White Mountains PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

White Mountains Bundle

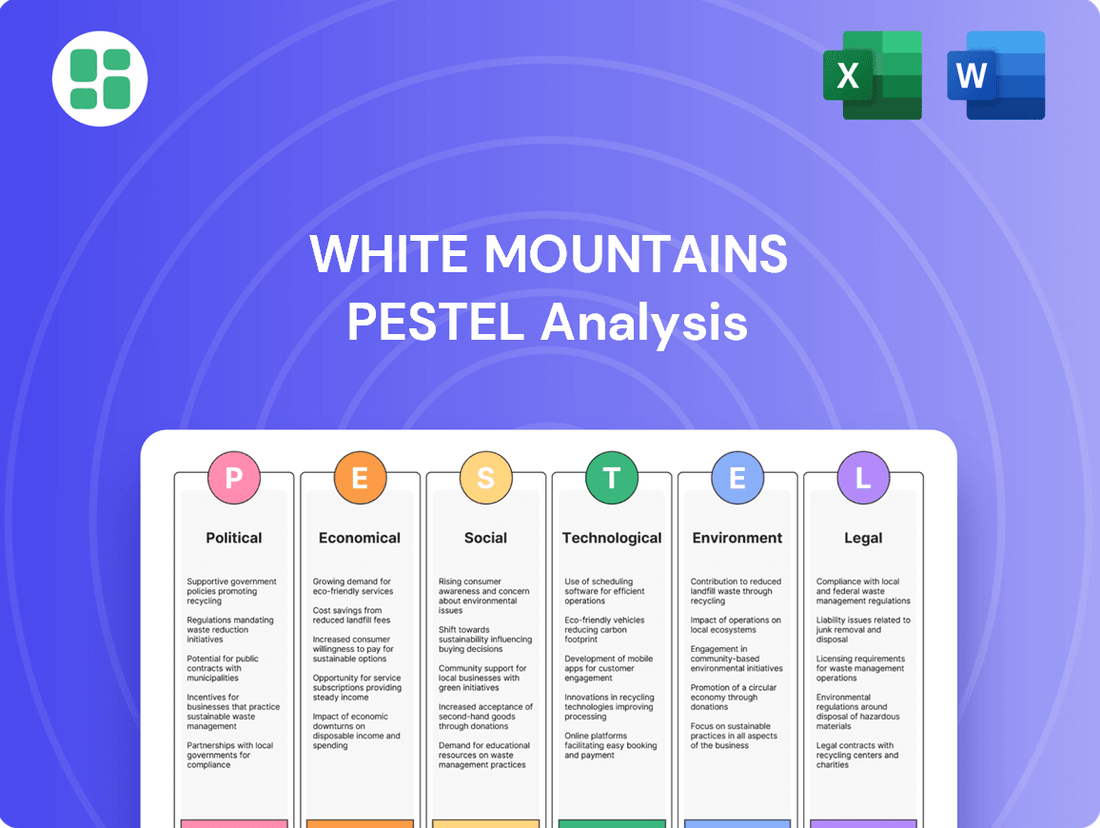

Discover the critical political, economic, social, technological, environmental, and legal factors shaping White Mountains 's future. Our comprehensive PESTLE analysis provides actionable insights into market dynamics, regulatory shifts, and emerging trends. Gain a competitive edge by understanding these external forces. Download the full PESTLE analysis now to unlock strategic intelligence and make informed decisions.

Political factors

The insurance sector, including companies like White Mountains, operates under a stringent regulatory framework. Evolving state and federal laws concerning solvency, capital adequacy, and consumer protection are constant considerations. For instance, the NAIC's Risk-Based Capital (RBC) requirements, which are periodically updated, directly influence how insurers manage their capital and risk exposure, impacting strategic deployment of resources.

Government fiscal policies, such as corporate tax rates and any specific insurance industry taxes, can significantly impact White Mountains' bottom line. For instance, changes in the US federal corporate tax rate, which currently stands at 21%, directly affect how much profit the company retains.

Monetary policies enacted by central banks, like the Federal Reserve, play a crucial role in shaping the investment income White Mountains earns from its considerable investment portfolio. Interest rate decisions are particularly impactful; a higher interest rate environment generally boosts investment income, as seen in the rising yields on fixed-income securities throughout 2023 and into early 2024.

