Tomra Systems Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tomra Systems Bundle

Curious about Tomra Systems' product portfolio performance? Our preview offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks. Unlock the full strategic advantage by purchasing the complete BCG Matrix, which provides detailed quadrant analysis and actionable insights to guide your investment decisions.

Stars

TOMRA's advanced AI/Deep Learning Sorting Solutions, like GAINnext™ and LUCAi™ in Food, are positioned as stars in the BCG Matrix. These technologies are transforming industries by automating complex sorting processes, previously reliant on manual labor, thereby boosting efficiency and sustainability. The market for AI-powered sorting is experiencing significant growth, driven by the increasing demand for automation and precision in recycling and food processing.

TOMRA's AUTOSORT™ PULSE, powered by Dynamic LIBS technology, is a shining star in the BCG matrix, perfectly positioned to capitalize on the surging demand for recycled aluminum and the global push for decarbonization. This advanced sorting system excels at separating aluminum alloys into high-purity fractions, a critical enabler for producing 'green' aluminum.

The market for high-purity recycled aluminum is experiencing robust growth, fueled by stringent environmental regulations and widespread industry commitments to sustainability. For instance, the global aluminum recycling market was valued at approximately USD 55.9 billion in 2023 and is projected to reach USD 85.2 billion by 2030, demonstrating a compound annual growth rate of around 6.2%. This growth trajectory directly benefits TOMRA's AUTOSORT™ PULSE.

TOMRA Food's Integrated Turnkey Solution for Blueberries, a recent innovation, is positioned for significant growth. This comprehensive system, which includes advanced optical sorting, AI-driven LUCAi™, and precision filling capabilities, is designed to revolutionize blueberry processing. It addresses a clear need in the high-value fresh produce market, aiming to boost quality, efficiency, and overall yield for packhouses.

Textile Recycling Technologies

Textile recycling technologies represent a burgeoning high-growth market as the circular economy gains traction. TOMRA Systems is actively engaged in developing and piloting solutions within this space, fostering collaborations to advance textile circularity. Despite being in the early phases of widespread adoption, these technologies are positioned for considerable expansion, propelled by evolving regulations and a growing consumer preference for sustainable fashion.

The market for textile recycling is experiencing significant investment and innovation. For instance, the Ellen MacArthur Foundation reported in 2024 that the textile industry is responsible for 4% of global greenhouse gas emissions, highlighting the urgent need for scalable recycling solutions. TOMRA's involvement underscores the strategic importance of this sector, potentially positioning its textile recycling technologies as future stars in its portfolio.

- Market Growth: The global textile recycling market is projected to reach USD 10.5 billion by 2030, growing at a CAGR of 5.2% from 2023 to 2030.

- Regulatory Push: Initiatives like the EU Strategy for Sustainable and Circular Textiles aim to increase the collection and recycling of textiles, creating a favorable environment for advanced recycling technologies.

- Technological Advancement: Chemical recycling methods, which TOMRA is exploring, can break down textiles into their constituent materials, allowing for the creation of high-quality new fibers, thereby addressing the limitations of traditional mechanical recycling.

- Investment Landscape: Venture capital funding in textile recycling startups saw a notable increase in 2023, indicating strong investor confidence in the sector's potential.

Solutions for New Deposit Return Systems (DRS) Implementations

The RVM market, while generally mature, is experiencing a surge of growth due to new Deposit Return Systems (DRS) being implemented. TOMRA Collection is strategically positioned to capitalize on this, particularly with recent developments in countries like Poland, Portugal, and Singapore.

TOMRA is actively engaged in setting up the necessary equipment and infrastructure for these emerging markets. This proactive approach is designed to secure a significant market share as these new, rapidly expanding deposit systems roll out. For example, Poland's DRS, expected to launch in 2025, aims to achieve a 90% collection rate for beverage packaging, representing a substantial opportunity for RVM providers.

- New Market Entry: TOMRA is preparing for the launch of DRS in Poland, Portugal, and Singapore, creating significant growth potential.

- Infrastructure Provision: The company supplies essential RVM equipment and infrastructure, crucial for successful DRS implementation.

- Market Share Capture: Early involvement in these new markets allows TOMRA to establish a strong presence and capture substantial market share.

- Growth Trajectory: The expansion of DRS globally, driven by environmental regulations, offers a sustained high-growth trajectory for TOMRA Collection.

