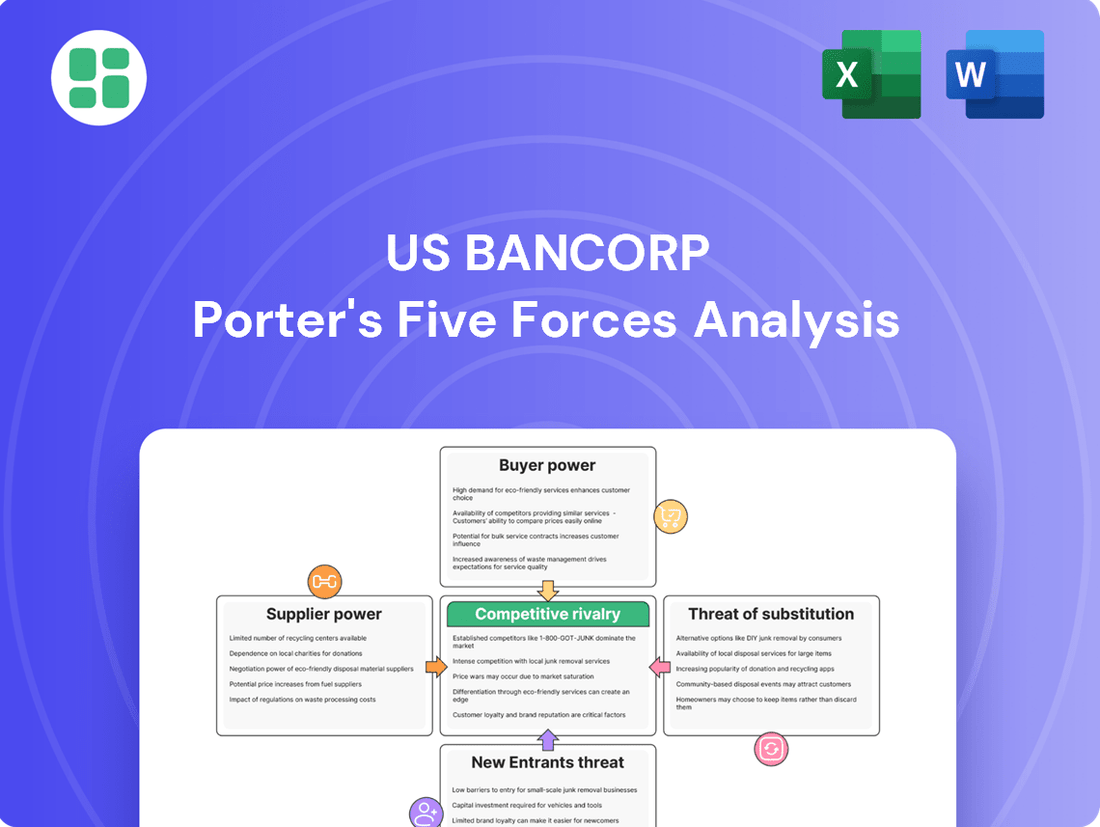

US Bancorp Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

US Bancorp Bundle

US Bancorp operates in a highly competitive financial services landscape, where the threat of new entrants is moderate due to significant regulatory hurdles and capital requirements. The bargaining power of buyers, primarily consumers and businesses, is substantial, driving a need for competitive pricing and superior customer service.

The bargaining power of suppliers, including technology providers and data vendors, presents a key consideration for US Bancorp, as efficient operations depend on reliable and cost-effective inputs. Furthermore, the threat of substitute products, such as fintech solutions and alternative payment methods, is growing, forcing traditional banks to innovate continuously.

The intensity of rivalry among existing competitors is fierce, with established players and emerging fintech firms vying for market share through product differentiation and digital transformation. This dynamic environment demands a deep understanding of these forces to navigate effectively.

Ready to move beyond the basics? Get a full strategic breakdown of US Bancorp’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The bargaining power of technology and software providers for U.S. Bancorp is influenced by the critical nature of their specialized financial technology, core banking systems, and cybersecurity platforms. This reliance grants these suppliers a degree of leverage.

However, the competitive landscape for these services, coupled with U.S. Bancorp's established long-term contracts and development of in-house capabilities, helps to temper this supplier power. For instance, in 2024, U.S. Bancorp continued to invest heavily in digital transformation, aiming to build more internal expertise and reduce reliance on single external vendors for core functions.

