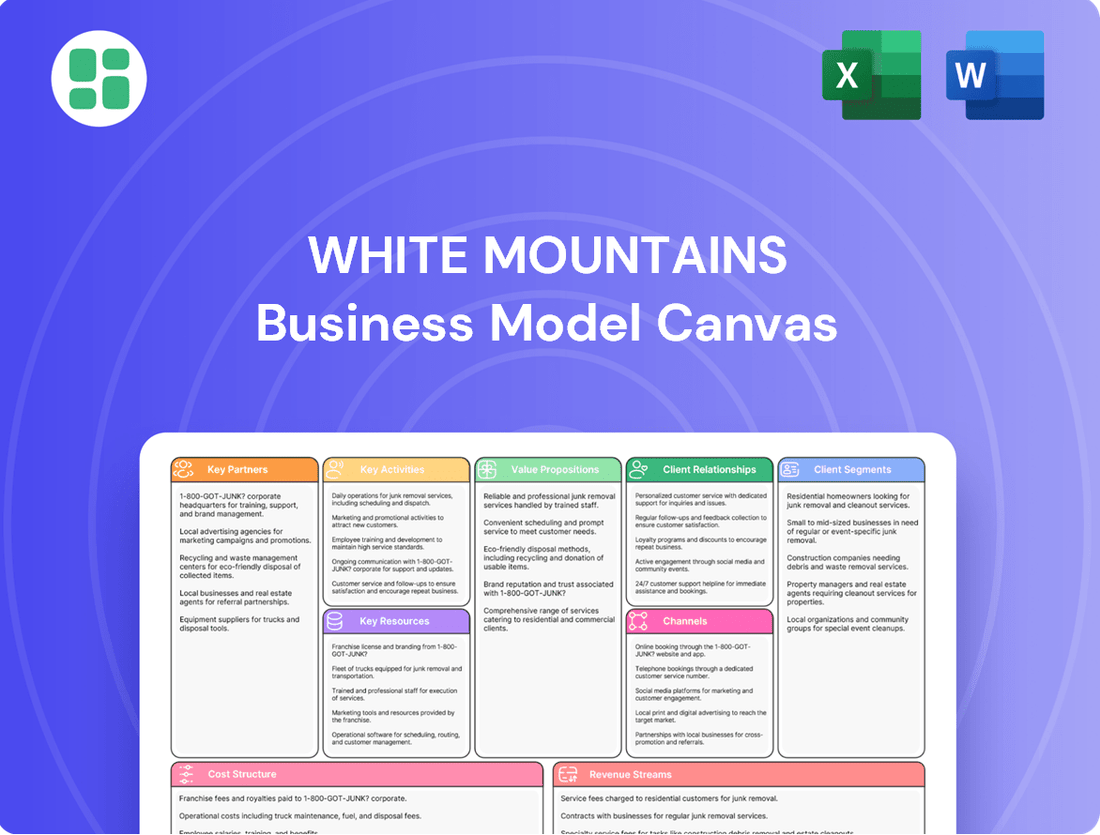

White Mountains Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

White Mountains Bundle

Unlock the full strategic blueprint behind White Mountains's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

White Mountains strategically acquires majority interests in specialty Managing General Agents (MGAs) and program administrators. For instance, their acquisition of Distinguished Programs and previous investment in Bamboo Ide8 Insurance Services highlight this focus. These moves are designed to broaden their footprint in specialized property and casualty insurance sectors, capitalizing on the MGA's unique underwriting knowledge and established distribution channels.

White Mountains' operating subsidiaries, including Ark and Bamboo, depend heavily on reinsurance providers to manage and reduce underwriting risks, particularly for severe events like natural disasters. These partnerships are essential for capital efficiency and financial stability, enabling the companies to underwrite more policies by transferring substantial potential losses.

For instance, the renewal of quota share reinsurance agreements with entities like Outrigger Re Ltd. underscores the continuous importance of these relationships. In 2023, White Mountains reported that its reinsurance segment, which includes these partnerships, contributed significantly to its overall financial performance, demonstrating the vital role reinsurance plays in their business model.

White Mountains actively collaborates with specialized financial advisory and legal firms to execute its acquisition and investment strategies. These partnerships are crucial for thorough due diligence, transaction structuring, and ensuring full regulatory compliance, especially within the complex M&A landscape.

For instance, in 2023, White Mountains' acquisition of Distinguished Programs involved significant legal support from firms like Skadden, Arps, Slate, Meagher & Flom LLP and Affiliates, demonstrating the reliance on expert external counsel for navigating intricate deal terms and legal frameworks.

Co-investors and Capital Partners

White Mountains strategically engages with co-investors and capital partners for significant investments, enhancing its capital deployment capabilities and risk diversification. For example, in the Distinguished Programs transaction, Aquiline Capital Partners was a key co-investor. Similarly, Ethos Capital and the British Columbia Investment Management Corporation partnered with White Mountains on the BroadStreet Partners deal.

These collaborations are instrumental in managing larger and more intricate transactions. They also grant White Mountains access to broader expertise and extensive networks, extending its investment reach beyond solely owned entities.

- Co-investment Examples: Aquiline Capital Partners (Distinguished Programs), Ethos Capital and BC Investment Management Corporation (BroadStreet Partners).

- Benefits of Partnerships: Shared capital deployment, diversified investment risk, access to additional expertise and networks.

- Strategic Importance: Crucial for large or complex transactions and expanding investment reach.

Technology and Data Analytics Providers

White Mountains, through its portfolio companies, fosters crucial relationships with technology and data analytics providers. These collaborations are fundamental to their ‘tech-driven underwriting’ approach, as seen with entities like Bamboo. This reliance on advanced technological infrastructure allows for more precise risk assessment and streamlined operations.