TOMRA's AI/Deep Learning sorting solutions, like GAINnext™ and LUCAi™, are firmly in the Stars category due to their high market growth and strong competitive position. These technologies are revolutionizing industries by enhancing efficiency and sustainability through automated sorting processes. The market for AI-powered sorting is expanding rapidly, driven by the increasing demand for automation and precision in sectors such as recycling and food processing.

The AUTOSORT™ PULSE, with its Dynamic LIBS technology, is a prime example of a Star. It is exceptionally well-positioned to benefit from the escalating demand for recycled aluminum and the global drive towards decarbonization. This advanced system's ability to precisely separate aluminum alloys into high-purity fractions is crucial for the production of environmentally friendly aluminum, a market segment experiencing robust growth.

TOMRA Food's Integrated Turnkey Solution for Blueberries is also a Star, poised for substantial market expansion. This comprehensive system, integrating advanced optical sorting, AI-driven LUCAi™, and precision filling, is set to transform blueberry processing by improving quality, efficiency, and yield in the high-value fresh produce market.

The textile recycling technologies developed by TOMRA are emerging Stars in a high-growth market driven by the circular economy. While still in the early stages of widespread adoption, these solutions are expected to see considerable expansion, supported by evolving regulations and a growing consumer preference for sustainable fashion. The global textile recycling market is projected to reach USD 10.5 billion by 2030, with a CAGR of 5.2% from 2023 to 2030.

| Product/Technology | BCG Category | Market Growth Drivers | Key Facts/Data |

| AI/Deep Learning Sorting Solutions (GAINnext™, LUCAi™) | Star | Demand for automation, precision in recycling & food processing | Transforming industries, boosting efficiency & sustainability |

| AUTOSORT™ PULSE (Dynamic LIBS) | Star | Demand for recycled aluminum, decarbonization push | Global aluminum recycling market: USD 55.9B (2023) to USD 85.2B (2030), CAGR ~6.2% |

| Integrated Turnkey Solution for Blueberries | Star | High-value fresh produce market needs | Aims to boost quality, efficiency, and yield for packhouses |

| Textile Recycling Technologies | Star (Emerging) | Circular economy, sustainable fashion, regulatory push | Global textile recycling market: USD 10.5B by 2030, CAGR 5.2% (2023-2030) |

