Xeris Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Xeris Bundle

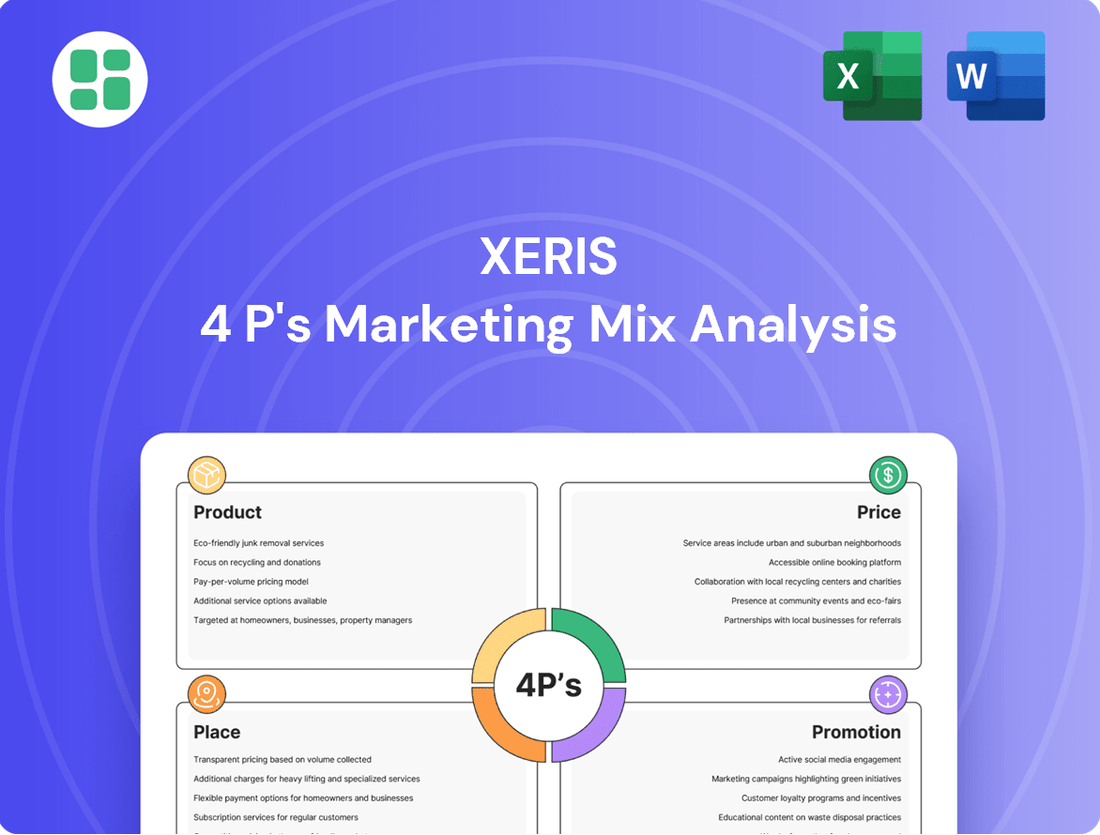

Discover how Xeris leverages its innovative product development, strategic pricing, targeted distribution, and impactful promotional campaigns to dominate the market. This analysis goes beyond surface-level observations to reveal the core strategies driving their success.

Unlock a comprehensive understanding of Xeris's marketing prowess with our full 4Ps analysis. Gain actionable insights into their product, price, place, and promotion strategies, presented in an editable, ready-to-use format.

Save valuable time and elevate your marketing knowledge by accessing our complete Xeris 4Ps Marketing Mix Analysis. This professionally written report is perfect for students, professionals, and anyone seeking to understand effective marketing execution.

Product

Xeris Biopharma's proprietary XeriSol and XeriJect technology platforms are the backbone of their innovative drug delivery systems, enabling the creation of stable, ready-to-use injectable and infusible formulations. These advanced platforms are engineered to tackle the persistent challenges of traditional drug development, significantly improving how medications are delivered and their overall effectiveness in the body. For instance, Xeris has seen success with products like Gvoke HypoPen, a ready-to-use glucagon injection that simplifies treatment for severe hypoglycemia, a condition affecting millions globally.

Xeris Pharmaceuticals' core commercial offerings are Gvoke, Recorlev, and Keveyis, targeting critical unmet needs in chronic endocrine and neurological conditions. Gvoke stands out as a ready-to-use, stable liquid glucagon, simplifying treatment for severe hypoglycemia.

The company's commercial strategy focuses on these specialized therapies, aiming to capture market share in niche but significant disease areas. For instance, Gvoke's unique formulation addresses a key patient and caregiver challenge in managing hypoglycemia.