These partnerships are not always formalized as traditional agreements but represent a deep integration of external technological capabilities. For instance, the adoption of state-of-the-art platforms by subsidiaries enhances their ability to process vast amounts of data efficiently, leading to more accurate pricing and product development.

The benefits derived from these relationships are significant, directly impacting competitive advantage. By leveraging sophisticated analytics, companies can improve policy administration, reduce operational costs, and deliver a superior customer experience, which is vital in today's insurance market.

- Enhanced Risk Assessment: Access to advanced data analytics tools enables more granular and accurate underwriting, potentially reducing claims costs.

- Operational Efficiency: State-of-the-art technology platforms streamline policy issuance, claims processing, and customer service, lowering administrative expenses.

- Improved Customer Experience: Data-driven insights allow for personalized product offerings and faster, more responsive customer interactions.

- Competitive Differentiation: Companies that effectively integrate technology and data analytics gain a significant edge in market responsiveness and innovation.

White Mountains cultivates vital relationships with reinsurance partners to manage risk and optimize capital. These collaborations are crucial for underwriting capacity and financial stability, especially in the face of catastrophic events.

Key partnerships with reinsurers ensure that the company can absorb potential losses, thereby allowing for greater policy underwriting. For example, in 2023, the company's reinsurance segment played a substantial role in its financial performance, highlighting the strategic importance of these arrangements.

The company also relies on specialized legal and financial advisors for executing acquisitions and investments. These expert partnerships are indispensable for navigating complex due diligence, structuring deals, and ensuring regulatory adherence in the M&A process.

Furthermore, White Mountains engages co-investors and capital partners for substantial transactions, bolstering capital deployment and diversifying investment risk. For instance, Aquiline Capital Partners co-invested in the acquisition of Distinguished Programs, while Ethos Capital and BC Investment Management Corporation partnered on the BroadStreet Partners deal in 2023.

| Partnership Type | Key Partners (Examples) | Strategic Importance | Financial Impact (2023 Data) |

|---|---|---|---|

| Reinsurance Providers | Outrigger Re Ltd. (renewals) | Risk management, capital efficiency, underwriting capacity | Reinsurance segment contributed significantly to overall financial performance. |

| M&A Advisors | Skadden, Arps, Slate, Meagher & Flom LLP and Affiliates (legal) | Due diligence, transaction structuring, regulatory compliance | Facilitated complex acquisitions like Distinguished Programs. |

| Co-investors/Capital Partners | Aquiline Capital Partners, Ethos Capital, BC Investment Management Corporation | Capital deployment, risk diversification, enhanced investment reach | Enabled larger transactions such as Distinguished Programs and BroadStreet Partners. |

What is included in the product

A detailed White Mountains Business Model Canvas outlining key customer segments, value propositions, and revenue streams, designed for strategic planning and investor presentations.

Saves hours of formatting and structuring your own business model, allowing businesses to quickly pinpoint and address their most pressing challenges.

Activities

White Mountains' key activities center on a disciplined approach to acquiring and managing financial services businesses, with a particular focus on insurance and related sectors. This involves meticulous due diligence and strategic negotiation to secure value-oriented opportunities. The company's success hinges on its ability to integrate these acquired entities effectively, fostering long-term growth within its diverse portfolio.

White Mountains' core activity revolves around disciplined capital allocation, strategically deploying its undeployed capital into new acquisitions and enhancing its existing portfolio companies. This strategic deployment is crucial for growth and value creation.

Beyond acquisitions, the company actively manages a diversified investment portfolio. This portfolio includes a mix of fixed income and equity securities, designed to generate returns and provide crucial support for its insurance operations.

In 2023, White Mountains' investment portfolio generated $1.2 billion in net investment income, a significant contribution to its overall financial performance and a testament to their active risk management and return optimization strategies.

White Mountains, through subsidiaries like Ark and Bamboo, actively underwrites specialty property and casualty insurance and reinsurance. This core activity involves meticulous risk assessment, precise policy pricing, and efficient claims management across diverse, often complex, insurance lines.

The company's strategy centers on niche markets and program-driven business, where their expertise allows for focused growth. In 2024, White Mountains continued to emphasize strong underwriting discipline, a key driver for achieving profitable outcomes in these specialized segments.

Providing Capital Solutions for Asset and Wealth Managers

The Kudu segment is central to White Mountains' strategy by offering crucial capital solutions tailored for asset and wealth management firms. This includes facilitating generational ownership transitions, supporting management buyouts, and providing growth capital to these specialized financial businesses worldwide.

This key activity involves a rigorous process of identifying and assessing promising investment opportunities within the asset and wealth management sector. Kudu doesn't just provide capital; it actively engages in offering strategic guidance and operational support to the firms it invests in, aiming to enhance their long-term success and value.

- Capital Solutions Offered: Kudu provides capital for generational ownership transfers, management buyouts, and growth financing.

- Target Market: Boutique asset and wealth management firms globally.

- Strategic Involvement: Kudu evaluates investment opportunities and offers strategic assistance to its portfolio companies.

Financial Reporting and Investor Relations

White Mountains engages in rigorous financial reporting, a cornerstone of its operations. This includes the timely dissemination of quarterly and annual reports, ensuring shareholders and the public have access to accurate financial data. In 2024, the company continued its commitment to transparency, providing detailed insights into its performance and strategic direction.

Maintaining robust investor relations is paramount. This involves proactive communication with shareholders, potential investors, and financial analysts to clearly articulate financial performance, strategic objectives, and future outlook. These efforts are crucial for building trust and ensuring fair valuation in the market.

