Tokai Carbon Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tokai Carbon Bundle

Curious about Tokai Carbon's strategic product positioning? This glimpse into their BCG Matrix reveals where their offerings might be thriving, stagnating, or demanding attention. Understanding these dynamics is crucial for any investor or strategist looking to navigate the competitive landscape.

To truly unlock the potential of this analysis, delve into the full Tokai Carbon BCG Matrix. Gain a comprehensive view of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights and data-driven recommendations to guide your next strategic move.

Don't just see the surface; own the strategy. Purchase the complete BCG Matrix report for Tokai Carbon and equip yourself with the detailed quadrant placements and expert advice needed to make informed investment and product development decisions.

Stars

Tokai Carbon's Fine Carbon segment, particularly its offerings for the semiconductor industry, is a significant growth engine. The company reported increased net sales in this area, driven by a rebound in demand for memory semiconductors. This performance reflects the segment's strong market position and the increasing importance of high-purity carbon materials in advanced electronics.

Recognizing the substantial growth prospects in semiconductors and the burgeoning AI market, Tokai Carbon is strategically investing in expanding its production capacity for fine carbon products. This proactive approach aims to capture market share and solidify its leadership in supplying critical materials for next-generation technologies. For instance, in 2023, the company continued to invest in enhancing its graphite electrode production, which has applications in semiconductor manufacturing processes.

Tokai Carbon's polycrystalline SiC wafers for EVs are a clear Star. Their established expertise in silicon carbide is a major advantage. The EV market's rapid expansion, with demand for SiC power semiconductors expected to surge, provides a strong growth trajectory for this segment.

The company's strategic collaboration with Soitec, announced in April 2024, further strengthens its foothold in this burgeoning sector. This partnership is expected to accelerate the development and deployment of advanced SiC wafer technologies crucial for next-generation EV power electronics.

Tokai Carbon's high-performance specialty graphite is a prime example of a Star in the BCG matrix. These advanced materials are essential for cutting-edge sectors such as aerospace and high-temperature industrial processes, demonstrating a strong position in rapidly expanding, specialized markets. The company's commitment to ongoing research and development in these areas is vital for sustaining its market dominance and technological leadership.

Advanced Carbon Materials for Battery Applications

Tokai Carbon's strategic investment in advanced carbon materials for battery applications signals a strong potential Star in their BCG matrix. This focus aligns with the booming electric vehicle market, where demand for superior battery components is soaring.

The company's commitment to research and development in this area is a key driver. For instance, in 2024, Tokai Carbon allocated a significant portion of its R&D budget towards developing next-generation anode and cathode materials, aiming to enhance battery energy density and lifespan.

- Market Growth: The global electric vehicle market is projected to reach over $1.5 trillion by 2030, indicating a substantial growth trajectory for battery materials.

- Tokai Carbon's Ambition: The company aims to capture a significant share of the renewable energy sector market within the next three years, underscoring its aggressive growth strategy.

- Technological Advancement: Innovations in graphite and other carbon allotropes are crucial for improving battery performance, a key area of Tokai Carbon's R&D focus.

- Competitive Landscape: While competitive, the rapid expansion of the EV sector creates ample opportunity for market leaders in advanced carbon materials.

Strategic Acquisitions in Fine Carbon Market

The fine carbon market is experiencing significant consolidation, with strategic acquisitions playing a key role in shaping its future. These moves are particularly important for companies looking to establish or expand their presence in high-growth segments.

In December 2024, a notable example of this trend was the consolidation of U.S.-based graphite processing companies, KBR, Inc. and MWI. This strategic combination was designed to bolster their Fine Carbon business within the United States, a market showing robust expansion.

These types of acquisitions are crucial for companies like Tokai Carbon, as they represent a direct investment in rapidly developing sectors. By integrating operations and expanding capabilities through such moves, businesses can secure a more substantial footprint in pivotal markets.

The U.S. fine carbon market, especially its applications in semiconductors and aerospace, is a prime example of a high-growth area. Strategic acquisitions here are characteristic of a Star in the BCG matrix, indicating a business unit with high market share in a high-growth industry. This inorganic growth strategy aims to capture a larger portion of this expanding market.

- Market Growth: The U.S. fine carbon market is projected to grow significantly, driven by demand in advanced technologies.

- Strategic Importance: Acquisitions in this sector enhance market share and competitive positioning.

