strategies are vital for companies like Xeris, allowing them to extend their distribution networks and marketing efforts without the need for extensive in-house infrastructure for every product or indication. This shared approach to market access can significantly accelerate growth.

- Expanded Market Penetration: Collaborations with pharmaceutical and commercialization partners allow Xeris to reach a wider patient base for its products.

- Product Application Expansion: Partnerships, such as the one with American Regent for Gvoke VialDx, open up new diagnostic or therapeutic applications.

- Shared Distribution and Marketing: These alliances enable Xeris to tap into established networks, reducing the cost and time associated with market entry.

- Accelerated Growth: By leveraging external expertise and reach, Xeris can more efficiently scale its commercial operations and drive revenue.

Xeris Pharmaceuticals utilizes a multi-faceted channel strategy, combining traditional distribution with direct engagement and digital outreach. This approach ensures broad market access and targeted communication with healthcare professionals and patients.

Key channels include major pharmaceutical wholesalers, specialty pharmacies, a dedicated direct sales force, digital marketing, medical conferences, scientific publications, and strategic partnerships.

These channels collectively support Xeris's mission to deliver innovative therapies, such as Gvoke and Recorlev, to patients while building strong relationships within the medical community and enhancing brand credibility.

In 2024, Xeris continued to emphasize digital marketing and direct sales force expansion, mirroring industry trends of increased digital ad spend and personalized prescriber engagement.

| Channel | Description | 2024 Focus/Activity |

|---|---|---|

| Wholesalers & Specialty Pharmacies | Leveraging established networks (McKesson, Cardinal Health, AmerisourceBergen) for broad reach. | Ensuring efficient delivery of ready-to-use medications to hospitals, clinics, and pharmacies. |

| Direct Sales Force | Educating physicians and nurses on product benefits (Gvoke, Recorlev). | Expanding market reach for established and pipeline products, building prescriber relationships. |

| Digital Marketing & Website | Online presence for product info, tech advancements, and investor relations. | Amplifying messages about XeriSol technology, reflecting increased industry digital ad spend. |

| Medical Conferences & Publications | Disseminating clinical data and engaging with Key Opinion Leaders (KOLs). | Presenting real-world evidence at events like ADA Scientific Sessions, publishing in journals. |

| Strategic Partnerships | Collaborating with other entities for market penetration and product application expansion. | Partnerships like American Regent for Gvoke VialDx to unlock new avenues for product utilization. |

Customer Segments

This customer segment comprises individuals diagnosed with diabetes, specifically those experiencing or at high risk of severe hypoglycemia. This often includes patients who rely on insulin therapy or certain oral medications like sulfonylureas, which can increase the likelihood of dangerously low blood sugar levels.

Xeris's Gvoke is a critical solution for this group, offering a ready-to-use liquid glucagon. This product directly addresses the urgent need for a fast, reliable, and easy-to-administer rescue medication during severe hypoglycemic events, providing a vital lifeline for patients and their caregivers.

In 2024, the prevalence of diabetes continues to be a significant health concern globally. Millions of individuals with diabetes require effective management strategies to prevent severe complications like hypoglycemia, underscoring the market's demand for accessible and efficient treatment options.

Individuals diagnosed with endogenous Cushing's syndrome represent a critical customer segment for Xeris's Recorlev. This rare endocrine disorder, affecting an estimated 1 in 50,000 to 1 in 100,000 people annually, demands specialized medical intervention. Recorlev offers a targeted therapeutic approach to manage the multifaceted and often debilitating symptoms associated with this condition.

Xeris Biopharma’s Keveyis is specifically designed for individuals diagnosed with primary periodic paralysis, a category of rare genetic conditions. These disorders manifest as unpredictable episodes of muscle weakness or complete paralysis, significantly impacting daily life.

This patient segment experiences debilitating muscle weakness, often triggered by factors like exercise, diet, or temperature changes. The rarity of these conditions means many patients have historically struggled to find effective treatments, making Keveyis a crucial advancement.

In 2024, the focus remains on reaching these underserved patients, ensuring they have access to this proven therapeutic option. The market for rare neurological disorders continues to grow, with an increasing emphasis on specialized treatments.

