Time Technoplast SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Time Technoplast Bundle

Time Technoplast's market position is shaped by its strong manufacturing capabilities and diverse product portfolio, but it also faces challenges from intense competition and evolving material costs. Understanding these dynamics is crucial for navigating the plastics industry.

Want the full story behind Time Technoplast's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Time Technoplast boasts an impressively broad and varied product range, encompassing everything from industrial packaging like drums and IBCs to lifestyle goods, automotive parts, and innovative composite cylinders. This extensive portfolio effectively serves both industrial clients and everyday consumers.

This strategic diversification is a significant strength, mitigating risks by lessening reliance on any single market sector and simultaneously expanding the company's overall market footprint. It’s a key factor in broadening revenue streams and ensuring greater financial resilience.

Further solidifying its market position, Time Technoplast holds a leadership role in nine out of the eleven countries where it operates. This widespread market dominance underscores strong global acceptance and consistent product demand.

Time Technoplast's leadership in key market segments is a significant strength. They are the world's largest producer of large plastic drums and command over 55% of the domestic industrial packaging market. This dominant position allows for significant economies of scale and strong customer loyalty.

Furthermore, the company's standing as the second-largest global manufacturer of composite cylinders and the third-largest worldwide for Intermediate Bulk Containers (IBCs) underscores its broad market influence. This diversified leadership across multiple product categories enhances brand recognition and provides a robust foundation for continued growth.

Time Technoplast stands out for its commitment to innovation, particularly in polymer processing. They were the first in India to introduce products like PE drums as a replacement for steel drums, Intermediate Bulk Containers (IBCs), and plastic fuel tanks. This pioneering spirit extends to their development of Type-IV composite cylinders, crucial for LPG, CNG, and emerging hydrogen applications, showcasing their forward-thinking approach to material science and manufacturing.

Strong Financial Performance and Growth Trajectory

Time Technoplast exhibits a compelling financial performance, underscored by significant year-over-year growth. In the fourth quarter of fiscal year 2024-2025, the company reported a robust net profit increase of 18.59%, reaching ₹109.52 crore, alongside a 4.66% rise in revenue to ₹1,470.82 crore.

The momentum continued into the full fiscal year ending March 2025, with net profit surging by 24.96% to ₹387.94 crore and sales climbing 9.30% to ₹5457.04 crore. This strong financial footing provides a solid foundation for future expansion.

Management has set an ambitious target of achieving 15% revenue growth annually over the next two to three years. This growth is strategically planned to be fueled by the company's established core packaging business and the burgeoning composite cylinder segment, indicating a clear path for sustained financial strength.

- Q4 FY25 Net Profit: ₹109.52 Cr (up 18.59%)

- Q4 FY25 Revenue: ₹1,470.82 Cr (up 4.66%)

- FY25 Net Profit: ₹387.94 Cr (up 24.96%)

- FY25 Revenue: ₹5457.04 Cr (up 9.30%)

- Projected Revenue Growth: 15% annually for the next 2-3 years

Commitment to Sustainability and Green Initiatives

Time Technoplast demonstrates a strong commitment to sustainability, targeting an increase in green energy consumption to 32% by fiscal year 2025. This strategic move is anticipated to result in a significant reduction of 35,000 tonnes of CO2 emissions, underscoring their dedication to environmental stewardship.

Further solidifying their eco-friendly approach, the company has launched Time Ecotech Private Limited (TEPL). This new subsidiary is specifically designed to handle the recycling and reprocessing of used industrial plastic packaging, directly contributing to circular economy principles and bolstering Time Technoplast's Environmental, Social, and Governance (ESG) profile.

- Increased Green Energy Use: Aiming for 32% by FY 2025.

- CO2 Emission Reduction: Projecting a decrease of 35,000 tonnes.

- Circular Economy Focus: Established Time Ecotech Private Limited (TEPL) for recycling industrial plastic packaging.

- Enhanced ESG Appeal: Commitment to sustainability improves overall ESG rating.

