US Bancorp PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

US Bancorp Bundle

Navigate the complex external forces shaping US Bancorp's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, technological advancements, social trends, environmental concerns, and legal frameworks are impacting the financial sector. Gain the strategic foresight needed to make informed decisions.

Unlock actionable intelligence on US Bancorp's operating environment. Our expertly crafted PESTLE analysis provides a deep dive into the critical factors influencing the company's performance and market position. Don't miss out on crucial insights – download the full version now and gain a competitive edge.

Political factors

The banking sector, including U.S. Bancorp, is heavily influenced by a robust regulatory environment. Agencies like the Federal Reserve, FDIC, and OCC set strict rules governing capital adequacy, liquidity, and consumer protection. For instance, the Dodd-Frank Act, enacted in 2010, continues to shape banking regulations, impacting compliance costs and risk management practices.

Changes in these regulations directly affect U.S. Bancorp's operational costs and profitability. Stricter capital requirements, such as the Basel III framework, can necessitate holding more capital, potentially reducing return on equity. As of early 2024, discussions around potential revisions to capital rules, particularly for larger banks, are ongoing, which could lead to further adjustments.

Future legislative actions concerning financial stability or systemic risk could also force significant strategic shifts for U.S. Bancorp. For example, increased scrutiny on non-bank financial institutions or new rules around digital assets could alter the competitive landscape and require substantial business model adaptations.

The Federal Reserve's monetary policy, particularly its stance on interest rates, directly impacts U.S. Bancorp's profitability. For instance, the Fed's decision to raise the federal funds rate by 5.25% to 5.50% in July 2023, a level maintained through early 2024, influences the bank's net interest margin, which is the difference between interest income and interest expense.

Higher interest rates generally boost U.S. Bancorp's potential lending profits but also increase the likelihood of customers defaulting on loans. Conversely, a period of low rates, like those seen in the immediate aftermath of the COVID-19 pandemic, can stimulate borrowing and economic activity but squeeze the bank's margins, necessitating strategic adjustments in lending and deposit-gathering tactics.

Government fiscal policies, such as taxation and spending, significantly shape the economic landscape, directly impacting the demand for banking services. For instance, the U.S. federal deficit was projected to reach $1.9 trillion in 2024, a figure that influences interest rate environments and overall economic expansion, which in turn affects loan demand and investment banking opportunities for institutions like U.S. Bancorp.

Increased government spending, particularly on infrastructure or stimulus programs, can provide a tailwind for economic growth, potentially boosting U.S. Bancorp's loan origination volumes and investment banking advisory services. The Infrastructure Investment and Jobs Act, enacted in 2021 and continuing its impact through 2024 and beyond, represents a substantial government investment that could spur corporate activity and financing needs.

Changes in corporate tax rates have a direct bearing on U.S. Bancorp's profitability and strategic capital deployment. While the Tax Cuts and Jobs Act of 2017 lowered the corporate tax rate to 21%, any future adjustments to this rate will influence the bank's after-tax earnings and its capacity for reinvestment, dividends, or share buybacks.

Geopolitical Stability and Trade Relations

Geopolitical stability and evolving trade relations significantly influence U.S. Bancorp's operating environment, even with its predominantly domestic focus. Global events can introduce volatility into financial markets, directly impacting investment values and foreign exchange rates for clients engaged in international business. For instance, ongoing trade disputes or regional conflicts can create market uncertainty, potentially dampening client confidence and reducing investment activity in the latter half of 2024 and into 2025.

U.S. Bancorp's investment services and corporate banking divisions are particularly susceptible to these global economic shifts. Political instability in key trading partner nations or emerging markets can lead to unpredictable market movements. This exposure means that while core operations might be shielded, the performance of its wealth management and international corporate clients can be directly affected, necessitating robust risk management strategies to navigate potential disruptions.

Consider the following impacts:

- Market Volatility: Geopolitical tensions, such as those observed in Eastern Europe and the Middle East throughout 2024, can trigger sharp fluctuations in global equity and bond markets, affecting the value of assets managed by U.S. Bancorp.

- Trade Policy Changes: Shifts in international trade agreements or the imposition of new tariffs can alter the profitability and operational strategies of U.S. Bancorp's corporate clients, impacting their borrowing needs and investment decisions.

- Currency Fluctuations: Political instability often leads to currency devaluations or appreciations, directly impacting the returns on foreign investments and the cost of international transactions for U.S. Bancorp's clientele.

- Investor Sentiment: Heightened geopolitical risks can erode investor confidence, leading to a decrease in capital flows into markets, which can slow down deal-making and lending activities for the bank.

Consumer Protection and Data Privacy Regulations

The political environment in the US is increasingly focused on safeguarding consumers and their data. This trend is driving the creation of new regulations, such as comprehensive state-level privacy acts and potential federal initiatives. For U.S. Bancorp, this means ongoing investment in strong data security and compliance processes is essential to meet these evolving legal requirements.

Failure to comply with these consumer protection and data privacy mandates can lead to significant financial penalties, damage to the bank's reputation, and erosion of customer confidence. For instance, the California Consumer Privacy Act (CCPA), which took effect in 2020 and was further amended by the California Privacy Rights Act (CPRA) in 2023, allows for statutory damages of up to $7,500 per intentional violation, highlighting the financial risks involved.

