Wonik QnC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wonik QnC Bundle

Navigate the complex external forces shaping Wonik QnC's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for the company. Equip yourself with actionable intelligence to make informed strategic decisions. Unlock the full potential of this analysis by downloading it now.

Political factors

South Korea is making a substantial commitment to its semiconductor industry, planning to boost its budget from 26 trillion won to 33 trillion won (approximately $23.2 billion) by April 2025. This significant investment is designed to cultivate a private-sector-driven innovation ecosystem.

These government initiatives will likely include favorable loan terms and tax credits specifically for research and development as well as capital expenditures. Companies like Wonik QnC, which are integral to the semiconductor supply chain, stand to gain considerably from this increased support.

The overarching goal of this policy is to enhance domestic semiconductor production capabilities and solidify South Korea's standing in the global market. This strategic focus on the semiconductor sector directly impacts companies involved in its various stages of production and development.

Ongoing trade disputes, notably between the United States and China, continue to disrupt the global semiconductor supply chain. These tensions have resulted in export restrictions on essential raw materials and advanced technologies, impacting companies like Wonik QnC. For instance, U.S. export controls announced in late 2023 and early 2024 have tightened restrictions on semiconductor manufacturing equipment and materials destined for China.

These geopolitical frictions foster an environment of uncertainty for manufacturers and suppliers. Consequently, nations are increasingly prioritizing self-sufficiency and the diversification of their supply chains to mitigate risks. This shift encourages regionalization of production and the development of alternative sourcing strategies, a trend that Wonik QnC must actively monitor and adapt to.

As a key supplier of critical materials for the semiconductor industry, Wonik QnC faces the imperative to navigate these intricate international trade policies. The company must be prepared for potential disruptions and adjust its operational and strategic planning to remain resilient amidst evolving global trade dynamics.

Governments worldwide, including the United States, the European Union, South Korea, and Japan, are actively pursuing industrial policies and offering substantial incentives to encourage the reshoring and nearshoring of semiconductor manufacturing. This strategic shift, seen as a critical move towards bolstering supply chain resilience, aims to lessen dependence on geographically concentrated production hubs, a trend amplified by geopolitical considerations and past disruptions.

For Wonik QnC, a company deeply embedded in the semiconductor materials supply chain, this global industrial policy push presents significant opportunities. The increased emphasis on domestic production could translate into heightened demand for Wonik QnC's advanced materials and solutions. Furthermore, strategic investments and incentives in key regions may provide favorable conditions for the company to establish new facilities or expand existing operations, aligning with national semiconductor manufacturing goals.

The US CHIPS and Science Act, for instance, allocated $52.7 billion for semiconductor manufacturing and research, with significant portions directed towards domestic production incentives. Similarly, the EU's European Chips Act proposes over €43 billion in public and private investment to bolster the continent's chip production capacity by 2030. These initiatives underscore a global commitment to strengthening semiconductor ecosystems, directly benefiting companies like Wonik QnC that supply essential components and materials.

Export Controls and Import Restrictions

Export controls on advanced chip technologies and import restrictions on critical raw materials by major economic powers are creating a fluctuating landscape for the semiconductor sector. For Wonik QnC, which supplies high-purity quartzware and chemical products essential for semiconductor manufacturing, navigating these evolving regulations demands careful attention. The company must ensure strict compliance while exploring alternative sourcing and production methods to manage potential disruptions. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) has been actively updating export control regulations concerning semiconductor manufacturing equipment and materials, impacting global supply chains. Wonik QnC's reliance on specific imported materials for its quartzware production means it's directly exposed to these trade policies.

Stability of International Relations

The stability of international relations is a critical factor for Wonik QnC, given its reliance on global supply chains for semiconductor materials. Geopolitical tensions, such as those impacting trade between major economies in 2024, can directly disrupt the flow of essential raw materials like quartz and silicon. For instance, trade disputes or sanctions involving key semiconductor manufacturing regions could lead to increased costs or outright shortages, impacting Wonik QnC's production capacity and market access. The company's ability to navigate these complexities and maintain resilient supply chains is paramount to its operational continuity and global competitiveness.

South Korea's ambitious plan to increase its semiconductor industry budget to 33 trillion won by April 2025 underscores a strong governmental push for domestic innovation and production. This policy shift, coupled with global efforts like the US CHIPS Act's $52.7 billion allocation and the EU's European Chips Act aiming for over €43 billion investment, creates a favorable environment for companies like Wonik QnC. These initiatives aim to bolster supply chain resilience and reduce reliance on concentrated production hubs, directly impacting material suppliers within the semiconductor ecosystem.

