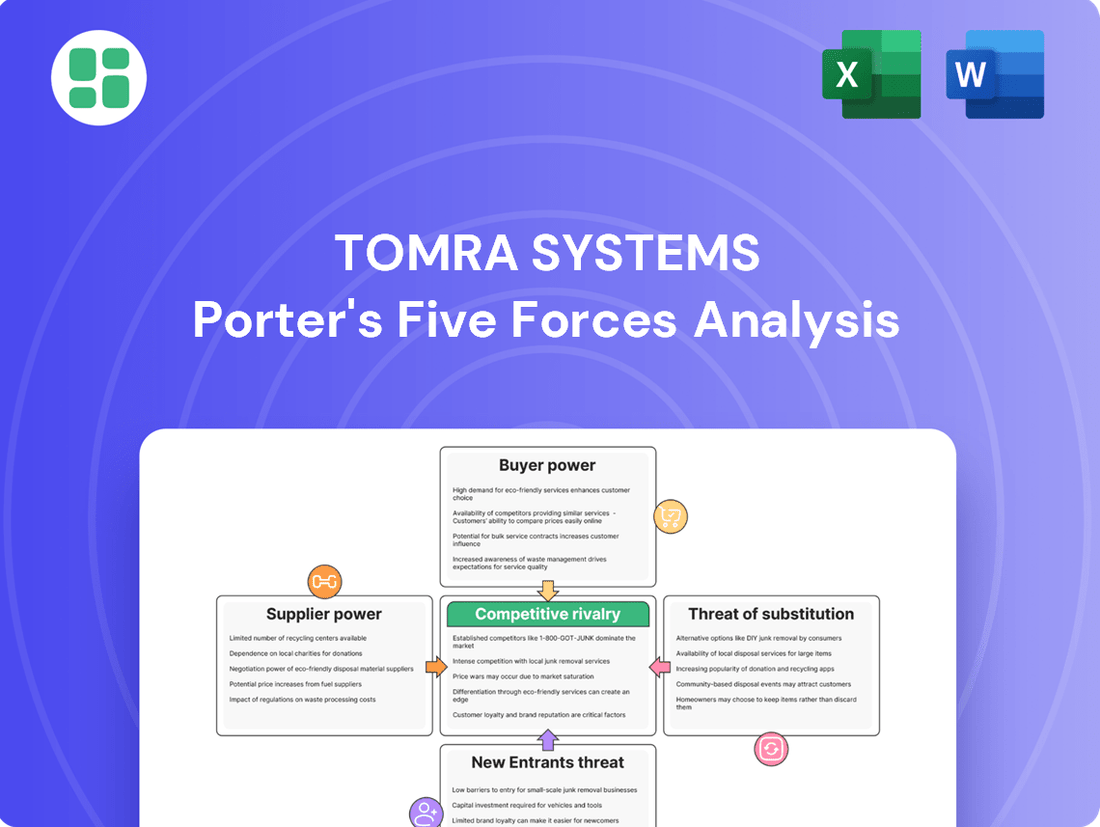

Tomra Systems Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tomra Systems Bundle

Tomra Systems operates in a dynamic market, facing moderate threats from new entrants and intense rivalry among existing players. Understanding the power of their buyers and the influence of their suppliers is crucial for strategic planning.

The complete report reveals the real forces shaping Tomra Systems’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Tomra Systems' reliance on specialized sensor technology and precision engineering for its advanced sorting and collection systems means that suppliers of these niche components often hold significant bargaining power. The high quality and unique nature of these inputs are critical for Tomra's innovative solutions, limiting the availability of suitable alternatives.

This dependency can translate into higher input costs for Tomra, potentially impacting its profit margins. For instance, in 2024, the global market for advanced sensor technology continued to see strong demand, with specialized components often commanding premium pricing due to their critical performance characteristics and limited supplier base.

Supplier concentration significantly impacts bargaining power. If Tomra Systems relies on a few key suppliers for specialized components like advanced optical sensors or high-precision robotic arms, those suppliers gain considerable leverage. This concentration means fewer alternatives for Tomra, potentially allowing suppliers to dictate prices and terms, directly affecting Tomra's cost of goods sold and overall profitability.