Time Technoplast's extensive product range, from industrial drums to composite cylinders, provides a robust defense against market volatility. Their leadership in nine operating countries, including over 55% of the domestic industrial packaging market, signifies strong brand equity and customer loyalty.

The company's financial health is a key strength, evidenced by a 24.96% net profit increase to ₹387.94 crore in FY25, with management targeting 15% annual revenue growth. Their commitment to innovation, particularly with Type-IV composite cylinders for emerging energy sectors, positions them for future expansion.

| Metric | FY25 Performance | Growth |

|---|---|---|

| Net Profit | ₹387.94 Cr | +24.96% |

| Revenue | ₹5457.04 Cr | +9.30% |

| Projected Annual Revenue Growth | 15% (next 2-3 years) |

What is included in the product

This SWOT analysis highlights Time Technoplast's robust manufacturing capabilities and diversified product portfolio as key strengths, while also identifying potential market saturation and reliance on specific raw materials as weaknesses. It explores opportunities in emerging markets and technological advancements, alongside threats from intense competition and evolving regulatory landscapes.

Offers actionable insights from Time Technoplast's SWOT to pinpoint and address critical business challenges.

Weaknesses

Time Technoplast's profitability is significantly tied to the fluctuating prices of crude oil and petrochemicals, the fundamental building blocks for its polymer products. For instance, a substantial surge in crude oil prices, which saw Brent crude averaging around $82.6 per barrel in the first half of 2024, directly escalates production expenses. This can squeeze profit margins, making it harder to maintain consistent financial results.

Time Technoplast has a history of over-promising and under-delivering on financial targets and return ratios, which has historically tarnished its market perception. This past performance can create a lingering skepticism among investors, potentially impacting current valuations despite recent improvements.

While the company is now demonstrating a clearer focus on improved capital allocation and a strategic shift towards higher-value products, overcoming the legacy of past performance perceptions remains a challenge. This historical data, particularly concerning inconsistent delivery on projections, can still weigh on investor confidence and influence how the market assesses future growth prospects.

The company's prior aggressive expansion, fueled by debt and capital expenditure in non-core segments, notably diverted management's attention. For instance, in the fiscal year ending March 2022, Time Technoplast reported a debt-to-equity ratio of 1.15, indicating a significant reliance on borrowed funds for its expansion efforts, which may have diluted focus from core competencies.

Time Technoplast faces significant challenges in its established product lines, such as industrial packaging. The market is crowded with both domestic and international players, leading to intense competition that can put downward pressure on prices. This environment necessitates constant innovation and cost management to stay ahead.

The highly competitive nature of these segments means that maintaining market share requires a continuous effort to differentiate products and services. In areas where products are more standardized, like certain types of polymer packaging, it becomes even harder to stand out, potentially impacting profit margins.

High Capital Expenditure Requirements for Growth

Time Technoplast's ambitious growth strategy, especially in its high-margin composite products segment, demands significant investment in capital expenditure. This is crucial for expanding production capacity and enhancing technological capabilities to meet market demand.

The company's financial projections highlight this commitment, with planned capital expenditure of ₹195 crore for FY25 and an estimated ₹200 crore for FY26. A substantial portion of this investment is earmarked for the composites division, indicating a strategic focus on this area.

- FY25 Capital Expenditure: ₹195 crore

- FY26 Capital Expenditure Guidance: ₹200 crore

- Investment Focus: Significant allocation towards composite product expansion

While these capital outlays are vital for future revenue generation and market positioning, they also present a potential challenge. High levels of capital expenditure can strain the company's financial resources, potentially leading to increased debt levels if not financed and managed prudently.

Exposure to Regulatory Changes in the Plastic Industry

Time Technoplast, like many in the plastic industry, faces significant headwinds from a global and domestic push for stricter environmental regulations. Policies targeting plastic waste, including potential bans or increased taxes on specific products, could directly impact demand and profitability. For instance, in 2024, several countries intensified efforts to curb single-use plastics, with some implementing extended producer responsibility schemes that could raise compliance costs for manufacturers.

