Wonik QnC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wonik QnC Bundle

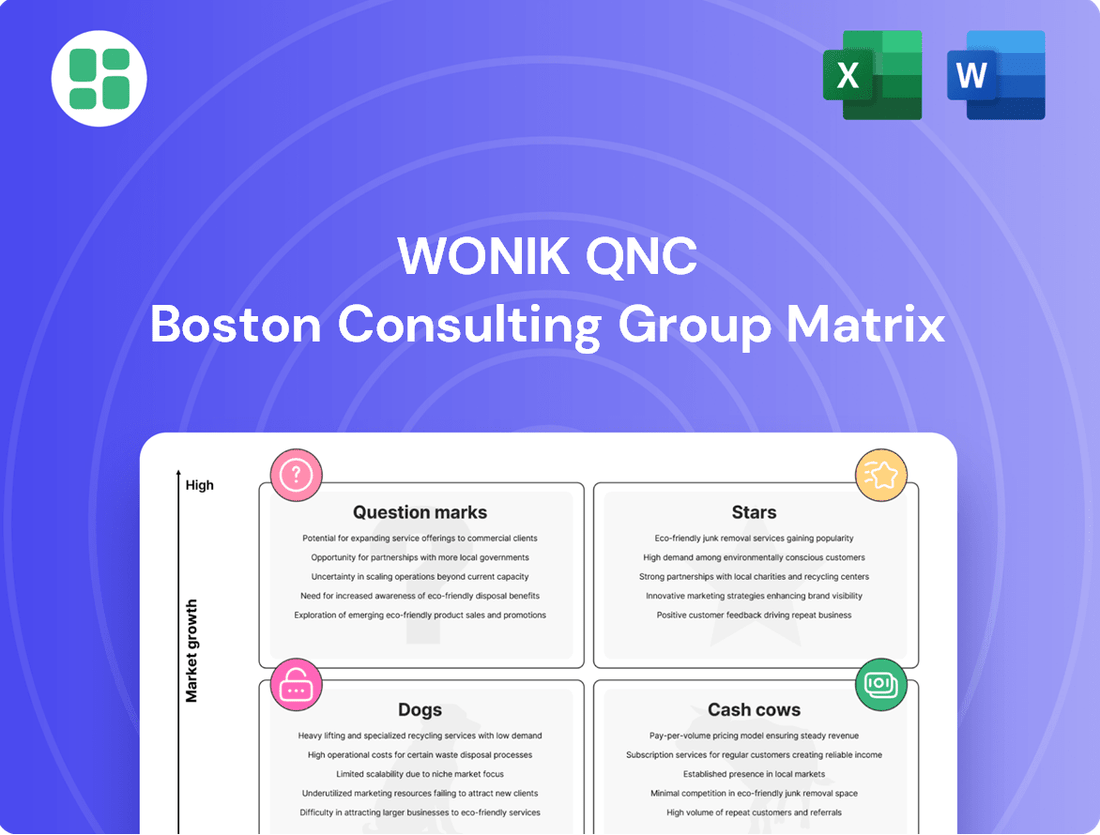

Curious about Wonik QnC's product portfolio performance? This glimpse into their BCG Matrix reveals the strategic positioning of their offerings, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly understand their market dynamics and unlock actionable insights for growth, dive into the complete BCG Matrix. Purchase the full report for a comprehensive breakdown and a clear roadmap to optimizing your investments and product strategies.

Stars

Wonik QnC's advanced synthetic quartz glass for next-generation semiconductors is a clear star. The semiconductor market is booming, with an impressive 16% growth expected in 2024 and a further 12.5% in 2025, driven by advanced nodes and AI.

This positions Wonik QnC's high-tech materials perfectly within this expanding high-growth segment. Their world-class technology in quartzware makes them a vital supplier to global semiconductor manufacturers, solidifying their strong market position.

High-purity quartzware for EUV lithography components is a prime example of a Star in Wonik QnC's portfolio. The demand for these specialized components is surging due to the increasing adoption of EUV lithography in cutting-edge semiconductor manufacturing. This trend is a significant growth driver for this product segment.

