US Bancorp Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

US Bancorp Bundle

Curious about US Bancorp's strategic product positioning? Our BCG Matrix analysis reveals their Stars, Cash Cows, Dogs, and Question Marks, offering a vital snapshot of their market performance. Don't miss out on the actionable insights that will guide your investment decisions.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix. Gain a comprehensive understanding of US Bancorp's portfolio and discover the strategic moves needed to capitalize on opportunities and mitigate risks.

This is your opportunity to gain a competitive edge. Secure the full US Bancorp BCG Matrix report for detailed quadrant breakdowns and expert recommendations, empowering you to make informed, impactful business strategies.

Stars

U.S. Bancorp's Payment Services segment, driven by its tech-focused merchant acquiring arm, Elavon, is a powerhouse. This division is pouring resources into exciting, fast-growing areas such as embedded payments, blockchain technology, and AI-powered infrastructure.

This commitment to innovation and broadening its payment offerings firmly places U.S. Bancorp as a frontrunner in the dynamic payments landscape. For instance, in 2023, U.S. Bancorp's total payment services revenue reached approximately $6.4 billion, showcasing the segment's substantial contribution.

The company's overarching strategy is to evolve into a bank that prioritizes its platform and infrastructure, utilizing these cutting-edge technologies to facilitate commerce. This forward-thinking approach is designed to capitalize on future payment trends and maintain a competitive edge.

U.S. Bancorp has heavily invested in its digital banking platforms, such as Bank Smartly®, aiming to enhance customer experience and drive growth. These investments reflect a strategic push into a market segment that is rapidly expanding and increasingly vital for financial institutions.

The company's commitment to digital innovation is evident in its partnerships and platform development, which focus on providing seamless online and mobile banking solutions. This focus is crucial for capturing market share in an era where digital accessibility is paramount for customer acquisition and retention.

U.S. Bancorp's digital initiatives have garnered industry recognition, highlighting its competitive standing in the digital banking space. For instance, in 2023, the company continued to see strong growth in its digital customer base, with mobile banking users increasing significantly, demonstrating the success of its strategy.

U.S. Bank's Wealth Management services are a clear star in its BCG Matrix. This division boasts exceptional customer satisfaction, topping the J.D. Power 2024 U.S. Full-Service Investor Satisfaction Study.

The segment consistently generates robust fee income, a testament to its strong market position. This success is further amplified by effective cross-selling opportunities with the bank's retail and commercial banking clients, solidifying its presence in a profitable and expanding market.

U.S. Bank is actively investing in expanding its product offerings while preserving the crucial human element that defines its client relationships. This strategic focus ensures continued growth and market leadership for its wealth management arm.

Specialized Commercial & Industrial (C&I) Lending

U.S. Bancorp has demonstrated robust expansion within its Commercial & Industrial (C&I) lending segment, notably by concentrating on high-potential areas like healthcare and Small Business Administration (SBA) loans. This strategic focus is key to their market penetration in these growing industries.

The bank’s performance in these specialized lending sectors underscores a deliberate strategy aimed at achieving profitable market share gains. For instance, in the first quarter of 2024, U.S. Bancorp reported a 7% year-over-year increase in average C&I loans, reaching $130.3 billion.

- Healthcare Lending Growth: The bank has seen significant traction in healthcare financing, a sector known for its steady demand and resilience.

- SBA Loan Dominance: U.S. Bancorp consistently ranks among the top SBA lenders, reflecting its commitment and expertise in supporting small businesses.

- Strategic Niche Focus: This targeted approach allows for deeper expertise and stronger relationships within specific C&I sub-sectors, driving competitive advantage.

- Profitability Driver: The concentration on these profitable niches contributes directly to the overall strength and growth of the bank's C&I portfolio.

Strategic FinTech Partnerships

U.S. Bancorp is strategically leveraging FinTech partnerships to drive growth, positioning itself effectively within a BCG matrix framework. Collaborations with companies like Greenlight for family financial education and Fiserv for integrated credit card platforms demonstrate a clear strategy to enhance customer offerings and operational efficiency. These alliances represent a capital-light approach, allowing U.S. Bancorp to tap into new digital markets and user bases efficiently.

The bank's engagement with FinTechs like Rain and Basefund for embedded payment solutions further underscores its commitment to expanding its financial ecosystem. By integrating these services, U.S. Bancorp can reach customers at the point of need, fostering deeper engagement and new revenue streams. This strategy is particularly relevant in 2024, as the digital payments landscape continues to evolve rapidly, with embedded finance becoming a key differentiator.

