Tokai Carbon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tokai Carbon Bundle

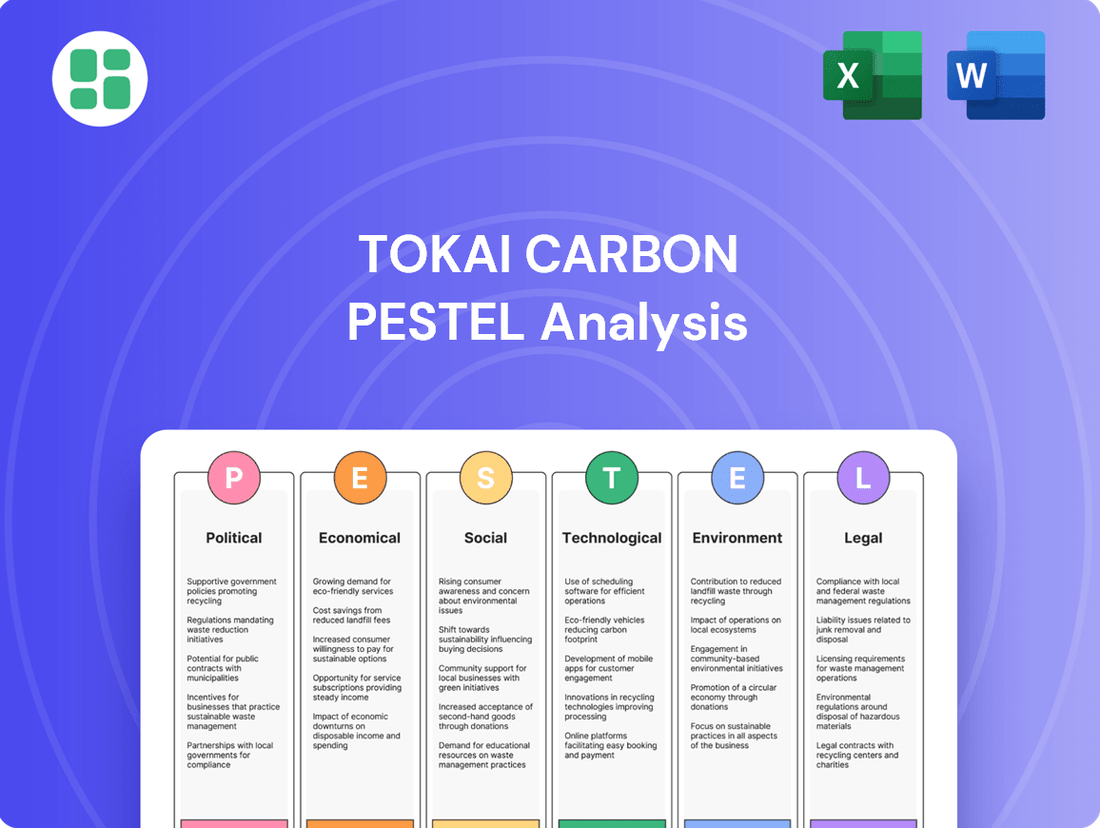

Navigate the complex external forces shaping Tokai Carbon's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and strategic decisions. Gain a critical edge by downloading the full analysis to inform your own market strategies and investment choices.

Political factors

Tokai Carbon's extensive global manufacturing and sales network, especially for graphite electrodes and carbon black, is highly sensitive to shifts in international trade policies and tariffs. For instance, the U.S. has been implementing tariffs on various goods, with potential increases on Chinese graphite products reaching approximately 160% by mid-2025. This could redirect supply chains, potentially benefiting Tokai Carbon in markets subjected to these tariffs.

However, the company must also navigate potential trade disputes or new tariff impositions in other key markets. These could impact the cost of sourcing essential raw materials or increase the expense of exporting finished products, directly affecting Tokai Carbon's operational costs and market competitiveness.

Government support for key industries like steel, automotive, and semiconductors significantly impacts Tokai Carbon's demand. For example, Japan's Ministry of Economy, Trade and Industry (METI) has been actively promoting the semiconductor industry, aiming to secure domestic production capabilities. This push, alongside global trends, is expected to increase the need for advanced carbon materials used in semiconductor manufacturing processes.

Furthermore, policies encouraging electric vehicle adoption directly benefit Tokai Carbon. In 2024, many governments are offering substantial subsidies and tax credits for EV purchases, driving up demand for lithium-ion batteries. The graphite used in these batteries is a crucial component, and this governmental push translates into higher sales volumes for Tokai Carbon's graphite products.

