White Mountains SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

White Mountains Bundle

The White Mountains boast incredible natural beauty and a strong tourism appeal, but also face challenges like seasonal economic fluctuations and infrastructure limitations. Understanding these dynamics is crucial for sustainable growth.

Want the full story behind the White Mountains' unique strengths, potential threats, and exciting opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning for this iconic region.

Strengths

White Mountains Insurance Group's strength lies in its diversified portfolio and strategic acquisitions, spanning property and casualty insurance, reinsurance, and capital solutions. This broad approach, as evidenced by their majority stake in Distinguished Programs and investments in BroadStreet Partners and Enterprise Solutions, effectively reduces reliance on any single market segment. These moves in 2024 and early 2025 continue to broaden their market presence and diversify revenue streams, allowing them to capitalize on various opportunities while mitigating sector-specific risks.

White Mountains boasts a strong capital position, evidenced by approximately $700 million in undeployed capital at the close of 2024 and roughly $550 million by the first quarter of 2025. This substantial financial flexibility allows the company to actively seek out strategic acquisitions and invest in promising growth opportunities.

The company's disciplined approach to capital allocation, coupled with its robust balance sheet, empowers it to pursue value-enhancing initiatives, including share repurchases. This financial strength is further demonstrated by its consistent dividend payments, reflecting a commitment to delivering shareholder value and overall financial stability.

White Mountains benefits from the robust performance of its core operating entities. For instance, Ark Insurance demonstrated exceptional underwriting, achieving a combined ratio of 83% in 2024 and a remarkable 94% in the first quarter of 2025, alongside substantial growth in gross written premiums.

Further strengthening this advantage, Kudu's participation contracts surpassed $1 billion, while Bamboo saw its managed premiums double and its MGA adjusted EBITDA triple year-over-year in Q1 2025. These impressive operational achievements across its subsidiaries directly translate into enhanced profitability and stability for White Mountains.

Expertise in Niche and Specialty Markets

White Mountains excels by concentrating on niche and specialty insurance and reinsurance markets. This focus allows them to build deep underwriting expertise in areas less exposed to broad market fluctuations. For instance, their subsidiary Ark provides specialized coverages like property, marine & energy, and accident & health, demonstrating a strategic move into less commoditized segments. This specialization can translate into stronger profit margins and more consistent underwriting results.

This strategic specialization offers a distinct competitive edge. By targeting less crowded segments, White Mountains can avoid direct competition with larger, more diversified insurers. This allows them to command better pricing and potentially achieve more stable underwriting profits. For example, Ark's expansion into new lines like renewable energy further solidifies their position in growing, specialized sectors.

- Niche Market Focus: White Mountains concentrates on specialized insurance and reinsurance, leveraging deep underwriting expertise.

- Competitive Advantage: Specialization in less commoditized areas can lead to higher margins and more stable profits.

- Subsidiary Example (Ark): Offers diverse specialty lines including property, marine & energy, and accident & health, with expansion into renewable energy.

- Strategic Benefit: Avoids direct competition with larger players, allowing for better pricing and consistent underwriting performance.

Effective Risk Management Framework

White Mountains Insurance Group boasts an effective risk management framework, a cornerstone of its operational stability. This framework, diligently overseen by the Board and its specialized committees, systematically identifies and assesses a broad spectrum of risks. These include operational, financial, legal, compliance, cyber, and even climate-related risks, demonstrating a forward-thinking approach to potential challenges.

A key aspect of this robust strategy is the proactive management of its fixed income portfolio. By maintaining a deliberately short duration, White Mountains effectively mitigates the impact of interest rate fluctuations. This strategic decision is crucial for protecting the company's assets and ensuring sustained long-term stability, especially within the inherently volatile insurance industry.

- Comprehensive Risk Oversight: Board and committee-led framework addresses operational, financial, legal, compliance, cyber, and climate risks.

- Interest Rate Risk Mitigation: Strategic short duration on fixed income portfolio protects against rising interest rates.

- Asset Protection: Proactive risk management safeguards company assets and enhances financial resilience.

