Tomra Systems PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tomra Systems Bundle

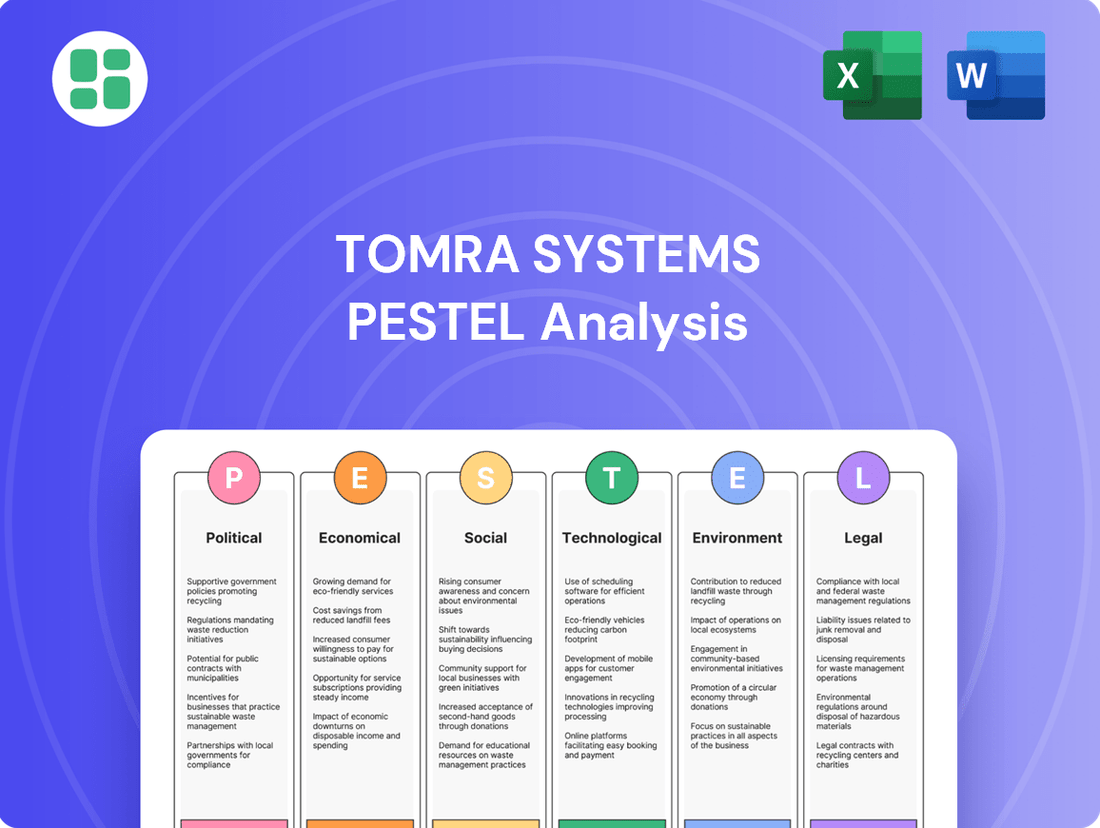

Unlock the critical external factors shaping Tomra Systems's future with our comprehensive PESTLE analysis. From evolving environmental regulations to technological advancements in recycling, understand the forces driving their strategy. Gain a competitive edge by leveraging these expert insights to inform your own market approach. Download the full version now for actionable intelligence.

Political factors

Government policies profoundly shape the recycling and waste management landscape, directly impacting TOMRA's business. For instance, the European Union's Circular Economy Action Plan, updated in 2023, sets ambitious targets for waste reduction and increased recycling rates, creating significant demand for TOMRA's sorting and collection technologies. Many countries are implementing or expanding Deposit Return Schemes (DRS), like the recent expansion in Portugal in 2023, which significantly boosts TOMRA's market for reverse vending machines.

International trade policies significantly shape TOMRA's global operations. For instance, the European Union's Green Deal and its focus on a circular economy, aiming for 70% recycling of municipal waste by 2030, directly benefit TOMRA's sorting technologies. Conversely, tariffs or trade disputes, such as those impacting global trade flows in 2024, could increase the cost of components for TOMRA's equipment or affect the price competitiveness of recycled materials, influencing market access.

Geopolitical tensions and evolving trade agreements are also critical considerations. As of early 2025, ongoing discussions around potential new trade blocs or adjustments to existing agreements, like the USMCA, could alter market access and supply chain dynamics for TOMRA's advanced sorting and recycling solutions. TOMRA's strategic planning must account for these shifts to maintain its competitive edge and operational efficiency across diverse international markets.