The cost and complexity of switching suppliers for Tomra's highly integrated or customized components are substantial. This means that if a supplier were to increase their prices or change their terms, Tomra might find it difficult and expensive to find an alternative. For instance, redesigning their sorting systems to accommodate new components, revalidating the performance of these new parts, and retraining their technical staff on the new supplier's products could lead to significant expenses and project delays.

These high switching costs effectively strengthen the bargaining power of Tomra's suppliers. When it's costly and time-consuming to change, Tomra is naturally less inclined to seek out new suppliers, even if current terms become unfavorable. This dependence on existing suppliers, due to the integration of their components, gives those suppliers leverage in negotiations.

Uniqueness of Input

Suppliers who provide proprietary technologies or unique materials that are essential for Tomra Systems' competitive edge, such as specialized AI algorithms for sorting or durable components for their reverse vending machines, hold significant bargaining power. Tomra's ability to innovate and differentiate its products hinges on these unique inputs, which can translate into greater supplier influence over pricing and supply terms.

For instance, a supplier of advanced optical sensors with patented technology crucial for Tomra's high-speed sorting solutions would likely command higher prices. Similarly, manufacturers of exceptionally robust and wear-resistant materials for the internal mechanisms of reverse vending machines, designed for high-volume usage, could leverage their unique offerings.

- Proprietary AI Algorithms: Suppliers developing and licensing unique artificial intelligence algorithms for material identification and sorting give Tomra a distinct advantage in the recycling technology market.

- Specialized Durable Materials: Providers of custom-engineered, high-durability plastics or metals for the demanding environment of reverse vending machines, ensuring longevity and reduced maintenance for Tomra's machines, possess leverage.

- Unique Sensor Technology: Companies that manufacture advanced, proprietary sensor arrays (e.g., hyperspectral imaging) critical for precise material detection in recycling applications can exert considerable influence.

Forward Integration Threat

The threat of forward integration by suppliers, though less frequent, could significantly bolster their bargaining power against Tomra Systems. If a supplier of crucial sorting technology or collection system components were to move into direct manufacturing and sales, they would essentially become a competitor. This would not only disrupt Tomra's supply chain but also potentially give the former supplier leverage over access to essential intellectual property and components.

This scenario highlights the strategic importance for Tomra to cultivate robust supplier relationships and explore avenues for supplier diversification. For instance, in 2024, Tomra's reliance on specialized technology providers for its advanced sensor-based sorting solutions underscores the potential impact if one of these key partners were to consider direct market entry.

- Forward Integration Risk: Suppliers of critical technologies could potentially enter Tomra's market directly.

- Impact on Supply Chain: This could limit Tomra's access to essential components and proprietary knowledge.

- Strategic Mitigation: Maintaining strong supplier partnerships and diversifying the supplier base are key defensive strategies.

Suppliers of specialized components for Tomra Systems, particularly those with proprietary technology like advanced sensors or unique materials, wield considerable bargaining power. This is due to the critical nature of these inputs for Tomra's innovative sorting and collection systems, coupled with limited alternatives and high switching costs for Tomra. In 2024, the demand for advanced sensor technology remained robust, allowing key suppliers to maintain premium pricing.

The concentration of suppliers for niche components, such as hyperspectral imaging sensors or high-durability materials for reverse vending machines, further amplifies their leverage. This limited supplier base means Tomra has fewer options, potentially leading to unfavorable pricing and terms that can impact profitability.

The cost and complexity involved in Tomra finding and integrating new suppliers for its highly customized and integrated systems are substantial. This makes it difficult for Tomra to switch, even if current suppliers increase prices, thereby strengthening the suppliers' negotiating position.

The bargaining power of Tomra's suppliers is a significant factor, especially given the specialized nature of their offerings. For example, providers of AI algorithms for material identification or unique, wear-resistant components for reverse vending machines can command higher prices and dictate terms due to their essential role in Tomra's product differentiation and performance.

| Supplier Characteristic | Impact on Tomra | Example for Tomra (2024) |

|---|---|---|

| Proprietary Technology (e.g., AI Algorithms) | High Bargaining Power | Suppliers of advanced optical sensors with patented technology |

| Supplier Concentration | Increased Leverage | Reliance on a few key manufacturers for precision robotic arms |

| High Switching Costs | Supplier Advantage | Costly redesign and revalidation for new sensor integration |

| Unique/Durable Materials | Strong Negotiating Position | Providers of custom-engineered, high-durability plastics for RVMs |

What is included in the product

This analysis dissects Tomra Systems' competitive environment by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the unique industry dynamics that shape its market position.