Ongoing geopolitical tensions and trade disputes, particularly between the US and China, continue to influence the semiconductor sector, leading to export controls on critical equipment and materials. These international trade policies necessitate careful navigation for companies like Wonik QnC, requiring strict compliance and proactive strategies for alternative sourcing and production to mitigate potential disruptions. The company's reliance on global supply chains means that international relations and potential sanctions directly affect its operational continuity and market access.

Governments worldwide are actively encouraging reshoring and nearshoring of semiconductor manufacturing through industrial policies and incentives, presenting significant opportunities for Wonik QnC. Increased domestic production in key regions could drive demand for the company's advanced materials. Strategic investments and favorable conditions in these regions may also support Wonik QnC's expansion plans, aligning with national semiconductor manufacturing goals.

The global push for semiconductor self-sufficiency, driven by geopolitical considerations and past supply chain disruptions, is reshaping the industry landscape. Nations are prioritizing diversification and regionalization of production, a trend that Wonik QnC must actively monitor and adapt to, ensuring its operations remain resilient amidst evolving global trade dynamics and policy shifts.

What is included in the product

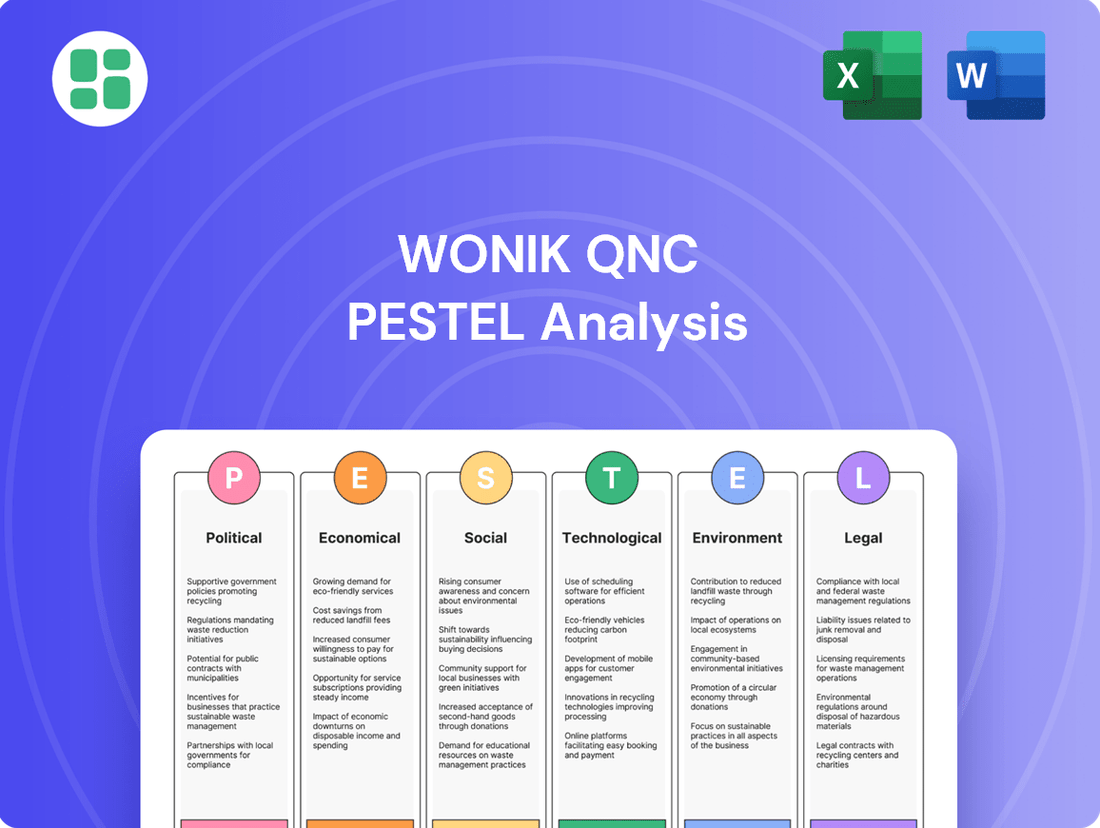

This PESTLE analysis examines the external macro-environmental factors impacting Wonik QnC, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive overview to help stakeholders identify opportunities and navigate potential threats in the global market.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making complex external factors easily digestible for strategic discussions.