- Application Focus: Key growth drivers include semiconductor manufacturing and aerospace components.

- Inorganic Growth: Consolidation through M&A is a primary strategy for capturing market opportunities.

Tokai Carbon's polycrystalline SiC wafers for EVs and its high-performance specialty graphite are clear Stars. These segments operate in high-growth markets with strong demand, positioning them for continued success. The company's investments and strategic partnerships in these areas underscore their Star status, indicating significant future potential.

What is included in the product

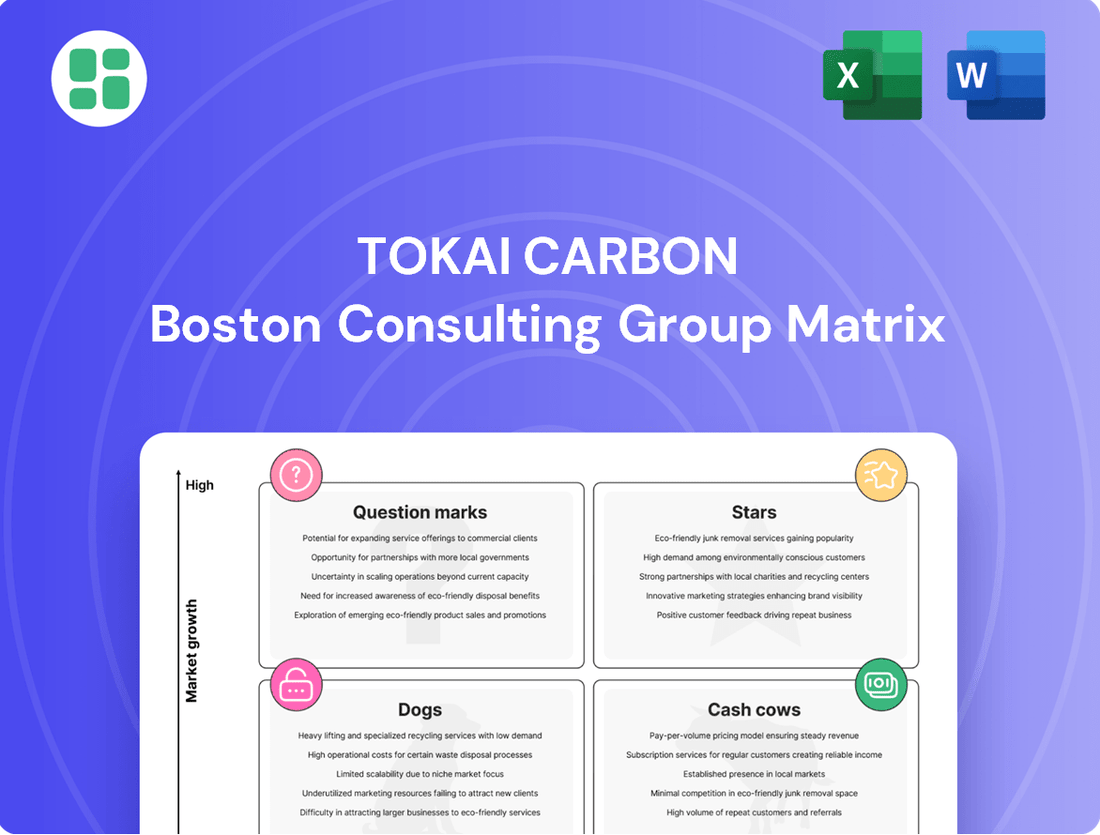

Tokai Carbon's BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, and Dogs to guide investment and resource allocation.

The Tokai Carbon BCG Matrix offers a clear, one-page overview placing each business unit in a quadrant, simplifying complex portfolio analysis.

Cash Cows

Tokai Carbon's Carbon Black segment, crucial for tire production, demonstrated strong performance in 2024. Despite broader industry headwinds, this division saw net sales rise and operating profit increase compared to the previous year.

The tire manufacturing industry, a primary consumer of carbon black, is projected for consistent annual growth of approximately 3%. This steady demand underpins the resilience of Tokai Carbon's carbon black business.

As a leading player in the carbon black market, this segment consistently generates substantial cash flow. Its stable demand characteristics firmly place it in the Cash Cow quadrant of the BCG matrix.

Tokai Carbon's Graphite Electrodes segment, despite a challenging 2024 marked by reduced sales and profits due to a slow steel market and fierce competition, is being strategically managed as a Cash Cow. The company is implementing significant structural reforms, including capacity cuts and facility consolidation, to bolster its earnings.

