White Mountains Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

White Mountains Bundle

Uncover the strategic brilliance behind White Mountains' success by delving into its Product, Price, Place, and Promotion. See how their offerings resonate with customers, how their pricing attracts and retains, their distribution channels connect them, and their promotions capture attention.

Gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for White Mountains. Ideal for business professionals, students, and consultants looking for strategic insights and actionable takeaways.

Product

White Mountains Insurance Group, through its specialized subsidiaries like Ark and WM Outrigger, offers a robust suite of property and casualty insurance and reinsurance products. This diverse portfolio spans critical areas such as property, specialty lines, marine and energy, accident and health, and casualty coverages, demonstrating a broad market reach.

This extensive product offering allows White Mountains to effectively serve a wide array of clients and adapt to the dynamic nature of global risks. For instance, in 2023, the company reported gross written premiums of $5.9 billion, reflecting the substantial volume and breadth of its insurance and reinsurance activities across these varied sectors.

White Mountains' HG Global segment is a key player in municipal bond reinsurance, primarily serving Build America Mutual Assurance Company (BAM). This specialized offering supports vital public finance projects, from infrastructure development to community initiatives.

While BAM was deconsolidated in July 2024, HG Global maintains its strategic focus on municipal bond reinsurance. The segment generates revenue through premiums earned in both primary and secondary markets, demonstrating continued activity in this niche sector.

Capital solutions for asset and wealth managers, primarily through its subsidiary Kudu Investment Management, LLC, represent a strategic diversification for White Mountains. This segment focuses on providing essential capital for critical transitions within boutique firms, such as ownership transfers, management buyouts, acquisitions, and general growth initiatives.

Kudu's investment approach is broad, encompassing a variety of asset classes. This demonstrates White Mountains' commitment to expanding its financial footprint beyond its historical insurance core, actively participating in the dynamic asset management landscape.

As of Q1 2024, Kudu Investment Management had approximately $1.5 billion in assets under management, reflecting significant capital deployment in this sector. This figure highlights the substantial role these capital solutions play in supporting the growth and stability of independent asset and wealth management businesses.

Property and Casualty Insurance Distribution

White Mountains actively participates in property and casualty insurance distribution via subsidiaries such as Bamboo Holdings LLC. Bamboo functions as a Managing General Agent (MGA), concentrating on distinct markets like California, which is a significant insurance market in the US.

This distribution strategy allows White Mountains to connect more directly with end consumers. It also facilitates the use of technology for streamlined underwriting processes and efficient premium administration, enhancing operational effectiveness.

- Distribution Channel: Operates as a Managing General Agent (MGA) through Bamboo Holdings LLC.

- Market Focus: Targets specific geographic markets, notably California, a key state for property and casualty insurance.

- Customer Reach: Enables more direct engagement with end consumers, bypassing traditional intermediary layers.

- Technological Integration: Leverages technology for efficient underwriting and premium management, aiming for improved speed and accuracy.

Strategic Investments and Acquisitions

White Mountains Insurance Group (WTM) actively pursues strategic investments and acquisitions to foster long-term value, primarily within the insurance and related financial services industries. This focus is evident in their capital deployment strategies, aiming to expand their fee-based insurance platform and diversify revenue sources.

Recent key moves highlight this strategy. In 2024, WTM Partners, a segment of White Mountains, saw significant capital deployment into BroadStreet Partners and Enterprise Solutions. Furthermore, the company acquired a majority stake in Distinguished Programs, a notable Managing General Agent (MGA) specializing in property and casualty insurance. These actions directly contribute to broadening WTM's presence in fee-based insurance operations and diversifying its overall earnings profile.

- Strategic Focus: Building long-term value through acquisitions in insurance and financial services.

- 2024 Deployments: Capital allocated to BroadStreet Partners and Enterprise Solutions under WTM Partners.

- Key Acquisition: Majority stake acquired in Distinguished Programs, a specialty P&C insurance MGA.

- Diversification Goal: Expanding the fee-based insurance platform and diversifying earnings streams.

