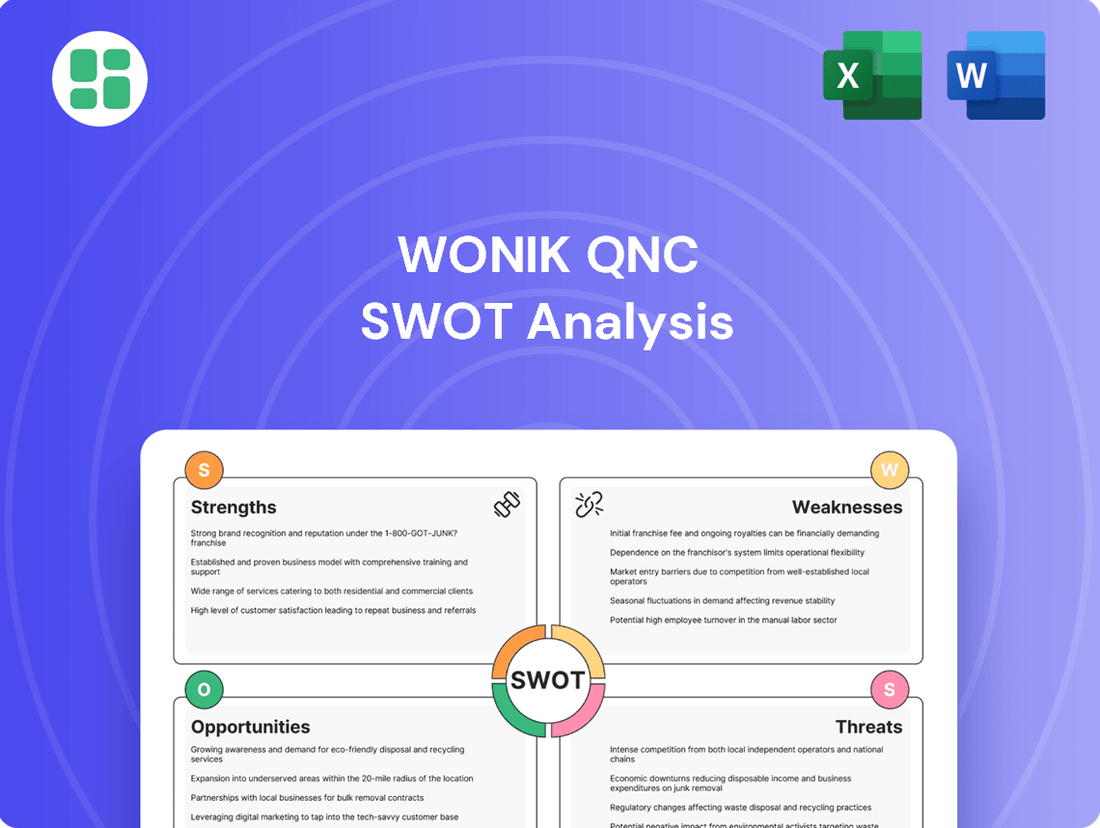

Wonik QnC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wonik QnC Bundle

Wonik QnC's innovative technology and strong market presence are key strengths, but they also face threats from emerging competitors and changing market demands. Understand the full strategic landscape, including detailed breakdowns of their opportunities and weaknesses.

Want the full story behind Wonik QnC's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Wonik QnC's strength lies in its diversified portfolio, encompassing high-purity quartzware, ceramics, and advanced synthetic quartz glass. This broad product offering serves various high-tech sectors, mitigating risks associated with dependence on a single market. For instance, in 2023, the company reported revenue of approximately ₩729.5 billion, with its quartz and ceramic divisions contributing significantly, showcasing the breadth of its market reach.

Beyond just producing materials, Wonik QnC offers crucial cleaning and coating services specifically for semiconductor and display components. These services are absolutely essential for keeping high-tech equipment running at its best and making sure it lasts longer, which is a big deal when you're dealing with such expensive machinery.

This focus on specialized services creates a reliable, recurring revenue stream for Wonik QnC. It also builds stronger, more lasting relationships with customers in the very demanding semiconductor, display, and solar cell industries, where performance and reliability are paramount.

Wonik QnC is strategically positioned in high-growth sectors like semiconductors, displays, and solar cells. These industries are experiencing robust expansion driven by technological advancements in AI, IoT, 5G, and electric vehicles. In 2024, the global semiconductor market alone was projected to reach over $600 billion, highlighting the significant demand for advanced materials.

