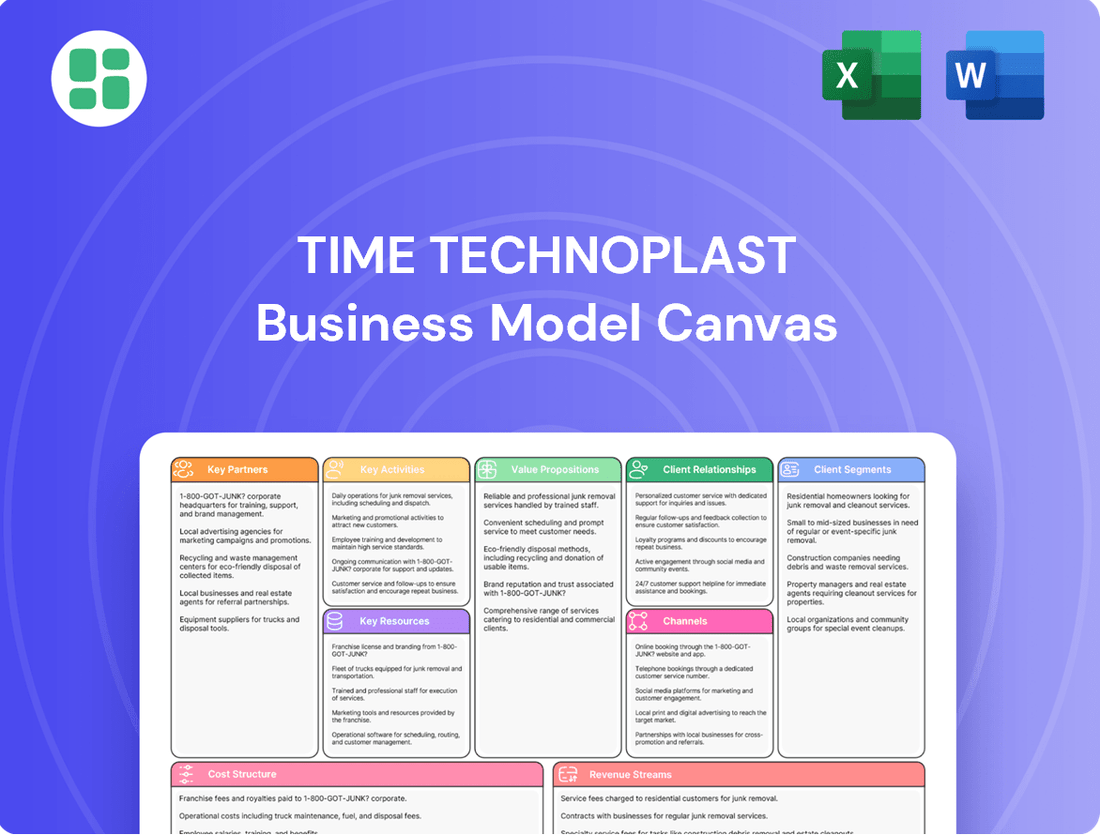

Time Technoplast Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Time Technoplast Bundle

Unlock the core strategies behind Time Technoplast's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, manage resources, and generate revenue in the competitive plastics industry. Gain actionable insights for your own business planning.

Partnerships

Time Technoplast has a strong history of collaborating with global technology leaders. For instance, their partnership with Mauser, Germany, has been crucial for advancing polymer processing and developing innovative products, particularly in the industrial packaging sector.

These alliances provide Time Technoplast with access to state-of-the-art manufacturing methods and product designs, which is key to staying ahead in specialized polymer products. This strategic approach helps them maintain a competitive advantage in the market.

A notable example of these collaborations is their joint ventures focused on manufacturing specialized containers, such as Intermediate Bulk Containers (IBCs). These ventures underscore their commitment to leveraging external expertise for product innovation and market penetration.

Time Technoplast's ability to secure reliable and cost-effective raw materials, primarily crude derivatives and polymers, is a cornerstone of its operations. The company actively cultivates strong ties with its suppliers, recognizing the inherent volatility in these commodity markets. This focus on supplier relationships is critical for maintaining production consistency and managing its cost base effectively.

To combat price fluctuations, Time Technoplast often enters into long-term supply agreements and maintains a diversified sourcing strategy. This approach helps to buffer the impact of market swings and ensures a steady flow of essential materials. For example, in fiscal year 2023, the company's raw material costs represented a significant portion of its overall expenses, highlighting the importance of these supplier partnerships.

Furthermore, the company's business model incorporates mechanisms to address raw material price volatility directly with its clients. By including pass-through clauses in customer contracts, Time Technoplast can effectively transfer a portion of increased raw material costs, thereby protecting its profit margins and ensuring financial stability amidst fluctuating input prices.