TOMRA Systems operates in diverse global markets, making political stability a crucial consideration. For instance, its significant presence in Europe, particularly Germany and Norway, benefits from established democratic governance and predictable regulatory environments. However, potential expansion into regions with less stable political landscapes, such as parts of Eastern Europe or emerging Asian economies, could introduce risks like policy reversals or increased corruption, impacting investment security and operational continuity.

Political factor 4

Government subsidies and grants play a crucial role in accelerating the adoption of green technologies and circular economy models. These financial incentives directly impact the cost-effectiveness of TOMRA's solutions for its clients, thereby stimulating demand. For instance, many European nations are actively providing funding for advanced sorting technologies and material recovery facilities, aligning with their ambitious recycling targets.

The availability and duration of these incentives vary significantly by region, influencing the pace of market penetration for TOMRA's offerings. Countries with robust and long-term support programs, such as Germany's Green Technology Funding Program or France's Extended Producer Responsibility (EPR) schemes, often see higher adoption rates. These programs can reduce the initial capital expenditure for clients, making investments in sophisticated waste management and recycling equipment more attractive.

- European Union's Circular Economy Action Plan continues to drive regulatory frameworks and funding opportunities for waste management and recycling infrastructure.

- National-level incentives in countries like Norway, Sweden, and the Netherlands often target specific waste streams and recycling technologies, directly benefiting TOMRA's customer base.

- Government grants in North America are increasingly focused on improving recycling rates and developing domestic processing capabilities, creating new market opportunities.

- The duration and predictability of these incentives are key factors for TOMRA's clients when making long-term investment decisions in advanced sorting and recycling equipment.

Political factor 5

Lobbying by industry associations and environmental groups significantly shapes policy on resource management, influencing recycling targets and technology standards. TOMRA actively engages in advocacy, aiming to create a regulatory environment that favors its solutions. For instance, in 2024, the European Federation for Waste Management and Environmental Services (FEAD) continued to advocate for harmonized recycling targets across the EU, a move that could bolster demand for advanced sorting technologies like TOMRA's.

These advocacy efforts are crucial for TOMRA's success. By pushing for higher recycling rates and the adoption of specific material bans, such as those targeting single-use plastics, TOMRA aims to directly increase the need for its sorting and collection systems. The company's own lobbying, often coordinated with industry partners, focuses on promoting the economic and environmental benefits of closed-loop systems and deposit return schemes (DRS).

The effectiveness of these lobbying efforts is evident in policy developments. For example, the expansion of DRS schemes in various regions, often driven by advocacy, directly benefits TOMRA's business model. By mid-2024, over 70 deposit return systems were operational globally, with many experiencing significant increases in collection rates, often exceeding 90% for beverage containers.

Key areas of policy influence include:

- Advocacy for increased recycled content mandates in new products, driving demand for high-quality recycled materials.

- Lobbying for stricter regulations on landfilling and incineration, promoting waste prevention and recycling.

- Promoting the adoption of digital solutions for waste tracking and management, aligning with TOMRA's technology offerings.

- Support for extended producer responsibility (EPR) schemes that incentivize efficient collection and recycling.

Government policies, particularly those promoting a circular economy, are a significant driver for TOMRA. The European Union's ambitious recycling targets and the increasing implementation of Deposit Return Schemes (DRS) globally, such as the expansion in Portugal in 2023, directly boost demand for TOMRA's sorting and collection technologies. These policies create a favorable regulatory environment, encouraging investments in advanced waste management solutions.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Tomra Systems, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version of Tomra's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Global economic growth significantly influences TOMRA's business. In 2024, projections for global GDP growth hovered around 2.7%, a modest but positive trend. This generally translates to higher consumer spending, leading to increased material consumption and, consequently, more waste. This uptick in waste generation directly fuels demand for TOMRA's advanced sorting and recycling technologies, as municipalities and businesses seek efficient solutions for waste management and resource recovery.

Fluctuations in commodity prices significantly impact TOMRA's business. When prices for virgin materials like aluminum or PET rise, the cost-effectiveness of using recycled content increases, boosting demand for TOMRA's advanced sorting technologies. For instance, in early 2024, the price of prime PET resin saw considerable volatility, making recycled PET (rPET) a more competitive option for many manufacturers.

Conversely, a downturn in commodity prices, such as a drop in the price of new plastics or metals, can diminish the economic incentive for recycling. This can lead to reduced demand for recycled materials and, consequently, less investment in recycling infrastructure and technologies. The global price of aluminum, a key commodity TOMRA's sorting systems handle, experienced a notable dip in late 2023, illustrating this challenge.