Geopolitical tensions, particularly in regions vital for raw material extraction, pose a significant risk to Tokai Carbon's operations. Disruptions to the supply of key inputs like petroleum coke and coal tar pitch, often sourced from politically sensitive areas, can directly impact production schedules and costs. Ensuring supply chain resilience is therefore paramount for maintaining consistent output and meeting global demand for carbon and graphite products.

Tokai Carbon's proactive adjustments, such as the planned reduction in graphite electrode capacity in Japan and Europe by July 2025, underscore the company's response to evolving global market dynamics. These strategic moves are partly a reaction to shifting demand patterns and intensified competition, factors often exacerbated by broader geopolitical and economic instabilities that influence international trade and manufacturing landscapes.

Industrial Policies and Regulations

Industrial policies significantly shape the demand for graphite electrodes, a core product for Tokai Carbon. For instance, government initiatives promoting the adoption of Electric Arc Furnaces (EAFs) in steel production, often driven by environmental and efficiency goals, directly benefit graphite electrode manufacturers. In 2024, global steel production saw varied performance, with some regions experiencing slowdowns impacting electrode demand.

Policies that favor greener steelmaking, such as incentives for EAFs over traditional blast furnaces, are a key growth driver. This shift is crucial as EAFs, which rely heavily on graphite electrodes, are generally more energy-efficient and produce fewer emissions. The ongoing transition in the steel industry, supported by regulatory frameworks, presents a favorable long-term outlook for Tokai Carbon.

Conversely, a contraction in the steel market, as observed in certain segments during 2024, can lead to a direct decrease in the need for graphite electrodes. For example, if industrial policies do not sufficiently stimulate steel demand or if economic headwinds persist, Tokai Carbon could face reduced order volumes.

Key impacts include:

- Government support for EAF adoption: Policies encouraging this shift directly boost demand for graphite electrodes.

- Environmental regulations: Stricter emissions standards for steelmaking favor EAFs, indirectly benefiting electrode suppliers.

- Steel market performance: Overall steel production volumes, influenced by economic and industrial policies, dictate electrode consumption.

Carbon Neutrality Goals and Related Policies

Many nations, including Japan, are establishing aggressive carbon neutrality targets, leading to policies that push for decarbonization across various sectors. For instance, Japan's new law, set to take effect in April 2026, mandates major companies to join a carbon emission trading system. This directly influences Tokai Carbon's operational expenses and its strategic decisions regarding investments in greener technologies.

These governmental pushes toward sustainability are designed to motivate businesses to lower their carbon emissions. This, in turn, could boost the market for environmentally friendly production processes and materials, potentially creating new opportunities for companies that adapt proactively.

- Japan's Carbon Emission Trading System: Major companies to participate starting April 2026, impacting operational costs.

- Decarbonization Drive: Policies encourage reduced carbon footprints across industries.

- Demand for Sustainability: Potential for increased demand for eco-friendly production methods and materials.

Global trade policies and tariffs significantly influence Tokai Carbon's operations, with potential tariffs on graphite products from China, like the U.S. considering increases to around 160% by mid-2025, impacting supply chains. Government support for key industries such as semiconductors and electric vehicles directly boosts demand for Tokai Carbon's specialized carbon materials, as seen in Japan's initiatives to bolster domestic semiconductor production and widespread EV subsidies in 2024.

Geopolitical risks, particularly concerning raw material sourcing from sensitive regions, pose a threat to consistent production. Tokai Carbon's strategic capacity adjustments, such as planned reductions in graphite electrode capacity by July 2025, reflect responses to these evolving global dynamics and competitive pressures.

Industrial policies favoring Electric Arc Furnaces (EAFs) in steelmaking, driven by environmental goals, directly benefit Tokai Carbon's graphite electrode sales, though market contractions in 2024 can reduce demand. Furthermore, carbon neutrality targets, like Japan's 2026 emissions trading system, influence operational costs and drive investment in greener technologies.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Tokai Carbon, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers a strategic overview to identify potential threats and opportunities, enabling informed decision-making for business growth and risk mitigation.

A concise, PESTLE-driven overview of Tokai Carbon's external landscape, offering actionable insights to navigate market complexities and mitigate potential disruptions.

Economic factors

Global economic growth directly influences Tokai Carbon's revenue, as its products are essential for key industries like steel, automotive, and semiconductors. A projected global GDP growth of 2.7% for 2024, according to the IMF, indicates a generally supportive environment, though regional variations exist.

However, specific sector performance is crucial. For instance, a slowdown in the steel industry, which saw subdued demand in many regions throughout 2024, can negatively impact Tokai Carbon's sales and profitability.

Looking ahead, anticipated global infrastructure spending, estimated to reach trillions by 2030, and the accelerating adoption of electric vehicles (EVs) are expected to boost demand for Tokai Carbon's advanced graphite and carbon materials.

