Tomra Systems Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tomra Systems Bundle

Tomra Systems leverages a powerful marketing mix, focusing on innovative product solutions that address global sustainability challenges. Their pricing reflects the advanced technology and long-term value proposition of their sorting and recycling equipment. Discover how their strategic placement and promotional efforts drive market leadership.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Tomra Systems' Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into a leader in resource management.

Product

TOMRA's core product, sensor-based sorting systems, utilizes advanced technologies like near-infrared and X-ray spectroscopy. These systems are designed for high-precision material identification and separation, a critical function for optimizing resource recovery. For instance, in the recycling sector, TOMRA's systems processed over 4.5 million tonnes of plastic waste globally in 2023 alone, demonstrating their significant impact on material circularity.

For the recycling industry, TOMRA offers advanced sorting technologies designed to significantly improve the quality and quantity of recovered materials like plastics, metals, and paper. These solutions are crucial for meeting the growing demand for high-quality recycled content.

A prime example of TOMRA's innovation is GAINnext™, its AI-powered deep learning system. This technology excels at separating food-grade plastics with exceptional purity, a vital capability for the circular economy. In 2023, TOMRA's recycling segment reported revenues of NOK 7.0 billion (approximately USD 660 million), underscoring the market's reliance on their solutions.

TOMRA's Food Processing and Grading Technologies, a key part of their Product offering, provide advanced sorting, grading, and peeling solutions. These innovations are designed to enhance food safety and significantly reduce waste throughout the supply chain. For instance, their sorting machines can identify and remove foreign materials with remarkable accuracy, contributing to safer food products for consumers.

The company's focus on optimizing yields and quality is evident in their solutions for growers, packers, and processors. Recent developments, such as the integration of AI-powered intelligence like LUCAi™, demonstrate a commitment to continuous improvement. This AI capability allows for more sophisticated defect detection and grading, leading to better resource utilization and higher-value end products.

TOMRA's technology plays a crucial role in the food industry's drive for sustainability and efficiency. By minimizing food loss, which globally accounts for roughly one-third of all food produced for human consumption according to the FAO, TOMRA's solutions directly address a major economic and environmental challenge. Their grading technologies ensure that only the highest quality produce reaches consumers, improving customer satisfaction and brand reputation.

Mining Ore Sorting Solutions

TOMRA Mining's sensor-based ore sorting solutions are designed to boost efficiency and prolong mine life by minimizing waste and maximizing ore recovery. These advanced systems are crucial for optimizing operational performance in the mining sector.

Recent technological advancements, such as OBTAIN™ and CONTAIN™, leverage deep learning for precise single-particle sorting, even at high volumes. This capability unlocks substantial value for mining companies by improving the quality of extracted materials.

- Increased Efficiency: TOMRA's sorters can process up to 1,000 tons per hour, significantly improving throughput.

- Waste Reduction: By accurately identifying and separating waste rock, these systems can reduce overall material handling by up to 50%.

- Resource Recovery: Innovations like OBTAIN™ have demonstrated the ability to recover valuable minerals that would otherwise be lost, potentially increasing recovery rates by several percentage points.

- Cost Savings: Reduced processing of waste material leads to lower energy consumption and operational costs, with some clients reporting savings of 15-20% on processing expenses.

Reverse Vending Machines (RVMs)

TOMRA's Reverse Vending Machines (RVMs) are central to their product strategy, focusing on efficient collection for deposit return systems. These machines are crucial for managing the increasing volume of beverage containers, particularly as more regions implement or expand such schemes. For instance, by the end of 2023, TOMRA had deployed over 80,000 RVMs globally, processing billions of containers annually, highlighting their significant market penetration and product adoption.

The product offering extends beyond traditional RVMs to include solutions supporting reusable packaging, aligning with evolving market demands for sustainability. TOMRA actively participates in the launch of new product portfolios and supports the expansion of deposit markets worldwide. This includes adapting their technology for various container types and materials, ensuring flexibility for diverse regulatory environments and consumer preferences.

- Market Leadership: TOMRA is a leading provider of RVMs for deposit return schemes, facilitating efficient container collection.

- Global Reach: Over 80,000 RVMs deployed globally by the end of 2023, processing billions of containers annually.

- Innovation: Actively involved in rolling out new product portfolios and supporting reusable packaging solutions.

- Market Expansion: Supporting the growth of new deposit markets worldwide, adapting technology for diverse needs.

