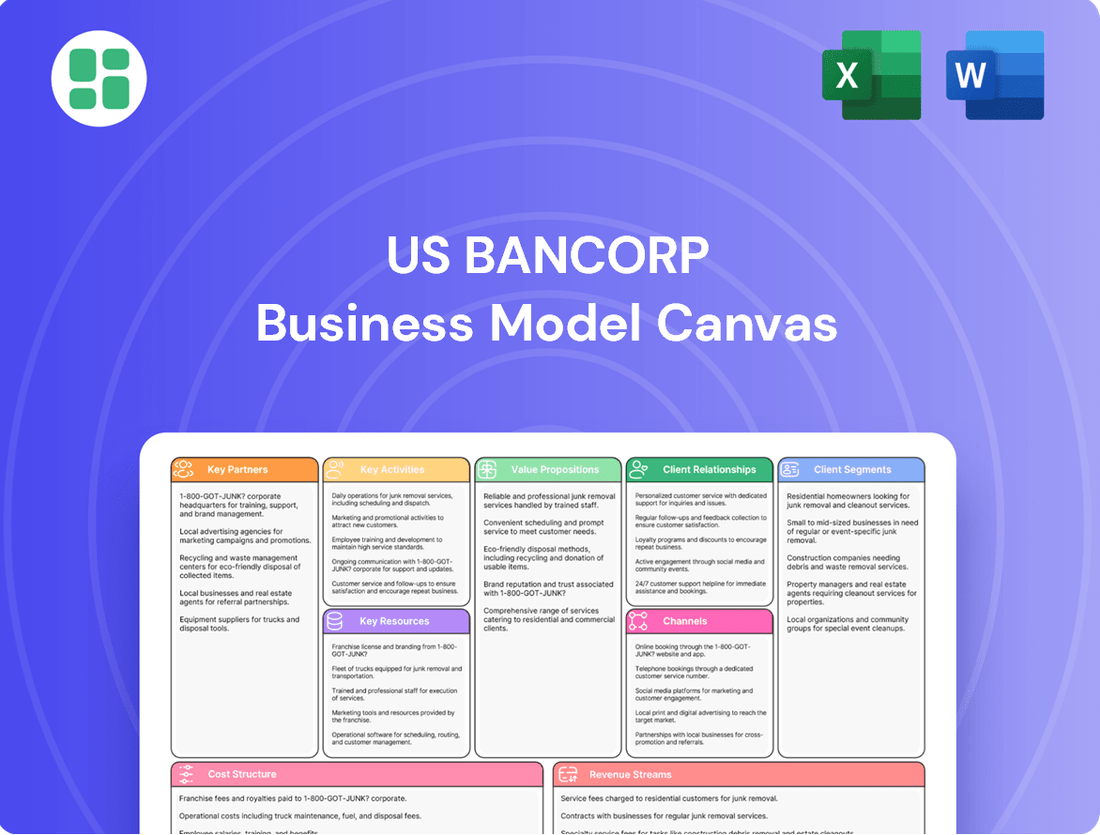

US Bancorp Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

US Bancorp Bundle

Uncover the intricate workings of US Bancorp's business model with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Gain invaluable insights into how US Bancorp structures its operations and delivers value. This Business Model Canvas is your key to understanding their competitive advantages and strategic partnerships, perfect for anyone looking to learn from a financial industry leader.

Ready to dissect the strategic framework of a major financial institution? Our full US Bancorp Business Model Canvas provides a complete, professionally crafted overview of their value proposition, cost structure, and channels. Download it now to elevate your strategic understanding.

Partnerships

U.S. Bancorp actively cultivates strategic alliances with other financial institutions to broaden its market penetration and diversify its product portfolio. These partnerships are crucial for accessing new customer segments and enhancing service delivery.

A prime illustration of this strategy is the deepened collaboration with Edward Jones. This alliance enables Edward Jones’s extensive network of financial advisors, serving approximately 8 million clients, to provide U.S. Bank’s deposit and credit card solutions. This move significantly extends U.S. Bank's reach beyond its existing branch network.

U.S. Bancorp actively collaborates with fintech and technology providers to bolster its digital offerings and introduce cutting-edge financial solutions. This strategic approach involves significant investments in areas like embedded payments, blockchain technology, and artificial intelligence infrastructure.

These partnerships are crucial for U.S. Bancorp to effectively compete within an increasingly API-driven financial landscape. For instance, in 2024, the company continued to emphasize its commitment to digital transformation, with technology and modernization remaining a key focus in its operational strategy.

U.S. Bancorp's strategic alliance with State Farm, initiated in 2020, is a cornerstone of its key partnerships. This collaboration allows State Farm agents to offer U.S. Bank's deposit accounts, co-branded credit cards, and personal loans directly to their extensive customer base.

This partnership has proven highly effective, providing U.S. Bank with access to over 900,000 State Farm customers. The integration facilitates a seamless customer experience, driving both customer acquisition and product penetration for U.S. Bancorp.

Payment Network and Merchant Acquiring Relationships

U.S. Bancorp's Elavon subsidiary maintains critical partnerships with major payment networks like Visa and Mastercard. These relationships are foundational, enabling Elavon to process a vast volume of transactions. As of 2024, Elavon stands as the second-largest bank-owned processor for Visa and Mastercard payments, underscoring its extensive reach and integration within the global payment ecosystem.

These alliances are not just about processing; they involve deep collaboration to ensure secure and efficient transaction flows for businesses of all sizes. Elavon's merchant acquiring relationships are vital, as they directly connect businesses to the payment networks, facilitating customer purchases and revenue generation. This network effect is a cornerstone of U.S. Bancorp's payment services business.

- Payment Network Integration: Direct partnerships with Visa and Mastercard are essential for transaction authorization and settlement.

- Merchant Acquiring: Facilitating relationships with merchants to accept card payments.

- Market Position: Elavon's status as the second-largest bank-owned processor highlights its significant market share and influence.