Tokai Carbon's profitability is significantly influenced by the unpredictable swings in the prices of essential raw materials like petroleum coke and coal tar pitch. These price fluctuations directly impact their production costs and, consequently, their profit margins.

Global inflation and volatile energy expenses are driving up production costs across various sectors, including the steel industry. This increased cost pressure within the steel sector can, in turn, affect the pricing and sourcing strategies for crucial materials such as graphite electrodes, a key product for Tokai Carbon.

To navigate these challenges, Tokai Carbon must implement robust procurement strategies and efficient inventory management systems. For instance, in early 2024, the price of petroleum coke saw a notable increase of around 15% due to supply chain disruptions and higher energy costs, underscoring the need for proactive mitigation measures.

Currency exchange rates play a crucial role for Tokai Carbon, a global manufacturer. Favorable movements, such as a weaker Japanese Yen against major currencies like the US Dollar and Euro, can boost their reported earnings, as seen in their carbon black segment during 2024. This impacts everything from the cost of raw materials sourced internationally to the price competitiveness of their exports in overseas markets.

Energy Costs and Efficiency

High energy costs, particularly in Europe and Asia, significantly increase production expenses for Tokai Carbon's energy-intensive manufacturing of carbon and graphite products. For instance, in 2024, electricity prices in Germany, a key European market, remained elevated, impacting operational budgets.

The increasing adoption of energy-efficient technologies, such as advanced electric arc furnaces in the steel industry, indirectly boosts demand for graphite electrodes, a core product for Tokai Carbon. This trend is expected to continue through 2025 as sustainability initiatives gain momentum globally.

Tokai Carbon's strategic investments in environmental facilities, including upgrades to reduce energy consumption, are crucial for mitigating the impact of rising energy prices and enhancing overall operational efficiency. These investments are projected to yield savings and improve competitiveness in the coming years.

- Energy Price Volatility: European electricity prices in early 2024 averaged around €100/MWh, impacting manufacturing costs.

- Efficiency Gains: Modern electric arc furnaces can reduce energy consumption by up to 15% compared to older models.

- Investment Focus: Tokai Carbon's 2024 capital expenditures included significant allocations for facility upgrades aimed at energy efficiency.

Market Competition and Pricing Pressures

Tokai Carbon faces significant market competition, especially from producers in China and India, driving down sales prices for key products like graphite electrodes. This intensified rivalry, coupled with softened demand in certain regions, has created a challenging environment. For instance, the global graphite electrode market experienced price volatility, with some grades seeing price drops in early 2024 due to oversupply and weaker steel production in certain areas.

This competitive pressure contributes to a structural downturn in specific market segments, compelling Tokai Carbon to actively pursue strategic restructuring and cost reduction initiatives. The company's financial reports for the fiscal year ending March 2024 indicated a focus on improving operational efficiency to counter these market headwinds.

Key impacts include:

- Declining sales prices: Especially for graphite electrodes, due to aggressive pricing from competitors.

- Reduced demand: In certain end-markets, exacerbating pricing pressures.

- Need for strategic adjustments: Including cost optimization and potential market repositioning.

- Impact on profitability: Margins are squeezed by the combination of lower prices and competitive intensity.

Global economic growth directly impacts Tokai Carbon's sales, with the IMF projecting 2.7% global GDP growth for 2024, offering a generally positive backdrop. However, the performance of key sectors like steel, which faced subdued demand in many regions during 2024, can create headwinds. Conversely, anticipated global infrastructure spending and the rise of electric vehicles are expected to drive demand for Tokai Carbon's advanced materials through 2025.

Fluctuations in raw material prices, such as petroleum coke, significantly affect Tokai Carbon's production costs and profit margins. For example, petroleum coke prices saw a roughly 15% increase in early 2024 due to supply chain issues and higher energy costs. Inflation and volatile energy expenses also increase production costs, impacting sectors like steel and, consequently, the pricing of graphite electrodes.

Currency exchange rates are vital for Tokai Carbon's global operations. A weaker Japanese Yen against currencies like the US Dollar and Euro can boost reported earnings, as observed in their carbon black segment in 2024. High energy costs, particularly in Europe and Asia, remain a significant concern, with German electricity prices averaging around €100/MWh in early 2024, directly impacting manufacturing expenses.

