White Mountains Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

White Mountains Bundle

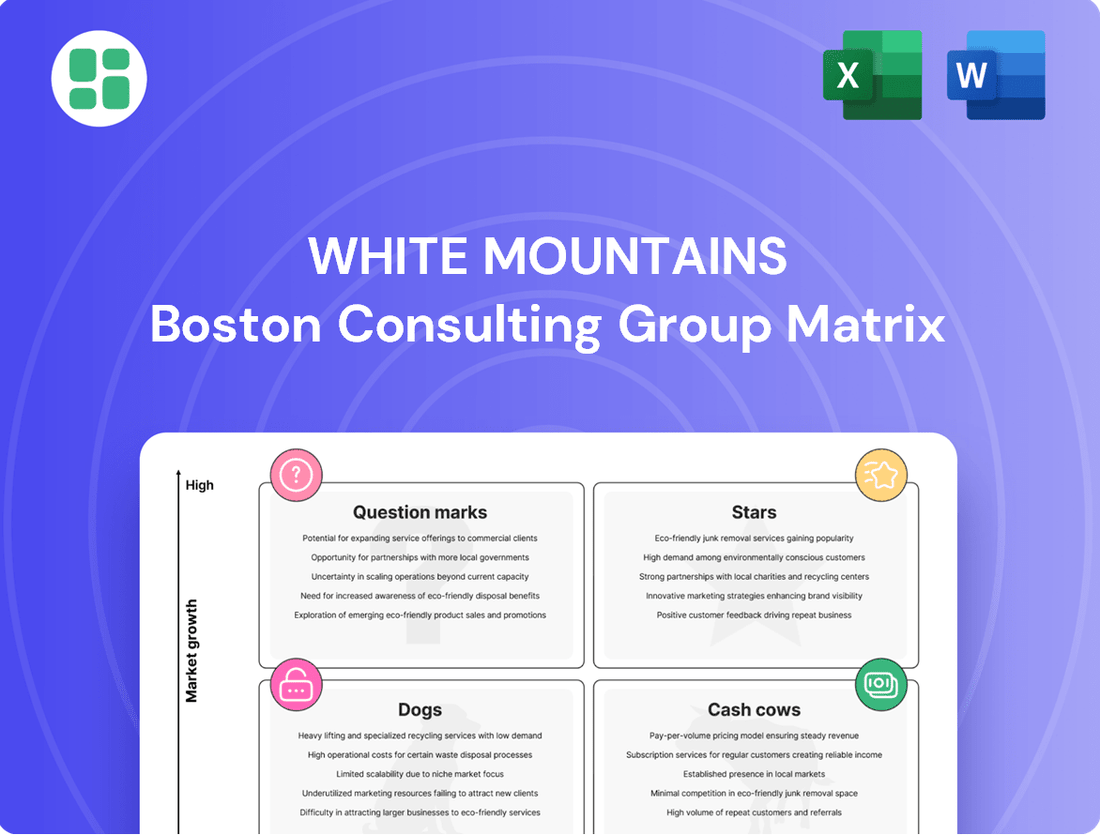

Curious about the White Mountains' strategic product portfolio? Our BCG Matrix preview offers a glimpse into their market positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

White Mountains is strategically focusing on emerging specialty Property & Casualty (P&C) lines, identifying high-growth niches like complex commercial risks and unique personal lines. These areas represent potential Stars in the BCG matrix, where the company seeks to build or solidify a dominant market share through specialized expertise and targeted capital deployment.

In 2024, the specialty P&C market continued its robust expansion, with several segments showing double-digit growth. For instance, cyber insurance, a key emerging specialty, saw premiums rise by an estimated 15-20% globally, driven by increasing cyber threats and regulatory demands. White Mountains' investment in these areas positions them to capitalize on this trend.

White Mountains' strategic investments in Insurtech partnerships, such as their ventures with companies leveraging AI for claims processing or blockchain for policy management, position them for high-growth potential. These collaborations aim to disrupt traditional insurance models by enhancing efficiency and customer experience.

For example, in 2024, White Mountains continued to evaluate and potentially increase stakes in Insurtechs demonstrating strong customer acquisition and revenue growth. If these ventures capture significant market share, they would fit the 'Star' category, requiring substantial cash investment for scaling but offering the promise of substantial future returns and market leadership.