Community and Non-profit Collaborations

U.S. Bancorp actively partners with community organizations and non-profits, demonstrating a strong commitment to social responsibility and local economic growth. These collaborations are strategically designed to address critical community needs, particularly in areas like financial literacy, affordable housing solutions, and broader economic development programs. For instance, in 2024, U.S. Bancorp continued its support for initiatives aimed at improving financial well-being for underserved populations.

These partnerships are more than just philanthropic gestures; they are integral to U.S. Bancorp's business model, fostering goodwill and strengthening its community ties. The bank's investment in these areas often yields tangible benefits, such as increased access to financial services and improved economic stability for residents. In 2023, the company announced a significant commitment to community development, allocating substantial resources to support these vital collaborations.

- Financial Literacy Programs: U.S. Bancorp supports programs that educate individuals and families on budgeting, saving, and responsible credit management, often reaching thousands of participants annually.

- Affordable Housing Initiatives: Collaborations focus on increasing the availability of safe and affordable housing through direct investment and partnerships with housing developers.

- Economic Development Support: These efforts aim to foster local business growth, create jobs, and stimulate economic activity within the communities served by U.S. Bancorp.

- Community Reinvestment: The bank's engagement aligns with its Community Reinvestment Act obligations, ensuring it meets the credit needs of the communities it serves.

U.S. Bancorp's key partnerships extend to financial advisors, fintech innovators, and major payment networks, significantly expanding its reach and service capabilities. Collaborations with entities like Edward Jones, which serves approximately 8 million clients, and State Farm, providing access to over 900,000 customers, are instrumental in driving customer acquisition and product penetration. Furthermore, its Elavon subsidiary's integration with Visa and Mastercard, positioning it as the second-largest bank-owned processor in 2024, underpins its robust payment processing infrastructure.

| Partner Type | Example Partner | Client Reach/Impact | Strategic Benefit | 2024 Focus |

|---|---|---|---|---|

| Financial Advisors | Edward Jones | ~8 million clients | Expanded deposit and credit card solutions | Continued integration of offerings |

| Insurance/Financial Services | State Farm | >900,000 customers | Access to deposit accounts, credit cards, personal loans | Deepened customer engagement |

| Payment Networks | Visa, Mastercard (via Elavon) | Second-largest bank-owned processor | Transaction processing, merchant acquiring | Enhancing secure transaction flows |

| Fintech Providers | Various | N/A | Digital offerings, embedded payments, AI | Driving digital transformation |

What is included in the product

A detailed blueprint of US Bancorp's operations, outlining its diverse customer segments, multi-channel delivery strategies, and broad financial value propositions.

This model emphasizes key resources like its extensive branch network and digital platforms, alongside revenue streams from lending, fees, and investments, all within a regulated financial services environment.

US Bancorp's Business Model Canvas provides a clear, one-page snapshot that helps stakeholders quickly identify and address the core components of their financial services strategy, thereby relieving the pain point of complex, multi-faceted organizational understanding.

Activities

US Bancorp's core banking activities revolve around attracting deposits from individuals, businesses, and institutions. These gathered funds are then strategically deployed into a wide array of lending operations, encompassing consumer loans, small business financing, large commercial credit, and mortgage lending. This dual focus on deposit gathering and lending is fundamental to the bank's revenue generation and operational model.

In 2024, US Bancorp continued to emphasize efficient deposit gathering, aiming to secure stable, low-cost funding. The bank actively manages its loan portfolio, which is a critical driver of net interest income. For instance, as of the first quarter of 2024, US Bancorp reported total loans of approximately $355 billion, showcasing the scale of its lending operations and its commitment to serving diverse credit needs across the economy.

U.S. Bancorp's payment processing and treasury management are core to its business, generating substantial fee income. In 2024, the company continued to invest heavily in its Elavon merchant acquiring business, a leading global payment processor, alongside robust debit card services. These offerings are crucial for businesses seeking efficient and secure transaction handling.

Treasury management solutions provide businesses with essential tools for cash flow optimization, payments, and liquidity management. This segment is characterized by ongoing innovation, particularly in developing digital payment platforms and embedding financial services directly into client workflows, enhancing convenience and operational efficiency for a wide range of corporate clients.

US Bancorp's wealth management and investment services are a cornerstone of its business model. This segment focuses on providing comprehensive financial solutions, including trust services and investment management, to both individual clients and institutional bodies. These offerings are designed to help clients navigate their financial journeys and achieve their long-term objectives.

A significant aspect of this key activity is generating substantial fee income through advisory services and portfolio management. For instance, in the first quarter of 2024, US Bancorp reported that its Wealth Management and Investment Services division saw revenue increase by 7% year-over-year, highlighting the ongoing demand for these specialized financial products and expertise.

Digital Transformation and Technology Investment

US Bancorp's commitment to digital transformation is a cornerstone of its strategy, involving substantial ongoing investment in technology. This focus is designed to elevate customer interactions and streamline internal processes.

Key areas of investment include enhancing mobile and online banking platforms, leveraging AI for automation, and bolstering cybersecurity measures. These efforts are directly aimed at improving user experience and fostering innovation.

- Digital Capabilities Enhancement: US Bancorp continues to invest heavily in its digital infrastructure, including mobile banking and online platforms, to provide seamless customer experiences.

- AI and Automation: The company is actively deploying AI-driven automation to improve operational efficiency and personalize customer services.

- Cybersecurity Investment: Significant resources are allocated to cybersecurity to protect customer data and maintain trust in its digital offerings.

- New Digital Product Development: US Bancorp is developing and launching new digital products, such as its Spend Management platform, to cater to evolving business needs.

Risk Management and Regulatory Compliance

US Bancorp's key activities heavily emphasize managing various risks, including credit, operational, and market risks. This proactive approach is crucial for maintaining financial health and stability. For instance, in the first quarter of 2024, US Bancorp reported a net charge-off rate of 0.38%, demonstrating their focus on credit risk mitigation.