While Time Technoplast emphasizes sustainability, the broader industry's environmental footprint remains a concern for regulators. Adapting to these evolving policies and the associated compliance costs will necessitate continuous innovation in product development and manufacturing processes. This could lead to increased operational expenses and potentially affect the competitiveness of certain product lines if market demand shifts away from regulated materials.

- Regulatory Scrutiny: Increased global and domestic pressure for environmental compliance, particularly concerning plastic waste, creates a significant risk.

- Potential Bans & Taxes: The threat of bans or higher taxation on certain plastic products could directly impact Time Technoplast's product portfolio and market reach.

- Compliance Costs: Adapting to new environmental policies and meeting stricter standards will likely incur additional operational and R&D expenses.

- Market Demand Shifts: Evolving consumer preferences and regulatory landscapes may necessitate shifts in product offerings, potentially impacting existing market demand.

Time Technoplast operates in highly competitive markets, particularly in industrial packaging, where numerous domestic and international players exert downward pressure on pricing. This intense competition necessitates continuous innovation and stringent cost management to maintain profitability and market share.

The company's past performance, marked by inconsistent delivery on financial targets and return ratios, has created a lingering skepticism among investors. This historical perception can hinder current valuations and affect market confidence in future growth prospects, despite recent efforts to improve capital allocation and focus on higher-value products.

Significant capital expenditure is required for Time Technoplast's growth strategy, especially in its composite products segment. Planned investments of ₹195 crore for FY25 and an estimated ₹200 crore for FY26, while crucial for expansion, could strain financial resources and potentially increase debt levels if not managed effectively.