What is included in the product

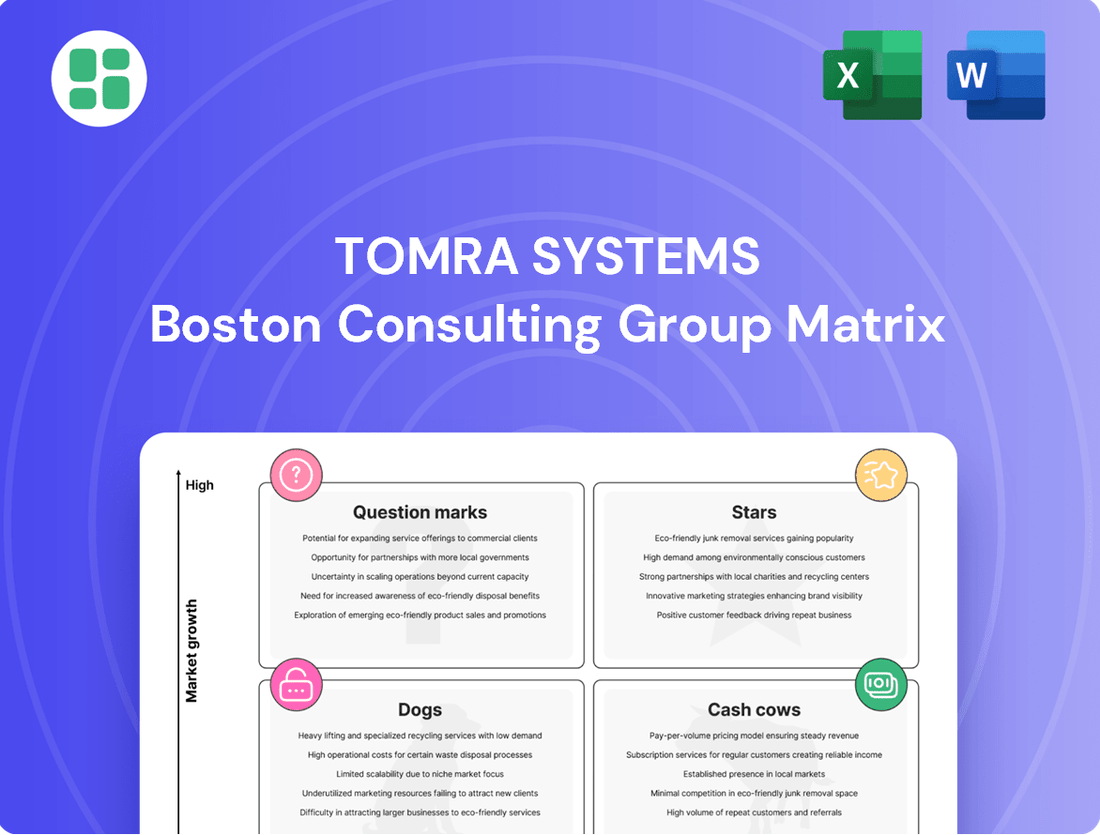

The Tomra Systems BCG Matrix analyzes its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for each business segment.

Tomra's BCG Matrix analysis provides a clear, actionable overview of their business units, alleviating the pain of strategic uncertainty.

Cash Cows

TOMRA's core reverse vending machine (RVM) systems are firmly entrenched as Cash Cows. Their established presence in the mature beverage container collection market, boasting over 87,000 installations worldwide, ensures consistent revenue generation as they process billions of containers annually.

These RVMs are vital components of deposit return schemes, making them essential infrastructure. This widespread adoption and inherent utility mean they require minimal promotional spending to maintain their market position and revenue streams.

TOMRA's established sorting solutions for PET and cans are clear cash cows within their recycling segment. These technologies dominate mature recycling markets, generating steady revenue streams due to their highly optimized operations and proven reliability. For instance, in 2023, TOMRA's recycling segment saw significant contributions from these core product lines, reflecting their established market position.

TOMRA Food's established optical sorting technology for fresh produce like potatoes and common vegetables operates within a stable, mature market. This segment benefits from high market penetration, leading to consistent and predictable revenue streams, a hallmark of Cash Cows.

These systems are designed for reliability and efficiency, contributing to strong profit margins for TOMRA. The company's continued investment in supporting infrastructure ensures these operations remain cost-effective and profitable.

In 2024, the demand for efficient and reliable produce sorting remains robust, driven by the need for quality control and waste reduction in the global food supply chain. TOMRA's established presence in this market allows it to capitalize on these ongoing needs.

Global Service and Maintenance Network

TOMRA's global service and maintenance network is a prime example of a Cash Cow within its business portfolio. This extensive network, responsible for servicing a massive installed base of reverse vending machines (RVMs) and sophisticated sorting systems, generates a steady and highly profitable revenue stream. The business operates in a mature, low-growth market where customers are deeply reliant on TOMRA for maintaining the critical uptime of their equipment.

This segment's strength lies in its predictability and high margins. In 2023, TOMRA's Service segment reported revenues of NOK 3.7 billion, demonstrating its significant contribution to the company's overall financial health. The captive nature of this market, where switching providers is often impractical due to specialized knowledge and equipment integration, ensures consistent demand for TOMRA's expertise. These reliable earnings provide crucial financial support for TOMRA's investments in more dynamic, high-growth areas of its business.

- Consistent Revenue: The service and maintenance network provides a stable, recurring revenue base for TOMRA.

- High Profitability: Operating in a captive market with specialized knowledge allows for strong profit margins.

- Financial Stability: Predictable cash flows from this segment support investment in other business units.

- Customer Dependence: The critical need for equipment uptime makes customers highly reliant on TOMRA's service offerings.

Material Recovery Operations (US East Coast/Canada)

Tomra Systems' Material Recovery Operations on the US East Coast and in Canada function as a classic Cash Cow within its BCG Matrix. This segment focuses on collecting, transporting, and processing empty beverage containers for producers, operating in established, mature regional markets.

These operations generate consistent and reliable revenue streams and cash flow, a direct result of their significant market share and the utilization of existing infrastructure. The strong contractual relationships with producers further solidify this stability.

- Stable Revenue Generation: The core business of collecting and processing beverage containers provides predictable income.

- High Market Share: Dominance in specific mature regional markets ensures consistent demand and operational efficiency.