These initiatives are designed to enhance operational efficiency and ensure a consistent supply within this mature industry, positioning the optimized graphite electrode business for stable returns post-restructuring. For instance, in 2024, the company aimed to streamline its electrode production, a critical step in maintaining profitability in a market where global demand for steel, and consequently graphite electrodes, experienced fluctuations.

Tokai Carbon's friction materials for the automotive sector are a prime example of a Cash Cow. This segment benefits from a mature market where demand for essential components like brake pads and clutch facings remains consistent.

The global market for automotive dry friction materials is projected to reach $15 billion by 2025, with a steady compound annual growth rate of 6% expected through 2033. This stable growth trajectory means Tokai Carbon's offerings in this area generate reliable revenue streams.

Given its established position, these friction materials likely require minimal additional investment for market expansion or aggressive promotion. The consistent cash flow generated, coupled with low reinvestment needs, firmly places this business unit within the Cash Cow quadrant of the BCG matrix.

Existing Industrial Furnaces and Related Products

The Industrial Furnaces and Related Products segment, alongside Fine Carbon, is a key area for Tokai Carbon to capitalize on medium- to long-term growth. This involves boosting production capacity and exploring new markets.

While new market development might position some aspects as 'Question Marks', the established industrial furnace product lines are likely a stable revenue generator within a mature sector. These established products act as Cash Cows for the company.

- Cash Cows: The existing industrial furnace product lines provide a reliable and consistent income stream.

- Revenue Generation: This segment generates stable profits that can be reinvested into other business areas, such as the 'Question Mark' opportunities in new markets.

- Market Position: Tokai Carbon's established presence in the industrial furnace sector suggests a strong market share, contributing to its Cash Cow status.

- Financial Contribution: In 2024, segments like this are crucial for funding research and development and expansion efforts.

Established Fine Carbon Products (Non-Semiconductor)

Tokai Carbon's established fine carbon products, excluding semiconductor applications, likely represent a Cash Cow within its BCG matrix. These include isotropic graphite and C/C composites utilized in general industrial sectors, heat treatment processes, and mold manufacturing.

The consistent demand for these products stems from their critical function across diverse industries. Tokai Carbon's extensive history and established market position ensure stable revenue generation from this segment.

For instance, in 2024, the demand for graphite electrodes, a key component in steel production, remained robust, directly benefiting Tokai Carbon's non-semiconductor fine carbon business. The company’s ability to deliver high-quality, reliable materials for these foundational industries underpins its Cash Cow status.

- Stable Revenue Streams: Non-semiconductor fine carbon products contribute consistent and predictable income.

- Mature Market Presence: Tokai Carbon leverages its long-standing expertise and market share in these established sectors.

- Broad Industrial Application: Isotropic graphite and C/C composites serve a wide array of general industrial needs.

- Critical Role in Manufacturing: These materials are essential for processes like heat treatment and mold production, ensuring ongoing demand.

Tokai Carbon's Carbon Black and Friction Materials segments are clear Cash Cows. These divisions benefit from consistent demand in mature markets, generating substantial and reliable cash flow with minimal need for reinvestment. For example, the carbon black business, vital for the automotive industry, saw its net sales increase in 2024, reflecting its stable revenue-generating capabilities.

The company's friction materials for the automotive sector also exemplify a Cash Cow. With the global market for automotive dry friction materials projected to reach $15 billion by 2025 and a steady 6% annual growth rate through 2033, this segment provides predictable income streams. These established product lines require limited capital expenditure for growth, allowing Tokai Carbon to allocate profits to other strategic areas.

Tokai Carbon's non-semiconductor fine carbon products, including isotropic graphite and C/C composites, also operate as Cash Cows. These materials are essential for general industrial applications like heat treatment and mold manufacturing, ensuring consistent demand. The company's strong market position and established expertise in these areas contribute to their reliable revenue generation, as seen with the robust demand for graphite electrodes in 2024 supporting this business.