Preview Before You Purchase

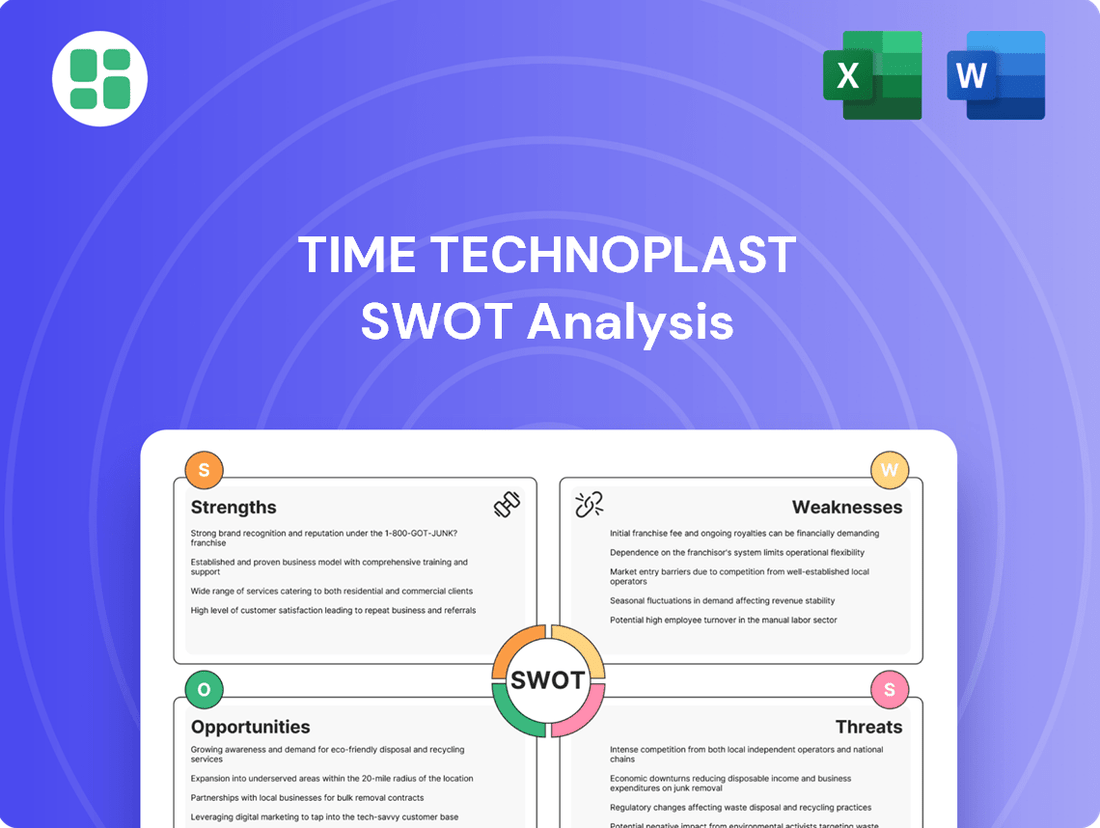

Time Technoplast SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Time Technoplast's strategic position.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Time Technoplast's internal Strengths and Weaknesses, alongside external Opportunities and Threats.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering actionable insights for Time Technoplast's business strategy.

Opportunities

The global market for composite cylinders, particularly for CNG, LPG, and hydrogen applications, is on a strong upward trajectory. This growth is fueled by increasing safety awareness, the demand for lighter and more portable solutions, and government pushes towards cleaner energy sources. Time Technoplast is strategically positioned to benefit from this trend, being the first in India to secure PESO approval for its Type-IV composite cylinders specifically designed for hydrogen, and holding a substantial order book for CNG cascades.

The global demand for sustainable packaging is surging, fueled by growing environmental awareness and consumer preference for eco-friendly options. This trend presents a substantial opportunity for Time Technoplast.

With its dedicated subsidiary, Time Ecotech Private Limited (TEPL), focused on recycling industrial plastic packaging, Time Technoplast is well-positioned to capitalize on this market. TEPL's operations directly align with the growing need for circular economy solutions in packaging.

This strategic focus allows Time Technoplast to develop and market innovative, eco-friendly packaging products, tapping into a segment projected to see significant growth. For instance, the global sustainable packaging market was valued at approximately $270 billion in 2023 and is expected to reach over $400 billion by 2028, growing at a CAGR of around 8-10%.

By embracing this opportunity, Time Technoplast can not only expand its product portfolio but also enhance its Environmental, Social, and Governance (ESG) credentials, attracting environmentally conscious investors and customers.

Time Technoplast's existing strong foothold in Asia and the MENA region, spanning operations across 11 countries, positions it well for further geographic expansion. The company has explicitly targeted further growth in the Middle East, Taiwan, and the ASEAN bloc. This strategic push into emerging markets is driven by their inherent potential for increased industrialization and a growing consumer base eager for polymer products.

These emerging economies represent significant untapped markets, offering Time Technoplast the opportunity to diversify its revenue streams and bolster its global market share. For instance, the ASEAN region's projected GDP growth of around 5% annually in the coming years, coupled with increasing disposable incomes, signals a robust demand for the company's diverse product portfolio, from automotive components to material handling solutions.

Technological Advancements and Product Innovation

Time Technoplast is well-positioned to capitalize on ongoing advancements in polymer science and material technology. The company's commitment to research and development in areas like advanced composites and smart polymers offers a clear path to creating enhanced existing products and introducing novel, high-performance solutions. This focus on innovation is crucial for staying competitive and capturing new market segments.

Specifically, the development of next-generation materials and applications, such as those for hydrogen storage in fuel cell vehicles, presents a significant opportunity. These specialized applications often command higher profit margins and can open up entirely new market frontiers for the company. For instance, the global hydrogen storage market is projected to grow substantially, with estimates suggesting a compound annual growth rate (CAGR) that could reach double digits by 2030, indicating a robust demand for such advanced material solutions.

- Enhanced Product Portfolio: Leveraging R&D in polymer science to upgrade current offerings with superior properties.

- New Market Entry: Developing specialized materials for emerging sectors like hydrogen storage, potentially boosting revenue streams.

