US Bancorp SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

US Bancorp Bundle

US Bancorp, a financial services giant, boasts significant strengths in its diversified business model and strong customer loyalty, but faces challenges from intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for navigating the financial sector.

Want the full story behind US Bancorp's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

U.S. Bancorp's strength lies in its extensive product offerings, spanning commercial and retail banking, investment services, mortgages, and trust operations. This broad spectrum allows the company to serve a wide array of customer needs, from individuals to large corporations, fostering deeper relationships and a more substantial market presence.

This diversification is a key stabilizer for revenue. For instance, fee-based income, particularly strong in its payment services division, provides a consistent revenue stream that is less susceptible to the volatility of interest rate cycles. In the first quarter of 2024, U.S. Bancorp reported noninterest income of $3.6 billion, a significant portion of which is derived from these fee-based services.

US Bancorp’s strong capital position is a significant advantage, underscored by its Common Equity Tier 1 (CET1) ratio. As of March 31, 2025, this ratio stood at 10.7%, and it remained at 10.7% by the end of June 2025. These figures comfortably exceed regulatory requirements, signaling robust financial health.

This solid capital base provides US Bancorp with considerable flexibility. It allows the company to pursue strategic growth initiatives, absorb potential economic shocks, and consistently return capital to shareholders through dividends and share buybacks, reinforcing investor confidence.

U.S. Bancorp consistently leads its peers in profitability, evidenced by a strong return on tangible common equity (ROTCE) of 17.5% reported in the first quarter of 2025. This robust performance stems from a deep-seated commitment to operational efficiency.

The bank's disciplined approach to managing expenses has resulted in positive operating leverage for several consecutive quarters. Looking ahead, U.S. Bancorp aims to further enhance this efficiency, targeting an efficiency ratio in the mid-to-high 50s by the 2026-2027 period.

Commitment to Technology and Digital Innovation

U.S. Bancorp's commitment to technology and digital innovation is a significant strength, with substantial investments aimed at enhancing customer experience and operational efficiency. The company is actively developing AI-driven services and modernizing its core infrastructure.

This strategic focus is evident in the expansion of digital platforms, such as U.S. Bank Smartly®, designed to meet evolving customer demands and create a competitive advantage. For instance, U.S. Bancorp reported a 16% increase in digital sales in the first quarter of 2024 compared to the previous year, highlighting the growing adoption and success of their digital initiatives.

- AI-Driven Services: Development and rollout of artificial intelligence tools to personalize customer interactions and streamline back-office processes.

- Infrastructure Modernization: Ongoing efforts to update legacy systems, improving scalability, security, and the speed of new product deployment.

- Digital Platform Expansion: Enhancements to mobile banking and online services, including the U.S. Bank Smartly® platform, to offer a seamless user experience.

- Investment in Innovation: Continued allocation of capital towards research and development in emerging financial technologies.

Strong Market Position and Reputation

U.S. Bancorp holds a formidable market position as one of the largest regional banks in the United States, boasting a substantial deposit market share across its operating regions. This scale, combined with a deeply ingrained brand reputation for reliability and exceptional customer service, provides a significant competitive advantage.

The company's commitment to ethical business practices is a key strength, evidenced by its recognition as one of the 2025 World's Most Ethical Companies. This distinction not only enhances its brand image but also fosters trust among customers, investors, and regulatory bodies, reinforcing its standing in the financial industry.

Key indicators of this strong market position include:

- Significant Deposit Market Share: U.S. Bancorp consistently ranks among the top banks by deposits in its key markets, demonstrating a deep and loyal customer base. For instance, as of Q1 2024, the bank reported total deposits of approximately $510 billion, underscoring its extensive reach.

- Brand Recognition and Trust: The bank's long-standing reputation for stability and customer-centricity translates into higher customer acquisition and retention rates.

- Awards and Recognition: Being named a World's Most Ethical Company in 2025 highlights a culture of integrity that resonates positively with stakeholders and differentiates it from competitors.

U.S. Bancorp's diverse product suite, encompassing commercial and retail banking, investment services, and mortgages, allows it to cater to a broad customer base, fostering strong relationships and market penetration.

This diversification, particularly the robust performance of its payment services division, provides a stable, fee-based revenue stream that mitigates interest rate volatility. For example, noninterest income reached $3.6 billion in Q1 2024.