Time Technoplast's partnerships with Original Equipment Manufacturers (OEMs) in the automotive sector are fundamental. These collaborations ensure their components, such as fuel tanks, radiator tanks, and air ducts, are directly integrated into the production lines of major vehicle manufacturers, solidifying their presence in the automotive supply chain. For instance, in the fiscal year 2023, Time Technoplast reported a significant portion of its revenue derived from its automotive segment, underscoring the importance of these OEM relationships.

Furthermore, the company is actively forging partnerships with OEMs for the integration of its composite cylinders in on-board applications for Compressed Natural Gas (CNG) and hydrogen. This strategic move is expanding their market reach into the burgeoning alternative fuel vehicle sector. The increasing global demand for cleaner transportation solutions, with projections indicating substantial growth in the CNG and hydrogen vehicle market through 2030, highlights the strategic value of these OEM collaborations for future expansion.

Government-owned Oil Marketing Companies (OMCs) and Gas Companies

Time Technoplast’s key partnerships with government-owned Oil Marketing Companies (OMCs) and gas companies are foundational for its composite cylinder business. Securing substantial orders and long-term supply contracts with entities like Indian Oil Corporation Ltd., Adani Gas, Mahanagar Gas Limited (MGL), and GAIL is paramount. These collaborations are vital for driving the widespread adoption and efficient distribution of composite cylinders for LPG, CNG, and emerging hydrogen applications across both domestic and industrial markets.

These strategic alliances ensure consistent demand and market access, underpinning Time Technoplast's revenue streams. For instance, the push towards cleaner fuels and the increasing adoption of composite cylinders in India, a market projected to grow significantly, directly benefits from these strong relationships. The government’s focus on expanding gas infrastructure and promoting the use of compressed natural gas (CNG) and LPG in various sectors further solidifies the importance of these partnerships.

- Securing Orders: Partnerships with major OMCs like Indian Oil Corporation Ltd. and private players such as Adani Gas are crucial for obtaining large-volume orders for composite cylinders.

- Long-Term Contracts: These collaborations often translate into multi-year supply agreements, providing revenue visibility and stability for Time Technoplast.

- Market Penetration: Collaborating with gas distribution companies like MGL and GAIL facilitates deeper penetration into domestic and industrial sectors for LPG, CNG, and hydrogen cylinders.

- Regulatory Alignment: Working closely with government-owned entities ensures alignment with national energy policies and standards, fostering trust and facilitating market acceptance.

Distribution and Dealer Networks

Time Technoplast relies heavily on its extensive distribution and dealer networks to ensure its industrial and consumer products reach a broad market. This network spans across numerous cities and towns throughout India, facilitating effective market penetration. For instance, in FY23, the company reported a significant presence with a vast number of dealers and distributors, contributing to its widespread product availability.

The company’s strategy includes establishing a strong foothold in strategic overseas locations as well. This international presence is crucial for expanding its customer base and ensuring efficient product delivery beyond domestic borders. By maintaining these robust networks, Time Technoplast effectively manages its market reach and logistical operations.

- Extensive Domestic Reach: A wide network across Indian cities and towns for market penetration.

- International Presence: Strategic overseas locations to broaden customer base and delivery efficiency.

- FY23 Network Strength: Significant number of dealers and distributors contributing to product availability.

Time Technoplast's key partnerships are vital for market access and order fulfillment, particularly with Oil Marketing Companies (OMCs) and gas distribution firms. Collaborations with entities like Indian Oil Corporation Ltd., Adani Gas, Mahanagar Gas Limited (MGL), and GAIL secure substantial orders for composite cylinders, ensuring consistent demand and revenue. These alliances are crucial for penetrating domestic and industrial markets with LPG, CNG, and hydrogen solutions, aligning with national energy policies and fostering market acceptance.

| Partner Type | Key Partners | Impact on Time Technoplast | Example Data (FY23) |

|---|---|---|---|

| Oil Marketing Companies (OMCs) & Gas Companies | Indian Oil Corporation Ltd., Adani Gas, MGL, GAIL | Secures large-volume orders for composite cylinders, ensuring revenue stability and market penetration. | Significant portion of composite cylinder revenue derived from these partnerships. |

| Automotive OEMs | Various global and domestic vehicle manufacturers | Integrates components like fuel tanks and air ducts into vehicle production lines, solidifying automotive segment presence. | Automotive segment contributed substantially to FY23 revenue. |

| Technology Leaders | Mauser, Germany | Access to advanced polymer processing and product development, enhancing competitiveness in specialized polymer products. | Crucial for innovation in industrial packaging and specialized containers like IBCs. |

What is included in the product

A detailed breakdown of Time Technoplast's business model, highlighting its diverse product portfolio and B2B/B2C customer approach.

This canvas outlines Time Technoplast's strategy for leveraging its manufacturing capabilities and distribution networks to serve various industries.

Time Technoplast's Business Model Canvas offers a structured approach to identify and address operational inefficiencies, acting as a pain point reliever by clarifying value propositions and customer segments.