- Financial Reporting: Regular issuance of 10-Q (quarterly) and 10-K (annual) filings with the SEC.

- Investor Communications: Hosting earnings calls and investor days to discuss financial results and strategy.

- Analyst Engagement: Providing information to financial analysts to facilitate their coverage and understanding of the company.

- Shareholder Meetings: Conducting annual shareholder meetings to address governance and strategic matters.

White Mountains' key activities are multifaceted, encompassing disciplined acquisition and management of financial services businesses, particularly in insurance. This involves rigorous due diligence and strategic integration to foster growth within its portfolio. The company also actively manages a diversified investment portfolio, generating significant net investment income, as evidenced by the $1.2 billion earned in 2023.

Furthermore, White Mountains underwrites specialty insurance and reinsurance through subsidiaries like Ark and Bamboo, focusing on niche markets and profitable underwriting. The Kudu segment provides essential capital solutions to asset and wealth management firms, aiding transitions and growth. Crucially, the company maintains transparency through robust financial reporting and active investor relations, ensuring clear communication of its performance and strategy.

| Key Activity | Description | Supporting Data/Focus |

| Acquisition & Management | Acquiring and managing financial services businesses, especially insurance. | Disciplined due diligence and integration. |

| Investment Portfolio Management | Managing a diversified portfolio of securities. | Generated $1.2 billion in net investment income in 2023. |

| Underwriting | Specialty P&C insurance and reinsurance underwriting. | Focus on niche markets and program business; strong underwriting discipline in 2024. |

| Capital Solutions (Kudu) | Providing capital to asset and wealth management firms. | Facilitating ownership transitions, MBOs, and growth capital. |

| Financial Reporting & Investor Relations | Ensuring transparency and communication. | Commitment to detailed reporting and engagement in 2024. |

Preview Before You Purchase

Business Model Canvas

The White Mountains Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the complete, professionally formatted canvas exactly as it will be delivered, ready for immediate use. There are no altered sections or simplified samples; what you see is precisely what you'll get.

Resources

White Mountains' substantial financial capital, including its undeployed cash, is a crucial key resource. As of the first quarter of 2024, the company reported approximately $1.1 billion in cash and cash equivalents, providing significant dry powder for strategic initiatives.

This robust capital base allows White Mountains to act decisively on opportunistic acquisitions and investments, a core element of its business model. The flexibility afforded by this financial strength enables the company to pursue new ventures and bolster the growth trajectories of its existing portfolio companies, fueling its strategic expansion.

White Mountains' core strength lies in its diverse portfolio of operating companies and subsidiaries. These include notable entities like Ark, HG Global, Kudu, and Bamboo, each a specialist in its own insurance and financial services niche.

These subsidiaries are not just holdings; they are vital contributors, bringing specialized expertise, established market access, and robust operations. This collective strength directly fuels White Mountains' overall value and generates diverse revenue streams.

For instance, Ark, a significant player in the specialty insurance market, reported gross written premiums of approximately $2.5 billion in 2023, showcasing the substantial revenue-generating capacity within the portfolio.

White Mountains' strength lies in its experienced management teams and skilled underwriting talent. These individuals bring a wealth of industry knowledge and strategic foresight, crucial for navigating the complexities of the insurance sector.

This human capital is essential for identifying lucrative opportunities and effectively managing the inherent risks within their diverse portfolio of businesses. Their expertise directly contributes to the company's operational excellence and overall performance.

For instance, in 2024, White Mountains continued to leverage this talent to drive growth in its specialty insurance segments, demonstrating the tangible impact of seasoned leadership on financial results.

Proprietary Technology Platforms and Data Analytics

White Mountains leverages proprietary technology platforms and advanced data analytics as crucial resources. These capabilities are fundamental to their strategy, enabling more efficient operations and sharper insights into risk. For instance, their investment in technology allows for sophisticated underwriting processes, which is vital in today's competitive insurance market.

The development and access to modern technology platforms, coupled with robust data analytics, are increasingly becoming a defining factor for success. Companies like Bamboo, a part of White Mountains' portfolio, showcase how these tools facilitate precise risk selection and streamlined operations. This technological backbone provides a significant competitive advantage, particularly as the insurance industry continues its digital transformation.

- Enhanced Underwriting Efficiency: Advanced analytics allow for faster and more accurate risk assessments, reducing manual effort and improving policy pricing.

- Precise Risk Selection: Data-driven insights enable the identification and mitigation of potential risks, leading to a healthier risk pool.

- Streamlined Operations: Technology platforms automate and optimize various business processes, from policy issuance to claims handling, boosting overall productivity.

- Tailored Product Development: Analytics help understand customer needs and market trends, facilitating the creation of customized insurance products.

Strong Investment Portfolio

White Mountains boasts a substantial and diversified investment portfolio, a cornerstone of its business model. This includes a mix of fixed income and equity securities, crucial for generating steady investment income and bolstering overall financial stability.

Managed by White Mountains Advisors, the portfolio's primary objective is to achieve a total return. This strategy carefully balances the needs of both policyholders and shareholders, ensuring the company's long-term health.

- Investment Income Generation: The portfolio's primary function is to produce investment income, which directly contributes to White Mountains' profitability and financial resilience.

- Diversification Strategy: Holding a broad range of assets across different sectors and geographies helps mitigate risk and capture various market opportunities.

- Asset Allocation: White Mountains Advisors actively manages the allocation of capital between different asset classes, such as bonds and stocks, to optimize risk-adjusted returns.

- Financial Stability Support: The strength and performance of the investment portfolio are vital for maintaining the company's financial stability and its ability to meet its obligations.