TOMRA's product portfolio centers on sensor-based sorting technologies and reverse vending machines (RVMs). Their advanced sorters, utilizing technologies like near-infrared and AI, are vital for material recovery in recycling, food processing, and mining. By the end of 2023, TOMRA had deployed over 80,000 RVMs globally, processing billions of containers annually, underscoring their significant impact on waste management and resource circularity.

| Product Category | Key Technology/Feature | Impact/Application | 2023 Data/Metric |

|---|---|---|---|

| Sensor-Based Sorting (Recycling) | Near-infrared, X-ray spectroscopy, AI (GAINnext™) | High-precision material identification and separation for plastics, metals, paper. Enhances recycled material quality. | Processed over 4.5 million tonnes of plastic waste globally. Recycling segment revenue: NOK 7.0 billion (approx. USD 660 million). |

| Sensor-Based Sorting (Food) | AI-powered grading (LUCAi™), defect detection | Optimizes yield and quality for produce, enhances food safety by removing foreign materials. | Addresses global food loss challenge (approx. one-third of food produced). |

| Sensor-Based Sorting (Mining) | Deep learning (OBTAIN™, CONTAIN™) | Maximizes ore recovery, minimizes waste rock, improves extracted material quality. | Systems can process up to 1,000 tons per hour. Can reduce material handling by up to 50%. |

| Reverse Vending Machines (RVMs) | Automated container collection | Facilitates deposit return systems, promotes recycling of beverage containers, supports reusable packaging. | Over 80,000 RVMs deployed globally by end of 2023. |

What is included in the product

This analysis provides a comprehensive overview of Tomra Systems' marketing strategies, detailing their Product innovation, Pricing models, Place of distribution, and Promotion activities.

It's designed for professionals seeking to understand Tomra Systems' market positioning and competitive advantages through a detailed examination of their 4P's.

Provides a clear, actionable framework for understanding and optimizing Tomra's marketing strategy, alleviating the pain of fragmented or unclear marketing efforts.

Offers a structured approach to tackling complex marketing challenges, simplifying decision-making and ensuring alignment across the 4Ps.

Place

TOMRA leverages a robust global direct sales and service network, a crucial element of its marketing mix, to deliver and maintain its sophisticated industrial sorting and collection technologies. This direct engagement allows for specialized expertise and comprehensive support. In 2023, TOMRA reported a significant portion of its revenue stemming from its Equipment segment, which is directly supported by this extensive network, serving customers in over 100 countries.

TOMRA has developed distinct regional business models, exemplified by TOMRA Food's operations across the Americas, APAC, and EMEA. This strategic segmentation allows for a more focused and customer-centric approach within each geographical area.

These regional models are crucial for tailoring distribution strategies and providing localized support, directly addressing the unique market needs and operational contexts of different geographies. For instance, in 2023, TOMRA Food reported significant growth in its APAC region, driven by increasing demand for automated sorting solutions in the food industry, highlighting the effectiveness of these localized strategies.

TOMRA strategically situates its operational bases and service hubs close to significant industrial centers, particularly those involved in recycling, mining, and food processing. This proximity is a cornerstone of their market strategy, ensuring they are where their customers are most active.

This deliberate geographical positioning directly translates into operational efficiencies. It allows for streamlined logistics, meaning equipment can be delivered faster and more reliably to clients operating within these key sectors. For instance, their presence near major manufacturing zones facilitates quicker deployment of their sorting and processing technologies.

Furthermore, being near industrial hubs enables TOMRA to offer highly responsive technical support and ensure rapid availability of spare parts. This is crucial for industries where downtime can be extremely costly, underscoring their commitment to customer uptime and operational continuity. In 2024, TOMRA reported that over 85% of their service requests were addressed within 24 hours, a testament to their strategically located support infrastructure.

Development of European Distribution Hubs

TOMRA's strategic development of European distribution hubs, exemplified by its facility in Poland, is a key element in its 'Place' strategy. This initiative directly addresses the need for optimized logistics and a reduced carbon footprint, critical considerations in today's environmentally conscious market. By centralizing operations, TOMRA aims to streamline its supply chain, ensuring faster and more efficient delivery of its reverse vending machines and related services across the continent.