Economic factors

The global semiconductor market is on a significant upswing, with sales expected to reach $627 billion in 2024 and climb to $697 billion by 2025. This growth is largely fueled by the escalating demand for chips used in artificial intelligence and advanced computing. The industry is even projected to surpass $1 trillion in sales by 2030.

This robust expansion directly benefits Wonik QnC, as the company supplies essential high-purity quartzware, ceramics, and chemical products crucial for semiconductor manufacturing processes. Increased chip production translates to higher demand for Wonik QnC's specialized materials.

The cost and dependable supply of high-purity quartz, a core component for Wonik QnC, directly influence the company's financial performance. Fluctuations in these raw material prices can significantly impact production expenses.

Geopolitical instability and environmental events pose risks to material availability, potentially causing shortages and driving up costs. For example, severe weather impacting quartz mining operations in regions like Brazil, a key supplier, could disrupt Wonik QnC's supply chain and increase their cost of goods sold.

Global inflationary pressures remain a significant concern, with the US experiencing a Consumer Price Index (CPI) increase of 3.4% year-over-year as of April 2024, impacting raw material and energy costs for Wonik QnC. Higher inflation directly translates to increased operational expenses, potentially squeezing profit margins if these costs cannot be fully passed on to customers.

Central banks worldwide, including the US Federal Reserve, have maintained or increased interest rates to combat inflation. The Fed's target range for the federal funds rate remains elevated, impacting Wonik QnC's cost of capital for new investments and ongoing operations. This makes financing expansion or significant capital expenditures more expensive.

These intertwined economic forces, inflation and interest rates, create a challenging environment for strategic financial planning. Wonik QnC must carefully manage its costs and debt levels, as higher borrowing costs can significantly dampen the attractiveness of new projects and impact overall profitability and investment decisions throughout 2024 and into 2025.

Currency Exchange Rate Fluctuations

Wonik QnC, as a global player, faces risks from fluctuating currency exchange rates. These shifts can directly influence the cost of its imported raw materials, like quartz and silicon carbide, and also affect the value of revenue earned from international sales. For instance, a stronger Korean Won could make imported materials cheaper but reduce the repatriated value of sales made in weaker currencies.

Significant currency movements can impact Wonik QnC's profitability and its ability to maintain competitive pricing in international markets. For example, if the Korean Won strengthens considerably against the US Dollar, sales denominated in USD would translate into fewer Won, potentially squeezing profit margins unless pricing adjustments are made. Conversely, a weaker Won could boost repatriated earnings but increase the cost of imported components.

Considering the company's international operations, currency volatility is a key economic factor. In 2024, the Korean Won experienced periods of weakness against the US Dollar, which could have provided a tailwind for Wonik QnC's export revenues. However, the global economic outlook, including interest rate differentials and geopolitical events, continues to shape exchange rate dynamics, requiring careful financial management.

- Impact on Raw Material Costs: Fluctuations in exchange rates directly alter the Won-denominated cost of imported components essential for Wonik QnC's manufacturing processes.

- Revenue Translation Effects: International sales revenue, when converted back into Korean Won, can be significantly impacted by the prevailing exchange rates.

- Competitive Pricing: Exchange rate shifts can affect Wonik QnC's pricing competitiveness in overseas markets relative to local competitors.

- 2024 Exchange Rate Trends: The Korean Won's performance against major currencies like the US Dollar in 2024 has presented both opportunities and challenges for companies with substantial international trade.

Investment in Advanced Manufacturing Capacity

The semiconductor industry is gearing up for substantial growth, with an estimated $185 billion earmarked for capital expenditures in 2025. This massive investment is expected to boost global manufacturing capacity by a notable 7%, driven by the construction of new fabrication plants worldwide.

This expansionary trend directly benefits companies like Wonik QnC, as it signals a significant uptick in demand for their specialized materials and essential cleaning services. These are critical components for setting up and maintaining new production lines, especially those incorporating advanced packaging technologies.

- Projected Semiconductor CapEx: $185 billion in 2025.

- Capacity Expansion: Anticipated 7% increase in global manufacturing capacity.

- Driver: Significant investment in new semiconductor fabs.

- Wonik QnC Impact: Increased demand for specialized materials and cleaning services for new production lines and advanced packaging.

Global economic growth is projected to be moderate, with the IMF forecasting 3.2% in 2024 and 3.2% in 2025. This steady, albeit not spectacular, growth underpins demand for semiconductors, directly benefiting Wonik QnC's market. However, persistent inflation, with the US CPI at 3.4% year-over-year in April 2024, continues to pressure operational costs and necessitates careful management of interest expenses, as central banks maintain elevated rates.