The cyber insurance market is booming, making it a prime candidate for a Star in White Mountains' BCG Matrix. In 2024, the global cyber insurance market was valued at approximately $11.7 billion and is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 20% through 2030.

If White Mountains' subsidiaries have significantly increased their cyber insurance capacity and customer base, capturing a substantial portion of this growth, they would represent a Star. This implies strong performance in a high-growth industry, necessitating ongoing investment to sustain market leadership and capitalize on the escalating demand for cyber protection.

Niche Reinsurance Opportunities

While White Mountains Insurance Group's primary focus is on Property & Casualty (P&C) reinsurance, exploring niche opportunities can unlock significant growth. These targeted segments often address emerging risks or cater to specialized industries, allowing for a strong market entry and competitive advantage.

Consider areas like cyber reinsurance, parametric insurance for climate-related events, or liability coverage for autonomous vehicles. These sectors are experiencing rapid expansion and present a chance for White Mountains to establish leadership.

- Cyber Reinsurance: The global cyber insurance market is projected to reach $20 billion by 2025, with reinsurance playing a crucial role in capacity provision.

- Parametric Insurance: This segment, triggered by predefined events like hurricanes or earthquakes, saw significant uptake in 2023, with growth expected to continue as climate volatility increases.

- Emerging Technologies Liability: As AI and autonomous systems become more prevalent, the need for specialized liability reinsurance will surge, offering a fertile ground for innovation.

Geographic Expansion in High-Growth Markets

Expanding successful Property & Casualty (P&C) insurance lines into new, high-growth geographic markets presents a significant opportunity for White Mountains to achieve a dominant market share. This strategy leverages the company's existing expertise and proven business models in territories experiencing robust economic development or favorable demographic shifts that are fueling increased demand for insurance products. For instance, expanding into emerging economies in Southeast Asia or parts of Africa, where insurance penetration is historically low but economic growth is projected to be strong, could position White Mountains as a leader.

In 2024, many of these high-growth markets are showing promising insurance sector expansion. For example, India's general insurance market is expected to grow at a compound annual growth rate (CAGR) of over 15% through 2025, driven by rising disposable incomes and increased awareness of insurance benefits. Similarly, countries like Vietnam and the Philippines are also experiencing double-digit growth in their P&C sectors. White Mountains could capitalize on this by establishing a strong local presence, adapting products to local needs, and leveraging digital distribution channels to reach a wider customer base.

- Market Entry Strategy: Focus on markets with projected GDP growth exceeding 5% annually, such as Nigeria or Indonesia, where insurance demand is set to rise significantly.

- Product Adaptation: Tailor P&C offerings to address specific local risks, like flood insurance in flood-prone regions of Bangladesh or micro-insurance products for agricultural communities in Kenya.

- Digital Penetration: Utilize mobile-first strategies to reach younger, tech-savvy populations in markets like Brazil, where smartphone penetration is over 80%.

- Partnership Opportunities: Collaborate with local financial institutions or established businesses in markets like Colombia to gain immediate market access and build trust.

Stars represent business units with high market share in high-growth industries. For White Mountains, these are likely to be in rapidly expanding specialty P&C lines and Insurtech ventures. These segments require significant investment to maintain their growth trajectory and market leadership. By focusing on areas like cyber insurance and innovative Insurtech platforms, White Mountains aims to capture substantial future returns.

The company's strategic push into specialty P&C lines, particularly cyber insurance, positions it to benefit from a market that saw global premiums rise by an estimated 15-20% in 2024. This aligns with the Star quadrant's need for substantial investment to fuel rapid expansion and solidify market dominance. White Mountains' investments in Insurtechs demonstrating strong customer acquisition and revenue growth also fall into this category, demanding capital for scaling but promising significant future returns.

White Mountains' focus on emerging specialty P&C lines, such as cyber reinsurance and liability for autonomous vehicles, targets high-growth sectors. The cyber reinsurance market, for instance, is projected to reach $20 billion by 2025, with reinsurance playing a vital role in capacity. These areas represent potential Stars, requiring ongoing investment to maintain leadership in markets with escalating demand.