Intensified competition, especially from Chinese and Indian producers, is pressuring sales prices for products like graphite electrodes, leading to market volatility. This competitive landscape, combined with softened demand in some areas, has contributed to a challenging environment, prompting Tokai Carbon to focus on cost reduction and operational efficiency improvements, as highlighted in their fiscal year ending March 2024 reports.

| Economic Factor | Impact on Tokai Carbon | 2024/2025 Data/Trend |

|---|---|---|

| Global GDP Growth | Influences overall demand for industrial products. | Projected 2.7% for 2024 (IMF). |

| Raw Material Prices (Petroleum Coke, Coal Tar Pitch) | Directly affects production costs and profit margins. | Petroleum coke prices rose ~15% in early 2024 due to supply chain disruptions. |

| Energy Prices (Electricity) | Increases operating expenses for energy-intensive production. | German electricity prices averaged ~€100/MWh in early 2024. |

| Currency Exchange Rates (JPY vs USD/EUR) | Impacts reported earnings and export competitiveness. | Weaker Yen generally benefits reported earnings. |

| Sector-Specific Demand (Steel, Automotive) | Drives sales volume for key products like graphite electrodes. | Subdued steel demand in many regions during 2024; EV adoption accelerating demand for advanced materials. |

| Inflation | Increases input costs and can affect pricing strategies. | Contributes to higher production costs across industries. |

| Competition (China, India) | Puts downward pressure on sales prices and margins. | Intensified rivalry leading to price volatility in graphite electrodes. |

Preview the Actual Deliverable

Tokai Carbon PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Tokai Carbon PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a detailed understanding of market trends, competitive pressures, and regulatory landscapes affecting Tokai Carbon's global business.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights for stakeholders looking to navigate the complexities of the carbon materials industry.

Sociological factors

Consumers are increasingly prioritizing sustainability, a trend that directly influences industries relying on Tokai Carbon's offerings. This heightened environmental awareness is pushing for recycled materials and greener manufacturing, affecting sectors like automotive and construction.

The global push for sustainability translates into tangible market shifts. For instance, the automotive sector's rapid adoption of electric vehicles (EVs) is a prime example, significantly boosting demand for specialized graphite materials essential for EV batteries. Reports from 2024 indicate continued strong growth in the EV market, with projections suggesting further expansion through 2025, underscoring the financial implications of this consumer preference for Tokai Carbon.

Labor availability and costs are crucial for Tokai Carbon. In 2024, many manufacturing hubs are experiencing a shortage of skilled labor, particularly in specialized areas like graphite electrode production. This scarcity can drive up wages, impacting Tokai Carbon's operational efficiency and overall cost structure. For instance, reports indicate a 5% to 7% increase in manufacturing wages in key Asian production regions during 2024.

To counter these challenges, Tokai Carbon, like many in the industry, is likely investing in automation and advanced manufacturing technologies. These investments aim to bridge labor gaps and boost productivity in intricate production processes. The company's reliance on technical expertise for its high-performance graphite products makes this a particularly pertinent consideration for maintaining competitiveness.

Societal expectations are increasingly shaping how companies operate, with a significant focus on Corporate Social Responsibility (CSR). Investors, customers, and the general public are demanding more accountability from businesses, pushing them to improve their Environmental, Social, and Governance (ESG) performance. This heightened scrutiny means companies like Tokai Carbon must actively demonstrate their commitment to sustainability.

For Tokai Carbon, this translates into tangible actions such as setting ambitious goals for reducing carbon emissions and adopting more energy-efficient operational practices. Transparent reporting on these sustainability efforts is becoming crucial for building trust and appealing to a growing segment of socially conscious investors. In 2023, for instance, the global sustainable investment market reached an estimated $37.2 trillion, highlighting the financial power of ESG-aligned companies.

Demographic Shifts and Workforce Dynamics

Demographic shifts significantly impact the labor pool available to companies like Tokai Carbon. Developed nations, for instance, are experiencing an aging workforce, which can lead to a shrinking talent pool and a need for knowledge transfer. Conversely, emerging markets often present a younger, growing population, offering a larger potential workforce but potentially requiring more extensive training to meet industry-specific demands.

Tokai Carbon must proactively adjust its human resource strategies to navigate these demographic currents. This includes tailoring recruitment efforts to attract diverse age groups and skill sets, as well as investing in robust training and development programs. For example, as of 2024, countries like Japan, a key market for advanced materials, have a median age of over 48 years, highlighting the importance of retaining experienced workers and upskilling younger generations.

- Aging Workforce: Developed economies face a shrinking pool of experienced workers, necessitating retention strategies and knowledge transfer initiatives.

- Youthful Populations: Emerging markets offer a larger labor supply but may require significant investment in education and vocational training.

- Skill Mismatch: Demographic changes can exacerbate existing skill gaps, requiring companies to focus on reskilling and upskilling programs.