Healthcare Professionals (Endocrinologists, Neurologists, Emergency Physicians)

Healthcare professionals like endocrinologists, neurologists, and emergency physicians are pivotal customer segments for Xeris. These specialists are directly involved in diagnosing and treating conditions that Xeris's innovative drug delivery systems address, such as diabetes and certain neurological disorders. Their prescribing habits significantly influence product adoption and market penetration.

These medical practitioners are the primary decision-makers when it comes to selecting therapies for their patients. Their understanding of patient needs and the efficacy of Xeris's products directly translates into prescription volume. For instance, in 2024, the market for diabetes management, a key area for Xeris, continued to expand, driven by increasing diagnoses and a demand for more convenient treatment options.

- Endocrinologists: Crucial for prescribing Xeris’s glucagon for hypoglycemia treatment.

- Neurologists: Key prescribers for Xeris’s diazepam nasal spray for seizure clusters.

- Emergency Physicians: Administer and prescribe Xeris products in acute care settings.

- Pharmacists and Nurses: Involved in dispensing and patient education, ensuring proper use of Xeris’s technologies.

Pharmaceutical and Biotech Companies (for Technology Licensing/Partnerships)

Pharmaceutical and biotech companies looking for innovative drug delivery technologies are key customers for Xeris's XeriSol and XeriJect platforms. These firms aim to improve the formulation of their own drug candidates, potentially enhancing efficacy or patient compliance.

These companies engage with Xeris through technology licensing or co-development partnerships. This allows them to leverage Xeris's proprietary formulation technology without the need for extensive internal R&D in that specific area.

- Target Partners: Companies with promising drug candidates that face formulation challenges, such as poor solubility or bioavailability.

- Value Proposition: Access to advanced, ready-to-use formulation technologies that can accelerate drug development timelines and improve product profiles.

- Revenue Streams: Milestone payments, upfront fees, and royalties on commercialized products developed using Xeris's technology.

- Market Opportunity: The global pharmaceutical licensing market is substantial, with many deals focused on innovative drug delivery systems. For instance, in 2023, licensing deals in the biotech and pharma sector continued to be a significant driver of value creation.

Xeris serves patients with critical medical conditions, including those with diabetes experiencing or at risk of severe hypoglycemia, and individuals with rare genetic disorders like primary periodic paralysis. Additionally, Xeris targets patients with endogenous Cushing's syndrome, a rare endocrine disorder.

Healthcare professionals such as endocrinologists, neurologists, and emergency physicians are key segments, influencing treatment decisions and product adoption. Pharmacists and nurses also play a role in patient education and dispensing.

Pharmaceutical and biotech companies represent another vital customer segment, seeking to leverage Xeris's proprietary XeriSol and XeriJect formulation technologies for their own drug candidates. This includes companies with drugs facing solubility or bioavailability challenges.

In 2024, the global diabetes market continued its expansion, driven by increasing diagnoses and the demand for convenient management solutions, highlighting the ongoing need for products like Xeris's Gvoke. The market for rare neurological disorders also saw continued growth, emphasizing the importance of specialized treatments.

Cost Structure

Xeris Biopharma dedicates a substantial portion of its financial resources to Research and Development. This investment is fundamental to their strategy, fueling the development of new therapies and the enhancement of existing technology platforms. These costs are essential for their long-term product pipeline and market competitiveness.

In 2024, Xeris continued to invest heavily in its R&D pipeline. This included progressing preclinical studies and conducting clinical trials for promising candidates such as XP-8121. These expenditures are directly tied to their commitment to innovation and bringing novel treatments to market.

Selling, General, and Administrative (SG&A) expenses are a significant component of Xeris's cost structure, largely driven by commercialization efforts. These costs include salaries for the sales force, which is crucial for promoting their pharmaceutical products.

Marketing campaigns for key products like Gvoke, Recorlev, and Keveyis also contribute heavily to SG&A. In 2023, Xeris reported SG&A expenses of $156.7 million, reflecting these substantial investments aimed at increasing product adoption and market penetration.