White Mountains' key resources include its significant financial capital, a diverse portfolio of operating companies like Ark and HG Global, experienced management and underwriting talent, proprietary technology platforms, and a substantial investment portfolio. These elements collectively enable the company to pursue strategic growth, manage risk effectively, and generate consistent returns.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Financial Capital | Undeployed cash and cash equivalents for strategic initiatives. | Approx. $1.1 billion in cash and equivalents (Q1 2024). |

| Operating Companies | Specialized insurance and financial services entities. | Ark reported $2.5 billion in gross written premiums (2023). |

| Human Capital | Experienced management teams and skilled underwriting talent. | Continued leveraging of talent for growth in specialty insurance segments (2024). |

| Technology & Analytics | Proprietary platforms for efficient operations and risk insights. | Enabling sophisticated underwriting and precise risk selection. |

| Investment Portfolio | Diversified mix of fixed income and equity securities. | Managed by White Mountains Advisors for total return. |

Value Propositions

White Mountains is dedicated to a disciplined approach to capital allocation, focusing on strategic acquisitions and enhancing operational performance to generate enduring shareholder value. This commitment resonates with investors prioritizing a financial services holding company that emphasizes sustainable growth and judicious investment strategies.

The company's strategy centers on identifying and executing value-enhancing opportunities, a core tenet for its long-term prosperity. For instance, in 2023, White Mountains completed the acquisition of a significant stake in Great American Insurance Group, a move designed to bolster its diversified portfolio and future earnings potential.

White Mountains, through its subsidiaries like Ark and Distinguished Programs, offers crucial access to specialized insurance sectors. These areas, often overlooked by larger insurers, cater to unique and complex risks, providing tailored solutions that are highly valued by brokers and agents seeking to serve specific client needs.

This strategic positioning allows White Mountains to tap into markets that may be less sensitive to broad economic cycles, offering a degree of diversification. For instance, in 2024, the specialty insurance market continued to demonstrate resilience, with certain segments reporting robust growth as demand for tailored coverage persisted.

The Kudu segment of White Mountains provides crucial capital solutions and strategic support specifically tailored for asset and wealth management firms. This segment acts as a vital partner, facilitating ownership transitions, management buyouts, and fueling growth strategies for these specialized financial businesses.

This offering is particularly valuable for boutique firms looking to navigate complex ownership changes or secure the capital needed for expansion. By providing both financial backing and strategic guidance, Kudu empowers these firms to achieve their long-term objectives.

For instance, in 2024, White Mountains has continued to actively deploy capital into the asset management sector through Kudu, supporting firms in their succession planning and growth phases. This strategic investment underscores the segment's commitment to fostering stability and progress within the independent asset management community.

Operational Excellence and Risk Management Expertise

White Mountains Insurance Group focuses on achieving operational excellence across its diverse portfolio of insurance businesses. This dedication ensures efficient processes, from underwriting to claims handling, which is crucial for maintaining profitability and customer satisfaction.

Their robust risk management expertise is a cornerstone of their business model, enabling them to navigate the complexities of the insurance market. This involves sophisticated modeling and a disciplined approach to capital allocation, safeguarding both policyholders and shareholders.

In 2024, White Mountains continued to demonstrate this through its strategic acquisitions and capital deployment. For instance, their continued investment in businesses like Esurance and the acquisition of National General Holdings have been managed with a keen eye on operational synergy and risk mitigation.

- Operational Efficiency: Streamlined underwriting and claims processes contribute to a lower expense ratio, enhancing profitability.

- Risk Mitigation: Advanced analytics and diversification across different insurance lines help manage exposure to catastrophic events.

- Financial Prudence: Disciplined capital management and a focus on long-term value creation ensure stability.

- Portfolio Strength: Strategic investments and acquisitions bolster the overall resilience and earning potential of the group.

Efficient Distribution and Technology-Enabled Services

White Mountains' value proposition centers on efficient distribution and technology-enabled services, particularly evident through its Managing General Agent (MGA) investments. For instance, Bamboo and Distinguished Programs utilize established networks of independent agents and brokers, ensuring broad market reach and customer access.

These partnerships are amplified by technology. White Mountains integrates advanced underwriting platforms that significantly speed up and improve the accuracy of policy issuance and ongoing administration. This technological backbone creates a smoother, more responsive experience for both their distribution partners and the end policyholders.

In 2024, this focus on efficiency is crucial. The insurance industry is increasingly competitive, and streamlined operations directly translate to cost savings and improved customer satisfaction. For example, by reducing manual processes, technology-enabled underwriting can lower operational expenses, allowing for more competitive pricing or higher profit margins.

- Efficient Distribution: Partnerships with independent agents and brokers through MGAs like Bamboo and Distinguished Programs.

- Technology Integration: Use of advanced underwriting platforms for faster, more accurate policy processes.

- Streamlined Experience: Enhanced speed and accuracy benefit both distribution partners and customers.

White Mountains provides access to specialized insurance markets through its subsidiaries, catering to complex risks with tailored solutions. This strategy allows them to operate in less economically sensitive niches, offering diversification. For instance, in 2024, the specialty insurance sector continued to show strength, with certain segments experiencing growth due to sustained demand for customized coverage.

Customer Relationships

White Mountains cultivates deep partnerships with the leadership of its acquired companies, frequently keeping existing management in place and allowing them to retain equity stakes. This strategy, evident in their long-term approach to acquisitions, fosters continuity and ensures that the interests of management are aligned with White Mountains' strategic goals. For instance, their acquisition of Esurance in 2011 saw a continued focus on leveraging the existing management's expertise, a model that has proven successful across their diverse portfolio.

White Mountains' insurance subsidiaries rely heavily on their network of independent agents and brokers to get their specialized products to market. These partnerships are the backbone of their distribution strategy, allowing them to access a wide range of customers across different geographies.