White Mountains offers a diverse product suite, including property, casualty, specialty lines, and accident & health insurance through subsidiaries like Ark and WM Outrigger. They also provide capital solutions for asset and wealth managers via Kudu Investment Management, which had $1.5 billion in assets under management as of Q1 2024. Their distribution strategy, exemplified by Bamboo Holdings LLC, focuses on specific markets like California, leveraging technology for efficient operations.

| Product Category | Key Subsidiaries/Segments | 2023 Gross Written Premiums | Key 2024 Developments | Target Audience |

| Property & Casualty Insurance/Reinsurance | Ark, WM Outrigger, Bamboo Holdings LLC | $5.9 billion (Total Group) | Acquisition of majority stake in Distinguished Programs (MGA) | Businesses, Individuals (various risk exposures) |

| Municipal Bond Reinsurance | HG Global (formerly served BAM) | N/A (BAM deconsolidated July 2024) | Continues focus on municipal bond reinsurance | Municipalities, Public Finance Projects |

| Capital Solutions for Asset/Wealth Managers | Kudu Investment Management, LLC | N/A (Focus on AUM) | $1.5 billion in AUM (Q1 2024) | Boutique asset/wealth management firms |

What is included in the product

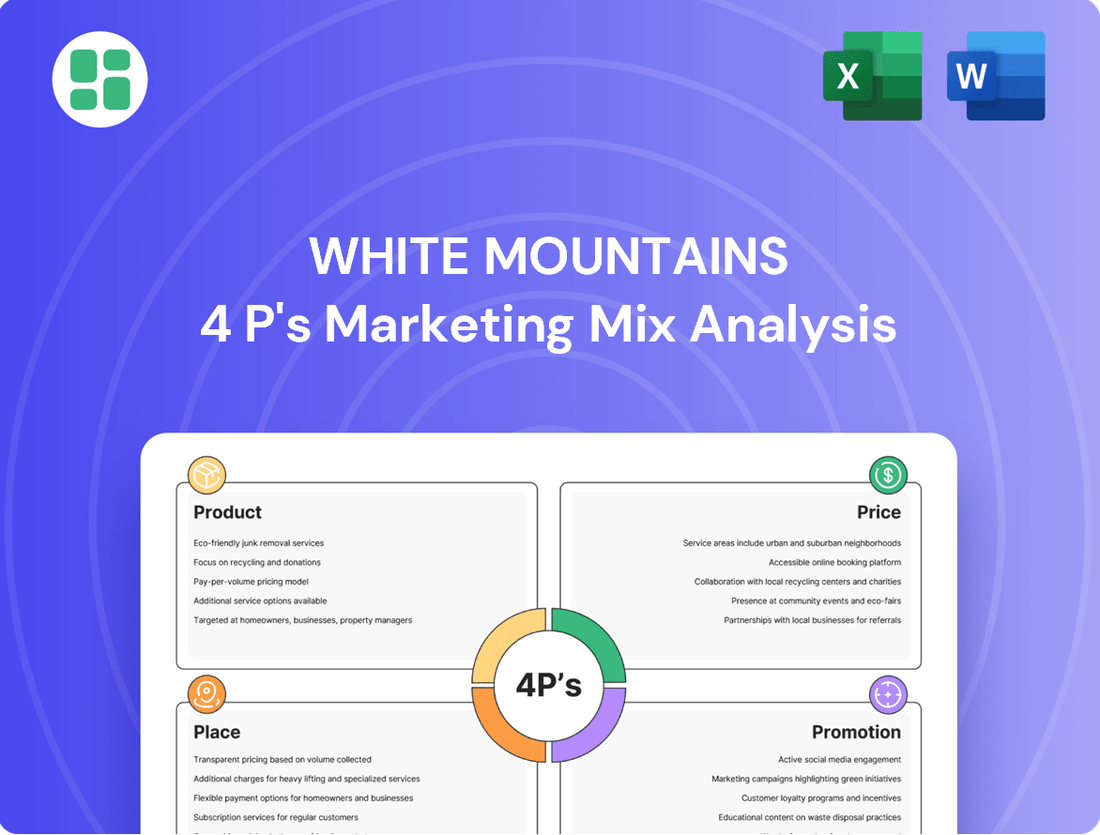

This analysis provides a comprehensive examination of the White Mountains' marketing mix, detailing their strategies for Product, Price, Place, and Promotion to understand their market positioning and competitive advantages.

This White Mountains 4Ps analysis simplifies complex marketing strategies, offering a clear, actionable roadmap to address customer pain points and drive engagement.

