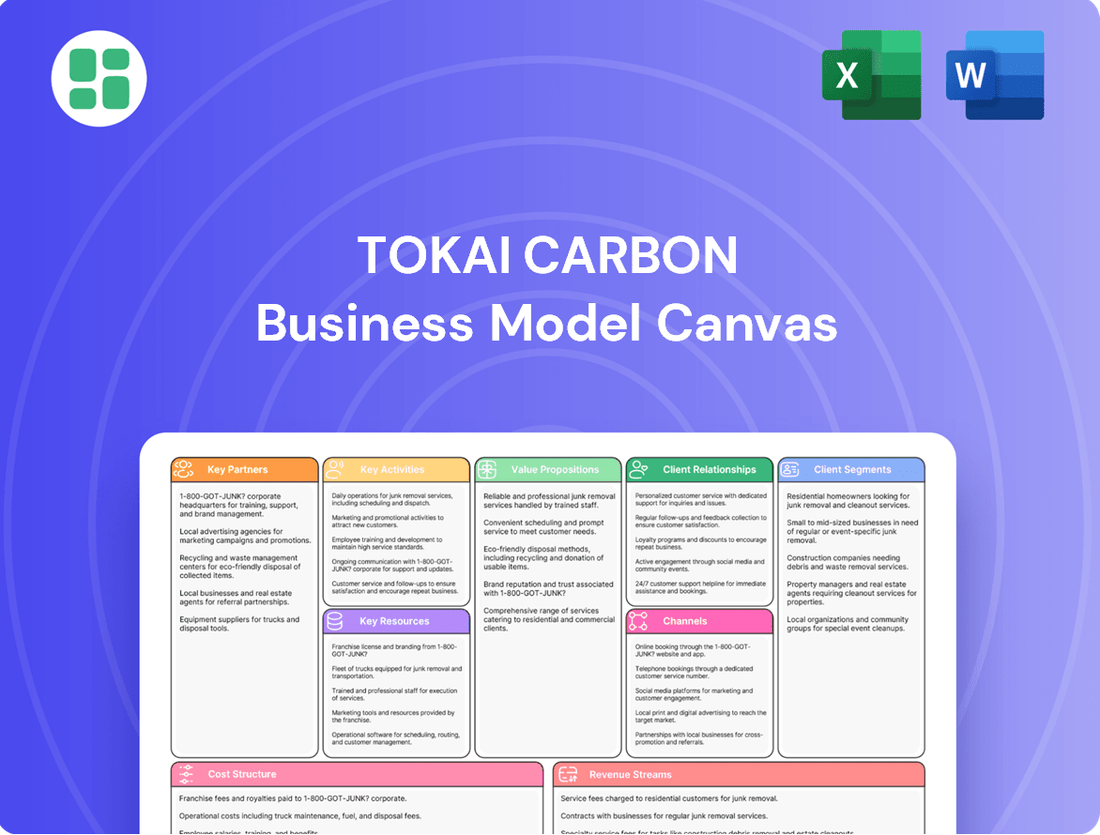

Tokai Carbon Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tokai Carbon Bundle

Unlock the strategic blueprint behind Tokai Carbon's success with our comprehensive Business Model Canvas. This in-depth analysis reveals how they leverage key resources and partnerships to deliver value to diverse customer segments. Discover their core revenue streams and cost drivers to understand their competitive advantage.

Ready to gain a deeper understanding of Tokai Carbon's operational excellence? Our full Business Model Canvas breaks down their value propositions, customer relationships, and channels, offering actionable insights for your own strategic planning. Download the complete, editable file to see how they thrive.

Partnerships

Tokai Carbon actively pursues strategic alliances with cutting-edge technology firms and academic research centers to tap into external knowledge and speed up new product creation. The company is targeting the establishment of at least five new collaborative ventures by the close of 2024.

A significant initiative is the technology development partnership, initiated in January 2025, with Bridgestone Corporation, Kyushu University, and Okayama University. This collaboration focuses on transforming carbon black from used tires into eco-friendly Carbon Black (eCB), directly supporting their Vision 2030 commitment to societal sustainability.

Tokai Carbon prioritizes robust relationships with its petroleum coke and coal tar pitch suppliers, the bedrock of its production continuity. These partnerships are vital for securing the consistent flow of essential raw materials needed for its graphite electrode and carbon black manufacturing.

The company actively works to fortify its supplier network, a strategy that extends beyond mere material acquisition. This includes a keen focus on supply chain sustainability, encompassing environmental responsibility, ethical human rights practices, and rigorous labor safety standards across all supplier operations.

Tokai Carbon actively partners with customers, like Bridgestone, to co-create solutions for evolving market needs, especially in carbon neutrality and recycling. This collaborative approach ensures their offerings align with sustainability goals.

A prime example is their joint project with Bridgestone and universities focused on developing eco-carbon black (eCB). This initiative highlights a dedication to improving resource circulation and advancing recycling technologies within the industry.

Acquisition and Integration Partners

Tokai Carbon strategically expands its reach through key acquisition and integration partners, diversifying its business and mitigating risks associated with over-reliance on single markets. A prime example is the December 2024 consolidation of two U.S.-based graphite processing entities, KBR, Inc. and MWI.

This integration is specifically designed to bolster Tokai Carbon's presence in pivotal and growing sectors, such as the U.S. fine carbon market. By bringing these companies under its umbrella, Tokai Carbon aims to leverage their expertise and market access to drive growth and innovation.

- Acquisition of KBR, Inc. and MWI: Completed in December 2024, this move signifies a significant investment in the U.S. fine carbon sector.

- Market Diversification: The integration aims to reduce dependence on existing business segments by tapping into new and expanding markets.

- Strategic Integration: The focus is on seamless operational and cultural integration to maximize the combined entity's potential and market competitiveness.

- U.S. Fine Carbon Market Focus: This partnership directly addresses the growing demand and opportunities within this specialized segment of the carbon industry.

Global Distribution Network Partners

Tokai Carbon leverages a global distribution network to ensure its specialized carbon products reach diverse markets efficiently. While direct sales are important, partnerships with local distributors and logistics providers are essential for expanding its international footprint and maintaining a robust global supply chain.

