Wonik QnC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wonik QnC Bundle

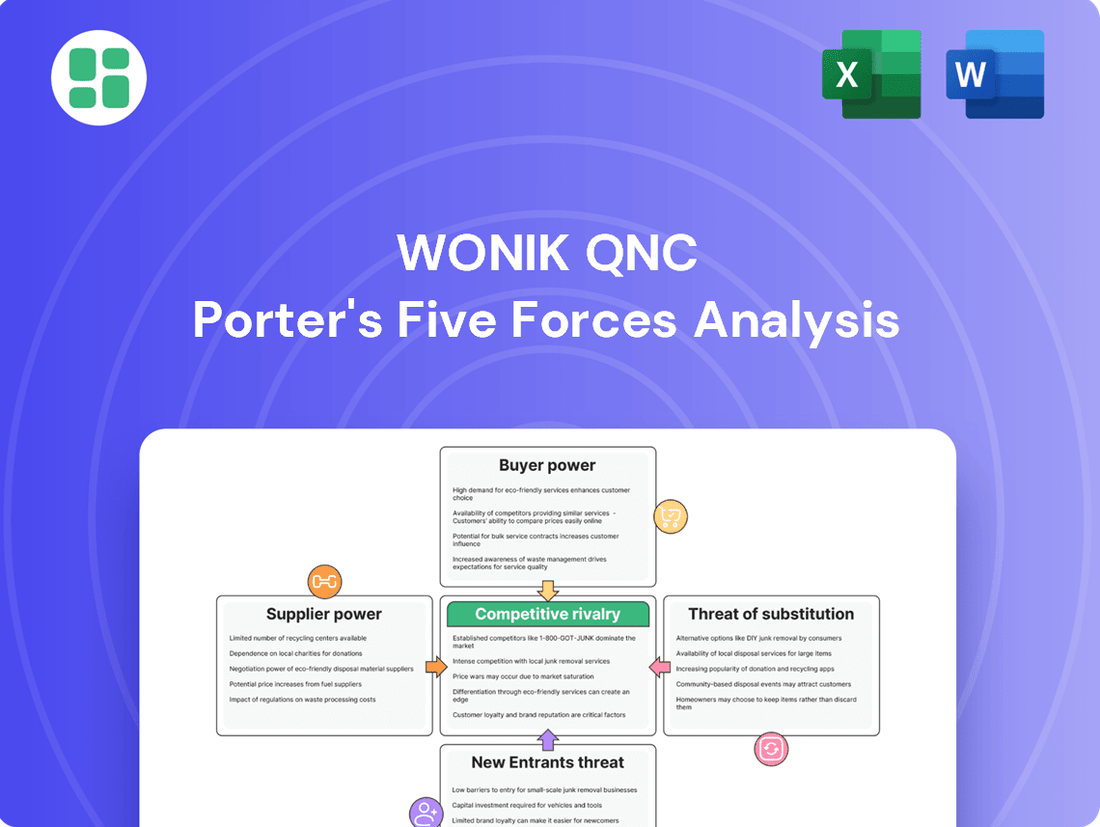

Understanding the competitive landscape for Wonik QnC is crucial for strategic planning. Our Porter's Five Forces analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Wonik QnC’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Wonik QnC's dependence on specialized raw materials such as high-purity quartz and advanced ceramics, essential for semiconductor and display production, highlights a key aspect of supplier bargaining power. These niche materials, with their complex processing needs, are often sourced from a select group of suppliers, giving them considerable leverage.

The limited number of producers for these critical inputs means that Wonik QnC may face concentrated supplier power. For instance, in 2024, the global market for high-purity quartz, a key component for wafer manufacturing, saw price increases driven by strong demand and production constraints, demonstrating the impact of supplier concentration.

Any disruptions to the supply chain for these advanced materials, whether stemming from geopolitical tensions, trade restrictions, or even environmental factors affecting resource extraction, can directly affect Wonik QnC's production schedules and overall costs. This vulnerability underscores the significant bargaining power held by suppliers of these specialized inputs.