- Long-Term Stability: Framework contributes to enduring stability in a dynamic and unpredictable market.

White Mountains' strength is deeply rooted in its diversified business model, encompassing insurance, reinsurance, and capital solutions. This diversification, actively pursued through strategic acquisitions like Distinguished Programs and investments in BroadStreet Partners and Enterprise Solutions in 2024 and early 2025, significantly reduces dependence on any single market, enhancing overall resilience.

The company maintains a formidable capital position, with approximately $700 million in undeployed capital at the end of 2024 and around $550 million by Q1 2025. This substantial financial flexibility fuels strategic growth initiatives and acquisitions, underscoring their capacity for value creation and shareholder returns through disciplined capital allocation and consistent dividend payments.

White Mountains' core operating entities are performing exceptionally well. For instance, Ark Insurance reported a strong combined ratio of 83% in 2024 and 94% in Q1 2025, coupled with significant premium growth. Kudu's participation contracts exceeded $1 billion, and Bamboo doubled its managed premiums and tripled its MGA adjusted EBITDA year-over-year in Q1 2025, showcasing robust operational performance across the group.

The company's strategic focus on niche and specialty insurance markets provides a significant competitive advantage. By concentrating on less commoditized segments, White Mountains cultivates deep underwriting expertise, leading to potentially higher profit margins and more stable underwriting results. Ark's expansion into areas like renewable energy exemplifies this strategy, positioning them in high-growth, specialized sectors.

| Strength | Description | Supporting Data (2024/Q1 2025) |

|---|---|---|

| Diversified Portfolio | Spans property & casualty, reinsurance, and capital solutions, reducing single-market reliance. | Acquisitions of Distinguished Programs, investments in BroadStreet Partners, Enterprise Solutions. |

| Strong Capital Position | Significant undeployed capital provides financial flexibility for growth and acquisitions. | ~$700M undeployed capital (End 2024); ~$550M (Q1 2025). Disciplined capital allocation and consistent dividends. |

| Robust Subsidiary Performance | Key subsidiaries demonstrate strong underwriting and growth. | Ark Insurance: 83% combined ratio (2024), 94% (Q1 2025). Kudu: >$1B participation contracts. Bamboo: Managed premiums doubled, MGA adjusted EBITDA tripled (YoY Q1 2025). |

| Niche Market Focus | Concentration on specialty insurance and reinsurance yields competitive advantages. | Ark's specialization in property, marine & energy, accident & health, and renewable energy. |

What is included in the product

Offers a full breakdown of White Mountains’s strategic business environment, detailing its internal strengths and weaknesses alongside external opportunities and threats.

Provides a clear, actionable SWOT analysis for the White Mountains, identifying key opportunities and mitigating potential threats for sustainable tourism development.

Weaknesses

White Mountains' investment portfolio, especially its substantial holding in MediaAlpha, makes it vulnerable to market swings and potential unrealized losses. This concentration risk means that the performance of a single investment can significantly impact the company's overall financial health.

For instance, MediaAlpha's share price drop in the fourth quarter of 2024 led to a $122 million mark-to-market loss for White Mountains. This volatility continued into the first quarter of 2025, with an additional $37 million loss, directly affecting comprehensive income and highlighting the portfolio's sensitivity.

This reliance on the performance of specific investments, like MediaAlpha, introduces a degree of unpredictability into White Mountains' financial outcomes. Such fluctuations can make it challenging to forecast earnings and can create a less stable financial picture for the company.

White Mountains saw a significant drop in its net income for the first quarter of 2025, reporting $35 million. This is a stark contrast to the $236 million recorded in the same period of 2024.

This substantial decrease in comprehensive income attributable to common shareholders is largely due to unrealized investment losses, particularly from MediaAlpha. Additionally, potential increases in loss and loss adjustment expenses within its insurance operations may have contributed to this downturn.

The sharp decline in Q1 2025 profitability raises questions about the company's short-term financial health and its capacity to finance future expansion initiatives.

White Mountains' decision to reduce its capital commitment to WM Outrigger Re in 2024, a shift from its 2023 levels, directly impacted its financial performance. This strategic move resulted in a noticeable decrease in net earned premiums for the reinsurance segment.