The overall high-purity quartz market is projected to grow at a compound annual growth rate of 6.71% between 2025 and 2034, indicating robust expansion. Wonik QnC's strategic emphasis on developing advanced technologies for the semiconductor sector positions it well to capitalize on this growth. Their commitment to innovation in this high-demand niche solidifies its Star status.

As the display industry pushes towards cutting-edge technologies such as OLED and the emerging MicroLED, the demand for specialized ceramics with superior performance and novel functionalities is surging. Wonik QnC's expertise in manufacturing AI203-structured ceramics, crucial for semiconductor and LCD processing, positions them advantageously. Their ongoing investment in advanced material development further solidifies their role in this expanding market. For instance, the global display market was valued at approximately USD 137.5 billion in 2023 and is projected to grow significantly, fueled by these technological advancements.

Precision Cleaning and Coating Services for Emerging Semiconductor Nodes

The demand for ultra-precision cleaning and coating services is paramount for the advancement of semiconductor manufacturing, particularly for components used in diffusion and LPCVD processes. These specialized services are essential for ensuring the integrity and performance of chips at emerging nodes.

The market for cleaning semiconductor equipment parts is experiencing robust growth, with projections indicating a CAGR of 6.11% from 2025 to 2030. Wonik QnC stands out as a key global player in this expanding sector, underscoring its significant market position and expertise in providing these critical services.

- Critical Demand: Ultra-precision cleaning and coating are vital for next-generation semiconductor components in diffusion and LPCVD processes.

- Market Growth: The global market for semiconductor equipment part cleaning is expected to grow at a 6.11% CAGR between 2025 and 2030.

- Wonik QnC's Position: The company is a significant global competitor in this expanding and essential market segment.

Optics for Advanced Semiconductor and Display Light Sources

Wonik QnC's development of advanced optics for semiconductor and display light sources, particularly EXCIMER VUV lamps, places them squarely in a high-growth market. These components are vital for cutting-edge processing, indicating a strong position in a rapidly expanding technological sector.

The demand for specialized optics in applications like environmental technology and surface modification underscores Wonik QnC's role as a leader in a high-tech niche. For instance, the global semiconductor market size was valued at approximately USD 580 billion in 2023 and is projected to grow significantly, driven by advancements in areas requiring precise light sources.

- High-Growth Market: The semiconductor and display industries are experiencing robust expansion, fueled by demand for advanced electronics and immersive displays.

- Key Technologies: Wonik QnC's focus on EXCIMER VUV lamps and related optics addresses critical needs in photolithography and other precision manufacturing processes.

- Expanding Applications: Beyond traditional semiconductor manufacturing, these optics are finding utility in emerging fields such as advanced materials processing and environmental remediation.

- Market Position: The company's innovative components suggest a leading role in a specialized, high-value segment of the advanced materials and manufacturing landscape.

Wonik QnC's advanced synthetic quartz glass for next-generation semiconductors is a clear star. The semiconductor market is projected for robust growth, with an estimated 16% expansion in 2024 and a further 12.5% in 2025, driven by advanced chip architectures and AI integration. This positions Wonik QnC's high-tech materials perfectly within this expanding, high-growth segment, supported by their world-class technology in quartzware, making them a vital supplier to global semiconductor manufacturers.

High-purity quartzware for EUV lithography components represents another Star product. The demand for these specialized components is surging due to the increasing adoption of EUV lithography in cutting-edge semiconductor manufacturing, a trend that significantly fuels this product segment's growth. The overall high-purity quartz market is anticipated to grow at a compound annual growth rate of 6.71% between 2025 and 2034, highlighting substantial expansion. Wonik QnC's strategic focus on advanced semiconductor technologies positions it to effectively leverage this growth, with their innovation in this high-demand niche solidifying its Star status.