- Increased Regulatory Scrutiny: Political pressure for stronger consumer data protection is a constant.

- Compliance Costs: U.S. Bancorp must allocate resources for data security upgrades and legal counsel.

- Reputational Risk: Data breaches or privacy violations can severely harm customer trust and brand image.

- Potential Fines: Non-compliance can result in substantial financial penalties, impacting profitability.

Government policies and political stability significantly shape the operating landscape for U.S. Bancorp. Changes in fiscal policy, such as tax rates and government spending, directly influence economic growth and demand for banking services. For instance, ongoing debates about the national debt and potential spending cuts in 2024 could impact interest rate environments and investment opportunities.

The ongoing focus on consumer protection and data privacy by lawmakers translates into increased compliance burdens for U.S. Bancorp. New regulations, potentially stemming from federal initiatives or state-level acts like the California Privacy Rights Act (CPRA), necessitate continuous investment in robust data security measures and legal adherence, with potential fines for non-compliance reaching substantial amounts.

Geopolitical events and evolving international trade relations introduce market volatility that can affect U.S. Bancorp's investment and corporate banking divisions. Tensions in global regions throughout 2024 have already demonstrated the capacity to trigger market fluctuations, impacting asset values and client confidence, thereby influencing lending and deal-making activities.

What is included in the product

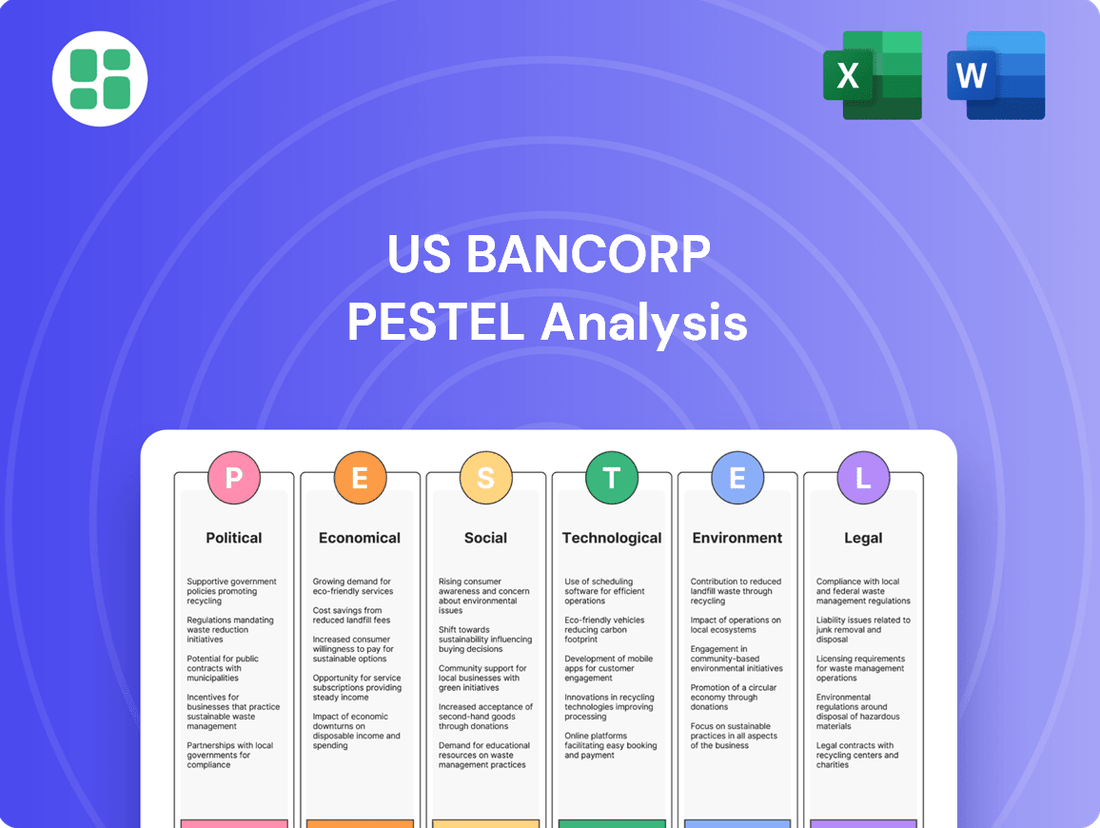

This PESTLE analysis examines how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal forces, shape the operating landscape for US Bancorp.

Provides a concise version of US Bancorp's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions.

Helps support discussions on external risk and market positioning for US Bancorp during planning sessions by offering a clear, summarized view of key factors.

Economic factors

The prevailing interest rate environment significantly impacts U.S. Bancorp's net interest margin (NIM). As of the first quarter of 2024, the Federal Reserve maintained its target federal funds rate range between 5.25% and 5.50%, a level that generally supports higher NIMs for banks. This environment allows U.S. Bancorp to earn more on its loan portfolio compared to the interest paid on deposits, contributing positively to profitability.

However, the sustainability of these higher rates is a key consideration. While higher rates boost interest income, they also increase funding costs as deposit rates adjust. U.S. Bancorp's ability to manage this dynamic, for instance, by attracting stable, lower-cost core deposits, will be crucial in maintaining a healthy NIM throughout 2024 and into 2025, especially if rate cuts begin to materialize.