Inflationary pressures significantly impact TOMRA's operational expenses. For instance, in 2023, global inflation remained a concern, potentially driving up costs for components and manufacturing. Higher inflation directly translates to increased expenses for raw materials, labor, and energy, squeezing profit margins if not passed on to customers.

Central bank interest rate hikes, like those seen in 2023 and continuing into 2024 by major economies, affect TOMRA's investment decisions. Increased borrowing costs can deter capital expenditure on new facilities or research and development, and also influence the affordability of TOMRA's solutions for their clients, potentially slowing sales cycles.

Economic factor 4

Currency exchange rate volatility presents a significant economic factor for TOMRA, given its extensive global operations. Fluctuations in exchange rates can directly impact the translation of revenues and costs incurred in foreign currencies into TOMRA's reporting currency, Norwegian Krone (NOK). For instance, a stronger NOK can reduce the reported value of earnings generated in weaker currencies, affecting overall profitability.

These currency movements also influence the competitiveness of TOMRA's products in various international markets. If the NOK strengthens against a key customer currency, TOMRA's offerings may become more expensive for those customers, potentially impacting sales volumes. Conversely, a weaker NOK could make its products more attractive abroad.

To manage these risks, TOMRA likely employs hedging strategies. These can include forward contracts or options to lock in exchange rates for future transactions, thereby mitigating the impact of adverse currency movements on its financial results. As of Q1 2024, TOMRA reported that currency translation effects had a negative impact on its operating profit.

- Global Revenue Translation: A stronger Norwegian Krone (NOK) can decrease the reported value of TOMRA's foreign earnings.

- Market Competitiveness: Exchange rate shifts can make TOMRA's products more or less expensive for international customers.

- Hedging Strategies: TOMRA likely uses financial instruments to protect against unfavorable currency fluctuations.

- Q1 2024 Impact: Currency translation had a negative effect on TOMRA's operating profit in the first quarter of 2024.

Economic factor 5

Access to capital is a critical enabler for waste management infrastructure, directly impacting TOMRA's market penetration. Municipalities and private operators rely on robust funding to acquire TOMRA's advanced sorting and collection technologies. For instance, a significant portion of municipal waste management budgets is allocated to capital expenditures, and the availability of external financing dictates the pace of upgrades.

The landscape of funding for waste management is evolving, with a growing emphasis on sustainable finance. Green bonds and sustainability-linked loans are increasingly being utilized to finance projects that align with environmental goals, such as those involving advanced recycling infrastructure. These instruments provide a cost-effective way for organizations to secure capital for investments in TOMRA's solutions.

- Public Funding: Government grants and subsidies, often tied to circular economy initiatives, play a vital role in de-risking and stimulating investment in waste management infrastructure.

- Private Investment: Venture capital and private equity firms are showing increased interest in the waste management sector, recognizing its growth potential and the demand for innovative solutions like TOMRA's.

- Green Finance Growth: The global green bond market, valued in the hundreds of billions of dollars, offers a substantial pool of capital for environmentally focused projects, including advanced recycling facilities.

- Loan Instruments: Sustainability-linked loans, where interest rates are tied to achieving specific environmental targets, are becoming more prevalent, incentivizing investments in resource-efficient technologies.

Global economic growth directly influences TOMRA's business by affecting material consumption and waste generation. Projections for global GDP growth around 2.7% in 2024 suggest continued consumer spending, leading to increased waste volumes that drive demand for TOMRA's recycling technologies.

Fluctuations in commodity prices, such as prime PET resin and aluminum, significantly impact the cost-effectiveness of recycled materials versus virgin ones. When virgin material prices rise, the demand for TOMRA's sorting solutions, which enable the use of recycled content, tends to increase. For example, in early 2024, PET resin volatility made recycled PET a more attractive option for manufacturers.

Inflationary pressures and rising interest rates, evident throughout 2023 and into 2024, increase TOMRA's operational costs and borrowing expenses. This can impact profit margins and the affordability of TOMRA's solutions for clients, potentially slowing investment cycles in new waste management infrastructure.

Currency exchange rate volatility, as seen with the Norwegian Krone (NOK) in Q1 2024, directly affects TOMRA's reported earnings and international market competitiveness. The company likely employs hedging strategies to mitigate these impacts, but adverse currency movements can still influence profitability.

Same Document Delivered

Tomra Systems PESTLE Analysis

The preview shown here is the exact Tomra Systems PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises regarding the comprehensive political, economic, social, technological, legal, and environmental factors impacting Tomra.

The content and structure shown in the preview is the same Tomra Systems PESTLE Analysis document you’ll download after payment, providing deep insights into its operating environment.