Expanding into high-growth geographic markets, like India's general insurance sector which is expected to grow at over 15% CAGR through 2025, also presents Star opportunities. By adapting products and leveraging digital channels in these regions, White Mountains can establish a dominant market share. The company's strategy of focusing on markets with projected GDP growth exceeding 5% annually, such as Nigeria or Indonesia, further underscores this pursuit of Star status.

| Business Unit | Industry Growth Rate | Market Share | Investment Needs | Potential Return |

|---|---|---|---|---|

| Cyber Insurance | High (15-20% in 2024) | Growing/Targeting Dominance | High | High |

| Insurtech Ventures (AI/Blockchain) | High (Emerging Tech) | Growing/Targeting Dominance | High | High |

| Emerging Markets P&C Expansion (e.g., India) | High (15%+ CAGR projected) | Growing/Targeting Dominance | High | High |

What is included in the product

This BCG Matrix overview provides strategic insights into Stars, Cash Cows, Question Marks, and Dogs.

A clear BCG Matrix visualizes the White Mountains' portfolio, easing the pain of strategic resource allocation.

Cash Cows

White Mountains' established commercial property insurance segment is a textbook Cash Cow. This business benefits from the company's deep-rooted expertise in a mature market, where it commands a stable and significant share. For 2024, the company's focus remains on optimizing operations and claims handling, ensuring this segment continues to be a reliable generator of substantial cash flow with minimal need for aggressive growth investment.

Certain mature personal lines, particularly those where White Mountains' subsidiaries have a well-entrenched customer base and strong brand recognition, could serve as cash cows. For example, in 2024, the personal auto insurance segment, a core area for many of its insurers, continued to demonstrate stable premium growth. This stability is driven by established market share and relatively inelastic demand, allowing for consistent cash generation.

These segments offer predictable premiums and claims, contributing significantly to the company's overall profitability without requiring aggressive marketing or product development spending. In 2024, the net written premiums for personal lines insurance, excluding specialty lines, remained robust, reflecting the mature nature and steady demand. This predictability allows for efficient capital allocation, supporting investments in other areas of the business.

White Mountains' fixed income investment portfolio, while not an insurance product itself, functions as a robust Cash Cow. This portfolio consistently generates reliable investment income, providing a steady stream of cash flow essential for funding various company initiatives and covering operational expenses.

In 2024, the company reported significant investment income from its fixed income holdings, contributing substantially to its overall profitability. This stable income generation allows White Mountains to allocate capital effectively, supporting dividend payments and reinvestment opportunities in its other business segments.

Run-off Insurance Operations

White Mountains' run-off insurance operations represent a classic example of a cash cow within a BCG matrix framework. These are essentially legacy insurance businesses that are no longer actively seeking new policyholders. Instead, they focus on managing the existing portfolio of policies until their natural expiration or settlement. This strategic focus allows them to generate consistent cash flow from ongoing premiums and investment income without the need for significant new capital injections, which is characteristic of a mature, high-market-share, low-growth business.

The primary advantage of these run-off operations is their ability to produce substantial and predictable cash generation. As liabilities are settled over time, the remaining capital and investment income can be harvested and redeployed by the parent company, White Mountains. This cash generation is crucial for funding growth initiatives in other business segments or for returning capital to shareholders. For instance, in 2024, the insurance industry saw a continued trend of companies seeking to offload legacy portfolios, creating opportunities for specialized run-off managers to acquire and efficiently manage these blocks of business.

- Predictable Cash Flow: Run-off operations generate steady cash from existing policies and investments.

- Minimal Capital Reinvestment: Unlike growth businesses, these operations require little new capital.

- Strategic Capital Allocation: Cash generated can be used to fund other, higher-growth ventures within White Mountains.

- Industry Trend Alignment: The increasing market for run-off solutions in 2024 highlights the strategic relevance of this segment.

Seasoned Specialty Insurance Programs

White Mountains' seasoned specialty insurance programs, particularly those with a long history and dominant market share in niche sectors, represent their Cash Cows. These programs benefit from deep industry knowledge and strong client retention, leading to consistent and high profit margins.

For example, their programs catering to specific, stable industries have demonstrated resilience and profitability. In 2024, the company continued to leverage its underwriting expertise in these established lines, contributing significantly to its overall financial performance. The consistent cash flow generated from these mature operations allows White Mountains to fund investments in other areas of its business.

- Dominant Market Share: These programs often hold a leading position in their respective specialty insurance markets.

- Consistent Profitability: They generate stable and predictable earnings due to established pricing models and low volatility.

- Strong Client Relationships: Long-standing ties with clients in niche industries foster loyalty and repeat business.

- Underwriting Discipline: A focus on rigorous risk assessment and pricing ensures sustained high profit margins.