Effortlessly assess competitive intensity and identify strategic vulnerabilities in the reverse vending and waste management industries.

Customers Bargaining Power

Tomra Systems' diverse customer base, spanning recycling, mining, and food processing, significantly dilutes the bargaining power of any single customer segment. Clients include municipalities, retailers, and industrial operators, meaning no one group holds a disproportionate sway over Tomra's revenue streams. This broad reach inherently limits the leverage individual customers can exert.

Tomra's customers often face substantial initial investments and integration expenses when adopting their advanced sorting and collection technologies. These costs create a significant barrier to switching, as moving to another provider would necessitate new hardware, software, and employee retraining.

For instance, a recycling facility implementing Tomra's sensor-based sorting equipment might spend millions on the initial setup and customization. The disruption and expense of replacing this integrated system with a competitor's solution, even if marginally cheaper, would likely outweigh the perceived benefits. This lock-in effect inherently limits the customer's leverage.

Tomra's sensor-based sorting technology provides compelling value by enhancing resource recovery and operational efficiency, directly translating into significant cost savings and new revenue streams for its customers. For instance, in the recycling sector, their advanced sorting systems can recover a higher percentage of valuable materials, reducing waste disposal costs and increasing the yield of sellable commodities.

The robust return on investment (ROI) and the clear environmental advantages associated with Tomra's solutions significantly diminish customer price sensitivity. Clients often find that the long-term benefits, such as improved material quality and reduced processing expenses, outweigh minor price variations, making them less inclined to switch based solely on cost.

Customer Sophistication and Information

Tomra's customer base, which includes significant industrial entities and government bodies, is generally highly informed about market pricing, competing technologies, and prevailing industry trends. This advanced knowledge enables them to perform detailed assessments and negotiate with greater leverage.

The availability of extensive market data empowers these customers to press for more favorable terms, enhanced product features, or superior after-sales services. For instance, in the recycling sector, large waste management companies often have sophisticated procurement departments that benchmark equipment against multiple suppliers and performance metrics.

- In 2023, Tomra reported revenue of approximately NOK 14.9 billion (USD 1.4 billion), indicating the scale of transactions with its major clients.

- The recycling industry, a key market for Tomra, saw significant investment in 2024, with governments worldwide setting ambitious recycling targets, increasing customer demand for advanced sorting technologies.

- Customers often possess detailed knowledge of the total cost of ownership, including operational efficiency and maintenance, which they use in their purchasing decisions.

Potential for Backward Integration

The potential for backward integration by very large customers, particularly in sectors like waste management or food processing, poses a subtle but real threat to Tomra Systems. These major clients, possessing substantial capital and operational expertise, might explore developing their own in-house sorting or collection solutions, especially for less complex, routine tasks. This possibility acts as a quiet pressure, compelling Tomra to maintain competitive pricing and superior service offerings to retain its client base.

For instance, a large municipal waste management entity might evaluate the cost-effectiveness of building its own basic sorting facilities versus continuing to lease or purchase Tomra's advanced technology. While the upfront investment and specialized knowledge required for sophisticated sorting are significant deterrents, the fundamental option of backward integration remains a consideration for dominant players. This latent threat underscores the importance of continuous innovation and value demonstration by Tomra.

- Backward Integration Threat: Large customers in waste management and food processing could develop in-house sorting capabilities.

- Capital & Expertise Required: Significant investment and specialized knowledge are necessary for such in-house development.

- Competitive Pressure: This potential threat encourages Tomra to offer competitive pricing and services.

- Focus on Routine Tasks: Backward integration is more likely for less complex, routine sorting operations.