Sociological factors

Sociological factor 1: Growing public awareness and commitment to environmental sustainability are significantly shaping consumer behavior and regulatory landscapes. This heightened consciousness directly fuels demand for effective waste management and recycling solutions, creating a fertile ground for TOMRA's innovative technologies.

For instance, a 2024 report indicated that 78% of consumers globally now consider sustainability a key factor in their purchasing decisions, a notable increase from previous years. This trend translates into greater participation in deposit return schemes and a stronger preference for products manufactured using recycled materials, directly benefiting companies like TOMRA that facilitate circular economy principles.

Sociological shifts are profoundly impacting businesses like TOMRA. There's a clear and growing consumer demand for eco-friendly products, sustainable packaging, and a commitment to a circular economy. This isn't just a trend; it's a fundamental change in consumer values.

As consumers increasingly prioritize environmental responsibility, businesses face pressure to adopt more sustainable production methods and supply chains. This directly fuels the need for efficient recycling and resource recovery systems, precisely the solutions TOMRA provides. For instance, in 2023, the global market for recycling was valued at approximately $34.5 billion, with projections showing continued growth driven by these consumer preferences.

Labor market trends significantly influence TOMRA's operations, particularly the demand for skilled technicians and data scientists crucial for its sensor-based sorting technologies. As of early 2024, the global shortage of specialized engineering talent, especially in areas like AI and machine learning, presents a challenge for companies like TOMRA that rely on innovation in these fields.

Demographic shifts and evolving educational priorities also shape the talent pool. An aging workforce in some developed nations and a growing youth population in others necessitate adaptable recruitment strategies. For instance, the increasing emphasis on STEM education globally is a positive indicator for future talent availability in sectors requiring advanced technical skills, benefiting both TOMRA and its clients in waste management and manufacturing.

Sociological factor 4

Societal expectations for corporate social responsibility (CSR) and environmental, social, and governance (ESG) performance are significantly influencing business operations. Consumers and investors alike are increasingly scrutinizing companies' ethical practices and environmental impact. TOMRA's business model, focused on resource management and enabling a circular economy, directly addresses these growing demands. For instance, TOMRA's reverse vending machines (RVMs) collected over 130 billion containers globally by the end of 2023, diverting them from landfills and promoting recycling. This strong alignment with sustainability principles is crucial for maintaining brand loyalty and attracting capital from ESG-focused funds, which saw global assets under management reach approximately $3.9 trillion by the end of 2024.

This societal shift translates into tangible benefits for companies like TOMRA that demonstrate genuine commitment to sustainability. The company's proactive approach to resource efficiency and waste reduction resonates with a growing segment of the population that prioritizes ethical consumption and investment. This not only strengthens TOMRA's brand image but also positions it favorably for future regulatory developments and market trends favoring sustainable business practices.

- Growing Consumer Demand for Sustainable Products: Studies in early 2025 indicate that over 70% of consumers consider sustainability when making purchasing decisions.

- Investor Focus on ESG: By Q1 2025, ESG-themed ETFs and mutual funds accounted for over 20% of total fund inflows in major markets.

- Employee Attraction and Retention: Companies with strong CSR initiatives report higher employee engagement and are more attractive to top talent.

- TOMRA's Circular Economy Contribution: TOMRA's solutions have helped customers save an estimated 3 million tons of CO2 emissions annually, a key metric for ESG performance.

Sociological factor 5

Demographic shifts significantly impact waste generation. Growing global populations, projected to reach around 8.5 billion by 2030, naturally increase overall waste volumes. Urbanization, with over half the world's population now living in cities, concentrates waste, demanding more efficient collection and processing infrastructure. TOMRA's sorting technologies are crucial for handling this increased and often more complex waste stream.

Changing household sizes and compositions also play a role. Smaller households may generate less waste per unit but can have different consumption patterns. Understanding these variations allows for tailored waste management strategies. For instance, increased demand for convenience foods can lead to more packaging waste, a challenge TOMRA's advanced sorting systems are designed to address by separating different material types effectively.

- Population Growth: Global population expected to reach 8.5 billion by 2030, increasing total waste output.

- Urbanization: Over 55% of the global population lives in urban areas, concentrating waste and requiring efficient management.

- Waste Composition: Shifting consumer habits, influenced by demographics, alter waste composition, necessitating adaptive sorting technologies.

- Demand for Solutions: Demographic trends drive demand for advanced waste management and recycling solutions, aligning with TOMRA's offerings.