The market for critical high-purity materials and advanced ceramics, essential for Wonik QnC's operations, is often dominated by a limited number of suppliers. This concentration grants these suppliers significant leverage in dictating prices and contract terms. For example, the semiconductor sector, a key market for advanced materials, has seen supply chain challenges due to a few key producers of materials like tantalum, impacting global availability and cost.

Wonik QnC faces substantial bargaining power from its suppliers due to high switching costs associated with its critical inputs, such as high-purity quartzware and ceramic components. These costs often include rigorous requalification procedures, potential product redesigns, and the risk of significant production interruptions, thereby solidifying customer reliance on established suppliers.

The highly specialized and often tailored nature of the raw material specifications required by Wonik QnC further entrenches this supplier dependency. This lack of readily available substitutes for their precise needs significantly limits Wonik QnC's negotiating leverage, as suppliers understand the difficulty and expense involved in finding alternative sources that meet their stringent quality and performance standards.

Supplier Forward Integration Potential

The potential for suppliers to integrate forward into manufacturing more complex parts poses a direct threat to Wonik QnC. This means suppliers, particularly those providing core materials, could begin producing finished or semi-finished goods, thereby entering into direct competition with their existing customers.

While the highly specialized nature of quartzware might limit this for some suppliers, the broader market is showing signs of this trend. For instance, major silicon and quartz suppliers are anticipated to expand into the Chemical Vapor Deposition (CVD) silicon carbide (SiC) market. This strategic move by upstream players signals a growing possibility of increased competition originating from suppliers themselves.

- Supplier Forward Integration: Suppliers may move into manufacturing complex parts, directly competing with Wonik QnC.

- Emerging Market Entry: Large silicon and quartz suppliers are expected to enter the CVD SiC market.

- Increased Competition: This forward integration by upstream players heightens competitive pressures for Wonik QnC.

Impact of Geopolitical Tensions on Supply Chains

Geopolitical tensions, such as those between major economic powers, can significantly disrupt global supply chains. For instance, trade restrictions and tariffs can make it harder and more expensive for companies like Wonik QnC to source essential raw materials. This uncertainty can give suppliers in less affected regions more leverage, potentially leading to higher prices or limited access to necessary components.

The impact of these geopolitical factors was evident in 2024, with ongoing trade disputes contributing to volatility in commodity markets. For example, the semiconductor industry, a key area for Wonik QnC's quartz products, experienced significant supply chain adjustments due to export controls and national security concerns. These events can directly translate into increased input costs for manufacturers.

- Increased Supplier Leverage: Geopolitical instability can shift power to suppliers in unaffected regions.

- Supply Chain Disruptions: Trade restrictions and tariffs directly impede the flow of critical raw materials.

- Rising Input Costs: Uncertainty and limited availability lead to higher prices for essential components.

- Localization Trends: Companies may rethink sourcing strategies, favoring more localized and secure supply chains.

Wonik QnC's reliance on a concentrated group of specialized raw material suppliers, such as those for high-purity quartz and advanced ceramics, grants these suppliers significant bargaining power. The limited availability and complex manufacturing processes for these niche inputs mean fewer alternatives for Wonik QnC, leading to potential price escalations and supply chain vulnerabilities.

In 2024, the semiconductor industry, a major consumer of high-purity quartz, experienced price hikes for critical materials due to robust demand and production bottlenecks at key suppliers. This situation directly impacts Wonik QnC's cost structure and operational planning, underscoring the leverage held by these upstream providers.

The high switching costs associated with qualifying new suppliers for specialized materials, coupled with the risk of production delays, further solidify the bargaining power of existing suppliers. This dependency limits Wonik QnC's ability to negotiate favorable terms, making it susceptible to supplier-dictated pricing and contract conditions.

What is included in the product

This analysis dissects the competitive forces impacting Wonik QnC, evaluating the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes within the quartz wafer industry.

Instantly visualize competitive pressures with a dynamic, interactive model that highlights key strategic levers for Wonik QnC.