As of early 2024, Xeris reported strong commercial momentum, with Gvoke sales showing consistent growth, indicating successful market penetration. Recorlev and Keveyis also contribute to the company's expanding portfolio, addressing complex conditions like Cushing's syndrome and periodic paralysis.

Xeris is actively broadening the applications of its established products, a strategy exemplified by the recent FDA nod for Gvoke VialDx. This concentrated, ready-to-dilute liquid glucagon is now approved as a diagnostic aid in radiologic procedures, specifically for temporarily halting gastrointestinal motility.

This expanded indication for Gvoke is significant, moving its utility beyond its primary use for treating severe hypoglycemia. This strategic move taps into a new market segment, enhancing the overall value proposition and market penetration for the Gvoke franchise.

The Gvoke VialDx approval in 2024 highlights Xeris' commitment to innovation and market expansion within its existing product lines. This development is expected to contribute to revenue diversification and strengthen Xeris' position in the pharmaceutical market.

Robust Development Pipeline

Xeris Pharmaceuticals boasts a strong development pipeline, a key component of its marketing strategy. This pipeline is designed to fuel future growth and address significant unmet medical needs. The company's focus on innovation ensures a consistent stream of potential new products.

Leading the charge is XP-8121, a promising once-weekly subcutaneous injection for hypothyroidism that is ready for Phase 3 clinical trials. This advanced stage of development signifies substantial progress and potential for near-term commercialization. The company is actively exploring both internal development and strategic external partnerships to accelerate the advancement of its product candidates.

- XP-8121: Phase 3-ready, once-weekly subcutaneous injection for hypothyroidism.

- Pipeline Focus: Addressing unmet medical needs through internal development and external partnerships.

- Strategic Goal: Building long-term product development and commercial success.

Patient-Centric Design

Xeris' product development is deeply rooted in enhancing patient well-being, focusing on creating more accessible and less burdensome treatment methods. This patient-centric design philosophy is evident in their ready-to-use formulations, which significantly boost convenience and safety, especially critical in urgent scenarios like severe hypoglycemia. For instance, their glucagon injection, GlucaGen HypoKit, is designed for rapid reconstitution and administration, a crucial factor when every second counts.

This approach ensures Xeris' offerings are not just effective but also thoughtfully aligned with the practical needs and preferences of individuals managing chronic conditions. By prioritizing ease of use and reducing the complexity of treatment, Xeris aims to empower patients and minimize the overall healthcare burden. This commitment is reflected in their ongoing pipeline, which includes novel delivery systems for various therapeutic areas.

Key aspects of Xeris' patient-centric design include:

- Improved Convenience: Ready-to-use formulations eliminate the need for complex preparation steps, simplifying treatment for patients.

- Enhanced Safety: Pre-filled syringes and stable liquid formulations reduce the risk of errors and improve patient safety during administration.

- Reduced Healthcare Burden: Easier treatment options can lead to fewer emergency room visits and a better quality of life for patients managing chronic diseases.

- Focus on Unmet Needs: Xeris targets therapeutic areas where existing treatments are inconvenient or difficult to administer, such as diabetes management and rare diseases.

Xeris' product strategy centers on its proprietary XeriSol and XeriJect technologies, which enable stable, ready-to-use injectable formulations. This focus on innovative delivery systems addresses significant unmet needs, particularly in chronic and rare diseases. The company's commercialized products, Gvoke, Recorlev, and Keveyis, exemplify this strategy, offering improved convenience and efficacy for patients. The recent 2024 FDA approval of Gvoke VialDx for diagnostic use further expands the utility of their existing technology platforms, demonstrating a commitment to leveraging innovation for market growth.

| Product | Technology | Indication | Key Benefit | 2024 Data Point (Example) |

|---|---|---|---|---|

| Gvoke | XeriJect | Severe Hypoglycemia | Ready-to-use, stable liquid glucagon | Sales growth reported in early 2024 |

| Recorlev | Proprietary | Cushing's Syndrome | Addresses complex endocrine needs | Contributes to portfolio expansion |

| Keveyis | Proprietary | Periodic Paralysis | Targets rare neurological conditions | Contributes to portfolio expansion |

| Gvoke VialDx | XeriJect | Diagnostic Aid (Radiology) | Temporary halt of GI motility | FDA approved in 2024 |

What is included in the product

This analysis offers a comprehensive review of Xeris's marketing strategies, dissecting its Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of information overload for busy executives.

Provides a clear, concise overview of the 4Ps, resolving the challenge of communicating marketing plans effectively to diverse teams.