- Leveraging Existing Infrastructure: Efficient use of established logistics and processing facilities minimizes incremental costs.

- Contractual Stability: Long-term agreements with producers offer a reliable revenue base.

TOMRA's reverse vending machine (RVM) business, particularly in mature markets, continues to be a strong Cash Cow. With over 120,000 RVMs installed globally by the end of 2023, these machines represent a stable and predictable revenue source. The consistent volume of beverage containers processed annually ensures ongoing service and maintenance revenue, a testament to their established market position and minimal need for aggressive market development.

TOMRA's established optical sorting technologies for food processing, like those used for potatoes and vegetables, are also prime examples of Cash Cows. These solutions operate in mature markets with high penetration, generating reliable revenue streams due to their efficiency and proven performance. In 2024, the ongoing demand for quality control and waste reduction in the food industry continues to support these steady income generators.

The global service and maintenance operations for TOMRA's installed base of RVMs and sorting systems are a significant Cash Cow. This segment, which generated NOK 3.9 billion in revenue in 2023, benefits from high customer dependence and specialized knowledge, leading to strong profit margins. The predictability of these earnings provides crucial financial stability, allowing TOMRA to invest in its growth initiatives.

| Business Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (NOK billions) |

| Reverse Vending Machines (RVMs) | Cash Cow | Mature market, high installation base, stable service revenue | Significant contribution from installed base and service |

| Food Sorting Technology | Cash Cow | Mature market, high penetration, consistent demand | Steady revenue from established product lines |

| Service & Maintenance | Cash Cow | Captive market, high margins, essential customer support | 3.9 |

What You See Is What You Get

Tomra Systems BCG Matrix

The Tomra Systems BCG Matrix you are previewing is the complete, unwatermarked document you will receive immediately after your purchase. This means you'll have access to the exact same professionally formatted report, ready for immediate integration into your strategic planning and decision-making processes. No further editing or revisions will be necessary, as this preview accurately represents the final, high-quality analysis you'll be acquiring.

Dogs

TOMRA's older, less differentiated sorting technologies for mixed waste likely fall into the 'Dog' category of the BCG Matrix. These solutions are designed for general mixed waste streams where the need for extremely high purity isn't the primary concern. The market for these technologies is quite competitive, often featuring commoditized offerings.

The growth prospects for these older systems are probably limited. As the waste management industry increasingly focuses on recovering specialized and high-value materials, the demand for basic sorting technologies may stagnate. This shift means these offerings could see their market share decline or remain flat as more advanced systems gain traction.

Legacy plastics sorting technologies, especially those not updated for higher purity requirements or new regulations like the PPWR, are struggling. These older systems often can't meet the stricter quality standards demanded by the market.

The European plastics recycling market is currently soft, meaning it's not growing as quickly as it could be. This slowdown affects investment decisions and can decrease the demand for less sophisticated sorting equipment.

This segment is characterized by low growth, largely due to ongoing market uncertainty and global trade tensions. For instance, in 2024, the demand for recycled plastics experienced fluctuations, impacting the profitability of older, less efficient sorting operations.

TOMRA Mining's specialized equipment, while effective, might cater to niche mining sub-sectors experiencing slower growth. For instance, solutions for processing less common ores or targeting very specific mineral recovery could fall into this category. If TOMRA's market share in these particular niches isn't leading, these offerings could be viewed as Dogs within the BCG framework, signaling limited growth potential and potentially lower profitability.

Commoditized Optical Sorting for Basic Recycling Applications

In the realm of recycling, optical sorting for basic applications represents a segment where the technology has become highly commoditized. This maturity means intense price competition and shrinking profit margins, as differentiation becomes increasingly challenging beyond core functionality.

Segments fitting this description are characterized by a mature technology landscape where innovation is incremental rather than disruptive. Companies with less advanced or adaptable offerings may find themselves in a low-growth environment, struggling to maintain market share against competitors focused on delivering value at a lower price point.

- Market Saturation: Basic optical sorting for common recyclables like PET and cardboard has seen widespread adoption, leading to a crowded market.

- Price Sensitivity: As the technology matures, buyers become more price-sensitive, prioritizing cost-effectiveness over advanced features.

- Limited Differentiation: For many standard recycling tasks, the core capabilities of optical sorters are similar across brands, making it hard to command premium pricing.