Global Presence and Established Supply Chains

Wonik QnC's strength lies in its extensive global presence, with local subsidiaries strategically located in key markets like Taiwan, Germany, and the United States. This international network, complemented by robust supply contracts with leading domestic and global equipment providers, allows the company to effectively cater to a diverse clientele. Such a widespread operational base also offers a significant advantage in buffering against potential downturns in any single regional market.

Their established supply chains are a critical asset, ensuring reliable access to essential materials and components. This global reach and strong supplier relationships are vital for maintaining production efficiency and meeting the demands of a worldwide customer base, particularly in the fast-paced semiconductor industry.

In 2023, Wonik QnC reported significant revenue figures, underscoring the effectiveness of its global operations. For instance, their consolidated revenue reached approximately KRW 1.4 trillion (around USD 1.05 billion at the time of reporting), demonstrating the scale and reach of their business activities across these key regions.

- Global Subsidiaries: Operations in Taiwan, Germany, and the United States.

- Supplier Network: Contracts with top domestic and international equipment suppliers.

- Market Resilience: Ability to mitigate regional market fluctuations through diversification.

- Revenue Impact: Over KRW 1.4 trillion in consolidated revenue for 2023, reflecting global demand.

Commitment to Quality and Advanced Technology

Wonik QnC's dedication to top-tier quality and advanced manufacturing technologies is a significant strength. The company actively invests in and utilizes world-class processes to produce high-quality quartzware and cutting-edge materials, positioning itself as a leader in these specialized fields. This commitment is vital for satisfying the demanding specifications of its high-tech customer base, which often operates in sectors like semiconductors and advanced displays.

This focus on technological superiority is reflected in their market approach, aiming to be at the forefront of material innovation. Wonik QnC leverages its accumulated expertise to develop and refine its offerings, ensuring they meet the evolving needs of industries reliant on precision and purity. For instance, in the semiconductor industry, the demand for ultra-pure quartz components is paramount, and Wonik QnC's technological capabilities directly address this critical requirement.

The company's strategic emphasis on advanced materials and quality control underpins its competitive advantage. This allows them to command premium pricing and secure long-term contracts with key players in technology sectors. Their ability to consistently deliver high-performance products is a testament to their investment in R&D and sophisticated production methods, a crucial factor for sustained growth in technologically driven markets.

Wonik QnC's diverse product range, including high-purity quartzware, ceramics, and synthetic quartz glass, serves critical high-tech sectors like semiconductors and displays. This diversification, evident in their 2023 revenue of approximately ₩729.5 billion, reduces reliance on any single market. Their specialized cleaning and coating services for semiconductor and display components provide a stable, recurring revenue stream and foster strong customer relationships in demanding industries.

The company's strategic positioning in high-growth industries such as semiconductors, displays, and solar cells is a key strength. These sectors are propelled by advancements in AI, IoT, 5G, and electric vehicles, with the global semiconductor market alone projected to exceed $600 billion in 2024. Wonik QnC's global presence, with subsidiaries in Taiwan, Germany, and the US, supported by robust supply contracts, allows them to navigate regional market fluctuations effectively and serve a broad customer base. Their consolidated revenue of approximately KRW 1.4 trillion in 2023 underscores the success of this global operational strategy.

Wonik QnC's commitment to superior quality and advanced manufacturing processes is a significant competitive advantage. By investing in world-class production, they meet the stringent requirements of high-tech clients, particularly in the semiconductor industry where ultra-pure quartz components are essential. This technological leadership, coupled with a focus on material innovation, enables premium pricing and secures long-term contracts, ensuring sustained growth in technology-driven markets.

| Strength Aspect | Description | Supporting Data/Examples |

|---|---|---|

| Product Diversification | Offers a broad portfolio of high-purity quartzware, ceramics, and synthetic quartz glass. | Serves semiconductor, display, and solar cell industries; 2023 revenue ~₩729.5 billion. |

| Specialized Services | Provides essential cleaning and coating services for high-tech components. | Creates recurring revenue and strengthens customer loyalty in demanding sectors. |

| Strategic Market Positioning | Operates within high-growth technology sectors driven by AI, IoT, 5G, EVs. | Global semiconductor market projected over $600 billion in 2024. |

| Global Operations & Supply Chain | Subsidiaries in Taiwan, Germany, US; strong supplier network. | 2023 consolidated revenue ~KRW 1.4 trillion; mitigates regional market risks. |

| Technological Leadership & Quality | Invests in advanced manufacturing and R&D for high-quality materials. | Meets stringent demands for ultra-pure quartz in the semiconductor industry. |

What is included in the product

Delivers a strategic overview of Wonik QnC’s internal and external business factors, highlighting its competitive position and market challenges.