- Greenlight Partnership: Enhances family financial literacy tools, a growing segment in digital banking.

- Fiserv Collaboration: Streamlines credit card platform integration, improving customer experience and operational synergy.

- Embedded Payments (Rain, Basefund): Expands U.S. Bancorp's reach into non-traditional financial touchpoints, driving capital-light growth.

- Digital Ecosystem Expansion: Allows U.S. Bancorp to compete effectively in high-growth digital environments without substantial upfront infrastructure investment.

U.S. Bank's Wealth Management division is a clear star in the BCG matrix for U.S. Bancorp. This segment consistently delivers strong fee income and excels in customer satisfaction, as evidenced by its top ranking in the J.D. Power 2024 U.S. Full-Service Investor Satisfaction Study. The strategy of expanding product offerings while maintaining personalized client relationships fuels its continued growth and market leadership.

What is included in the product

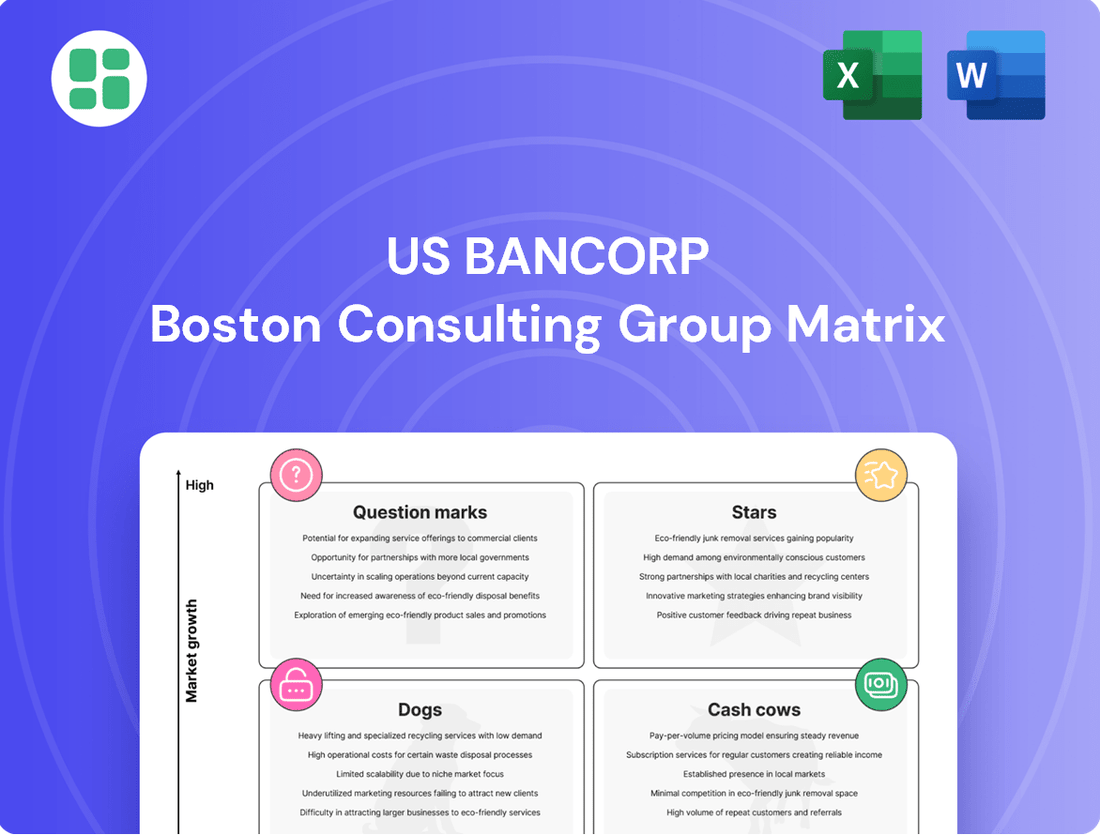

US Bancorp's BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

US Bancorp's BCG Matrix offers a clear, one-page overview of business units, alleviating the pain of complex strategic analysis.

Cash Cows

U.S. Bancorp's traditional deposit products, like checking and savings accounts, are its cash cows. These are mature markets, meaning they don't grow super fast, but they are incredibly reliable. Think of them as the bedrock of the bank's funding, providing a steady stream of low-cost money that U.S. Bancorp can then use to make loans and earn interest.