Strict adherence to banking regulations and capital requirements is another core activity. This ensures the company operates within legal frameworks and maintains sufficient financial buffers. As of the first quarter of 2024, US Bancorp's common equity tier 1 (CET1) capital ratio stood at a strong 11.6%, exceeding regulatory minimums and underscoring their commitment to robust capital management.

Maintaining high capital levels and excellent asset quality are fundamental to US Bancorp's business model. These elements are vital for ensuring long-term financial stability and fostering investor confidence in the company's operations and future prospects.

- Risk Mitigation: Actively managing credit, operational, and market risks to protect the company's financial standing.

- Regulatory Adherence: Ensuring full compliance with all applicable banking laws and capital requirements.

- Capital Strength: Maintaining robust capital ratios, such as a CET1 ratio of 11.6% in Q1 2024, to ensure stability.

- Asset Quality: Focusing on high-quality assets, evidenced by a low net charge-off rate of 0.38% in Q1 2024.

US Bancorp's core banking activities involve attracting deposits and extending credit across various segments. The bank actively manages its loan portfolio, a key driver of net interest income. In Q1 2024, total loans stood at approximately $355 billion, reflecting its significant lending presence.

Payment processing and treasury management are vital, generating substantial fee income. The company's Elavon merchant acquiring business and debit card services are central to this, facilitating billions in transactions for businesses globally.

Wealth management and investment services offer comprehensive financial solutions, contributing significantly to fee income. In Q1 2024, this division saw a 7% year-over-year revenue increase, demonstrating strong client demand for expertise.

Digital transformation is a major focus, with investments in mobile and online platforms, AI for automation, and cybersecurity. New digital products, like the Spend Management platform, are being developed to meet evolving business needs.

Risk management and regulatory compliance are paramount. In Q1 2024, US Bancorp maintained a strong CET1 capital ratio of 11.6% and a low net charge-off rate of 0.38%, highlighting robust financial health and adherence to regulations.

Full Document Unlocks After Purchase

Business Model Canvas

The US Bancorp Business Model Canvas you are currently viewing is the precise document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use file. Upon completing your order, you will gain full access to this exact Business Model Canvas, allowing you to immediately leverage its insights for strategic planning and analysis.

Resources

U.S. Bancorp maintains a robust capital base, exemplified by its Common Equity Tier 1 (CET1) ratio, which stood at approximately 11.8% as of the first quarter of 2024. This strong capital position is crucial for its lending activities and its ability to withstand economic downturns.

The bank's liquidity management is equally vital, ensuring it has readily available funds to meet its obligations and fund its operations. U.S. Bancorp actively monitors its liquidity coverage ratio (LCR) and net stable funding ratio (NSFR) to comply with regulatory standards and maintain financial stability.

These financial resources allow U.S. Bancorp to pursue strategic growth, such as expanding its commercial banking services and investing in new technologies, while also providing a cushion against unexpected market volatility.

US Bancorp's extensive branch network and ATM infrastructure are vital physical resources, even with a strong digital push. As of the first quarter of 2024, US Bancorp operated approximately 2,100 banking offices and over 4,000 ATMs across its footprint. This physical presence ensures accessibility for customers who prefer in-person transactions or require cash services, reinforcing brand visibility and fostering local relationships.

US Bancorp's proprietary digital banking platforms and mobile applications are central to its operations, enabling seamless customer transactions and account management. These digital assets are supported by robust data centers and advanced cybersecurity systems, which are critical for maintaining operational integrity and protecting sensitive customer information.

In 2024, US Bancorp continued its commitment to technological advancement, with significant investments in areas like artificial intelligence and blockchain technology. This focus on innovation is designed to enhance operational efficiency, drive the development of new financial products, and ensure secure, modern customer interactions across all digital touchpoints.

Skilled Workforce and Human Capital

US Bancorp's skilled workforce is a cornerstone of its operations, comprising over 70,000 employees. This extensive team includes specialized roles such as financial advisors, technology experts, risk managers, and customer service professionals, all contributing to the delivery of a wide array of financial services.

The collective expertise and commitment of these individuals are crucial for fostering strong customer relationships and ensuring the effective execution of the company's diverse financial offerings. Their deep understanding of financial markets and client needs allows US Bancorp to provide tailored solutions.

Key aspects of US Bancorp's human capital include:

- Extensive Talent Pool: A workforce exceeding 70,000 individuals, covering a broad spectrum of financial and technical expertise.

- Specialized Expertise: A significant number of employees are financial advisors, technology specialists, risk management professionals, and customer service experts.

- Service Delivery: The dedication and skill of this workforce are fundamental to providing high-quality financial services and maintaining client satisfaction.

- Innovation and Risk Management: Human capital is vital for driving technological innovation and effectively managing the complex risks inherent in the financial sector.

Brand Reputation and Customer Trust

U.S. Bancorp's brand reputation is a cornerstone of its business model, representing a significant intangible asset built over decades. This established name signals stability and reliability, crucial factors for customers in the financial sector.

Customer trust is paramount, directly impacting U.S. Bancorp's ability to attract new clients and retain existing ones. In 2024, a strong reputation for ethical conduct and exceptional customer service continues to be a key differentiator in a competitive market.

- Brand Recognition: U.S. Bancorp is consistently recognized as a leading financial institution.

- Customer Loyalty: A strong reputation fosters higher customer retention rates.

- Ethical Conduct: Perceived integrity builds confidence and long-term relationships.

- Market Standing: Trust enhances overall market position and competitive advantage.