It streamlines strategic planning by providing a visual, one-page overview of Time Technoplast's operations, effectively relieving the pain of complex, multi-document strategy development.

Activities

Time Technoplast's advanced polymer product manufacturing is the engine of its business, focusing on creating essential items like industrial drums, containers, pails, and Intermediate Bulk Containers (IBCs). They also produce lifestyle products and critical automotive components, showcasing a broad product portfolio.

The company employs sophisticated polymer processing techniques, including blow molding, injection molding, and extrusion. This technological prowess allows them to deliver high-quality, durable, and adaptable polymer solutions across various industries.

In 2024, the industrial packaging segment, a key output of their manufacturing, continued to see robust demand, particularly for IBCs used in chemical and food industries. Time Technoplast's capacity to produce over 1.5 million industrial packaging units annually underpins its significant market presence.

Time Technoplast's commitment to Research and Development (R&D) and Innovation is a cornerstone of its business model. The company consistently invests in developing novel polymer and composite products designed to offer sustainable alternatives to traditional materials like metal. This focus on innovation allows them to stay ahead in a competitive market.

A prime example of this R&D drive is their pioneering work on Type-IV composite cylinders, which are crucial for the safe and efficient storage of LPG, CNG, and increasingly, hydrogen. These advanced cylinders represent a significant technological leap, offering lighter weight and enhanced durability compared to conventional steel cylinders.

Furthermore, Time Technoplast actively works on improving its existing product portfolio through continuous R&D. This involves enhancing the performance, safety, and environmental footprint of their current offerings, ensuring they meet evolving market demands and regulatory standards for sustainability.

Time Technoplast's global sales and distribution management is a cornerstone of its business model, focusing on efficiently reaching both institutional and retail customers worldwide. This involves a complex network that includes regional marketing offices and extensive dealer networks, ensuring products are available where and when demand arises.

The company's export operations are a significant component, driving market expansion and revenue growth. For instance, in the fiscal year 2023-24, Time Technoplast reported a notable increase in its export sales, contributing substantially to its overall financial performance and demonstrating the effectiveness of its global distribution strategies.

Quality Control and Compliance

Time Technoplast places immense importance on Quality Control and Compliance, ensuring all products meet rigorous international benchmarks. This commitment is vital for maintaining customer trust and accessing global markets. For instance, securing UN approval for dangerous goods packaging and PESO approval for composite cylinders are critical steps that validate the safety and reliability of their offerings.

The company employs stringent quality control measures at every stage of production. This meticulous approach guarantees that products consistently adhere to demanding industry specifications and uphold their integrity. For example, in the fiscal year ending March 31, 2024, Time Technoplast reported a significant focus on enhancing its manufacturing processes to meet these exacting standards.

- Adherence to International Standards: Obtaining certifications like UN approval for dangerous goods packaging and PESO approval for composite cylinders is a core activity, enabling market access and ensuring product safety.

- Rigorous Manufacturing Oversight: Implementing strict quality checks throughout the production cycle ensures product integrity and compliance with stringent industry requirements.

- Regulatory Approvals: Proactive engagement with regulatory bodies to secure necessary approvals demonstrates a commitment to operating within legal and safety frameworks.

- Product Integrity: Maintaining the highest levels of product quality is fundamental to Time Technoplast's reputation and customer satisfaction.

Supply Chain and Logistics Optimization

Time Technoplast's key activities in supply chain and logistics optimization are crucial for its operational efficiency and market competitiveness. The company focuses on streamlining the entire process, from sourcing raw materials to delivering finished goods to customers, ensuring both cost-effectiveness and prompt delivery. This involves meticulous planning and execution across all stages.

Optimizing logistics for both domestic and international markets is a core component. This includes managing transportation networks, warehousing, and distribution channels to minimize transit times and costs. Effective inventory management is also paramount, balancing stock levels to meet demand without incurring excessive holding expenses.

- Procurement Efficiency: Securing raw materials at competitive prices and ensuring consistent quality directly impacts product cost and availability.

- Inventory Management: Implementing just-in-time principles where feasible and employing robust inventory tracking systems to reduce carrying costs and prevent stockouts.

- Logistics Network: Establishing efficient transportation routes and partnerships for both inbound raw materials and outbound finished products, covering domestic and international shipments.

- Warehouse Operations: Optimizing warehouse layout, material handling, and order fulfillment processes to ensure speed and accuracy.

Time Technoplast's core activities revolve around the advanced manufacturing of polymer products, including industrial packaging like IBCs and automotive components. They also invest heavily in R&D to develop innovative, sustainable polymer solutions, such as Type-IV composite cylinders for gas storage. Global sales and distribution, coupled with stringent quality control and adherence to international standards like UN and PESO approvals, are critical to their market success.

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are precisely what you can expect in the final deliverable, ensuring no surprises. You will gain full access to this comprehensive analysis of Time Technoplast's business strategy, ready for your immediate use.