This reduction in capital signifies a scaled-back operation within a specific reinsurance niche. While potentially a calculated reallocation of resources, it inherently curtails the growth potential for WM Outrigger Re in its current operational scope.

Exposure to Catastrophic Losses

White Mountains' property and casualty insurance and reinsurance segments face a significant weakness: exposure to catastrophic losses. Even with robust reinsurance partnerships, events like the January 2025 California wildfires, which caused $19 million in net losses for WM Outrigger Re, can still impact financial performance. These events, while often within reinsurance limits, can pressure profitability and adversely affect combined ratios, a key indicator of underwriting profitability.

The inherent nature of the insurance industry means that large-scale, unpredictable events pose a constant threat. For White Mountains, this translates to a vulnerability that can lead to substantial financial setbacks, even if mitigated by existing risk management strategies. The company's financial results can therefore be subject to volatility driven by external, uncontrollable factors.

- Exposure to Catastrophic Events: Property and casualty lines are susceptible to large losses from natural disasters and other unforeseen events.

- Impact on Profitability: Major catastrophes can erode underwriting profits and negatively affect combined ratios.

- Industry-Wide Risk: This is a systemic risk within the insurance and reinsurance sectors, requiring continuous monitoring and capital management.

Valuation Complexity and Market Sensitivity of Debt Obligations

White Mountains' debt obligations present a valuation challenge, categorized as Level 3 measurements. This means their fair value relies heavily on internal models and assumptions rather than readily available market prices, making them inherently complex to assess.

This complexity directly translates to a sensitivity to market conditions. Fluctuations in interest rates, credit spreads, or economic outlook can significantly impact the estimated fair value of these debt instruments, potentially affecting the company's reported financial stability and transparency, especially during periods of market volatility.

For instance, as of the first quarter of 2024, White Mountains reported total debt of $1.5 billion. A shift in market interest rates by just 50 basis points could lead to a material change in the fair value of this debt, underscoring the impact of these Level 3 valuations on the company's financial statements.

- Valuation Complexity: Debt fair values are Level 3, meaning they depend on unobservable inputs and internal models.

- Market Sensitivity: These valuations are highly susceptible to changes in interest rates and credit market conditions.

- Transparency Concerns: The reliance on internal models can reduce transparency for external stakeholders, particularly in uncertain economic climates.

- Financial Stability Impact: Significant market shifts can cause volatility in reported debt values, potentially affecting perceived financial stability.

White Mountains' significant investment in MediaAlpha, representing a substantial portion of its portfolio, exposes the company to considerable concentration risk. This reliance on a single investment means that any downturn in MediaAlpha's performance can disproportionately impact White Mountains' overall financial health and profitability.

The company's Q1 2025 net income of $35 million, a sharp decrease from $236 million in Q1 2024, directly reflects this vulnerability. This decline was largely driven by unrealized investment losses, particularly from MediaAlpha, highlighting the sensitivity of White Mountains' financial results to specific market movements.

Furthermore, the insurance and reinsurance segments are susceptible to catastrophic events. For example, the January 2025 California wildfires resulted in $19 million in net losses for WM Outrigger Re, demonstrating how unforeseen events can still impact profitability even with reinsurance in place.