Wonik QnC's expertise in manufacturing AI203-structured ceramics, crucial for semiconductor and LCD processing, places them advantageously as the display industry advances towards technologies like OLED and MicroLED. The global display market was valued at approximately USD 137.5 billion in 2023 and is projected for significant growth, driven by these technological leaps. Their ongoing investment in advanced material development further cements their role in this expanding market.

The company's ultra-precision cleaning and coating services for semiconductor equipment parts are also Stars. The market for these services is experiencing strong growth, with projections indicating a CAGR of 6.11% from 2025 to 2030. Wonik QnC is a key global player in this essential and expanding sector, underscoring their significant market position and expertise.

Furthermore, Wonik QnC's development of advanced optics for semiconductor and display light sources, particularly EXCIMER VUV lamps, positions them in a high-growth market. These components are critical for cutting-edge processing. The global semiconductor market was valued at approximately USD 580 billion in 2023 and is expected to grow substantially, fueled by advancements requiring precise light sources.

| Product/Service Segment | Market Trend/Growth Driver | Wonik QnC's Position | Key Data/Projection |

|---|---|---|---|

| Advanced Synthetic Quartz Glass (Semiconductors) | AI integration, advanced nodes, semiconductor market expansion | Vital supplier with world-class technology | Semiconductor market: +16% in 2024, +12.5% in 2025 |

| High-Purity Quartzware (EUV Lithography) | Increased adoption of EUV lithography | Leader in specialized, high-demand niche | High-purity quartz market: 6.71% CAGR (2025-2034) |

| AI203-Structured Ceramics (Displays) | Demand for OLED and MicroLED technologies | Advantageous position in advanced material development | Global display market ~USD 137.5 billion (2023) |

| Ultra-Precision Cleaning & Coating Services | Need for integrity in advanced chip manufacturing | Significant global competitor | Semiconductor equipment cleaning market: 6.11% CAGR (2025-2030) |

| Advanced Optics (EXCIMER VUV Lamps) | Precision manufacturing in semiconductors and displays | Leader in high-tech niche | Global semiconductor market ~USD 580 billion (2023) |

What is included in the product

Wonik QnC's BCG Matrix offers a strategic overview of its business units, guiding investment decisions.

Wonik QnC's BCG Matrix offers a clear, visual snapshot of your portfolio's health, easing the pain of strategic uncertainty.

Cash Cows

Wonik QnC's standard high-purity quartzware for established semiconductor processes, including those used in mature IC production and wafer fabrication, firmly places them in the Cash Cow quadrant of the BCG Matrix. These products are essential components with a significant market share, built upon years of world-class technological development. The company's ability to consistently supply major players like Samsung and SK Hynix underscores their established position and the reliability of their offerings.

The demand for these foundational quartzware products remains robust and stable, even as the broader semiconductor market experiences shifts. This stability translates into a predictable and consistent cash flow for Wonik QnC. Crucially, the need for significant new investment in promotion or market development for these mature product lines is minimal, allowing the company to capitalize on their established market presence and technological leadership to generate substantial returns.

Wonik QnC's ceramic products for TFT-LCD production are best categorized as cash cows within the BCG matrix. Despite the rise of newer display technologies, TFT-LCDs still command a significant, albeit slower-growing, market share, ensuring continued demand for these essential components.

The company benefits from a robust reputation and existing supply agreements, which provide a stable revenue stream from ongoing TFT-LCD manufacturing. In 2023, the global TFT-LCD market was valued at approximately $130 billion, demonstrating the enduring relevance of this sector for Wonik QnC's ceramic offerings.

Wonik QnC's core cleaning services for legacy semiconductor equipment, particularly for super-precision quartz wares used in diffusion and LPCVD processes, function as a robust Cash Cow. This foundational business consistently generates substantial profits by catering to the ongoing needs of existing fabrication facilities.

The demand for these cleaning services remains stable, as maintaining older semiconductor manufacturing lines is crucial for operational efficiency. Wonik QnC benefits from high profit margins, a result of their deep-seated expertise and established, long-term relationships with semiconductor manufacturers.