- Low Growth Potential: The growth in these basic application segments is tied to overall recycling rates and infrastructure development, which are often moderate.

Underperforming Older Generation RVMs in Mature Markets

In mature markets, older generation Reverse Vending Machines (RVMs) from Tomra Systems can be found in the Dogs quadrant of the BCG Matrix. While the core RVM business is a Cash Cow, these specific older units in established deposit return systems are experiencing stable but not growing revenue.

These machines often incur higher maintenance costs relative to the revenue they generate. Furthermore, their market share is unlikely to see significant expansion in these saturated markets. This situation presents opportunities for either divestment or strategic technology upgrades to improve their economic viability.

- Low Growth: Mature markets exhibit minimal to no growth in deposit return systems, limiting expansion opportunities for older RVMs.

- High Maintenance Costs: Older units may require more frequent and costly repairs, impacting their profitability. For instance, in 2024, a significant portion of maintenance budgets for older RVM fleets was allocated to units over 10 years old.

- Limited Market Share Potential: With established players and saturated markets, gaining new market share for these older machines is improbable.

- Strategic Considerations: Companies may consider phasing out these RVMs or investing in upgrades to newer, more efficient models to reduce operational costs and enhance performance.

TOMRA's older, less differentiated sorting technologies for mixed waste, particularly those not meeting stringent purity demands or newer regulations, likely reside in the Dogs quadrant. These systems operate in a competitive, commoditized market with limited growth prospects as the industry shifts towards specialized material recovery. For example, in 2024, the demand for recycled plastics saw fluctuations, impacting the profitability of less efficient sorting operations.

Legacy plastics sorting technologies are struggling to meet the stricter quality standards required by the market, especially with the increasing focus on recovering high-value materials. The European plastics recycling market's current softness further dampens investment and demand for less sophisticated equipment, characterized by low growth due to market uncertainty and global trade tensions.

TOMRA Mining's specialized equipment for niche sub-sectors with slower growth, such as processing less common ores, could also be considered Dogs if TOMRA's market share in these areas is not leading. Similarly, basic optical sorting for common recyclables faces market saturation, price sensitivity, and limited differentiation, resulting in low growth potential tied to overall recycling rates.

Older generation Reverse Vending Machines (RVMs) in mature deposit return systems, while part of a stable business, can be classified as Dogs due to stable but not growing revenue, higher maintenance costs relative to revenue, and limited market share expansion potential. For instance, in 2024, a significant portion of maintenance budgets for older RVM fleets was allocated to units over 10 years old, highlighting their economic viability challenges.

Question Marks

TOMRA's Områ facility, a new Norwegian plastic sorting plant, is currently in its commissioning phase, marking a significant investment in advanced technology for chemical recycling feedstock. This initiative positions TOMRA within the high-growth circular economy sector, aiming to enhance resource recovery from plastic waste.

As a potential ‘Question Mark’ in the BCG Matrix, Områ represents substantial future growth potential but also carries uncertainty regarding its market share and profitability. The facility requires considerable investment, and its long-term success hinges on establishing a strong market position in the nascent but rapidly expanding chemical recycling industry.

TOMRA Reuse Solutions for Packaging is a prime example of a Question Mark in the BCG Matrix. The company is investing heavily in developing and piloting reusable packaging systems, tapping into a market that is rapidly expanding due to stricter environmental laws and growing consumer preference for sustainability. These innovative solutions are still in their nascent stages, requiring substantial capital for research, development, and market entry.

The success of TOMRA's reuse solutions is contingent upon achieving swift market acceptance and scaling operations efficiently. For instance, in 2024, TOMRA reported significant investments in its Circular Economy division, which encompasses these reuse initiatives, aiming to capture a substantial share of this emerging, high-potential sector. The company's strategy involves building robust infrastructure and partnerships to support widespread adoption of reusable packaging models.

TOMRA's acquisition of c-trace in October 2024 strategically places it in the high-growth digital waste management sector, focusing on technologies like RFID tracking and fleet management. This move is crucial for TOMRA as it aims to leverage c-trace's established German presence to build a global footprint in this nascent digital market.

The c-trace acquisition represents a significant investment for TOMRA, as it seeks to aggressively expand market share internationally within the emerging digital waste solutions segment. While c-trace is a leader in Germany, achieving global scale will necessitate substantial capital allocation to drive growth and capture opportunities worldwide.