Global geopolitical instability and escalating trade tensions continue to be significant concerns, introducing market uncertainty that can impact investment valuations and overall economic growth. For instance, ongoing conflicts and shifts in international relations create volatility in currency markets and commodity prices, directly affecting the profitability of financial services companies.

As a financial services holding company with international exposures, White Mountains Insurance Group (WTM) must closely monitor these geopolitical dynamics. Their diverse portfolio, which includes businesses in property and casualty insurance, specialty admitted and non-admitted insurance, and reinsurance, is susceptible to disruptions caused by trade disputes or political unrest in key operating regions.

For example, a sudden imposition of tariffs or sanctions between major economies could disrupt supply chains and increase operational costs for WTM’s subsidiaries, while also impacting the performance of their investment portfolio. The company's ability to navigate these risks will be crucial for maintaining stable earnings and capital appreciation throughout 2024 and into 2025.

Government-backed Insurance Programs

Government-backed insurance programs, such as flood insurance or crop insurance, can significantly impact private insurers like White Mountains. These programs can either create direct competition by offering coverage at subsidized rates or present opportunities for public-private partnerships. For instance, the National Flood Insurance Program (NFIP) in the US, while providing essential coverage, also shapes the market dynamics for private flood insurers. In 2024, discussions around the NFIP's reauthorization and potential reforms continue, which could lead to increased private sector involvement or altered risk-sharing models.

White Mountains needs to closely monitor the evolution of these government initiatives. The expansion of programs like Medicare Advantage, which involves private insurers administering government-funded health benefits, demonstrates a growing trend of public-private collaboration. In 2025, the continued growth of such managed care programs within government healthcare systems will likely present both competitive pressures and strategic partnership opportunities for diversified insurance groups.

Key considerations for White Mountains include:

- Assessing the competitive impact of government-subsidized insurance offerings on specific market segments.

- Identifying potential for public-private partnerships where government mandates or programs can be leveraged for mutual benefit.

- Analyzing regulatory changes affecting government-backed insurance and their implications for market access and profitability.

- Evaluating the financial stability and long-term viability of government insurance programs as a factor in market strategy.

Political Stability and Policy Consistency

Political stability in White Mountains' key operating markets, such as the United States and Bermuda, is crucial for a predictable regulatory and economic landscape. For instance, the U.S. insurance sector, a significant area for White Mountains, generally benefits from a relatively stable regulatory framework, though state-level variations exist.

Frequent shifts in government policies or political leadership can introduce uncertainty, impacting long-term planning and investment decisions for an insurance holding company. For example, potential changes in U.S. federal tax policy or international trade agreements could affect capital allocation and profitability. In 2024, ongoing legislative debates around climate risk disclosure and cybersecurity regulations highlight the dynamic nature of the political environment.

- U.S. Political Stability: The U.S. generally offers a stable political environment, crucial for long-term insurance investments.

- Regulatory Consistency: Predictable regulatory frameworks reduce operational uncertainty for companies like White Mountains.

- Policy Shifts Impact: Changes in tax laws or trade policies can directly influence financial performance and strategic planning.

- Emerging Risks: Evolving regulations concerning climate and cybersecurity present ongoing political considerations.

Political stability in key markets like the U.S. and Bermuda underpins White Mountains' operational predictability. However, evolving regulations, such as those concerning climate risk disclosure and cybersecurity, necessitate constant adaptation. For example, the U.S. federal corporate tax rate at 21% directly impacts retained earnings, and any legislative changes could significantly alter profitability.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the White Mountains, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into emerging threats and opportunities, enabling strategic decision-making for stakeholders in the region.

This PESTLE analysis for the White Mountains acts as a pain point reliever by providing a clean, summarized version of external factors for easy referencing during meetings or presentations, ensuring everyone is aligned on market dynamics.

Economic factors

Interest rate fluctuations significantly influence White Mountains' investment portfolio. As of early 2024, the Federal Reserve maintained a target range of 5.25%-5.50% for the federal funds rate, a level that has provided a favorable environment for investment income. However, expectations for potential rate cuts in late 2024 or 2025 could lead to a compression of these returns.