The bank maintains a strong capital position, with a CET1 ratio of 10.7% as of June 2025, exceeding regulatory requirements and enabling strategic growth and capital returns.

US Bancorp leads in profitability with a Q1 2025 ROTCE of 17.5%, driven by operational efficiency and a target efficiency ratio in the mid-to-high 50s by 2026-2027.

| Strength Category | Description | Key Metric/Data Point |

|---|---|---|

| Product Diversification | Extensive offerings across banking, investments, and mortgages. | Serves individuals to large corporations. |

| Fee-Based Income Stability | Strong revenue from payment services. | Noninterest income: $3.6 billion (Q1 2024). |

| Capital Strength | Robust financial health and regulatory compliance. | CET1 Ratio: 10.7% (June 2025). |

| Profitability & Efficiency | Leading profitability and cost management. | ROTCE: 17.5% (Q1 2025); Target Efficiency Ratio: mid-to-high 50s. |

| Digital Innovation | Investment in technology for customer experience. | Digital sales up 16% (Q1 2024). |

| Market Position & Brand | Large regional bank with strong reputation. | Deposits: ~$510 billion (Q1 2024); Recognized as a World's Most Ethical Company (2025). |

What is included in the product

Analyzes US Bancorp’s competitive position through key internal and external factors, highlighting its strengths in digital innovation and opportunities in expanding financial services.

Offers a clear, actionable framework for US Bancorp to address competitive pressures and capitalize on market opportunities.

Weaknesses

U.S. Bancorp's international presence is notably less extensive than many of its larger global banking competitors. This means the company's growth is more heavily tied to the U.S. economy, potentially missing out on opportunities from faster-growing markets abroad.

This concentration makes U.S. Bancorp more vulnerable to domestic economic downturns. For instance, while specific 2024 or 2025 international revenue figures for U.S. Bancorp are not yet fully reported, its reliance on the U.S. market means that a slowdown in the American economy directly impacts its performance more significantly than a globally diversified bank.

U.S. Bancorp navigates a fiercely competitive landscape, challenged by the sheer scale of larger national banks and the disruptive agility of fintech innovators. This rivalry directly impacts profitability, potentially compressing net interest margins and demanding substantial investment in technology to maintain market relevance.

U.S. Bancorp's mortgage banking revenue is a significant area of weakness due to its inherent volatility. This noninterest income stream is highly sensitive to fluctuations in interest rates and the overall health of the housing market, making it an unpredictable contributor to the bank's financial performance.

The impact of this volatility is evident in recent financial results. For instance, U.S. Bancorp reported a notable 17% decline in mortgage banking revenue during the second quarter of 2025. Such drops directly affect the company's total revenue growth and can create challenges in forecasting and financial planning.

Potential for Market Apathy Towards Stock Valuation

U.S. Bancorp's stock has, at times, traded at a discount to its earnings potential, indicating a potential disconnect with market sentiment. This underperformance suggests investors may be overlooking the bank's fundamental strengths, leading to a degree of market apathy regarding its valuation.

Several factors could be contributing to this perception. Concerns surrounding the Federal Reserve's interest rate policy and the ongoing risks associated with commercial real estate (CRE) loans have created headwinds for the banking sector. For instance, as of Q1 2024, regional banks, including those with significant CRE exposure, saw increased scrutiny, impacting overall investor confidence.

- Underperformance vs. Earnings: U.S. Bancorp's stock price hasn't always reflected its robust earnings, suggesting a potential undervaluation by the market.

- Interest Rate Sensitivity: Market apprehension regarding potential interest rate cuts can dampen enthusiasm for bank stocks, impacting valuations.

- Commercial Real Estate Exposure: Lingering concerns about the health of the CRE market create a cautious sentiment among investors, potentially affecting U.S. Bancorp's perceived value.

- Communication Challenge: The bank faces the ongoing task of effectively articulating its financial health and strategic advantages to overcome market skepticism.

Integration Challenges from Acquisitions

US Bancorp's acquisition of Union Bank in 2022, a move aimed at bolstering its California market share, has presented significant integration hurdles. These challenges have led to increased operational costs and one-time charges, negatively impacting efficiency metrics. For instance, the bank reported that the integration process contributed to a rise in its efficiency ratio during the initial phases.

Successfully merging large entities like Union Bank into US Bancorp's existing infrastructure is a complex undertaking. The primary weakness lies in the difficulty of realizing the projected revenue synergies and achieving the expected operational efficiencies in a timely manner. This requires substantial ongoing investment and careful management to overcome the inherent complexities of integrating two distinct banking systems and cultures.