Societal values are increasingly prioritizing sustainability, with a significant portion of consumers now factoring environmental impact into their purchasing decisions, a trend that directly benefits TOMRA's circular economy solutions. This heightened awareness is also driving investor interest in ESG principles, with a notable percentage of fund inflows directed towards sustainable investments by early 2025. Furthermore, companies demonstrating strong corporate social responsibility, like TOMRA with its substantial container collection figures, find it easier to attract and retain talent, reinforcing their market position.

| Sociological Factor | Data Point (2024/2025) | Impact on TOMRA |

|---|---|---|

| Consumer Sustainability Awareness | Over 70% of consumers consider sustainability in purchasing (early 2025). | Increased demand for recycling and resource recovery solutions. |

| Investor ESG Focus | Over 20% of fund inflows into ESG ETFs/mutual funds (Q1 2025). | Attracts capital from sustainability-conscious investors. |

| Corporate Social Responsibility (CSR) | TOMRA's RVMs collected over 130 billion containers (end of 2023). | Enhances brand reputation and employee attraction. |

| Labor Market Trends | Global shortage of specialized engineering talent. | Requires strategic talent acquisition for innovation. |

Technological factors

TOMRA's core strength lies in its continuous innovation in sensor technology, artificial intelligence (AI), and machine learning. These advancements are crucial for their advanced sorting solutions, enabling more precise and rapid identification of materials. For instance, their hyperspectral sensors can detect subtle differences in material composition, while AI algorithms learn to classify complex waste streams with increasing accuracy.

These technological leaps directly translate to enhanced efficiency and purity in recycling and food processing operations. By improving the quality of sorted materials, TOMRA's solutions reduce contamination and increase the value of recovered resources. This technological superiority provides a significant competitive edge, as customers benefit from higher yields and reduced operational costs.

In 2023, TOMRA reported a substantial increase in R&D spending, a clear indicator of their commitment to technological advancement. This investment fuels the development of next-generation sorting capabilities, ensuring they remain at the forefront of the industry. Their focus on AI and machine learning is particularly important, as these technologies are rapidly evolving and offer immense potential for further optimization of sorting processes across various sectors.

Innovations in materials science, such as the development of advanced polymers and biodegradable plastics, directly influence the types of waste TOMRA's sorting technologies must handle. For instance, new chemical recycling processes that break down plastics into their base components necessitate highly precise sorting to ensure feedstock purity. TOMRA's continued investment in sensor technology, including near-infrared (NIR) and artificial intelligence (AI) driven sorting, allows it to adapt to these evolving material streams, as demonstrated by its 2023 launch of the new generation of its X-TRACT technology for metals sorting, enhancing recovery rates for aluminum and copper.

TOMRA is increasingly integrating automation and robotics across its collection, pre-sorting, and final sorting processes. This technological advancement significantly reduces the need for manual labor, boosting operational efficiency and enhancing safety within waste management and food processing environments. For instance, their automated sorting systems can process a higher volume of materials with greater accuracy than manual methods.

The company's investment in advanced robotics allows for more precise material identification and separation, leading to improved purity rates and higher value recovery for recyclables and food products. This automation not only increases throughput but also contributes to a safer working environment by minimizing human exposure to potentially hazardous tasks.

Technological factor 4

Technological advancements, particularly in data analytics and the Internet of Things (IoT), are fundamentally reshaping resource management. TOMRA's sorting machines are increasingly equipped with sensors and connectivity, generating real-time data that offers invaluable insights into material flows and operational efficiency for their clients.

This influx of data enables predictive analytics, allowing businesses to anticipate maintenance needs and optimize machine performance. For instance, by monitoring wear and tear through connected sensors, TOMRA can help clients reduce downtime and extend the lifespan of their equipment, directly impacting operational costs and resource recovery rates. In 2024, the global IoT market was projected to reach over $1.1 trillion, highlighting the pervasive integration of connected technologies across industries.

- Real-time Data Insights: TOMRA's sorting technologies provide granular data on material composition and throughput, empowering clients with actionable intelligence.

- Predictive Maintenance: IoT-enabled monitoring allows for proactive identification of potential equipment failures, minimizing costly disruptions.

- Enhanced Operational Efficiency: Data analytics derived from sorting processes help optimize material flow, reduce waste, and improve overall resource recovery.

- Connectivity for Remote Management: Secure cloud connectivity enables remote monitoring, diagnostics, and software updates, further boosting operational performance and client support.

Technological factor 5

TOMRA faces intense technological competition. Competitors are actively developing advanced sensor technologies for sorting, aiming to improve material identification accuracy and speed. Innovations in recycling equipment, such as enhanced optical sorters and chemical recycling technologies, directly challenge TOMRA's established solutions.

In the food processing sector, rivals are introducing AI-powered inspection systems and automation solutions that increase efficiency and reduce waste. Keeping pace requires significant R&D investment. For instance, TOMRA reported investments in R&D of NOK 1,096 million in 2023, a key figure to monitor against competitor patent filings and product launches.