Fluctuations in currency exchange rates, particularly the Korean Won against major currencies like the US Dollar, present both opportunities and risks for Wonik QnC's international revenue and raw material import costs. The semiconductor industry's significant capital expenditure plans, totaling $185 billion for new fabs in 2025, signal robust demand for Wonik QnC's essential products and services, driving an anticipated 7% increase in global manufacturing capacity.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on Wonik QnC | Key Considerations |

| Global GDP Growth | 3.2% (IMF) | 3.2% (IMF) | Steady demand for semiconductors | Moderate but stable market conditions |

| US Inflation (CPI) | 3.4% YoY (April 2024) | Projected to moderate | Increased operational costs, potential margin pressure | Cost management, pricing strategy |

| Interest Rates (US Fed Funds Rate) | Elevated target range | Likely to remain elevated | Higher cost of capital for investments | Financing strategy, debt management |

| Currency Exchange Rates (KRW/USD) | Volatile, periods of weakness for KRW | Continued volatility expected | Impacts import costs and export revenue translation | Hedging strategies, international pricing |

| Semiconductor CapEx | Significant investment | $185 billion | Increased demand for materials and services | Capacity planning, supply chain readiness |

Preview the Actual Deliverable

Wonik QnC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Wonik QnC covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to this detailed report upon completing your purchase.

Sociological factors

The semiconductor industry, a key area for advanced manufacturing, is experiencing a significant shortage of skilled workers. This includes highly specialized roles, such as experienced glassblowers essential for producing the high-purity quartzware Wonik QnC relies on.

This talent deficit is partly due to an aging workforce in traditional manufacturing and a growing gap between the technical skills employers need and those available in the job market. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a need for over 1.4 million new computer and information technology jobs by 2030, highlighting the broader trend of demand for specialized technical expertise.

Such shortages can directly affect Wonik QnC's ability to maintain and scale its production, potentially leading to slower output and increased operational costs as they compete for limited talent.

An aging workforce in developed manufacturing regions, including key markets for Wonik QnC, presents a significant hurdle for sustained talent acquisition and effective knowledge transfer. For instance, in South Korea, the average age of manufacturing workers has been steadily increasing, impacting the pool of experienced personnel. This demographic shift necessitates proactive strategies to ensure a robust future workforce.

Wonik QnC must focus on attracting and retaining emerging talent by offering competitive compensation packages and robust career development opportunities. Investing in continuous training programs is crucial to equip employees with the evolving skill sets demanded by advanced manufacturing technologies. This proactive approach will help bridge the experience gap and foster innovation within the company.

Societal expectations for corporate social responsibility (CSR) are growing, pushing manufacturers like Wonik QnC to show genuine commitment. This means focusing on things like ethically sourcing raw materials, ensuring fair treatment of workers, and actively benefiting the communities where they operate.

By prioritizing CSR, Wonik QnC can significantly boost its public image. This enhanced reputation not only attracts customers who value ethical business but also appeals to investors and potential employees who are increasingly looking for companies with strong social and environmental credentials. For instance, in 2024, reports indicated that over 70% of consumers consider a company's CSR efforts when making purchasing decisions.

Consumer Demand for Advanced Electronics

The relentless global appetite for sophisticated electronics, from AI-enhanced computers to cutting-edge smartphones, is a powerful engine for the semiconductor and display sectors. This ongoing consumer desire directly fuels the need for essential materials and services provided by companies like Wonik QnC, shaping its future prospects. For instance, the global smartphone market alone was projected to reach over 1.2 billion units shipped in 2024, with a significant portion featuring advanced processors and displays.

This trend translates into a consistent demand for the high-purity materials Wonik QnC specializes in. As consumers seek faster, more capable devices, the underlying component requirements escalate. Consider the rapid adoption of AI features in consumer electronics; this necessitates more powerful chips, which in turn require advanced manufacturing processes and materials.

Key drivers of this demand include:

- Growing adoption of AI and machine learning in consumer devices, increasing the complexity and performance requirements of semiconductors.

- The continuous upgrade cycle for smartphones and personal computers, driven by technological advancements and new feature introductions.

- Expansion of the Internet of Things (IoT) ecosystem, requiring a vast array of connected electronic devices with embedded semiconductors.

- Increased consumer spending on premium and feature-rich electronic products, particularly in emerging markets.