- Higher Margins: Targeting niche applications that typically yield better profitability due to advanced technology and specialized demand.

- Innovation in Materials: Exploring smart polymers and advanced composites to create differentiated products that meet evolving industry needs.

Government Initiatives Promoting Green Energy and Infrastructure

Government initiatives are a significant tailwind for Time Technoplast. Schemes like the Sustainable Alternative Towards Affordable Transportation (SATAT) are directly boosting demand for Compressed Biogas (CBG) infrastructure, a key area for the company's composite cylinder solutions. The government's focus on expanding gas infrastructure, including LNG and CNG networks, further solidifies the market for Time Technoplast's storage and transportation products.

These policies translate into tangible market opportunities. For instance, the push for cleaner fuels and the development of a robust gas distribution network create a sustained demand for the specialized composite cylinders that Time Technoplast manufactures. This alignment between government policy and the company's core competencies is a strong driver for future growth.

Specific examples of this opportunity include:

- SATAT Scheme: Encourages the production and use of CBG, directly increasing the need for CBG storage and transportation cylinders.

- LNG/CNG Infrastructure Investment: Government-backed investments in building out LNG and CNG refueling stations and distribution networks create a consistent demand for composite cylinders used in these applications.

- Renewable Energy Push: Broader government support for green energy and infrastructure development creates a favorable environment for Time Technoplast's sustainable product offerings.

The growing global demand for composite cylinders, especially for CNG, LPG, and burgeoning hydrogen applications, presents a significant opportunity for Time Technoplast. The company's early PESO approval for Type-IV composite cylinders for hydrogen and its substantial CNG cascade order book position it to capitalize on this trend, driven by safety, portability, and cleaner energy mandates.

Time Technoplast can leverage its subsidiary, Time Ecotech Private Limited, to tap into the expanding sustainable packaging market, valued at approximately $270 billion in 2023 and projected to exceed $400 billion by 2028. This aligns with the increasing consumer and regulatory focus on circular economy principles.

Geographic expansion into high-growth regions like the Middle East, Taiwan, and the ASEAN bloc, where industrialization and consumer demand are rising, offers a substantial avenue for revenue diversification and increased market share. The ASEAN region's projected 5% annual GDP growth further underscores this potential.

Continued investment in research and development for advanced polymers and composite materials, particularly for niche applications like hydrogen storage, can unlock higher-margin opportunities and create a competitive edge. The hydrogen storage market alone is anticipated to experience robust double-digit CAGR growth by 2030.

Threats

The composite cylinder market, while a growth area for Time Technoplast, is seeing a significant influx of new participants. Global heavyweights such as Hexagon Composites, Worthington Enterprises, and Luxfer Gas Cylinders are intensifying their presence, bringing substantial resources and established market reach.

This escalating competition poses a direct threat of pricing pressure, potentially squeezing the healthy profit margins Time Technoplast has benefited from. For instance, Hexagon Composites reported a 12% increase in revenue for its composite cylinder segment in Q1 2024, indicating strong market penetration and competitive activity.

To counter this, Time Technoplast must prioritize maintaining its technological edge and ensuring cost-efficiency across its production processes. Failure to do so could lead to a dilution of market share in this lucrative segment, impacting overall profitability.

Economic downturns, including potential recessions and persistent inflation, pose a significant threat. These conditions can dampen industrial activity and curb consumer spending across key markets like automotive and FMCG, directly affecting demand for Time Technoplast's products.

For instance, a projected slowdown in global manufacturing output for 2024-2025 could translate into reduced orders for industrial components. This could lead to lower sales volumes and increased inventory, putting pressure on Time Technoplast's pricing power and overall profitability.

The materials science landscape is constantly shifting, potentially introducing superior or more sustainable alternatives to polymers. For instance, advancements in biodegradable materials and innovative packaging solutions could significantly impact the demand for Time Technoplast's core polymer products.

