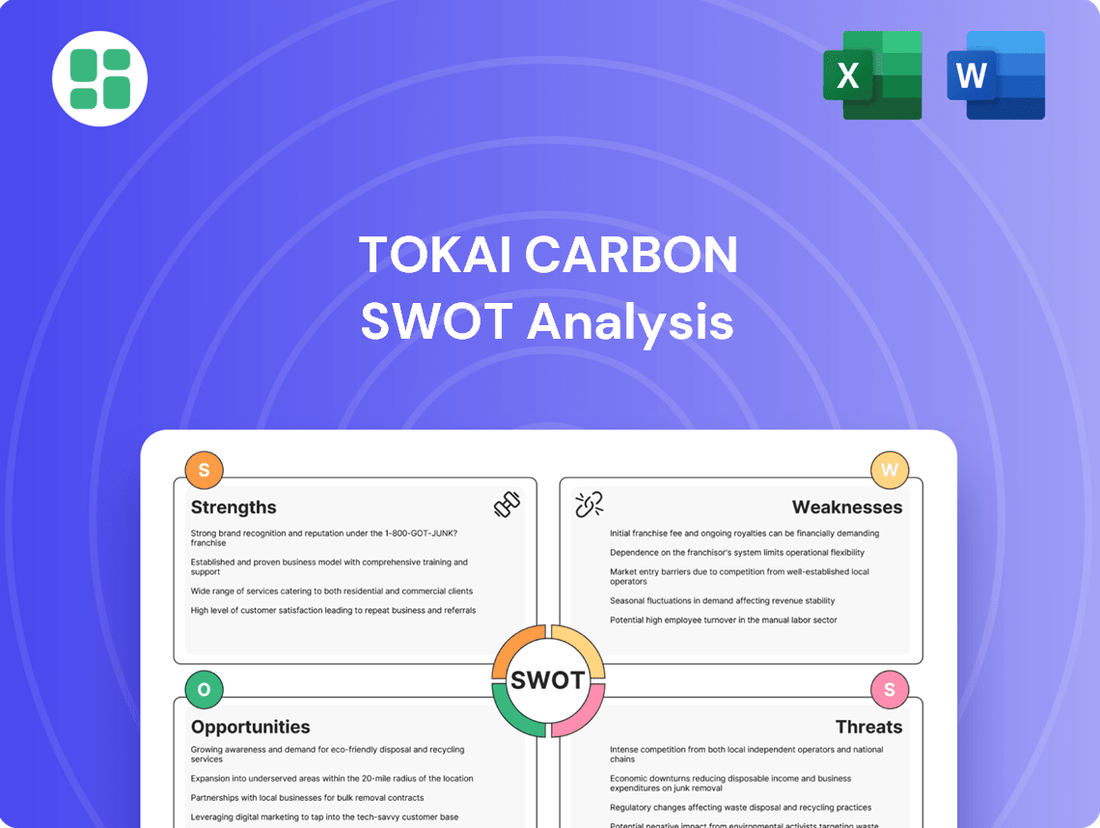

Tokai Carbon SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tokai Carbon Bundle

Tokai Carbon's strengths lie in its established position in critical industries like automotive and semiconductors, but understanding its vulnerabilities and the competitive landscape is crucial for strategic advantage.

Our comprehensive SWOT analysis delves into these areas, revealing potential threats and untapped opportunities that could significantly impact your investment or business strategy.

Want the full story behind Tokai Carbon's market position and future trajectory? Purchase the complete SWOT analysis to gain access to actionable insights and a professionally written, fully editable report designed to support your planning and decision-making.

Strengths

Tokai Carbon stands as a formidable global leader in the manufacturing of carbon and graphite products, a position solidified by its extensive and diversified portfolio. This broad product offering, encompassing vital materials like carbon black, graphite electrodes, fine carbon, and friction materials, ensures robust and varied revenue streams.

This diversification is a key strength, significantly reducing the company's vulnerability to downturns in any single market segment. For instance, its significant presence in the graphite electrode market, essential for steel production, is complemented by its carbon black division, crucial for tire manufacturing and other industrial applications.

As of the first half of fiscal year 2024, Tokai Carbon reported net sales of ¥179.1 billion, showcasing the scale of its operations. The company's ability to serve a wide spectrum of industrial demands, from automotive to electronics, underscores its resilience and strategic market positioning.