Education and Training Infrastructure

The availability and quality of education and vocational training programs are paramount for cultivating the skilled workforce essential for the semiconductor and advanced materials sectors. For instance, in 2024, South Korea, Wonik QnC's home market, continued to invest heavily in STEM education, with government initiatives aiming to increase graduates in specialized fields relevant to advanced manufacturing. This focus directly impacts the talent pool available for companies like Wonik QnC.

Collaborations between industry and educational institutions are vital for Wonik QnC to ensure a consistent supply of talent possessing the specific technical expertise required. By partnering with universities and technical colleges, Wonik QnC can influence curriculum development and provide internships, bridging the gap between academic learning and practical industry needs. This proactive approach helps secure a pipeline of qualified engineers and technicians.

- Growing Demand for Specialized Skills: The semiconductor industry's rapid advancement necessitates a workforce proficient in areas like materials science, nanotechnology, and advanced process engineering.

- Industry-Academia Partnerships: Wonik QnC benefits from collaborations that provide direct access to research and development, as well as a source of future employees trained in cutting-edge technologies.

- Government Support for Education: Public funding and policy frameworks that bolster STEM education and vocational training directly enhance the educational infrastructure supporting Wonik QnC's talent acquisition efforts.

- Global Talent Competition: Wonik QnC must compete globally for top talent, making a robust domestic education system and attractive training programs crucial for retaining skilled professionals.

Societal expectations are shifting, with a greater emphasis on corporate social responsibility (CSR). Consumers and investors alike are increasingly scrutinizing companies for their ethical practices, environmental impact, and community engagement. For Wonik QnC, demonstrating a strong commitment to CSR is no longer optional; it’s a key differentiator. For instance, in 2024, surveys indicated that over 70% of consumers factor a company's social and environmental performance into their purchasing decisions.

This growing awareness means Wonik QnC must proactively showcase its efforts in areas like ethical sourcing, fair labor practices, and positive community impact. By doing so, the company can enhance its brand reputation, attract ethically-minded customers, and appeal to investors prioritizing sustainable and responsible businesses. This focus on societal values directly influences market perception and long-term viability.

Technological factors

The relentless march towards smaller process nodes, such as sub-3nm, and sophisticated packaging techniques like chiplets and 3D stacking, are driving an unprecedented demand for ultra-pure materials in semiconductor fabrication.

Wonik QnC's specialization in high-purity quartzware and synthetic quartz glass directly addresses these evolving needs, making it a key supplier for the production of advanced semiconductors, including those powering AI technologies.

For instance, the global semiconductor manufacturing equipment market was valued at approximately $135 billion in 2023 and is projected to grow significantly, with advanced materials like those supplied by Wonik QnC being critical enablers of this expansion.

Wonik QnC's commitment to Research and Development is crucial for staying ahead in the fast-paced semiconductor and display sectors. Significant R&D investment allows the company to develop innovative materials and services that meet the evolving needs of these industries. This focus enables them to create solutions for new fabrication processes and enhance existing cleaning and coating technologies.

In 2023, Wonik QnC reported R&D expenses of approximately ₩33.5 billion, representing a notable increase from previous years, underscoring their dedication to technological advancement. This investment is directly channeled into developing next-generation materials for advanced semiconductor nodes and next-generation display technologies, ensuring their competitive edge.

The increasing integration of automation and Industry 4.0 principles is a significant technological driver. Wonik QnC can benefit from these advancements by implementing AI-driven quality control and robotic process automation in its quartz wafer production, potentially boosting output by an estimated 15-20% based on industry benchmarks for similar manufacturing processes. This also opens avenues for developing specialized quartz materials optimized for high-speed, automated semiconductor fabrication lines, a growing segment within the electronics industry.

Material Innovation and Synthetic Quartz

The demand for ultra-pure materials, particularly synthetic quartz, is surging due to its critical role in advanced technologies like AI accelerators and quantum computers. Wonik QnC's expertise in producing these high-purity synthetic quartz glass materials positions them to capitalize on this trend, meeting the stringent performance and purity requirements of cutting-edge manufacturing processes.

This technological shift is underscored by the rapid growth in the semiconductor industry, a primary consumer of synthetic quartz. For instance, the global semiconductor market was valued at approximately $600 billion in 2023 and is projected to reach over $1 trillion by 2030, driven by innovations in AI and high-performance computing, both of which rely heavily on the purity and quality of materials like synthetic quartz.

- Growing AI and Quantum Computing Markets: These sectors are creating unprecedented demand for materials with exceptional purity and thermal stability.

- Wonik QnC's Material Prowess: The company's advanced synthetic quartz is engineered to meet the exacting specifications for next-generation semiconductor fabrication.