These alliances are critical for Tokai Carbon's growth strategy, which saw significant investments in manufacturing facilities in key emerging markets during 2024. For instance, the company continued to bolster its presence in Vietnam and India, underscoring the need for reliable local distribution channels to support these expanded operations.

- Local Distributors: Partnering with established local distributors provides market access and navigates regional complexities, vital for Tokai Carbon's global sales strategy.

- Logistics Providers: Collaborations with specialized logistics firms ensure the safe and timely transport of sensitive carbon materials across international borders.

- Emerging Market Expansion: In 2024, investments in Vietnam and India highlight the strategic importance of these partnerships for reaching new customer bases and optimizing supply chains in growth regions.

Tokai Carbon cultivates vital partnerships with technology firms and research institutions to accelerate innovation and product development, aiming for at least five new collaborations by the end of 2024. Their collaboration with Bridgestone, Kyushu University, and Okayama University, initiated in January 2025, focuses on eco-friendly carbon black production from used tires, aligning with sustainability goals.

Tokai Carbon's strategic acquisitions, such as the December 2024 consolidation of U.S.-based graphite processors KBR, Inc. and MWI, are key to diversifying its business and strengthening its position in the U.S. fine carbon market. These integrations are designed to enhance market access and leverage specialized expertise.

The company also relies on strong relationships with raw material suppliers like petroleum coke and coal tar pitch providers to ensure production continuity, while actively working to enhance supply chain sustainability through ethical and safe practices. Furthermore, partnerships with local distributors and logistics providers are crucial for efficiently reaching global markets and supporting expansion efforts in regions like Vietnam and India, which saw significant investment in 2024.

What is included in the product

Tokai Carbon's business model focuses on providing essential carbon products to diverse industrial sectors, leveraging its established manufacturing capabilities and global distribution network.

This model highlights key customer relationships and revenue streams derived from high-performance graphite electrodes and other carbon materials.

Tokai Carbon's Business Model Canvas offers a clear, structured approach to understanding their operations, acting as a pain point reliever by simplifying complex strategies into an easily digestible, one-page snapshot.

Activities

Tokai Carbon's primary focus is the large-scale production of a wide array of carbon and graphite materials. This includes essential products like carbon black, crucial for tire manufacturing and pigments, and graphite electrodes, vital for the steel industry's electric arc furnaces. Their portfolio also extends to fine carbon, friction materials for automotive applications, and specialized graphite used in electronics and industrial processes.

The company operates a robust global manufacturing network to support its extensive product lines. With key production facilities strategically located in Japan, Thailand, the United States, and Canada, Tokai Carbon ensures a consistent and widespread supply chain to meet international demand. This global presence is fundamental to their ability to serve diverse markets and maintain competitive production capabilities.

In 2023, Tokai Carbon's consolidated net sales reached approximately 376.3 billion Japanese Yen. The graphite electrodes segment, a significant part of their manufacturing activities, contributed substantially to this revenue, reflecting the ongoing demand from the global steel production sector.

Tokai Carbon's core strength lies in its dedicated Research and Development (R&D) of advanced materials. This includes a strong focus on high-performance specialty graphite materials, crucial for cutting-edge technological applications. They are also heavily invested in developing advanced carbon materials specifically for the burgeoning battery market.

In 2024, the company demonstrated its commitment to innovation by investing ¥3 billion, roughly $28 million, in R&D. This significant allocation of resources is strategically aimed at expanding their market share, particularly within the rapidly growing renewable energy sector.

Tokai Carbon manages a complex global supply chain, sourcing raw materials like petroleum coke and needle coke for its graphite electrodes. This involves ensuring a steady flow of high-quality inputs and maintaining robust business continuity plans with key suppliers to prevent disruptions.

In 2024, the company continued its focus on optimizing its graphite electrode operations. This includes structural reforms aimed at enhancing efficiency and better matching production with evolving market demands, particularly from the electric arc furnace steelmaking sector.

Sales, Marketing, and Customer Technical Support

Tokai Carbon's sales and marketing efforts are geared towards engaging a broad spectrum of industries, including critical sectors like steel, automotive, and semiconductors. This requires a multi-faceted approach to reach and resonate with a diverse customer base.

The company prioritizes building strong, trust-based relationships with its clients. This involves understanding their unique challenges and offering tailored solutions that enhance their competitive edge in their respective markets.

Customer technical support is integral to Tokai Carbon's strategy. By providing expert assistance, the company ensures that customers can effectively utilize its products, maximizing performance and achieving their operational goals.

In 2024, Tokai Carbon reported significant sales figures, with its carbon products division demonstrating robust performance, reflecting the strong demand from its key industrial sectors. For instance, the company's graphite electrode sales, crucial for the steel industry, remained a strong contributor to its revenue streams.

- Sales Engagement: Direct sales teams and distribution partners actively engage with customers in the steel, automotive, and semiconductor industries.

- Marketing Focus: Highlighting product innovation, reliability, and cost-effectiveness to build brand recognition and attract new clients.

- Technical Support: Providing on-site and remote technical assistance, product customization, and application development support.

- Customer Relationship Management: Emphasizing long-term partnerships through consistent communication and problem-solving.

Sustainability Initiatives and Environmental Management

Tokai Carbon actively pursues sustainability through various initiatives, focusing on reducing its environmental footprint. Key activities include lowering CO2 emissions, enhancing resource recycling, and adopting energy-efficient technologies across its operations.

The company has established concrete goals to drive its environmental performance. Notably, Tokai Carbon aims for a significant 30% reduction in CO2 emissions by 2030, using 2020 as its baseline year. This ambitious target underscores their commitment to climate action.

- CO2 Emission Reduction: Targeting a 30% decrease by 2030 (vs. 2020 levels).

- Resource Recycling: Implementing programs to maximize material reuse and minimize waste.

- Energy Efficiency: Investing in and deploying advanced, energy-saving systems.

- Environmental Facility Investment: Allocating capital to upgrade and expand environmental protection infrastructure.