Higher interest rates generally bolster White Mountains' investment income, as a substantial portion of its assets are in fixed-income securities. Conversely, a decline in rates, such as the anticipated reductions in 2025, would likely reduce the earnings generated from these investments, impacting the company's overall profitability and its ability to maintain strong capital adequacy ratios.

Inflationary pressures significantly impact White Mountains' operations, particularly within its property and casualty insurance segments. Rising costs for repairs and replacements directly increase claims expenses. For example, the US Consumer Price Index (CPI) saw a notable increase, with annual inflation rates fluctuating around 3-4% in late 2023 and early 2024, impacting material and labor costs for insurers.

These escalating costs necessitate adjustments in insurance product pricing to maintain underwriting profitability. If premiums do not keep pace with inflation, the profitability of insurance underwriting activities can be eroded, affecting the company's overall financial performance. The ability to accurately forecast and price for inflation is a critical factor for success in the current economic climate.

Global economic growth directly impacts White Mountains' demand for insurance. For instance, a robust economy in 2024, with the IMF forecasting 3.2% global growth for the year, generally translates to higher consumer spending and business activity, boosting premium volumes across various insurance lines. This growth also positively affects the performance of White Mountains' investment portfolio, as stronger economic conditions typically support asset appreciation.

Conversely, recession risks pose a significant challenge. Should economic downturns materialize in key markets during 2024 or 2025, White Mountains could experience slower premium growth. Moreover, certain insurance lines might see an uptick in claims during economic contractions, while investment portfolios could face headwinds from declining asset values, impacting overall profitability.

Catastrophe Bond Market and Reinsurance Pricing

Conditions in the global catastrophe bond market and the broader reinsurance market are critical for White Mountains, influencing how effectively the company can offload significant or catastrophic risks. When these markets offer favorable pricing and abundant capacity, it directly supports White Mountains' efforts to manage its exposures and sustain profitability.

For instance, the catastrophe bond market saw robust activity in 2024, with issuance reaching an estimated $15 billion by mid-year, indicating strong investor demand and competitive pricing. This trend continued into early 2025, with projections suggesting a similar issuance volume, which benefits insurers like White Mountains seeking to transfer risk at attractive rates.

- Catastrophe Bond Market Growth: The market has demonstrated resilience, with total outstanding volume expected to exceed $50 billion by the end of 2025, providing ample capacity.

- Reinsurance Pricing Trends: While reinsurance rates saw significant increases in prior years due to major loss events, early 2025 indications suggest a stabilization or even slight softening in certain lines, benefiting buyers.

- Investor Appetite: Investor demand for uncorrelated, yield-enhancing assets like cat bonds remains strong, driving down the cost of capital for risk transfer.

- Impact on White Mountains: Favorable reinsurance and cat bond pricing allows White Mountains to secure protection more cost-effectively, thereby enhancing its underwriting margins and overall financial stability.

Global Capital Market Performance

Global capital markets significantly influence the valuation of White Mountains' investment portfolio. In 2024, major equity indices like the S&P 500 saw substantial gains, with the index reaching new all-time highs, driven by strong corporate earnings and easing inflation concerns. Fixed-income markets also experienced shifts, with bond yields fluctuating based on central bank policy expectations.

These market dynamics directly affect White Mountains' comprehensive income through unrealized gains and losses on its equity and fixed-income investments. For instance, a robust equity market performance in early 2025 could boost the value of its public equity holdings, while rising interest rates might pressure its bond portfolio's market value.

- Equity Market Performance: The S&P 500 index, a key benchmark, demonstrated resilience and growth throughout 2024, reflecting investor confidence and economic recovery.

- Fixed Income Volatility: Bond yields saw considerable movement in 2024 and early 2025, influenced by inflation data and anticipated monetary policy adjustments by major central banks.

- Impact on Portfolio Value: Fluctuations in these markets directly translate to changes in the market value of White Mountains' diverse investment assets, impacting its reported financial position.