US Bancorp's key resources are its robust financial standing, extensive physical and digital infrastructure, and its skilled workforce. The bank's strong capital base, demonstrated by its CET1 ratio of approximately 11.8% in Q1 2024, underpins its lending and operational resilience. Its significant physical footprint, with around 2,100 banking offices and over 4,000 ATMs as of Q1 2024, complements its advanced digital platforms. These digital assets, including proprietary banking apps, are continuously enhanced through investments in AI and blockchain, ensuring secure and efficient customer interactions.

| Resource Category | Key Resources | Q1 2024 Data/Notes |

|---|---|---|

| Financial Capital | Common Equity Tier 1 (CET1) Ratio | ~11.8% |

| Physical Infrastructure | Banking Offices | ~2,100 |

| Physical Infrastructure | ATMs | ~4,000+ |

| Digital Infrastructure | Proprietary Digital Platforms & Mobile Apps | Ongoing AI & Blockchain Investment |

| Human Capital | Total Employees | 70,000+ |

| Intangible Assets | Brand Reputation & Customer Trust | Key Differentiator in Competitive Market |

Value Propositions

U.S. Bancorp’s comprehensive financial solutions act as a powerful value proposition, offering a true one-stop shop for a vast range of needs. This includes everything from everyday banking and sophisticated investment services to crucial mortgage lending, trust management, and essential payment processing.

This integrated approach significantly streamlines financial management for individuals, businesses, and even large institutions. By consolidating diverse financial services, U.S. Bancorp enhances both convenience and operational efficiency for its clients, fostering stronger relationships and greater client retention.

For instance, in 2024, U.S. Bancorp’s diverse revenue streams, including net interest income and non-interest income from fees and services, demonstrate the breadth of their offerings. This robust financial model supports their ability to provide these all-encompassing solutions.

Customers increasingly prioritize the security and stability of their financial partners. U.S. Bancorp, as a large, well-capitalized institution, offers this reassurance, particularly during periods of economic uncertainty. In 2024, U.S. Bancorp’s robust risk management framework and advanced cybersecurity protocols are central to safeguarding client assets and sensitive data.

US Bancorp offers customers a blend of physical and digital touchpoints, ensuring accessibility for everyone. Their extensive branch network, combined with a vast ATM footprint, provides traditional banking convenience. This is complemented by sophisticated digital platforms, including online banking and a robust mobile app, allowing for seamless account management on the go.

This multi-channel strategy is a key value proposition, catering to diverse customer needs and preferences. For instance, as of the first quarter of 2024, US Bancorp reported having approximately 2,200 branches and over 4,000 ATMs across its service areas, demonstrating a significant physical presence to complement its digital offerings.

Tailored Solutions for Diverse Segments

U.S. Bancorp excels at crafting specific offerings for its varied clientele. This means individuals get personalized banking and loan options, while large corporations benefit from sophisticated treasury and corporate finance services. This focus ensures each customer group receives the tools they need to succeed.

The company's commitment to tailored solutions is evident in recent innovations. For instance, the introduction of their Spend Management platform in 2024 directly addresses the complex needs of businesses seeking better control over their expenditures. This platform exemplifies how U.S. Bancorp adapts its services to evolving market demands.

- Individual Banking: Personalized checking, savings, and loan products.

- Small Business: Targeted credit, deposit, and payment solutions.

- Corporate & Commercial: Advanced treasury management, capital markets, and lending.

- Wealth Management: Customized investment and financial planning services.

Expert Financial Advice and Guidance

U.S. Bancorp's wealth management division provides expert financial advice, guiding clients through complex financial landscapes. This personalized guidance is crucial for achieving long-term objectives, fostering client confidence.

By offering tailored financial planning and investment strategies, U.S. Bancorp cultivates stronger, more trusting relationships with its clientele. This advisory role is a cornerstone of their customer engagement strategy.

- Personalized Financial Planning: U.S. Bancorp offers tailored advice to help clients navigate their financial futures.

- Expert Guidance: Clients receive professional insights to make informed decisions about their wealth.

- Relationship Building: This advisory service strengthens customer loyalty and trust through dedicated support.

- Goal Achievement: The focus is on helping clients meet their specific, long-term financial aspirations.

U.S. Bancorp offers a broad spectrum of financial services, acting as a single point of contact for diverse needs. This includes everything from basic banking and investment management to specialized areas like mortgage lending and payment processing, simplifying financial management for all client types.

The company's strategy focuses on providing integrated solutions that enhance client convenience and operational efficiency. By consolidating various financial services, U.S. Bancorp aims to build stronger customer relationships and improve retention rates through a seamless experience.

In 2024, U.S. Bancorp's financial performance, driven by both interest income and fee-based services, underscores its capacity to deliver these comprehensive offerings. This diversified revenue model supports their commitment to providing a wide array of financial tools.

Security and stability are paramount for financial institutions. U.S. Bancorp, as a robust and well-capitalized entity, provides this assurance, especially during uncertain economic times. Their 2024 risk management protocols and cybersecurity measures are designed to protect client assets and data.

| Value Proposition | Description | 2024 Relevance |

|---|---|---|

| Comprehensive Financial Solutions | One-stop shop for banking, investments, lending, and payments. | Diverse revenue streams support broad service delivery. |

| Integrated Approach | Streamlines financial management for individuals and businesses. | Enhances convenience and operational efficiency for clients. |

| Security and Stability | Reassurance through strong capitalization and risk management. | Robust cybersecurity and risk frameworks protect client assets. |

| Tailored Client Offerings | Personalized services for individuals, businesses, and corporations. | Innovations like Spend Management platform address specific market needs. |

Customer Relationships

For its high-value customers, small businesses, and corporate clients, U.S. Bancorp offers dedicated financial advisors and relationship managers. These professionals provide personalized advice and craft tailored solutions to meet complex financial needs.

This proactive engagement aims to build long-term loyalty by ensuring clients receive comprehensive support. For instance, in 2023, U.S. Bancorp reported that its wealth management division, which includes these advisory services, saw significant growth, contributing to the bank's overall revenue stability.

U.S. Bancorp heavily relies on digital self-service, with a substantial portion of customer interactions happening via online platforms and mobile apps. This allows customers to seamlessly manage their finances, from checking balances to processing payments, all without needing direct human assistance.

The bank's commitment to intuitive digital interfaces and robust self-service tools empowers customers to efficiently handle their banking needs. This digital-first approach is crucial for managing a large customer base and streamlining operations, reflecting a trend where digital engagement is paramount for financial institutions.