In the first quarter of 2024, U.S. Bancorp reported total deposits of $470.6 billion. This massive base, largely comprised of these traditional products, is essential for the bank's overall financial health and its ability to operate profitably. The focus on relationship deposits further strengthens this cash cow status by fostering customer loyalty and reducing churn.

U.S. Bancorp's established credit card portfolio is a significant Cash Cow. As a leading U.S. issuer, it consistently generates substantial fee income from its large base of credit and debit card customers.

This segment thrives in a mature market due to U.S. Bancorp's high market share and strong customer loyalty. This translates into predictable and reliable cash flow, requiring minimal new investment for ongoing operations.

In 2024, U.S. Bancorp reported that its credit card segment continued to be a strong contributor to its overall financial performance, demonstrating the resilience and profitability of this established business line.

U.S. Bancorp's Corporate Trust Services is a prime example of a cash cow within its business portfolio. This segment benefits from substantial switching costs for clients, ensuring a stable and predictable stream of recurring fee income. In 2023, U.S. Bancorp reported that its corporate trust business contributed significantly to its noninterest income, demonstrating its consistent revenue generation capabilities in a well-established market.

Core Commercial Banking Relationships

US Bancorp's core commercial banking relationships represent a significant cash cow within its BCG matrix. These long-standing ties with corporate and commercial clients provide a bedrock of consistent revenue through treasury management, traditional lending, and a suite of other essential banking services. This stability means they are less vulnerable to the sharp swings often seen in other market segments, making them a crucial contributor to the bank's overall profitability.

These mature relationships are characterized by their reliable cash flow generation. For instance, in 2024, US Bancorp reported robust performance in its commercial banking segment, driven by these deep-rooted client connections. The bank’s ability to offer integrated financial solutions, from payments to capital markets access, solidifies these relationships and ensures ongoing revenue streams.

- Stable Revenue Generation: Core commercial banking relationships provide predictable income, acting as a reliable source of funds for the company.

- Low Market Sensitivity: These segments are less impacted by short-term market volatility, offering a consistent performance.

- Integrated Service Offering: US Bancorp leverages its comprehensive suite of financial products to deepen client loyalty and revenue.

- Profitability Driver: The consistent profitability from these established relationships underpins the bank's overall financial strength.

Residential Mortgage Servicing

U.S. Bancorp's residential mortgage servicing operation functions as a cash cow within its business portfolio. Despite fluctuations in mortgage originations, the substantial existing portfolio generates consistent fee income, providing a reliable revenue stream.

This segment thrives on the immense volume of loans under management, translating into predictable cash flows. The mature market characterized by significant barriers to entry further solidifies its position as a stable income generator.

- Steady Fee Income: U.S. Bancorp serviced approximately $470 billion in residential mortgages as of the first quarter of 2024, contributing significantly to its non-interest income.

- Predictable Cash Flow: The servicing business generates recurring revenue from loan payments, offering stability even during periods of economic uncertainty.

- High Barriers to Entry: Establishing and maintaining a large-scale mortgage servicing operation requires substantial capital, regulatory compliance, and technological infrastructure, limiting new competition.

U.S. Bancorp's wealth management advisory services represent a significant cash cow. These services cater to a mature market with high customer loyalty, generating consistent fee-based revenue. The bank's established reputation and broad client base allow it to effectively cross-sell these valuable services, ensuring a stable income stream.

In 2024, U.S. Bancorp's wealth management division demonstrated continued strength, benefiting from the steady demand for personalized financial advice and investment management. This segment requires relatively low investment for growth, focusing instead on optimizing existing client relationships.

| Business Segment | BCG Matrix Category | Key Characteristics | 2024 Data Point |

| Traditional Deposit Products | Cash Cow | Mature market, low-cost funding, stable revenue | $470.6 billion in total deposits (Q1 2024) |

| Credit Card Portfolio | Cash Cow | High market share, predictable fee income, strong loyalty | Continued strong contributor to financial performance |

| Corporate Trust Services | Cash Cow | High switching costs, recurring fee income, established market | Significant contributor to noninterest income (2023) |

| Residential Mortgage Servicing | Cash Cow | Substantial loan portfolio, consistent fee income, high barriers to entry | Serviced ~$470 billion in mortgages (Q1 2024) |

What You’re Viewing Is Included

US Bancorp BCG Matrix

The US Bancorp BCG Matrix preview you are viewing is the complete, unadulterated document you will receive immediately after purchase. This means no watermarks, no demo content, and no missing sections—just the fully formatted, analysis-ready report ready for your strategic planning needs.