Interest rate movements are a significant economic factor for White Mountains. With the Federal Reserve's target range for the federal funds rate at 5.25%-5.50% in early 2024, investment income was supported. However, potential rate cuts anticipated for late 2024 and into 2025 could lead to lower returns on fixed-income assets, impacting overall profitability.

Inflation directly affects White Mountains' property and casualty insurance segments by increasing claims costs for repairs and replacements. The US CPI, hovering around 3-4% annually in late 2023 and early 2024, highlights rising material and labor expenses. To maintain underwriting profitability, insurers must adjust premiums to match these escalating costs.

Global economic growth, projected at 3.2% by the IMF for 2024, generally boosts demand for insurance and positively impacts investment portfolios. Conversely, recessionary risks in key markets during 2024-2025 could temper premium growth and potentially increase claims in certain insurance lines, while also creating headwinds for asset values.

Favorable conditions in the catastrophe bond and reinsurance markets are crucial for White Mountains' risk management. With cat bond issuance estimated at $15 billion by mid-2024 and strong investor demand continuing into early 2025, risk transfer remains accessible at competitive rates, supporting underwriting margins.

Same Document Delivered

White Mountains PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the White Mountains covers all key aspects, providing valuable insights for strategic planning and decision-making.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the White Mountains region.

Sociological factors

The global population is getting older, with the proportion of people aged 65 and over expected to reach 16% by 2050, up from 10% in 2022. This demographic shift directly influences the insurance market, as an aging population often has different needs and risk profiles. For instance, demand for health and long-term care insurance is likely to rise, while the need for life insurance might change depending on retirement planning and family structures.

Changing household structures, such as a rise in single-person households and smaller family units, also reshape insurance demand. Insurers need to consider how these trends affect property and casualty insurance, potentially leading to a greater need for coverage tailored to smaller living spaces or different lifestyle risks. Adapting product offerings to be more prevention-focused or age-friendly, perhaps with discounts for home safety modifications or telehealth services, will be crucial for companies like White Mountains to remain competitive.

Modern consumers, across all age demographics, now demand intuitive and personalized digital experiences when interacting with insurance providers. This includes easy online policy management, streamlined claims processing, and readily available customer support through digital channels. For instance, a 2024 survey indicated that 78% of consumers expect to be able to manage their insurance policies entirely online, a significant jump from previous years.

White Mountains and its diverse portfolio of insurance companies must prioritize ongoing investment in digital transformation initiatives to align with these evolving expectations. Failing to do so risks customer attrition and a diminished competitive edge in a market increasingly shaped by digital-first providers. The company's strategic focus on enhancing digital capabilities directly addresses this by aiming to improve customer satisfaction and operational efficiency.

Public perception of the insurance sector, especially regarding how claims are processed and how transparent pricing is, significantly shapes consumer trust and loyalty. A 2024 survey by J.D. Power indicated that while overall customer satisfaction with auto insurance improved slightly, issues with claims satisfaction remain a key driver of dissatisfaction, highlighting the need for better communication and fairer outcomes.

For White Mountains, cultivating a reputation for fairness and dependability is paramount to drawing in and keeping policyholders. In 2025, industry analysts project that insurers demonstrating superior claims handling efficiency and transparent pricing structures will likely see higher customer retention rates, potentially exceeding 85% for those with consistently positive customer feedback.

Increased Risk Awareness and Demand for Specific Coverages

Societal shifts are increasingly highlighting potential dangers, from sophisticated cyberattacks to the tangible effects of climate change. This heightened awareness directly fuels a greater need for insurance policies designed to specifically address these emerging risks. For instance, the global cyber insurance market was projected to reach $20.3 billion in 2024, a significant jump from previous years, reflecting this growing concern.

This evolving landscape presents a clear avenue for White Mountains to innovate. By developing and marketing specialized insurance products, the company can cater to these growing societal demands for protection against novel threats. This strategic alignment allows White Mountains to tap into new market segments and solidify its relevance in a changing world.

- Cyber Threats: The increasing frequency and sophistication of cyberattacks necessitate robust cybersecurity insurance.

- Climate Change: Extreme weather events and their economic consequences are driving demand for specialized property and business interruption coverage.

- Product Innovation: White Mountains can leverage this trend by creating tailored policies for these specific risk areas.