While Tomra's diverse customer base and high switching costs generally limit customer bargaining power, large, well-informed clients can exert influence. These customers, often with significant capital and operational expertise, possess detailed market knowledge and can explore backward integration for simpler tasks, creating a subtle pressure on Tomra to maintain competitive pricing and superior value propositions.

| Factor | Impact on Customer Bargaining Power | Tomra's Mitigation Strategy |

| Customer Base Diversity | Lowers individual customer power. | Broad market penetration across recycling, mining, food. |

| Switching Costs | Lowers customer power due to high integration expenses. | Advanced, proprietary technology requiring significant investment. |

| Customer Knowledge & Negotiation | Increases customer power through informed purchasing. | Focus on clear ROI and long-term value proposition. |

| Potential for Backward Integration | Increases customer power for less complex tasks. | Continuous innovation and superior service to retain clients. |

What You See Is What You Get

Tomra Systems Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis for Tomra Systems delves into the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This detailed breakdown will equip you with actionable insights into Tomra's strategic positioning and the key factors influencing its profitability.

Rivalry Among Competitors

Tomra Systems demonstrates formidable competitive rivalry, especially within the reverse vending machine (RVM) sector where it commands a substantial market share. This leadership, built over five decades of innovation, creates a high barrier for new entrants and existing rivals seeking to directly challenge its dominance. While other companies operate in recycling and food sorting, few can match Tomra's integrated scale and comprehensive product portfolio across these specialized niches.

The global waste management and circular economy sectors are booming, with significant expansion driven by urbanization and stricter environmental rules. This growth allows companies like Tomra to expand their operations without directly clashing over existing market share, which can temper competitive intensity.

The digital waste management market, a key area for Tomra, is expected to see substantial growth between 2024 and 2034. This expansion creates opportunities for new entrants and existing players to capture new demand, potentially softening the direct competitive pressure among established firms.

Tomra Systems distinguishes itself through substantial investment in research and development, consistently launching sophisticated sensor-based sorting technologies. Innovations like their AI-powered GAINNEXT and Dynamic LIBS solutions create a significant competitive advantage, making it difficult for competitors to match their advanced capabilities.

This commitment to technological differentiation acts as a strong barrier to entry, allowing Tomra to maintain its market leadership and justify premium pricing for its specialized equipment. For instance, in 2023, Tomra reported R&D expenses of NOK 1.2 billion (approximately $110 million USD), underscoring their dedication to staying ahead in a rapidly evolving technological landscape.

Diverse Competitor Landscape

Tomra Systems operates within a competitive arena populated by companies like Key Technology and STEINERT, alongside numerous smaller, specialized sorting equipment manufacturers. While these players offer viable alternatives, their competitive thrust is often confined to specific market segments, such as food processing or metal recovery, rather than challenging Tomra's broad product and service spectrum.

This segmentation means that while direct, head-to-head competition across all of Tomra's offerings is somewhat limited, the sheer number of niche players contributes to a fragmented rivalry. For instance, in the food sorting sector, competitors might excel in specific applications, but lack Tomra's integrated solutions for diverse waste streams or advanced material recovery.

- Key Technology: A significant competitor, particularly in food sorting, known for its optical sorters.

- STEINERT: A major player in sensor-based sorting, with a strong presence in the metals and mining industries.

- Niche Specialists: Numerous smaller firms focus on highly specific sorting technologies or material types, creating a fragmented competitive landscape.

- Tomra's Advantage: Tomra's strength lies in its comprehensive portfolio and ability to offer integrated solutions across multiple industries, mitigating the impact of highly specialized competitors.

Regulatory Landscape and Policy Drivers

The regulatory environment is a significant force shaping competitive rivalry for companies like Tomra. Increasingly stringent environmental regulations and policies, particularly those promoting circular economy initiatives, are creating new market opportunities. For instance, the expansion of deposit return systems (DRS) across Europe and the introduction of recycled content targets in various regions directly benefit established players with advanced sorting and collection technologies, such as Tomra. These regulatory tailwinds can, in some ways, reduce direct rivalry by expanding the overall market for recycling solutions.

However, these same regulations also spur investment in sophisticated sorting and collection technologies throughout the industry. This heightened investment can intensify competition among existing players and attract new entrants eager to capitalize on these growing markets. For example, by 2024, the European Union's Circular Economy Action Plan continues to drive demand for improved waste management and recycling infrastructure, directly impacting the competitive landscape.

- Environmental Regulations: Policies mandating higher recycling rates and the use of recycled materials create demand for advanced sorting technologies.

- Deposit Return Systems (DRS): The widespread implementation and expansion of DRS in various countries, particularly in Europe, benefit companies like Tomra that provide the necessary infrastructure and technology.