- Industry Growth Projections: The semiconductor industry's expansion, fueled by AI, indicates a robust future market for Wonik QnC's specialized products.

Intellectual Property Protection

Protecting intellectual property (IP) surrounding advanced materials, manufacturing techniques, and specialized services is paramount for Wonik QnC's sustained competitive edge. This is particularly true given the dynamic nature of the semiconductor and display industries where they operate. Robust IP strategies are essential to shield proprietary knowledge, which directly translates to market leadership.

The swift evolution of technology demands proactive measures to safeguard innovations. For instance, in the semiconductor sector, patents on novel etching processes or material compositions can prevent competitors from replicating core technologies. Wonik QnC's investment in R&D, which was approximately 3.6% of its revenue in 2023, directly fuels the creation of this valuable IP. The company actively pursues patents to secure its technological advancements.

- Patent Filings: Wonik QnC actively files patents for new material formulations and manufacturing processes, securing its innovations in the competitive landscape.

- Trade Secrets: Key manufacturing know-how and proprietary algorithms are maintained as trade secrets, offering a layer of protection beyond patents.

- Licensing Agreements: Strategic licensing of certain technologies can generate revenue while maintaining control over core IP.

- Global IP Strategy: Wonik QnC implements a global IP strategy to protect its innovations across key international markets where it operates and sells its products.

The semiconductor industry's rapid advancement, particularly towards sub-3nm process nodes and sophisticated packaging like chiplets, fuels demand for ultra-pure materials. Wonik QnC's expertise in high-purity quartzware and synthetic quartz glass positions it as a vital supplier for these cutting-edge fabrication needs, including those for AI technologies.

The company's R&D investment, around ₩33.5 billion in 2023, directly supports the development of materials for next-generation semiconductor nodes and displays. This focus on innovation is critical as the global semiconductor market, a key consumer of synthetic quartz, is projected to grow significantly, exceeding $1 trillion by 2030.

Furthermore, the integration of Industry 4.0 principles, such as AI-driven quality control and automation, offers Wonik QnC opportunities to enhance production efficiency and develop materials tailored for automated fabrication lines. This technological adoption is essential for maintaining competitiveness in the fast-evolving electronics sector.

| Technological Factor | Impact on Wonik QnC | Supporting Data/Trend |

| Miniaturization & Advanced Packaging | Increased demand for ultra-pure materials (quartzware) | Push towards sub-3nm nodes, chiplets, 3D stacking |

| AI & Quantum Computing | Demand for high-purity synthetic quartz | These sectors require materials with exceptional purity and thermal stability |

| Industry 4.0 & Automation | Opportunities for efficiency gains and new product development | AI-driven quality control, robotic automation in manufacturing |

| R&D Investment | Enables development of next-gen materials and processes | Wonik QnC's R&D expenses were approx. ₩33.5 billion in 2023 |

Legal factors

Wonik QnC faces increasing pressure to adhere to a complex web of environmental laws governing everything from how it sources raw materials to how it handles waste and manages energy use. These regulations are becoming more stringent, impacting operational costs and strategic planning.

A significant area of focus will be compliance with emerging regulations on per- and polyfluoroalkyl substances (PFAS), particularly within the semiconductor sector. These rules, anticipated to be implemented between 2025 and 2026, will require substantial investment in alternative materials and process modifications to ensure product safety and market access.

International trade laws, including tariffs and export controls, significantly impact Wonik QnC's global operations. For instance, the US-China trade tensions in recent years led to increased tariffs on various goods, potentially affecting the cost of raw materials or finished products for companies like Wonik QnC. Navigating these complex legal frameworks is crucial for maintaining a smooth supply chain and ensuring market access.

Wonik QnC must remain vigilant about evolving trade regulations and their implications. The imposition of tariffs can directly influence Wonik QnC's cost of goods sold and pricing strategies in international markets. For example, a 25% tariff on imported silicon wafers, a key material in semiconductor manufacturing, could increase production costs by a substantial margin, impacting profitability.

Wonik QnC must strictly adhere to labor laws, including those focused on worker safety. This is particularly crucial given the handling of materials like silicon dust in their quartz manufacturing processes. Failure to comply can lead to significant legal repercussions and operational disruptions.

Ensuring a safe working environment is not just a legal obligation but a business imperative. For instance, in 2024, workplace safety violations in the manufacturing sector often resulted in fines averaging thousands of dollars, impacting profitability and reputation. Adherence to these regulations is key to maintaining operational continuity.