White Mountains' established commercial property insurance segment is a textbook Cash Cow. This business benefits from the company's deep-rooted expertise in a mature market, where it commands a stable and significant share. For 2024, the company's focus remains on optimizing operations and claims handling, ensuring this segment continues to be a reliable generator of substantial cash flow with minimal need for aggressive growth investment.

Certain mature personal lines, particularly those where White Mountains' subsidiaries have a well-entrenched customer base and strong brand recognition, could serve as cash cows. For example, in 2024, the personal auto insurance segment, a core area for many of its insurers, continued to demonstrate stable premium growth. This stability is driven by established market share and relatively inelastic demand, allowing for consistent cash generation.

These segments offer predictable premiums and claims, contributing significantly to the company's overall profitability without requiring aggressive marketing or product development spending. In 2024, the net written premiums for personal lines insurance, excluding specialty lines, remained robust, reflecting the mature nature and steady demand. This predictability allows for efficient capital allocation, supporting investments in other areas of the business.

White Mountains' run-off insurance operations represent a classic example of a cash cow within a BCG matrix framework. These are essentially legacy insurance businesses that are no longer actively seeking new policyholders. Instead, they focus on managing the existing portfolio of policies until their natural expiration or settlement. This strategic focus allows them to generate consistent cash flow from ongoing premiums and investment income without the need for significant new capital injections, which is characteristic of a mature, high-market-share, low-growth business.

The primary advantage of these run-off operations is their ability to produce substantial and predictable cash generation. As liabilities are settled over time, the remaining capital and investment income can be harvested and redeployed by the parent company, White Mountains. This cash generation is crucial for funding growth initiatives in other business segments or for returning capital to shareholders. For instance, in 2024, the insurance industry saw a continued trend of companies seeking to offload legacy portfolios, creating opportunities for specialized run-off managers to acquire and efficiently manage these blocks of business.

White Mountains' seasoned specialty insurance programs, particularly those with a long history and dominant market share in niche sectors, represent their Cash Cows. These programs benefit from deep industry knowledge and strong client retention, leading to consistent and high profit margins. For example, their programs catering to specific, stable industries have demonstrated resilience and profitability. In 2024, the company continued to leverage its underwriting expertise in these established lines, contributing significantly to its overall financial performance. The consistent cash flow generated from these mature operations allows White Mountains to fund investments in other areas of its business.

White Mountains' fixed income investment portfolio, while not an insurance product itself, functions as a robust Cash Cow. This portfolio consistently generates reliable investment income, providing a steady stream of cash flow essential for funding various company initiatives and covering operational expenses. In 2024, the company reported significant investment income from its fixed income holdings, contributing substantially to its overall profitability. This stable income generation allows White Mountains to allocate capital effectively, supporting dividend payments and reinvestment opportunities in its other business segments.

| Segment | BCG Classification | Key Characteristics | 2024 Financial Insight |

| Commercial Property Insurance | Cash Cow | Mature market, stable share, optimized operations | Focus on efficient claims handling for consistent cash flow. |

| Mature Personal Lines (e.g., Auto) | Cash Cow | Entrenched customer base, strong brand, inelastic demand | Stable premium growth driven by established market share. |

| Run-off Insurance Operations | Cash Cow | Legacy portfolios, no new business focus, liability settlement | Generates predictable cash from existing policies and investments. |

| Seasoned Specialty Insurance Programs | Cash Cow | Niche sectors, dominant market share, strong client retention | Consistent high profit margins from underwriting expertise. |

| Fixed Income Investment Portfolio | Cash Cow | Reliable investment income generation | Contributes substantially to overall profitability through stable income. |

Full Transparency, Always

White Mountains BCG Matrix

The preview you are currently viewing is the identical, fully completed White Mountains BCG Matrix report you will receive upon purchase. This means no watermarks, no placeholder text, and no surprises—just the comprehensive, ready-to-deploy strategic analysis you need for informed decision-making.

Dogs

Underperforming legacy reinsurance portfolios within White Mountains would fall into the Dogs category of the BCG Matrix. These are segments that have low growth and low market share, meaning they are not strategically important and are likely draining resources. For instance, if a particular line of legacy business saw its premiums shrink by 15% in 2024 and now represents less than 1% of the company's total revenue, it would be a prime candidate for this classification.