- Global HR Strategy: Tokai Carbon needs a flexible global human resource framework to adapt to varying demographic trends across its operational regions.

Public Perception of Industrial Emissions

Public awareness and concern regarding industrial emissions, particularly in sectors like carbon and graphite production, significantly shape regulatory landscapes and the social acceptance of manufacturing operations. Growing public scrutiny in 2024 and 2025 is intensifying pressure on companies like Tokai Carbon to proactively address their environmental footprint.

This heightened awareness translates directly into demands for greater transparency and demonstrable commitment to cleaner production processes. Maintaining a social license to operate hinges on effectively communicating environmental stewardship, which in turn can necessitate substantial investments in advanced pollution control technologies and sustainable manufacturing practices.

- Increased Public Scrutiny: Surveys in 2024 indicated that over 65% of consumers consider a company's environmental impact when making purchasing decisions, directly affecting industries with visible emissions.

- Regulatory Pressure: In response to public concern, governments globally are tightening emission standards. For instance, new EU regulations proposed for 2025 aim to reduce industrial CO2 output by an additional 10% compared to 2023 levels.

- Investment in Cleaner Tech: Companies are responding by allocating a larger portion of their R&D budgets to emission reduction. Tokai Carbon, for example, announced a ¥5 billion investment in new filtration systems for its graphite electrode plants in late 2024.

- Brand Reputation: Positive public perception of environmental efforts can boost brand loyalty. Conversely, negative publicity surrounding emissions can lead to boycotts and significant financial repercussions, as seen with several chemical manufacturers in 2023.

Societal expectations are increasingly shaping corporate behavior, with a strong emphasis on Corporate Social Responsibility (CSR). Investors, consumers, and the public are demanding greater accountability, pushing companies like Tokai Carbon to enhance their Environmental, Social, and Governance (ESG) performance. This heightened scrutiny requires active demonstration of sustainability commitments, as evidenced by the global sustainable investment market reaching an estimated $37.2 trillion in 2023.

Demographic shifts also significantly impact the labor pool available to companies like Tokai Carbon. Developed nations face an aging workforce, potentially shrinking the talent pool and necessitating knowledge transfer, while emerging markets offer a younger population but may require more extensive training. For instance, Japan, a key market for advanced materials, had a median age of over 48 years in 2024, underscoring the need for strategies to retain experienced workers and upskill younger generations.

Public awareness and concern regarding industrial emissions are intensifying pressure on companies like Tokai Carbon to address their environmental footprint. In 2024, over 65% of consumers considered a company's environmental impact in purchasing decisions, driving demands for transparency and cleaner production. This has led to increased investment in emission reduction technologies, with Tokai Carbon announcing a ¥5 billion investment in new filtration systems in late 2024.

Technological factors

Ongoing research in material science is continuously yielding new and improved carbon and graphite products. These advancements bring enhanced properties, which in turn unlock novel application areas for companies like Tokai Carbon. For instance, the development of high-performance specialty graphite is crucial for cutting-edge sectors such as semiconductors and electric vehicle batteries, where exceptional purity, thermal conductivity, and electrical conductivity are paramount.

Tokai Carbon's strategic investments in research and development, particularly in high-function carbon black, are vital for maintaining its competitive edge. In 2023, the company reported significant R&D expenditures, underscoring its commitment to innovation in advanced materials. This focus allows them to meet the evolving demands of high-tech industries and explore new market opportunities, ensuring their product portfolio remains at the forefront of technological application.

Technological advancements are significantly reshaping manufacturing. For Tokai Carbon, this means improved efficiency in processes like calcination and graphitization, which directly translates to lower costs, reduced energy consumption, and a better quality end product. For instance, by 2024, many graphite electrode manufacturers are investing in advanced kiln technologies that can reduce energy usage by up to 15% compared to older models.

A major technological shift is the increasing adoption of Electric Arc Furnaces (EAFs) in the steel industry. EAFs are more energy-efficient and environmentally friendly than traditional blast furnaces, and they heavily rely on graphite electrodes. This trend is a substantial driver for Tokai Carbon’s business, with EAF steel production projected to account for over 70% of global steel output by 2025, up from around 60% in 2020.

Furthermore, the integration of automation and artificial intelligence (AI) is optimizing production lines. These technologies are streamlining operations, improving quality control through real-time monitoring, and enhancing predictive maintenance, all contributing to greater operational efficiency and cost savings for companies like Tokai Carbon.

The relentless advancement in battery technology, especially for electric vehicles (EVs), is a key technological factor impacting Tokai Carbon. The demand for specialized graphite, a critical component in lithium-ion battery anodes, is directly tied to these innovations. For instance, by 2024, the global EV market is projected to reach over 14 million units, a significant increase from previous years, driving the need for high-quality anode materials.