Intellectual Property Laws

Intellectual property laws are a cornerstone for Wonik QnC, safeguarding its unique quartz glass technologies, advanced manufacturing methods, and proprietary material formulas. Strong IP protection is crucial for maintaining a competitive advantage in the rapidly evolving semiconductor and display industries, where innovation is paramount.

Wonik QnC actively manages its portfolio of patents, trademarks, and trade secrets to deter infringement and preserve its market position. For instance, as of early 2024, the company holds numerous patents related to high-purity quartz glass manufacturing, a critical component for semiconductor equipment. This robust IP strategy is essential for securing its technological leadership and preventing unauthorized use of its innovations.

- Patent Protection: Wonik QnC's commitment to R&D is reflected in its growing patent filings, which are vital for protecting its core technologies in quartz glass production.

- Trademark Management: Safeguarding its brand identity and product names through trademark registration is key to market recognition and consumer trust.

- Trade Secret Defense: Protecting confidential manufacturing processes and material compositions as trade secrets provides a crucial layer of competitive advantage.

- IP Enforcement: Proactive monitoring and enforcement of its intellectual property rights are necessary to prevent costly infringements and maintain market exclusivity.

Industry-Specific Certifications and Standards

Wonik QnC must comply with rigorous industry certifications and quality standards, particularly for its high-purity materials. These are not just best practices but legal imperatives, ensuring product integrity for sensitive applications. For instance, the semiconductor industry, a key market for Wonik QnC, operates under strict guidelines like ISO 9001, which dictates quality management systems. Failure to meet these standards can result in significant legal penalties and market exclusion.

Adherence to these benchmarks is crucial for Wonik QnC's market access and reputation. These standards, such as those governing the purity levels of silicon or other precursor materials, directly impact the performance and reliability of semiconductor chips, advanced displays, and solar cells. For example, in 2024, the global semiconductor market continued its demand for ultra-pure materials, with suppliers facing increased scrutiny over contamination control, directly impacting legal compliance for companies like Wonik QnC.

Key legal and operational factors include:

- ISO 9001 Compliance: Ensuring a robust quality management system is a fundamental legal requirement for operating in many global markets.

- Specific Material Purity Standards: Meeting legal specifications for trace element concentrations in materials used for electronics manufacturing is critical.

- Environmental Regulations: Compliance with regulations regarding the production and handling of chemicals used in material synthesis is a legal necessity.

- Export Control Laws: Adhering to international trade laws and regulations governing the export of advanced materials is essential for global sales.

Wonik QnC must navigate an increasingly complex legal landscape, particularly concerning environmental regulations and emerging substance restrictions like PFAS, which will impact operations and material sourcing from 2025 onwards. International trade laws, including tariffs and export controls, directly affect its global supply chain and market access, with potential tariff increases on key materials like silicon wafers posing significant cost challenges.

Compliance with labor laws, especially those related to worker safety in handling materials like silicon dust, is paramount to avoid legal penalties and operational disruptions, with fines for violations in the manufacturing sector averaging thousands of dollars in 2024. Furthermore, robust intellectual property protection through patents, trademarks, and trade secrets is vital for maintaining its competitive edge in the technology-driven semiconductor and display industries, with the company holding numerous patents related to high-purity quartz glass manufacturing.

Environmental factors

Wonik QnC's core business relies heavily on quartz, a natural resource. The company's commitment to sustainability in sourcing this material is crucial. While quartz extraction generally has a less severe environmental impact than mining other minerals, Wonik QnC must prioritize responsible mining practices to ensure long-term availability and minimize ecological disruption.

To further bolster its environmental stewardship, Wonik QnC could explore integrating recycled quartz content into its production processes. This approach not only reduces reliance on virgin materials but also contributes to a circular economy. For instance, in 2023, the global market for recycled construction materials saw significant growth, indicating a growing acceptance and demand for such practices across industries, a trend Wonik QnC can leverage.

Wonik QnC's production of high-purity quartzware and ceramics is inherently energy-hungry. This means the company is under increasing scrutiny to lower its energy usage and carbon footprint. For instance, the semiconductor industry, a key market for Wonik QnC, is actively pushing suppliers towards sustainability goals, with many aiming for significant reductions in Scope 1 and Scope 2 emissions by 2030. This pressure encourages investments in renewable energy and more energy-efficient manufacturing technologies.

Effective waste management, particularly the recycling of manufacturing by-products and end-of-life quartz products, is a critical environmental focus for Wonik QnC. The company's commitment to minimizing landfill waste directly impacts its sustainability footprint.