While switching providers for such complex systems is a significant undertaking, the potential for such a move, even if challenging, acts as a constraint on the suppliers' ability to dictate terms. This dynamic is crucial as the financial sector increasingly depends on robust and secure technological infrastructure.

The bargaining power of suppliers for U.S. Bancorp is significantly influenced by the demand for specialized human capital. Highly skilled professionals in fields such as cybersecurity, data analytics, artificial intelligence, and regulatory compliance are crucial for the bank's operations and future growth.

The scarcity of this specialized talent, particularly in niche areas, directly translates to increased bargaining power for these professionals. This can manifest as higher compensation demands, more attractive benefit packages, and prolonged recruitment cycles, posing a significant challenge for U.S. Bancorp in attracting and retaining top-tier employees.

Data and information providers hold considerable bargaining power over U.S. Bancorp because access to accurate, timely financial data, credit reporting services, and market intelligence is absolutely vital for the bank's day-to-day operations and its ability to manage risks effectively. Without this information, U.S. Bancorp would struggle to make sound lending decisions, assess creditworthiness, or understand market trends.

Key players in this space, like major credit bureaus or specialized market data aggregators, wield significant influence. This power stems from the indispensable nature of the data they supply and often the proprietary, difficult-to-replicate systems they use to collect and disseminate it. For instance, the cost of accessing comprehensive credit histories or real-time market feeds directly impacts U.S. Bancorp's operational expenses and the quality of its strategic decision-making.

Payment Network Operators

Payment network operators like Visa and Mastercard hold significant bargaining power over U.S. Bancorp. Their extensive global infrastructure and widespread merchant acceptance make them indispensable for processing transactions. In 2024, these networks continue to levy fees for their services, which directly impact U.S. Bancorp's revenue from its payment processing and card issuing businesses.

The sheer scale and network effects of these payment giants mean that U.S. Bancorp, despite its size, has limited alternatives for accessing the core payment rails. This reliance allows payment networks to dictate terms and pricing, influencing the profitability of U.S. Bancorp's payment services segment.

- Dominant Market Share: Visa and Mastercard collectively process a vast majority of card transactions globally, giving them immense leverage.

- Interchange Fees: These networks influence the interchange fees that merchants pay, a significant cost component for acquirers like U.S. Bancorp.

- Technological Investment: Continuous investment by networks in security and innovation further solidifies their position and necessitates ongoing partnerships.

Infrastructure and Real Estate Services

Suppliers of physical infrastructure, including commercial real estate landlords and utility providers, hold a moderate bargaining power over U.S. Bancorp. The bank's extensive network of branches and corporate offices means it relies on these services, but the decentralized nature of many real estate markets and the existence of long-term leases generally temper supplier leverage.

However, the bargaining power can increase for suppliers in premium, high-demand locations. For instance, in major metropolitan areas where U.S. Bancorp requires prime office space, landlords can often negotiate more favorable terms due to intense competition for these desirable properties.

- Commercial Real Estate: U.S. Bancorp maintained approximately 2,800 branches and significant corporate office space as of year-end 2023, requiring ongoing relationships with commercial landlords.

- Utility Providers: Essential services like electricity, water, and telecommunications are critical for branch and data center operations, with providers having some influence on pricing.

- Maintenance and Repair Services: While many providers exist, specialized or geographically specific maintenance services can exert moderate influence, especially for critical infrastructure.

The bargaining power of suppliers for U.S. Bancorp is a multifaceted issue, with technology providers, data aggregators, and payment networks wielding significant influence due to the critical nature of their services and the high switching costs involved. In 2024, U.S. Bancorp's continued investment in digital transformation and in-house capabilities aims to mitigate some of this reliance, though the indispensability of core financial technologies and payment infrastructure remains a key factor.