Tokai Carbon's key activities revolve around the large-scale production of carbon and graphite materials, including carbon black and graphite electrodes vital for industries like steel and automotive. They also focus heavily on R&D for advanced materials, particularly for the battery and renewable energy sectors, as evidenced by their ¥3 billion R&D investment in 2024. The company manages a global supply chain and implements structural reforms to optimize operations and meet market demands.

| Key Activity | Description | 2024 Relevance/Data |

| Material Production | Manufacturing carbon black, graphite electrodes, fine carbon, friction materials, and specialized graphite. | Graphite electrode sales remain a strong revenue contributor. |

| Research & Development | Developing advanced carbon and graphite materials for batteries, electronics, and industrial processes. | ¥3 billion (approx. $28 million) invested in R&D for market expansion, especially in renewables. |

| Global Operations & Supply Chain | Operating manufacturing facilities worldwide and managing raw material sourcing. | Focus on optimizing graphite electrode operations and ensuring supply chain continuity. |

| Sales & Customer Engagement | Serving steel, automotive, and semiconductor industries with technical support and tailored solutions. | Robust performance in carbon products division, highlighting strong industrial demand. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct snapshot of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this comprehensive analysis of Tokai Carbon's business model, formatted for immediate use.

Resources

Tokai Carbon's advanced manufacturing facilities and equipment are the backbone of its operations, enabling the production of high-quality carbon and graphite products. These specialized plants, strategically located across Japan, Europe, and North America, are equipped with cutting-edge machinery essential for their diverse product lines.

The company is actively expanding its global manufacturing footprint, with significant new investments in emerging markets such as Thailand, Vietnam, and India. This expansion underscores a commitment to meeting growing global demand and diversifying production capabilities, ensuring a robust supply chain for their specialized materials.

Tokai Carbon's competitive edge is deeply rooted in its vast intellectual property portfolio. This includes a significant number of patents and a wealth of proprietary know-how specifically focused on carbon and graphite material science and advanced manufacturing techniques. This expertise is crucial for their operations.

A key area of this proprietary knowledge lies in their ability to refine diverse types of oil into essential raw materials for carbon black production. This specialized refining capability allows them to control a vital input, contributing to their cost efficiency and product quality.

In 2024, Tokai Carbon's commitment to R&D, a driver of their intellectual property, was evident in their continued investment in developing new carbon materials. While specific R&D expenditure figures for the full year are still being finalized, their ongoing focus on innovation in areas like advanced graphite for batteries underscores the strategic importance of their IP.

Tokai Carbon's business model hinges on its highly skilled workforce, a critical asset in driving innovation and operational efficiency. This team includes experienced engineers, dedicated scientists, and specialized technical experts who are instrumental in developing and refining the company's advanced carbon products.

The company actively invests in its human capital, recognizing it as a primary source of value creation. For instance, in fiscal year 2023, Tokai Carbon reported significant investments in research and development, a direct reflection of their commitment to nurturing R&D talent and fostering a culture of continuous improvement.

Access to Critical Raw Materials

Tokai Carbon's business model hinges on securing consistent access to essential raw materials like petroleum coke and coal tar pitch. These are the very building blocks for their graphite electrode and carbon black products. For instance, in 2023, the global supply of petroleum coke experienced fluctuations due to refinery operations, highlighting the importance of Tokai Carbon's supplier relationships.

The company actively cultivates robust, long-term partnerships with its suppliers. This strategy is crucial for maintaining a stable and dependable supply chain, mitigating the risks associated with raw material availability and price volatility. These established relationships are a key resource, ensuring they can meet production demands.

- Petroleum Coke: Essential for graphite electrode manufacturing.

- Coal Tar Pitch: A critical binder for graphite electrodes and a component in carbon black.

- Supplier Relationships: Long-term contracts and strategic partnerships ensure supply stability.

- Supply Chain Resilience: Diversified sourcing and strong supplier ties mitigate disruption risks.

Financial Capital and Investment Capacity

Tokai Carbon's substantial financial capital is a cornerstone of its business model, fueling critical investments. This robust financial backing allows the company to pursue ambitious research and development initiatives, expand its global footprint, and implement necessary structural reforms to stay competitive.

A prime example of this strategic deployment of capital is their significant investment in the carbon black business. Tokai Carbon committed ¥57 billion (approximately €353 million) to this sector over a three-year period concluding in 2026. This demonstrates a clear focus on strengthening core business areas and ensuring future growth.

- R&D Investment: Financial capital supports ongoing innovation in materials science and production processes.

- Global Expansion: Funds are allocated to establish and enhance manufacturing facilities and sales networks worldwide.

- Structural Reforms: Capital enables necessary upgrades and changes to operational structures for efficiency.

- Carbon Black Focus: A specific ¥57 billion commitment over three years ending in 2026 highlights strategic investment in key business segments.

Tokai Carbon's key resources are its advanced manufacturing capabilities, extensive intellectual property, skilled workforce, and strong supplier relationships. These elements collectively enable the company to produce high-quality carbon and graphite products and maintain a competitive edge in the global market.

The company's financial capital is also a crucial resource, enabling investments in R&D, global expansion, and structural reforms. A notable example is the ¥57 billion investment in the carbon black business, demonstrating a commitment to strengthening core segments.

| Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Manufacturing Facilities | Strategically located plants with cutting-edge machinery in Japan, Europe, and North America. | Ongoing expansion in Thailand, Vietnam, and India to meet growing demand. |

| Intellectual Property | Patents and proprietary know-how in carbon and graphite material science and manufacturing. | Continued R&D investment in 2024, focusing on new materials like advanced graphite for batteries. |

| Skilled Workforce | Experienced engineers, scientists, and technical experts. | Significant investment in R&D talent and continuous improvement culture. |

| Raw Material Access | Consistent access to petroleum coke and coal tar pitch through strong supplier relationships. | Mitigating risks from 2023's fluctuating petroleum coke supply via diversified sourcing and partnerships. |

| Financial Capital | Funds for R&D, global expansion, and structural reforms. | ¥57 billion committed to carbon black business over three years ending 2026. |

Value Propositions

Tokai Carbon delivers indispensable, high-grade carbon and graphite materials, such as carbon black and graphite electrodes. These are vital for industries like steel manufacturing, automotive production, and electronics, directly impacting the performance and durability of finished goods.