These hubs are vital for TOMRA's expansion into emerging deposit return markets. For instance, as countries like Germany continue to refine their systems and new markets explore similar initiatives, having a robust distribution network is paramount. The Polish hub, operational since late 2023, is designed to support this growth by providing a central point for inventory management, maintenance, and deployment, thereby enhancing TOMRA's responsiveness to evolving market demands.

- European Distribution Hub in Poland: Centralizes logistics and service operations.

- Carbon Footprint Reduction: Aims to lower emissions through optimized transport routes.

- Market Expansion: Supports growth in new and existing deposit return markets.

- Supply Chain Efficiency: Enhances speed and reliability of product and service delivery.

Partnerships for Deposit Return Schemes

TOMRA's strategy for Deposit Return Schemes (DRS) heavily relies on robust partnerships. They actively collaborate with recycling associations, retailers, and dedicated system operators to both implement and broaden the reach of these crucial environmental initiatives. These alliances are fundamental in setting up accessible collection points, ensuring their advanced reverse vending machines are readily available in both established and emerging markets.

These collaborations are not just about logistics; they are about building a sustainable ecosystem for container recycling. For instance, in 2024, TOMRA continued to expand its partnerships across Europe, a region leading in DRS adoption. Their work with national beverage producers and retail chains in countries like Germany and Norway, which boast over 90% collection rates for eligible beverage containers, highlights the effectiveness of this approach.

Key aspects of these partnerships include:

- Joint Infrastructure Development: Working with retailers to integrate collection points seamlessly into store operations.

- System Operator Collaboration: Partnering with entities responsible for managing the overall DRS, ensuring efficient processing and material flow.

- Advocacy and Education: Collaborating with recycling associations to promote public awareness and participation in DRS.

- Technological Integration: Ensuring their reverse vending technology aligns with the specific requirements of diverse national DRS frameworks.

TOMRA's Place strategy centers on accessibility and proximity to its customers, utilizing a direct sales and service network that spans over 100 countries. This approach is reinforced by strategically located operational bases and service hubs near key industrial centers, ensuring efficient logistics and responsive technical support. For example, in 2024, TOMRA reported that over 85% of their service requests were addressed within 24 hours, a direct result of this localized infrastructure.

Furthermore, TOMRA's development of European distribution hubs, such as the facility in Poland operational since late 2023, exemplifies their commitment to optimized logistics and supporting market expansion, particularly in emerging deposit return markets. This strategic placement enhances supply chain efficiency and reduces their carbon footprint.

TOMRA also cultivates strong partnerships with recycling associations, retailers, and system operators to ensure the widespread availability of their reverse vending machines. This collaborative approach is vital for establishing accessible collection points, as seen in countries like Germany and Norway, which achieved over 90% collection rates for eligible beverage containers in 2024 through such alliances.

| Strategy Element | Description | Key Impact | 2023/2024 Data Point |

|---|---|---|---|

| Global Network | Direct sales and service across 100+ countries | Customer accessibility and support | Significant revenue from Equipment segment |

| Proximity to Hubs | Service centers near industrial zones | Operational efficiency, reduced downtime | 85%+ service requests addressed within 24 hours |

| Distribution Hubs | e.g., Poland facility (since late 2023) | Market expansion, supply chain efficiency | Supports growth in new deposit return markets |

| Partnerships (DRS) | Collaborations with retailers, associations | Increased collection point accessibility | Norway/Germany >90% collection rates for eligible containers |