- Market Opportunity: Addressing these evolving societal concerns opens up significant growth potential for the company.

Workforce Trends and Talent Acquisition

The insurance sector, including companies like White Mountains, faces a critical need for specialized skills in data science, artificial intelligence, and cybersecurity to drive innovation and maintain a competitive edge. By the end of 2024, the demand for AI specialists in financial services was projected to outstrip supply by a significant margin, impacting the pace of technological adoption.

Attracting and retaining a diverse and highly skilled workforce presents both a substantial challenge and a key opportunity for White Mountains. As of early 2025, the insurance industry is actively competing for top talent, with many firms implementing enhanced benefits and professional development programs to improve employee retention rates, which have seen some improvement in the sector over the past year.

- Talent Gap: Shortage of professionals in AI, data analytics, and cybersecurity is a growing concern across the insurance industry.

- Retention Efforts: Companies are investing more in training and competitive compensation to keep skilled employees.

- Diversity Initiatives: Focus on building a more inclusive workforce to foster innovation and broaden perspectives.

Societal awareness of emerging risks like cyber threats and climate change is escalating, directly increasing demand for specialized insurance coverage. The global cyber insurance market, for instance, was projected to reach $20.3 billion in 2024, highlighting this trend. White Mountains can capitalize on this by developing innovative policies to protect against these evolving dangers.

Technological factors

The insurance industry, including companies like White Mountains, is seeing significant shifts due to AI and data analytics. By 2024, insurers are increasingly adopting AI for tasks like fraud detection, which can reduce losses. These tools are also improving the accuracy of risk assessments, allowing for more precise pricing of policies.

White Mountains can capitalize on these technological advancements to streamline operations. For instance, AI-powered underwriting can process applications faster and more accurately than traditional methods. This efficiency gain, coupled with data-driven insights into customer behavior, enables the creation of more personalized insurance products and competitive pricing strategies, potentially boosting market share.

As insurance operations increasingly move online, the threat of cyberattacks and data breaches is a significant concern for White Mountains. Protecting sensitive policyholder information and maintaining the integrity of their digital infrastructure requires ongoing, substantial investment in advanced cybersecurity measures. For example, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, underscoring the critical need for robust defenses.

White Mountains must continuously adapt its cybersecurity strategies to counter evolving threats. This includes implementing multi-factor authentication, regular security audits, and employee training to mitigate risks. The company's commitment to data protection is paramount for maintaining customer trust and regulatory compliance in the digital age.

InsurTech startups are actively reshaping the insurance landscape with innovative business models and cutting-edge technologies. Think about embedded insurance, seamlessly integrated into other purchases, or telematics, using data from vehicles to personalize premiums. These advancements are not just buzzwords; they represent tangible shifts in how insurance is offered and consumed.

For White Mountains, staying ahead means closely observing and potentially adopting these InsurTech innovations. This proactive approach is crucial for maintaining a competitive edge and ensuring the company can adapt swiftly to evolving market demands. For instance, the global InsurTech market was valued at approximately $5.2 billion in 2023 and is projected to grow significantly, highlighting the increasing impact of these technologies.

Automation of Core Insurance Processes

Automation, driven by advancements in AI and robotic process automation, is significantly reshaping core insurance operations. These technologies are streamlining everything from policy administration and underwriting to claims processing and customer service interactions. For White Mountains, this translates into a powerful avenue for enhancing operational efficiency and reducing costs. For instance, by 2024, the global insurance automation market was projected to reach over $10 billion, indicating substantial investment and adoption in this area.

The impact of this automation is multifaceted, directly affecting the bottom line and competitive positioning. Reduced manual intervention in tasks like data entry, claims verification, and policy issuance minimizes errors and speeds up turnaround times. This efficiency gain is crucial in a market where customer expectations for quick and seamless service are increasingly high. By 2025, it's estimated that businesses leveraging advanced automation could see operational cost reductions of up to 30% in specific functions.

- Streamlined Operations: AI and RPA are automating tasks like policy issuance, claims handling, and customer support, leading to faster processing times.

- Cost Reduction: Automation directly lowers operational expenses by minimizing manual labor and reducing errors in core insurance processes.