For instance, their carbon black significantly enhances tire strength and longevity, a crucial factor in automotive safety and efficiency. In 2024, the global tire market, where such components are essential, was projected to reach over $300 billion, highlighting the scale of demand for these critical inputs.

Tokai Carbon's value proposition centers on its specialized high-performance materials, particularly advanced graphite and fine carbon products. These are crucial for demanding sectors like semiconductors. For instance, their super high-purity silicon carbide (SiC) is engineered to meet the exacting requirements of modern chip manufacturing processes.

Tokai Carbon's commitment to reliability is underscored by its extensive global network of production facilities. This widespread presence allows them to serve customers across various regions, ensuring a consistent flow of essential carbon materials. For instance, in 2023, the company reported a consolidated net sales of ¥284.5 billion, reflecting the scale of their operations and their ability to meet global demand.

The company actively works on optimizing its operational efficiency across these international sites. This focus helps mitigate potential disruptions and maintain a dependable supply chain, even when faced with economic uncertainties or geopolitical shifts. Their strategic adjustments are geared towards ensuring customers can rely on Tokai Carbon for their critical material requirements throughout the year.

Technical Expertise and Collaborative R&D

Tokai Carbon's technical expertise is a cornerstone of its value proposition, enabling the development of advanced carbon materials. This deep knowledge fuels collaborative research and development efforts, allowing the company to partner with clients on bespoke solutions. For instance, their work on eco Carbon Black demonstrates a commitment to sustainability through joint innovation.

This collaborative R&D approach not only drives product innovation but also strengthens customer relationships by co-creating value. Tokai Carbon's investment in research is substantial, with a focus on materials science and engineering. In fiscal year 2023, the company reported significant expenditures on R&D, underscoring its dedication to staying at the forefront of carbon technology.

- Deep Technological Prowess: Tokai Carbon possesses extensive expertise in carbon material science and manufacturing processes.

- Collaborative R&D: The company actively engages with customers to jointly develop new and improved carbon-based products.

- Sustainable Material Development: A key focus is the creation of environmentally friendly materials, exemplified by their work on eco Carbon Black.

- Innovation-Driven Solutions: Technical expertise translates into innovative product offerings that meet evolving market demands.

Commitment to Sustainability and Eco-Friendly Solutions

Tokai Carbon demonstrates a powerful commitment to sustainability, offering value through initiatives like CO2 emission reduction and material recycling. This focus on eco-friendly solutions, including the development of products such as eCB, directly addresses the growing global demand for reduced carbon footprints.

Their dedication is reflected in tangible actions, such as setting targets for greenhouse gas reduction. For instance, in the fiscal year ending March 2024, Tokai Carbon reported progress in their environmental efforts, aiming to contribute to a circular economy.

- Reduced CO2 Emissions: Actively working to lower their operational carbon output.

- Material Recycling: Implementing programs to reuse and recycle materials within their production processes.

- Environmentally Friendly Products: Developing and promoting products like eCB that offer lower environmental impact.

- Alignment with Global Trends: Positioning themselves to meet increasing market and regulatory demands for sustainability.

Tokai Carbon provides critical, high-performance carbon and graphite materials essential for advanced industries. Their offerings, like super high-purity silicon carbide for semiconductors, enable technological progress. The company's global production network ensures reliable supply, a crucial factor given the scale of demand in sectors like automotive, where their carbon black enhances tire performance. In 2024, the global tire market alone was valued at over $300 billion.

Tokai Carbon's value proposition is built on deep technological expertise and collaborative R&D, leading to innovative, often bespoke, material solutions. They are also committed to sustainability, developing eco-friendly products like eCB and actively reducing their CO2 emissions. This dual focus on innovation and environmental responsibility positions them well to meet evolving market needs.

| Value Proposition Element | Description | Supporting Data/Example |

|---|---|---|

| High-Performance Materials | Supplying specialized carbon and graphite products vital for advanced manufacturing. | Super high-purity silicon carbide for semiconductor production. |

| Reliable Global Supply | Ensuring consistent availability of essential materials through an extensive production network. | Consolidated net sales of ¥284.5 billion in fiscal year 2023. |

| Technological Innovation & Collaboration | Leveraging R&D expertise to co-create advanced material solutions with customers. | Development of eco Carbon Black (eCB) through joint innovation. |

| Sustainability Focus | Offering environmentally conscious products and reducing operational carbon footprint. | Commitment to CO2 emission reduction and material recycling initiatives. |

Customer Relationships

Tokai Carbon focuses on building enduring, strategic partnerships with its key industrial customers. These collaborations are vital, especially within demanding sectors such as steel manufacturing, automotive production, and the semiconductor industry, where consistent quality and supply are paramount.

These long-term relationships are forged through a deep understanding of client needs and a proven track record of reliability. For instance, in fiscal year 2023, Tokai Carbon reported that its carbon black segment, a key material for the automotive industry, maintained stable demand, underscoring the importance of these established partnerships.

Tokai Carbon excels in customer relationships through deep technical support and joint development efforts. This allows them to tailor material solutions precisely to client needs, tackling intricate problems head-on.

This collaborative development model is key to their strategy, enabling the creation of innovative products proactively, often anticipating market demand. For instance, in 2024, their focus on co-creation with key automotive partners led to the early-stage development of next-generation graphite materials for electric vehicle battery components.

Tokai Carbon cultivates strong customer ties through its direct sales force and specialized account management. These teams are deeply familiar with the specific requirements of their industrial clientele, enabling them to offer customized solutions and prompt support.

This direct approach is crucial for industries relying on specialized carbon products. For instance, in 2023, Tokai Carbon's graphite electrode segment, a key area for direct sales, saw continued demand from the steel industry, which is increasingly focused on electric arc furnace (EAF) production.

Focus on Customer Competitiveness

Tokai Carbon's customer relationships are built on a foundation of enhancing their clients' competitiveness. They strive to offer products and solutions that directly contribute to the success of their customers, particularly world-leading tire manufacturers.