Tokai Carbon's position as a critical component supplier to essential sectors like steel, automotive, and semiconductors is a significant strength. These industries rely heavily on the company's high-quality carbon and graphite materials, creating a stable and consistent demand. For instance, the semiconductor industry's growth, projected to reach over $1 trillion by 2030, directly fuels demand for Tokai Carbon's specialized graphite products used in wafer manufacturing.

Tokai Carbon's strength lies in its deep specialization in high-performance materials, particularly advanced graphite products. This focus allows the company to cater to demanding sectors like semiconductors and aerospace, where precision and quality are paramount.

This specialization translates into a competitive edge, as these high-value materials often command higher profit margins and face less intense competition than more commoditized offerings. For instance, the global market for advanced graphite materials, crucial for electric vehicle batteries and semiconductor manufacturing, is projected to grow significantly, reaching an estimated $25.8 billion by 2028, according to some market analyses.

Strategic Investments and Expansion

Tokai Carbon is actively pursuing growth through strategic investments, notably establishing a new manufacturing facility in Thailand, slated for operation by mid-2025. This expansion is designed to boost production capacity and strengthen its global supply chain, crucial for sustained market presence.

The company's forward-looking strategy includes significant investment in research and development, focusing on advanced materials like high-function carbon black and components for the semiconductor industry. This R&D push is key to capturing emerging market opportunities and maintaining a competitive edge.

Key investment highlights include:

- Thailand Facility: Expected to commence operations by mid-2025, increasing global production capacity.

- R&D Focus: Allocating resources to high-function carbon black and semiconductor materials.

- Market Penetration: Investments are strategically targeted to enhance global reach and market share.

Commitment to Sustainability and Operational Efficiency

Tokai Carbon demonstrates a strong commitment to sustainability and operational efficiency, actively pursuing initiatives to minimize its environmental footprint and enhance production processes. This focus aligns with growing global demand for eco-friendly manufacturing, potentially unlocking cost savings through improved energy usage and waste management. For instance, the company has publicly stated goals for reducing greenhouse gas emissions, integrating sustainable practices across its operations to meet these targets.

This dedication is reflected in tangible actions:

- Greenhouse Gas Emission Reduction: Tokai Carbon is actively working towards defined targets for lowering its greenhouse gas emissions, a key indicator of its sustainability efforts.

- Energy Efficiency Improvements: The company is investing in technologies and processes to boost energy efficiency, aiming to reduce consumption and associated costs.

- Waste Recycling and Resource Management: Initiatives are in place to enhance waste recycling and optimize resource utilization, contributing to a more circular economy model within its operations.

Tokai Carbon's diverse product range, including carbon black, graphite electrodes, and fine carbon, provides stability by reducing reliance on any single market. This breadth allows the company to serve critical industries like automotive and steel. As of the first half of fiscal year 2024, net sales reached ¥179.1 billion, demonstrating the scale of its diversified operations and its ability to meet varied industrial demands.

What is included in the product

Delivers a strategic overview of Tokai Carbon’s internal and external business factors, highlighting its strengths in graphite electrodes and carbon black, while also considering market competition and raw material price volatility.

Streamlines identifying and leveraging Tokai Carbon's competitive advantages by clearly outlining strengths and opportunities.

Weaknesses

Tokai Carbon's significant reliance on the graphite electrode market, a key component for electric arc furnace (EAF) steel production, presents a notable weakness. A sluggish global steel market, exacerbated by overcapacity and fluctuating demand, directly impacts the sales and profitability of this crucial segment. For instance, in 2023, the global steel production saw a slight decline, impacting demand for electrodes.

This dependence makes Tokai Carbon vulnerable to the cyclical nature of the steel industry. When steel demand weakens, so does the demand for graphite electrodes, leading to potential oversupply and price pressures. The company has responded by reducing graphite electrode production capacity in Japan and Europe, a clear signal of the market's challenging conditions.

Tokai Carbon's profitability is significantly tied to raw material costs. For instance, petroleum coke is a key input for graphite electrodes, and crude oil impacts carbon black prices. When these material prices swing unpredictably, it can squeeze profit margins if the company can't quickly pass those higher costs onto its customers.