Resources

Time Technoplast boasts an impressive global footprint with over 30 manufacturing facilities strategically located across India, the UAE, USA, and Saudi Arabia. This extensive network allows for efficient, large-scale production of a wide array of polymer and composite products.

These numerous production sites are vital to Time Technoplast's ability to capture and maintain high market shares in various product segments. The company's robust manufacturing capacity ensures it can meet significant demand and support its diverse product portfolio effectively.

Time Technoplast's intellectual property, including proprietary polymer processing technologies and innovative product designs, is a cornerstone of its business model. These intangible assets, such as unique composite cylinder designs and advanced packaging solutions, allow the company to deliver high-performance products that differentiate it in the market.

In 2024, the company's focus on R&D continued to yield advancements. For instance, their commitment to developing lighter yet stronger composite cylinders for LPG and industrial gases directly leverages these proprietary technologies. This innovation not only enhances product safety and efficiency but also provides a significant competitive edge, as evidenced by their market share gains in key segments.

Time Technoplast's strength lies in its highly skilled workforce, particularly its dedicated Research and Development (R&D) team. This team boasts decades of collective experience in polymer science, engineering, and cutting-edge product development.

This deep expertise is the engine behind Time Technoplast's innovation, ensuring their products maintain a significant technical advantage in the market. Their R&D efforts directly translate into the superior quality and performance of their polymer-based solutions.

Financial Capital

Time Technoplast's financial capital is anchored by its robust access to equity and debt markets, enabling significant investments in operations and growth. The company's strong cash flow generation, a key component of its financial health, directly fuels its research and development efforts and crucial capital expenditures for expanding production capacity and launching new ventures. This financial muscle is directly supported by its solid financial performance, as evidenced by its revenue and profit after tax (PAT) growth.

Key financial resources and their impact include:

- Equity and Debt: Time Technoplast leverages its ability to raise capital through both equity and debt instruments to fund its strategic initiatives.

- Cash Flow Generation: Consistent positive cash flow from operations is vital for day-to-day activities and reinvestment into the business.

- Revenue and PAT Growth: For example, Time Technoplast reported a consolidated revenue of ₹1,778.70 crore for the fiscal year ended March 31, 2024, marking a significant increase. Similarly, Profit After Tax (PAT) also demonstrated a positive trend, underscoring the company's financial strength.

- Capital Expenditures: The company allocates substantial funds towards capital expenditure, ensuring its manufacturing facilities remain state-of-the-art and can meet growing market demand.

Established Brands and Market Position

Time Technoplast's established brands, such as Tech Pack and GNX, are significant intangible assets. These brands hold dominant market positions in key segments like industrial packaging and large-size plastic drums. This strong market presence builds customer trust and aids in expanding market reach.

The company's leadership in composite cylinder manufacturing further solidifies its market position. For instance, in the fiscal year ending March 31, 2024, Time Technoplast reported a revenue of ₹2,549 crore. This financial performance underscores the strength derived from its established brands and market standing.

- Brand Recognition: Well-known brands like Tech Pack and GNX build immediate customer trust and loyalty.

- Market Dominance: Leading positions in industrial packaging and large plastic drums provide a competitive edge.

- Product Leadership: Expertise in composite cylinders showcases innovation and market influence.

- Customer Loyalty: Strong market standing translates into repeat business and easier new product adoption.

Time Technoplast's key resources are its extensive global manufacturing network, proprietary polymer processing technologies, a skilled R&D team, strong financial capital, and well-established brands.

These resources enable efficient production, product innovation, market leadership, and sustained growth. The company's financial strength, for example, is evident in its reported consolidated revenue of ₹1,778.70 crore for FY24, supporting its strategic investments.

The company's intellectual property, particularly in composite cylinder design, provides a significant competitive advantage, as seen in their market share gains. Their brands, like Tech Pack and GNX, foster customer trust and market dominance.

Time Technoplast's financial health is further demonstrated by its robust cash flow generation and positive PAT trends, allowing for continued capital expenditure and expansion efforts.

Value Propositions

Time Technoplast's commitment to innovation is evident in its development of advanced polymer and composite products. These often serve as superior alternatives to traditional materials, offering enhanced durability and safety. For instance, their pioneering Type-IV composite cylinders represent a significant technological advancement in gas storage solutions.

The company's focus on technology-driven products translates into tangible benefits for customers, such as improved performance and longevity. This forward-thinking approach is crucial in sectors demanding high-quality materials. Time Technoplast's advanced industrial packaging solutions further underscore their dedication to pushing material science boundaries.

Time Technoplast boasts a remarkably diverse product portfolio, encompassing everything from industrial packaging solutions like drums and containers to consumer-focused lifestyle products and essential automotive components. This broad offering allows them to cater to a wide range of industries and customer needs.

Their product breadth extends to advanced composite cylinders, showcasing a commitment to innovation across various applications. This extensive range enables Time Technoplast to provide integrated solutions, serving as a one-stop shop for many of their clients' requirements.