US Bancorp provides comprehensive customer support via its call centers and online chat services. These channels are crucial for addressing customer inquiries, resolving technical difficulties, and facilitating transactional assistance, ensuring customers have access to help when they need it.

In 2024, US Bancorp continued to invest in its customer service infrastructure. The company reported that its digital channels, including online chat, handled a significant volume of customer interactions, demonstrating their importance alongside traditional call center support. This multi-channel approach aims to enhance customer experience and accessibility.

Community Engagement and Local Presence

U.S. Bancorp cultivates strong customer ties through its widespread branch network and active participation in community programs, reinforcing its local presence and building trust. This hands-on approach facilitates direct interactions, creating a tangible connection with communities, which is especially valuable for small businesses and individual customers.

This commitment to local engagement is reflected in their significant community investments. For instance, in 2024, U.S. Bancorp committed $100 million to support affordable housing initiatives and community development projects across its operating regions. This strategy not only strengthens relationships but also positions the bank as a vital partner in local economic growth.

- Branch Network Reach: U.S. Bancorp operated approximately 2,900 branches across 26 states as of the end of 2023, providing accessible points of contact for a broad customer base.

- Community Development Investments: The bank's 2024 commitment of $100 million underscores its dedication to local presence and community building.

- Customer Trust: A strong local presence and community involvement are key drivers in fostering customer trust and loyalty, particularly among small businesses and retail clients.

Alliance-Driven Customer Acquisition and Service

U.S. Bank cultivates customer relationships indirectly through strategic alliances, significantly broadening its reach. By integrating its banking products into partner ecosystems, such as those with State Farm and Edward Jones, U.S. Bank accesses new customer segments. This approach allows them to offer banking services to clients who may not directly interact with traditional U.S. Bank branches, effectively expanding their customer base.

- Alliance Integration: U.S. Bank's products are embedded within the platforms of partners like State Farm and Edward Jones.

- Expanded Customer Base: These alliances provide access to millions of potential customers who are already engaged with partner services.

- Service Accessibility: Banking services become more accessible to a wider audience, including those who prefer digital or integrated solutions.

U.S. Bancorp employs a multi-faceted approach to customer relationships, combining personalized advisory services for high-value clients with robust digital self-service options for a broader audience. This strategy is supported by extensive community engagement and strategic alliances, ensuring accessibility and trust across diverse customer segments.

The bank's digital channels, including online and mobile platforms, handle a significant volume of customer interactions, demonstrating their importance in daily banking. Complementing this, U.S. Bancorp maintains a substantial physical presence with approximately 2,900 branches as of the end of 2023, facilitating direct customer contact and community involvement.

Strategic partnerships, such as those with State Farm and Edward Jones, further extend U.S. Bancorp's reach by embedding banking services into partner ecosystems, accessing millions of new potential customers. In 2024, the bank's commitment to community development, including a $100 million investment in affordable housing, reinforces its role as a local partner and builds customer loyalty.

| Customer Relationship Strategy | Key Channels/Methods | Supporting Data/Facts |

|---|---|---|

| Personalized Advisory | Dedicated Financial Advisors, Relationship Managers | Significant growth in wealth management division (2023) |

| Digital Self-Service | Online Platforms, Mobile Apps | High volume of customer interactions via digital channels (2024) |

| Direct Support | Call Centers, Online Chat Services | Crucial for inquiries, issue resolution, and transactional assistance |

| Community Engagement | Branch Network, Community Programs | Approx. 2,900 branches (end of 2023); $100 million community investment (2024) |

| Strategic Alliances | Product Integration with Partners (e.g., State Farm, Edward Jones) | Access to millions of customers within partner ecosystems |

Channels

U.S. Bancorp maintains a substantial physical branch network, a cornerstone for delivering traditional banking services and fostering customer relationships. These locations act as vital hubs for consultations and handling more intricate financial needs, reinforcing the bank's presence in local communities.

As of the first quarter of 2024, U.S. Bancorp operated approximately 2,900 branches across 26 states. This extensive network allows the bank to serve a broad customer base, offering face-to-face interactions that are crucial for building trust and providing personalized financial advice.

US Bancorp's online banking platform serves as a primary digital gateway, enabling customers to effortlessly manage accounts, pay bills, and transfer funds. This comprehensive portal also facilitates loan applications and access to a suite of financial management tools, underscoring its importance for everyday banking convenience and broad accessibility.

U.S. Bank's mobile banking application serves as a crucial channel, offering customers unparalleled convenience for managing their finances anytime, anywhere. Features like mobile check deposit, Zelle for peer-to-peer payments, customizable account alerts, and digital card controls streamline daily banking tasks. In 2024, U.S. Bank continued to invest in enhancing this digital experience, aiming to further solidify its position in the competitive mobile banking landscape.

Automated Teller Machines (ATMs)

US Bancorp leverages its extensive Automated Teller Machine (ATM) network as a crucial component of its customer service and accessibility strategy. This network offers customers round-the-clock access to essential banking functions, reinforcing the bank's commitment to convenience. In 2024, US Bancorp continued to operate thousands of ATMs across its service footprint, facilitating millions of transactions annually.

These ATMs are instrumental in extending the bank's physical presence and service availability beyond traditional branch hours. They serve as vital touchpoints for routine transactions, ensuring customers can manage their finances efficiently at any time. This accessibility is key to customer retention and attracting new clients seeking convenient banking solutions.

- 24/7 Access: ATMs provide continuous availability for cash withdrawals, deposits, and balance checks.

- Extended Reach: The ATM network allows US Bancorp to serve customers in locations without physical branches or outside of standard business hours.

- Transaction Volume: ATMs handle a significant portion of daily customer banking needs, reducing the burden on teller services.

- Cost Efficiency: While requiring investment, ATMs can offer a more cost-effective way to provide basic banking services compared to fully staffed branches for every transaction.

Direct Sales Force and Relationship Managers

US Bancorp leverages a direct sales force and dedicated relationship managers as crucial channels for engaging business, commercial, and institutional clients. These professionals are instrumental in both acquiring new business and nurturing existing client relationships, offering tailored financial advice and customized solutions.