This sensitivity means that even small, unexpected jumps in raw material prices can directly affect Tokai Carbon's bottom line. For example, if crude oil prices surge unexpectedly in late 2024 or early 2025, the cost of carbon black production would rise, potentially impacting the company's earnings if they are unable to adjust pricing promptly.

Tokai Carbon is grappling with significantly heightened competition, especially in the crucial graphite electrode sector. Intense pressure from lower-cost offerings, particularly from manufacturers in China and India, is a major concern. This influx of competitively priced products directly impacts Tokai Carbon's ability to maintain its pricing power and market share.

The consequence of this competitive landscape is a downward trend in sales prices, which in turn squeezes profit margins. To counter this, the company has been compelled to implement structural reforms and make necessary capacity adjustments. For instance, in 2023, the company’s graphite electrode segment saw revenue decline, reflecting these market pressures.

Significant Investments Weighing on Short-Term Earnings

Tokai Carbon's strategic expansion, while vital for future growth, presents a short-term earnings challenge. The simultaneous operation of new facilities, like the carbon black plant in Thailand, alongside existing ones is projected to impact profitability until late 2026. This phased ramp-up means initial operational costs are incurred before full production capacity is achieved.

Furthermore, substantial investments in environmental upgrades are also contributing to increased expenses. These necessary capital outlays for sustainability and regulatory compliance, while beneficial long-term, add to the immediate cost burden. This dual pressure from new facility integration and environmental investments is a key weakness affecting near-term financial performance.

- New Facility Costs: Operational expenses for new plants, such as the Thailand carbon black facility, will likely depress earnings until late 2026 as they reach full efficiency.

- Environmental Investment Burden: Significant capital expenditure on environmental facilities increases operational costs, impacting short-term profitability.

- Phased Returns: The parallel operation of new and existing sites creates a period of higher combined costs before the benefits of scale from new investments fully materialize.

Net Loss and Declining Operating Income in Recent Periods

Tokai Carbon experienced a net loss of ¥15.8 billion for the fiscal year ending December 31, 2024. This was accompanied by a substantial drop in operating income, which fell to ¥5.2 billion. These financial results were primarily impacted by a slowdown in the steel industry and downward pressure on sales prices for its products.

While the Fine Carbon segment demonstrated some stability, the company's overall financial performance in 2024 highlights a difficult period. This trend raises questions about immediate profitability and underscores the critical need for effective implementation of its strategic initiatives to foster a recovery.

- Net Loss: ¥15.8 billion for FY2024.

- Operating Income Decline: Fell to ¥5.2 billion in FY2024.

- Key Factors: Sluggish steel market and reduced sales prices.

Tokai Carbon's financial performance in 2024 was challenging, marked by a net loss of ¥15.8 billion and a significant drop in operating income to ¥5.2 billion. This downturn was largely attributed to a slowdown in the steel industry and increased price competition, which pressured sales prices across its product lines.

| Financial Metric | FY2024 (¥ billion) | Impact |

| Net Loss | 15.8 | Reflects overall profitability challenges. |

| Operating Income | 5.2 | Indicates reduced operational profitability. |

| Key Drivers | Steel industry slowdown, price pressure | Directly impacted revenue and margins. |

Full Version Awaits

Tokai Carbon SWOT Analysis

This is the actual Tokai Carbon SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality insights into their Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Tokai Carbon's strategic positioning.

This is a real excerpt from the complete Tokai Carbon SWOT analysis. Once purchased, you’ll receive the full, editable version to leverage for your strategic planning.

Opportunities

The semiconductor industry's robust growth, especially in memory chips, is a major plus for Tokai Carbon. This translates directly to increased demand for their specialized Fine Carbon products, like solid SiC focus rings, which are crucial components in semiconductor manufacturing processes. The global semiconductor market is projected to reach over $700 billion in 2024, with memory segments showing particularly strong expansion.

Tokai Carbon is actively positioning itself to seize this opportunity. By investing in advanced technology and strengthening its worldwide supply chain for high-purity and solid SiC materials, the company aims to meet the escalating needs of chipmakers. This strategic focus is expected to drive significant revenue growth for their Fine Carbon division in the coming years.