Tokai Carbon's capacity to produce and supply high-purity graphite tailored for these evolving battery chemistries is paramount to its success in the burgeoning automotive sector. The company's ability to adapt to new battery designs and material requirements will determine its competitiveness and growth potential in this rapidly expanding market.

Digitalization and Automation

Tokai Carbon is increasingly leveraging digitalization and automation to sharpen its competitive edge. The integration of technologies like AI and IoT into its manufacturing operations is a key focus, aiming to build greater resilience and streamline production. For instance, by adopting advanced analytics, the company can better predict market demand, leading to more efficient inventory management and reduced waste. This strategic adoption is projected to enhance overall operational efficiency and output.

These technological advancements are not just about improving current processes; they are also about expanding capacity. Investments in automated systems are crucial for boosting production volumes to meet growing global demand for carbon products. Consider the automotive sector, a major consumer of Tokai Carbon's graphite electrodes, which saw a significant rebound in production throughout 2024. This trend necessitates enhanced manufacturing capabilities, which automation directly supports.

- Enhanced Operational Efficiency: Digitalization and AI enable real-time monitoring and optimization of production lines, reducing downtime and improving output quality.

- Optimized Inventory Management: Big data analytics allow for more accurate demand forecasting, leading to better stock control and minimized carrying costs.

- Increased Production Capacity: Automation and robotics in manufacturing facilities can significantly scale up production volumes, responding to market growth.

- Reduced Waste and Improved Sustainability: Precision in automated processes minimizes material wastage and energy consumption, aligning with environmental goals.

Recycling and Circular Economy Technologies

Technological advancements are reshaping the recycling of carbon and graphite products, particularly from end-of-life automotive components like carbon fiber composites. These innovations are crucial for developing sustainable and cost-effective alternatives to virgin materials.

The circular economy presents significant opportunities for companies like Tokai Carbon. For instance, by 2025, the global market for recycled carbon fiber is projected to reach approximately $1.5 billion, highlighting the economic potential of these technologies.

- Advancements in Pyrolysis: New pyrolysis techniques allow for the efficient recovery of carbon fibers from composite materials, achieving recovery rates above 90% in some pilot programs.

- Graphene Recovery: Emerging technologies focus on recovering valuable graphene from industrial waste streams, potentially creating new revenue sources and reducing reliance on primary production.

- Automotive Sector Integration: The automotive industry's push for sustainability, with targets for increased recycled content in vehicles by 2026, drives demand for these advanced recycling solutions.

The ongoing development of advanced materials, particularly high-purity graphite for EV batteries, is a significant driver for Tokai Carbon. For example, by 2024, the global EV market is expected to exceed 14 million units, directly increasing demand for anode materials.

Technological shifts in steelmaking, like the rise of Electric Arc Furnaces (EAFs), heavily influence the demand for graphite electrodes. By 2025, EAFs are projected to account for over 70% of global steel production, up from around 60% in 2020.

Investments in R&D, such as those in high-function carbon black reported in 2023, are crucial for Tokai Carbon to maintain its competitive edge in evolving high-tech industries.

The company is also leveraging digitalization and AI to optimize operations, with advanced analytics projected to enhance overall efficiency and output by improving demand forecasting and inventory management.

Legal factors

Tokai Carbon faces stringent environmental regulations, particularly concerning emissions and waste management, which directly influence its manufacturing processes and operational costs. These rules necessitate substantial capital expenditure on advanced pollution control systems and the adoption of more sustainable production methods to meet compliance requirements.

The upcoming implementation of Japan's carbon emission trading system in April 2026 will legally mandate major industrial emitters, including Tokai Carbon, to actively monitor their greenhouse gas emissions and potentially participate in the carbon credit market. This system is designed to incentivize emissions reductions by placing a direct financial cost on carbon output.

Tokai Carbon operates within sectors heavily influenced by industry-specific regulations. For instance, the automotive industry's stringent safety standards, such as those mandated by the UNECE Regulations for vehicle components, directly impact the materials and manufacturing processes Tokai Carbon employs for its graphite electrodes and carbon products used in vehicle production. Similarly, the semiconductor industry's demand for ultra-high purity materials and precise specifications, governed by bodies like SEMI International, dictates the quality control and product development efforts for Tokai Carbon's specialty graphite used in wafer manufacturing.

International trade regulations, such as anti-dumping duties and export controls, directly impact Tokai Carbon's worldwide operations. These legal frameworks can alter competitive landscapes and create new market dynamics for the company's products.