- Circular Economy Initiatives: Government-backed programs promoting a circular economy encourage innovation and investment in resource recovery, potentially leading to increased competition as more companies enter the space.

- Recycled Content Targets: Mandates for minimum recycled content in products drive demand for high-quality recycled materials, benefiting companies with efficient sorting and processing capabilities.

Tomra Systems faces robust competition, particularly from established players like Key Technology and STEINERT, who specialize in optical and sensor-based sorting respectively, often focusing on specific sectors like food processing or metals. While Tomra's broad portfolio and integrated solutions offer a significant advantage, the presence of numerous niche specialists across various waste streams and material types fragments the competitive landscape. However, Tomra's substantial R&D investments, totaling NOK 1.2 billion (approximately $110 million USD) in 2023, and its leadership in advanced sensor technologies, such as AI-powered GAINNEXT, create high barriers to entry and differentiation.

The growing global demand for recycling and circular economy solutions, projected to see significant growth in the digital waste management market between 2024 and 2034, fuels both expansion for established players and opportunities for new entrants. This market expansion can temper direct rivalry by increasing overall demand, yet it also intensifies competition as more companies invest in sophisticated sorting and collection technologies to capitalize on stricter environmental regulations and the expansion of deposit return systems (DRS) globally.

| Competitor | Specialization | Market Focus | Tomra's Differentiator |

| Key Technology | Optical Sorters | Food Sorting | Broad Portfolio, Integrated Solutions |

| STEINERT | Sensor-Based Sorting | Metals, Mining | Advanced AI & Sensor Tech |

| Niche Specialists | Specific Sorting Tech/Materials | Fragmented Segments | Scale, Comprehensive Offerings |

SSubstitutes Threaten

Manual sorting and less automated methods can act as substitutes for Tomra's advanced systems, especially in regions with lower labor costs or for smaller businesses with limited capital. These alternatives, while less efficient, offer a more budget-friendly entry point for sorting operations.

For instance, in some agricultural sectors in developing economies, manual labor might still be the primary method for sorting produce. This reliance on cheaper labor makes the initial investment in Tomra's technology less appealing, even if the long-term benefits in accuracy and speed are significant. Globally, the informal sector often employs manual sorting, representing a substantial, albeit less efficient, alternative.

In the waste management sector, alternative resource recovery technologies present a significant threat of substitution to sensor-based sorting systems like those offered by Tomra. Established methods such as incineration for waste-to-energy, traditional landfilling, and basic mechanical recycling processes are readily available and often more cost-effective in the short term for certain waste streams.

These substitutes, while generally yielding lower purity and less comprehensive material recovery, can still attract customers due to existing infrastructure and simpler operational requirements. For instance, in regions with limited advanced recycling capabilities, landfilling remains a dominant disposal method, diverting waste that could otherwise be sorted. The global waste-to-energy market was valued at approximately $30 billion in 2023 and is projected to grow, indicating continued reliance on these alternative thermal treatment methods.

In food processing and mining, alternative methods for optimizing operations can act as substitutes for sensor-based sorting. For instance, more rigorous upstream raw material selection or the implementation of different mechanical separation techniques could reduce the reliance on advanced sorting technologies.

While Tomra's sensor-based sorting systems provide exceptional precision, some businesses might opt for traditional approaches. These could involve relying on conventional quality control measures at later stages of the production process, thereby substituting the need for upfront, highly accurate sorting.

Emerging Technologies and Material Alternatives

The development of entirely new materials that are inherently easier to recycle or reuse, or breakthrough technologies in material science, could pose a long-term substitute threat for TOMRA Systems. For instance, advancements in single-polymer packaging or biodegradable materials could simplify waste streams, potentially reducing the demand for sophisticated sorting solutions. This shift could impact TOMRA's core business if these alternatives gain significant market traction.

Consider the growing interest in circular economy models. Companies are actively seeking solutions that minimize waste and maximize resource utilization. If new materials emerge that are inherently more circular, requiring less complex processing, this could present a challenge. For example, a widely adopted, easily compostable material for single-use items might bypass the need for advanced recycling infrastructure.

The threat is amplified by potential technological leaps in material science. Imagine breakthroughs that allow for the effortless separation of mixed materials or the creation of truly closed-loop systems without specialized equipment. Such innovations could disintermediate TOMRA's current offerings. For example, research into self-degrading plastics that break down into harmless components without sorting could reduce the need for mechanical recycling.