Investing in robust recycling infrastructure is key for Wonik QnC to foster a circular economy for its quartz materials. This approach not only reduces environmental impact but can also lead to cost savings through material reuse.

Globally, the push for circular economy principles is intensifying; for instance, the European Union aims for a 65% recycling rate for municipal waste by 2035, a benchmark Wonik QnC can aspire to for its own operational waste streams.

Water Usage and Pollution Control

Semiconductor manufacturing, a core area for companies like Wonik QnC, is incredibly water-intensive. For instance, the global semiconductor industry's water consumption is projected to reach billions of gallons annually, with advanced fabrication plants alone requiring millions of gallons per day. Wonik QnC needs to prioritize water conservation through closed-loop systems and recycling technologies.

Effective pollution control is equally critical. The chemicals and materials used in semiconductor production can pose environmental risks if not managed properly. Wonik QnC must adhere to stringent environmental regulations, such as those set by the EPA or equivalent bodies in its operating regions, to treat wastewater and prevent the discharge of hazardous substances. Failure to do so can result in significant fines and reputational damage.

Looking ahead, the increasing focus on sustainability and water scarcity in many regions where semiconductor manufacturing operates will likely drive further innovation in water management. Wonik QnC's proactive approach to minimizing its water footprint and ensuring robust pollution control will be a key factor in its long-term operational viability and environmental stewardship. For example, by 2025, many semiconductor hubs are expected to implement even stricter water discharge standards, requiring advanced treatment solutions.

Key considerations for Wonik QnC include:

- Implementing advanced water recycling and purification systems to reduce overall consumption.

- Investing in state-of-the-art wastewater treatment technologies to meet or exceed regulatory discharge limits.

- Continuously monitoring water usage and effluent quality to identify areas for improvement and ensure compliance.

- Exploring partnerships or collaborations for water resource management in water-stressed regions.

Supply Chain Environmental Resilience

Climate change is a growing concern for the semiconductor industry, impacting supply chains. Extreme weather events, like floods or droughts, can disrupt the mining of essential raw materials, such as quartz, a key component for semiconductor manufacturing. For Wonik QnC, this means potential shortages or increased costs for their quartz products. In 2024, the semiconductor industry continued to grapple with the lingering effects of supply chain vulnerabilities exposed in prior years, with climate-related disruptions becoming a more prominent factor in risk assessments.

Building resilience is crucial for Wonik QnC. This involves diversifying their sources for raw materials, ensuring they aren't overly reliant on a single geographic region that might be more susceptible to climate impacts. Developing robust contingency plans and investing in technologies that can help mitigate the effects of extreme weather are also vital strategies. For instance, securing multiple quartz suppliers in different geological zones can buffer against localized disruptions.

Wonik QnC's proactive approach to supply chain environmental resilience will be a key differentiator. By actively managing climate-related risks, they can ensure a more stable supply of critical materials, thereby maintaining production levels and customer trust. This focus on sustainability and adaptation is not just about risk mitigation but also about long-term operational efficiency and competitive advantage in a changing global landscape.

- Climate-related disruptions can impact quartz mining, a critical input for semiconductor manufacturing.

- Diversifying raw material sources is a key strategy for Wonik QnC to build supply chain resilience.

- Implementing mitigation strategies for climate risks ensures stable production and customer reliability.

- Proactive environmental resilience contributes to Wonik QnC's long-term operational efficiency and competitive edge.

Wonik QnC's environmental strategy centers on responsible quartz sourcing and minimizing its operational footprint. The company is focused on energy efficiency, waste reduction, and water management, particularly given the water-intensive nature of semiconductor manufacturing. Adherence to strict pollution control regulations is paramount, with increasing pressure from the semiconductor industry for suppliers to meet ambitious sustainability targets, such as significant emission reductions by 2030.

The company is also building resilience against climate change impacts, which can disrupt raw material supply chains. Diversifying quartz sources and developing contingency plans are key strategies. For instance, securing multiple quartz suppliers in different geological zones can buffer against localized climate-related disruptions, ensuring stable production and customer reliability.

Wonik QnC's commitment to circular economy principles, including the recycling of manufacturing by-products, is vital. By investing in robust recycling infrastructure, the company can reduce its environmental impact and potentially achieve cost savings through material reuse, aligning with global trends towards greater sustainability.

PESTLE Analysis Data Sources

Our Wonik QnC PESTLE Analysis is meticulously constructed using data from reputable sources such as the International Monetary Fund (IMF), World Bank, and national government statistical agencies. We incorporate insights from leading industry analysis firms and environmental regulatory bodies to ensure a comprehensive view.