Customers Bargaining Power

Wonik QnC's customer base is heavily concentrated within the high-tech sectors of semiconductors, displays, and solar cells. Key clients include major global semiconductor manufacturers, who are significant purchasers of Wonik QnC's quartz products.

These large-volume buyers wield considerable bargaining power. They can leverage their substantial orders to negotiate favorable pricing, demand superior product quality, and enforce strict delivery timelines, directly impacting Wonik QnC's profitability and operational efficiency.

The semiconductor industry, specifically, is characterized by a limited number of dominant buyers. This consolidation among customers amplifies their collective influence, making it crucial for Wonik QnC to maintain strong relationships and offer compelling value propositions to retain these vital accounts.

While Wonik QnC's quartz products are often highly specialized, certain raw materials or more basic components can be somewhat standardized. This allows some of their customers to more readily compare pricing across various suppliers, potentially increasing their bargaining power.

In sectors like consumer electronics, where Wonik QnC has significant customer relationships, intense competition frequently puts pressure on these customers to lower their own product costs. This cost pressure directly translates into heightened price sensitivity for the components they source from companies like Wonik QnC, leading to more aggressive price negotiations.

Large players in the semiconductor and display industries have significant financial muscle and technical capabilities. This means they could, in theory, start making some of the parts they currently buy, like specialized quartzware, for themselves. This potential for backward integration gives them considerable leverage when negotiating prices with suppliers like Wonik QnC.

While creating highly specialized, high-purity quartzware demands a unique skillset, the mere possibility of customers developing this capability internally acts as a powerful bargaining tool. This threat is especially potent for components that are less technically demanding or where alternative production methods are more readily available.

Availability of Multiple Suppliers

The availability of multiple suppliers significantly impacts the bargaining power of customers in the semiconductor and display industries. Companies in these sectors actively seek to diversify their supplier base to reduce reliance on any single provider and to strengthen their negotiating position. This diversification allows them to switch suppliers more readily if terms become unfavorable.

For Wonik QnC, if customers have access to several other qualified suppliers for its quartz products, this directly enhances their bargaining power. Customers can then leverage competitive offers from alternative vendors, compelling Wonik QnC to maintain competitive pricing and superior service levels to retain business. This dynamic is particularly pronounced for products that are not highly differentiated.

- Diversification Strategy: Many semiconductor manufacturers aim to source critical components from at least three different suppliers to ensure supply chain resilience.

- Price Sensitivity: In markets with readily available alternatives, customers often prioritize cost-effectiveness, putting pressure on suppliers like Wonik QnC to optimize their pricing structures.

- Supplier Landscape: The presence of numerous global and regional quartz suppliers for semiconductor manufacturing equipment components means customers have a broad range of choices, increasing their leverage.

Fluctuations in Customer Demand

The cyclical nature of the semiconductor and display industries means that demand from Wonik QnC's customers can fluctuate significantly. During downturns or periods of oversupply, customers gain more power as they can delay orders or demand lower prices. For instance, in 2023, the global semiconductor market experienced a contraction, which would have increased customer leverage. Conversely, during periods of high demand, like the current AI-driven surge, Wonik QnC's bargaining power increases as customers compete for limited supply.

Wonik QnC's customers, particularly major players in the semiconductor and display sectors, possess substantial bargaining power due to their significant order volumes and the industry's consolidated buyer landscape. This leverage allows them to negotiate favorable pricing and demand high product quality, directly impacting Wonik QnC's profitability.