This focus means Tokai Carbon isn't just a supplier; they aim to be a strategic partner. By providing advanced materials and technical support, they enable their customers to innovate and excel in their respective markets. For instance, in the automotive sector, advancements in tire technology directly impact fuel efficiency and safety, areas where Tokai Carbon's materials play a crucial role.

- Enabling Customer Innovation: Tokai Carbon's carbon black products are critical for tire performance, allowing manufacturers to develop tires with improved grip and durability.

- Strategic Partnership: The company works closely with clients to understand their development and production challenges, offering tailored solutions.

- Market Leadership Support: By supplying high-quality materials, Tokai Carbon helps its customers maintain their leading positions in competitive global markets.

Addressing Evolving Industry Needs

Tokai Carbon is keenly focused on understanding and addressing the dynamic requirements of its clientele. This proactive approach is particularly evident in their efforts to support customer transitions towards carbon neutrality and enhance resource circulation initiatives. For instance, in 2024, the company emphasized its commitment to developing advanced graphite materials crucial for next-generation battery technologies, a key area driven by the global push for decarbonization.

The company's strategy includes offering innovative solutions tailored to these evolving industry demands. This involves not just product development but also adapting their overall business strategies to align with sustainability goals and the circular economy. Tokai Carbon's investment in research and development for materials that facilitate energy efficiency and waste reduction underscores this commitment.

- Customer-Centric Innovation: Actively engaging with customers to identify and meet emerging needs, especially in sustainability and resource efficiency.

- Carbon Neutrality Solutions: Developing and offering products and technologies that support customers' decarbonization efforts.

- Resource Circulation Focus: Adapting business strategies to promote and enable the circular economy within their customer base.

- Strategic Adaptation: Continuously evolving their business models and product portfolios in response to market shifts and customer priorities.

Tokai Carbon cultivates deep, collaborative relationships with its industrial clients, acting as more than just a supplier. They focus on co-creation and technical support, particularly in high-demand sectors like automotive and semiconductors, ensuring tailored solutions. This approach is vital for customer innovation and market leadership.

For example, in 2024, Tokai Carbon highlighted its work with automotive partners on next-generation graphite for EV batteries, demonstrating a commitment to future-proofing client needs. Their direct sales force and specialized account management further strengthen these ties, ensuring responsive service and customized product offerings.

The company's strategy involves proactively addressing customer needs, including their transition to carbon neutrality and circular economy initiatives. This customer-centric innovation is supported by ongoing R&D, as seen in their focus on advanced materials for energy efficiency and waste reduction.

| Customer Relationship Aspect | Key Focus Areas | Examples of Engagement |

|---|---|---|

| Strategic Partnerships | Long-term collaboration, reliability | Steel, automotive, semiconductor industries |

| Technical Support & Co-creation | Tailored solutions, joint development | Next-gen graphite for EV batteries (2024 initiative) |

| Direct Sales & Account Management | Customized solutions, prompt support | Graphite electrodes for EAF steel production (2023 demand) |

| Sustainability & Innovation Support | Carbon neutrality, resource circulation | Advanced materials for energy efficiency |

Channels

Tokai Carbon relies heavily on its direct sales force to connect with key industrial clients. This approach allows for in-depth technical consultations and the development of tailored product solutions, which are crucial for high-value, complex sales to large enterprises.

In fiscal year 2023, Tokai Carbon reported consolidated net sales of ¥344.9 billion. The direct sales model facilitates the understanding and fulfillment of specific customer needs in sectors like automotive and semiconductors, where product performance is paramount.

Tokai Carbon's global distribution network is a cornerstone of its business model, allowing for the efficient delivery of graphite electrodes and other carbon products to diverse markets worldwide. This extensive network is strategically supported by its international manufacturing bases, ensuring a robust supply chain that can meet varied customer demands across continents.

In 2024, Tokai Carbon continued to optimize this network, leveraging its presence in key regions like Asia, Europe, and North America. For instance, its facilities in Japan, the United States, and Europe play a crucial role in serving major industrial hubs, facilitating timely product availability and reducing logistical complexities for its global clientele.

Tokai Carbon's technical sales teams are essential for bridging the gap between complex carbon materials and customer needs. They engage directly with engineers and R&D departments, explaining the unique advantages of products like fine carbon and specialty graphite for specific applications.

These specialized teams are critical for demonstrating how Tokai Carbon's materials can enhance performance in sectors such as semiconductors and automotive manufacturing. For instance, in 2024, the demand for high-purity graphite in advanced battery technologies continued to surge, requiring sales teams to articulate material benefits for improved energy density and charging speeds.

Industry Trade Shows and Conferences

Tokai Carbon actively participates in key industry trade shows and conferences. This is a vital channel for them to display their latest advancements in carbon materials and technologies. These events provide direct interaction opportunities with a broad spectrum of customers, from established clients to prospective buyers, facilitating crucial feedback and relationship building.

These gatherings are instrumental for business development, allowing Tokai Carbon to scout emerging market trends and competitive landscapes. For instance, in 2024, participation in events like the Carbon Capture Technology Expo Europe allowed them to demonstrate their solutions for industrial decarbonization, a growing sector. Such engagement directly supports their innovation pipeline and market positioning.

- Product Showcase: Demonstrating new graphite electrodes, carbon black, and specialty carbon products.

- Customer Engagement: Meeting with automotive, semiconductor, and industrial clients to discuss needs and solutions.

- Market Intelligence: Gathering insights on technological shifts and competitor activities in the carbon materials sector.

- Networking: Building relationships with potential partners and industry influencers.

Online Presence and Investor Relations Portal

Tokai Carbon's official website and dedicated investor relations portal are crucial communication channels. These platforms disseminate vital information about the company's diverse product portfolio, its commitment to sustainability, and its latest financial performance. They also provide direct contact points for stakeholders seeking further details or wishing to engage with the company.

In 2024, Tokai Carbon continued to leverage its online presence to enhance transparency and accessibility for its investor base. The company's website serves as a comprehensive resource, offering detailed insights into its operational segments, including graphite electrodes, industrial furnaces, and fine carbon products. This digital hub is essential for keeping investors informed about strategic developments and market positioning.