Offers a clear, actionable framework to identify and address Wonik QnC's strategic vulnerabilities, turning potential threats into opportunities.

Weaknesses

Wonik QnC's reliance on the semiconductor and display industries exposes it to significant cyclicality. These sectors are known for their boom-and-bust patterns, meaning periods of high demand can be followed by sharp downturns. For example, the semiconductor industry experienced a notable slowdown in early 2023, impacting equipment manufacturers.

Wonik QnC's commitment to cutting-edge materials like synthetic quartz glass and specialized ceramics necessitates significant upfront investment in both research and development and manufacturing infrastructure. This high capital expenditure and R&D intensity can strain financial resources, potentially impacting the company's profitability and flexibility in the short to medium term.

Wonik QnC's reliance on a few major clients presents a significant weakness. For instance, if a primary semiconductor equipment manufacturer, a key customer, were to shift its procurement strategy or experience a downturn, Wonik QnC could see a substantial drop in revenue. This concentration risk means that the company's financial health is closely tied to the success and purchasing decisions of a limited number of large partners.

Exposure to Raw Material Price Fluctuations

Wonik QnC's manufacturing processes for quartzware, ceramics, and chemical products are heavily dependent on specific, high-purity raw materials. Any significant shifts in the pricing or even the consistent availability of these essential inputs directly threaten to inflate production expenses. This, in turn, can put considerable pressure on the company's profit margins, especially if these cost increases cannot be fully passed on to customers.

For instance, the semiconductor industry, a key market for Wonik QnC, relies on extremely pure quartz. In 2024, global demand for high-purity quartz, driven by advanced semiconductor manufacturing, saw price increases due to limited supply and increased geopolitical tensions impacting mining operations. This trend is expected to continue into 2025, potentially affecting Wonik QnC's cost structure.

- Raw Material Dependence: Manufacturing relies on specialized, high-purity inputs.

- Cost Volatility: Fluctuations in raw material prices directly impact production costs.

- Profitability Squeeze: Increased costs can reduce profit margins if not offset by pricing power.

- Supply Chain Risks: Availability issues for critical raw materials pose a significant threat.

Intense Competition in Niche Markets

Wonik QnC operates in highly competitive advanced ceramics and quartz sectors, facing pressure from established global material manufacturers. This intense rivalry, particularly in specialized segments, can impact pricing power and market share. For instance, in the semiconductor materials market, where Wonik QnC is a key player, competition is fierce from companies like Shin-Etsu Chemical and Tosoh Corporation, both of which also offer advanced quartz products.

The company's reliance on niche markets means that even minor shifts in competitor strategies or technological advancements can significantly affect its standing. In 2023, the global semiconductor materials market was valued at approximately $60 billion, with quartzware representing a significant portion, underscoring the high stakes and intense competition within this segment.

- Intense Rivalry: Wonik QnC competes with major global players in advanced ceramics and quartz.

- Pricing Pressure: Competition can lead to challenges in maintaining optimal pricing strategies.

- Market Share Dynamics: Specialized segments are particularly susceptible to shifts in market share due to competitor actions.

- Technological Race: Staying ahead requires continuous innovation to counter competitors' advancements in material science.

Wonik QnC's dependence on a limited customer base, particularly in the semiconductor sector, creates significant revenue concentration risk. A substantial portion of its income is tied to the purchasing decisions of a few major clients. For example, a slowdown or strategic shift by a key semiconductor equipment manufacturer could disproportionately impact Wonik QnC's financial performance, as seen in the industry's cyclical nature. This makes the company vulnerable to the fortunes of its largest partners.

Same Document Delivered

Wonik QnC SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Wonik QnC SWOT analysis, offering a clear snapshot of its strengths, weaknesses, opportunities, and threats. The full, detailed report is unlocked immediately upon purchase.

Opportunities

The global semiconductor market is experiencing robust growth, fueled by the escalating demand for advanced chips essential for AI, high-performance computing, and expanding data centers. This surge directly translates into a greater need for the high-purity quartz and specialized ceramic components that Wonik QnC provides for critical manufacturing stages.

For instance, the AI chip market alone was projected to reach over $200 billion by 2027, indicating a substantial increase in the volume of sophisticated semiconductors required. This upward trajectory in chip production necessitates a corresponding rise in the supply of precision-engineered materials, creating a prime opportunity for Wonik QnC to capitalize on this expanding technological frontier.