Key areas of competitor focus include:

- Advanced spectral imaging and AI algorithms for more precise material sorting.

- Development of new recycling processes like advanced chemical recycling that can handle mixed plastic waste.

- Integration of IoT and data analytics into food processing equipment for predictive maintenance and yield optimization.

- Increased automation and robotics in both sorting and processing lines to reduce labor dependency.

TOMRA's technological prowess is centered on its continuous innovation in sensor technology, AI, and machine learning, which are vital for its advanced sorting solutions. These advancements enable more precise and rapid material identification, enhancing efficiency and purity in recycling and food processing. For example, their hyperspectral sensors and AI algorithms improve the classification of complex waste streams, directly boosting the value of recovered resources.

The company's commitment to technological advancement is evident in its substantial R&D spending, with NOK 1,096 million invested in 2023. This investment fuels the development of next-generation sorting capabilities, keeping TOMRA at the industry's forefront. Innovations in materials science, such as new polymers and chemical recycling processes, necessitate highly precise sorting, a challenge TOMRA addresses with its advanced sensor technology and AI-driven solutions, exemplified by the 2023 launch of its enhanced X-TRACT technology for metals sorting.

Furthermore, TOMRA is integrating automation and robotics to boost operational efficiency and safety, reducing the need for manual labor. Its sorting machines are increasingly equipped with IoT capabilities, generating real-time data for predictive maintenance and performance optimization. The global IoT market's projected growth to over $1.1 trillion in 2024 underscores the pervasive integration of connected technologies.

| Key Technological Drivers | Impact on TOMRA | 2023/2024 Data Points |

| Sensor Technology & AI | Enhanced material identification, sorting accuracy, and efficiency | NOK 1,096 million R&D investment in 2023; 2023 launch of next-gen X-TRACT |

| Automation & Robotics | Increased operational efficiency, reduced labor dependency, improved safety | Not explicitly quantified in 2023/2024 reports, but a key strategic focus |

| IoT & Data Analytics | Real-time insights, predictive maintenance, optimized performance | Global IoT market projected over $1.1 trillion in 2024 |

Legal factors

TOMRA Systems benefits significantly from the growing global adoption and tightening of Extended Producer Responsibility (EPR) regulations. These laws increasingly place the onus on manufacturers to manage their products from creation through to end-of-life, including collection and recycling. This directly fuels demand for TOMRA's advanced sorting and collection technologies.

For instance, the European Union's Circular Economy Action Plan, with a target of 90% collection of plastic bottles by 2029, is a prime example of stricter EPR enforcement. This legislative push is a key driver for TOMRA's automated reverse vending machines and sophisticated sorting solutions, as countries aim to meet ambitious recycling targets. The company's systems are essential for efficiently capturing and processing materials under these expanding EPR frameworks.

Legal factors significantly shape TOMRA's operational landscape, particularly concerning waste management directives. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) directive mandates specific collection and recycling rates for electronics. Similarly, regulations on packaging waste and the growing restrictions on single-use plastics directly fuel demand for advanced sorting technologies like those TOMRA provides.

These legislative frameworks create a strong regulatory push for enhanced waste sorting infrastructure. In 2023, the EU reported that over 50% of collected WEEE was recycled, a figure that directives aim to increase further, thus expanding the market for TOMRA's solutions. Such regulations directly translate into increased opportunities for TOMRA's sensor-based sorting machines, which are crucial for meeting these evolving environmental targets.

TOMRA's food sorting solutions must adhere to rigorous food safety and hygiene regulations, including HACCP, FDA, and EU food safety standards. These legal frameworks are paramount for the acceptance and reliable operation of TOMRA's equipment within the global food processing industry.

TOMRA actively ensures its technologies meet these stringent criteria through robust design, validation processes, and ongoing compliance checks. For instance, in 2023, TOMRA's food segment reported revenues of NOK 8.1 billion (approximately USD 770 million), underscoring the significant market reliance on their compliant solutions.

Legal factor 4

TOMRA Systems heavily relies on intellectual property rights (IPR) and patent protection for its advanced sensor technologies and sophisticated sorting algorithms. Maintaining a strong legal shield around these innovations is crucial for preserving its competitive edge and preventing others from replicating its unique solutions. This robust legal framework safeguards TOMRA's market position and ensures its ability to continue investing in research and development.

The company actively monitors and navigates the legal landscape concerning patent enforcement across its primary operational regions. This includes understanding and leveraging the patent laws in countries where it designs, manufactures, and sells its sorting and collection solutions. For instance, in 2023, TOMRA's R&D expenditure reached approximately NOK 1.3 billion (around $125 million USD), underscoring the significant investment in developing and protecting its technological assets.