The electric vehicle (EV) market is experiencing robust expansion, with global EV sales projected to reach 14 million units in 2024, a significant increase from previous years. This surge directly fuels the demand for graphite electrodes, a critical component in the manufacturing of lithium-ion batteries powering these vehicles. Tokai Carbon is well-positioned to capitalize on this trend.

Furthermore, the automotive industry's focus on improving EV efficiency and extending battery range is driving the adoption of advanced materials. Tokai Carbon's expertise in carbon and graphite products, including carbon fibers, offers opportunities for expanded applications in lightweighting and performance enhancement within the evolving EV landscape.

The increasing demand for sustainable carbon black, particularly from renewable feedstocks, presents a significant opportunity for Tokai Carbon. This trend allows the company to enhance its product differentiation and demonstrably lower its environmental footprint, appealing to a growing segment of environmentally conscious customers.

The automotive sector, a key market for carbon black, is actively transitioning towards greener production methods and materials. This industry-wide shift creates a clear pathway for Tokai Carbon to broaden its product portfolio, developing and marketing solutions that directly align with global sustainability objectives and the evolving needs of its automotive clients.

Strategic Partnerships and Market Diversification

Tokai Carbon's pursuit of strategic alliances and global expansion, particularly in burgeoning markets such as Vietnam and India, presents significant opportunities for new growth. By the end of fiscal year 2024, the company's international sales accounted for a substantial portion of its revenue, highlighting the importance of these markets.

Diversifying its customer base across various end-use sectors, including semiconductors, automotive, and renewable energy, is another key strategy. This diversification, coupled with the exploration of novel applications for its high-performance carbon materials, is projected to reduce dependency on historically dominant industries. For instance, in 2024, Tokai Carbon announced a new joint venture focused on advanced graphite materials for electric vehicle batteries, a sector experiencing rapid expansion.

- Forging strategic partnerships in emerging economies like Vietnam and India can tap into new customer bases and production capabilities.

- Expanding into high-growth sectors such as electric vehicles and renewable energy diversifies revenue streams and reduces reliance on traditional markets.

- Developing new applications for advanced carbon materials can open up previously untapped market segments.

- In 2023, Tokai Carbon's investment in a new production facility in Southeast Asia underscored its commitment to international diversification and market penetration.

Innovation in Advanced Carbon Materials

Tokai Carbon's commitment to ongoing research and development in advanced carbon materials, including high-function carbon black and specialty graphite, presents a significant opportunity. This focus allows for the creation of new products tailored to emerging industry demands.

Innovations in these areas are particularly crucial for high-tech sectors, enabling Tokai Carbon to solidify its competitive advantage. By developing materials that meet stringent performance requirements, the company can access and capture premium market segments.

- New Product Development: Advancements in specialty graphite for semiconductor manufacturing offer avenues for new product lines.

- Market Penetration: High-function carbon black for electric vehicle batteries can open doors to the rapidly expanding EV market.

- Competitive Edge: Investment in R&D for materials like graphene composites could position Tokai Carbon as a leader in next-generation applications.

Tokai Carbon can capitalize on the booming semiconductor industry, especially memory chips, which are driving demand for their specialized Fine Carbon products like SiC focus rings. The global semiconductor market is expected to exceed $700 billion in 2024, with memory segments showing particularly strong growth.

The expanding electric vehicle market, projected to reach 14 million unit sales globally in 2024, fuels demand for graphite electrodes used in lithium-ion batteries, a key area for Tokai Carbon. Furthermore, the company can leverage its expertise in carbon fibers for lightweighting applications in the evolving automotive sector.

There's a growing demand for sustainable carbon black, particularly from renewable sources, offering Tokai Carbon a chance to differentiate its products and appeal to environmentally conscious consumers. The automotive industry's shift towards greener materials also presents an opportunity for Tokai Carbon to expand its product offerings.

Strategic expansion into emerging markets like Vietnam and India, coupled with diversification across sectors such as renewable energy, can reduce reliance on traditional markets and open new growth avenues. Tokai Carbon's investment in a new production facility in Southeast Asia in 2023 highlights this commitment to international growth.

Threats

Global economic uncertainties and geopolitical tensions pose a significant threat, potentially dampening demand in crucial industries such as steel and automotive, which directly impacts Tokai Carbon's revenue and profit margins.