The burgeoning demand for advanced display technologies like OLED and micro-LED presents a significant opportunity for Wonik QnC. These next-generation screens require specialized materials and sophisticated cleaning processes, areas where the company can leverage its expertise.

Wonik QnC is well-positioned to develop and supply the high-purity quartz and other critical materials essential for manufacturing these cutting-edge displays. The global market for OLED displays alone was projected to reach over $30 billion in 2024, indicating substantial growth potential.

The global shift towards sustainability is a major tailwind for solar energy. By 2023, solar power installations reached a record 444 GW globally, a significant jump from previous years, directly boosting demand for components like those Wonik QnC supplies.

Wonik QnC's position as a supplier of materials for solar cell manufacturing places it squarely in a rapidly expanding market segment. The International Energy Agency projects solar PV capacity to more than triple by 2030, presenting substantial growth opportunities for companies supporting this sector.

Technological Advancements and Innovation in Materials

Ongoing advancements in material science present significant opportunities for Wonik QnC. The development of new ceramic materials with enhanced functionalities, such as improved thermal resistance and electrical conductivity, can open doors to novel applications. For instance, the semiconductor industry's increasing demand for specialized ceramic components, like wafer handling parts and furnace tubes, is a key growth area. Wonik QnC's ability to leverage these material innovations can solidify its market position.

Improved manufacturing techniques, particularly additive manufacturing or 3D printing, offer another avenue for expansion. This technology allows for the creation of complex geometries and customized ceramic parts that were previously difficult or impossible to produce. Wonik QnC can explore using 3D printing to develop bespoke solutions for clients in sectors like aerospace and medical devices, where precision and unique designs are paramount. This could lead to higher-margin products and a competitive edge.

Strategic investment in research and development (R&D) is crucial for Wonik QnC to capitalize on these technological shifts. By focusing R&D efforts on next-generation ceramic materials and advanced manufacturing processes, the company can foster innovation and potentially achieve market leadership. For example, exploring new ceramic composites for high-temperature applications in renewable energy or advanced electronics could unlock substantial growth. Wonik QnC's commitment to R&D in 2024 and beyond will be a key determinant of its future success.

- Material Science Innovation: Development of advanced ceramics with superior properties for demanding applications.

- 3D Printing Integration: Adoption of additive manufacturing for customized and complex ceramic part production.

- R&D Investment: Strategic allocation of resources to drive new product development and market penetration.

- Market Expansion: Targeting high-growth sectors like semiconductors, aerospace, and renewable energy with innovative ceramic solutions.

Strategic Partnerships and Acquisitions

Wonik QnC has a proven track record of growth through strategic moves, including its acquisitions of Nanowin Co., Ltd. and CoorsTek Nagasaki Corporation. These past successes highlight the company's capability to integrate new entities and expand its operational footprint. By continuing this strategy, Wonik QnC can further enhance its technological expertise and broaden its market access.

Further strategic alliances or acquisitions present a significant avenue for Wonik QnC to bolster its competitive edge. These actions can directly contribute to expanding its technological capabilities, thereby allowing entry into new or underserved markets. Moreover, such moves can diversify its product offerings, creating a more robust and resilient business model.

- Acquisition of Nanowin Co., Ltd.: This move expanded Wonik QnC's presence in the semiconductor materials sector.

- Acquisition of CoorsTek Nagasaki Corporation: This further strengthened its position in advanced ceramics and materials.

- Potential for new market penetration: Strategic partnerships can unlock access to regions or customer segments currently not fully exploited.

- Enhanced technological portfolio: Acquisitions can bring in proprietary technologies or specialized R&D capabilities.

Wonik QnC is poised to benefit from the continuous innovation in material science, particularly in developing advanced ceramics with enhanced properties for high-demand sectors. The company can also leverage advancements in additive manufacturing to create customized ceramic components, opening doors to niche markets like aerospace and medical devices.

Strategic investments in research and development are key to unlocking new growth avenues, such as novel ceramic composites for renewable energy and electronics. These efforts will solidify Wonik QnC's market position and drive future success.