The Industrial Furnaces segment, particularly its established product lines, functions as a Cash Cow by providing stable profits. These earnings are crucial for funding research and development and expansion efforts in other business areas, such as new market exploration.

| Business Segment | BCG Matrix Quadrant | Key Characteristics | 2024 Performance Indication |

|---|---|---|---|

| Carbon Black | Cash Cow | High market share, stable demand, low reinvestment needs | Increased net sales and operating profit |

| Friction Materials (Automotive) | Cash Cow | Mature market, consistent demand, predictable revenue | Steady income generation supported by market growth projections |

| Fine Carbon (Non-Semiconductor) | Cash Cow | Essential industrial applications, established market presence | Robust demand benefiting from related industries |

| Industrial Furnaces (Established Products) | Cash Cow | Stable revenue, mature sector, funding for growth areas | Reliable profit generation |

What You’re Viewing Is Included

Tokai Carbon BCG Matrix

The preview you are seeing is the exact, unwatermarked Tokai Carbon BCG Matrix report you will receive immediately after your purchase. This comprehensive document is fully formatted and ready for immediate strategic application, offering a clear and actionable analysis of Tokai Carbon's product portfolio.

Dogs

Tokai Carbon's Smelting and Lining business is firmly positioned in the 'Dog' quadrant of the BCG matrix. This segment saw its profitability significantly diminish, resulting in substantial impairment losses recorded for the fiscal year ending December 31, 2024.

The challenges faced by this business are rooted in a weak steel market and decreased demand for key products, such as aluminum smelting cathodes. These factors point to a market characterized by low growth and poor profitability, making it a prime candidate for strategic restructuring or divestment.

Before restructuring, some Tokai Carbon graphite electrode plants, like the Shiga Plant in Japan and facilities in Europe, were struggling. This underperformance stemmed from a combination of decreased demand, fierce competition, and escalating energy expenses.

The company’s move to consolidate production and the temporary closure of the Shiga Plant by July 2025 highlights that these particular operations held a small market share and generated low profits within a difficult market environment.

These specific, underperforming assets within the Graphite Electrode business are indicative of the challenges Tokai Carbon is actively working to resolve through its strategic restructuring efforts.

Tokai Carbon's legacy products, particularly those catering to industries experiencing a downturn or facing intense commoditization, represent potential 'Dogs' in their BCG matrix. For instance, certain graphite electrodes or carbon black grades used in older automotive technologies or traditional manufacturing processes might fall into this category. These products likely face shrinking market share and minimal growth opportunities.

While specific segment data for 2024 is still emerging, Tokai Carbon's overall financial reports often highlight challenges in mature markets. For example, in the fiscal year ending March 2024, the company noted that while overall sales increased, certain segments faced pressure due to global economic slowdowns and increased competition, hinting at the presence of products with declining demand.

Divested Entities (e.g., TOKAI ERFTCARBON GmbH non-GE business)

Tokai Carbon's strategic portfolio management has included divesting non-core assets. For instance, the sale of TOKAI ERFTCARBON GmbH, previously involved in the graphite electrode sector, to Lenbach Equity Opportunities III exemplifies this approach. Such divestitures are typically undertaken for businesses that exhibit low market share or limited growth potential, aligning with the principles of portfolio optimization.

The divestment of entities like TOKAI ERFTCARBON GmbH, if parts of it were indeed sold off due to underperformance, would place them in the Dogs category of the BCG Matrix. This classification signifies businesses with low relative market share in a slow-growing industry. Tokai Carbon's ongoing efforts to refine its business portfolio aim to enhance overall profitability and focus resources on more promising segments.

- Divestment Rationale: Businesses with low market share and poor growth prospects are prime candidates for divestment to streamline operations.

- BCG Matrix Placement: Such divested entities would historically be classified as Dogs, indicating low growth and low market share.

- Portfolio Optimization: Tokai Carbon's strategy involves actively managing its portfolio, including the sale of non-essential or underperforming business units.

- Financial Impact: Divestitures can free up capital and management attention, allowing for reinvestment in higher-potential business areas.

Products with High CO2 Emissions without Carbon Neutrality Path

Tokai Carbon's commitment to carbon neutrality by 2030 and 2050 means that product lines with high CO2 emissions and no clear reduction strategy could become problematic. These products, lacking an economically viable path to decarbonization, risk becoming cash traps in a market prioritizing environmental responsibility. For instance, without significant investment in cleaner production methods, certain graphite electrode manufacturing processes, which are energy-intensive, could fall into this category. In 2023, the industrial sector globally accounted for approximately 24% of total greenhouse gas emissions, highlighting the pressure on heavy industries like carbon product manufacturing to adapt.