The potential for backward integration by large customers, coupled with the availability of multiple suppliers for certain quartz components, further amplifies their negotiating strength. In 2023, the semiconductor market contraction intensified this customer leverage, while current AI-driven demand may shift the balance.

| Customer Segment | Key Bargaining Factors | Impact on Wonik QnC |

|---|---|---|

| Semiconductor Manufacturers | High order volume, potential backward integration, supplier diversification needs | Price pressure, demand for strict quality and delivery |

| Display Manufacturers | Significant purchasing power, price sensitivity due to end-market competition | Negotiation on pricing, potential for switching suppliers |

| Solar Cell Producers | Volume purchasing, cost optimization focus | Price negotiations, demand for cost-effective solutions |

Same Document Delivered

Wonik QnC Porter's Five Forces Analysis

This preview shows the exact, comprehensive Porter's Five Forces Analysis of Wonik QnC you'll receive immediately after purchase, offering a detailed examination of industry competition and profitability. You're looking at the actual, fully formatted document, which will be available for instant download and use the moment you buy, ensuring no surprises or placeholders. This is the complete, ready-to-use analysis file, providing deep insights into Wonik QnC's competitive landscape.

Rivalry Among Competitors

The high-purity quartz and advanced ceramics sectors serving the semiconductor industry are dominated by a few key global players, creating a landscape of intense rivalry. Companies such as Sibelco, The Quartz Corp., and Kyocera are significant forces, directly competing with Wonik QnC for market dominance in these critical material segments.

This concentration means that competition for market share is particularly fierce, especially as demand for advanced semiconductor materials continues to grow. The presence of numerous smaller, specialized firms further intensifies this rivalry, forcing established companies to constantly innovate and optimize their offerings to maintain a competitive edge.

Wonik QnC distinguishes itself by providing high-purity quartzware, ceramics, and advanced synthetic quartz glass, crucial components for cutting-edge technology manufacturing. This focus on specialized, high-performance materials is a core element of their competitive strategy, aiming to meet the exacting demands of industries like semiconductors.

The semiconductor industry, a key market for Wonik QnC, saw significant investment in 2024, with global capital expenditures projected to reach over $200 billion, underscoring the demand for advanced materials. Companies like Wonik QnC compete by offering products with superior performance characteristics, extended durability, and unique properties tailored for advanced semiconductor fabrication processes, driving innovation in materials science.

Manufacturing high-purity quartzware and advanced ceramics requires substantial upfront investment in specialized machinery and production lines. For instance, Wonik QnC's significant capital expenditure in its semiconductor materials segment underscores this reality. These high fixed costs pressure companies to operate at peak capacity to spread the costs and achieve profitability.

The drive for high capacity utilization can intensify competition. If multiple players in the sector, including Wonik QnC's peers, face similar cost structures, they may engage in aggressive pricing strategies to secure market share and keep their factories running efficiently. This dynamic can lead to price erosion, impacting margins for all involved.

Market Growth and Technological Advancements

The semiconductor, display, and solar sectors are booming, thanks to the increasing demand for AI, 5G, and electric vehicles. This surge directly translates into higher demand for Wonik QnC's specialized materials. For instance, the global semiconductor market alone was projected to reach over $600 billion in 2024, showcasing the immense scale of opportunity.

However, this growth isn't without its challenges. The intense competition means that companies are pouring significant resources into research and development. This R&D push is aimed at creating cutting-edge materials and more efficient manufacturing processes to gain a competitive edge.

To stay ahead, continuous technological innovation is not just beneficial, it's absolutely critical for companies like Wonik QnC. The ability to adapt and introduce new, superior materials will be the key differentiator in this rapidly evolving landscape.

- Market Expansion Drivers: AI, 5G, and EVs are fueling significant growth across semiconductor, display, and solar industries.

- Industry Growth Figures: The global semiconductor market was anticipated to exceed $600 billion in 2024.

- Competitive Response: Competitors are heavily investing in R&D for advanced materials and processes.

- Innovation Imperative: Continuous technological advancement is crucial for maintaining competitiveness.

Global and Regional Competitive Dynamics

Competitive rivalry in the quartz glass industry is intensely global, with key players like Shin-Etsu Chemical, Tosoh Corporation, and Momentive Performance Materials having significant operations across various continents. However, regional nuances are critical. For instance, the burgeoning growth of local ceramic suppliers in China is reshaping the competitive landscape there, while geopolitical considerations are increasingly pushing for localization strategies, impacting global supply chains and market access.