For instance, in 2024, the independent agent channel remained a dominant force in specialty insurance distribution, with many of White Mountains' portfolio companies leveraging this established network to place complex risks. This model fosters deep market penetration and allows for tailored solutions that resonate with specific client needs.

Kudu cultivates robust relationships with the leaders of specialized asset and wealth management firms. They offer customized capital solutions and continuous strategic guidance, fostering long-term partnerships built on shared growth and value creation.

These are not just transactional engagements; Kudu aims for deeply collaborative partnerships. This approach ensures alignment of interests and a commitment to mutual success, a strategy that has proven effective in the competitive landscape of asset management.

For instance, in 2024, Kudu continued to deepen its engagement with key principals, providing capital that supported several firms in expanding their product offerings and client bases. This direct engagement is a cornerstone of their strategy, differentiating them from more passive capital providers.

Investor and Shareholder Engagement

White Mountains actively cultivates relationships with its investors and shareholders through consistent financial reporting and dedicated investor information meetings. This proactive approach ensures stakeholders remain thoroughly informed regarding the company's financial performance, strategic direction, and future prospects, fostering trust and transparency.

The company's commitment to open communication is evident in its detailed quarterly and annual reports, which provide a comprehensive overview of operations and financial health. For instance, as of the first quarter of 2024, White Mountains reported total revenue of $1.2 billion, demonstrating consistent operational output for its stakeholders to review.

- Regular Financial Reporting: Dissemination of quarterly and annual financial statements.

- Investor Information Meetings: Hosting calls and webcasts to discuss performance and strategy.

- Transparent Communication: Providing clear updates on company developments and outlook.

- Shareholder Value Focus: Demonstrating commitment to delivering long-term returns.

Client-Centric Approach for Specialty Insurance

White Mountains' specialty insurance segment, while largely operating through intermediaries like brokers and agents, fundamentally prioritizes a client-centric philosophy. This means that even though direct interaction might be limited, the focus remains on understanding and meeting the specific needs of the end customer.

This approach translates into developing highly tailored insurance products designed for niche markets, ensuring that policyholders receive coverage that precisely matches their unique risks. For instance, in 2024, the company continued to refine its offerings in areas like workers' compensation for specialized industries, where standard policies often fall short.

The effectiveness of this client-centric model is indirectly measured by customer satisfaction and retention, driven by the quality of products and the efficiency of claims handling provided by its various subsidiaries. A positive experience, even if mediated, builds trust and encourages long-term relationships.

- Tailored Coverage: Developing niche insurance products that precisely fit specific client risks.

- Intermediary Focus: Leveraging brokers and agents to deliver client-centric solutions.

- Claims Excellence: Ensuring efficient and effective claims management to build trust.

- Indirect Satisfaction: Fostering client loyalty through the quality of services offered by subsidiaries.

White Mountains cultivates a strong relationship with its investors through transparent financial reporting and dedicated investor relations efforts, ensuring stakeholders are well-informed about performance and strategy. This commitment to clear communication fosters trust and supports long-term shareholder value. For instance, in Q1 2024, White Mountains reported $1.2 billion in revenue, providing a solid data point for investor analysis.

| Relationship Type | Key Engagement Strategy | Example/Data Point (2024) |

|---|---|---|

| Acquired Company Leadership | Retaining management, equity stakes, strategic guidance | Focus on continuity and aligned interests |

| Independent Agents & Brokers | Building strong distribution networks | Dominant channel for specialty insurance placement |

| Asset/Wealth Management Principals | Customized capital, strategic partnership | Deepened engagement supporting expansion |

| Investors & Shareholders | Transparent reporting, investor meetings | Q1 2024 Revenue: $1.2 billion |

Channels

White Mountains primarily leverages strategic acquisitions and direct equity investments as its core channels for expansion and market penetration. This approach involves directly engaging with target companies and their stakeholders to secure controlling or substantial ownership stakes, thereby broadening its investment portfolio and overall market presence.

In 2024, White Mountains continued to execute this strategy, notably with its acquisition of a majority stake in Great American Insurance Group, a move that significantly bolstered its presence in the property and casualty insurance sector. This direct investment exemplifies their commitment to hands-on growth and integrating valuable assets into their existing structure.

White Mountains heavily relies on independent agents and brokers as its key distribution channel for property and casualty insurance. This network is crucial for reaching a broad customer base across the United States.

Through Managing General Agents (MGAs) such as Distinguished Programs and Bamboo, White Mountains effectively utilizes these independent intermediaries. These agents are the primary point of contact for policyholders, facilitating the placement of insurance coverage.

In 2024, the insurance industry continued to see a strong reliance on independent agents, with surveys indicating that a significant majority of consumers still prefer working with an agent for complex insurance needs. This trend underscores the continued importance of this channel for White Mountains' business model.

Kudu's capital solutions are directly offered to asset and wealth management firms. This means Kudu actively reaches out to the leaders of these businesses to discuss their capital needs and potential partnerships.

The process involves direct negotiation and building ongoing relationships with the management teams of these financial advisory firms. This direct approach ensures tailored solutions and a clear understanding of each firm's unique situation.

For instance, in 2024, Kudu continued to focus on this direct engagement model, facilitating capital raises for numerous independent advisory firms. This strategy has proven effective in identifying and supporting growth-oriented businesses within the financial services sector.

Investor Relations Platforms and Corporate Website

White Mountains effectively communicates with its investor base and the wider financial community through its dedicated investor relations platforms and corporate website. These digital channels serve as the primary conduit for disseminating crucial company information.