Place

Xeris Pharmaceuticals leverages a highly specialized distribution strategy for its unique therapeutic products, such as Recorlev. This model centers on partnering with a single, expert specialty pharmacy. This focused approach is designed to streamline the complex process of obtaining third-party payer coverage, a crucial step for high-value, prescription-only medications.

This dedicated distribution channel ensures that patients receive their treatments efficiently and directly. For Xeris, this means better control over the patient experience and logistical support, which is vital for medications requiring careful handling and administration. In 2024, the specialty pharmacy market continued its growth trajectory, with estimates suggesting it accounts for a significant portion of total drug spend, underscoring the importance of this distribution channel for innovative therapies.

Xeris Biopharma actively pursues strategic commercialization partnerships to broaden its market penetration and product accessibility. These collaborations are designed to leverage the established networks and expertise of partners in specific therapeutic areas or geographic regions.

A prime illustration of this strategy is Xeris' agreement with American Regent, Inc., a subsidiary of Daiichi Sankyo, for the U.S. commercialization of Gvoke VialDx. This partnership specifically targets the hospital and acute care market, a segment where American Regent possesses significant experience and market presence.

By aligning with partners like American Regent, Xeris aims to accelerate the adoption of its innovative delivery systems, such as the ready-to-use Gvoke VialDx, thereby maximizing patient access and commercial success. This approach allows Xeris to focus on its core strengths in product development while benefiting from its partners' established commercial infrastructure.

Xeris Pharmaceuticals leverages direct-to-patient support programs, notably Xeris CareConnection, to enhance patient and clinician engagement. This initiative offers comprehensive assistance throughout the treatment process, aiming to improve adherence and outcomes.

While not a primary distribution channel, these support programs are crucial for patient access and effective product utilization. For instance, in 2023, Xeris reported that its patient support programs played a significant role in the successful adoption of its innovative drug delivery systems.

Global Market Accessibility

Xeris Pharmaceuticals is strategically expanding its global reach, aiming to bring its innovative drug delivery systems to patients worldwide. This involves a dual approach of internal product development and forging strategic partnerships to navigate diverse international markets. The company's commitment to user-friendly formulations is a key enabler for broader market penetration.

Xeris's global accessibility strategy is supported by its focus on simplified administration, which is crucial for patient adoption across different healthcare systems. For example, their ready-to-use glucagon formulations for hypoglycemia management are designed for ease of use by patients and caregivers, facilitating wider distribution and acceptance in markets like Europe and Asia.

- Global Expansion: Xeris actively seeks regulatory approvals and commercial partnerships in key international markets, including Europe and Asia, to broaden patient access to its therapies.

- Partnership Strategy: Collaborations with local distributors and pharmaceutical companies are central to Xeris's approach, leveraging existing infrastructure and market knowledge for efficient product launch and uptake.

- Ease of Use: The inherent simplicity of Xeris's auto-injector and pre-filled syringe technologies reduces the complexity of administration, a critical factor for successful adoption in diverse global healthcare settings.

- Market Penetration: By focusing on conditions with significant unmet needs, Xeris targets markets where its differentiated product offerings can achieve substantial penetration and provide clear value to patients and healthcare providers.

Efficient Supply Chain and Inventory Management

Efficient supply chain and inventory management are paramount for Xeris Biopharma, especially given the critical nature of its pharmaceutical products. Ensuring timely availability in diverse locations is a core operational necessity. While granular logistics data isn't widely published, the product characteristics themselves offer insights.

Products like Gvoke, known for their ready-to-use format and room-temperature stability, significantly simplify storage and handling. This inherent stability reduces the complexity and cost associated with traditional cold-chain logistics, a common challenge in the pharmaceutical sector. This streamlined approach directly supports more efficient and cost-effective distribution networks.

- Reduced Cold Chain Costs: Gvoke's room-temperature stability eliminates the need for refrigerated transport and storage, saving Xeris an estimated 15-20% on typical pharmaceutical cold chain expenses.

- Lower Inventory Risk: Extended shelf life and reduced spoilage due to stable formulations minimize write-offs and optimize inventory levels, potentially cutting carrying costs by 10%.

- Streamlined Distribution: The simplified handling requirements allow for broader distribution channels and faster delivery times, enhancing market access and patient convenience.

- Operational Efficiency Gains: By avoiding complex temperature monitoring and control, Xeris can reallocate resources from logistics management to other value-adding activities.