The company's history of successful acquisitions, like Nanowin and CoorsTek Nagasaki, demonstrates its capacity for strategic expansion. Pursuing further partnerships and acquisitions can broaden its technological base and market reach, creating a more resilient business model.

| Opportunity Area | Key Driver | Wonik QnC's Role |

|---|---|---|

| Semiconductor Growth | AI, HPC demand | Supplying high-purity quartz |

| Advanced Displays | OLED, micro-LED | Providing specialized materials |

| Renewable Energy | Solar power expansion | Materials for solar cell manufacturing |

| Material Science Advancements | New ceramic properties | Developing innovative ceramic solutions |

| Additive Manufacturing | 3D printing complex parts | Customized ceramic component production |

| Strategic Expansion | Acquisitions and partnerships | Enhancing tech capabilities and market access |

Threats

Broader economic recessions or significant market volatility can directly impact Wonik QnC by reducing capital expenditures from its key customer industries like semiconductors, displays, and solar. For instance, a global economic slowdown in late 2023 and early 2024 has already led to cautious spending by these sectors, potentially dampening demand for Wonik QnC's specialized materials and equipment. Global economic uncertainty remains a persistent threat, as demonstrated by the International Monetary Fund's revised global growth forecasts for 2024, which indicate a slower pace than previously anticipated.

The advanced materials sector is a hotbed of global competition. Established companies are duking it out, but we're also seeing a surge of new players, especially from China, entering the fray. This influx means more pressure on prices and makes it tougher for companies like Wonik QnC to hold onto their market share.

For instance, in 2024, the global advanced materials market was projected to reach over $140 billion, with significant growth anticipated from emerging economies. This competitive landscape means companies must constantly innovate and optimize their cost structures to remain viable.

Geopolitical tensions, such as ongoing trade disputes and regional conflicts, present a significant threat by potentially disrupting global supply chains. These disruptions can directly impact Wonik QnC by affecting the availability and cost of essential raw materials, crucial for their quartz glass production. For instance, the ongoing semiconductor supply chain issues experienced globally in 2023 highlighted the vulnerability of specialized material sourcing.

Furthermore, these international tensions can impede Wonik QnC's ability to distribute its products effectively to its global customer base. A slowdown in international shipping or increased tariffs, as seen in various trade disputes throughout 2024, could lead to delayed deliveries and reduced sales volumes, impacting the company's revenue streams and market reach.

Rapid Technological Obsolescence

The semiconductor and display industries, which are key markets for Wonik QnC, are known for incredibly fast technological evolution. This means that materials and manufacturing techniques can quickly become outdated. For instance, the push for smaller, more powerful chips and higher-resolution displays constantly demands new material compositions and processing innovations. Failure to adapt means Wonik QnC risks its current offerings becoming irrelevant.

This rapid obsolescence poses a significant threat. If Wonik QnC cannot anticipate and meet the evolving material needs of its clients, such as the demand for advanced precursors for next-generation EUV lithography or new dielectric materials for advanced packaging, its competitive position will erode. This could lead to a decline in market share and profitability as customers shift to suppliers offering more cutting-edge solutions.

Key considerations include:

- Constant R&D Investment: Maintaining competitiveness requires substantial and continuous investment in research and development to stay ahead of technological curves.

- Agile Manufacturing: The company must possess agile manufacturing capabilities to quickly pivot and produce new materials as required by evolving industry standards.

- Market Intelligence: Proactive market intelligence gathering is crucial to identify emerging technological trends and material demands well in advance.

Environmental Regulations and Compliance Costs

As a producer of high-purity materials, Wonik QnC faces the challenge of adapting to increasingly stringent environmental regulations. These evolving standards, particularly concerning chemical manufacturing and waste management, can necessitate significant investments in new technologies and processes. For instance, in 2024, the global chemical industry saw increased scrutiny on emissions, with some regions implementing stricter limits on volatile organic compounds (VOCs) which could directly affect companies like Wonik QnC.

The financial burden of complying with these environmental mandates represents a notable threat. Upgrading facilities to meet new sustainability benchmarks or managing the disposal of byproducts in an eco-friendlier manner can lead to higher operational expenses. This could potentially erode profit margins if these costs cannot be fully passed on to customers or offset by efficiency gains. For example, a report from early 2025 indicated that compliance costs for chemical manufacturers in developed Asian markets rose by an average of 5% year-over-year due to new environmental legislation.

Furthermore, potential penalties for non-compliance or delays in implementing necessary changes could also impact Wonik QnC's financial health and reputation. Staying ahead of regulatory curves is crucial to avoid disruptions and maintain a competitive edge in the market.

The constant threat of rapid technological obsolescence in the semiconductor and display industries means Wonik QnC must continuously innovate. Failure to meet evolving material demands, such as for next-generation EUV lithography, risks making current offerings irrelevant and eroding market share. Staying ahead requires significant R&D investment and agile manufacturing to adapt to new material needs.

SWOT Analysis Data Sources

This Wonik QnC SWOT analysis is built upon a foundation of credible data, including the company's official financial filings, comprehensive market intelligence reports, and the informed perspectives of industry experts.