Key information shared includes detailed financial reports, investor presentations, and timely company news, ensuring transparency and accessibility. In 2024, the company continued to leverage these platforms to provide up-to-date insights into its performance and strategic direction.

- Investor Relations Website: A central hub for all investor-related materials, including financial statements, SEC filings, and management presentations.

- Press Releases: Official announcements regarding significant company events, financial results, and strategic initiatives are distributed promptly.

- SEC Filings: All required regulatory filings, such as 10-K and 10-Q reports, are made available, offering comprehensive financial data and disclosures.

Reinsurance Markets and Brokers

White Mountains primarily interacts with other insurers and reinsurers to manage its risk through reinsurance treaties. These relationships are often facilitated by specialized reinsurance brokers, who are key intermediaries in this market.

This channel is fundamental for White Mountains' Ark/WM Outrigger segment, enabling effective risk transfer and robust capital management. For instance, in 2024, the reinsurance market continued to be a critical component for insurers seeking to offload specific risks, particularly in catastrophe-exposed lines.

- Reinsurance Brokers: Act as essential intermediaries, connecting White Mountains with a broad network of reinsurers.

- Risk Transfer: This channel allows White Mountains to transfer portions of its insurance portfolio risks, thereby protecting its capital base.

- Capital Management: By strategically utilizing reinsurance, White Mountains optimizes its capital allocation and enhances its financial stability.

- Market Access: Brokers provide access to diverse reinsurance capacity and expertise, crucial for effectively placing complex treaties.

White Mountains utilizes a multi-faceted channel strategy, prioritizing direct acquisitions and equity investments for portfolio expansion. This is complemented by a robust network of independent agents and brokers for its property and casualty insurance distribution. Additionally, capital solutions are directly offered to asset and wealth management firms via Kudu, and reinsurance treaties are managed through specialized brokers.

In 2024, White Mountains' direct investment in Great American Insurance Group exemplified its acquisition channel, significantly boosting its P&C segment. The reliance on independent agents remained strong, with industry data in 2024 showing continued consumer preference for agents for complex insurance needs. Kudu's direct engagement with financial advisory firms for capital raises also continued to be a key strategy.

| Channel | Description | 2024 Focus/Data Point |

|---|---|---|

| Direct Acquisitions & Equity Investments | Strategic purchases of controlling or substantial stakes in companies. | Majority stake acquisition in Great American Insurance Group. |

| Independent Agents & Brokers | Distribution network for property and casualty insurance. | Continued strong reliance, with consumer preference for agents noted in industry surveys. |

| Kudu Capital Solutions | Direct offerings to asset and wealth management firms. | Facilitated capital raises for numerous independent advisory firms. |

| Reinsurance Treaties | Risk management through agreements with reinsurers, facilitated by brokers. | Critical for Ark/WM Outrigger segment, with the reinsurance market remaining vital for risk transfer. |

Customer Segments

Shareholders and institutional investors are a core customer segment for White Mountains. They are primarily looking for consistent, long-term value creation driven by disciplined capital allocation and strategic investments in diversified financial services businesses. For instance, as of the first quarter of 2024, White Mountains reported a book value per share of $65.54, reflecting ongoing efforts to grow shareholder equity.

White Mountains, through its specialized operating companies such as Ark, Bamboo, and Distinguished Programs, targets policyholders within distinct niche and specialty property and casualty insurance sectors. These segments often possess complex or unusual risk characteristics, requiring tailored insurance solutions.

Key areas of focus include commercial real estate, hospitality, cyber risks, environmental liability, and homeowners insurance. This strategic approach allows White Mountains to effectively serve clients with unique needs that may not be adequately met by broader market offerings.

The Kudu segment specifically partners with boutique asset and wealth management firms worldwide. These firms are typically looking for capital to fund key initiatives like ownership changes, management buyouts, strategic acquisitions, or to fuel general business expansion.

These boutique firms often prioritize finding a capital partner who can offer long-term support without exerting controlling influence over their operations. This approach allows them to maintain their unique culture and strategic direction.

As of early 2024, the wealth management industry continues to see consolidation, with many smaller firms exploring strategic capital injections to remain competitive against larger players. This trend highlights the demand for partners like Kudu.

Municipal Entities and Public Finance Obligors

The HG Global segment, via its reinsurance arrangement with Build America Mutual (BAM), directly engages with municipal entities and various public finance obligors. These clients rely on BAM’s municipal bond insurance to bolster their creditworthiness and improve their access to capital markets.

This insurance offering is particularly crucial for public finance obligors as it aims to mitigate risks associated with debt issuance. By securing municipal bond insurance, these entities can often achieve more favorable interest rates, thereby reducing the overall cost of borrowing for public infrastructure projects and services.

Key benefits for these customer segments include:

- Enhanced Credit Quality: Municipal bond insurance, reinsured by HG Global, strengthens the perceived creditworthiness of the issuer.

- Improved Market Access: Insured municipal bonds often attract a broader investor base, facilitating easier and more efficient capital raising.

- Lower Borrowing Costs: The credit enhancement provided by insurance can lead to lower yields on municipal debt, saving public entities significant funds over the life of the bonds.

- Greater Investor Confidence: Insurance provides a layer of security that can boost investor confidence, especially for issuers with less established credit profiles.

Independent Insurance Agents and Brokers

Independent insurance agents and brokers are a cornerstone for White Mountains, acting as the primary channel for their specialized insurance offerings. These intermediaries depend on White Mountains' subsidiaries for robust products, streamlined underwriting processes, and dependable assistance to effectively cater to their diverse clientele.

In 2024, the specialty insurance market continued to demonstrate resilience, with independent agents playing a crucial role in navigating its complexities. These agents are vital for White Mountains' reach, connecting its niche insurance solutions with the appropriate policyholders.