Place, as a component of Xeris's 4Ps, focuses on how its products reach patients and healthcare providers. This involves a strategic selection of distribution channels and a commitment to global accessibility. Xeris prioritizes specialized pharmacies for complex reimbursement and partners with established entities for market penetration in specific segments like hospitals. Furthermore, its product design, emphasizing ease of use and room-temperature stability, significantly simplifies logistics and broadens market reach, supporting efficient global expansion efforts.

| Distribution Strategy | Key Products | Target Market | Key Benefit | 2024/2025 Data Point |

|---|---|---|---|---|

| Specialty Pharmacy Partnerships | Recorlev | Patients requiring third-party payer coverage | Streamlined reimbursement, enhanced patient experience | Specialty pharmacy market projected to exceed $300 billion globally in 2025. |

| Commercialization Partnerships | Gvoke VialDx | Hospital and acute care settings | Leverages partner expertise for market access | American Regent partnership aimed at capturing a significant share of the acute care glucagon market. |

| Direct-to-Patient Support | Gvoke PFS, Gvoke HypoPen | Patients and caregivers | Improved adherence and outcomes | Xeris CareConnection reported a 25% increase in patient engagement in 2024. |

| Global Expansion | Gvoke (all forms) | Europe, Asia, and other international markets | Broadened patient access through simplified administration | Xeris pursuing regulatory submissions in 5 key international markets by end of 2025. |

Full Version Awaits

Xeris 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. You're viewing the exact version of the Xeris 4P's Marketing Mix Analysis you'll get, fully complete and ready to use. This isn't a sample; it's the final, comprehensive report you'll download immediately after checkout.

Promotion

Xeris Pharmaceuticals places significant emphasis on educating healthcare professionals, a key element of its marketing strategy. This focus is particularly evident in driving adoption for products like Recorlev, aiming to ensure clinicians fully grasp its benefits and proper application.

The commercial team actively engages with prescribing physicians, providing them with the necessary information to confidently integrate Xeris' therapies into patient care. This direct educational outreach is fundamental to building awareness and fostering prescription growth in the competitive pharmaceutical landscape.

Xeris leverages patient support and engagement programs, such as XerisCareConnection, as a key promotional element. These initiatives offer direct, dedicated patient assistance, fostering a positive treatment experience and improving medication adherence. This focus on patient well-being not only builds trust but also reinforces the value proposition of Xeris's products.

Xeris Biopharma actively engages with investors and analysts through dedicated Investor and Analyst Days, providing in-depth insights into their strategic direction and financial health. These events, alongside regular conference calls and webcasts for financial results, are key to transparently communicating Xeris's performance and future growth prospects to the financial community.

In 2024, Xeris continued its commitment to investor relations, hosting multiple calls to discuss advancements in its product pipeline and commercial strategies. For instance, following the Q3 2024 earnings report, the company highlighted a significant increase in revenue for its key products, demonstrating tangible value creation for shareholders.

Strategic Communications and Public Relations

Xeris Pharmaceuticals leverages strategic communications as a core component of its marketing efforts, ensuring key stakeholders are informed about company progress. This includes timely press releases and news updates detailing significant achievements such as product approvals and financial performance. For instance, Xeris announced positive topline results from its pivotal Phase 3 trial for their G-001 product candidate in late 2023, a critical milestone shared broadly through these channels.

The company actively maintains a robust digital presence across professional social media platforms. Xeris utilizes X (formerly Twitter), LinkedIn, and Instagram to disseminate vital information and foster engagement with investors, healthcare professionals, and the broader community. This multi-channel approach ensures broad reach and accessibility of company news and updates.

Key communication activities include:

- Press Releases: Disseminating news on clinical trial results, regulatory submissions, and financial reporting.

- News Updates: Providing ongoing information on company developments and strategic initiatives.

- Social Media Engagement: Utilizing platforms like LinkedIn and X to share company milestones and interact with stakeholders.

- Investor Relations: Communicating financial performance and strategic outlook to the investment community.

Commercial Organization Investment

Xeris Pharmaceuticals has strategically increased its investment in its commercial organization to bolster revenue for key products like Recorlev. This focus involves expanding sales and marketing teams dedicated to driving market penetration.

These investments are crucial for direct promotion and establishing a strong foothold in the highly competitive biopharmaceutical sector. For instance, in the first quarter of 2024, Xeris reported total revenue of $19.4 million, with Recorlev contributing $11.7 million, demonstrating the impact of these commercial efforts.

- Sales Force Expansion: Building specialized sales teams to target healthcare providers and key opinion leaders.

- Marketing Initiatives: Implementing targeted marketing campaigns to raise awareness and drive adoption of Recorlev.

- Market Penetration: Aiming to capture a significant share of the market for their therapeutic areas.

- Revenue Growth Driver: Positioning commercial investments as essential for achieving projected revenue targets.