Preview Before You Purchase

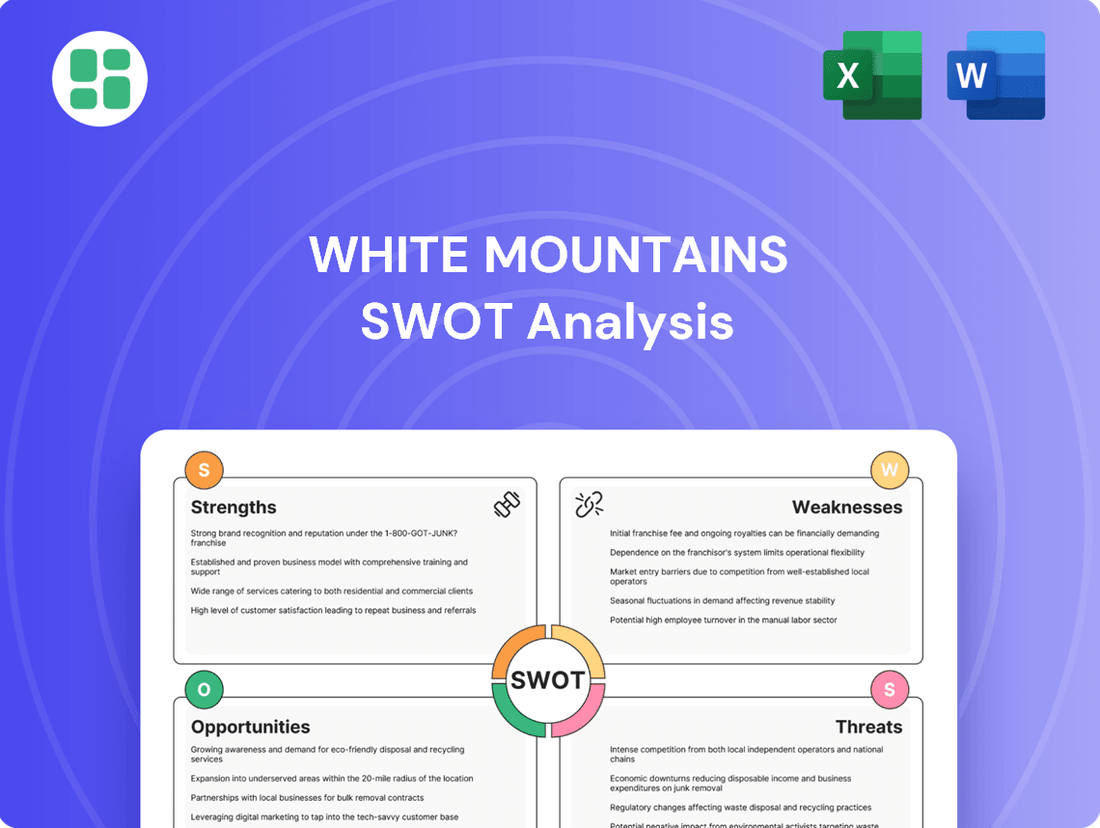

White Mountains SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at the White Mountains' Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

White Mountains' substantial undeployed capital, reported at approximately $550 million as of Q1 2025, creates a significant opportunity for strategic acquisitions. This financial flexibility allows the company to actively pursue targets within its core insurance and financial services markets, as well as explore adjacent sectors.

The company's recent moves, such as acquiring BroadStreet Partners and Enterprise Solutions through WTM Partners, highlight a strategic shift towards venture capital-style investments. This diversification into high-growth areas offers a promising avenue for capturing future returns and expanding its investment portfolio.

Further solidifying its position, White Mountains is set to acquire a majority stake in Distinguished Programs. This move specifically enhances its footprint in the specialty property and casualty managing general agent (MGA) space, demonstrating a targeted approach to bolstering its existing capabilities.

White Mountains, through its operating company Ark, is poised for growth in specialty insurance and reinsurance. Ark's strategy includes expanding into new, profitable niche markets like energy and marine insurance. This expansion is supported by attractive market pricing and Ark's strong underwriting capabilities, aiming to boost gross written premiums.

The company anticipates that these specialty lines will contribute significantly to enhanced profitability. For instance, the global specialty insurance market was valued at approximately $700 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 5% through 2030, indicating substantial room for expansion.

The insurance sector is seeing significant gains from technology like data analytics and insurtech. White Mountains' investment in Bamboo, an insurance distribution platform, is a prime example. Bamboo has impressively doubled its managed premiums and tripled its MGA adjusted EBITDA year-over-year, demonstrating the power of tech for efficiency.

Growth in Asset and Wealth Management Solutions via Kudu

White Mountains' Kudu segment, which offers capital solutions to boutique asset and wealth management firms, is demonstrating robust growth. The portfolio value managed by Kudu has now surpassed the $1 billion mark, showcasing significant expansion in this area. This growth highlights Kudu's increasing importance in White Mountains' strategy.