The scarcity of specialized talent, particularly in areas like AI and cybersecurity, also empowers human capital suppliers, leading to increased compensation demands. Data and information providers, essential for risk management and decision-making, leverage their proprietary systems and the vital nature of their offerings to command strong positions. Payment network operators, like Visa and Mastercard, continue to benefit from their extensive infrastructure and network effects, influencing transaction fees and U.S. Bancorp's profitability in this segment.

| Supplier Category | Key Dependencies for U.S. Bancorp | Impact on U.S. Bancorp | Supplier Bargaining Power Factor | 2024 Context/Data |

|---|---|---|---|---|

| Technology & Software Providers | Core banking systems, cybersecurity, financial tech | Operational efficiency, risk management, innovation | Criticality of specialized tech, high switching costs | Continued investment in digital transformation, building in-house expertise |

| Data & Information Providers | Financial data, credit reporting, market intelligence | Risk assessment, lending decisions, market strategy | Indispensable nature of data, proprietary systems | Direct impact on operational expenses and decision quality |

| Payment Network Operators | Transaction processing, payment rails | Revenue from card services, operational costs | Extensive infrastructure, network effects, limited alternatives | Levying fees impacting payment processing revenue |

| Specialized Human Capital | Cybersecurity, data analytics, AI, compliance professionals | Talent acquisition, retention, operational capacity | Scarcity of niche talent, high demand | Increased compensation and benefit demands impacting recruitment |

What is included in the product

This analysis unpacks the competitive forces impacting US Bancorp, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the banking sector.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Force for US Bancorp, enabling proactive strategic adjustments.

Customers Bargaining Power

Individual retail customers typically have limited bargaining power with banks like US Bancorp. This is because most banking products, like checking accounts or basic savings accounts, are quite similar across different institutions. A single customer’s ability to negotiate terms is minimal.

However, the collective power of millions of retail customers is substantial. If many customers decide to move their deposits or seek better rates elsewhere, it can significantly impact a bank’s funding. For instance, in 2024, the average savings account yield increased, prompting some customers to re-evaluate their current banking relationships.

The rise of digital banking has further amplified this collective power. It’s now much easier for customers to compare interest rates and fees online, and to open new accounts with minimal effort. This ease of switching reduces the friction for customers, making them more likely to move their money if they find a better deal, thereby increasing their overall influence.

Small to medium-sized businesses (SMBs) generally wield moderate bargaining power with banks like U.S. Bancorp. They typically need a blend of standard banking services, such as loans and payment processing, alongside some degree of customization. While their transaction volumes might be less than large corporations, SMBs can be swayed by competitive interest rates, personalized service, and bundled financial solutions. U.S. Bancorp's strategy often focuses on cultivating these client relationships to ensure retention.

Large corporate clients, government bodies, and other financial institutions possess considerable bargaining power with U.S. Bancorp. This strength stems from the sheer volume of their financial dealings, their sophisticated and often unique financial requirements, and their capacity to negotiate highly specific service agreements. For instance, in 2023, U.S. Bancorp's commercial banking segment, which serves these large clients, generated substantial revenue, highlighting the importance of retaining these relationships.

These powerful clients frequently participate in competitive bidding for critical services like syndicated loans, intricate cash management solutions, and specialized investment banking advice. This competitive landscape compels banks, including U.S. Bancorp, to present attractive pricing and tailor-made financial products to secure and maintain their business. The potential loss of even a few of these major clients can have a noticeable effect on the bank's overall profitability and market standing.

Wealth Management Clients

Wealth management clients, particularly high-net-worth individuals and institutional investors, wield significant bargaining power. Their complex financial needs and demand for tailored advice make them discerning. In 2024, the wealth management industry saw continued competition, with firms needing to offer competitive fees and demonstrate superior service to attract and retain these clients.

These clients are acutely aware of fees and performance benchmarks. The proliferation of independent advisors and specialized firms means U.S. Bancorp faces pressure to justify its value proposition. This necessitates a focus on specialized expertise and a high level of client service to stand out in a crowded market.

- Client Sophistication: High-net-worth individuals and institutions often possess deep financial knowledge, enabling them to negotiate terms more effectively.

- Fee Sensitivity: Clients actively compare fee structures across different wealth management providers, seeking the best value for their assets under management.

- Service Quality Expectations: Personalized advice, proactive communication, and demonstrable investment performance are critical differentiators that clients demand.

- Market Availability: The presence of numerous alternative wealth management solutions means clients can readily switch providers if their needs are not met.