- Distribution Network: Independent agents and brokers form a critical part of White Mountains' go-to-market strategy, enabling access to specialized insurance segments.

- Product Access: They provide policyholders with access to White Mountains' unique and competitive specialty insurance products.

- Client Service: These partners leverage White Mountains' underwriting expertise and support to deliver tailored solutions to their clients.

- Market Insight: Their on-the-ground experience offers valuable feedback for product development and market adaptation.

White Mountains serves a diverse set of customer segments, each with unique needs and motivations. These include shareholders seeking long-term value, policyholders in specialized insurance niches, boutique asset management firms needing capital, municipal entities requiring credit enhancement, and independent insurance agents acting as distribution partners.

The company's strategy is to provide tailored solutions and capital through its various operating segments, addressing specific market demands across financial services and insurance.

For instance, in Q1 2024, White Mountains reported a book value per share of $65.54, indicating a focus on shareholder value. Simultaneously, the demand for capital by boutique wealth management firms, as highlighted by industry consolidation trends in early 2024, underscores the relevance of the Kudu segment's offerings.

| Customer Segment | Needs Addressed | White Mountains' Offering | Example Data/Context (2024) |

|---|---|---|---|

| Shareholders/Institutional Investors | Long-term value creation, disciplined capital allocation | Strategic investments in diversified financial services | Book value per share: $65.54 (Q1 2024) |

| Niche Policyholders (via Ark, Bamboo, etc.) | Tailored insurance for complex/unusual risks | Specialized property and casualty insurance products | Focus on commercial real estate, hospitality, cyber, environmental |

| Boutique Asset/Wealth Managers (via Kudu) | Capital for growth, ownership changes, acquisitions | Long-term capital partnership without control | Industry consolidation driving demand for capital |

| Municipal Entities/Public Finance Obligors (via HG Global/BAM) | Enhanced creditworthiness, improved market access, lower borrowing costs | Municipal bond insurance (reinsured by HG Global) | Mitigates debt issuance risks for infrastructure projects |

| Independent Insurance Agents/Brokers | Robust products, streamlined underwriting, dependable assistance | Access to specialized insurance solutions, market insight | Crucial distribution channel for niche insurance markets |

Cost Structure

White Mountains' cost structure is significantly influenced by the expenses tied to acquiring and integrating new businesses. These costs encompass substantial outlays for legal counsel, thorough due diligence processes, and fees paid to investment bankers who facilitate these transactions.

The capital deployed for these acquisitions represents a major component of their investment costs. For instance, in 2023, White Mountains completed the acquisition of a majority stake in New Hampshire Mutual Bancorp for $135 million, highlighting the significant capital commitment involved in their growth strategy.

For White Mountains' insurance and reinsurance segments, the primary cost drivers are underwriting expenses, which cover the costs of assessing and accepting risk, and loss adjustment expenses, related to investigating and settling claims. The most substantial cost, however, is the actual payment of claims, a variable expense directly tied to the frequency and severity of insured events.

In 2024, managing these costs effectively is paramount. White Mountains' strategy relies heavily on robust risk management practices and strategic reinsurance purchasing to mitigate the impact of these variable expenses. For instance, a well-structured reinsurance program can significantly reduce the company's exposure to large, unexpected losses.

General and Administrative Expenses at White Mountains encompass the operational costs of the holding company and its various subsidiaries. These include essential expenditures like employee salaries and benefits, the upkeep of office spaces, and the maintenance of technology infrastructure. The company actively works to keep these overheads lean, aiming for efficiency across its diverse portfolio.

Reinsurance Premiums and Ceding Commissions

White Mountains incurs significant costs by purchasing reinsurance to transfer risk, a crucial element in managing its insurance operations. These reinsurance premiums represent a major expense category for the company's insurance segments. For instance, in 2024, the company's focus on specialty insurance lines likely means substantial premium outflows for risk mitigation.

While ceding commissions, paid by reinsurers to the primary insurer, help to offset some of these reinsurance costs, the net expense remains a key financial consideration. These commissions are essentially a fee for the business ceded to the reinsurer. The net cost of reinsurance directly impacts the profitability and capital efficiency of White Mountains' underwriting activities.

- Reinsurance Premiums: A primary cost driver for underwriting segments.

- Ceding Commissions: Act as a partial offset to reinsurance premium costs.

- Net Reinsurance Cost: A critical metric for profitability and risk management.

- 2024 Impact: Ongoing strategic positioning in specialty insurance influences these cost dynamics.

Investment Management and Advisory Fees

Investment management and advisory fees are a significant component of White Mountains' cost structure. These expenses cover the costs associated with overseeing and growing the company's diverse investment portfolio. This includes payments to both internal teams responsible for investment strategy and external advisors who provide specialized expertise.

These fees are crucial for optimizing investment returns, which in turn, fund the company's operations and growth initiatives. For instance, in 2024, White Mountains continued to strategically allocate capital across various asset classes, necessitating robust management and advisory services to ensure performance targets are met.

Key aspects of this cost category include:

- External Advisor Fees: Payments to third-party firms for specialized investment research, asset allocation, and portfolio management.

- Internal Management Costs: Salaries, benefits, and operational expenses for White Mountains' in-house investment professionals.

- Performance-Based Fees: Potential additional fees paid to advisors or managers based on achieving specific investment benchmarks or return thresholds.

- Research and Data Subscriptions: Costs for accessing market data, analytical tools, and research reports essential for informed investment decisions.