Wonik QnC itself operates on a global scale, with manufacturing and sales facilities in key markets such as the United States, Taiwan, and Europe. This broad operational footprint means the company contends with a diverse set of competitors, ranging from established multinational corporations to emerging regional specialists. The dynamic nature of these regional markets, influenced by factors like technological adoption rates and government industrial policies, adds another layer of complexity to the competitive environment.

- Global Presence: Major competitors like Shin-Etsu Chemical and Tosoh Corporation operate worldwide, intensifying global rivalry.

- Regional Shifts: China's domestic ceramic suppliers are gaining traction, altering regional competitive dynamics.

- Localization Trends: Geopolitical factors are driving a move towards localized production and supply chains, impacting global players.

- Wonik QnC's Footprint: Operations in the US, Taiwan, and Europe place Wonik QnC directly against a wide array of global and regional competitors.

The competitive landscape for high-purity quartz and advanced ceramics is intensely global, marked by a few dominant players and numerous specialized firms. This rivalry is amplified by significant market growth, as seen in the semiconductor industry's projected over $200 billion in capital expenditures for 2024. Companies like Wonik QnC must continuously innovate and optimize their offerings to capture market share in this dynamic environment.

SSubstitutes Threaten

Technological advancements in alternative materials pose a significant threat to Wonik QnC. The semiconductor and display sectors are actively exploring new substrates and coatings that could replace traditional quartzware and ceramics, potentially reducing demand for Wonik QnC's offerings.

For instance, ongoing research into advanced ceramic composites and novel glass formulations aims to offer superior performance characteristics, such as higher thermal stability or improved chemical resistance, at competitive price points. This innovation directly challenges the established market position of quartzware in high-purity applications.

This dynamic necessitates continuous investment in research and development for Wonik QnC to maintain its competitive edge. In 2023, the global advanced ceramics market was valued at approximately $25 billion and is projected to grow, indicating the increasing viability of substitute materials.

The threat of substitutes for Wonik QnC's products hinges significantly on the price-performance trade-offs offered by alternatives. If other materials or technologies can deliver similar or better results at a reduced cost, customers might be tempted to switch. For instance, while quartz glass is essential in semiconductor manufacturing, ongoing research into alternative materials for wafer carriers and furnace tubes aims to reduce costs without compromising critical performance metrics.

Wonik QnC's core offerings, particularly high-purity quartz glass for semiconductor fabrication, present a high barrier to direct substitution due to their specialized properties and stringent quality requirements. In 2024, the demand for advanced semiconductor components continued to drive the need for materials that can withstand extreme temperatures and chemical environments, a niche where Wonik QnC excels. Any substitute would need to replicate this high level of purity and reliability, which is difficult and costly to achieve.

Advancements in semiconductor manufacturing, like new dry etching or atomic layer deposition (ALD) methods, could disrupt the demand for Wonik QnC's quartzware and ceramic components. For instance, the transition towards EUV lithography, which requires highly specialized optics and masks, might necessitate different materials or designs for wafer handling and processing equipment. While quartz remains critical for many steps, the industry's drive for higher precision and novel materials means Wonik QnC must continuously innovate to avoid its products becoming less relevant.

Customer Willingness to Adopt New Technologies

Customer willingness to adopt new technologies is a significant factor in the threat of substitutes for Wonik QnC. Semiconductor fabrication plants often face high switching costs, involving extensive requalification processes and potential retooling of production lines when changing materials or components. This inertia means that substitutes must offer compelling advantages to overcome these hurdles.

However, the semiconductor industry is characterized by rapid innovation. If a substitute material or technology provides a substantial leap in performance, such as improved chip density or reduced power consumption, or a significant cost advantage, customers will be strongly incentivized to explore and adopt it. For instance, the ongoing drive for smaller, more powerful, and energy-efficient chips in 2024 continues to push the boundaries of acceptable switching costs for new materials that promise these benefits.