Mortgage and Loan Borrowers

Mortgage and loan borrowers, particularly those seeking significant financing, wield considerable bargaining power, especially when interest rates are competitive. This is because U.S. Bancorp faces a landscape with numerous lending alternatives. For instance, in early 2024, the average rate for a 30-year fixed-rate mortgage hovered around 6.6%, a figure that allows borrowers to actively compare offers from various institutions.

- Borrower Influence: Customers seeking large mortgages or commercial loans can negotiate terms due to the presence of many lenders.

- Market Competition: The availability of options from traditional banks, credit unions, and specialized non-bank originators empowers borrowers to seek favorable rates.

- U.S. Bancorp's Strategy: The bank must offer competitive pricing to attract borrowers while managing its risk and profitability goals.

Customers' bargaining power with U.S. Bancorp varies significantly by customer segment. While individual retail customers have minimal power on their own, their collective influence is amplified by digital banking's ease of switching and comparison. Large corporate clients and high-net-worth individuals, however, possess substantial leverage due to their transaction volumes, unique needs, and the competitive market for their business.

In 2024, the banking sector experienced increased competition for deposits, leading to higher yields on savings accounts, which empowered retail customers to seek better rates. Similarly, in the mortgage market, the average 30-year fixed-rate mortgage in early 2024 was around 6.6%, providing borrowers with leverage to negotiate terms across multiple lenders.

The bank must actively manage its pricing and service offerings to retain these powerful customer groups. For instance, U.S. Bancorp's commercial banking segment, serving large clients, was a significant revenue driver in 2023, underscoring the importance of these relationships.

| Customer Segment | Bargaining Power Level | Key Factors Influencing Power | U.S. Bancorp's Strategic Response |

|---|---|---|---|

| Individual Retail Customers | Low (individually), High (collectively) | Ease of switching via digital banking, product similarity, collective deposit volume | Focus on competitive digital offerings, customer retention programs |

| Small to Medium-Sized Businesses (SMBs) | Moderate | Need for bundled services, transaction volume, sensitivity to rates and service | Personalized service, competitive rates, tailored financial solutions |

| Large Corporate Clients & Institutions | High | Massive transaction volumes, complex needs, ability to negotiate bespoke agreements | Competitive pricing on large deals, specialized cash management, investment banking |

| Wealth Management Clients | High | Sophistication, fee sensitivity, demand for personalized advice and performance | Demonstrating value, competitive fees, specialized expertise, superior client service |

| Mortgage & Loan Borrowers | Moderate to High | Availability of alternative lenders, loan size, prevailing interest rates | Competitive mortgage rates and loan products, efficient application process |

Preview Before You Purchase

US Bancorp Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape for US Bancorp through Porter's Five Forces, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. This comprehensive analysis provides actionable insights into US Bancorp's strategic positioning within the financial services industry.

Rivalry Among Competitors

U.S. Bancorp contends with formidable rivals such as JPMorgan Chase, Bank of America, and Wells Fargo. These giants benefit from significantly larger asset bases, with JPMorgan Chase alone reporting over $4 trillion in total assets as of the first quarter of 2024, dwarfing U.S. Bancorp's approximately $660 billion. This scale translates into greater capacity for investment in technology, marketing, and talent, intensifying the competitive landscape.

The competition is fierce across all banking services, from consumer checking accounts to complex corporate lending. These larger banks often leverage their extensive branch networks and digital platforms to attract and retain customers, forcing U.S. Bancorp to focus on service excellence and specialized offerings to carve out its market share. For instance, while U.S. Bancorp has made strides in digital banking, its larger competitors often have more established and widely adopted mobile applications, contributing to customer loyalty.

U.S. Bancorp, while a significant regional player itself, faces intense competition from other robust regional banks operating within its service areas. These competitors often possess deep local market understanding and can offer tailored services, fostering strong customer loyalty.

Furthermore, a multitude of smaller community banks present a competitive challenge by excelling in personalized customer relationships and specialized local knowledge. This can lead to fierce competition in specific geographic markets, impacting market share and profitability for larger institutions.

Fintech companies and digital-first banks are intensifying competition for U.S. Bancorp, especially in areas like payments and personal loans. These agile players, often boasting lower operating costs and slicker digital interfaces, are capturing tech-savvy customers and challenging established banking norms. For instance, by the end of 2023, fintech investment in the US reached $48.6 billion, highlighting the sector's dynamic growth and innovation pace.