Inflationary pressures can increase U.S. Bancorp's operational expenses and potentially curb consumer spending, leading to softer loan demand. For instance, if inflation outpaces wage growth significantly, consumers may have less discretionary income for new loans.

However, a scenario of moderate inflation alongside strong economic expansion, evidenced by a healthy Gross Domestic Product (GDP) growth rate, can boost overall business and consumer activity. This environment typically stimulates demand for banking services like lending and payment processing. In Q1 2024, the US GDP grew at an annualized rate of 1.3%, indicating continued, albeit moderating, economic expansion.

The Consumer Price Index (CPI) in the U.S. saw an increase of 3.4% year-over-year in April 2024. This rate of inflation requires careful monitoring by U.S. Bancorp for strategic financial planning, balancing the potential for higher interest income against the risks of reduced borrowing and increased operational costs.

Unemployment rates have a direct impact on U.S. Bancorp's loan performance. For instance, the U.S. unemployment rate stood at 3.9% in April 2024, a slight increase from 3.8% in March 2024, indicating a stable but closely watched labor market.

When unemployment rises, more individuals and businesses struggle to meet their financial obligations, leading to higher loan defaults and delinquencies. This necessitates increased loan loss provisions for U.S. Bancorp, impacting its profitability.

Conversely, a robust labor market, characterized by low unemployment, generally supports stronger credit quality. This environment reduces the risk of defaults and encourages more borrowing, which is beneficial for the bank's lending activities.

Consumer Spending and Savings Behavior

Consumer spending and savings habits are crucial for U.S. Bancorp. When consumers feel secure and have extra money, they tend to spend more and use credit, which directly benefits the bank through higher transaction volumes and interest earnings. For instance, in Q1 2024, U.S. Bancorp reported a 7% increase in credit and debit card spending compared to the previous year, reflecting a generally robust consumer.

Conversely, a shift towards saving more or cutting back on non-essential purchases can slow down deposit growth and reduce the demand for new loans. This behavioral change directly impacts the bank's ability to grow its loan portfolio and can influence the overall profitability of its lending operations. The personal saving rate in the U.S. hovered around 3.7% in early 2024, a notable increase from pre-pandemic levels, indicating a cautious consumer sentiment.

- Consumer Confidence: Higher consumer confidence typically correlates with increased spending and credit utilization, benefiting U.S. Bancorp's revenue streams.

- Savings Rate: A rising personal saving rate can lead to slower loan growth and potentially impact deposit levels as consumers prioritize accumulating cash.

- Disposable Income: The amount of disposable income available directly influences discretionary spending, affecting credit card usage and fee income for the bank.

- Economic Outlook: Consumers' perception of the future economic environment heavily influences their willingness to spend versus save, creating a direct link to U.S. Bancorp's performance.

Real Estate Market Dynamics

The U.S. real estate market's condition is a critical economic factor for U.S. Bancorp, influencing both its mortgage and commercial lending businesses. A robust housing market, characterized by rising property values and increased housing starts, generally translates to higher demand for new mortgages and a lower risk of defaults on existing ones. For instance, in early 2024, the median home price saw a notable increase compared to the previous year, indicating continued demand despite higher interest rates.

Commercial real estate performance, including office, retail, and industrial sectors, also directly impacts U.S. Bancorp's loan portfolios. Elevated commercial vacancy rates, particularly in office spaces, can lead to increased loan delinquencies and reduced demand for new commercial development loans. Data from late 2023 and early 2024 showed persistent challenges in certain commercial segments, with vacancy rates remaining elevated in major metropolitan areas.

- Residential Property Values: As of Q1 2024, the S&P CoreLogic Case-Shiller Home Price Index indicated year-over-year price appreciation, suggesting a generally healthy residential market.

- Commercial Vacancy Rates: National office vacancy rates hovered around 19% in late 2023, presenting a headwind for commercial real estate lending.

- Housing Starts: New housing starts in early 2024 showed signs of recovery from earlier lows, though still sensitive to interest rate movements and construction costs.

- Mortgage Originations: Mortgage origination volumes in 2024 were influenced by prevailing mortgage rates, impacting the pipeline for new lending business.

The prevailing interest rate environment significantly impacts U.S. Bancorp's net interest margin (NIM). As of the first quarter of 2024, the Federal Reserve maintained its target federal funds rate range between 5.25% and 5.50%, a level that generally supports higher NIMs for banks. This environment allows U.S. Bancorp to earn more on its loan portfolio compared to the interest paid on deposits, contributing positively to profitability.

However, the sustainability of these higher rates is a key consideration. While higher rates boost interest income, they also increase funding costs as deposit rates adjust. U.S. Bancorp's ability to manage this dynamic, for instance, by attracting stable, lower-cost core deposits, will be crucial in maintaining a healthy NIM throughout 2024 and into 2025, especially if rate cuts begin to materialize.

Inflationary pressures can increase U.S. Bancorp's operational expenses and potentially curb consumer spending, leading to softer loan demand. For instance, if inflation outpaces wage growth significantly, consumers may have less discretionary income for new loans. However, a scenario of moderate inflation alongside strong economic expansion, evidenced by a healthy Gross Domestic Product (GDP) growth rate, can boost overall business and consumer activity. This environment typically stimulates demand for banking services like lending and payment processing. In Q1 2024, the US GDP grew at an annualized rate of 1.3%, indicating continued, albeit moderating, economic expansion. The Consumer Price Index (CPI) in the U.S. saw an increase of 3.4% year-over-year in April 2024. This rate of inflation requires careful monitoring by U.S. Bancorp for strategic financial planning, balancing the potential for higher interest income against the risks of reduced borrowing and increased operational costs.