These teams are designed to provide a high-touch experience, understanding the unique needs of each client. For instance, in 2024, US Bancorp continued to invest in training its relationship managers to offer more sophisticated treasury management, lending, and capital markets solutions, directly impacting client retention and growth.

- Client Acquisition: Direct sales teams actively pursue new business opportunities across various market segments, from small businesses to large corporations.

- Relationship Deepening: Existing clients benefit from dedicated relationship managers who act as primary points of contact, ensuring satisfaction and identifying opportunities for expanded services.

- Customized Solutions: These channels allow for the development of highly specialized financial products and services, meeting the complex needs of commercial and institutional clients.

- Market Insight: The direct interaction provides valuable feedback on market trends and client needs, informing product development and strategic planning.

US Bancorp utilizes a multi-channel approach, blending physical and digital touchpoints to serve its diverse customer base. This strategy ensures accessibility and convenience, from in-person consultations at its extensive branch network to seamless self-service via its digital platforms.

The bank's digital channels, including its online banking portal and mobile app, are central to everyday transactions and account management for millions of customers. These platforms offer features like mobile check deposit and peer-to-peer payments, reflecting a strong emphasis on digital convenience. As of Q1 2024, U.S. Bancorp operated approximately 2,900 branches, complemented by a vast ATM network providing 24/7 access for essential banking needs.

For its business and commercial clients, US Bancorp relies on a direct sales force and dedicated relationship managers. These professionals deliver tailored advice and customized financial solutions, fostering strong client relationships and driving growth through personalized service and market insights.

| Channel | Description | Key Features | 2024 Data/Focus |

|---|---|---|---|

| Physical Branches | Traditional banking centers for consultations and complex needs. | Face-to-face interaction, community presence. | Approx. 2,900 branches across 26 states in Q1 2024. |

| Online Banking | Primary digital platform for account management. | Bill pay, fund transfers, loan applications, financial tools. | Comprehensive portal for everyday banking convenience. |

| Mobile App | On-the-go financial management. | Mobile check deposit, Zelle, alerts, card controls. | Continued investment in enhancing user experience. |

| ATM Network | 24/7 access for essential transactions. | Cash withdrawals, deposits, balance checks. | Thousands of ATMs facilitating millions of transactions. |

| Direct Sales/Relationship Managers | High-touch engagement for business clients. | Acquisition, nurturing relationships, tailored solutions. | Focus on treasury management, lending, and capital markets. |

Customer Segments

Individual consumers represent a vast and essential customer base for U.S. Bancorp, encompassing everyday people looking for fundamental banking solutions. This segment utilizes services such as checking and savings accounts, credit cards, personal loans, and mortgages to manage their daily financial lives. For instance, U.S. Bancorp's Bank Smartly® Checking account is designed to meet these common transactional needs.

In 2024, the banking sector continued to see robust engagement from individual consumers, with U.S. Bancorp actively serving millions of these customers. The company's retail banking division, a core component of its operations, focuses on building strong relationships with individuals by providing accessible and reliable financial products. This broad demographic is key to the bank's deposit base and fee income generation.

Small and medium-sized businesses (SMBs) are a cornerstone of U.S. Bancorp's customer base, relying on a comprehensive suite of financial tools. These businesses need everything from foundational business checking and savings accounts to critical financing like business loans and credit cards. In 2024, U.S. Bancorp continues to emphasize its commitment to this sector.

U.S. Bancorp's support for SMBs extends to essential operational services such as payment processing via its subsidiary Elavon, which is crucial for many businesses' daily transactions. Furthermore, sophisticated treasury management solutions are offered to help these companies manage their cash flow and optimize financial operations. This integrated approach aims to foster growth and enhance efficiency for a wide range of businesses.

To further empower SMBs, U.S. Bancorp has introduced innovative solutions like its new Spend Management platform. This platform is designed to give businesses greater control and visibility over their expenditures, a vital component for managing profitability and strategic planning. The bank's focus on providing tailored offerings underscores its dedication to the success of the SMB segment.

Large corporations and commercial clients represent a crucial segment for U.S. Bancorp, demanding advanced financial solutions. This includes access to substantial corporate lending, intricate capital markets services for raising funds and managing risk, and sophisticated treasury management to optimize cash flow. In 2024, U.S. Bancorp continued to serve these clients with a broad suite of offerings, including global corporate trust services that facilitate complex transactions and ensure regulatory compliance.

Governmental Entities

U.S. Bancorp actively partners with governmental entities, offering specialized banking, treasury management, and payment processing solutions designed to meet the distinct operational and regulatory requirements of public sector organizations. These services are crucial for efficient public fund management and disbursement.

The bank provides tailored cash management and investment strategies to governmental clients, aiming to optimize liquidity and returns while adhering to strict compliance standards. This often includes support for public finance initiatives and municipal services.

- Governmental Entities: U.S. Bancorp's commitment to public sector clients is evident in its comprehensive suite of financial services.

- Specialized Services: This segment benefits from tailored treasury and payment solutions, including robust cash management and investment options.

- Regulatory Focus: Services are designed with a keen understanding of the unique regulatory landscape governing public entities.

- Public Finance Support: The bank plays a role in supporting municipal finance and the operational needs of various government agencies.

Institutional Investors and Wealth Management Clients

U.S. Bancorp serves a crucial customer segment comprising high-net-worth individuals, along with institutions like foundations and endowments. These clients require sophisticated wealth management, trust services, and expert investment advisory to preserve and grow their substantial assets.

For these sophisticated clients, U.S. Bancorp provides tailored asset servicing solutions. The bank's deep expertise is leveraged to develop personalized strategies aimed at optimizing financial outcomes. In 2024, U.S. Bancorp continued to focus on deepening relationships with these key stakeholders, recognizing their significant contribution to the firm's overall asset and wealth management growth.

- Targeting Affluent Individuals: U.S. Bancorp focuses on individuals with significant investable assets, offering them comprehensive financial planning and wealth preservation strategies.