- Improved Efficiency: Companies adopting these technologies can achieve significant gains in overall productivity and service delivery speed.

- Market Trend: The global insurance automation market is experiencing robust growth, with significant investments expected to continue through 2025.

Cloud Computing and Digital Infrastructure

The increasing adoption of cloud computing and modernized digital infrastructure is a significant technological factor for White Mountains. This shift offers enhanced scalability and flexibility, allowing the company to adapt quickly to market demands and manage vast amounts of data more effectively. For instance, by mid-2024, global public cloud spending was projected to reach $679 billion, a 17.9% increase from 2023, highlighting the widespread reliance on these platforms.

This technological foundation is vital for supporting advanced analytics, which can provide deeper insights into market trends and customer behavior. It also enables the development and deployment of robust digital platforms and fosters agile business operations. Companies leveraging cloud solutions often see improved efficiency and reduced operational costs, crucial for maintaining a competitive edge in the insurance sector.

Key benefits include:

- Scalability: Easily adjust computing resources up or down based on business needs.

- Flexibility: Access data and applications from anywhere, supporting remote work and diverse operations.

- Data Management: Improved capabilities for storing, processing, and analyzing large datasets for strategic decision-making.

- Innovation: Facilitates the adoption of new technologies like AI and machine learning for competitive advantage.

The integration of Artificial Intelligence (AI) and advanced data analytics is revolutionizing insurance operations for companies like White Mountains. By 2024, AI is increasingly utilized for fraud detection, leading to reduced losses, and for more precise risk assessments, enabling accurate policy pricing.

Leveraging AI for underwriting can significantly speed up application processing and improve accuracy. This, combined with data-driven customer insights, allows for personalized insurance products and competitive pricing, potentially increasing market share.

The increasing reliance on digital platforms heightens the risk of cyberattacks, necessitating substantial investment in cybersecurity for White Mountains. The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, emphasizing the critical need for robust defense mechanisms.

White Mountains must continually update its cybersecurity strategies to counter evolving threats, including implementing multi-factor authentication and regular security audits to maintain customer trust and regulatory compliance.

Legal factors

White Mountains navigates a dynamic insurance regulatory landscape, with state and federal bodies frequently updating rules on capital requirements, consumer safeguards, and market practices. For instance, the National Association of Insurance Commissioners (NAIC) continues to refine solvency standards, impacting how insurers like White Mountains manage their reserves and risk exposure. Staying compliant demands significant resources and ongoing adaptation to these evolving legal stipulations.

Stringent data privacy regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) significantly impact how White Mountains handles customer information. These laws mandate careful practices for data collection, storage, and usage, requiring robust security measures and clear consent protocols.

Failure to comply with these evolving data protection laws can lead to substantial financial penalties. For instance, GDPR violations can incur fines up to 4% of annual global revenue or €20 million, whichever is higher, while CCPA violations can result in fines of $2,500 to $7,500 per violation. Maintaining compliance is therefore paramount to avoid both financial repercussions and damage to White Mountains' reputation.

Consumer protection regulations are crucial for insurers like White Mountains, dictating fair practices in sales, marketing, and claims. These rules are designed to safeguard policyholders and ensure transparency. For instance, in 2024, the National Association of Insurance Commissioners (NAIC) continued to emphasize enhanced consumer protections, particularly around data privacy and cybersecurity, impacting how companies like White Mountains handle sensitive customer information.

Adherence to these consumer protection mandates is vital for maintaining customer trust and avoiding significant regulatory penalties. Regulators are increasingly scrutinizing sales practices, especially in areas like annuity sales, where suitability and disclosure are paramount. Failure to comply can lead to fines and reputational damage, as seen in various state-level enforcement actions throughout 2024.

Antitrust Laws and M&A Scrutiny

White Mountains, as a company actively acquiring businesses, particularly within the insurance industry, must navigate a landscape governed by antitrust laws. These regulations are designed to prevent monopolies and ensure a competitive marketplace, directly affecting how White Mountains can expand through mergers and acquisitions.