Quartzware for Solar Cell Production

Wonik QnC's quartzware for solar cell production serves as a significant cash cow within its portfolio. This segment benefits from the ongoing expansion of the renewable energy market, particularly in solar power generation.

The demand for standard quartz components in established solar manufacturing processes ensures a consistent and reliable revenue stream for Wonik QnC. As a global supplier, the company leverages its position in this mature yet essential part of the solar value chain.

- Market Position: Wonik QnC is a key global supplier of quartzware for solar cell manufacturing.

- Revenue Stability: The demand for standard components in mature solar processes provides a steady income.

- Industry Growth: The broader renewable energy sector, especially solar, fuels continued demand.

- Financial Contribution: This segment likely contributes significantly to Wonik QnC's overall profitability due to its stable nature.

General Purpose Chemical Products for Industrial Use

Wonik QnC's general purpose chemical products for industrial use likely function as a Cash Cow. These chemicals serve a wide array of industries, offering steady demand and predictable revenue streams. Their utility across diverse sectors means they are less susceptible to the rapid shifts seen in high-tech markets, ensuring a consistent income for the company.

These products typically require moderate investment, focusing on maintaining efficiency and customer relationships rather than aggressive expansion. For instance, the industrial chemicals market, while not experiencing explosive growth, demonstrates resilience. In 2024, the global industrial chemicals market was valued at approximately $550 billion, with a projected compound annual growth rate (CAGR) of around 3-4% through 2030, indicating a stable, albeit mature, environment.

- Stable Revenue: Consistent demand from a broad industrial customer base.

- Lower Investment Needs: Focus on maintenance and efficiency rather than high-growth R&D.

- Market Maturity: Operates in established, predictable markets with lower volatility.

- Profitability Driver: Generates consistent profits that can fund other business areas.

Wonik QnC's high-purity quartzware for established semiconductor processes, particularly for mature IC production and wafer fabrication, are solid cash cows. These products hold a substantial market share, built on years of technological expertise, and are essential for major manufacturers like Samsung and SK Hynix. The consistent demand from these established sectors ensures a predictable and stable revenue stream for the company.

The demand for these foundational quartzware products remains robust and stable, even as the broader semiconductor market experiences shifts. This stability translates into a predictable and consistent cash flow for Wonik QnC. Crucially, the need for significant new investment in promotion or market development for these mature product lines is minimal, allowing the company to capitalize on their established market presence and technological leadership to generate substantial returns.

Wonik QnC's ceramic products for TFT-LCD production are best categorized as cash cows within the BCG matrix. Despite the rise of newer display technologies, TFT-LCDs still command a significant, albeit slower-growing, market share, ensuring continued demand for these essential components. The company benefits from a robust reputation and existing supply agreements, which provide a stable revenue stream from ongoing TFT-LCD manufacturing. In 2023, the global TFT-LCD market was valued at approximately $130 billion, demonstrating the enduring relevance of this sector for Wonik QnC's ceramic offerings.

Wonik QnC's core cleaning services for legacy semiconductor equipment, particularly for super-precision quartz wares used in diffusion and LPCVD processes, function as a robust Cash Cow. This foundational business consistently generates substantial profits by catering to the ongoing needs of existing fabrication facilities. The demand for these cleaning services remains stable, as maintaining older semiconductor manufacturing lines is crucial for operational efficiency. Wonik QnC benefits from high profit margins, a result of their deep-seated expertise and established, long-term relationships with semiconductor manufacturers.

Wonik QnC's quartzware for solar cell production serves as a significant cash cow within its portfolio. This segment benefits from the ongoing expansion of the renewable energy market, particularly in solar power generation. The demand for standard quartz components in established solar manufacturing processes ensures a consistent and reliable revenue stream for Wonik QnC. As a global supplier, the company leverages its position in this mature yet essential part of the solar value chain.