Place

White Mountains' primary underwriting operations for insurance and reinsurance are strategically anchored in the United Kingdom and Bermuda through its key subsidiary, Ark. These locations are crucial for accessing major global insurance markets, notably including active participation within the prestigious Lloyd's of London market.

This dual-hub approach allows Ark to effectively operate on an international scale, tapping into varied and diverse risk pools. For instance, Bermuda's role as a leading hub for catastrophe reinsurance, coupled with London's established specialty insurance capabilities, provides White Mountains with a robust platform for global reach and risk diversification.

White Mountains, through its subsidiary Ark, leverages a robust network of insurance and reinsurance brokers and wholesalers. This strategy is crucial for market penetration, allowing access to both open market placements and partnerships with Managing General Agents (MGAs). In 2024, this established intermediary model continued to be a cornerstone of Ark's distribution, facilitating efficient client acquisition and broad market reach for its specialized insurance and reinsurance offerings.

White Mountains leverages direct-to-consumer (DTC) channels and Managing General Agent (MGA) partnerships to reach specific markets. Through its 'Other Operations' and Bamboo, the company provides insurance directly to the travel sector and individual consumers.

The MGA model, prominently seen with Bamboo, facilitates targeted distribution and underwriting for niche markets or specific geographic areas. This approach allows White Mountains to efficiently serve specialized insurance needs, as demonstrated by Bamboo's focus on travel insurance solutions.

Investor Relations and Public Exchanges

White Mountains Insurance Group, Ltd. (WTM) actively engages with the financial community by maintaining its listing on major stock exchanges, offering investors clear access and trading opportunities. As of early 2024, the company's shares are traded on the New York Stock Exchange (NYSE) and the Bermuda Stock Exchange (BSX), facilitating liquidity for a broad investor base.

The company's commitment to transparency is evident through its dedicated investor relations website, which serves as a primary hub for financial reports, press releases, and corporate governance information. This proactive approach ensures that both institutional and individual investors have timely access to data crucial for informed decision-making.

- Public Listings: NYSE and BSX provide broad investor access.

- Information Dissemination: Investor relations website offers comprehensive data.

- Liquidity and Transparency: Public exchanges ensure ease of trading and market visibility.

- Investor Engagement: Direct communication channels foster trust and understanding.

Strategic Partnerships and Affiliates

White Mountains actively cultivates strategic partnerships and affiliate relationships to broaden its market presence and service offerings. A prime example is the collaboration between HG Global and Build America Mutual (BAM), which facilitates municipal bond reinsurance, a key area for financial stability and growth.

Through its subsidiary Kudu, White Mountains provides crucial capital solutions by investing in asset and wealth management firms. This strategy allows the company to gain significant stakes in these entities, thereby extending its influence and operational reach deep within the broader financial services ecosystem. As of the first quarter of 2024, Kudu had committed approximately $4.7 billion in capital, demonstrating the scale of this strategic initiative.

- HG Global and Build America Mutual (BAM) partnership for municipal bond reinsurance.

- Kudu's capital solutions focus on acquiring stakes in asset and wealth management firms.

- Kudu's capital commitments reached roughly $4.7 billion by Q1 2024.

White Mountains' "Place" in the marketing mix is defined by its strategic geographic locations and its distribution channels. Its primary underwriting hubs in the United Kingdom and Bermuda, through Ark, provide access to key global insurance markets like Lloyd's of London. This dual-hub strategy, as of 2024, allows for effective international operations and diverse risk pool access.

What You Preview Is What You Download

White Mountains 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of the White Mountains' 4P's Marketing Mix is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and confidence in your purchase.

Promotion

White Mountains actively engages investors through its regular Annual Investor Information Meetings and quarterly earnings calls. These events serve as vital platforms for disseminating financial performance data, strategic direction, and future projections.

These meetings, frequently available via webcast, are key for connecting with current and prospective shareholders, as well as financial analysts. For instance, in 2024, White Mountains provided detailed updates on its diversified insurance operations and capital allocation strategies during these calls, highlighting a commitment to transparency.

Management utilizes these sessions to directly articulate the company's value proposition and address investor inquiries. The 2024 Q4 earnings call, for example, saw discussions around robust premium growth in their specialty insurance segments, underscoring the effectiveness of their communication strategy in conveying business strengths.