Non-Strategic Small Acquisitions in White Mountains' portfolio, especially those made in prior years, might be categorized as Dogs. These are typically smaller businesses that haven't achieved substantial market growth or seamlessly integrated with the main P&C operations. For instance, if White Mountains acquired a niche insurance provider in 2022 that operates in a market projected to grow only 2% annually and has shown minimal revenue increase since then, it would fit this profile.

Outdated technology platforms are like a heavy anchor for White Mountains. These internal systems, often costly to maintain, drag down efficiency and fail to provide any competitive edge. Think of them as a drain on resources, not contributing to growth but instead hindering the company's ability to adapt quickly in the market.

In 2024, companies across industries are facing significant challenges with legacy IT infrastructure. For instance, a report by Gartner in early 2024 indicated that a substantial percentage of IT budgets are still allocated to maintaining these older systems, diverting funds that could be used for innovation and digital transformation. This directly impacts agility and can indirectly erode market share as competitors leverage more modern, efficient solutions.

Declining Niche Insurance Products

Within White Mountains' portfolio, certain niche property and casualty (P&C) insurance products are showing signs of decline. These are typically specialized coverages facing reduced demand or facing fierce, unprofitable competition, resulting in a low market share and dim growth outlook.

These products might be kept in the portfolio due to existing customer obligations or a gradual divestment strategy. For instance, some older, less adaptable specialty lines might be struggling to compete with newer, more flexible offerings in the market.

- Legacy Product Strain: Certain legacy specialty lines, like specific types of inland marine insurance or older forms of professional liability, may be experiencing declining demand as industries evolve and new risks emerge.

- Intense Competition: In some niche areas, a high number of smaller, specialized insurers can lead to price wars and reduced profitability, making it difficult for larger players like White Mountains to maintain a significant, profitable market share.

- Low Growth Prospects: Products that are tied to declining industries or are being superseded by technological advancements often fall into this category, presenting minimal opportunities for future expansion.

Businesses with High Expense Ratios

Businesses with high expense ratios within White Mountains' portfolio, particularly those in stagnant markets with low market share, would be classified as Dogs in the BCG Matrix. These segments consume resources without generating significant returns, acting as cash traps.

For instance, if a particular niche insurance product line within White Mountains had an expense ratio exceeding 40% of its premium volume, and its market share remained below 5% in a mature, non-growing segment, it would fit the Dog profile. Such units drain capital and management attention, offering little prospect for future growth or profitability.

- High Expense Ratio: A segment where operating expenses significantly outpace revenue generation, indicating operational inefficiency. For example, a unit with an expense ratio of over 35% relative to its net premiums written.

- Low Market Share: A business unit that holds a minimal position in its respective market, often less than 10%.

- Stagnant Market: Operating within an industry or segment that exhibits little to no growth, limiting opportunities for expansion.

- Cash Trap: Segments that require ongoing investment to maintain operations but yield minimal profits or cash flow, thus trapping capital.

Dogs within White Mountains' portfolio represent areas with low market share and low growth potential, often requiring significant resources without yielding substantial returns. These could include legacy product lines or smaller, underperforming acquisitions that haven't integrated well. For example, a niche specialty insurance product that saw its market share decline to 3% in 2024 and operates in a sector with projected annual growth of only 1% would be a prime candidate for this classification.

Outdated technology platforms are a classic example of a Dog. These systems, while costly to maintain, offer no competitive advantage and hinder innovation. In 2024, many companies are still grappling with the cost of maintaining legacy IT, with reports suggesting that up to 50% of IT budgets are spent on upkeep rather than new development, directly impacting agility.

Businesses with high expense ratios in stagnant markets also fall into the Dog category. If a unit within White Mountains has an expense ratio over 40% and holds less than 5% market share in a non-growing segment, it's a drain on resources. These segments are cash traps, demanding investment without generating meaningful profits.

| Category | Characteristics | Example for White Mountains (Hypothetical) | 2024 Data Implication |

|---|---|---|---|

| Dogs | Low Market Share, Low Growth | Legacy specialty insurance line with 3% market share in a 1% growth industry | Requires divestment or significant restructuring to avoid continued resource drain. |

| Dogs | High Expense Ratio, Stagnant Market | Niche P&C product with 45% expense ratio and 4% market share in a mature market | Indicates operational inefficiency and lack of competitive edge, necessitating cost reduction or exit. |

| Dogs | Outdated Technology | Internal underwriting system predating 2010 | Hinders efficiency and innovation, increasing operational costs and reducing responsiveness to market changes. |

Question Marks

White Mountains' newly launched Insurtech initiatives, such as its investment in Cover Genius in 2024, exemplify its exploration of high-growth potential market segments. These ventures, while promising, currently hold a low market share, necessitating significant capital infusion to establish viability and achieve scale.