Regulatory bodies, such as the Federal Trade Commission (FTC) and the Department of Justice (DOJ) in the United States, closely examine proposed mergers and acquisitions. This scrutiny is heightened when a deal could potentially reduce competition in a specific market. For instance, in 2023, the FTC and DOJ continued to review a significant number of M&A deals across various sectors, with a particular focus on those that might stifle innovation or lead to higher prices for consumers. This rigorous review process can lead to delays, require divestitures of certain assets, or even block deals altogether, thereby impacting White Mountains' strategic growth plans.

- Antitrust Compliance: White Mountains must ensure all M&A activities comply with national and international antitrust legislation.

- Regulatory Review: Mergers and acquisitions undergo scrutiny by competition authorities to assess potential impacts on market competition.

- Strategic Impact: Antitrust concerns can influence deal structuring, timelines, and the overall feasibility of growth strategies through acquisition.

- Market Concentration: Regulators are particularly watchful of deals that could lead to significant market concentration in the insurance sector.

Corporate Governance and Compliance Requirements

Publicly traded financial services holding companies, such as White Mountains Insurance Group, operate under a rigorous framework of corporate governance and compliance. This necessitates adherence to stringent reporting mandates from regulatory bodies like the Securities and Exchange Commission (SEC).

Key areas of focus include maintaining transparency in financial disclosures, ensuring fair executive compensation practices, and upholding robust board oversight. For instance, in 2023, White Mountains reported total revenue of $5.3 billion, underscoring the scale of operations requiring diligent compliance.

These legal factors directly impact operational strategies and risk management. Failure to comply can result in significant penalties and reputational damage.

- SEC Filings: White Mountains must submit quarterly (10-Q) and annual (10-K) reports detailing financial performance and business operations.

- Sarbanes-Oxley Act (SOX): Compliance with SOX provisions ensures the accuracy and reliability of financial reporting and internal controls.

- Board Independence: Regulations often mandate a certain percentage of independent directors on the board to ensure objective decision-making.

- Executive Compensation Scrutiny: Public companies face increased scrutiny over executive pay packages, requiring detailed disclosures and justification.

Legal factors significantly shape White Mountains' operational landscape, necessitating strict adherence to evolving insurance regulations and consumer protection laws. Compliance with data privacy statutes like GDPR and CCPA is paramount, with potential fines for violations reaching substantial amounts, such as up to 4% of global revenue under GDPR. The company must also navigate antitrust regulations, particularly during mergers and acquisitions, as demonstrated by the ongoing scrutiny of deals by bodies like the FTC and DOJ in 2023, which can impact growth strategies.

Environmental factors

Climate change is undeniably intensifying the frequency and severity of natural disasters. This means more frequent and powerful wildfires, hurricanes, and floods, which directly impacts companies like White Mountains that operate in the property and casualty insurance and reinsurance sectors. Higher claims payouts stemming from these events are a direct consequence, putting pressure on profitability.

For the insurance industry, and specifically for White Mountains, this translates to increased underwriting risk. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, a record high. These events lead to a surge in claims, impacting the financial stability and profitability of insurers who bear the brunt of these escalating costs.

Investor and stakeholder emphasis on Environmental, Social, and Governance (ESG) factors is increasingly shaping White Mountains' investment and underwriting decisions, directly impacting its corporate image. For instance, as of early 2025, over 80% of institutional investors surveyed by a major financial research firm indicated that ESG considerations are a significant component of their investment analysis.

Integrating robust ESG data into risk assessments is no longer optional but a critical necessity for maintaining profitability and ensuring compliance with evolving regulations. By Q1 2025, several key insurance markets have introduced enhanced disclosure requirements for climate-related risks, pushing companies like White Mountains to adopt more sophisticated environmental risk modeling.

Insurance regulators are stepping up requirements for financial institutions to detail their exposure to climate-related risks and how they plan to manage them. This means White Mountains needs to update its reporting and risk management practices to align with these growing expectations.

For instance, the National Association of Insurance Commissioners (NAIC) has been actively developing climate risk disclosure guidelines, with many states already implementing or considering similar mandates. By July 2024, a significant number of U.S. states are expected to have specific climate risk disclosure requirements in place for insurers, pushing companies like White Mountains to enhance their data collection and analytical capabilities.