Unemployment rates have a direct impact on U.S. Bancorp's loan performance. For instance, the U.S. unemployment rate stood at 3.9% in April 2024, a slight increase from 3.8% in March 2024, indicating a stable but closely watched labor market. When unemployment rises, more individuals and businesses struggle to meet their financial obligations, leading to higher loan defaults and delinquencies. This necessitates increased loan loss provisions for U.S. Bancorp, impacting its profitability. Conversely, a robust labor market, characterized by low unemployment, generally supports stronger credit quality. This environment reduces the risk of defaults and encourages more borrowing, which is beneficial for the bank's lending activities.

Consumer spending and savings habits are crucial for U.S. Bancorp. When consumers feel secure and have extra money, they tend to spend more and use credit, which directly benefits the bank through higher transaction volumes and interest earnings. For instance, in Q1 2024, U.S. Bancorp reported a 7% increase in credit and debit card spending compared to the previous year, reflecting a generally robust consumer. Conversely, a shift towards saving more or cutting back on non-essential purchases can slow down loan growth and potentially impact deposit levels as consumers prioritize accumulating cash. This behavioral change directly impacts the bank's ability to grow its loan portfolio and can influence the overall profitability of its lending operations. The personal saving rate in the U.S. hovered around 3.7% in early 2024, a notable increase from pre-pandemic levels, indicating a cautious consumer sentiment.

The U.S. real estate market's condition is a critical economic factor for U.S. Bancorp, influencing both its mortgage and commercial lending businesses. A robust housing market, characterized by rising property values and increased housing starts, generally translates to higher demand for new mortgages and a lower risk of defaults on existing ones. For instance, in early 2024, the median home price saw a notable increase compared to the previous year, indicating continued demand despite higher interest rates. Commercial real estate performance, including office, retail, and industrial sectors, also directly impacts U.S. Bancorp's loan portfolios. Elevated commercial vacancy rates, particularly in office spaces, can lead to increased loan delinquencies and reduced demand for new commercial development loans. Data from late 2023 and early 2024 showed persistent challenges in certain commercial segments, with vacancy rates remaining elevated in major metropolitan areas.

| Economic Factor | Data Point (Q1 2024 or latest available) | Impact on U.S. Bancorp |

| Federal Funds Rate | 5.25% - 5.50% | Supports higher Net Interest Margin (NIM) |

| GDP Growth (Annualized) | 1.3% (Q1 2024) | Indicates moderating economic expansion, potentially boosting loan demand |

| Consumer Price Index (CPI) YoY | 3.4% (April 2024) | Increases operational costs, potential for reduced consumer spending |

| Unemployment Rate | 3.9% (April 2024) | Stable labor market, low unemployment supports credit quality |

| Credit/Debit Card Spending YoY | +7% (Q1 2024) | Indicates robust consumer spending, beneficial for transaction volumes |

| Personal Saving Rate | ~3.7% (Early 2024) | Cautious consumer sentiment, potential for slower loan growth |

| Median Home Price | Increased YoY (Early 2024) | Supports residential lending, lower default risk |

| Office Vacancy Rate | ~19% (Late 2023) | Headwind for commercial real estate lending |

Full Version Awaits

US Bancorp PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of US Bancorp delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. It provides critical insights for strategic planning and risk assessment.

Sociological factors

The U.S. population is undergoing significant demographic shifts, with the proportion of individuals aged 65 and over projected to reach 22% by 2050. This aging trend, coupled with increasing ethnic and racial diversity, which saw the Hispanic or Latino population grow by 23% between 2010 and 2020, directly impacts financial service demands. U.S. Bancorp needs to tailor retirement planning and wealth management services for older demographics while developing culturally sensitive products for diverse communities.

The rise of digital-native generations, like Gen Z, who are now entering their prime earning years, necessitates a focus on mobile-first banking and digital investment platforms. A 2024 report indicated that 70% of Gen Z prefer digital channels for banking transactions. U.S. Bancorp's ability to offer seamless, intuitive digital experiences is crucial for attracting and retaining these younger customers, influencing product innovation and market reach.

Consumer trust is paramount for financial institutions like U.S. Bancorp, with public perception often shaped by historical events such as the 2008 financial crisis and ongoing concerns about ethical conduct and transparency. A strong reputation for reliability and customer-centricity directly fuels U.S. Bancorp's capacity to draw in and keep its customer base.

In 2023, U.S. Bancorp reported a customer satisfaction score of 78% in a recent industry survey, underscoring the ongoing importance of service quality. The company's commitment to corporate social responsibility, including its 2024 pledge to invest $100 million in community development initiatives, plays a vital role in bolstering this trust and ensuring long-term customer loyalty.

The financial literacy rate in the U.S. is a key factor for U.S. Bancorp. In 2024, a significant portion of Americans still struggled with basic financial concepts, impacting their engagement with financial products. Initiatives aimed at improving financial literacy, such as those supported by U.S. Bancorp, can unlock new customer segments and increase product adoption.