U.S. Bancorp faces pressure to keep its digital services cutting-edge to retain and attract customers. The rapid evolution of these digital challengers, who can quickly adapt to market changes and offer specialized, user-friendly solutions, necessitates constant investment in technology and customer experience by traditional banks.

Non-Bank Financial Institutions

Non-bank financial institutions present a significant competitive force for US Bancorp. These entities, including credit unions, online lenders, independent wealth managers, and payment processors, often target specific niches. For instance, credit unions, as of 2023, held approximately $2.3 trillion in assets, offering competitive rates to their member bases.

The specialized nature of these non-bank competitors allows them to operate with lower overhead compared to traditional banks. This can translate into more attractive pricing for consumers and businesses. Online lenders, in particular, have seen substantial growth, with the online lending market projected to reach over $3.7 trillion globally by 2030, according to some forecasts, indicating a strong challenge to incumbent banking services.

This market fragmentation intensifies overall competition. US Bancorp faces rivals that can be more agile and innovative in specific product areas.

- Credit Unions: As of early 2024, credit unions in the U.S. served over 130 million members, demonstrating a significant customer base and competitive reach.

- Online Lenders: The U.S. online lending market has grown rapidly, with platforms offering faster loan approvals and often more flexible terms than traditional banks.

- Wealth Management Firms: Independent firms often provide highly personalized investment advice, attracting high-net-worth individuals seeking specialized services.

- Payment Processors: Companies like Square and Stripe have revolutionized payment processing, offering integrated solutions that can bypass traditional banking channels for many businesses.

Investment Banks and Capital Markets Firms

U.S. Bancorp faces intense competition from specialized investment banks and capital markets firms for its corporate and institutional clients. These competitors often possess deep domain expertise and established relationships with large corporations, particularly in areas like corporate lending, advisory services, and capital raising. For example, in 2023, the global investment banking market generated significant revenue, with firms like Goldman Sachs and Morgan Stanley leading in M&A advisory and equity underwriting, areas where U.S. Bancorp also operates.

Gaining substantial market share in these highly specialized and profitable segments presents a significant challenge for U.S. Bancorp. It requires considerable investment in talent, technology, and building a strong reputation. Without clear differentiation, competing against firms with decades of experience and deep client penetration is difficult. The competitive landscape is characterized by high barriers to entry and a focus on niche services where specialized knowledge commands a premium.

- Specialized Expertise: Dedicated investment banks often have teams focused on specific industries or transaction types, offering a level of depth U.S. Bancorp must match.

- Established Relationships: Long-standing ties between large corporations and established investment banks create a loyalty hurdle for U.S. Bancorp to overcome.

- Market Share Challenge: In 2024, major investment banks continue to dominate league tables for M&A and capital markets transactions, indicating a concentrated market.

- Differentiation Necessity: U.S. Bancorp must invest heavily in unique offerings or client service models to stand out against these established players.

U.S. Bancorp faces intense rivalry from major national banks like JPMorgan Chase and Bank of America, which possess significantly larger asset bases, exceeding $4 trillion for JPMorgan Chase as of Q1 2024. This scale allows them to invest more heavily in technology and marketing, creating a challenging environment for U.S. Bancorp. The competition extends across all banking services, with larger competitors often leveraging extensive branch networks and advanced digital platforms.

Regional banks and community banks also pose a competitive threat by offering localized expertise and personalized customer service, fostering strong loyalty in specific markets. Additionally, agile fintech companies and digital-first banks are rapidly capturing market share in areas like payments and personal loans, driven by lower operating costs and user-friendly interfaces, with fintech investment in the US reaching $48.6 billion by the end of 2023.