Products that are heavily carbon-intensive and do not have a defined strategy for reducing their CO2 footprint could be considered Tokai Carbon's "cash traps" within the BCG matrix framework. This is particularly true as regulatory pressures and consumer demand for sustainable products increase. For example, if a specific type of carbon black production process remains highly emissive and lacks a feasible technological upgrade, it could face future market challenges. Companies are increasingly scrutinizing their supply chains for carbon intensity, and products that cannot demonstrate a clear decarbonization roadmap may see reduced market share or increased operational costs due to carbon pricing mechanisms, which were projected to cover around 23% of global emissions by 2025.

Without a clear and economically sound plan to significantly reduce CO2 emissions, high-emission products could become liabilities for Tokai Carbon. This situation would be exacerbated by a growing market preference for environmentally friendly goods and stricter government regulations. For example, if a particular refractory material production method is inherently carbon-intensive and a cost-effective alternative is not available or developed, it could become a cash trap. Such products might face declining sales or incur higher operational expenses due to carbon taxes, impacting overall profitability. The global average carbon price was approximately $5.75 per tonne of CO2 in 2021, a figure expected to rise as climate policies strengthen.

- High CO2 Emission Products: These are manufacturing outputs or processes that inherently release significant amounts of carbon dioxide.

- Lack of Carbon Neutrality Path: The absence of a concrete, economically feasible strategy to reduce or offset these emissions.

- Cash Trap Potential: Such products may consume resources without generating sufficient future returns due to market shifts and regulatory costs.

- Market and Regulatory Risks: Increasing environmental consciousness and stricter climate policies can lead to declining demand and increased operational expenses for non-compliant products.

Tokai Carbon's Smelting and Lining business, particularly segments like aluminum smelting cathodes, operates in a low-growth, low-profitability market. This positioning, coupled with challenges in the steel market, places it squarely in the 'Dog' category of the BCG matrix. The company recognized substantial impairment losses for this segment in the fiscal year ending December 31, 2024, underscoring its underperformance.

The strategic consolidation and temporary closure of certain graphite electrode plants, such as the Shiga Plant by July 2025, reflect an effort to address these 'Dog' assets. These operations historically held a small market share and generated minimal profits within a challenging market environment, indicating a need for restructuring or divestment to optimize the company's portfolio.

Tokai Carbon's divestment of non-core or underperforming units, like TOKAI ERFTCARBON GmbH, aligns with managing 'Dog' businesses. These actions are taken to streamline operations and reallocate resources to more promising areas, a common strategy for businesses with low market share in slow-growing industries.

Products with high CO2 emissions and no clear decarbonization strategy risk becoming 'cash traps,' potentially falling into the 'Dog' category as markets prioritize sustainability. With global industries facing pressure to reduce emissions, such as the industrial sector's 24% contribution to greenhouse gases in 2023, these products face significant market and regulatory risks.

Question Marks

Tokai Carbon's recycled carbon black technology, a joint venture initiated in January 2025 with Bridgestone and academic institutions, targets the sustainable recycling of carbon black from used tires. This initiative aligns with growing environmental consciousness, positioning it as a high-growth potential segment.

Despite its promising future, the technology currently holds a minimal market share, reflecting its nascent stage of development and the substantial investments needed for commercialization and market acceptance. This places it firmly in the Question Mark category of the BCG matrix, requiring strategic evaluation and significant resource allocation to potentially move towards a Star.

Tokai Carbon's Fine Carbon business, while a powerhouse in semiconductors, is strategically eyeing new frontiers. The company is actively exploring and developing applications in burgeoning sectors like new energy storage and advanced composites for novel industries. These represent areas where Tokai Carbon currently holds a low market share but sees significant growth potential.

These ventures fall into the "Question Marks" category of the BCG Matrix, signifying high market growth but low relative market share. For instance, the burgeoning solid-state battery market, projected to reach over $100 billion by 2030, presents a prime opportunity for fine carbon's advanced material properties. Such initiatives necessitate considerable investment in research and development, alongside dedicated market development efforts to establish a foothold.

Tokai Carbon's expansion into emerging markets, with over $150 million invested in Vietnam and India during 2024, signifies an initial phase of establishing a presence. This strategic move anticipates a 25% boost in production capacity, but the immediate focus is on building market share in these nascent territories.

The substantial capital outlay in these new manufacturing facilities, while geared for long-term growth, places these operations in the question mark category of the BCG matrix. Significant investment is required to gain traction and solidify market position, a characteristic of this strategic quadrant.