- Serving Institutional Needs: The bank caters to the unique requirements of foundations, endowments, and other institutional investors, providing specialized asset management and fiduciary services.

- Expertise in Wealth Management: U.S. Bancorp leverages its extensive financial expertise to deliver personalized investment advisory and trust solutions, aiming to meet the complex financial goals of its high-net-worth and institutional clientele.

- Asset Servicing Solutions: Beyond advisory, the bank offers robust asset servicing capabilities, ensuring efficient and secure management of client portfolios.

U.S. Bancorp's customer segments are diverse, ranging from individual consumers and small businesses to large corporations and governmental entities. High-net-worth individuals and institutions also form a key segment, requiring specialized wealth and asset management services.

In 2024, U.S. Bancorp continued to refine its offerings for each segment, focusing on digital innovation and personalized financial solutions. The bank's strategy emphasizes building long-term relationships by understanding and addressing the unique financial needs of these distinct customer groups.

The bank's commitment to small and medium-sized businesses is underscored by its provision of essential services like payment processing through Elavon and advanced treasury management tools, including its Spend Management platform. For larger corporate clients, U.S. Bancorp offers comprehensive capital markets services and global corporate trust solutions.

| Customer Segment | Key Needs | U.S. Bancorp Offerings (Examples) | 2024 Focus |

|---|---|---|---|

| Individual Consumers | Daily banking, credit, loans | Checking/Savings Accounts, Credit Cards, Mortgages | Digital accessibility, relationship building |

| Small & Medium Businesses (SMBs) | Operational finance, growth capital | Business Accounts, Loans, Payment Processing (Elavon), Treasury Management | Spend Management platform, tailored solutions |

| Large Corporations | Capital markets, risk management | Corporate Lending, Capital Markets Services, Global Corporate Trust | Complex transaction support, regulatory compliance |

| Governmental Entities | Public fund management, treasury | Treasury Management, Payment Processing, Public Finance Support | Regulatory adherence, efficient fund disbursement |

| High-Net-Worth & Institutions | Wealth preservation, asset growth | Wealth Management, Trust Services, Investment Advisory, Asset Servicing | Deepening relationships, personalized strategies |

Cost Structure

Interest expense on deposits and borrowings represents a significant cost for U.S. Bancorp. In the first quarter of 2024, the company reported total interest expense of $3.6 billion. This figure reflects the cost of funds acquired through customer deposits, as well as other borrowing activities.

The bank's funding strategy, which includes a mix of retail deposits, wholesale funding, and long-term debt, directly impacts this expense. For instance, a higher proportion of more expensive wholesale funding or increased reliance on borrowed funds would naturally drive up interest costs. The sensitivity of these costs to changes in market interest rates, such as those set by the Federal Reserve, is a key factor in managing profitability.

Compensation and employee benefits represent a substantial cost for U.S. Bancorp, reflecting its extensive workforce of over 70,000 individuals. In 2023, total employee compensation and benefits expenses amounted to approximately $9.8 billion, highlighting the significant investment in its human capital.

The bank actively pursues disciplined expense management strategies to ensure these significant costs are optimized. This approach aims to maintain competitive compensation packages to attract and retain skilled talent, which is crucial for delivering effective financial services and driving innovation.

US Bancorp's commitment to technological advancement is reflected in its substantial technology and communication expenses. These costs are driven by significant investments in upgrading IT infrastructure, enhancing digital platforms, bolstering cybersecurity measures, and exploring emerging technologies such as artificial intelligence and blockchain. For instance, in 2023, the company reported technology and communications expenses of approximately $3.8 billion, underscoring the scale of these crucial expenditures.

Occupancy and Equipment Costs

US Bancorp's extensive physical presence, including thousands of branches and ATMs, drives significant occupancy and equipment costs. These expenses encompass rent for prime locations, utilities to power facilities, ongoing maintenance, and the depreciation of essential banking equipment. The bank actively manages its real estate portfolio, seeking efficiencies to reduce these overheads. For instance, in 2023, US Bancorp reported total non-interest expense of $17.7 billion, a portion of which is directly attributable to maintaining its physical infrastructure.

The bank's commitment to a widespread physical network, while crucial for customer accessibility, necessitates substantial investment in property and equipment. This includes leasing and maintaining corporate offices, data centers, and the vast majority of its retail branch locations. US Bancorp’s strategic approach involves a continuous evaluation of its real estate footprint to ensure it aligns with evolving customer needs and operational efficiency goals. This optimization effort aims to balance the cost of maintaining this infrastructure with the benefits it provides in customer engagement and service delivery.

- Branch Network: US Bancorp operates a substantial number of physical branches across its service areas, contributing to occupancy and equipment expenses.

- ATM Infrastructure: Maintaining a widespread network of ATMs also incurs costs related to placement, servicing, and technology upgrades.

- Real Estate Optimization: The bank regularly analyzes its real estate holdings to identify opportunities for consolidation or relocation to reduce occupancy costs.

- Depreciation: Significant depreciation charges are recognized on the value of banking equipment, furniture, and leasehold improvements across its facilities.

Marketing and Advertising Expenses

US Bancorp dedicates significant resources to marketing and advertising to acquire new customers and promote its diverse financial products. These costs are essential for building brand awareness and driving customer engagement across various channels.

In 2024, the banking sector, including institutions like US Bancorp, continued to invest heavily in digital marketing strategies. This includes search engine optimization (SEO), pay-per-click (PPC) advertising, social media campaigns, and content marketing to reach a broad audience. Traditional media, such as television, radio, and print advertising, also remain relevant for certain demographic segments. Promotional activities for specific offerings, like new credit card launches or mortgage rate specials, also contribute to these expenses.

Key components of US Bancorp's marketing and advertising costs include:

- Digital Marketing: Investments in online advertising platforms, social media engagement, and content creation.

- Traditional Advertising: Spending on television, radio, print, and outdoor media placements.

- Promotional Campaigns: Costs associated with special offers, discounts, and product launch events.