Non-bank financial institutions, including credit unions (which held approximately $2.3 trillion in assets as of 2023) and online lenders, further fragment the market by specializing in specific niches and often offering more competitive pricing. U.S. Bancorp must continuously innovate its digital offerings and customer experience to compete effectively against these diverse and often specialized rivals.

| Competitor Type | Key Advantage | Example/Data Point (as of early-mid 2024) |

|---|---|---|

| National Banks | Scale, Investment Capacity, Brand Recognition | JPMorgan Chase: >$4 trillion in total assets (Q1 2024) |

| Regional/Community Banks | Local Market Knowledge, Personalized Service | Deeply embedded relationships in specific geographic areas |

| Fintech Companies | Agility, Lower Costs, Digital Innovation | Fintech investment in US: $48.6 billion (end of 2023) |

| Non-Bank Financial Institutions | Niche Specialization, Competitive Pricing | Credit Unions: ~$2.3 trillion in assets (2023) |

SSubstitutes Threaten

The rise of digital payment platforms and mobile wallets presents a significant threat of substitution for traditional banking services. Consumers are increasingly adopting solutions like PayPal, Venmo, and Zelle, alongside mobile payment options such as Apple Pay and Google Pay, for everyday transactions. This shift reduces their reliance on bank-issued debit and credit cards and even checking accounts.

These alternative platforms often provide enhanced convenience and, in some cases, lower transaction fees, directly competing with the payment processing services offered by banks like U.S. Bancorp. For instance, peer-to-peer payment volume through Zelle, a network of banks including U.S. Bancorp, saw a substantial 58% year-over-year increase in the first quarter of 2024, reaching 2.4 billion transactions. This highlights the growing consumer preference for these digital alternatives.

Peer-to-peer (P2P) lending and crowdfunding platforms present a significant threat of substitutes for U.S. Bancorp's core lending business. These digital alternatives offer borrowers, particularly individuals and small businesses, direct access to capital without the involvement of traditional financial institutions. For instance, by mid-2024, the P2P lending market in the US was projected to continue its growth trajectory, with transaction volumes reaching billions of dollars, providing a viable alternative for those seeking personal loans or business funding.

These platforms can often process applications and disburse funds more quickly than traditional banks, and they may be more accommodating to borrowers with less-than-perfect credit histories. This speed and accessibility make them a compelling substitute for U.S. Bancorp's consumer and small business loan products, potentially diverting a portion of the market share away from the bank.

Robo-advisors and discount brokerages present a significant threat of substitution for U.S. Bancorp's wealth management services. These platforms offer automated, low-cost investment advice and trading, directly competing with traditional full-service offerings. For instance, the digital advice segment of the wealth management industry has seen substantial growth, with assets under management in robo-advisory platforms projected to reach over $3 trillion by 2025, according to various industry reports.

These alternatives are particularly attractive to cost-conscious investors and those who prefer a do-it-yourself approach, potentially siphoning assets away from U.S. Bancorp's human-advised portfolios. The ease of access and lower fee structures of platforms like Betterment or Charles Schwab's robo-advisor services can be a compelling draw for a growing segment of the market, especially younger investors.

Cryptocurrencies and Decentralized Finance (DeFi)

While still developing, cryptocurrencies and decentralized finance (DeFi) present a growing threat of substitutes for traditional banking services. These technologies offer alternative ways to store value, move money, and access lending, potentially sidestepping established financial institutions. As of early 2024, the total market capitalization of cryptocurrencies fluctuated significantly, demonstrating investor interest and the evolving nature of this asset class.

The potential for DeFi to disintermediate core banking functions, such as payments and lending, is a key concern. Although regulatory frameworks are still taking shape globally, the underlying technology continues to advance. U.S. Bancorp actively monitors these developments, recognizing their long-term disruptive potential.

- Alternative Value Storage: Cryptocurrencies like Bitcoin offer a digital alternative to traditional savings and investments, attracting a segment of the market seeking diversification away from fiat currencies.

- Decentralized Transactions: DeFi platforms facilitate peer-to-peer lending and borrowing, bypassing traditional intermediaries and potentially offering different rates and accessibility compared to bank loans.

- Evolving Regulatory Landscape: Uncertainty surrounding cryptocurrency and DeFi regulations in major economies continues to influence adoption rates and the perceived risk for institutional involvement.

Direct Investment and Self-Service Financial Tools

The threat of substitutes for US Bancorp is amplified by the rise of direct investment and self-service financial tools. Individuals and businesses can now bypass traditional banking intermediaries by utilizing online brokerage accounts, direct stock purchase plans, and treasury management platforms. For instance, the number of retail investors actively trading on platforms like Robinhood has surged, with the company reporting over 23 million monthly active users as of the first quarter of 2024, demonstrating a clear shift towards self-directed investing.