The integration process has also necessitated significant capital outlay, diverting resources that could otherwise be used for organic growth or other strategic initiatives. This investment is crucial for harmonizing IT systems, consolidating operations, and ensuring a seamless customer experience, but it represents a clear weakness in the short to medium term.

- Integration Complexity: The 2022 Union Bank acquisition created operational complexities and one-time charges impacting efficiency.

- Synergy Realization: Achieving anticipated revenue synergies and operational efficiencies from large-scale integrations remains an ongoing challenge for US Bancorp.

- Investment Requirements: Significant investment is required to successfully integrate Union Bank, potentially impacting short-term profitability.

U.S. Bancorp's reliance on mortgage banking revenue creates a significant vulnerability. This income stream is inherently volatile, highly susceptible to shifts in interest rates and the housing market's overall health. For example, the bank experienced a 17% drop in mortgage banking revenue in Q2 2025, directly impacting its top-line growth and complicating financial forecasting.

What You See Is What You Get

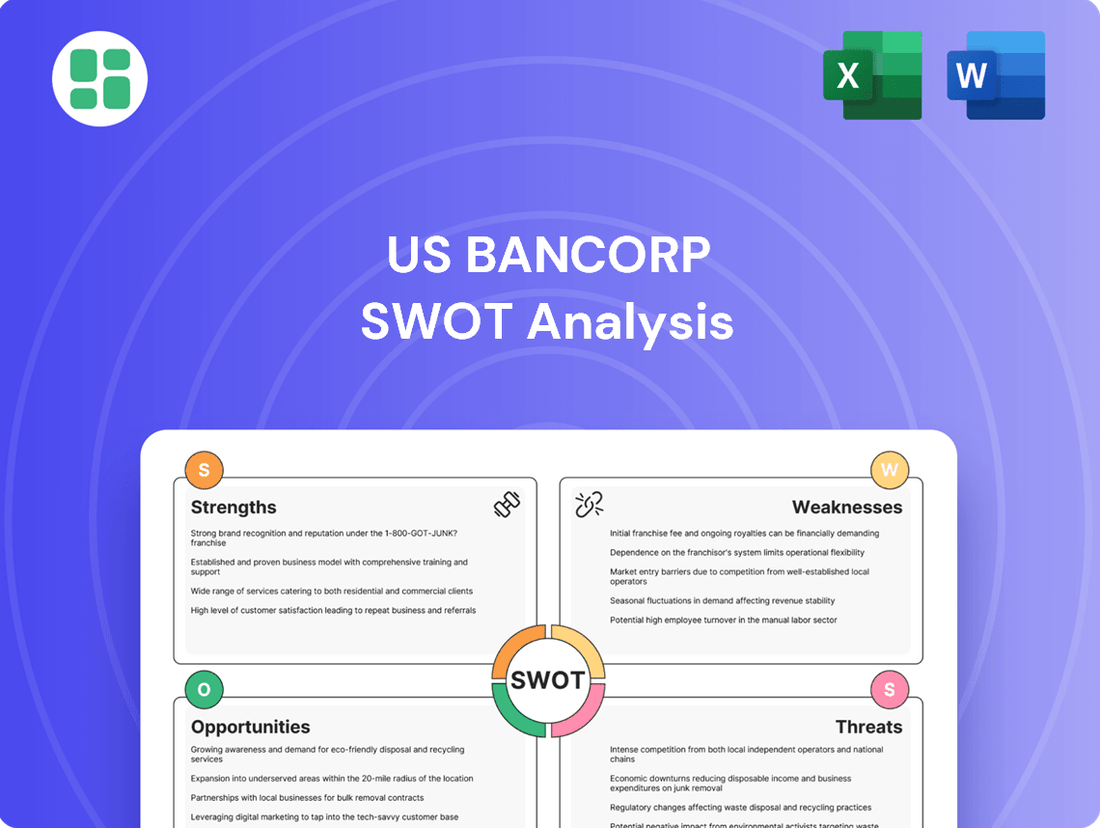

US Bancorp SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive look at US Bancorp's Strengths, Weaknesses, Opportunities, and Threats.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You will gain access to actionable insights for strategic planning.

This preview reflects the real document you'll receive—professional, structured, and ready to use. Understand US Bancorp's competitive landscape and internal capabilities fully.