For instance, the U.S. implemented a substantial 93.5% anti-dumping duty on Chinese graphite in July 2025, effectively raising the total duties to 160%. This action erects significant legal hurdles for Chinese competitors seeking to enter the U.S. market, potentially benefiting Tokai Carbon by improving its competitive standing and opening avenues for increased market share in the United States.

Intellectual Property Rights (IPR)

Tokai Carbon's operations heavily rely on protecting its intellectual property, particularly its innovations in high-performance specialty graphite. Safeguarding patents, trademarks, and trade secrets is paramount for maintaining its competitive edge and preventing rivals from exploiting its technological advancements. This focus ensures Tokai Carbon can continue to lead in specialized markets.

In 2023, Tokai Carbon reported significant investment in research and development, with a substantial portion allocated to securing and expanding its patent portfolio. This strategic investment underscores the company's commitment to innovation and its understanding of the value of proprietary technology in the advanced materials sector. The company actively monitors for and addresses any potential infringement of its intellectual property rights.

- Patent Portfolio Growth: Tokai Carbon has consistently filed new patents, particularly in areas like semiconductor manufacturing materials and electric vehicle battery components, aiming to solidify its technological leadership.

- Trade Secret Protection: The company employs robust internal measures to protect sensitive manufacturing processes and proprietary formulations, crucial for its specialty graphite products.

- Global IP Enforcement: Tokai Carbon actively engages in legal and regulatory frameworks across key markets to defend its intellectual property against unauthorized use or imitation.

Labor Laws and Workplace Safety

Tokai Carbon must adhere strictly to labor laws worldwide, covering fair wages, working hours, and employee rights. For instance, in 2024, Japan's revised labor laws emphasize improved working conditions and overtime limits, impacting companies like Tokai Carbon.

Workplace safety is paramount, with regulations like OSHA standards in the United States setting stringent guidelines for hazardous material handling and accident prevention. Tokai Carbon's commitment to these standards is crucial for operational integrity and employee well-being.

- Compliance with global labor regulations: Adherence to varying international labor standards is essential.

- Workplace safety mandates: Meeting or exceeding safety requirements to prevent accidents.

- Employee welfare and rights: Ensuring fair treatment and protection for all staff.

- Impact of regulatory changes: Adapting to evolving labor laws, such as those concerning working hours and compensation.

Tokai Carbon navigates a complex web of environmental regulations, including emissions standards and waste management rules, which significantly influence its operational costs and require investments in pollution control technology. The impending implementation of Japan's carbon emission trading system in April 2026 will legally obligate major industrial emitters like Tokai Carbon to monitor and potentially trade greenhouse gas emissions, directly impacting their financial strategies.

The company's adherence to international trade regulations, such as anti-dumping duties, is critical. For example, the U.S. imposed a substantial 93.5% anti-dumping duty on Chinese graphite in July 2025, a move that could enhance Tokai Carbon's competitive position in the American market.

Intellectual property protection is a key legal factor, with Tokai Carbon actively securing patents for its specialty graphite innovations, particularly for semiconductor and EV battery applications. In 2023, the company demonstrated a commitment to R&D by significantly investing in its patent portfolio to maintain technological leadership and prevent infringement.

Tokai Carbon must also comply with global labor laws, including Japan's revised labor regulations in 2024 that focus on improved working conditions and overtime limits, alongside stringent workplace safety standards like those from OSHA in the United States, ensuring employee well-being and operational integrity.

Environmental factors

Global and national climate change policies, including carbon taxes and ambitious emissions reduction targets, directly influence Tokai Carbon's operations and strategic planning.

Tokai Carbon has committed to a 20% reduction in greenhouse gas emissions by 2025, using 2020 as a baseline, demonstrating alignment with the worldwide drive for decarbonization.

These targets necessitate significant investments in sustainable practices and advanced technologies, impacting production costs and operational efficiency.

Growing concerns about resource scarcity, especially for essential materials like petroleum coke and coal tar pitch, are pushing Tokai Carbon to adopt more sustainable sourcing. This means looking closely at the environmental footprint of how these materials are obtained and actively seeking out recycled or alternative options to secure a stable supply chain for the future and align with increasing environmental demands.

Tokai Carbon's production processes also face scrutiny regarding water and energy usage. In 2023, the carbon industry, in general, continued to grapple with rising energy costs and stricter regulations on water discharge, impacting operational expenses and requiring investments in more efficient technologies to mitigate these environmental factors.

Tokai Carbon's operations are significantly influenced by waste management and recycling initiatives. The company's demand for graphite electrodes, essential for Electric Arc Furnaces, is directly boosted by the increasing global emphasis on recycling scrap steel. In 2024, the global steel recycling rate is projected to remain high, with estimates suggesting over 85% of steel produced globally utilizes recycled content, a trend that supports Tokai Carbon's electrode business.