- Brand Building: Expenditures on public relations, sponsorships, and corporate branding initiatives.

US Bancorp's cost structure is heavily influenced by interest expenses, compensation, technology investments, and maintaining its physical infrastructure. In Q1 2024, interest expense was $3.6 billion, and in 2023, employee costs reached approximately $9.8 billion, while technology spending was around $3.8 billion. These significant outlays are managed through disciplined expense control and strategic real estate optimization.

| Cost Category | 2023 Expense (Approx.) | Q1 2024 Expense (Approx.) | Key Drivers |

|---|---|---|---|

| Interest Expense | Not Specified | $3.6 billion | Deposits, borrowings, market interest rates |

| Compensation & Benefits | $9.8 billion | Not Specified | Large workforce, talent acquisition/retention |

| Technology & Communications | $3.8 billion | Not Specified | IT infrastructure, digital platforms, cybersecurity, emerging tech |

| Occupancy & Equipment (Non-Interest Expense Portion) | Portion of $17.7 billion | Not Specified | Branch network, ATMs, real estate, depreciation |

Revenue Streams

Net Interest Income (NII) is US Bancorp's primary revenue engine. It's the profit a bank makes from the spread between the interest it receives on its assets, like loans and securities, and the interest it pays out on its liabilities, such as customer deposits and borrowings. This core component is highly sensitive to changes in interest rates, the volume of loans the bank originates, and the types of deposits it holds.

For the first quarter of 2024, US Bancorp reported NII of $3.6 billion. This figure demonstrates the significant impact of the prevailing interest rate environment on the bank's profitability, as higher rates generally lead to wider net interest margins, assuming loan growth keeps pace and funding costs remain manageable.

US Bancorp's Payment Services revenue, a key component of its noninterest income, is bolstered by fees from credit and debit card transactions. In 2024, this segment continues to benefit from growing consumer spending and the increasing adoption of digital payment methods.

Merchant acquiring services, primarily through its Elavon subsidiary, is another substantial contributor. Elavon's global reach and diverse client base, from small businesses to large enterprises, drive revenue growth as transaction volumes rise and more businesses integrate payment processing into their operations.

The company also generates revenue from various other payment processing solutions, including treasury management and corporate payments. This diversification, coupled with a strategic focus on embedded payment solutions, positions Payment Services as a resilient and growing revenue stream for US Bancorp.

US Bancorp generates significant revenue from trust and investment management fees. This income stream comes from managing client assets, offering specialized trust services, and providing expert investment advice.

This fee-based income is directly tied to the growth of assets under management (AUM) and the increasing demand for sophisticated wealth management services. As of the first quarter of 2024, US Bancorp reported strong growth in its wealth management segment, reflecting this trend.

Service Charges on Deposits

US Bancorp generates revenue through service charges on deposits, which form a significant portion of its noninterest income. These fees are collected from various deposit-related services, including checking accounts and overdrafts. For instance, in the first quarter of 2024, US Bancorp reported $1.5 billion in noninterest income from consumer and business banking, with a notable contribution from deposit-related fees.

While the landscape of banking fees is evolving due to regulatory scrutiny and market competition, these charges continue to be a vital component of the bank's revenue streams. For example, while overdraft fee income might face pressures, other service charges on accounts still contribute reliably to the overall financial picture.

- Checking Account Fees: Charges for maintaining accounts, transaction volumes, or specific account features.

- Overdraft Fees: Income generated when customers exceed their available balance.

- Other Deposit Services: Fees for services like wire transfers, stop payments, or account research.

Card and Lending Fees

Card and lending fees are a significant revenue driver for U.S. Bancorp, encompassing a variety of charges tied to their extensive credit card and loan portfolios. This includes income from annual credit card fees, foreign transaction fees, and penalties for late payments. Additionally, the bank generates revenue from loan origination and servicing fees across both consumer and commercial lending segments.

U.S. Bancorp actively seeks to expand this revenue stream through strategic initiatives. The introduction of innovative credit card products and the development of new lending platforms are key to driving growth in this area. For instance, in the first quarter of 2024, U.S. Bancorp reported total net interest income of $3.4 billion, with a substantial portion attributable to its lending activities and associated fees.

- Annual Fees: Charges levied on customers for the privilege of using certain credit cards.

- Foreign Transaction Fees: Fees applied to purchases made in a foreign currency or processed outside the customer's home country.

- Late Payment Fees: Penalties incurred when customers fail to make minimum payments by the due date.

- Loan Origination Fees: Charges associated with processing and approving new loans, both for individuals and businesses.

- Servicing Fees: Ongoing fees for managing and collecting payments on outstanding loans.

US Bancorp's revenue streams are diverse, with Net Interest Income (NII) serving as the primary engine, reflecting the profit from lending and deposit activities. Payment Services, driven by merchant acquiring and card transaction fees, represents another substantial contributor, benefiting from increased digital payments. The bank also garners significant income from trust and investment management, tied to assets under management, and from service charges on various deposit accounts.

| Revenue Stream | Description | 2024 Data Point |

| Net Interest Income (NII) | Profit from interest rate spreads on loans and securities versus deposits and borrowings. | Q1 2024: $3.6 billion |

| Payment Services | Fees from credit/debit card transactions and merchant acquiring services. | Growing with consumer spending and digital payment adoption. |

| Trust & Investment Management | Fees for managing client assets and providing investment advice. | Strong growth in wealth management segment as of Q1 2024. |

| Service Charges on Deposits | Fees from checking accounts, overdrafts, wire transfers, etc. | Q1 2024: Contributed to $1.5 billion in consumer/business banking noninterest income. |

| Card & Lending Fees | Annual fees, foreign transaction fees, late payment fees, loan origination fees. | Substantial portion of total net interest income (Q1 2024: $3.4 billion) from lending activities. |

Business Model Canvas Data Sources

The US Bancorp Business Model Canvas is built using a combination of internal financial disclosures, market research reports, and competitive analysis. These sources provide a comprehensive view of the bank's operations, customer base, and industry landscape.