Xeris's Cost of Goods Sold (COGS) encompasses the direct expenses tied to producing and delivering its commercial products. This includes the cost of raw materials, the labor involved in manufacturing, and the overhead directly attributable to production facilities. For instance, in 2024, Xeris's focus on expanding its product lines would likely see a corresponding increase in these direct costs as production scales up.

Manufacturing and Supply Chain Costs

Xeris Pharmaceuticals faces significant expenses in its manufacturing and supply chain operations. These include the costs associated with producing its innovative drug formulations, ensuring rigorous quality control throughout the process, and managing inventory effectively to meet demand. Distribution logistics, from warehousing to final delivery, also represent a substantial expenditure.

The efficiency of Xeris's supply chain directly impacts these costs. Factors such as production volume, the inherent complexity of its drug formulations, and the optimization of its logistics network play a crucial role in determining the overall manufacturing and supply chain expenses. For instance, in 2023, Xeris reported that its cost of goods sold was $101.2 million, reflecting these inherent manufacturing and supply chain outlays.

- Manufacturing Expenses: Costs related to the production of Xeris's drug products, including raw materials, labor, and facility overhead.

- Quality Control: Investment in ensuring product safety and efficacy through stringent testing and compliance measures.

- Inventory Management: Expenses tied to storing and managing finished goods and raw materials to prevent stockouts while minimizing holding costs.

- Distribution Logistics: Costs associated with transporting products from manufacturing sites to distributors and ultimately to patients, including cold chain management where applicable.

Intellectual Property Maintenance and Legal Costs

Xeris Pharmaceuticals dedicates substantial resources to maintaining and defending its extensive patent portfolio. These legal and administrative expenses are critical for safeguarding its proprietary technologies, such as its innovative subcutaneous injection platforms.

These costs are fundamental to Xeris's strategy of ensuring long-term market exclusivity for its products, particularly for its glucagon-like peptide-1 (GLP-1) receptor agonist formulations. For instance, in 2023, companies in the biopharmaceutical sector often saw patent-related legal expenses ranging from millions to tens of millions of dollars annually, depending on the number and complexity of patents in force.

- Patent Portfolio Defense: Ongoing legal fees for patent prosecution, oppositions, and potential litigation.

- Administrative Costs: Fees associated with patent annuities, renewals, and intellectual property management software.

- Strategic Value: These expenditures are directly tied to protecting Xeris's competitive advantage and future revenue streams.

Xeris's cost structure is significantly influenced by its manufacturing and supply chain operations, encompassing raw material acquisition, production labor, and facility overhead. These direct costs are crucial for delivering its specialized drug formulations. In 2023, Xeris reported its Cost of Goods Sold at $101.2 million, highlighting these essential operational outlays.

The company also incurs substantial Selling, General, and Administrative (SG&A) expenses, primarily driven by its commercialization efforts. These costs include sales force compensation and marketing campaigns for key products like Gvoke and Recorlev. In 2023, SG&A expenses totaled $156.7 million, underscoring the investment in market penetration.

Furthermore, Xeris allocates considerable resources to Research and Development, essential for advancing its pipeline and maintaining technological leadership. These investments are vital for long-term growth and market competitiveness.

| Cost Category | 2023 Expense (Millions USD) | Key Drivers |

|---|---|---|

| Cost of Goods Sold (COGS) | 101.2 | Raw materials, manufacturing labor, production overhead |

| Selling, General, and Administrative (SG&A) | 156.7 | Sales force, marketing, general operations |

| Research and Development (R&D) | 133.0 | Pipeline development, clinical trials, platform enhancement |

Revenue Streams

Xeris's core revenue generation hinges on the net sales of its three key commercialized products: Gvoke, Recorlev, and Keveyis. These products address specific medical needs, with Gvoke targeting severe hypoglycemia, Recorlev for Cushing's syndrome, and Keveyis for primary periodic paralysis.

The company has experienced robust sales momentum for both Recorlev and Gvoke. In 2024, Recorlev demonstrated substantial year-over-year growth, and Gvoke also saw impressive sales increases. This trend is projected to continue into 2025, underscoring the market's positive reception and demand for these treatments.