Opportunities

U.S. Bancorp has a substantial opportunity to grow its fee-based services, especially in areas like payments, trust, and wealth management. This expansion can significantly boost non-interest income.

By capitalizing on its robust payment infrastructure and effective cross-selling strategies, the bank can build a more diversified revenue stream. This diversification makes its income less susceptible to fluctuations in interest rates.

In the first quarter of 2024, U.S. Bancorp reported non-interest income of $3.4 billion, a slight increase from the previous year, indicating the growing importance of these fee-based revenue sources.

U.S. Bancorp's strategic partnerships, like its collaborations with State Farm and Edward Jones, are key to broadening its market presence and customer acquisition. These alliances allow the bank to tap into new customer segments and offer integrated financial solutions.

Enhancing digital capabilities, including investments in embedded finance and AI-driven insights, is crucial for improving customer experience and operational efficiency. For instance, the bank's digital transformation efforts aim to provide more personalized and seamless banking services, attracting a younger, tech-oriented demographic.

US Bancorp has an opportunity to boost its performance by focusing its loan growth on high-margin areas like commercial and industrial (C&I) loans and credit cards. This targeted approach can be more effective than broad expansion, especially when aiming to improve profitability.

By emphasizing capital-light growth strategies and refining its loan mix, US Bancorp can enhance its revenue streams and net interest margin. This is particularly beneficial if interest rates stabilize or begin to decrease, as it allows the bank to capture value without necessarily increasing its overall risk exposure.

For instance, in Q1 2024, US Bancorp reported a 4% increase in its credit card business revenue, highlighting the potential within this segment. Similarly, a strategic focus on C&I lending, which has shown resilience, could further bolster the bank's financial health.

Leveraging Data for Personalized Customer Solutions

U.S. Bancorp can significantly enhance customer engagement by utilizing its vast customer data. By employing advanced analytics, the bank can offer tailored financial products and advice, moving beyond generic offerings. This personalized approach fosters deeper relationships and unlocks greater cross-selling potential.

The bank's extensive customer base, numbering over 70 million individuals and businesses as of early 2024, provides a rich dataset. Leveraging this information allows for the identification of specific customer needs and preferences, leading to more effective product development and marketing campaigns. This data-driven strategy is crucial for driving sustained organic growth in a competitive market.

- Deepened Customer Relationships: Personalized solutions increase customer satisfaction and loyalty.

- Increased Cross-Selling: Data insights highlight opportunities to offer relevant additional products.

- Enhanced Customer Loyalty: Tailored experiences reduce churn and build stronger brand affinity.

- Sustained Organic Growth: Improved customer retention and acquisition drive revenue.

Optimizing Efficiency Through Technology and Cost Initiatives

US Bancorp's focus on expense discipline and technology upgrades offers a clear path to boosting its efficiency ratio. By streamlining operations through automation, the bank can unlock substantial cost savings. This improved efficiency directly translates to enhanced profitability, providing capital for further strategic investments and growth opportunities.

The bank's ongoing digital transformation is a key driver for operational optimization. For instance, in the first quarter of 2024, US Bancorp reported an efficiency ratio of 56.6%, a figure that can be further improved through continued tech adoption.

- Continued investment in AI and automation: Expect further reductions in manual processing and associated labor costs.

- Digital channel optimization: Enhancing online and mobile banking capabilities can reduce reliance on more expensive branch interactions.

- Data analytics for cost management: Leveraging data to identify and eliminate inefficiencies across all business units.

- Strategic partnerships for technology: Collaborating with fintech firms can accelerate the adoption of cost-saving technologies.

US Bancorp has a significant opportunity to leverage its extensive customer data, numbering over 70 million individuals and businesses as of early 2024, to offer more personalized financial products and advice. This data-driven approach can foster deeper customer relationships and unlock greater cross-selling potential, driving sustained organic growth.

The bank can also capitalize on its robust payment infrastructure and strategic partnerships, such as those with State Farm and Edward Jones, to broaden its market reach and acquire new customers. By enhancing digital capabilities, including embedded finance and AI, US Bancorp can improve customer experience and attract a younger, tech-savvy demographic.

Focusing loan growth on high-margin areas like commercial and industrial (C&I) loans and credit cards, which saw a 4% revenue increase in Q1 2024, presents another avenue for improved profitability. Furthermore, continued investment in expense discipline and technology upgrades, aiming to improve its Q1 2024 efficiency ratio of 56.6%, can boost overall operational efficiency and profitability.