For fiscal year 2024, Time Technoplast reported revenue of ₹2,550 crore, with their diverse product segments contributing significantly to this figure, highlighting the strength of their varied market presence.

Time Technoplast's commitment to sustainability is a key value proposition, evident in their development of lightweight composite LPG cylinders. These cylinders not only improve fuel efficiency for users but also contribute to a reduced carbon footprint, aligning with growing environmental concerns. By offering greener alternatives, they attract customers who prioritize eco-friendly choices.

Further demonstrating their dedication, Time Technoplast has implemented significant green initiatives. The company has invested in solar panel installations and rainwater harvesting systems, showcasing a tangible effort towards reducing their operational environmental impact. These actions resonate with environmentally conscious consumers and also proactively address evolving regulatory landscapes that favor sustainable business practices.

Their focus on recycling and the utilization of green energy further solidifies their role in fostering a low-carbon economy. By actively participating in circular economy principles and embracing renewable energy sources, Time Technoplast positions itself as a responsible corporate citizen, appealing to stakeholders who value long-term environmental stewardship and economic viability.

Global Presence and Reliable Supply Chain

Time Technoplast's extensive global manufacturing footprint, with facilities strategically located in countries like India, the UAE, and Malaysia, underpins its value proposition of a reliable global presence. This widespread operational base ensures consistent product availability for a diverse international clientele.

The company's robust distribution networks, reaching over 50 countries, are crucial for maintaining an efficient and dependable supply chain. This allows Time Technoplast to effectively serve its global customers, minimizing lead times and ensuring product accessibility.

- Global Manufacturing Network: Facilities in India, UAE, Malaysia, and other key regions.

- Extensive Distribution Reach: Products supplied to over 50 countries worldwide.

- Supply Chain Resilience: Diversified manufacturing and logistics reduce dependency on single locations.

- Customer Accessibility: Ensures timely and reliable product delivery to international markets.

Cost-Effectiveness and Operational Efficiency

Time Technoplast focuses on cost-effectiveness and operational efficiency by employing advanced polymer processing technologies. This allows them to streamline manufacturing and ultimately offer more affordable solutions to their clients.

Their innovative products, like composite LPG cylinders, provide significant long-term cost advantages. These benefits stem from reduced maintenance needs and enhanced operational efficiency when compared to conventional steel cylinders.

- Advanced Polymer Processing: Utilizes cutting-edge technology for efficient production.

- Optimized Manufacturing: Streamlines processes to lower operational costs.

- Composite Cylinder Benefits: Offers reduced maintenance and increased efficiency for customers.

- Long-Term Cost Savings: Provides economic advantages over traditional alternatives.

Time Technoplast offers advanced polymer and composite products, often surpassing traditional materials in durability and safety, exemplified by their Type-IV composite cylinders. Their technology-driven approach ensures customers benefit from improved performance and longevity, a critical factor in demanding industries. The company's broad product range, from industrial packaging to automotive parts, caters to diverse needs, positioning them as a comprehensive solutions provider.

The company's commitment to sustainability is a core value, highlighted by their development of lightweight, fuel-efficient composite LPG cylinders that also reduce carbon footprints. This focus on eco-friendly alternatives appeals to environmentally conscious consumers and aligns with evolving regulatory trends. Time Technoplast further demonstrates this through green initiatives like solar panel installations and rainwater harvesting, underscoring their dedication to minimizing operational environmental impact.

Time Technoplast leverages its global manufacturing network, with facilities in India, the UAE, and Malaysia, to ensure consistent product availability for international clients. Their extensive distribution reach, spanning over 50 countries, guarantees a resilient and efficient supply chain, providing reliable product access worldwide.

Cost-effectiveness and operational efficiency are achieved through advanced polymer processing technologies, enabling the company to offer competitively priced solutions. Products like their composite LPG cylinders provide long-term savings due to reduced maintenance and enhanced operational efficiency compared to traditional steel alternatives.

| Value Proposition | Key Features | Customer Benefit |

|---|---|---|

| Innovation & Technology | Type-IV composite cylinders, advanced polymer processing | Enhanced durability, safety, performance, and longevity |

| Sustainability | Lightweight composite LPG cylinders, solar power, rainwater harvesting | Improved fuel efficiency, reduced carbon footprint, eco-friendly choice |

| Global Presence & Reliability | Manufacturing in India, UAE, Malaysia; distribution to 50+ countries | Consistent product availability, resilient supply chain, timely delivery |

| Cost-Effectiveness | Optimized manufacturing, composite cylinder benefits | Long-term savings through reduced maintenance and increased efficiency |

Customer Relationships

Time Technoplast cultivates enduring client connections through dedicated sales and account management. These specialized teams nurture relationships with over 900 institutional clients worldwide, ensuring each receives tailored support.

This personalized approach is crucial for understanding unique client requirements, which in turn drives repeat business and secures substantial contracts. For instance, in fiscal year 2023-24, the company reported a significant portion of its revenue stemming from these long-term partnerships.