Rest assured, the BCG Matrix report you see here is the exact file that will be delivered to you upon completing your purchase. It's a professionally crafted document, meticulously detailing US Bancorp's business units within the BCG framework, designed for immediate application in your business strategy.

What you are previewing is the definitive US Bancorp BCG Matrix report that you will own after your purchase. This comprehensive analysis is ready for direct download, allowing you to integrate its insights into your strategic decision-making processes without delay.

Dogs

U.S. Bancorp's residential mortgage origination business appears to be in the Dogs quadrant of the BCG Matrix. The company has seen a decrease in its mortgage banking revenue, signaling a shrinking market presence. This strategic move to divest parts of its residential mortgage loan portfolio further underscores a low market share and limited growth potential in this sector.

US Bancorp's auto loan originations likely fall into the Dogs quadrant of the BCG Matrix. The bank has strategically reduced its focus on auto lending, evidenced by portfolio divestitures. This move suggests a deliberate withdrawal from a segment characterized by limited growth potential and intensified competition.

U.S. Bancorp's physical branch network, while still a component of its strategy, faces challenges with outdated or underperforming locations. These branches, particularly those in low-growth markets, can become costly liabilities, draining resources without generating commensurate returns or strategic advantage.

In 2024, U.S. Bancorp continued its efforts to optimize its branch footprint. While specific numbers on branch closures or consolidations are proprietary, the trend across the banking industry, including U.S. Bancorp, has been a strategic reduction in physical locations to improve efficiency and focus on digital channels. This recalibration aims to convert potential cash traps into more efficient operational models.

Niche Prepaid Card Services

Niche prepaid card services within US Bancorp's Payments Services segment are currently facing challenges, acting as headwinds. This indicates that certain specialized prepaid card offerings are experiencing a slowdown in growth and a diminished market position, likely due to shifting consumer preferences or increased competition.

The data suggests these niche prepaid card services are characterized by low market growth and a small market share, placing them in the "Dog" category of the BCG Matrix. For instance, in 2024, the prepaid card market, while generally robust, has seen specific sub-segments struggle as digital payment alternatives gain traction.

- Declining Demand: Certain niche prepaid cards may be losing relevance as consumers adopt more flexible and integrated digital payment solutions.

- Intense Competition: The prepaid card space is crowded, with new entrants and established players vying for market share, particularly in specialized niches.

- Low Growth & Market Share: These services contribute minimally to overall revenue growth and hold a small percentage of the market, characteristic of a "Dog" in the BCG framework.

Underperforming Commercial Real Estate (CRE) Loan Segments

While the commercial lending sector generally appears robust, certain segments within U.S. Bancorp's commercial real estate (CRE) loan portfolio may be underperforming. Industry-wide concerns about CRE risk, coupled with U.S. Bancorp's observed run-offs in this area, point to potential trouble spots.

These underperforming segments could experience an uptick in delinquency rates. This trend poses a direct threat to the bank's overall asset quality, especially if it doesn't coincide with significant growth in other lending areas.

- Office Sector Weakness: The office CRE sector continues to grapple with reduced demand due to remote work trends. For instance, in Q1 2024, office vacancy rates in major U.S. markets hovered around 18%, impacting loan performance.

- Retail CRE Challenges: While some retail segments show resilience, others, particularly those reliant on lower-income demographics or facing intense e-commerce competition, may present higher default risks.

- Multifamily Loan Concentration: Although multifamily properties generally perform well, over-concentration in specific geographic areas or segments with high supply could lead to localized underperformance.

U.S. Bancorp's legacy IT systems and infrastructure, particularly those supporting older banking functions, can be viewed as Dogs. These systems often require significant maintenance, are less adaptable to new technologies, and may not offer a competitive advantage.

The cost of maintaining these aging systems diverts resources that could be invested in more growth-oriented areas. In 2024, the push for digital transformation across the financial sector means that lagging technology becomes a distinct disadvantage.

| Business Unit | BCG Category | Rationale |

| Residential Mortgage Origination | Dog | Decreasing revenue and strategic divestitures indicate low market share and growth potential. |

| Auto Loan Originations | Dog | Deliberate reduction in focus and portfolio divestitures point to limited growth and high competition. |

| Underperforming Physical Branches | Dog | Outdated or low-traffic branches in slow-growth markets are costly liabilities. |

| Niche Prepaid Card Services | Dog | Low market growth and small market share due to shifting consumer preferences and digital alternatives. |

| Certain Commercial Real Estate Loans (e.g., Office Sector) | Dog | Weakness in specific CRE segments like office space, driven by remote work trends, leads to potential underperformance and higher delinquency risks. |

| Legacy IT Systems | Dog | High maintenance costs and lack of adaptability to new technologies hinder competitive advantage. |

Question Marks

U.S. Bancorp is actively exploring and investing in blockchain-based financial solutions, notably completing the first fully digital, blockchain-based trade finance transaction by a U.S. bank. This positions them to capitalize on a high-growth, transformative area within finance.