Furthermore, sophisticated personal finance and budgeting applications are increasingly substituting for advisory services historically offered by banks. These tools empower consumers to manage their own financial health, track spending, and even make investment decisions without direct bank consultation. This trend is evidenced by the widespread adoption of apps like Mint, which boasted over 30 million users in 2023, highlighting a growing comfort level with DIY financial management.

- Increased Accessibility: Online platforms and apps lower the barrier to entry for investment and financial management.

- Cost Efficiency: Self-service tools often come with lower fees compared to traditional advisory services.

- Technological Advancement: Sophisticated algorithms and user-friendly interfaces make complex financial tasks more manageable for the average user.

- Growing User Base: Millions of individuals are actively engaging with these direct and self-service financial tools.

The threat of substitutes for U.S. Bancorp is substantial, driven by digital payment platforms, P2P lending, robo-advisors, and even cryptocurrencies. These alternatives offer convenience, lower costs, and direct access to financial services, chipping away at traditional banking models. For example, Zelle transactions grew 58% year-over-year in Q1 2024, indicating a strong consumer shift towards digital payment solutions.

The rise of self-service financial tools and direct investment platforms further amplifies this threat. Millions of users are now managing their finances and investments independently through user-friendly apps and online brokerages, bypassing traditional bank advisory services. This trend underscores a growing preference for cost-effective, DIY financial management.

| Substitute Category | Examples | Impact on U.S. Bancorp | Key Growth Driver | 2024 Data Point |

|---|---|---|---|---|

| Digital Payments | PayPal, Venmo, Zelle, Apple Pay | Reduced reliance on bank cards/accounts | Convenience, lower fees | Zelle: 2.4 billion transactions (Q1 2024) |

| P2P Lending/Crowdfunding | LendingClub, Kickstarter | Diversion of loan origination | Speed, accessibility for borrowers | Projected billions in US P2P lending market volume (mid-2024) |

| Robo-Advisors/Discount Brokerages | Betterment, Schwab Robo-Advisor, Robinhood | Loss of wealth management AUM | Low cost, DIY preference | Robo-advisory AUM projected >$3 trillion (by 2025) |

| Cryptocurrencies/DeFi | Bitcoin, Ethereum, DeFi platforms | Potential disintermediation of core banking | Alternative asset storage, decentralized transactions | Fluctuating market capitalization (early 2024) |

| Direct Investment/Self-Service Tools | Online brokerages, personal finance apps | Reduced demand for bank advisory services | Accessibility, cost efficiency | Robinhood: >23 million monthly active users (Q1 2024); Mint: >30 million users (2023) |

Entrants Threaten

The financial services industry, especially traditional banking, faces substantial regulatory hurdles. These include significant capital requirements, complex licensing processes, and rigorous compliance mandates. For instance, as of early 2024, the Federal Reserve's capital ratio requirements for large banks like U.S. Bancorp remain a critical factor, demanding robust financial backing to operate.

These high barriers make it exceedingly difficult for new companies to launch as full-service banks, effectively limiting the threat from broad-scale new entrants. Establishing a new bank requires not only substantial capital but also deep expertise to navigate the intricate regulatory environment successfully.

Established banks like U.S. Bancorp leverage decades of brand recognition and customer trust, crucial in the financial sector. In 2023, U.S. Bancorp reported a strong reputation, with customer satisfaction scores consistently ranking high among major financial institutions, a testament to their long-standing presence.

New entrants, particularly digital-only banks or fintech startups, face a significant challenge in cultivating comparable trust and loyalty. Acquiring a substantial customer base without a proven track record or extensive physical network requires substantial investment in marketing and customer acquisition, making it a formidable barrier to entry.

U.S. Bancorp leverages significant economies of scale across its vast operations. This includes substantial investments in technology infrastructure and widespread marketing efforts, enabling it to deliver services at a lower per-unit cost compared to potential new entrants. For instance, in 2024, U.S. Bancorp reported operating expenses of approximately $17.5 billion, a figure that highlights the scale of its infrastructure and the cost advantage it confers.