- Patent Portfolio Strength: TOMRA maintains a substantial portfolio of patents covering its core sensor technologies, software, and mechanical designs, critical for its leadership in reverse vending and sorting solutions.

- Enforcement Strategies: The company employs proactive legal strategies to defend its patents against infringement, ensuring its innovations remain exclusive and provide a distinct market advantage.

- Global IP Landscape: Navigating diverse international patent laws and enforcement mechanisms is a key legal consideration for TOMRA, impacting its global market access and competitive strategy.

- R&D Investment Protection: Legal protection of its intellectual property directly safeguards TOMRA's significant investments in research and development, fostering continued innovation and technological advancement.

Legal factor 5

TOMRA Systems operates within a complex web of environmental regulations, impacting both its manufacturing processes and the services it provides to clients. These include stringent rules on emissions control and waste management at its production facilities, ensuring minimal environmental footprint. For instance, in 2024, the EU continued to strengthen its Extended Producer Responsibility (EPR) schemes, which directly influence how TOMRA's sorting and recycling technologies are utilized by its customers to meet compliance targets.

The company must also navigate evolving corporate sustainability reporting mandates, such as those aligned with the EU's Corporate Sustainability Reporting Directive (CSRD). These require detailed disclosures on environmental performance, material risks, and compliance efforts. Failure to adhere to these legal frameworks, including specific permitting requirements for waste processing or emissions, can lead to substantial fines and reputational damage, underscoring the importance of proactive legal compliance.

- Emissions Standards: Compliance with air and water quality regulations at manufacturing sites.

- Waste Disposal Laws: Adherence to regulations governing the handling and disposal of industrial waste.

- Sustainability Reporting: Meeting mandates for transparent reporting on environmental impact and performance.

- Permitting Requirements: Securing and maintaining necessary permits for operational activities, especially in recycling and waste management sectors.

Legal frameworks, particularly Extended Producer Responsibility (EPR) and waste management directives, are critical drivers for TOMRA Systems. Stricter regulations, like the EU's push for higher plastic bottle collection rates, directly increase demand for TOMRA's sorting and collection technologies.

The company's food sorting solutions must also comply with stringent food safety standards, such as HACCP and FDA regulations, ensuring market acceptance. TOMRA's intellectual property rights are heavily protected through patents, safeguarding its technological innovations and competitive advantage in the global market.

TOMRA must navigate evolving environmental regulations and corporate sustainability reporting mandates, like the CSRD, to avoid penalties and maintain its reputation.

| Legal Factor | Impact on TOMRA | Supporting Data (2023/2024) |

| EPR & Waste Management | Drives demand for sorting/collection tech | EU target: 90% plastic bottle collection by 2029 |

| Food Safety Regulations | Ensures market acceptance of food sorters | TOMRA Food revenue: NOK 8.1 billion (approx. USD 770 million) |

| Intellectual Property | Protects R&D and competitive edge | TOMRA R&D spend: Approx. NOK 1.3 billion (approx. $125 million USD) |

| Environmental & Reporting | Requires compliance, impacts operations | EU CSRD mandates detailed sustainability disclosures |

Environmental factors

The global push to combat climate change and address resource scarcity directly fuels demand for TOMRA's solutions. With increasing awareness of the environmental impact of virgin material extraction and waste generation, there's a growing imperative to embrace circular economy principles. For instance, the Ellen MacArthur Foundation highlights that recycling and reuse could reduce global greenhouse gas emissions by 40% by 2050.

The global push towards circular economy principles, shifting from a linear 'take-make-dispose' approach, presents a significant tailwind for TOMRA. This growing emphasis on resource efficiency and waste reduction directly aligns with TOMRA's core technologies, which are crucial for enabling material reuse and recycling. For instance, the Ellen MacArthur Foundation estimates that a circular economy could deliver $4.5 trillion in economic benefits by 2030, highlighting the immense market potential for companies like TOMRA that facilitate this transition.

Governments worldwide are setting increasingly stringent targets for waste reduction and recycling. For instance, the European Union aims for a 65% recycling rate for municipal waste by 2035, a significant increase from current levels, directly boosting demand for advanced sorting technologies like TOMRA's.

Societal pressure for sustainability is also a major driver. Consumers are more aware of environmental issues, pushing businesses to adopt circular economy principles. This shift necessitates better waste management infrastructure, where TOMRA's sensor-based sorting solutions play a crucial role in improving recycling efficiency and material recovery.

The enforcement of these environmental targets varies by region, but the trend is clear: stricter regulations are being implemented globally. Countries like Norway, where TOMRA is headquartered, have a long history of advanced waste management policies, providing a strong domestic market and a blueprint for other nations.