The adoption rate of new technologies is also influenced by the perceived risk versus reward. Businesses in the semiconductor sector are often risk-averse due to the capital-intensive nature of their operations and the precision required. Therefore, a substitute needs to demonstrate not only potential benefits but also reliability and scalability to gain traction.

Key considerations influencing customer adoption include:

- Performance Enhancement: Substitutes offering superior chip performance (e.g., higher clock speeds, lower latency) are more likely to be adopted.

- Cost Reduction: Significant cost savings in material sourcing or manufacturing processes can drive adoption.

- Technological Advancements: Breakthroughs in material science or manufacturing techniques that enable next-generation semiconductor designs are strong adoption drivers.

- Supply Chain Stability: The reliability and stability of the substitute's supply chain are crucial for widespread adoption, especially in a sector sensitive to disruptions.

Emergence of Disruptive Technologies

While Wonik QnC's core business relies on high-purity quartz and advanced ceramics, the long-term threat of substitutes is amplified by the potential emergence of truly disruptive technologies. These aren't just incremental improvements but fundamental shifts in chip architecture or manufacturing processes that could render current material requirements obsolete. For instance, advancements in quantum computing or novel semiconductor materials could bypass the need for traditional silicon processing, impacting the demand for specialized quartzware.

The semiconductor industry is characterized by rapid innovation, and a breakthrough in areas like neuromorphic computing or photonic integrated circuits could drastically alter the landscape. Such paradigm shifts, though infrequent, represent the most significant threat of substitution. Wonik QnC's strategic imperative is to maintain vigilant monitoring of research and development across the global technology sector to proactively identify and adapt to these potentially industry-defining changes, ensuring continued relevance in a dynamic market.

Consider the following potential disruptive forces:

- Development of new semiconductor materials: Research into materials like graphene or 2D semiconductors could lead to entirely new manufacturing methods that reduce reliance on traditional quartz components.

- Advancements in chip architecture: Innovations such as in-memory computing or optical interconnects might fundamentally change how chips are designed and produced, potentially decreasing the need for current high-purity quartz applications.

- Quantum computing breakthroughs: While still nascent, successful quantum computing could revolutionize computation, creating a demand for entirely different types of materials and manufacturing processes, thereby substituting current offerings.

While Wonik QnC's high-purity quartz and ceramics are critical for current semiconductor needs, the threat of substitutes is real, driven by innovation in materials and manufacturing processes. For example, new etching techniques or alternative substrate materials could reduce the reliance on traditional quartzware in specific applications.

The semiconductor industry's relentless pursuit of performance and cost efficiency means that any material offering comparable or superior characteristics at a lower price point poses a viable substitute threat. The global advanced ceramics market, valued at around $25 billion in 2023, highlights the increasing competitiveness of alternative materials.

Customer adoption of substitutes depends on overcoming high switching costs, but significant performance gains or cost reductions, especially in 2024's competitive chip market, can incentivize this change. Disruptive technologies, though less frequent, represent the most substantial substitution risk for Wonik QnC.

Key substitute considerations for Wonik QnC include:

| Substitute Factor | Impact on Wonik QnC | Example |

|---|---|---|

| Performance Enhancement | High | New materials enabling higher chip density. |

| Cost Reduction | Medium | Cheaper wafer carriers reducing manufacturing overhead. |

| Technological Advancements | High | Graphene or 2D semiconductors potentially altering manufacturing needs. |

| Supply Chain Stability | Medium | Reliability of alternative material suppliers. |

Entrants Threaten

Entering the high-purity quartzware and advanced ceramics market, particularly for demanding semiconductor applications, necessitates substantial capital outlays. This includes significant investments in specialized manufacturing facilities, cutting-edge machinery, and ongoing research and development efforts. For instance, the cost of diffusion equipment alone can run into millions of dollars, creating a formidable barrier for new players.

The threat of new entrants into the high-purity quartz and advanced ceramics market is significantly mitigated by the extensive research and development (R&D) and technological expertise required. Developing and producing these specialized materials demands profound scientific knowledge, deep material science understanding, and highly sophisticated manufacturing processes that are not easily replicated.