Financial inclusion is also critical. As of late 2024, millions of Americans remained unbanked or underbanked. U.S. Bancorp's efforts to expand access to banking services, particularly in underserved communities, directly correlate with its potential market reach and the overall demand for its offerings.

Workforce Trends and Talent Management

Sociological shifts are significantly reshaping the workforce, impacting how companies like U.S. Bancorp attract and retain talent. Employees increasingly prioritize work-life balance and flexible work arrangements, with a recent survey indicating that 70% of workers would consider leaving a job that didn't offer flexibility. This evolving landscape necessitates a strategic approach to talent management.

U.S. Bancorp must actively adapt to these changing expectations by offering competitive benefits packages that include robust support for work-life integration and embracing diverse work models. The growing emphasis on diversity, equity, and inclusion (DEI) is also a critical factor; companies with strong DEI initiatives report higher employee engagement and better financial performance. In 2023, U.S. Bancorp reported progress in its DEI efforts, highlighting increased representation in leadership roles.

To maintain a skilled and motivated workforce in a competitive labor market, U.S. Bancorp's talent management strategies must be forward-thinking. This includes fostering an inclusive corporate culture that values varied perspectives and experiences. Furthermore, the financial services sector, like many others, is seeing a demand for specialized skills, making continuous learning and development programs essential for employee retention and growth.

- Work-Life Balance Expectations: A significant majority of the workforce now prioritizes flexibility, impacting recruitment and retention strategies.

- Diversity, Equity, and Inclusion (DEI): Strong DEI programs are linked to improved employee morale and business outcomes, with U.S. Bancorp actively working on its representation metrics.

- Talent Attraction and Retention: Adapting to these sociological trends through competitive benefits and an inclusive culture is vital for securing top talent in a competitive market.

- Skill Demand: The need for specialized skills in financial services underscores the importance of ongoing employee development and training initiatives.

Ethical Consumerism and ESG Expectations

Ethical consumerism is a significant force, with a growing number of consumers and investors prioritizing environmental, social, and governance (ESG) factors. This trend directly impacts financial institutions like U.S. Bancorp, which face increasing pressure to showcase their commitment to sustainability and responsible practices.

U.S. Bancorp must actively demonstrate its dedication to ESG principles across its operations and lending activities. This includes transparent reporting on environmental impact, social initiatives, and robust governance structures. For instance, in 2023, U.S. Bancorp announced a goal to finance $100 billion in renewable energy by 2030, directly addressing environmental concerns.

- Growing Consumer Demand: A significant portion of consumers now consider a company's ethical stance when making purchasing decisions.

- Investor Scrutiny: ESG performance is a key metric for many institutional investors, influencing capital allocation. U.S. Bancorp's ESG rating from MSCI in 2024 was 'AA', indicating strong performance.

- Brand Reputation: Aligning with ethical values enhances brand appeal, attracting a customer base that values social responsibility.

- Risk Mitigation: Proactive ESG management can mitigate reputational and regulatory risks, fostering long-term stability.

Societal values are shifting, with a greater emphasis on financial inclusion and accessibility. U.S. Bancorp's efforts to serve unbanked and underbanked populations, such as its 2024 initiative to expand access in rural areas, directly address this trend. This focus not only broadens market reach but also aligns with a societal demand for equitable financial services.

Technological factors

U.S. Bancorp is navigating a significant digital transformation, with mobile banking at its core. By the end of 2024, over 70% of their customer interactions were projected to occur through digital channels, highlighting the critical need for advanced mobile platforms. This trend underscores the expectation for seamless, intuitive, and secure digital experiences for all banking needs.

The bank's investment in user-friendly mobile apps and online portals is paramount for maintaining a competitive edge and retaining its customer base. In 2024, U.S. Bancorp reported a 15% year-over-year increase in mobile app engagement, demonstrating customer preference for digital self-service options.

The increasing frequency and sophistication of cyberattacks demand continuous, significant investment in cybersecurity for U.S. Bancorp. In 2023, the financial services sector saw a notable rise in ransomware attacks, with costs averaging millions per incident, underscoring the critical need for robust defenses to protect sensitive customer data and financial operations.

Maintaining customer trust hinges on U.S. Bancorp's ability to safeguard personal information and ensure the integrity of transactions, as breaches can lead to severe financial penalties and irreparable reputational harm. For instance, regulatory fines for data privacy violations can reach billions, making proactive security measures a crucial business imperative.

Essential components for U.S. Bancorp include advanced threat detection systems, secure data encryption, and comprehensive employee training programs to mitigate internal vulnerabilities and respond effectively to emerging cyber threats.

Artificial intelligence and machine learning are fundamentally reshaping U.S. Bancorp's business. These technologies are being integrated across operations, from bolstering fraud detection and risk management to personalizing customer interactions and powering automated financial advice. For instance, in 2024, many financial institutions, including U.S. Bancorp, are investing heavily in AI to streamline back-office processes and enhance customer experience.

By adopting AI and ML, U.S. Bancorp can significantly boost operational efficiency and improve the precision of its decision-making. This allows for the creation of more customized financial products and services, directly addressing evolving customer needs. The strategic deployment of these advanced technologies is crucial for maintaining a competitive edge and driving future expansion in the dynamic financial landscape.