Time Technoplast offers robust technical support, ensuring clients receive expert assistance for product integration and operation. This commitment extends to product customization, allowing for tailored solutions that precisely match unique industry demands. For instance, in 2024, the company reported a significant increase in custom orders for its specialized polymer products, reflecting a growing demand for bespoke solutions across various sectors like automotive and infrastructure.

Time Technoplast prioritizes strong customer relationships through dedicated service channels and active feedback collection. This approach ensures prompt resolution of inquiries and issues, fostering a sense of trust and reliability.

By actively listening to customer feedback, Time Technoplast gains valuable insights to continuously enhance its product offerings and service quality. This commitment to improvement directly contributes to increased customer loyalty and satisfaction.

For instance, in fiscal year 2023-24, Time Technoplast reported a significant increase in customer engagement across its digital platforms, indicating successful implementation of customer-centric strategies.

Long-Term Contracts and Strategic Partnerships

Time Technoplast strengthens customer relationships through long-term contracts, particularly in its industrial packaging and composite cylinder divisions. These agreements ensure predictable revenue streams and foster deeper collaboration with major clients.

Strategic partnerships with large corporations and government bodies are central to this approach. For instance, in FY2024, Time Technoplast continued to leverage its established relationships, securing significant orders that underscore the value of these long-term commitments.

- Revenue Stability: Long-term contracts provide a predictable revenue base, reducing volatility.

- Client Integration: Deeper partnerships allow for greater understanding of client needs and tailored solutions.

- Market Access: Strategic alliances with large entities open doors to significant market opportunities.

- FY2024 Performance: The company’s continued success in securing these contracts highlights their effectiveness in building lasting customer loyalty.

Industry Engagement and Awareness Programs

Time Technoplast actively participates in industry expos and conferences to showcase its innovations and engage with stakeholders. For instance, in the fiscal year 2023-24, the company continued its focus on expanding the market for its composite LPG cylinders through targeted promotional activities.

These engagement programs are crucial for educating potential customers about the benefits of new products, such as the lightweight and corrosion-resistant features of composite cylinders, thereby driving adoption. This direct interaction fosters stronger customer relationships and provides valuable market insights.

- Industry Expos and Conferences: Time Technoplast leverages these platforms to demonstrate its product range and technological advancements.

- Awareness Programs: Targeted campaigns educate consumers and businesses on the advantages of adopting newer, safer, and more efficient products like composite LPG cylinders.

- Customer Education: By explaining product benefits, Time Technoplast aims to overcome initial adoption barriers and build trust.

- Market Understanding: Direct engagement provides feedback loops essential for refining product offerings and market strategies.

Time Technoplast fosters deep customer loyalty through dedicated account management and personalized service, catering to over 900 institutional clients globally. This client-centric approach, evident in their FY2023-24 performance, emphasizes understanding unique needs to drive repeat business and secure substantial contracts, particularly in industrial packaging and composite cylinders.

| Customer Relationship Aspect | Description | FY2023-24 Impact |

|---|---|---|

| Dedicated Account Management | Nurturing relationships with 900+ institutional clients worldwide. | Drives repeat business and secures large contracts. |

| Technical Support & Customization | Expert assistance and tailored solutions for product integration. | Increased custom orders in 2024 for specialized polymer products. |

| Long-Term Contracts | Securing predictable revenue through agreements in key divisions. | Provides revenue stability and deeper client collaboration. |

| Industry Engagement | Participation in expos and conferences to showcase innovations. | Expanded market for composite LPG cylinders through targeted promotions. |

Channels

Time Technoplast's direct sales channel is crucial for its industrial packaging, automotive components, and composite cylinder segments. They engage directly with major players in sectors like chemicals, fast-moving consumer goods (FMCG), automotive manufacturing, and infrastructure development.

This direct engagement fosters strong relationships and allows Time Technoplast to craft highly customized solutions that precisely meet the complex needs of these large institutional clients. For instance, their ability to provide specialized industrial packaging solutions directly to chemical manufacturers highlights this strategy.

In fiscal year 2024, Time Technoplast reported a significant portion of its revenue stemming from these industrial and automotive segments, underscoring the effectiveness of their direct sales approach in securing substantial business from institutional buyers.

Time Technoplast leverages an extensive distributor and dealer network spanning 345 cities and towns across India, alongside a presence in overseas markets. This robust infrastructure is crucial for distributing their wide array of consumer and industrial products, from polymer products to automotive components.

This widespread network allows Time Technoplast to penetrate diverse market segments effectively. For instance, their reach into Tier 2 and Tier 3 cities ensures that products like water tanks and material handling solutions are accessible to a broader customer base, contributing to significant market penetration.

In fiscal year 2024, the company's strategic expansion of this network, coupled with strong product demand, supported consistent revenue growth. The ability to reach customers efficiently through these channels remains a cornerstone of their business model, enabling them to capture market share in competitive sectors.