- Website Accessibility: The company's official website, tokai-carbon.com, acts as the primary gateway for all corporate information.

- Investor Relations Focus: A dedicated section on the website provides specific resources for investors, including financial reports, presentations, and annual securities reports.

- Information Dissemination: Key updates on product innovation, sustainability efforts, and financial results are regularly published through these online channels.

- Stakeholder Engagement: Contact information for investor relations is readily available, facilitating direct communication and inquiries from shareholders and potential investors.

Tokai Carbon utilizes a multi-faceted channel strategy, blending direct engagement with broad digital outreach. Their direct sales force and technical teams are paramount for complex B2B relationships, particularly in high-tech sectors. This is complemented by a robust global distribution network ensuring product availability across diverse markets.

Industry trade shows and conferences serve as critical platforms for showcasing innovation and gathering market intelligence, as seen in their 2024 participation in events focused on decarbonization. The company's digital presence, including its official website and investor relations portal, ensures transparency and accessibility for all stakeholders, providing essential corporate and financial information.

| Channel | Description | Key Activities | 2024 Focus |

|---|---|---|---|

| Direct Sales Force | Personalized client interaction for high-value products. | Technical consultations, tailored solutions, relationship building. | Deepening engagement in semiconductor and battery sectors. |

| Global Distribution Network | Efficient delivery of carbon products worldwide. | Logistics optimization, supply chain management, regional support. | Strengthening presence in North America and Europe. |

| Industry Trade Shows & Conferences | Showcasing advancements and market intelligence gathering. | Product demonstrations, networking, competitor analysis. | Highlighting solutions for industrial decarbonization. |

| Official Website & Investor Relations | Disseminating corporate and financial information. | Information updates, stakeholder communication, transparency. | Enhancing accessibility of operational segment details. |

Customer Segments

Steel Industry Manufacturers are a cornerstone customer segment for Tokai Carbon, primarily relying on its graphite electrodes. These electrodes are critical components for electric arc furnaces (EAFs), the dominant technology in modern steel production. In 2024, global crude steel production was projected to reach approximately 1.9 billion metric tons, highlighting the immense demand for these essential materials.

The health and performance of this segment are intrinsically tied to global steel production volumes and prevailing market conditions. Fluctuations in steel prices, construction activity, and automotive manufacturing directly impact the purchasing power and demand from steelmakers. For instance, a robust construction sector in 2024, a key driver for steel demand, would translate to increased electrode consumption.

The automotive industry is a cornerstone customer for Tokai Carbon, particularly through its demand for carbon black, a key component in tire manufacturing and other industrial rubber goods. This sector also relies on Tokai Carbon for friction materials used in braking systems.

Tokai Carbon's engagement with global Original Equipment Manufacturers (OEMs) and their extensive supplier networks ensures their products are integral to vehicle production. The company anticipates continued, stable expansion within this vital automotive segment.

Semiconductor manufacturers are a cornerstone customer segment for Tokai Carbon, relying heavily on their fine carbon products. These include specialized carbon materials and high-purity silicon carbide (SiC), essential components for producing advanced semiconductors.

Tokai Carbon sees substantial growth potential in this sector, driven by the increasing demand for semiconductors fueled by AI and data technologies. For instance, the global AI chip market was valued at approximately $20 billion in 2023 and is projected to grow significantly in the coming years, directly benefiting suppliers like Tokai Carbon.

Advanced Technology and Aerospace Companies

Tokai Carbon serves advanced technology and aerospace companies that demand cutting-edge specialty graphite materials. These sectors require graphite with exceptional thermal and electrical properties for critical components. For instance, the aerospace industry utilizes graphite in applications ranging from aircraft brakes to satellite structures, where lightweight strength and heat resistance are paramount. In 2024, the global aerospace market was valued at approximately $900 billion, underscoring the significant demand for high-performance materials.

The need for precision and reliability in these industries means Tokai Carbon's graphite solutions are essential for innovation. Companies in the semiconductor manufacturing sector, another key area, rely on specialty graphite for wafer handling, furnace components, and other high-temperature processes. The semiconductor industry, a major driver of technological advancement, saw global revenues around $600 billion in 2024. This segment of Tokai Carbon's customer base is characterized by stringent quality requirements and a continuous push for material science improvements.

- High-Performance Materials: Customers in aerospace and advanced tech require graphite with superior thermal conductivity, strength, and purity for demanding applications.

- Innovation Drivers: These segments are at the forefront of technological development, creating a constant need for novel graphite solutions.

- Critical Applications: Tokai Carbon's graphite is used in vital components such as satellite parts, semiconductor manufacturing equipment, and advanced electronics.

- Market Value: The aerospace market exceeded $900 billion in 2024, while the semiconductor industry generated around $600 billion, highlighting the economic significance of these customer segments.

Aluminum Smelting and Industrial Furnace Operators

Aluminum smelting operations rely heavily on Tokai Carbon's cathode blocks, essential components for the electrolysis process that produces aluminum. These blocks are critical for the efficiency and longevity of the smelting cells. In 2024, global primary aluminum production was projected to reach approximately 70 million metric tons, underscoring the significant demand for these high-performance materials.

Industrial furnace operators, including those in the steel and other heavy industries, utilize Tokai Carbon's furnace lining blocks and carbon electrodes. These products are vital for maintaining high temperatures and ensuring the structural integrity of furnaces. For instance, blast furnaces, a key area for furnace lining blocks, are fundamental to steel production, with global crude steel output in 2023 exceeding 1.8 billion metric tons.

- Aluminum Electrolysis: Cathode blocks are fundamental for the aluminum smelting process, directly impacting energy efficiency and operational lifespan of electrolysis cells.

- Industrial Furnace Linings: Furnace lining blocks provide crucial thermal insulation and resistance to extreme conditions in blast furnaces and other high-temperature industrial applications.

- Carbon Electrodes: These are used in submerged arc furnaces, vital for processes like ferroalloy production and other smelting operations requiring high electrical conductivity and thermal stability.