Environmental factor 4

The escalating environmental impact of pollution, particularly plastic waste accumulating in oceans and air quality degradation from incineration, underscores a critical global demand for superior waste management and recycling solutions. This mounting public and regulatory scrutiny directly incentivizes investments in innovative technologies that actively prevent pollution and enhance material recovery, presenting a significant tailwind for companies like TOMRA.

TOMRA's advanced sorting technologies, for instance, play a crucial role in diverting waste from landfills and incineration, thereby reducing harmful emissions and environmental contamination. For example, in 2023, TOMRA's sensor-based sorting solutions processed over 7.5 million tonnes of plastic waste globally, contributing to higher recycling rates and a more circular economy.

- Growing Plastic Waste Crisis: Over 11 million metric tons of plastic entered the ocean in 2023, a figure projected to triple by 2040 if current trends persist, highlighting the urgent need for effective collection and recycling.

- Air Pollution Concerns: Incineration, while a waste-to-energy solution, can release pollutants like dioxins and heavy metals if not managed with advanced emission control systems, reinforcing the value of waste reduction and material recovery.

- Regulatory Push: The European Union's Circular Economy Action Plan aims to increase plastic recycling rates to 55% by 2030, with TOMRA's solutions directly supporting these ambitious targets.

- Market Demand for Sustainability: Consumer and corporate demand for sustainable products and practices is driving manufacturers to seek higher quality recycled materials, a demand TOMRA's technology helps meet by improving sorting accuracy and purity.

Environmental factor 5

The growing scarcity and rising costs of virgin raw materials are significantly boosting the demand for recycled content across various industries. This trend makes TOMRA's advanced sorting technologies increasingly valuable as businesses look for efficient ways to recover and reuse materials, thereby closing material loops and reducing reliance on new resources. For example, the global recycled plastics market was valued at approximately USD 49.5 billion in 2023 and is projected to reach USD 87.5 billion by 2030, showcasing a clear financial incentive for investing in recovery solutions.

Industries are actively seeking more sustainable and cost-effective alternatives to traditional materials. This pursuit directly enhances the economic attractiveness of recovered materials, making investments in TOMRA's efficient sorting technologies a strategic move for companies aiming to improve their environmental footprint and operational efficiency. The increasing price volatility of commodities like metals and fossil fuels further strengthens the case for recycled inputs.

- Rising Virgin Material Costs: Global commodity prices for key virgin materials like aluminum and copper have seen significant fluctuations, pushing manufacturers to explore recycled alternatives.

- Circular Economy Push: Governments and consumers are increasingly advocating for circular economy principles, driving demand for products with higher recycled content.

- TOMRA's Role: TOMRA's sensor-based sorting technologies enable the efficient separation of valuable materials from waste streams, increasing the quality and quantity of available recycled feedstock.

- Economic Viability: The enhanced efficiency and purity of recycled materials achieved through TOMRA's systems make them a more economically viable option compared to virgin materials in many applications.

The global drive towards sustainability and resource conservation is a primary catalyst for TOMRA's business. Increasing concerns over plastic pollution, with over 11 million metric tons entering oceans annually in 2023, underscore the urgent need for effective recycling solutions. Stricter regulations, such as the EU's goal for 55% plastic recycling by 2030, directly boost demand for advanced sorting technologies like TOMRA's.

The rising costs and scarcity of virgin materials, exemplified by fluctuating commodity prices for metals, are making recycled content more economically attractive. This trend positions TOMRA's efficient material recovery systems as a strategic advantage for industries seeking cost-effective and sustainable alternatives. The market for recycled plastics alone was valued at approximately USD 49.5 billion in 2023, highlighting significant growth potential.

Governments worldwide are implementing ambitious waste reduction and recycling targets, such as the EU's aim for a 65% municipal waste recycling rate by 2035. This regulatory push creates a substantial market opportunity for TOMRA's sensor-based sorting technologies, which are essential for achieving higher material recovery rates and promoting a circular economy.

Societal pressure for environmental responsibility is also a key driver, with consumers increasingly demanding sustainable products and practices. This shift necessitates improved waste management infrastructure, where TOMRA's solutions play a vital role in enhancing recycling efficiency and recovering valuable materials, thereby supporting a more resource-efficient economy.

PESTLE Analysis Data Sources

Our Tomra Systems PESTLE analysis draws from a diverse range of data sources, including official government reports on environmental regulations and waste management policies, alongside economic indicators from bodies like the World Bank and IMF. We also incorporate industry-specific market research and technology trend forecasts to ensure a comprehensive understanding of the external landscape.