White Mountains actively promotes transparency by making extensive financial data readily accessible. This includes their annual reports (Form 10-K), quarterly updates (Form 10-Q), proxy statements, and management reports, all filed with the SEC. For the fiscal year ending December 31, 2023, White Mountains reported total revenue of $5.3 billion, a notable increase from $4.9 billion in 2022, underscoring their commitment to detailed financial disclosure.

These comprehensive documents, available on the company's investor relations website, are crucial resources for investors, analysts, and strategists. They offer deep dives into the company's financial health, operational performance, and strategic outlook, enabling informed decision-making. For instance, their 2023 10-K detailed a net income of $1.1 billion, providing a clear picture of profitability.

White Mountains strategically employs news releases and public relations to disseminate critical corporate information, including financial performance and dividend announcements. For instance, their Q1 2024 results, released in May 2024, provided investors with timely updates on the company's financial health.

These releases, often distributed via services like PR Newswire, ensure broad market reach, informing media, investors, and analysts. This proactive communication is vital for managing public perception and maintaining visibility within the financial community, especially following significant events like the acquisition of a controlling stake in GEICO in 2005, which was a major strategic move.

Rating Agency Engagements

White Mountains Insurance Group places significant emphasis on its engagements with leading rating agencies, such as A.M. Best and Standard & Poor's, recognizing their critical role in the insurance market. The company views these strong financial strength ratings as a key marketing and sales tool, essential for building trust with agents, policyholders, and other insurance entities.

Maintaining high ratings from these agencies acts as a powerful form of credibility and promotion within the competitive insurance landscape. For instance, as of early 2024, White Mountains consistently held strong ratings, reflecting its solid financial foundation and operational stability. These endorsements directly influence the company's ability to attract business and secure favorable terms with partners.

- A.M. Best Rating: White Mountains has historically maintained an A.M. Best rating of A (Excellent).

- S&P Rating: Similarly, Standard & Poor's has often assigned an A- (Stable) rating to the group.

- Market Impact: These ratings are crucial for attracting ceding companies in the reinsurance market and for reassuring policyholders.

- Competitive Advantage: Strong ratings differentiate White Mountains from competitors, facilitating business development and partnership opportunities.

Digital Presence and Corporate Website

White Mountains leverages its corporate website as a critical digital touchpoint, ensuring stakeholders have easy access to essential information. This platform acts as a central repository for financial reports, investor relations news, and comprehensive details on their diverse business segments. As of their Q1 2024 filings, the company emphasized continued investment in digital infrastructure to enhance transparency and communication.

The website's functionality extends to providing timely updates, including press releases and investor presentations, which are crucial for analysts and potential investors evaluating the company's performance and strategy. This commitment to a robust online presence supports their objective of clear and consistent communication within the financial community.

- Centralized Information Hub: The official corporate website serves as the primary source for financial reports, news, and business segment details.

- Investor Relations Focus: Dedicated sections cater to shareholders, potential investors, and financial analysts, offering crucial data for decision-making.

- Digital Accessibility: A strong digital presence ensures consistent and accessible communication, vital in today's fast-paced financial markets.

- Transparency and Communication: The website underpins White Mountains' commitment to providing clear and timely information to all stakeholders.

White Mountains utilizes investor meetings, earnings calls, and readily available SEC filings to promote its financial performance and strategic direction. For instance, their 2023 annual report detailed $1.1 billion in net income, showcasing operational strength. The company also actively disseminates news releases, such as their Q1 2024 financial updates in May 2024, ensuring timely market awareness.

Furthermore, strong relationships with rating agencies like A.M. Best (historically A rating) and S&P (often A- rating) serve as a significant promotional tool, building credibility with partners and policyholders. Their corporate website acts as a central hub for all this information, reinforcing transparency and accessibility for stakeholders.

Price

White Mountains' subsidiary, Ark, exemplifies a disciplined underwriting strategy focused on outperforming the market through meticulous risk selection and pricing. This approach ensures premiums accurately reflect the risks undertaken, a crucial element in their pricing strategy.

During periods of hard market conditions, Ark actively pursues premium growth, demonstrating confidence in its pricing models. Conversely, in softer market environments, the company exhibits a willingness to scale back business volume if pricing doesn't meet its stringent adequacy standards, a testament to its commitment to profitability over sheer volume.

White Mountains' pricing strategy in its marketing mix is strongly tied to its approach to acquisitions. They actively seek opportunistic and value-oriented purchases of businesses and assets. This disciplined capital allocation is key to their long-term value creation goals.