Polycrystalline SiC Wafer Production Ramp-up

Tokai Carbon's recent completion of a new polycrystalline silicon carbide (SiC) wafer production line positions this segment as a potential Star within their business portfolio. However, the current phase of ramping up this new capacity and achieving broad market penetration, especially beyond existing collaborations, places it firmly in the Question Mark category of the BCG matrix. This strategic move necessitates continued financial commitment to capitalize on the projected expansion of the electric vehicle (EV) power semiconductor sector.

The ramp-up phase for new production capacity, particularly for advanced materials like SiC wafers, is inherently capital-intensive. Tokai Carbon's investment in this new line reflects a commitment to a high-growth market, but the immediate challenge lies in translating this capacity into significant market share. Success hinges on effectively navigating the adoption curve for these specialized wafers.

- Market Penetration: Securing widespread adoption of new SiC wafer capacity beyond initial key partnerships is crucial for moving this segment from Question Mark to Star.

- Investment Needs: Continued investment is required to support the production ramp-up and capture the anticipated growth in the EV power semiconductor market.

- Competitive Landscape: The SiC wafer market is competitive, requiring Tokai Carbon to demonstrate technological superiority and cost-effectiveness to gain traction.

- EV Market Growth: The projected growth of the EV market, a key driver for SiC demand, is a significant factor influencing the future success of this segment.

Anode Materials for Advanced Batteries

Tokai Carbon's anode materials segment places it directly within the burgeoning battery market. New or developing anode materials for advanced battery chemistries, such as those for solid-state batteries, would likely fall into the Question Mark category for Tokai Carbon.

These advanced anode materials are positioned in a high-growth sector, driven by the increasing demand for electric vehicles and energy storage solutions. For instance, the global market for lithium-ion battery anode materials was projected to reach approximately $11.5 billion in 2024, with significant growth anticipated.

- High Growth Potential: The market for advanced anode materials is expanding rapidly due to technological advancements in battery energy density and charging speeds.

- Nascent Market Share: Tokai Carbon's presence in new anode material products likely represents a small current market share, necessitating substantial investment.

- Investment Requirements: Significant capital expenditure is required for research, development, and scaling production to compete effectively in this evolving landscape.

- Strategic Importance: Success in this segment could position Tokai Carbon as a key supplier for next-generation battery technologies.

Tokai Carbon's ventures into new, high-growth markets with currently low market penetration, such as recycled carbon black technology and advanced anode materials for next-generation batteries, are prime examples of Question Marks. These segments require substantial investment to develop and scale, aiming to capture future market share.

The company's strategic expansion into emerging markets like Vietnam and India in 2024, involving significant capital outlay for new production facilities, also places these operations in the Question Mark quadrant. The focus is on building initial market presence and capacity, with future success dependent on gaining traction.

Similarly, the polycrystalline silicon carbide (SiC) wafer production line, while targeting the high-growth electric vehicle (EV) power semiconductor sector, is in a ramp-up phase. This necessitates continued financial commitment to translate new capacity into significant market share amidst a competitive landscape.

These Question Mark segments, such as advanced battery materials and SiC wafers, represent Tokai Carbon's strategic bets on future growth drivers. The success of these initiatives hinges on effective market penetration and navigating the inherent investment needs and competitive dynamics of these nascent, high-potential areas.

| Business Segment | Market Growth | Relative Market Share | BCG Category | Strategic Focus |

|---|---|---|---|---|

| Recycled Carbon Black Technology | High | Low | Question Mark | Develop technology, gain market acceptance, secure investment |

| Fine Carbon (New Energy Storage, Advanced Composites) | High | Low | Question Mark | R&D investment, market development, establish foothold |

| Emerging Markets (Vietnam, India) | High (Anticipated) | Low | Question Mark | Build production capacity, establish market presence, gain traction |

| Polycrystalline SiC Wafer Production | High (EV Sector) | Low (Initial Phase) | Question Mark | Ramp up capacity, achieve broad market penetration, secure EV market share |

| Advanced Anode Materials (Battery Market) | High | Low | Question Mark | Invest in R&D, scale production, become key supplier for next-gen batteries |

BCG Matrix Data Sources

Our Tokai Carbon BCG Matrix leverages financial reports, industry growth data, and competitive analysis to accurately position business units.