- Emerging Materials: Innovations in single-polymer packaging or fully biodegradable alternatives could simplify waste streams, reducing reliance on complex sorting.

- Material Science Breakthroughs: Advances in material science that inherently reduce the need for sophisticated sorting technologies pose a potential substitute threat.

- Circular Economy Impact: The push for circular economy principles might favor materials designed for easier reuse or decomposition, potentially bypassing advanced recycling needs.

- Technological Disruption: Novel technologies enabling effortless material separation or inherent recyclability could diminish the market for current sorting solutions.

Behavioral Changes and Waste Reduction at Source

Behavioral changes aimed at waste reduction at the source, such as increased adoption of reusable packaging, could diminish the demand for advanced sorting technologies. For instance, a significant consumer shift towards refillable containers, as seen in some European markets, might reduce the volume of single-use items needing sorting. This trend, if it gains widespread traction, could present a competitive threat by lowering the overall need for the sophisticated sorting equipment Tomra specializes in, impacting its market share.

Efforts to promote direct consumer separation of waste streams, rather than relying on automated sorting, also represent a potential substitute. If consumers become more diligent in pre-sorting recyclables at home, the necessity for complex material recovery facilities (MRFs) might decrease. This would directly challenge the value proposition of Tomra's sorting solutions. For example, extended producer responsibility schemes that mandate source separation could indirectly lessen the reliance on advanced sorting machinery.

- Reduced Demand: Increased source reduction and reuse models can directly decrease the volume of mixed waste requiring sorting.

- Consumer Behavior Shift: A significant move towards reusable packaging or enhanced consumer pre-sorting could alter market dynamics for sorting equipment providers.

- Circular Economy Impact: While aligned with circular economy goals, widespread adoption of these practices could redefine the market for waste management technologies.

Manual sorting and less automated methods, particularly in regions with lower labor costs or for smaller businesses, represent a direct substitute for Tomra's advanced systems. These alternatives, while less efficient, offer a more budget-friendly entry point. For instance, in some agricultural sectors in developing economies, manual labor remains the primary sorting method, making the initial investment in Tomra's technology less appealing despite long-term benefits.

Alternative resource recovery technologies, such as incineration for waste-to-energy and traditional landfilling, pose a significant threat in the waste management sector. These methods are often more cost-effective in the short term. For example, the global waste-to-energy market was valued at approximately $30 billion in 2023, indicating continued reliance on these thermal treatment methods, even though they yield lower material recovery purity compared to sensor-based sorting.

Innovations in material science, such as the development of single-polymer packaging or biodegradable materials, could simplify waste streams and reduce the demand for sophisticated sorting solutions. For example, research into self-degrading plastics that break down without sorting could directly challenge Tomra's core business if these alternatives gain significant market traction.

| Substitute Category | Description | Example/Impact |

|---|---|---|

| Manual Labor | Less automated sorting methods | Dominant in developing economies' agriculture; lower initial cost |

| Alternative Waste Treatment | Incineration, landfilling | Cost-effective short-term; lower material recovery purity |

| Material Science Innovations | Single-polymer, biodegradable materials | Simplifies waste streams; reduces need for complex sorting |

| Behavioral Shifts | Source reduction, reusable packaging | Decreases volume of mixed waste; impacts demand for sorting equipment |

Entrants Threaten

The sensor-based sorting and collection systems market demands significant upfront capital for research, development, and manufacturing infrastructure. Tomra's commitment to cutting-edge AI and sensor technologies, exemplified by advancements like GAINNEXT and Dynamic LIBS, requires substantial R&D expenditure, thereby establishing a considerable barrier for prospective competitors.

The significant technological complexity inherent in developing and deploying advanced sensor-based solutions presents a substantial barrier to entry for new competitors in Tomra's markets. Mastering areas like optics, robotics, software development, and material science requires years of dedicated research and development, a steep learning curve that deters many potential entrants.

Tomra's established expertise, cultivated over decades, makes it incredibly challenging for newcomers to replicate its capabilities. This deep knowledge base, coupled with a highly skilled workforce, means that new entrants would need considerable time and investment to even approach Tomra's level of technical proficiency and product innovation.