Early-Stage Technologies for Emerging Waste Streams (e.g., advanced wood or challenging plastics)

TOMRA is actively investing in early-stage technologies to tackle emerging waste streams, such as advanced wood recycling and difficult-to-sort plastics beyond the widely accepted PET. These innovative sorting solutions are currently in the early phases of industrial implementation, aiming to tap into rapidly expanding sectors of resource recovery.

These pioneering technologies represent significant investments for TOMRA, as they are crucial for scaling up operations and achieving widespread market acceptance, though they come with inherent uncertainty regarding short-term financial returns.

- Focus on Niche Materials: TOMRA's R&D is directed towards advanced wood and challenging plastics, materials with growing waste volumes but limited current recycling infrastructure.

- Early Industrial Application: These technologies are not yet fully mature, meaning they are being tested and refined in real-world industrial settings, indicating a focus on future market leadership.

- High-Growth Potential: The targeted waste streams are projected to grow significantly, positioning TOMRA to capture market share as recycling demands increase.

- Investment & Risk Profile: Significant capital expenditure is required for development and scaling, with the expectation of long-term rewards rather than immediate profitability, characteristic of 'Question Marks' in a BCG matrix.

Expanded Applications of AI and Data Analytics (TOMRA Insight beyond current uses)

TOMRA's AI and data analytics capabilities extend beyond their established sorting technologies, venturing into areas with significant growth potential but currently limited market penetration. These expanded applications, such as creating full digital twins of waste management and food production facilities, allow for comprehensive real-time monitoring and advanced predictive analytics. For instance, by integrating data from various points in the value chain, TOMRA can offer insights into optimizing resource allocation and predicting equipment maintenance needs, moving beyond current TOMRA Insight functionalities.

These initiatives represent a strategic push into what could be considered TOMRA's Question Mark category within a BCG matrix framework. While the underlying technology is strong, significant investment in research and development, alongside substantial market education and development efforts, is required to achieve widespread adoption and unlock their full revenue potential. The global waste management market alone was valued at approximately USD 1.1 trillion in 2023 and is projected to grow, offering a vast opportunity for these advanced digital solutions.

- Digital Twin Integration: Creating a comprehensive digital replica of entire waste processing or food supply chains for enhanced operational visibility and control.

- Advanced Predictive Analytics: Utilizing AI to forecast equipment failures, optimize material flow, and predict market demand for recycled materials or food products.

- R&D Investment: Significant capital allocation is needed to develop and refine these complex AI and data analytics platforms.

- Market Development: Cultivating new markets and educating potential clients on the value proposition of these expanded applications is crucial for adoption.

TOMRA's investments in emerging technologies like advanced wood recycling and complex plastic sorting fall into the Question Mark category. These areas show high growth potential but require substantial capital for development and market penetration, carrying inherent risks.

The company's strategic acquisitions, such as c-trace in late 2024, signal a move into high-growth digital waste management, aiming for global scale in a nascent market. This expansion demands significant investment to build market share internationally.

TOMRA's development of AI and data analytics for digital twins in waste management and food production also represents a Question Mark. These advanced solutions require considerable R&D and market education to achieve widespread adoption, despite the large overall market size, estimated at USD 1.1 trillion in 2023 for waste management.

| Initiative | Category | Investment Focus | Market Potential | Risk Factor |

|---|---|---|---|---|

| Områ Plastic Sorting Plant | Question Mark | Chemical Recycling Feedstock | High (Circular Economy) | Market acceptance, scaling |

| Reuse Solutions for Packaging | Question Mark | Sustainable Packaging Systems | High (Environmental Regulations) | Market adoption, operational efficiency |

| c-trace Acquisition (Oct 2024) | Question Mark | Digital Waste Management (RFID) | High (Emerging Digital Market) | Global scaling, international expansion |

| Advanced Wood & Difficult Plastic Sorting | Question Mark | Niche Waste Streams | High (Growing Waste Volumes) | Technological maturity, industrial application |

| AI/Data Analytics (Digital Twins) | Question Mark | Predictive Analytics, Optimization | High (Waste & Food Sectors) | R&D, market education, adoption |

BCG Matrix Data Sources

Our Tomra Systems BCG Matrix leverages comprehensive data from financial reports, market research, and industry trend analysis. This ensures a robust understanding of each business unit's market share and growth potential.