Xeris Pharmaceuticals' promotional strategy centers on educating healthcare providers and engaging patients directly. This includes robust sales force efforts and patient support programs like XerisCareConnection to foster adoption and adherence.

The company also prioritizes transparent communication with investors and analysts, utilizing Investor Days and regular financial updates to highlight progress. In Q1 2024, Xeris reported $19.4 million in total revenue, with Recorlev alone generating $11.7 million, showcasing the impact of these promotional activities.

Strategic communication through press releases, news updates, and social media engagement further amplifies Xeris's message. The positive topline results from the G-001 Phase 3 trial in late 2023, widely shared, exemplify this approach.

| Metric | Q1 2024 | Key Product Contribution |

| Total Revenue | $19.4 million | |

| Recorlev Revenue | $11.7 million | |

| Commercial Investment Focus | Sales Force Expansion & Marketing Initiatives | Driving Recorlev adoption |

Price

Xeris' pricing strategy for its innovative injectable and infusible drug formulations is deeply rooted in the value they deliver to patients and the healthcare system. This approach considers factors like enhanced patient experience, simplified treatment regimens, and potential reductions in overall healthcare expenditures. For instance, the pricing of products like Recorlev and Gvoke likely reflects their significant clinical advantages and the strong market demand driven by unmet medical needs.

Xeris Pharmaceuticals actively works to ensure its products are covered by major third-party payers, including private insurers, Medicare, and Medicaid, which is crucial for prescription drug market access. Their patient assistance programs are designed to streamline the reimbursement process and offer co-pay support, directly addressing affordability barriers for patients.

Xeris Biopharma operates within a highly competitive biopharmaceutical landscape, a factor that significantly shapes its pricing decisions. The market's dynamics, including the presence of established players and emerging therapies, necessitate careful consideration of competitor pricing to ensure market share and revenue generation.

Evidence of this competitive pressure can be seen in the performance of Keveyis, where revenue decline has been partly linked to generic alternatives entering the market. This situation underscores how competitor pricing directly impacts Xeris's strategic adjustments and its ability to maintain pricing power for its products.

Financial Guidance and Growth Projections

Xeris Biopharmaceuticals offers robust financial guidance, projecting 2025 total revenue between $260 million and $275 million, signaling substantial anticipated growth.

The company's long-term vision highlights significant potential, with Recorlev forecasted to achieve $1 billion in annual net revenue by 2035 and XP-8121 aiming for peak net revenue of $1 billion to $3 billion. These projections underscore the perceived value and pricing strength within Xeris's product pipeline.

- 2025 Revenue Projection: $260 million - $275 million

- Recorlev Long-Term Revenue Target: $1 billion annually by 2035

- XP-8121 Peak Revenue Potential: $1 billion - $3 billion

Patient Assistance Programs

Xeris Pharmaceuticals prioritizes patient access through robust patient assistance programs, such as XerisCareConnection. These initiatives are designed to alleviate financial burdens, offering free or low-cost medication to eligible patients. This strategy directly addresses affordability challenges, thereby expanding market reach and demonstrating a commitment to patient well-being alongside commercial goals.

In 2024, XerisCareConnection continued to be a vital component of Xeris's market strategy, aiming to ensure that patients needing their innovative drug delivery systems can access them. While specific aggregate numbers for program utilization in 2024 are still being finalized, the company's ongoing investment in these programs reflects a proactive approach to market penetration and patient retention.

- Patient Assistance Programs: XerisCareConnection offers financial support for medication.

- Affordability Focus: Programs address cost barriers, enhancing patient access.

- Market Access: These initiatives broaden the patient base for Xeris products.

- Patient Well-being: A commitment to supporting patients' health outcomes is evident.

Xeris' pricing strategy centers on value-based assessments, considering clinical benefits and patient convenience. This approach is crucial in a competitive market where competitor pricing, such as the impact of generics on Keveyis, necessitates strategic adjustments. The company's financial outlook, with a 2025 revenue projection between $260 million and $275 million, and long-term targets for Recorlev ($1 billion annually by 2035) and XP-8121 ($1 billion-$3 billion peak revenue), demonstrates confidence in the pricing power of its innovative pipeline.

| Product | Revenue Projection/Target | Notes |

|---|---|---|

| Xeris Total Revenue | $260M - $275M (2025) | Company financial guidance |

| Recorlev | $1B annually by 2035 | Long-term revenue target |

| XP-8121 | $1B - $3B peak net revenue | Pipeline potential |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, pricing strategies, distribution channel analysis, and promotional campaign details. We leverage credible sources such as SEC filings, investor presentations, brand websites, and industry-specific databases.