Tomra Systems benefits from over five decades of building trust and a vast global network of installed systems. This deep-rooted presence and established customer loyalty create a significant barrier for any new company attempting to enter the market.

Newcomers face the daunting task of replicating Tomra's extensive track record and the rapport it has cultivated with clients, particularly for critical applications like reverse vending machines or advanced industrial sorting solutions. The capital investment and time required to achieve similar market penetration and credibility are substantial.

Regulatory Hurdles and Standards

The threat of new entrants for Tomra Systems is significantly mitigated by the substantial regulatory hurdles and stringent quality standards present in the sectors it operates within. For instance, in the food and beverage industry, compliance with food safety regulations and environmental standards requires considerable investment and expertise, acting as a substantial barrier. New companies entering these markets must dedicate significant resources to understand and adhere to these complex legal frameworks, often necessitating lengthy approval processes for new technologies.

Tomra's focus on advanced sorting and recycling technologies means new entrants must also contend with performance and safety certifications. Obtaining these can be a protracted and expensive endeavor. For example, the development and certification of advanced sensor technology for material sorting, a core competency for Tomra, can take years and millions in R&D. This high cost of entry and the time required for regulatory approval effectively deter many potential competitors.

- Regulatory Complexity: Industries like food processing and waste management face intricate regulations that new entrants must navigate, adding significant cost and time to market entry.

- Certification Requirements: Technologies used in these sectors, particularly those related to safety and environmental impact, require rigorous and often costly certifications.

- Compliance as a Barrier: The need for compliance with standards such as those set by the European Food Safety Authority (EFSA) or environmental agencies creates a high barrier to entry for less capitalized or less experienced newcomers.

- Investment in R&D and Approvals: New entrants require substantial upfront investment in research and development, alongside the resources to manage lengthy approval processes, making it difficult to compete with established players like Tomra.

Economies of Scale and Experience Curve

Tomra Systems benefits significantly from economies of scale in its manufacturing, procurement, and global distribution networks. Its substantial installed base and high production volumes enable cost efficiencies that are difficult for new entrants to replicate. For instance, in 2023, Tomra reported revenues of NOK 15.7 billion (approximately USD 1.47 billion), reflecting its significant operational scale.

The experience curve further solidifies Tomra's competitive position. Through continuous refinement of its recycling and sorting technologies, Tomra has developed optimized processes and designs that reduce production costs and improve system performance. This accumulated knowledge and operational expertise create a formidable barrier to entry for any newcomer attempting to match Tomra's efficiency and product quality.

- Economies of Scale: Tomra's large production volumes and global reach lead to lower per-unit costs in manufacturing and supply chain operations.

- Experience Curve Advantage: Decades of operational experience have allowed Tomra to optimize its recycling and sorting technologies, reducing costs and enhancing efficiency.

- Cost Competitiveness: These factors combine to make Tomra's systems more cost-effective to produce and operate than those of potential new entrants.

The threat of new entrants for Tomra Systems is generally low due to high capital requirements for R&D and manufacturing, coupled with significant technological complexity in areas like AI-powered sensor sorting. Tomra's established expertise and decades of market presence, including a vast global network of installed systems, create a formidable barrier for newcomers seeking to replicate its capabilities and customer trust.

Regulatory complexity and stringent quality certifications further deter new entrants, as navigating these requirements demands substantial investment and time. Economies of scale in manufacturing and procurement, along with the advantages gained from an experience curve in optimizing its technologies, also contribute to Tomra's cost competitiveness, making it difficult for new players to match its efficiency and market position.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High R&D and manufacturing investment for advanced sensor technology. | Significant financial hurdle. |

| Technological Complexity | Expertise needed in optics, robotics, AI, and material science. | Steep learning curve and development time. |

| Brand Reputation & Network | Decades of trust and a large installed base. | Difficult to replicate customer loyalty and market penetration. |

| Regulatory & Certification Hurdles | Compliance with industry-specific safety and environmental standards. | Adds cost, time, and complexity to market entry. |

| Economies of Scale & Experience | Cost efficiencies from high production volumes and optimized processes. | New entrants struggle to match cost competitiveness. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Tomra Systems leverages data from their annual reports, investor presentations, and industry-specific market research reports to understand competitive dynamics.