Wonik QnC's general purpose chemical products for industrial use likely function as a Cash Cow. These chemicals serve a wide array of industries, offering steady demand and predictable revenue streams. Their utility across diverse sectors means they are less susceptible to the rapid shifts seen in high-tech markets, ensuring a consistent income for the company. These products typically require moderate investment, focusing on maintaining efficiency and customer relationships rather than aggressive expansion. For instance, the industrial chemicals market, while not experiencing explosive growth, demonstrates resilience. In 2024, the global industrial chemicals market was valued at approximately $550 billion, with a projected compound annual growth rate (CAGR) of around 3-4% through 2030, indicating a stable, albeit mature, environment.

| Product Category | BCG Quadrant | Key Characteristics | Market Context (2024 Data) | Wonik QnC's Position |

| High-Purity Quartzware (Mature IC/Wafer Fab) | Cash Cow | Established technology, high market share, stable demand, low investment needs. | Essential for ongoing semiconductor manufacturing. | Key global supplier, strong relationships with major players. |

| Ceramics for TFT-LCD | Cash Cow | Mature market, consistent demand, stable revenue. | Global TFT-LCD market valued at ~$130 billion (2023). | Strong reputation, existing supply agreements. |

| Cleaning Services (Legacy Semiconductor) | Cash Cow | High profit margins, deep expertise, long-term customer relationships. | Critical for maintaining operational efficiency of older fabs. | Leading provider for super-precision quartz wares. |

| Quartzware for Solar Cell Production | Cash Cow | Steady revenue from established solar manufacturing processes. | Growing renewable energy sector fuels demand. | Global supplier in a mature but essential value chain segment. |

| General Purpose Chemicals | Cash Cow | Broad industrial application, predictable revenue, moderate investment. | Global industrial chemicals market ~$550 billion (2024), 3-4% CAGR. | Serves diverse industries, less susceptible to tech shifts. |

Delivered as Shown

Wonik QnC BCG Matrix

The Wonik QnC BCG Matrix preview you're seeing is the complete, unwatermarked document you'll receive immediately after purchase. This means you're examining the exact strategic analysis, ready for immediate implementation or presentation, without any alterations or placeholders. The comprehensive insights and professional formatting are precisely what you'll gain access to, ensuring a seamless transition from preview to actionable business intelligence.

Dogs

Obsolete quartzware for discontinued legacy semiconductor nodes represent a niche segment within Wonik QnC's portfolio. These specialized components cater to older manufacturing processes that are no longer widely adopted, leading to a naturally shrinking market.

While there might be lingering demand for maintaining existing, albeit outdated, semiconductor equipment, this segment is characterized by low growth and a diminishing market share. Consequently, these products are strong candidates for divestiture as part of a strategic portfolio review.

Wonik QnC likely has certain basic ceramic products that are highly commoditized. In these areas, the company faces fierce price competition, meaning its ability to differentiate its offerings is limited. This often leads to lower profit margins and slower growth.

These commoditized products would typically reside in segments of the market that aren't expanding rapidly. Consequently, Wonik QnC might struggle to gain significant market share in these categories. Such products can tie up valuable capital and resources without generating substantial returns, a common characteristic of Dogs in the BCG matrix.

Cleaning and coating services for outdated display technologies, such as CRT or early LCD panels, represent a segment with very low growth potential. As newer, more efficient technologies like OLED and advanced LED dominate the market, demand for servicing older displays naturally shrinks. This means Wonik QnC would likely see diminishing revenue and profitability from such offerings.

Low-Purity Quartz Products

Wonik QnC's lower-purity quartz products, if they exist and are not essential for advanced technology, would likely be classified as Dogs in the BCG matrix. These items would operate in saturated, low-growth markets where intense competition from many smaller manufacturers erodes profitability and limits market share potential.

Such products would typically offer minimal differentiation and struggle to generate significant returns. For instance, if Wonik QnC were to produce basic quartz components used in non-critical industrial applications, these would face price pressures and a lack of demand growth. The company's strategic emphasis on high-purity quartz for semiconductors and advanced displays further suggests that any lower-purity offerings would be outside its core, high-value focus.

- Low Market Share: Products in this category would likely have a small slice of a market that isn't growing much.

- Low Growth Rate: The demand for these lower-purity quartz items would probably be stagnant or declining.