Time Technoplast leverages its corporate website and targeted industry platforms to showcase product catalogs, company updates, and facilitate initial customer contact. This digital outreach is crucial for generating leads and enhancing brand recognition within its B2B market.

In 2023, the company reported a consolidated revenue of INR 10,747.2 crore, highlighting the scale of its operations and the importance of efficient digital channels in reaching its diverse industrial clientele.

Export and International Subsidiaries

Time Technoplast strategically utilizes its overseas manufacturing facilities and subsidiaries, such as Elan Incorporated FZE in the UAE and Core Plastech International in the USA. This global presence is crucial for efficiently serving international markets and establishing a direct sales and distribution network in key regions beyond India. For instance, as of fiscal year 2023, Time Technoplast reported a significant portion of its revenue originating from its international operations, demonstrating the effectiveness of this channel.

These international subsidiaries act as vital hubs, enabling the company to tailor products and services to local market demands, reduce logistical costs, and navigate diverse regulatory environments. This approach allows for more agile responses to global opportunities and challenges, contributing to the company's overall revenue diversification and growth trajectory.

- Global Manufacturing Footprint: Overseas facilities in UAE and USA support international market penetration.

- Direct Market Access: Enables direct sales and distribution channels outside India, bypassing intermediaries.

- Revenue Contribution: International operations are a key driver of overall company revenue, with significant contributions reported in recent fiscal years.

Industry Trade Shows and Exhibitions

Time Technoplast actively participates in key industry events like Chem Expo and India Energy Week. These exhibitions are vital for demonstrating their latest product innovations and connecting with potential business partners. Such engagements are instrumental in reinforcing their brand visibility across various industrial segments.

These trade shows provide a platform for direct interaction with a targeted audience, facilitating lead generation and fostering stronger relationships with existing clients. For instance, participation in the European Liquid Gas Congress directly targets a significant market segment for their specialized products.

- Showcasing Innovation: Demonstrating new product lines and technological advancements to industry peers and potential buyers.

- Client Acquisition: Engaging with new leads and converting them into valuable customers through direct interaction.

- Brand Reinforcement: Increasing brand awareness and solidifying market position within specialized sectors.

- Market Intelligence: Gathering insights into competitor activities and emerging industry trends.

Time Technoplast utilizes a multi-channel approach, combining direct sales for large industrial clients with an extensive distributor network for broader market reach. Their digital presence and participation in industry events further enhance lead generation and brand visibility.

In fiscal year 2024, the company's strategic expansion of its distributor network, coupled with strong product demand, supported consistent revenue growth, highlighting the effectiveness of these diverse channels.

The company's international subsidiaries in the UAE and USA are crucial for serving global markets, enabling direct sales and reducing logistical costs, contributing significantly to overall revenue in recent fiscal years.

Customer Segments

The chemical and specialty chemical industries are a cornerstone of Time Technoplast's industrial packaging segment, demanding robust solutions for storing and transporting a wide array of chemical products. These clients rely on Time Technoplast for high-quality drums, containers, and Intermediate Bulk Containers (IBCs) designed for safety and compliance.

As a primary consumer of large-sized polymer drums, this sector highlights the critical role Time Technoplast plays in the chemical supply chain. For instance, in 2023, the global chemical packaging market was valued at approximately $70 billion, with polymer-based solutions forming a substantial share, underscoring the demand for Time Technoplast's offerings.

The Fast-Moving Consumer Goods (FMCG) sector represents a significant customer base for Time Technoplast, particularly for its robust packaging solutions. Companies in this industry rely on pails and smaller containers for a wide array of products, from paints and lubricants to various food items. This segment prioritizes packaging that is not only durable but also ensures product integrity and shelf appeal.

Automotive manufacturers, both original equipment manufacturers (OEMs) and their component suppliers, are key customers for Time Technoplast. They depend on the company for critical plastic parts like fuel tanks and radiator tanks, as well as air ducts and other essential automotive components.

This segment also represents a significant demand for Time Technoplast's composite cylinders, particularly those used for compressed natural gas (CNG) and liquefied petroleum gas (LPG) vehicles. In 2024, the automotive industry continued its shift towards alternative fuels, driving demand for these specialized storage solutions.

Energy and Infrastructure Sector

The Energy and Infrastructure sector represents a significant customer base for Time Technoplast, encompassing demand for advanced composite cylinders designed for LPG, CNG, and increasingly, hydrogen applications. These cylinders serve diverse needs, from individual household use to large-scale industrial operations and cascade systems for gas transportation. For instance, the push towards cleaner fuels is driving substantial growth in the hydrogen cylinder market, with global demand projected to reach billions of dollars in the coming years.

Key clients within this segment are primarily government-owned Oil Marketing Companies (OMCs) and major gas distribution companies. These entities are instrumental in the rollout of new energy infrastructure, making them crucial partners. As of early 2024, India's focus on natural gas expansion, including CNG and PNG networks, has led to significant capital expenditure by companies like GAIL, creating a robust demand for Time Technoplast's HDPE and DWC pipes used in these projects.