- Market Demand: The substantial global output of aluminum and steel in 2023 and 2024 highlights the consistent and significant demand for these specialized carbon products.

Tokai Carbon's customer base is diverse, spanning heavy industries to advanced technology sectors. Key segments include steel manufacturers, who are major consumers of graphite electrodes for electric arc furnaces, and the automotive industry, relying on carbon black for tires and friction materials. The semiconductor sector is increasingly important, requiring high-purity carbon materials and silicon carbide for advanced chip production.

Furthermore, aerospace and other advanced technology companies utilize specialty graphite for its exceptional thermal and electrical properties. Aluminum smelting operations depend on Tokai Carbon's cathode blocks for efficient electrolysis. Finally, industrial furnace operators across various sectors, including steel, use furnace lining blocks and carbon electrodes for high-temperature processes.

| Customer Segment | Key Products Supplied | 2024 Market Context/Demand Driver |

|---|---|---|

| Steel Industry | Graphite Electrodes | Global crude steel production projected around 1.9 billion metric tons. |

| Automotive Industry | Carbon Black, Friction Materials | Continued stable expansion anticipated; key for tire and brake components. |

| Semiconductor Industry | Fine Carbon Products, Silicon Carbide (SiC) | Driven by AI and data technologies; global AI chip market valued ~ $20 billion in 2023. |

| Aerospace & Advanced Tech | Specialty Graphite | Global aerospace market valued ~ $900 billion; demand for high-performance materials. |

| Aluminum Smelting | Cathode Blocks | Global primary aluminum production projected around 70 million metric tons. |

| Industrial Furnaces | Furnace Lining Blocks, Carbon Electrodes | Essential for steel and other heavy industries; 2023 global crude steel output > 1.8 billion metric tons. |

Cost Structure

Tokai Carbon's cost structure is heavily influenced by the acquisition of key raw materials, primarily petroleum coke and coal tar pitch. These essential components for their graphite electrode and carbon black products represent a substantial portion of their overall expenses.

The financial performance of Tokai Carbon is directly tied to the volatility of these commodity markets. For instance, in 2023, the average price of petroleum coke saw significant fluctuations, impacting the company's procurement budget and, consequently, its profitability.

These price swings in raw materials necessitate careful inventory management and strategic sourcing to mitigate cost impacts. Tokai Carbon's ability to secure these materials at competitive prices is a critical factor in maintaining its cost advantage and market position.

Tokai Carbon's manufacturing and production costs encompass the significant expenses tied to running its worldwide network of production facilities. These costs include substantial energy consumption, labor wages for its workforce, and the depreciation of its advanced machinery. For instance, in the fiscal year ending December 2023, Tokai Carbon reported a cost of goods sold of ¥319.5 billion, reflecting these operational expenditures.

The company is actively engaged in structural reforms aimed at optimizing production efficiency and managing these costs more effectively. These initiatives are crucial for maintaining competitiveness in the global market. By streamlining operations, Tokai Carbon seeks to reduce its cost base and improve overall profitability.

Tokai Carbon's commitment to innovation is reflected in its significant Research and Development (R&D) expenses. These ongoing investments are crucial for creating advanced, high-performance materials and pioneering sustainable technologies that drive the company's future growth.

In 2024, Tokai Carbon allocated ¥3 billion to R&D initiatives. This substantial financial commitment underscores the company's focus on staying at the forefront of material science and developing solutions that meet evolving market demands and environmental considerations.

Logistics and Distribution Costs

Tokai Carbon's logistics and distribution costs are significant, encompassing the movement of raw materials like petroleum coke and pitch to its manufacturing facilities and the subsequent delivery of finished graphite electrodes and carbon black to customers worldwide. These expenses include international freight, warehousing at strategic locations, and the ongoing management of inventory to ensure timely supply. For instance, in 2023, the company reported substantial costs related to its global supply chain operations, reflecting the complexities of transporting bulk materials and finished goods across continents.

The company's commitment to efficient distribution is crucial for maintaining its competitive edge. These costs are directly influenced by global shipping rates, fuel prices, and the geographical spread of its customer base. Tokai Carbon's financial reports often highlight these operational expenditures as a key component of its cost of goods sold, underscoring the importance of optimizing these processes.

- Freight Expenses: Costs incurred for shipping raw materials and finished products via sea, rail, and road.

- Warehousing and Storage: Expenses related to maintaining inventory in strategically located warehouses to facilitate timely delivery.

- Inventory Management: Costs associated with tracking, managing, and optimizing stock levels to meet customer demand efficiently.

- Customs and Duties: Fees and tariffs applicable to international shipments, impacting the overall distribution cost.

Environmental Compliance and Sustainability Investments

Tokai Carbon incurs significant costs to meet strict environmental regulations, particularly in North America where compliance standards are high. These expenses cover pollution control technologies and ongoing monitoring systems. For example, in 2023, the company reported increased depreciation and amortization related to environmental facilities, reflecting these ongoing investments.

Investing in carbon neutrality initiatives is another key cost driver. This includes exploring and implementing lower-emission production processes and potentially purchasing carbon credits. The development of their new plant in Thailand also necessitates substantial upfront capital for environmentally sound infrastructure and sustainable operational design.

- Environmental Regulation Compliance: Costs associated with meeting air and water quality standards, waste management, and chemical handling regulations, especially in regions like North America.

- Carbon Neutrality Initiatives: Expenditures on research and development for cleaner production methods, energy efficiency upgrades, and potential investments in renewable energy sources.

- Sustainability Investments: Capital outlays for new environmental protection facilities, upgrades to existing plants, and the integration of sustainable practices into new projects, such as the Thai plant.

Tokai Carbon's cost structure is dominated by raw material procurement, primarily petroleum coke and coal tar pitch, which are vital for their graphite electrodes and carbon black. The company's profitability is sensitive to the price fluctuations of these commodities, as seen in 2023 when petroleum coke prices varied significantly. Effective inventory management and strategic sourcing are crucial to mitigate these cost impacts.