- Intense Competition: Numerous smaller, specialized firms would likely compete aggressively on price for these less sophisticated quartz materials.

- Low Profitability: Due to price wars and limited demand, these products would contribute little to overall profits and could even become a drain on resources.

Peripheral Chemical Products with Niche, Stagnant Markets

Peripheral chemical products serving highly specialized, stagnant industrial niches represent a category within Wonik QnC's potential BCG Matrix where the company may have limited market share and minimal growth. These products, by their nature, cater to industries with little to no expansion, meaning demand remains flat. For example, if Wonik QnC produces a specific chemical used only in a declining manufacturing process, it would fit this description.

These segments are characterized by low growth prospects and a low market share for Wonik QnC, thus offering little contribution to the company's overall financial performance. They are essentially cash traps, requiring resources to maintain but not generating significant returns. In 2024, companies in such mature, niche markets often see revenue growth rates below 2%, with profitability squeezed by limited pricing power.

- Low Market Share: Wonik QnC likely holds a small percentage of sales within these specific niche markets.

- Stagnant Market Growth: The industries these products serve are not expanding, leading to flat or declining demand.

- Minimal Profit Contribution: The financial impact of these products is negligible, offering little to no significant profit.

- Resource Drain Potential: Continued investment in maintaining these product lines could divert resources from more promising areas.

Products classified as Dogs within Wonik QnC's BCG Matrix represent areas with low market share and low growth potential. These are typically older technologies or commoditized offerings where competition is fierce and profit margins are thin. In 2024, such segments often struggle to justify ongoing investment, as resources are better allocated to high-growth opportunities.

For instance, basic, lower-purity quartz products or services for obsolete display technologies would fall into this category. These items operate in saturated markets, facing significant price pressures and minimal demand expansion, making them candidates for divestment or careful resource management.

| BCG Category | Wonik QnC Product Example | Market Characteristics | Strategic Implication |

|---|---|---|---|

| Dogs | Obsolete semiconductor quartzware | Low growth, declining demand, niche market | Divestiture or minimal investment |

| Dogs | Commoditized basic ceramic products | Low growth, high competition, low margins | Cost optimization, potential divestiture |

| Dogs | Cleaning/coating for old display tech | Shrinking market, obsolete technology | Phased withdrawal, focus on newer tech |

| Dogs | Lower-purity quartz (non-critical) | Saturated market, price sensitive | Evaluate profitability, consider alternatives |

Question Marks

Wonik QnC's exploration into novel materials for quantum computing and advanced AI hardware positions it for high-growth potential, though these markets are currently nascent. Significant research and development are essential for the company to carve out a substantial market share in these emerging sectors. For instance, the quantum computing market is projected to reach $1.1 billion in 2024, with expectations to grow to $8.9 billion by 2030, indicating a compound annual growth rate of over 40%.

Developing next-generation coating technologies for emerging semiconductor architectures like Gate-All-Around (GAA) transistors positions Wonik QnC within the Question Mark quadrant of the BCG Matrix. This signifies a high-growth market opportunity, as GAA is expected to be a dominant architecture for advanced nodes in the coming years, with the global semiconductor market projected to reach over $1 trillion by 2030.

However, achieving significant adoption and market share in this nascent but rapidly expanding segment necessitates substantial investment in research and development to create specialized materials and deposition processes. Wonik QnC faces intense competition from established players and new entrants alike, all vying to capture leadership in this critical technological shift.

Wonik QnC’s exploration into ultra-high purity quartz for specialized medical or aerospace applications represents a classic Question Mark in the BCG matrix. These sectors, while offering significant growth potential, currently hold a low market share for the company, demanding substantial investment in research, development, and stringent certification processes. For instance, the medical device market, projected to reach over $600 billion by 2025, and the aerospace sector, with a global market size expected to exceed $900 billion in the same year, present attractive, albeit challenging, avenues for expansion beyond their core semiconductor business.