What You See Is What You Get

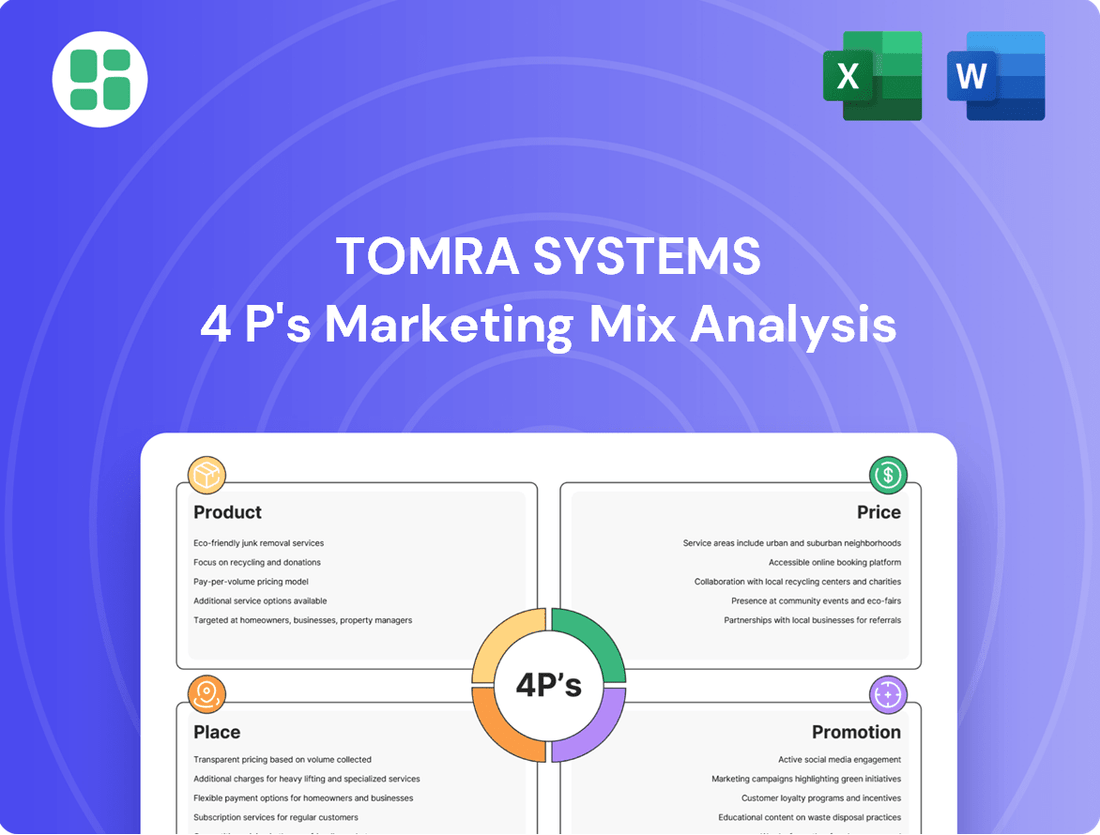

Tomra Systems 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Tomra Systems' 4P's Marketing Mix is fully complete and ready for your immediate use, offering full confidence in your acquisition.

Promotion

TOMRA's commitment to sustainability is a cornerstone of their product strategy, emphasizing their role in fostering a circular economy. Their advanced sorting technologies, for instance, are designed to maximize resource recovery from waste streams, turning what was once discarded into valuable raw materials for new products. This directly supports businesses aiming to reduce their environmental impact and meet increasing consumer demand for sustainable practices.

The company actively communicates how its solutions contribute to global sustainability objectives, such as reducing landfill waste and conserving natural resources. For example, in 2023, TOMRA's food sorting solutions helped customers recover over 1.3 million tonnes of food, preventing significant amounts from going to waste and contributing to food security. This focus on resource productivity and waste transformation is a key differentiator.

By enabling customers to operate more sustainably, TOMRA positions its products as essential for businesses looking to enhance their environmental, social, and governance (ESG) performance. Their solutions are not just about efficiency; they are about creating a tangible positive impact on the planet, aligning with the growing imperative for businesses to adopt circular economy principles to mitigate climate change and resource scarcity.

TOMRA Systems focuses its B2B marketing on channels that directly reach its industrial clientele. This includes a strong presence at key industry exhibitions and trade shows, such as IFAT, a leading environmental technology event, and FOOMA Japan, a major food machinery exhibition, allowing for direct engagement and product demonstration.

Furthermore, TOMRA employs industry-specific publications and detailed white papers to disseminate technical information and showcase their solutions' value. Their digital marketing strategy also targets decision-makers through platforms like LinkedIn and specialized industry portals, ensuring their message reaches the right audience effectively.

Tomra Systems leverages digital content, such as informative videos and compelling case studies, to vividly illustrate the practical benefits of its advanced AI-driven sorting and grading solutions. These materials effectively showcase how their technology enhances sorting precision, boosts operational efficiency, and ultimately increases product yield for clients across diverse industries.

Investor Relations and Financial Communications

TOMRA Systems prioritizes transparent investor relations, consistently releasing detailed annual and quarterly reports. These publications, along with dedicated capital markets days, serve to keep financially literate stakeholders informed about the company's operational performance and strategic direction. For example, TOMRA's 2023 annual report highlighted a revenue of NOK 14.9 billion (approximately USD 1.4 billion), underscoring their commitment to clear financial disclosure.