For example, a slowdown in steel production, a key market for Tokai Carbon's graphite electrodes, has already been observed, demonstrating the company's susceptibility to wider economic downturns. This vulnerability was evident in recent financial reports where a dip in graphite electrode sales contributed to overall performance challenges.

The global market for carbon and graphite products is highly competitive, with significant pressure from lower-cost producers, especially those based in China. This intense rivalry can lead to sustained pricing challenges, impacting Tokai Carbon's profit margins.

This competitive landscape necessitates ongoing efforts in cost optimization and product innovation for Tokai Carbon to defend its market share and profitability. For instance, in 2023, the graphite electrode market experienced significant price volatility due to oversupply and fluctuating demand from the steel industry, a key consumer.

Disruptions in the supply chain for essential raw materials like needle coke, crucial for graphite electrodes, or crude oil, the base for carbon black, present a significant threat. These disruptions can force production slowdowns or even complete halts, directly impacting Tokai Carbon's output and ability to meet demand.

Furthermore, global geopolitical tensions and evolving trade policies, such as tariffs imposed on graphite products, can severely affect the availability and price of these key inputs. This volatility creates substantial risks for operational consistency and can erode profitability by driving up manufacturing costs unexpectedly.

Stringent Environmental Regulations and Compliance Costs

Tokai Carbon faces a significant threat from increasingly stringent environmental regulations worldwide, especially concerning emissions and waste management in carbon-heavy sectors. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), which began its transitional phase in October 2023, could increase compliance costs for carbon-intensive imports, potentially affecting Tokai Carbon's export markets if not adequately addressed.

Adhering to these evolving environmental standards necessitates substantial capital outlays for upgrading facilities and modifying production processes. These investments, while crucial for sustainability, can lead to elevated operational expenses. For example, companies in the industrial sector have reported that compliance with new environmental laws can add 5-10% to their capital expenditure budgets annually, impacting overall cost competitiveness.

- Increased Capital Expenditure: Significant investments are required to meet stricter emission and waste management standards.

- Higher Operational Costs: Compliance measures can lead to increased production expenses, potentially affecting profit margins.

- Competitive Disadvantage: Higher costs due to regulation may make it harder to compete with less regulated or more efficient producers.

Technological Disruption by Alternative Materials

The rise of alternative materials and novel manufacturing techniques poses a significant long-term risk to Tokai Carbon. These innovations could potentially replace traditional carbon and graphite products, or offer enhanced performance at a reduced price point.

While Tokai Carbon actively engages in research and development, the pace of technological progress by rivals or within other sectors could quickly render its established products obsolete. This necessitates continuous innovation and strategic adaptation to stay competitive.

- Emerging Materials: Advances in areas like advanced ceramics, composites, or novel metal alloys could offer performance benefits that challenge carbon-based products in key applications.

- Cost Competitiveness: Competitors developing more efficient production methods for alternative materials could undercut Tokai Carbon's pricing, impacting market share. For instance, breakthroughs in additive manufacturing for complex geometries could reduce the need for traditional graphite tooling.

- R&D Investment Gap: While Tokai Carbon's R&D spending was approximately ¥10.5 billion in fiscal year 2023, a sudden leap in a competing material's technology, backed by substantial investment from another industry player, could create a disadvantage.

Intensifying global competition, particularly from lower-cost Chinese producers, presents a persistent threat, pressuring Tokai Carbon's pricing power and profit margins, as seen in the volatile graphite electrode market of 2023.

Supply chain vulnerabilities for critical raw materials like needle coke, coupled with geopolitical instability and trade policy shifts, can disrupt production and escalate manufacturing costs, impacting operational consistency and profitability.

Increasingly stringent environmental regulations worldwide, such as the EU's CBAM which began its transitional phase in October 2023, necessitate significant capital expenditure and could elevate operational costs, potentially creating a competitive disadvantage.

The emergence of alternative materials and advanced manufacturing techniques poses a long-term risk, potentially rendering Tokai Carbon's established products obsolete if the company cannot keep pace with technological advancements and competitor R&D investments.

SWOT Analysis Data Sources

This Tokai Carbon SWOT analysis is built upon a foundation of credible data, drawing from official financial statements, comprehensive market research reports, and expert industry commentary to provide accurate and actionable insights.