Threats

Interest rate volatility, especially the Federal Reserve's anticipated rate cuts in 2024, presents a significant challenge for U.S. Bancorp's net interest income. While the bank actively manages its balance sheet to mitigate these effects, sustained periods of lower interest rates could compress its net interest margin (NIM), potentially making it harder to achieve profitability goals.

U.S. Bancorp, like many regional banks, is exposed to potential headwinds within its commercial real estate (CRE) loan portfolio. Rising delinquency rates in the CRE sector, particularly in certain property types, present a tangible risk. For instance, by Q1 2024, the delinquency rate on U.S. commercial mortgages had climbed to approximately 4.2%, a notable increase from earlier periods.

Declining property values, exacerbated by higher interest rates, could further strain the asset quality of these loans. This environment necessitates vigilant monitoring and proactive risk management to mitigate potential impacts on U.S. Bancorp's profitability and overall financial health.

US Bancorp, like all major financial institutions, faces the ongoing challenge of an evolving regulatory landscape. New rules, such as the proposed Basel III Endgame, are set to increase capital requirements for large banks, potentially impacting US Bancorp's return on equity and requiring adjustments to its balance sheet.

These stricter compliance standards and higher capital buffers, while designed to enhance financial stability, can also lead to increased operating costs and may limit the bank's strategic flexibility in areas like lending or product development. Adapting to these regulatory shifts while maintaining profitability presents a significant hurdle for the company.

Cybersecurity and Data Breaches

U.S. Bancorp, like all financial institutions, faces significant threats from cybersecurity risks and potential data breaches. In the digital banking era, safeguarding customer data is a critical challenge. A successful cyberattack could result in substantial financial penalties and severe damage to the bank's reputation, directly impacting customer trust and loyalty.

The financial services sector is a prime target for cybercriminals. For example, in 2023, the financial industry experienced a notable increase in ransomware attacks. U.S. Bancorp must continually invest in advanced security measures to mitigate these evolving threats and protect its vast customer base and sensitive financial information.

- Increased Sophistication of Cyber Threats: Attackers are constantly developing new methods to breach financial systems.

- Regulatory Scrutiny and Fines: Data breaches can lead to hefty fines from regulatory bodies, impacting profitability.

- Reputational Damage: A breach erodes customer confidence, potentially leading to customer attrition.

- Operational Disruption: Cyberattacks can halt critical banking operations, causing significant financial losses.

Economic Uncertainty and Recessionary Pressures

Broader economic uncertainties, such as persistent inflation and ongoing geopolitical risks, continue to cast a shadow over the financial landscape. These factors can dampen loan demand and pressure asset quality, potentially impacting U.S. Bancorp's overall financial performance. The specter of a recession, even if mild, could lead to increased credit losses and a slowdown in business activity.

While U.S. Bancorp has demonstrated a history of prudent lending practices, a significant economic downturn presents a substantial threat. A severe recession could strain borrowers, leading to a rise in non-performing loans and impacting the bank's profitability. For instance, if consumer spending contracts sharply, businesses may default on loans, directly affecting the bank's balance sheet.

- Inflationary Pressures: Ongoing inflation can erode purchasing power and increase operating costs for businesses, potentially leading to higher default rates.

- Geopolitical Instability: International conflicts and trade disputes can disrupt global supply chains and financial markets, creating volatility that affects economic growth and lending.

- Recessionary Fears: Projections for 2024 and 2025 have included varying degrees of recession risk, which could translate into higher credit loss provisions for U.S. Bancorp if economic conditions worsen significantly.

- Interest Rate Sensitivity: While higher rates can boost net interest margins, rapid or unexpected rate hikes can also increase the risk of borrower defaults, particularly for those with variable-rate debt.

The increasing sophistication of cyber threats poses a significant risk to U.S. Bancorp, potentially leading to substantial financial losses and reputational damage. The financial sector remains a prime target, with ransomware attacks seeing a notable increase in 2023. Regulatory scrutiny and potential fines for data breaches add another layer of concern, impacting profitability and requiring continuous investment in advanced security measures to protect customer data and maintain trust.

SWOT Analysis Data Sources

This US Bancorp SWOT analysis is built upon a foundation of comprehensive data, including the company's official financial statements, detailed market research reports, and expert industry analysis to provide a robust and insightful assessment.