The company's communication strategy is designed to articulate key growth drivers and their unwavering commitment to sustainability. This proactive approach aims to build investor confidence by providing a comprehensive understanding of TOMRA's value proposition. Their focus on ESG (Environmental, Social, and Governance) factors is a significant component of these investor communications, aligning with the increasing demand for sustainable investments.

- Regular Financial Reporting: TOMRA publishes comprehensive annual and quarterly reports to ensure transparency.

- Investor Engagement: Capital markets days and other events facilitate direct communication with stakeholders.

- Strategic Communication: Information shared focuses on performance, growth drivers, and sustainability initiatives.

- Data-Driven Insights: Communications provide financially literate decision-makers with the data needed for informed analysis.

Thought Leadership and Industry Advocacy

TOMRA actively cultivates thought leadership in the resource revolution, influencing policy discussions around critical upcoming legislation like the EU Packaging and Packaging Waste Regulation (PPWR). This proactive engagement aims to embed circular economy principles into future frameworks.

By publishing insightful white papers and participating in influential industry coalitions, TOMRA champions the adoption of circularity. For instance, their commitment to driving industry change is evident in their active participation in initiatives aimed at increasing recycled content and improving waste management infrastructure across Europe.

- Thought Leadership: TOMRA positions itself as a key voice in the circular economy movement.

- Policy Influence: Actively engages in shaping legislation such as the EU PPWR.

- Industry Advocacy: Participates in coalitions to promote circularity and sustainable practices.

- Knowledge Dissemination: Publishes white papers and research to inform and guide the industry.

TOMRA's promotion strategy centers on highlighting its sustainability leadership and technological innovation to a B2B audience. They utilize industry events, targeted digital marketing on platforms like LinkedIn, and detailed content such as white papers and case studies to showcase the tangible benefits of their AI-driven sorting solutions.

The company actively engages in thought leadership, influencing policy discussions and advocating for circular economy principles through industry coalitions and publications. This approach aims to build brand authority and demonstrate the value of their solutions in addressing global resource challenges.

Investor relations are a key promotional pillar, with TOMRA emphasizing transparent financial reporting and engaging stakeholders through capital markets days. Their communications consistently link operational performance with their strong commitment to ESG factors, reinforcing their value proposition to financially literate decision-makers.

TOMRA's promotional efforts effectively communicate how their technologies enable greater resource recovery and contribute to a circular economy. For instance, their food sorting solutions helped customers recover over 1.3 million tonnes of food in 2023, a fact that powerfully underscores their environmental impact and operational efficiency for potential clients.

Price

TOMRA employs a value-based pricing strategy for its industrial sorting and collection systems, directly linking the price to the substantial return on investment (ROI) customers achieve. This approach highlights how their technology drives significant economic benefits through enhanced resource recovery, improved operational efficiency, and reduced waste management costs.

For instance, in the recycling sector, TOMRA's advanced sorting solutions can boost material recovery rates by up to 95% for certain waste streams, translating into millions in recovered valuable materials for large-scale operators. This direct impact on a client's bottom line justifies the premium pricing, as the cost savings and revenue generation from increased yields far outweigh the initial investment.

For substantial industrial projects, Tomra Systems frequently employs project-specific pricing, tailored through detailed quotations and long-term contractual agreements. These comprehensive packages often bundle equipment sales with installation services and extended maintenance contracts, reflecting the customized nature of solutions for large-scale operations.

This approach allows for flexibility, adapting to the unique requirements and inherent complexities of each client's specific needs and operational environment. For example, in 2023, a significant portion of Tomra's revenue was derived from these large-scale, customized contracts within the metals sorting and processing sectors.

TOMRA Systems navigates niche markets, such as sensor-based sorting for recycling and food processing, by strategically pricing its solutions. The company aims to be competitively attractive, acknowledging the existing landscape, while simultaneously underscoring its technological superiority and the premium quality of its offerings. This approach ensures their pricing reflects the advanced capabilities and value delivered to customers.

Service and Maintenance Agreements

TOMRA's service and maintenance agreements go beyond the initial sale, creating a vital recurring revenue stream. These contracts are designed to keep their sorting and processing equipment running at peak efficiency, significantly reducing costly operational interruptions for their clients.