Fintech Innovation and Competition

Fintech innovation presents a dual challenge and opportunity for U.S. Bancorp. Agile fintech companies are increasingly offering specialized services that can chip away at traditional banking revenue streams. For instance, the digital payments sector, a key area for fintech disruption, saw transaction volumes surge. U.S. Bancorp's strategy must involve either building its own innovative digital capabilities, collaborating with fintechs through partnerships, or acquiring promising startups to ensure it remains competitive and relevant in the evolving financial landscape.

The competitive pressure from fintechs is significant, as these companies often leverage advanced technology to provide user-friendly and cost-effective solutions. In 2024, global fintech investment continued to be robust, with significant funding flowing into areas like digital banking, payments, and wealth management. U.S. Bancorp needs to adapt by integrating new technologies and exploring new business models to counter this disruption.

- Fintech Investment: Global fintech funding reached over $100 billion in 2023, with projections for continued growth in 2024, indicating strong investor confidence in the sector's innovation.

- Digital Payments Growth: The digital payments market is expected to grow at a compound annual growth rate of approximately 12% through 2028, highlighting a key area of fintech competition.

- Partnership Strategies: U.S. Bancorp has actively pursued partnerships, such as its collaboration with Plaid for data aggregation, to enhance its digital offerings and customer experience.

Cloud Computing and Infrastructure Modernization

U.S. Bancorp's technological evolution hinges on its strategic migration to cloud computing and the modernization of its IT infrastructure. This shift is paramount for boosting scalability, operational flexibility, and ultimately, cost-effectiveness. By embracing cloud-based solutions, the bank can accelerate the rollout of new customer-facing services and significantly enhance its data analytics capabilities, crucial for understanding evolving market trends.

These technological advancements are not just about efficiency; they are foundational for resilience and growth. Modernizing IT infrastructure allows for more robust disaster recovery protocols, ensuring business continuity even in challenging circumstances. For instance, a 2024 report indicated that financial institutions leveraging cloud infrastructure saw an average of 15% improvement in application deployment speed.

The bank's commitment to investing in a resilient and agile IT backbone is directly linked to its digital transformation goals. This includes supporting the increasing demand for digital banking services and maintaining operational stability in a rapidly changing technological landscape. U.S. Bancorp's 2024 IT budget allocated a significant portion to cloud migration and infrastructure upgrades, reflecting this strategic priority.

- Scalability and Flexibility: Cloud platforms offer on-demand resource allocation, allowing U.S. Bancorp to scale operations up or down based on business needs, a key advantage in the dynamic financial sector.

- Enhanced Data Analytics: Modernized infrastructure, often cloud-native, provides the processing power and tools necessary for advanced data analytics, enabling deeper customer insights and more informed decision-making.

- Cost Efficiency: Transitioning from on-premises hardware to cloud services can lead to reduced capital expenditures and optimized operational costs through pay-as-you-go models.

- Improved Disaster Recovery: Cloud-based solutions typically offer more sophisticated and geographically dispersed disaster recovery capabilities compared to traditional data centers, bolstering business continuity.

U.S. Bancorp's technological trajectory is heavily influenced by advancements in artificial intelligence (AI) and machine learning (ML). These technologies are being integrated to enhance fraud detection, refine risk management, and personalize customer experiences, with significant investments made in 2024 to leverage these capabilities. The bank's strategic deployment of AI and ML aims to boost operational efficiency and improve decision-making accuracy.

The competitive landscape is further shaped by fintech innovations, as agile companies offer specialized digital services. Global fintech investment remained strong in 2023, exceeding $100 billion, with continued growth anticipated for 2024, particularly in digital payments. U.S. Bancorp is actively pursuing partnerships, such as its collaboration with Plaid, to bolster its digital offerings and maintain relevance.

The migration to cloud computing and IT infrastructure modernization are critical for U.S. Bancorp's scalability and operational flexibility. Financial institutions utilizing cloud infrastructure saw an average 15% improvement in application deployment speed in 2024. This strategic shift supports the growing demand for digital banking services and ensures business continuity.

Legal factors

U.S. Bancorp navigates a stringent legal landscape governed by federal and state banking regulations. Key among these are capital adequacy rules, such as those derived from Basel III, which dictate minimum capital reserves banks must hold. For instance, as of Q1 2024, U.S. Bancorp's Common Equity Tier 1 (CET1) ratio remained robust, exceeding regulatory minimums, reflecting its compliance efforts.

Compliance with anti-money laundering (AML) and know-your-customer (KYC) mandates is critical, requiring substantial investment in technology and personnel. Failure to adhere to these, alongside lending regulations, can result in hefty fines and severe reputational damage, impacting customer trust and market standing.

The financial sector, including U.S. Bancorp, faces increasing regulatory scrutiny regarding data privacy and security. Laws like the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), alongside other state-level regulations, mandate stricter controls over how customer data is collected, processed, and shared. Failure to comply can result in significant penalties, with CCPA civil penalties potentially reaching $7,500 per intentional violation, impacting operational costs and brand reputation.

U.S. Bancorp operates under a stringent framework of consumer protection laws, crucial for maintaining trust and regulatory compliance. Legislation such as the Truth in Lending Act (TILA), Fair Credit Reporting Act (FCRA), and the Equal Credit Opportunity Act (ECOA) govern key banking activities. These laws mandate transparency in lending terms, accuracy in credit reporting, and fairness in credit access, directly impacting how U.S. Bancorp engages with its customer base.