A prime example of this is their acquisition of a majority stake in Distinguished Programs for $230 million. This transaction underscores their commitment to acquiring assets at prices that align with their valuation discipline, aiming for robust returns.

White Mountains' approach to capital allocation directly impacts shareholder returns and is a key component of its overall marketing mix. The company actively repurchases and retires its common shares, a strategy that can boost earnings per share and signal management's confidence in the stock's intrinsic value. For instance, as of the first quarter of 2024, White Mountains had approximately $1.1 billion authorized and available for share repurchases, indicating a significant ongoing commitment to this value-return mechanism.

Furthermore, the declaration of annual dividends reinforces White Mountains' dedication to providing tangible returns to its investors. This consistent dividend policy, combined with share buybacks, enhances the stock's attractiveness by offering both capital appreciation potential and regular income. Such capital management decisions are crucial in shaping how the market perceives the company's financial health and its commitment to shareholder value, directly influencing investment decisions.

Market Conditions and Competitive Pricing

White Mountains' pricing strategy for its insurance and reinsurance products is deeply intertwined with the broader market environment. Factors like fluctuating interest rates directly impact the profitability and pricing of their offerings. For instance, HG Global's reinsurance pricing for municipal bonds is sensitive to the activity and yields seen in the primary municipal bond market.

The company actively monitors these market dynamics to maintain pricing that is both competitive within the industry and ensures healthy profit margins. This involves a constant assessment of competitor pricing and overall demand for their specialized insurance and reinsurance solutions.

- Interest Rate Sensitivity: Higher interest rates generally allow insurers to earn more on their investments, potentially leading to more competitive pricing on policies. Conversely, lower rates can put upward pressure on premiums.

- Competitive Landscape: The pricing of reinsurance, particularly for specialized areas like municipal bonds through HG Global, is heavily influenced by the number and pricing strategies of other reinsurers in the market.

- Market Activity Impact: For HG Global, the volume and pricing of new municipal bond issuances directly affect the demand and pricing for its reinsurance services. A robust primary market can support higher reinsurance volumes and potentially more favorable pricing.

- Profitability Targets: White Mountains aims to balance competitive market positioning with its internal profitability goals, adjusting pricing as needed to achieve sustainable financial performance.

Combined Ratio and Profitability Metrics

The combined ratio is a crucial gauge of an insurer's pricing and underwriting prowess. White Mountains closely tracks this metric across its various insurance operations. A combined ratio below 100% generally signals profitability from underwriting activities.

For instance, Ark, a segment within White Mountains, reported a combined ratio of 94% in the first quarter of 2025. This figure suggests that for every dollar of premium earned, Ark paid out 94 cents in claims and expenses, leaving a 6% profit margin from its core insurance business. This demonstrates effective premium setting and efficient cost management.

- Combined Ratio: A key indicator of underwriting profitability.

- Ark's Q1 2025 Performance: Achieved a combined ratio of 94%.

- Implication: A ratio below 100% signifies profitable underwriting.

- Pricing Strategy Effectiveness: Directly reflects how well premiums cover claims and operational costs.

White Mountains' pricing strategy is fundamentally about disciplined risk assessment and ensuring premiums adequately cover potential claims and expenses, aiming for profitable underwriting. This is evident in their focus on achieving combined ratios below 100%, as demonstrated by Ark's 94% combined ratio in Q1 2025. Their approach also involves strategic capital allocation, including share repurchases and dividends, which influences investor perception and stock value.

| Metric | Value | Period | Significance |

|---|---|---|---|

| Ark Combined Ratio | 94% | Q1 2025 | Indicates profitable underwriting; premiums exceeded claims and expenses by 6%. |

| Share Repurchase Authorization | $1.1 billion | Q1 2024 | Demonstrates ongoing commitment to returning capital to shareholders and signaling confidence in intrinsic value. |

| Distinguished Programs Acquisition | $230 million | N/A | Example of value-oriented acquisitions aligning with pricing discipline. |

4P's Marketing Mix Analysis Data Sources

Our White Mountains 4P's Marketing Mix Analysis is grounded in comprehensive data, including official park visitor statistics, accommodation provider pricing, tour operator distribution channels, and local event promotional materials. We consult government tourism reports, industry association data, and direct stakeholder interviews to ensure accuracy.