White Mountains' cost structure is heavily weighted towards expenses related to acquisitions, including due diligence, legal fees, and investment banker compensation. The company also incurs significant costs in its insurance operations, primarily underwriting expenses and claims payments, which are variable and depend on insured events. In 2024, managing these costs involves robust risk management and strategic reinsurance, with premiums for risk transfer being a major expense. Investment management fees, covering both internal teams and external advisors, are also crucial for portfolio growth and operational funding.

| Cost Category | Description | 2023/2024 Relevance |

|---|---|---|

| Acquisition Costs | Due diligence, legal, investment banker fees | Ongoing strategy for business integration. |

| Underwriting & Claims | Assessing risk, settling claims, actual claim payouts | Core operational costs for insurance segments. |

| Reinsurance Premiums | Costs to transfer risk to other insurers | Significant expense, particularly in specialty insurance lines in 2024. |

| Investment Management Fees | Internal and external advisor costs for portfolio oversight | Essential for optimizing returns on capital deployed. |

| General & Administrative | Holding company and subsidiary operational expenses | Focus on lean overheads across the diverse portfolio. |

Revenue Streams

White Mountains' primary revenue source, net written premiums, comes from its property and casualty insurance and reinsurance businesses, notably through its subsidiaries Ark and Bamboo. This figure reflects the premiums retained by the company after ceding a portion to reinsurers, signifying the core income from its underwriting activities.

White Mountains' financial performance is significantly driven by its investment income, encompassing both net investment income and the fluctuations from realized and unrealized gains or losses within its diverse portfolio. This income stream is crucial for the company's overall profitability.

The company’s investments, such as its stake in MediaAlpha, play a direct role in shaping these gains and losses. For instance, MediaAlpha reported a net revenue of $102.8 million in the first quarter of 2024, showcasing the kind of operational success that can translate into positive investment outcomes for White Mountains.

White Mountains generates significant revenue through fees and commissions from its program administration activities, particularly through its Managing General Agent (MGA) investments like Distinguished Programs. These fees are directly tied to the volume and profitability of the premiums handled.

For Distinguished Programs, revenue streams encompass a wide range of services including product development, marketing, underwriting, policy issuance, and claims management. Essentially, White Mountains earns a percentage or a fixed fee for each of these essential functions performed on behalf of the insurance carriers.

In 2024, the MGA segment, which includes Distinguished Programs, is a key contributor to White Mountains' overall financial performance. While specific fee percentages vary, the success of these programs, measured by premium growth and underwriting profitability, directly translates into higher commission and fee income for White Mountains.

Management and Performance Fees from Asset Management Solutions

Kudu, a key part of White Mountains, earns money from management and performance fees tied to its asset and wealth management firm contracts. These fees offer a steady income source that doesn't typically move in the same direction as broader market trends.

For instance, in 2024, the asset management industry saw continued growth, with global assets under management projected to reach over $130 trillion. This expansion directly benefits Kudu by increasing the base upon which its management fees are calculated.

- Management Fees: A percentage of the assets managed by Kudu's partner firms.

- Performance Fees: Earned when investment strategies exceed specific benchmarks, adding a variable component to revenue.

- Stable Income: Fee-based income provides a predictable revenue stream, less susceptible to market volatility compared to trading profits.

- Growth Potential: As asset and wealth management firms grow their client bases and assets, Kudu's fee income naturally scales.

Dividends and Distributions from Subsidiaries and Investments

White Mountains Insurance Group generates revenue through dividends and distributions received from its diverse portfolio of subsidiaries and investments. This income stream reflects the profitability and capital returns from its deployed capital across various insurance and non-insurance ventures.

These dividends and distributions are a direct result of the successful operations of its consolidated and unconsolidated entities, providing White Mountains with a consistent return on its strategic investments. For instance, in 2023, the company reported total revenues of $5.1 billion, with a significant portion stemming from its underwriting and investment activities which indirectly fuel these distributions.

- Dividends from Subsidiaries: Payments received from wholly or partially owned insurance and non-insurance businesses.

- Distributions from Investments: Returns from minority stakes and other financial holdings.

- Return on Capital: A key indicator of how effectively White Mountains is deploying its capital.

- Profitability Indicator: Reflects the underlying success of its portfolio companies.

White Mountains' revenue streams are multifaceted, stemming from its core insurance operations, investment activities, and strategic partnerships. Net written premiums from its property and casualty insurance and reinsurance businesses, like Ark and Bamboo, form the bedrock of its income. This is complemented by substantial investment income, including net investment income and capital gains from its varied portfolio, such as its stake in MediaAlpha, which reported $102.8 million in net revenue in Q1 2024.

Furthermore, fees and commissions generated from program administration, notably through MGAs like Distinguished Programs, contribute significantly. Kudu's asset and wealth management operations add another layer of revenue through management and performance fees, benefiting from the industry's growth, with global assets under management projected to exceed $130 trillion in 2024. Finally, dividends and distributions from its subsidiaries and investments provide a consistent return on deployed capital, reflecting the overall profitability of its diverse ventures.

| Revenue Stream | Primary Source | 2024 Context/Data |

|---|---|---|

| Net Written Premiums | Insurance & Reinsurance (Ark, Bamboo) | Core underwriting income. |

| Investment Income | Portfolio gains & income (e.g., MediaAlpha) | MediaAlpha Q1 2024 net revenue: $102.8M. |

| Fees & Commissions | Program Administration (Distinguished Programs) | Percentage of premiums handled by MGAs. |

| Asset Management Fees | Kudu (Management & Performance Fees) | Industry AUM projected >$130T in 2024. |

| Dividends & Distributions | Subsidiaries & Investments | Reflects profitability of deployed capital. |

Business Model Canvas Data Sources

The White Mountains Business Model Canvas is informed by a blend of regional economic data, tourism industry reports, and local business surveys. These sources provide a comprehensive view of the market landscape and operational realities.