Operational expenses, including energy consumption, labor, and machinery depreciation, represent a substantial portion of Tokai Carbon's costs. In the fiscal year ending December 2023, the cost of goods sold reached ¥319.5 billion, reflecting these production expenditures. The company is actively pursuing structural reforms to enhance production efficiency and manage these costs more effectively.

Research and Development (R&D) is a significant investment area, with ¥3 billion allocated in 2024 to foster innovation in advanced materials and sustainable technologies. Logistics and distribution costs are also considerable, driven by global shipping, warehousing, and inventory management to serve a worldwide customer base.

Environmental compliance and carbon neutrality initiatives add to the cost structure, requiring investments in pollution control, cleaner production processes, and sustainable infrastructure for new projects like the Thailand plant. These expenditures are essential for meeting regulatory standards and achieving sustainability goals.

| Cost Category | Key Components | 2023 Impact/Data |

|---|---|---|

| Raw Materials | Petroleum Coke, Coal Tar Pitch | Significant price volatility impacting procurement budgets. |

| Production Operations | Energy, Labor, Machinery Depreciation | Cost of Goods Sold: ¥319.5 billion (FY 2023). |

| Research & Development | Material Innovation, Sustainable Tech | ¥3 billion allocated in 2024. |

| Logistics & Distribution | Freight, Warehousing, Inventory Management | Substantial costs due to global supply chain complexity. |

| Environmental & Sustainability | Compliance, Carbon Neutrality, New Facilities | Increased depreciation for environmental facilities in 2023; capital for Thai plant. |

Revenue Streams

Tokai Carbon's sales of carbon black are a cornerstone of its revenue, with this material finding extensive use in the automotive industry for tire manufacturing, as well as in other industrial rubber products. This segment also caters to demand for black pigments in inks and coatings, and for conductive materials in electronics.

In 2024, the carbon black segment continued to be a significant revenue driver for Tokai Carbon, reflecting its ongoing importance in key global industries. The company’s strategic focus on high-performance carbon blacks for specialized applications has supported consistent growth in this area.

Tokai Carbon's primary revenue stream comes from the sale of graphite electrodes. These are essential for electric arc furnaces used in steel production. For instance, in 2023, the company's consolidated net sales reached ¥219.5 billion, with a significant portion attributed to this core product line.

Tokai Carbon generates revenue from selling a variety of fine carbon products. This includes specialized carbon materials, solid silicon carbide, and silicon carbide coatings. These sales are a significant income source, heavily influenced by the semiconductor industry's needs.

In 2024, the demand for advanced semiconductor manufacturing technologies directly boosted sales of these high-performance carbon products. For instance, the semiconductor sector's ongoing expansion, driven by AI and advanced computing, translates into increased orders for materials like silicon carbide components used in wafer processing equipment.

Sales of Friction Materials

Tokai Carbon generates revenue through the sale of friction materials. These materials are crucial components in industrial machinery and braking systems for a wide range of vehicles, including automobiles and heavy equipment. This segment contributes significantly to the company's overall earnings by supplying essential parts for safety and operational efficiency.

In 2024, the automotive sector, a key consumer of friction materials, continued to show resilience. For instance, global vehicle production in the first half of 2024 was estimated to be around 45 million units, providing a steady demand for these components. Tokai Carbon's expertise in developing high-performance friction materials, such as those used in electric vehicles (EVs) which require specialized braking solutions, positions them well within this evolving market.

- Revenue Source: Direct sales of friction materials to manufacturers of industrial machinery and automotive brakes.

- Market Application: Used in diverse applications ranging from heavy-duty industrial equipment to passenger car braking systems.

- Key Demand Drivers: Global vehicle production, industrial output, and advancements in braking technology, particularly for EVs.

Sales from Smelting & Lining Business

Tokai Carbon's smelting and lining business generates revenue primarily through the sale of essential carbon-based products vital for various industrial processes. These include cathode blocks, which are critical components in aluminum electrolysis, and blast furnace blocks used in steel manufacturing.

The company also supplies carbon electrodes, indispensable for smelting furnaces across different industries. This segment, while subject to short-term market volatility, holds significant growth potential driven by global industrial expansion and infrastructure development.

- Revenue Sources: Cathode blocks for aluminum electrolysis, blast furnace blocks for steel production, and carbon electrodes for smelting furnaces.

- Market Drivers: Global demand for aluminum and steel, industrial production levels, and infrastructure projects.

- Growth Outlook: Positive, supported by increasing industrial activity and technological advancements in smelting processes.

Tokai Carbon's revenue streams are diverse, encompassing the sale of carbon black, graphite electrodes, fine carbon products, friction materials, and smelting and lining products. These segments collectively cater to a wide array of global industries.

In 2024, the company's performance in these areas reflects ongoing demand from key sectors. For example, the automotive industry's continued activity supports revenue from friction materials, while the semiconductor sector's expansion boosts sales of fine carbon products.

Graphite electrodes remain a primary revenue driver, essential for the steel industry. The company's fine carbon products, including silicon carbide, are also crucial for advanced manufacturing, particularly in semiconductors.

| Revenue Stream | Key Products | Primary Industries Served | 2023 Revenue Contribution (Approximate) |

|---|---|---|---|

| Carbon Black | Carbon Black | Automotive (Tires), Rubber, Inks, Coatings, Electronics | Significant |

| Graphite Electrodes | Graphite Electrodes | Steel Production (Electric Arc Furnaces) | Largest Contributor (¥219.5 billion consolidated net sales in 2023) |

| Fine Carbon Products | Silicon Carbide, Carbon Materials, Coatings | Semiconductor Manufacturing, Advanced Materials | Growing, driven by tech demand |

| Friction Materials | Brake Pads, Clutch Facings | Automotive, Industrial Machinery | Steady, supported by vehicle production |

| Smelting and Lining | Cathode Blocks, Blast Furnace Blocks, Carbon Electrodes | Aluminum Smelting, Steel Manufacturing, Industrial Furnaces | Stable, linked to industrial output |

Business Model Canvas Data Sources

The Tokai Carbon Business Model Canvas is built upon a foundation of financial disclosures, industry analysis, and internal strategic assessments. These sources provide a comprehensive view of the company's operations, market position, and future direction.