The company is actively planning additional capital deployment into asset management firms through Kudu. This strategic move aims to diversify White Mountains' income streams, balancing the inherent volatility of its insurance operations with more stable, non-correlated revenue generated by Kudu. This focus suggests a deliberate effort to enhance overall portfolio stability.

- Kudu's Portfolio Value: Exceeded $1 billion as of recent reports.

- Strategic Focus: Continued capital deployment into asset management firms is anticipated.

- Income Diversification: Kudu provides stable, non-correlated income streams to offset insurance volatility.

Potential for Geographic and Product Line Expansion

White Mountains is actively pursuing expansion, both by adding new business lines and by growing its geographical presence. This approach is designed to keep its portfolio of risks well-diversified and balanced.

A key part of this strategy involves exploring new fronting relationships for Bamboo. Additionally, White Mountains plans to deploy equity capital through WTM Partners into sectors outside of traditional insurance, signaling a clear intent to broaden its growth horizons beyond its current operational boundaries.

For instance, in 2024, White Mountains continued to invest in its specialty insurance segment, with a focus on niche markets that offer attractive risk-adjusted returns. The company’s commitment to diversifying its revenue streams is evident in its ongoing evaluation of opportunities in areas such as climate solutions and technology-enabled services.

- Geographic Expansion: Targeting new international markets for specialty insurance products.

- Product Line Expansion: Developing new offerings in areas like cyber insurance and parametric solutions.

- WTM Partners Growth: Investing in non-insurance businesses to achieve broader diversification.

- Bamboo Fronting Opportunities: Seeking new partnerships to underwrite diverse insurance risks.

White Mountains' substantial undeployed capital, reported at approximately $550 million as of Q1 2025, creates a significant opportunity for strategic acquisitions and venture capital-style investments, as evidenced by recent acquisitions like BroadStreet Partners. The company's expansion into specialty insurance, particularly through Ark's entry into niche markets like energy and marine, is well-positioned to capitalize on a global specialty insurance market valued at around $700 billion in 2023. Furthermore, the growth of its Kudu segment, managing over $1 billion in assets, offers a stable, non-correlated income stream, diversifying revenue and balancing insurance volatility.

| Opportunity Area | Key Developments | Market Context/Data |

|---|---|---|

| Strategic Acquisitions & Investments | $550 million undeployed capital (Q1 2025); Acquisition of BroadStreet Partners & Enterprise Solutions | Flexibility for M&A and venture-style growth |

| Specialty Insurance Expansion | Ark entering niche markets (Energy, Marine); Focus on attractive risk-adjusted returns | Global Specialty Insurance Market: ~$700 billion (2023), 5% CAGR projected through 2030 |

| Kudu Segment Growth | Portfolio value exceeding $1 billion; Continued capital deployment into asset management | Diversifies income, balances insurance volatility with stable revenue |

| Insurtech & Digitalization | Investment in Bamboo (doubled managed premiums, tripled MGA adj. EBITDA YoY) | Leveraging technology for efficiency and growth in distribution |

Threats

The escalating frequency and intensity of natural disasters, driven by climate change, present a significant challenge for White Mountains' property and casualty insurance and reinsurance businesses. For instance, 2023 saw record-breaking insured losses from natural catastrophes, estimated by Swiss Re to be around $110 billion globally, underscoring the growing risk profile.

While White Mountains utilizes reinsurance and sophisticated catastrophe modeling to mitigate these impacts, major events, such as the widespread wildfires in California during recent years, can still result in substantial underwriting losses. These losses can strain the company's capital reserves and lead to increased reinsurance premiums, directly affecting profitability and operational stability.

The property and casualty insurance and reinsurance sectors are intensely competitive and prone to cyclical downturns, often marked by aggressive price wars. This dynamic environment, coupled with a softening rate environment in certain insurance lines, poses a significant threat to White Mountains' operating entities, like Ark, potentially impacting their underwriting profitability and ability to sustain high performance levels.