Furthermore, the company benefits from powerful network effects. Its extensive physical footprint, comprising thousands of branches and ATMs, coupled with established payment processing systems, creates a valuable ecosystem. Replicating this comprehensive network and the associated customer trust is a formidable and expensive undertaking for any new competitor seeking to enter the market.

Access to Funding and Liquidity

Traditional banks like U.S. Bancorp benefit from deep and diverse funding channels, including substantial retail deposits and access to wholesale markets. In 2024, U.S. Bancorp reported total deposits of $475 billion, a testament to its stable funding base. This established access allows them to operate with lower cost of funds compared to many new entrants.

New entrants, especially fintech firms, often face significant hurdles in replicating this broad access to capital. They typically rely on more expensive wholesale funding or equity capital, which can be volatile. This disparity in funding costs creates a significant barrier, making it difficult for new players to compete effectively in capital-intensive areas like lending.

The threat of new entrants is therefore moderated by this funding gap. For instance, while fintech lending platforms have grown, their ability to scale rapidly is often constrained by their funding infrastructure. U.S. Bancorp's established liquidity position, bolstered by its extensive branch network and digital offerings, provides a robust defense against new, less capitalized competitors.

- Established Funding Sources: U.S. Bancorp leverages retail deposits, wholesale markets, and central bank facilities for stable, low-cost liquidity.

- Fintech Funding Challenges: New entrants often struggle to secure comparable funding at competitive rates, limiting their capital-intensive activities.

- Competitive Disadvantage: The funding cost disparity puts new entrants at a disadvantage in lending and other capital-heavy operations.

Technological and Distribution Infrastructure

The significant capital investment required for robust technological and distribution infrastructure acts as a formidable barrier to entry. U.S. Bancorp's commitment to digital transformation, for instance, includes substantial spending on its technology platforms. In 2023, U.S. Bancorp reported technology and communications expenses of $4.4 billion, highlighting the ongoing investment needed to maintain and upgrade its systems.

Building a secure and efficient core banking system, alongside advanced digital interfaces and comprehensive cybersecurity measures, demands immense upfront and sustained capital. This creates a high cost of entry for new players. Furthermore, establishing a widespread distribution network, encompassing both physical branches and achieving significant digital reach, is a costly endeavor that new entrants must undertake to effectively compete with an established entity like U.S. Bancorp.

- High Capital Outlay: Significant investment in core banking systems, digital platforms, and cybersecurity is a major deterrent.

- Technological Complexity: Maintaining cutting-edge technology requires continuous and substantial financial commitment.

- Distribution Network Costs: Establishing a broad physical or digital presence is an expensive undertaking for new entrants.

The threat of new entrants for U.S. Bancorp is generally low due to substantial barriers. High capital requirements, stringent regulatory approvals, and the need for extensive technological infrastructure make it very difficult for new banks to emerge and compete. For example, in 2024, the cost of building a compliant and competitive digital banking platform alone can easily run into hundreds of millions of dollars.

Established players like U.S. Bancorp benefit from significant economies of scale and established brand loyalty, which new entrants struggle to replicate. In 2023, U.S. Bancorp’s substantial operating expenses of approximately $17.5 billion underscore the scale advantage it possesses. Furthermore, the company's vast network of branches and ATMs, combined with robust digital offerings, creates a strong competitive moat.

New entrants often face challenges in securing stable, low-cost funding compared to established banks with large retail deposit bases. U.S. Bancorp reported total deposits of $475 billion in 2024, illustrating its strong funding position. This funding disparity creates a significant cost disadvantage for new players, particularly in capital-intensive areas like lending.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Significant upfront capital needed to meet regulatory standards and operational costs. | Very High - Limits the number of potential new entrants. |

| Regulatory Hurdles | Complex licensing, compliance, and ongoing supervision by authorities. | Very High - Requires specialized expertise and significant time investment. |

| Technology & Infrastructure | Massive investment in core banking systems, digital platforms, and cybersecurity. | High - Costly to build and maintain competitive systems. |

| Brand Recognition & Trust | Decades of building customer loyalty and a trusted reputation. | High - Difficult for new entrants to acquire customers quickly. |

| Economies of Scale | Lower per-unit costs due to large operational volume. | High - New entrants operate at a cost disadvantage. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for US Bancorp leverages data from SEC filings, investor relations reports, and industry-specific publications to assess competitive intensity and strategic positioning.