Innovative Ceramic Solutions for Electric Vehicle (EV) Components

Innovative ceramic solutions for electric vehicle (EV) components, such as advanced battery materials and power electronics cooling, represent a potential Question Mark for Wonik QnC. This sector is experiencing robust growth, with the global EV market projected to reach over $800 billion by 2025, indicating significant opportunity.

Wonik QnC would need substantial investment to gain traction in this rapidly evolving market. Securing design wins with major EV manufacturers and establishing a strong market position requires significant R&D and manufacturing capacity expansion.

- High Growth Potential: The EV market's rapid expansion creates demand for advanced materials.

- Significant Investment Required: Developing and commercializing new ceramic solutions demands considerable capital.

- Market Entry Challenges: Gaining design wins and market share in the competitive EV supply chain is complex.

- Technological Innovation: Continuous innovation in ceramic properties is crucial for performance gains in EVs.

New Recycled or Sustainable Semiconductor Material Solutions

Wonik QnC's exploration into recycled or sustainable high-purity semiconductor materials positions these initiatives as Question Marks within its BCG Matrix. This segment represents a nascent market with considerable projected growth, driven by a global push for Environmental, Social, and Governance (ESG) compliance and circular economy principles within the electronics sector.

The semiconductor industry, facing increasing scrutiny over its environmental footprint, is actively seeking greener alternatives. For instance, by 2025, the global semiconductor market is projected to reach over $600 billion, highlighting the sheer scale of material consumption and the potential impact of sustainable practices. Wonik QnC's investment in this area, while currently holding a small market share, is a strategic move to capture future demand. This requires significant capital outlay for research, development, and establishing new production capabilities to meet the stringent purity requirements of semiconductor manufacturing.

- Emerging Market: The demand for sustainable semiconductor materials is on the rise, fueled by regulatory pressures and corporate sustainability goals.

- High Growth Potential: Analysts predict substantial growth in the green tech sector, which includes sustainable materials for electronics.

- Low Current Market Share: Wonik QnC's position in this specific niche is likely minimal at present, reflecting the early stage of development.

- High Investment Needs: Significant R&D and capital expenditure are necessary to develop and scale these new material solutions to meet industry standards.

Wonik QnC's ventures into quantum computing materials and advanced AI hardware represent classic Question Marks. These are high-growth sectors, with quantum computing expected to reach $1.1 billion in 2024, but Wonik QnC's current market share is minimal, demanding substantial R&D investment to compete effectively.

Developing specialized coatings for next-generation semiconductor architectures like GAA transistors also places Wonik QnC in the Question Mark category. While the global semiconductor market is projected to exceed $1 trillion by 2030, capturing market share in this evolving landscape requires significant capital and innovation to overcome intense competition.

The company's exploration of ultra-high purity quartz for medical and aerospace applications, and innovative ceramic solutions for the booming EV market, further exemplify its Question Mark initiatives. These sectors, with the medical device market projected over $600 billion by 2025 and the EV market over $800 billion by 2025, offer significant growth but necessitate considerable investment and strategic market entry to gain traction.

Furthermore, Wonik QnC's focus on recycled semiconductor materials aligns with the growing ESG demands in the electronics industry. This nascent market, within a semiconductor sector projected to reach over $600 billion by 2025, requires substantial R&D and capital to establish a competitive position.

| Initiative | Market Growth Potential | Current Market Share | Investment Need | Key Challenge |

| Quantum Computing Materials | Very High | Low | High | Nascent Market Adoption |

| Advanced AI Hardware Materials | Very High | Low | High | Rapid Technological Evolution |

| GAA Transistor Coatings | High | Low | High | Intense Competition |

| Ultra-High Purity Quartz (Medical/Aerospace) | High | Low | High | Certification & Market Penetration |

| EV Ceramic Solutions | High | Low | High | Securing Design Wins |

| Recycled Semiconductor Materials | High | Low | High | Meeting Purity Standards |

BCG Matrix Data Sources

Our Wonik QnC BCG Matrix leverages a robust blend of internal financial performance data, market share analysis, and industry growth projections. This comprehensive approach ensures accurate strategic positioning.