Failure to adhere to these consumer protection statutes can result in significant penalties. For instance, in 2023, the Consumer Financial Protection Bureau (CFPB) reported issuing over $3.1 billion in total relief for consumers across various enforcement actions. U.S. Bancorp's commitment to these regulations is therefore vital to mitigate legal risks, avoid costly fines, and preserve its reputation in the competitive financial services landscape.

Anti-Trust and Competition Law

Anti-trust and competition laws are critical for U.S. Bancorp, shaping its ability to grow through mergers and acquisitions. Regulatory bodies like the Department of Justice and the Federal Trade Commission closely examine any deals to ensure they don't stifle competition. For instance, the U.S. banking sector saw significant consolidation in 2023 and early 2024, with regulators paying close attention to market share impacts.

U.S. Bancorp's strategic moves, such as potential acquisitions or significant partnerships, face intense scrutiny under these regulations. The aim is to maintain a level playing field in the financial services market. Failure to comply can lead to substantial fines or even the unwinding of approved transactions, as seen in past cases where large financial institutions faced challenges to their expansion plans.

Key aspects of anti-trust and competition law relevant to U.S. Bancorp include:

- Merger Review: Scrutiny of acquisitions to prevent monopolies or significant reduction in competition.

- Market Conduct: Regulations against anti-competitive practices like price-fixing or predatory pricing.

- Regulatory Approval: Requirement for explicit approval from antitrust authorities before major transactions.

- Compliance Costs: Significant investment in legal and compliance teams to navigate complex competition frameworks.

Litigation and Legal Risks

U.S. Bancorp, like any major financial institution, navigates a landscape rife with litigation and legal risks. These can manifest in various forms, from customer-initiated class-action lawsuits concerning fees or practices to disputes with third-party vendors or internal employee-related legal challenges. For instance, in the first quarter of 2024, U.S. Bancorp reported $450 million in litigation reserves, reflecting ongoing legal matters and potential future settlements.

Furthermore, regulatory scrutiny and potential enforcement actions from bodies like the Consumer Financial Protection Bureau (CFPB) or the Office of the Comptroller of the Currency (OCC) represent significant legal headwinds. These investigations can lead to substantial fines, mandated changes in business practices, and reputational damage. In 2023, the financial sector as a whole saw an increase in regulatory fines, with penalties related to compliance and consumer protection being particularly prevalent.

Mitigating these inherent legal risks requires a multi-faceted approach. U.S. Bancorp relies on proactive legal counsel to anticipate and address potential issues. Robust internal controls are crucial for ensuring compliance with a complex web of financial regulations. Additionally, the effective implementation of dispute resolution mechanisms aims to resolve conflicts efficiently, thereby minimizing both the financial impact of litigation and any associated reputational harm.

- Customer Litigation: Potential for class-action lawsuits related to product offerings, fees, or service delivery.

- Regulatory Actions: Risk of fines, sanctions, or mandated operational changes stemming from investigations by financial regulators.

- Vendor and Employee Disputes: Legal challenges arising from contractual disagreements with suppliers or employment-related claims.

- Mitigation Strategies: Emphasis on strong internal controls, expert legal guidance, and efficient dispute resolution to manage legal exposure.

U.S. Bancorp operates under a complex web of consumer protection laws, including the Truth in Lending Act and the Fair Credit Reporting Act, which mandate transparency and fairness in customer dealings. The Consumer Financial Protection Bureau (CFPB) reported over $3.1 billion in consumer relief from enforcement actions in 2023, highlighting the potential financial impact of non-compliance.

Antitrust laws, enforced by bodies like the Department of Justice, scrutinize mergers and acquisitions to prevent market monopolization. The banking sector's consolidation trends in 2023-2024 mean U.S. Bancorp must carefully navigate these regulations to ensure its growth strategies do not violate competition principles.

Litigation and regulatory enforcement remain significant legal risks, with U.S. Bancorp holding $450 million in litigation reserves as of Q1 2024. Proactive legal counsel, robust internal controls, and efficient dispute resolution are crucial for managing this exposure and avoiding substantial fines or reputational damage.

Environmental factors

U.S. Bancorp is actively integrating climate risk management into its operations, a trend amplified by regulatory expectations and investor scrutiny. This involves a deep dive into both physical risks, like those posed by increased extreme weather events impacting collateral, and transition risks, stemming from policy changes and technological shifts towards a low-carbon economy.

In 2024, financial institutions like U.S. Bancorp are enhancing their credit assessment processes to incorporate climate-related factors. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) framework is increasingly adopted, pushing for greater transparency on how climate risks affect portfolios. This proactive approach aims to safeguard asset values and ensure long-term portfolio resilience.

Investors and stakeholders are increasingly prioritizing transparency in Environmental, Social, and Governance (ESG) performance, making it a crucial environmental factor. U.S. Bancorp faces growing expectations to offer detailed ESG disclosures, covering areas like its carbon footprint, sustainable financing initiatives, and overall governance. For instance, in 2023, U.S. Bancorp reported a 12% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, demonstrating progress in its environmental stewardship.