Companies like Wonik QnC have cultivated decades of experience and proprietary know-how, establishing a substantial barrier for any new player attempting to enter the market. This accumulated expertise, coupled with a strong portfolio of intellectual property and patents, makes it incredibly challenging for newcomers to achieve the necessary quality and cost-effectiveness to compete.

The semiconductor, display, and solar industries demand exceptionally high standards for purity, precision, and durability in their components. Newcomers would find it incredibly difficult to match the consistent quality and performance that major customers expect, making market entry a significant hurdle.

The rigorous and lengthy qualification processes conducted by major fabrication plants (fabs) further deter potential new entrants. For instance, in 2024, the lead time for qualifying a new material supplier for advanced semiconductor nodes can extend well over a year, involving extensive testing and validation.

Established Customer Relationships and Supply Chain Integration

Wonik QnC benefits from deeply entrenched relationships with key semiconductor and display manufacturers, cultivated over years of consistent performance and dedicated technical assistance. These established connections create significant barriers for any new company attempting to enter the market, as clients prioritize the proven reliability and support of existing partners for their critical component needs.

While some customers may explore supplier diversification, the inertia of loyalty to long-standing, trusted relationships remains a powerful deterrent to new entrants. This loyalty often stems from the significant effort and risk involved in qualifying and integrating new suppliers into complex manufacturing processes.

- Established Partnerships: Wonik QnC's long-standing ties with major industry players are a key defensive moat.

- Supply Chain Inertia: The cost and complexity of switching suppliers in the semiconductor and display sectors are substantial.

- Customer Preference for Proven Reliability: Clients in these high-stakes industries often opt for suppliers with a demonstrated track record.

Regulatory Hurdles and Environmental Compliance

The manufacturing of specialized materials, like those produced by Wonik QnC, is often subject to stringent environmental regulations and requires numerous permits. For instance, in 2024, the European Union continued to tighten its chemical regulations, impacting material production. New companies entering this sector must allocate substantial capital towards ensuring compliance, thereby increasing the initial investment and overall market entry complexity.

Geopolitical shifts also play a crucial role, as they can alter regulatory frameworks and create additional barriers for international market participation. For example, trade disputes or changes in import/export laws can significantly impact a new entrant's ability to source materials or distribute finished products globally, as seen in various trade agreements discussions throughout 2024.

- Regulatory Complexity: Navigating environmental laws and permit acquisition demands significant resources and expertise.

- Compliance Costs: New entrants face substantial upfront investments in meeting environmental standards.

- Geopolitical Influence: International relations and trade policies can introduce further entry barriers.

The threat of new entrants into Wonik QnC's market is low due to substantial capital requirements for specialized manufacturing and R&D, as well as the need for deep technological expertise. Established players like Wonik QnC benefit from decades of experience and intellectual property, making it difficult for newcomers to match quality and cost-effectiveness. Furthermore, rigorous customer qualification processes, which can take over a year in 2024 for semiconductor nodes, and entrenched customer relationships with proven reliability create significant barriers.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High investment in specialized facilities and machinery. | Significant financial hurdle. | Diffusion equipment costs can exceed millions of dollars. |

| Technological Expertise | Need for deep material science knowledge and sophisticated processes. | Difficult to replicate existing capabilities. | Proprietary know-how and patents held by established firms. |

| Customer Qualification | Lengthy and rigorous testing by major clients. | Extends market entry timeline. | Qualification for advanced semiconductor nodes can take over 12 months. |

| Customer Relationships | Loyalty to proven suppliers and inertia in switching. | New entrants struggle to gain initial traction. | Clients prioritize reliability and established support networks. |

Porter's Five Forces Analysis Data Sources

Our Wonik QnC Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from industry-specific market research reports, financial statements of key players, and publicly available company filings. This blend of sources allows for a comprehensive understanding of competitive intensity and strategic positioning within the semiconductor materials sector.