Xeris Pharmaceuticals earns royalty revenue by licensing its innovative XeriSol and XeriJect technology platforms to other drug developers. This means companies can use Xeris's advanced delivery systems for their own medications, and in return, Xeris receives a share of the profits.

These royalty agreements are structured to provide Xeris with income based on the future commercial success of products that incorporate its technologies. For instance, if a partner company launches a new drug using XeriJect, Xeris will receive a percentage of that drug's sales revenue.

As of early 2024, Xeris has secured multiple licensing agreements, underscoring the broad applicability and value of its proprietary drug delivery technologies across the pharmaceutical industry. These partnerships are projected to contribute significantly to Xeris's long-term financial stability and growth.

Milestone payments from strategic partnerships represent a significant revenue stream for Xeris. These payments are typically tied to the achievement of specific development, regulatory, or commercial goals outlined in collaboration agreements. For instance, Xeris received a milestone payment from American Regent following the FDA approval of Gvoke VialDx, highlighting the value generated from successful product advancements within these alliances.

Contract and Other Revenue

Contract and Other Revenue captures income generated from Xeris's expertise and technology through various agreements. This includes revenue from formulation feasibility studies and collaborative research initiatives with partners, highlighting the early-stage value Xeris provides.

This revenue stream is crucial for validating Xeris's platform and fostering strategic relationships. For instance, in 2023, Xeris reported contract revenue of $0.3 million, demonstrating its engagement in early-stage development projects.

- Formulation Feasibility Studies: Xeris conducts studies to assess the viability of its drug delivery technologies for specific therapeutic compounds.

- Collaborative Research: Revenue from joint research and development projects with pharmaceutical and biotechnology companies.

- Technology Licensing: Potential future revenue from licensing its proprietary delivery systems to third parties.

Potential Future Product Sales (e.g., XP-8121)

Future revenue growth for Xeris is anticipated to be driven by new product introductions, with XP-8121 being a key contributor. This candidate, currently in Phase 3 trials for hypothyroidism, is expected to generate significant peak net revenue upon its market launch. This pipeline asset represents a substantial long-term revenue stream as it progresses through development and toward commercialization.

- XP-8121: Phase 3 ready for hypothyroidism treatment.

- Projected Peak Net Revenue: Expected to be substantial.

- Long-Term Opportunity: Significant revenue potential as pipeline assets reach commercialization.

Xeris's revenue streams are multifaceted, primarily driven by the net sales of its commercialized products like Gvoke and Recorlev, which showed strong growth in 2024. The company also generates income through licensing its proprietary XeriSol and XeriJect drug delivery technologies to other pharmaceutical firms, receiving royalties based on their commercial success.

Additional revenue comes from milestone payments tied to development and regulatory achievements within strategic partnerships, such as the payment received from American Regent for Gvoke VialDx approval. Contract revenue, including formulation feasibility studies and collaborative research, also contributes, with $0.3 million reported in 2023 for early-stage projects.

Looking ahead, Xeris anticipates significant future revenue from pipeline assets like XP-8121, currently in Phase 3 trials for hypothyroidism, which is expected to generate substantial peak net revenue upon market launch.

| Product/Activity | 2024 Performance Indicator | Revenue Type |

| Gvoke | Impressive sales increases | Net Sales |

| Recorlev | Substantial year-over-year growth | Net Sales |

| XeriSol/XeriJect Licensing | Multiple licensing agreements secured | Royalty Revenue |

| Gvoke VialDx Approval | Milestone payment from American Regent | Milestone Payments |

| Formulation Feasibility Studies | $0.3 million revenue in 2023 | Contract Revenue |

| XP-8121 (Hypothyroidism) | Phase 3 ready, projected substantial peak net revenue | Net Sales (Future) |

Business Model Canvas Data Sources

The Xeris Business Model Canvas is informed by a robust blend of financial performance data, comprehensive market research, and internal strategic assessments. This multi-faceted approach ensures each component of the canvas is grounded in actionable and verifiable information.