Meeting these demands for robust ESG reporting can significantly bolster investor confidence and attract capital from the rapidly expanding socially responsible investment (SRI) sector. Furthermore, strong ESG performance and transparent communication contribute to an improved brand reputation, which is vital in the competitive financial services landscape. The bank's commitment to sustainable finance, including $9.1 billion in green financing in 2023, directly addresses this growing environmental concern.

The growing demand for sustainable finance offers U.S. Bancorp a significant avenue to expand its offerings. This includes developing green lending products, issuing green bonds, and providing investment services focused on environmentally responsible projects. For instance, by the end of 2023, U.S. Bancorp had facilitated over $50 billion in renewable energy financing, showcasing its commitment and capacity in this burgeoning market.

Financing renewable energy projects, sustainable infrastructure development, and energy-efficient upgrades are key components of this strategy. The global sustainable finance market reached an estimated $3.4 trillion in 2023, indicating substantial growth potential. By actively participating, U.S. Bancorp can tap into this expanding market, aligning with international environmental objectives and creating new revenue streams.

Operational Environmental Footprint

U.S. Bancorp faces increasing pressure to shrink its direct environmental impact, focusing on reducing energy usage, waste, and water consumption across its facilities. By investing in energy-efficient upgrades and sustainable practices, the bank can realize cost savings and bolster its reputation for corporate citizenship. For instance, in 2023, U.S. Bancorp reported a 16% reduction in Scope 1 and 2 greenhouse gas emissions compared to a 2019 baseline, demonstrating tangible progress in operational efficiency.

Key initiatives contributing to this reduction include:

- Energy Efficiency: Upgrading lighting and HVAC systems in corporate offices and branches to reduce overall energy consumption.

- Waste Reduction: Implementing comprehensive recycling programs and minimizing single-use materials.

- Sustainable Procurement: Prioritizing vendors with strong environmental track records and sourcing eco-friendly products.

Reputational Risk from Environmental Controversies

U.S. Bancorp faces reputational risks if associated with industries or projects that draw environmental criticism. For instance, continued financing of fossil fuel projects, despite growing calls for a transition to cleaner energy, could alienate environmentally conscious investors and customers. This scrutiny intensified in 2024 as climate advocacy groups continued to highlight financial institutions' roles in funding carbon-intensive industries.

Public and activist pressure can mount if the bank is seen as enabling activities that harm the environment or exacerbate climate change. Reports in late 2024 by organizations tracking corporate environmental impact often cited major banks, including U.S. Bancorp, for their exposure to sectors contributing to greenhouse gas emissions, impacting public perception.

To counter these threats, U.S. Bancorp emphasizes its commitment to environmental due diligence and responsible lending policies. In its 2025 sustainability reports, the bank detailed initiatives aimed at increasing its financing for renewable energy projects and reducing its own operational carbon footprint, signaling a strategic effort to align with stakeholder expectations and mitigate reputational damage.

Key areas of focus for mitigating reputational risk include:

- Financing of Fossil Fuels: Continued exposure to coal, oil, and gas projects can attract negative attention.

- Climate Risk Disclosure: Transparency regarding financed emissions and climate transition plans is increasingly scrutinized by regulators and the public.

- Stakeholder Engagement: Proactive dialogue with environmental groups and investors is vital for managing perceptions.

- Sustainable Finance Growth: Expanding investments in renewable energy and green technologies can bolster a positive environmental image.

U.S. Bancorp is navigating increasing regulatory and investor demands for climate risk integration, impacting its operational strategies and disclosures. The bank is enhancing credit assessment to include climate factors, adopting frameworks like TCFD for greater transparency and portfolio resilience.

Investor focus on ESG performance is driving U.S. Bancorp to provide detailed disclosures on its carbon footprint and sustainable financing, with a 12% reduction in Scope 1 and 2 emissions reported by 2023 from a 2019 baseline. This commitment is crucial for attracting capital from the growing socially responsible investment sector.

The bank is actively expanding its sustainable finance offerings, including green lending and green bonds, having facilitated over $50 billion in renewable energy financing by the end of 2023. This aligns with global environmental objectives and taps into the substantial global sustainable finance market, which reached an estimated $3.4 trillion in 2023.

U.S. Bancorp faces reputational risks from financing carbon-intensive industries, with scrutiny intensifying in 2024. To mitigate this, the bank emphasizes environmental due diligence and is increasing financing for renewable energy projects, as detailed in its 2025 sustainability reports.

| Environmental Factor | U.S. Bancorp Action/Data (2023-2025) | Market Context |

|---|---|---|

| Climate Risk Management | Enhanced credit assessment, TCFD adoption | Growing regulatory and investor pressure |

| ESG Disclosure & Performance | 12% Scope 1 & 2 GHG reduction (vs. 2019 baseline) | Increased demand for transparency from SRI sector |

| Sustainable Finance | $50B+ renewable energy financing facilitated (by end of 2023) | Global sustainable finance market ~$3.4T in 2023 |

| Reputational Risk Mitigation | Focus on environmental due diligence, increased renewable financing | Scrutiny on fossil fuel financing, activist pressure |

PESTLE Analysis Data Sources

Our US Bancorp PESTLE analysis is built on a robust foundation of data from official government agencies like the Federal Reserve and SEC, alongside reports from reputable financial institutions and market research firms. We incorporate economic indicators, regulatory updates, and industry-specific trends to provide a comprehensive view.