If these substitute materials achieve widespread adoption and become cost-competitive, they represent a substantial long-term threat. This necessitates continuous adaptation and innovation from Time Technoplast to remain relevant in evolving markets.

Supply Chain Disruptions and Geopolitical Risks

Time Technoplast faces significant threats from global supply chain disruptions, amplified by ongoing geopolitical tensions and potential trade restrictions. These vulnerabilities could impede the timely acquisition of essential raw materials and components, directly impacting production schedules and increasing operational costs.

Such disruptions can lead to production delays and an inability to fulfill customer orders, thereby affecting Time Technoplast's market responsiveness and financial performance. For instance, the ongoing conflict in Eastern Europe and its ripple effects on energy and commodity prices underscore the fragility of global logistics networks, a risk that directly concerns manufacturers like Time Technoplast.

- Supply Chain Vulnerabilities: Recent global events, including port congestion and shipping container shortages experienced through 2023 and into early 2024, have highlighted the susceptibility of complex supply chains.

- Geopolitical Impact: Escalating trade disputes and regional conflicts can trigger sudden imposition of tariffs or export bans, directly affecting the cost and availability of key inputs for Time Technoplast.

- Operational & Financial Strain: Production halts or significant cost escalations due to supply chain issues can reduce profit margins and damage the company's reputation for reliability.

Regulatory and Public Scrutiny on Plastic Pollution

Growing global concern over plastic pollution is intensifying regulatory and public scrutiny on companies like Time Technoplast. This can manifest as stricter environmental laws, potentially increasing operational costs and limiting product portfolios. For instance, many regions are implementing extended producer responsibility (EPR) schemes, which can add financial burdens for waste management and recycling.

The increasing demand for sustainable alternatives and the negative perception of plastic waste can impact market acceptance and brand reputation. By mid-2024, several major consumer goods companies announced significant targets to reduce virgin plastic usage, signaling a market shift that could affect demand for traditional plastic products. This heightened awareness translates to potential challenges in maintaining market share if sustainability initiatives are not robustly addressed.

- Stricter Regulations: Expect increased compliance costs and potential bans on certain plastic products due to evolving environmental legislation worldwide.

- Public Perception: Negative sentiment towards plastic waste can harm brand image and consumer purchasing decisions, impacting market acceptance.

- Market Shift: Growing consumer preference for sustainable alternatives could reduce demand for conventional plastic products, requiring adaptation.

- EPR Schemes: Extended Producer Responsibility programs may impose new financial obligations related to the end-of-life management of plastic products.

Intensifying competition in the composite cylinder market, with major players like Hexagon Composites and Worthington Enterprises expanding their presence, poses a significant threat of pricing pressure and market share erosion for Time Technoplast. Economic downturns and persistent inflation could also dampen demand across key sectors, impacting sales volumes and profitability. Furthermore, advancements in sustainable materials and stricter environmental regulations surrounding plastic usage present long-term challenges to Time Technoplast's product portfolio and market acceptance.

| Threat Category | Specific Threat | Impact on Time Technoplast | Supporting Data/Trend (2024-2025) |

|---|---|---|---|

| Competition | Increased competition in composite cylinders | Pricing pressure, potential market share loss | Hexagon Composites reported 12% revenue growth in composite cylinders (Q1 2024) |

| Economic Factors | Economic slowdowns, inflation | Reduced industrial activity, lower consumer spending, decreased demand | Projected global manufacturing slowdown for 2024-2025 |

| Material Substitution | Advancements in biodegradable/alternative materials | Reduced demand for core polymer products, need for innovation | Growing consumer preference for sustainable alternatives |

| Regulatory & Public Perception | Stricter environmental laws, plastic pollution concerns | Increased operational costs, potential product portfolio limitations, brand reputation risk | Implementation of Extended Producer Responsibility (EPR) schemes, major consumer goods companies setting virgin plastic reduction targets by mid-2024 |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry insights to ensure a robust and accurate strategic assessment.