Demand for Green Insurance Products

Growing consumer and corporate awareness of environmental issues is fueling a significant rise in demand for 'green' insurance products. This trend is prompting insurers to develop policies that cover environmental risks, promote sustainable practices, and offer incentives for eco-friendly behaviors. For White Mountains, this represents a clear avenue for product innovation and market expansion.

The market for sustainable insurance is experiencing robust growth. For instance, the global green insurance market was valued at approximately $12.5 billion in 2023 and is projected to reach over $25 billion by 2030, growing at a compound annual growth rate of around 10%. This expansion is driven by increasing regulatory pressures and a greater emphasis on Environmental, Social, and Governance (ESG) factors by investors and policyholders alike.

- Growing Demand: Consumers and businesses are increasingly seeking insurance solutions that align with sustainability goals.

- Product Innovation: This demand encourages the development of specialized policies, such as those covering renewable energy projects or offering discounts for eco-friendly operations.

- Market Opportunity: White Mountains can leverage this trend to diversify its portfolio and tap into a rapidly expanding segment of the insurance industry.

- ESG Integration: The focus on ESG principles is making green insurance a key component of broader corporate sustainability strategies.

Resource Scarcity and Supply Chain Disruptions

Environmental factors, particularly resource scarcity and supply chain disruptions, pose significant challenges for White Mountains. Events like widespread natural disasters can strain the availability of essential materials needed for claims processing, directly impacting operational costs and the speed of claims settlement. In 2024, the insurance industry experienced increased claims related to extreme weather, highlighting the vulnerability of supply chains for construction materials.

This necessitates a proactive approach to supply chain management and strategic pricing adjustments to account for potential cost escalations. For instance, the cost of lumber, a key material in property repairs, saw significant volatility in late 2023 and early 2024, influenced by factors like housing demand and global shipping costs.

- Increased material costs: Volatility in the prices of construction materials like lumber and steel can directly increase the cost of claims.

- Supply chain bottlenecks: Disruptions in global shipping and manufacturing can delay the availability of necessary repair parts and materials.

- Impact on claims settlement: Scarcity can lead to longer claim resolution times and higher payouts for property and casualty insurers.

- Need for resilient sourcing: Companies must develop diversified and resilient supply chains to mitigate these environmental risks.

The increasing frequency and severity of climate-related events directly impact White Mountains' property and casualty insurance and reinsurance operations, leading to higher claims. In 2023, the U.S. recorded a record 28 billion-dollar weather and climate disasters, as per NOAA, escalating underwriting risk and claims payouts.

Investor and regulatory focus on Environmental, Social, and Governance (ESG) factors is intensifying, with over 80% of institutional investors in early 2025 considering ESG in their analysis, pushing for robust environmental risk modeling and disclosure.

Demand for green insurance products is growing, with the global market projected to double from approximately $12.5 billion in 2023 to over $25 billion by 2030, presenting a significant opportunity for product innovation and market expansion for White Mountains.

Environmental factors like resource scarcity and supply chain disruptions, evidenced by volatile lumber prices in late 2023 and early 2024, directly increase claims processing costs and settlement times for insurers.

| Environmental Factor | Impact on White Mountains | Supporting Data (2023-2025) |

|---|---|---|

| Climate Change & Natural Disasters | Increased claims frequency and severity, higher payouts, amplified underwriting risk. | 28 billion-dollar weather/climate disasters in the U.S. (2023). |

| ESG Focus | Pressure for enhanced risk assessment, data integration, and corporate image management. | >80% of institutional investors consider ESG (early 2025). |

| Green Insurance Demand | Opportunity for product diversification and market growth. | Global green insurance market projected to reach >$25 billion by 2030 (from ~$12.5 billion in 2023). |

| Supply Chain Disruptions | Elevated material costs for claims, delayed settlement, increased operational expenses. | Volatility in construction material prices (late 2023-early 2024). |

PESTLE Analysis Data Sources

Our White Mountains PESTLE Analysis is built on a robust foundation of data from federal, state, and local government agencies, including the National Park Service and regional planning commissions. We also incorporate insights from reputable tourism boards, environmental organizations, and economic development reports specific to the White Mountains region.