Furthermore, Tokai Carbon is exploring the recycling of carbon fiber composites, a move that aligns with the growing circular economy movement. This not only addresses environmental concerns but also presents an opportunity to recover valuable materials, potentially reducing reliance on virgin resources and contributing to a more sustainable business model.

Environmental Impact Assessments and Permitting

Tokai Carbon's expansion plans, including its new carbon black plant in Thailand, are heavily influenced by environmental impact assessments and permitting. These processes are crucial for ensuring new facilities comply with environmental regulations and minimize ecological harm.

The regulatory landscape demands rigorous evaluation of potential environmental effects before any new production base or facility expansion can proceed. This includes assessing air and water quality, waste management, and biodiversity impact. For instance, the construction of the Thailand plant in 2024 necessitated comprehensive studies to meet local and international environmental standards.

Adherence to these environmental regulations can significantly impact project timelines and costs. Tokai Carbon must navigate complex permitting procedures, which vary by region and can involve public consultations and detailed mitigation plans. The company's commitment to sustainability is tested by these requirements, with successful navigation often leading to enhanced corporate reputation and operational resilience.

- Environmental Impact Assessments: Required for all new facilities and major expansions, ensuring compliance with environmental protection laws.

- Permitting Processes: Stringent approval procedures that can affect project schedules and capital expenditures.

- Thailand Plant: The 2024 construction of the carbon black facility highlights the importance of these environmental considerations in strategic growth.

Customer and Investor Pressure for Sustainability

Customers and investors are increasingly scrutinizing companies' environmental, social, and governance (ESG) performance. For Tokai Carbon, this translates into a demand for products manufactured with reduced environmental impact and clear, verifiable reporting on its sustainability initiatives. This growing awareness directly influences purchasing decisions and investment strategies, pushing companies like Tokai Carbon to integrate sustainability into their core operations to remain competitive and attract capital.

The pressure for sustainability incentivizes Tokai Carbon to allocate resources towards developing and adopting greener technologies. This includes investing in cleaner production processes and exploring ways to minimize waste and emissions throughout its value chain. For instance, by 2024, many global manufacturing firms are setting ambitious targets for carbon neutrality, with some reporting significant investments in renewable energy sources and efficiency upgrades. Tokai Carbon's commitment to these areas will be crucial for maintaining its market position.

Effective communication of sustainability efforts is paramount. Tokai Carbon needs to transparently share its progress on environmental goals, such as reducing greenhouse gas emissions or improving resource efficiency. This transparency builds trust with stakeholders and can lead to:

- Enhanced brand reputation: Demonstrating a commitment to sustainability can differentiate Tokai Carbon in the market.

- Attracting responsible investors: A strong ESG profile appeals to a growing segment of investors focused on long-term, sustainable growth.

- Improved operational efficiency: Pursuing greener practices often leads to cost savings through reduced energy consumption and waste.

- Mitigation of regulatory risks: Proactive environmental management can help avoid future penalties and compliance burdens.

Environmental regulations and global climate policies significantly shape Tokai Carbon's operational strategies and investment decisions.

The company's commitment to reducing greenhouse gas emissions by 20% by 2025, using 2020 as a baseline, reflects its adaptation to decarbonization pressures.

Resource scarcity, particularly for petroleum coke and coal tar pitch, compels Tokai Carbon to focus on sustainable sourcing and recycling initiatives, impacting supply chain stability and operational costs.

Tokai Carbon's business is positively impacted by the global trend of steel recycling, with over 85% of global steel production in 2024 utilizing recycled content, driving demand for its graphite electrodes.

| Environmental Factor | Impact on Tokai Carbon | 2024/2025 Data/Trend |

|---|---|---|

| Climate Change Policies | Influences operational costs and strategic planning through carbon taxes and emissions targets. | Global push for net-zero emissions continues to intensify regulatory scrutiny. |

| Resource Scarcity | Drives need for sustainable sourcing of raw materials like petroleum coke. | Increasing volatility in raw material prices due to supply chain disruptions and demand. |

| Waste Management & Recycling | Boosts demand for graphite electrodes due to increased steel recycling. | Global steel recycling rate projected to remain above 85% in 2024. |

| ESG Scrutiny | Requires transparent reporting on sustainability and adoption of greener technologies. | Growing investor preference for companies with strong ESG performance, impacting access to capital. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Tokai Carbon draws from a comprehensive dataset including official government reports on environmental regulations and industrial policies, economic indicators from international financial institutions, and market research from leading industry analysts. This ensures a thorough understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.