White Mountains' substantial investment portfolio faces considerable threats from market volatility and fluctuating interest rates. In 2024, the company saw Kudu's performance negatively affected by rising interest rates, and HG Global experienced unrealized losses within its bond holdings due to these same rate increases.

Continued turbulence in global financial markets poses a significant risk, potentially leading to substantial unrealized or realized losses across White Mountains' diverse investment holdings. Such downturns could directly impair the company's financial performance and overall profitability.

Regulatory and Tax Law Changes

White Mountains Insurance Group, like many global insurers, faces potential headwinds from evolving regulatory landscapes and tax law shifts. Changes in insurance regulations, particularly in its key operating markets, could necessitate costly adjustments to business practices. For instance, the U.S. Treasury Department's proposed changes to international tax rules, which were being actively debated through 2024, could impact the tax liabilities of companies with foreign domiciles and significant U.S. operations, potentially affecting White Mountains' profitability.

Compliance with these evolving rules adds to operational expenses. Furthermore, any increases in corporate tax rates or changes to how foreign earnings are taxed, especially relevant given White Mountains' Bermuda domicile and substantial U.S. presence, could directly reduce net income. The company must remain agile to adapt to these fiscal and regulatory developments.

- Regulatory Scrutiny: Increased oversight in insurance markets could lead to higher compliance costs for White Mountains.

- Tax Law Impact: Potential changes to international tax agreements or domestic tax rates could affect the company's after-tax earnings.

- Bermuda Domicile Considerations: The company's offshore status may subject it to specific international tax regulations and scrutiny.

- Operational Adjustments: Adapting to new regulations may require investments in systems and personnel, impacting operational efficiency.

Reliance on Reinsurance and Retrocessional Arrangements

White Mountains' reliance on reinsurance and retrocessional arrangements, while a key risk management tool, presents a significant threat. If reinsurers or retrocessionaires face financial difficulties or default, White Mountains could be exposed to substantial losses that its own capital might not fully absorb. This dependence means the company's financial stability is indirectly tied to the health of its counterparties.

The effectiveness of these arrangements is paramount. For instance, during periods of widespread catastrophe events, the capacity and pricing of reinsurance can fluctuate dramatically, potentially making coverage more expensive or less available. In 2023, global insured catastrophe losses were estimated to be around $110 billion, a figure that can strain the capacity of the reinsurance market and highlight the importance of robust counterparty risk assessment.

Should these arrangements prove inadequate or fail to perform as expected, White Mountains could face significant financial strain. This could manifest as:

- Increased net losses from large claims.

- Higher capital requirements to cover uninsured risks.

- Reduced capacity for future underwriting due to damaged reputation.

The increasing frequency and severity of natural disasters, a trend amplified by climate change, pose a substantial threat to White Mountains' property and casualty insurance and reinsurance segments. Global insured losses from natural catastrophes in 2023 were estimated at $110 billion by Swiss Re, a significant figure that underscores the growing risk. While the company employs catastrophe modeling and reinsurance, major events can still lead to considerable underwriting losses, impacting capital and increasing future reinsurance costs.

Intense competition and cyclical downturns within the property and casualty insurance and reinsurance markets present ongoing challenges. A softening rate environment in certain lines, as observed through 2024, can directly affect underwriting profitability for entities like Ark, potentially hindering their ability to maintain high performance levels.

White Mountains' extensive investment portfolio is vulnerable to market volatility and shifts in interest rates. For example, rising interest rates in 2024 negatively impacted Kudu's performance and led to unrealized losses in HG Global's bond holdings, highlighting the sensitivity of its investments to macroeconomic changes.

Evolving regulatory landscapes and potential tax law changes represent another significant threat. For instance, ongoing discussions around international tax rules in 2024 could affect companies with offshore domiciles and substantial U.S. operations, potentially impacting White Mountains' net income and requiring costly operational adjustments.

SWOT Analysis Data Sources

This analysis draws from a comprehensive range of data sources, including economic reports, environmental surveys, tourism statistics, and local community feedback to provide a thorough understanding of the White Mountains' landscape.