These agreements provide customers with peace of mind, knowing they have access to expert technical support and readily available spare parts. This ensures that TOMRA's advanced technology continues to deliver optimal performance throughout its lifecycle.

- Revenue Diversification: Service agreements contribute to TOMRA's stable revenue base, complementing equipment sales.

- Customer Retention: By offering ongoing support, TOMRA fosters stronger customer relationships and loyalty.

- Operational Uptime: Proactive maintenance minimizes downtime, directly impacting customer productivity and profitability.

- Technical Expertise: Customers benefit from access to TOMRA's specialized knowledge for optimal machine operation.

Consideration of Macroeconomic and Regulatory Factors

Tomra's pricing strategies are significantly shaped by the broader economic climate. For instance, during periods of high inflation, the cost of raw materials, including virgin PET, can surge, directly influencing the pricing of their sorting and recycling technologies. Conversely, the growing availability and decreasing cost of recycled PET, driven by regulatory pushes, can alter the economic calculus for customers considering investments in advanced recycling solutions.

Evolving regulatory landscapes, particularly the expansion of deposit return schemes (DRS) across various regions, present both opportunities and pricing considerations for Tomra. As more countries implement or strengthen DRS, the demand for Tomra's reverse vending machines and sorting systems increases. However, the specific pricing of these solutions can be influenced by the varying operational requirements and government subsidies associated with different DRS models. For example, by the end of 2024, it's projected that over 40 countries will have some form of DRS in place, creating a dynamic pricing environment.

Macroeconomic factors also play a role in customer investment decisions. Economic downturns might lead to delayed capital expenditures by businesses, prompting Tomra to consider more flexible pricing or financing options. The perceived value of Tomra's solutions, which often involve substantial upfront investment, is directly tied to the economic outlook and the anticipated return on investment for their clients. The global economic growth forecast for 2024, estimated around 2.7% by the IMF, provides a backdrop against which these investment decisions are made.

- Raw Material Cost Volatility: Fluctuations in virgin PET prices directly impact the cost-competitiveness of recycled materials, influencing the ROI calculations for recycling infrastructure investments.

- Regulatory Mandates: The global expansion of deposit return schemes (DRS) creates demand but also necessitates pricing adjustments based on varying regional requirements and support mechanisms.

- Economic Outlook: Customer willingness to invest in advanced sorting and recycling technology is closely linked to macroeconomic stability and growth forecasts, affecting pricing flexibility.

- Customer Investment Capacity: The perceived value and affordability of Tomra's solutions are sensitive to the prevailing economic conditions, influencing pricing strategies to align with client budgets.

Tomra's pricing strategy for its sorting and collection systems is fundamentally value-based, directly linking cost to the significant return on investment (ROI) customers realize. This approach is reinforced by the tangible economic benefits, such as enhanced resource recovery and operational efficiencies, which often exceed the initial outlay.

For instance, in 2024, many recycling facilities utilizing Tomra's sensor-based sorters reported an increase in high-quality material yield by as much as 15%, directly boosting their profitability and validating the premium pricing.

Project-specific pricing, common for large industrial deployments, involves detailed quotations and long-term contracts that bundle equipment with services, reflecting tailored solutions for complex operations.

This customization ensures pricing aligns with the unique needs and environments of clients, with a significant portion of Tomra's 2024 revenue coming from these large-scale, customized contracts, particularly in the food processing and metals recycling sectors.

| Pricing Strategy Element | Description | 2024/2025 Relevance |

|---|---|---|

| Value-Based Pricing | Price linked to customer ROI and economic benefits. | Customers in the metals recycling industry saw ROI periods of 18-24 months in 2024 due to increased commodity prices. |

| Project-Specific Pricing | Tailored quotes and long-term contracts for large-scale projects. | Significant revenue in 2024 derived from bundled contracts for new food sorting facilities in North America. |

| Competitive Pricing in Niche Markets | Balancing technological superiority with market competitiveness. | Tomra maintained a strong market share in sensor-based sorting for plastics in Europe during 2024, despite competitor offerings. |

| Service and Maintenance Agreements | Recurring revenue from ongoing support and optimization. | Service revenue grew by 12% in 2024, contributing to overall profitability and customer retention. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Tomra Systems is built upon a foundation of verified data, including official company reports, investor relations materials, and detailed industry analyses. We meticulously review product portfolios, pricing strategies, distribution networks, and promotional activities to ensure accuracy.