While blockchain technology presents significant future potential, U.S. Bancorp's current market share in this emerging sector is minimal. This necessitates substantial investment to establish a strong presence and scale operations effectively.

U.S. Bancorp's geographic expansion into markets like the Southeast and Texas positions these ventures as potential Stars or Question Marks in a BCG Matrix framework. These regions offer significant growth potential, aligning with the high-growth market characteristic. However, the company's current limited physical presence means they start with a low market share, requiring substantial investment to build brand recognition and customer base.

U.S. Bancorp is heavily investing in AI-driven automation to streamline operations and control expenses. This strategic move aims to boost operational efficiency across the board. For instance, in 2024, the bank reported a significant reduction in processing times for certain customer service inquiries due to AI integration.

While AI represents a major growth area for many sectors, U.S. Bancorp's proprietary AI applications are still in their formative stages regarding their market impact. The bank is actively developing these tools to enhance its banking services and create a competitive edge, but their full potential and market share dominance are yet to be realized.

Emerging Embedded Finance Verticals

U.S. Bancorp is actively broadening its embedded finance offerings beyond traditional payments, targeting high-growth sectors such as insurance carriers, healthcare providers, and online automotive sales. This strategic pivot aims to capture new revenue streams by integrating financial services directly into the customer journey within these specialized verticals.

While these emerging verticals represent significant growth potential, U.S. Bancorp's market penetration in each niche is still in its nascent stages. The bank's market share within insurance, healthcare, and online auto retail embedded finance solutions is currently developing, necessitating focused investment and strategic execution to build a dominant presence.

- Insurance Carriers: Embedded payments in insurance can streamline premium collection and claims payouts, offering a smoother experience for policyholders.

- Healthcare Systems: Facilitating patient payments for medical services directly at the point of care or through digital health platforms is a key focus.

- Online Auto Retailers: Integrating financing and payment options directly into the car buying process online enhances convenience for consumers.

New Digital Lending Products for Niche Segments

US Bancorp's exploration into new digital lending products for niche segments, such as small businesses or specific demographic groups, aligns with a Stars or Question Marks quadrant in the BCG Matrix. These initiatives offer significant growth potential by addressing unmet market needs. For instance, the digital small business lending market in the U.S. was projected to grow substantially, with some reports indicating a compound annual growth rate exceeding 15% leading up to 2024.

However, these ventures typically begin with a small market share, necessitating considerable investment in technology, marketing, and customer acquisition. The success of these products hinges on their ability to gain traction and scale rapidly; otherwise, they risk becoming Question Marks that consume resources without generating sufficient returns, or worse, devolving into Dogs.

Key considerations for these new digital lending products include:

- Targeted Market Identification: Precisely defining and understanding the needs of niche customer segments is crucial for product design and marketing effectiveness.

- Digital Infrastructure Investment: Robust and scalable digital platforms are essential for efficient origination, servicing, and customer experience.

- Customer Acquisition Strategy: Developing cost-effective strategies to reach and onboard these niche customers is vital for initial adoption and growth.

- Risk Management Frameworks: Implementing appropriate risk assessment and mitigation strategies tailored to the specific profiles of niche borrowers is paramount.

Question Marks in U.S. Bancorp's BCG Matrix represent new ventures or business units with high growth potential but currently low market share. These are areas where the bank is investing significantly, such as its blockchain initiatives or expansion into new embedded finance verticals. For instance, while the digital lending market for small businesses shows strong growth, U.S. Bancorp's presence in this specific niche is still developing. Successful Question Marks can evolve into Stars, but they carry the risk of becoming Dogs if they fail to gain market traction despite substantial investment. In 2024, the bank's focus on these emerging areas underscores a strategic bet on future revenue streams, requiring careful monitoring of market penetration and competitive response.

BCG Matrix Data Sources

Our US Bancorp BCG Matrix leverages a blend of internal financial statements, market share data, and industry growth projections to accurately position each business unit.