The company's strategic focus on these nascent Insurtech solutions indicates a deliberate move into areas with substantial technological innovation and evolving customer demands. For instance, Cover Genius's focus on embedded insurance solutions positions it within a rapidly expanding digital distribution channel.

White Mountains' expansion into untapped international markets for its Property & Casualty (P&C) offerings would position these ventures as Stars within the BCG Matrix. These emerging markets, while offering substantial growth potential, necessitate considerable initial investment to build brand recognition and capture market share from established competitors.

White Mountains could position specialized ESG-focused insurance products as a potential star in its BCG matrix. This category addresses the burgeoning demand for coverage against environmental liabilities, social impact, and governance failures.

While the market for ESG insurance is growing, White Mountains' initial market share may be modest. This necessitates substantial investment in marketing and product development to capture a significant portion of this emerging sector.

AI-Driven Underwriting Solutions

AI-driven underwriting solutions represent a significant investment area for White Mountains, fitting into the question mark category of the BCG matrix. While these technologies are nascent, with early-stage deployment and market adoption, they hold immense potential for future growth and efficiency gains within the insurance sector.

These advanced AI systems are designed to streamline the underwriting and claims processing, promising to reduce operational costs and improve accuracy. However, their current market impact is minimal, necessitating substantial research and development to unlock their full capabilities and achieve widespread adoption.

- Early Stage Deployment: AI underwriting solutions are still being integrated and tested, with limited market penetration.

- High Investment Needs: Significant capital is required for R&D, data infrastructure, and talent acquisition to develop these advanced capabilities.

- Future Growth Potential: The market for AI in insurance is projected to expand significantly, offering a strong competitive advantage to early adopters.

- Low Current Market Share: Despite the promise, these solutions have not yet translated into substantial gains in market share for companies investing in them.

Targeted Microinsurance Ventures

Targeted microinsurance ventures, focusing on underserved populations or emerging markets, would likely be positioned as Question Marks within the BCG Matrix for White Mountains. These markets offer substantial growth prospects due to significant unmet needs, but initial market share would be minimal.

White Mountains would need to invest heavily in building distribution networks and brand recognition to capture these opportunities. For instance, in many developing economies, insurance penetration remains remarkably low; in Sub-Saharan Africa, for example, it was estimated to be below 3% in 2023, highlighting the vast untapped potential for microinsurance products.

- High Growth Potential: Emerging markets exhibit rapid economic expansion and a large, uninsured population eager for affordable financial protection.

- Low Market Share: Entering these nascent markets means starting with a negligible presence, necessitating substantial investment to gain traction.

- Strategic Investment: Significant capital will be required for product development, regulatory navigation, and establishing robust distribution channels, potentially through partnerships with local NGOs or mobile network operators.

- Future Stars: Successful microinsurance initiatives could evolve into major profit centers if market share is successfully cultivated and operational efficiencies are achieved.

White Mountains' ventures into AI-driven underwriting and targeted microinsurance initiatives are prime examples of Question Marks in the BCG Matrix. These areas demand significant investment for research, development, and market penetration, aiming to transform into future Stars.

The company's strategic allocation of capital to these nascent Insurtech opportunities, such as Cover Genius, underscores a commitment to capturing high-growth potential markets despite their current low market share.

These initiatives, while requiring substantial upfront funding and facing uncertain market adoption, are positioned to capitalize on evolving customer needs and technological advancements in the insurance sector.

The potential upside is considerable, as successful development and market capture could lead to substantial future returns and a strengthened competitive position.

| Initiative | Market Growth | Market Share | Investment Needs | Potential |

|---|---|---|---|---|

| AI Underwriting | High | Low | Very High | Star |

| Microinsurance (Emerging Markets) | High | Very Low | High | Star |

| Insurtech (e.g., Cover Genius) | High | Low | High | Star |

BCG Matrix Data Sources

Our White Mountains BCG Matrix leverages comprehensive market data, including financial reports, industry growth trends, and competitive landscape analysis, to provide strategic insights.