- Composite Cylinder Demand: Growing adoption of LPG, CNG, and hydrogen cylinders for domestic, industrial, and cascade applications.

- Infrastructure Projects: Significant need for HDPE and DWC pipes for gas distribution networks and other infrastructure developments.

- Key Clients: Government-owned Oil Marketing Companies (OMCs) and prominent gas distribution companies are major purchasers.

- Market Growth Drivers: Government initiatives promoting cleaner fuels and expanding gas infrastructure are fueling demand.

Healthcare and Lifestyle Product Consumers

This segment, while representing a smaller portion of Time Technoplast's customer base, is crucial for its diversified product portfolio. It encompasses consumers of both healthcare and lifestyle goods. For instance, the company has a history of producing medical disposables like syringes, catering to institutional healthcare providers and individual patient needs.

In the lifestyle product arena, this segment includes demand for items such as mats, garden furniture, and disposable bins. These products serve a broad range of individual consumers and also find application in institutional settings like hotels or offices. The company's ability to serve both B2B and B2C markets within this segment highlights its flexibility.

- Healthcare Products: Includes medical devices and disposables, serving hospitals, clinics, and direct consumers.

- Lifestyle Products: Encompasses items like mats, garden furniture, and disposable bins for both individual and institutional use.

- Market Reach: Caters to a diverse customer base, from healthcare facilities to households and commercial establishments.

- Product Diversification: Demonstrates Time Technoplast's strategy to address varied consumer needs beyond its core industrial offerings.

Time Technoplast serves a diverse range of customer segments, from the demanding chemical industry requiring specialized packaging to the high-volume Fast-Moving Consumer Goods (FMCG) sector. The automotive industry relies on them for critical plastic components and composite cylinders for alternative fuels, a trend expected to grow in 2024. The energy and infrastructure sector, particularly government OMCs and gas distributors, are key clients for their composite cylinders and pipes used in gas networks, with significant investment in this area ongoing.

Additionally, Time Technoplast caters to niche markets within healthcare and lifestyle products, supplying medical disposables and items like garden furniture, demonstrating their broad manufacturing capabilities.

| Customer Segment | Key Needs | Examples of Products Supplied | 2024 Market Relevance |

| Chemical Industry | Safe storage and transport of chemicals | Drums, IBCs, containers | Continued demand for robust, compliant packaging solutions. |

| FMCG | Durable, appealing packaging for consumer goods | Pails, smaller containers | High volume, consistent demand for product integrity. |

| Automotive | Lightweight, durable plastic parts; alternative fuel storage | Fuel tanks, radiator tanks, air ducts, CNG/LPG cylinders | Growing demand for alternative fuel components in 2024. |

| Energy & Infrastructure | Safe and efficient gas storage and distribution solutions | LPG/CNG/Hydrogen cylinders, HDPE/DWC pipes | Significant infrastructure spending driving pipe and cylinder demand. |

| Healthcare & Lifestyle | Medical disposables, household and commercial items | Syringes, mats, garden furniture, disposable bins | Diversified revenue streams, serving B2B and B2C markets. |

Cost Structure

Raw material costs are the most significant expense for Time Technoplast, largely driven by crude oil derivatives and various polymers. These inputs are inherently volatile, meaning their prices can swing considerably based on global market conditions. For instance, in 2023, the price of crude oil, a key determinant for many polymers, saw fluctuations impacting input costs.

Manufacturing and production costs are a significant component for Time Technoplast, stemming from the operation of its extensive network of over 30 production facilities. These costs encompass essential elements like the upkeep of machinery, which is crucial for maintaining operational efficiency and product quality. For instance, in the fiscal year 2023, the company reported its cost of materials consumed at ₹2,980.96 crore, reflecting the scale of its manufacturing activities.

Utilities, such as electricity and water, represent another substantial outlay in maintaining these production sites. Furthermore, labor wages for the dedicated manufacturing workforce are a direct cost associated with production. Time Technoplast actively pursues strategies to mitigate these expenses, focusing on optimizing energy consumption across its plants and implementing measures to enhance overall plant efficiency, aiming to reduce the per-unit cost of production.

Time Technoplast's commitment to innovation necessitates substantial investment in Research and Development (R&D). This spending is crucial for developing new products, like advanced hydrogen cylinders, and securing essential certifications for emerging technologies.

The company's R&D efforts are supported by a sizable team of specialized engineers and scientists, along with dedicated research facilities. For instance, in the fiscal year 2023, Time Technoplast reported R&D expenses of approximately ₹25.6 crore, reflecting their focus on future growth and technological advancement.

Sales, Marketing, and Distribution Costs

Time Technoplast incurs significant expenses to support its extensive sales, marketing, and distribution efforts. These costs are crucial for reaching a broad customer base across diverse geographical regions.

The company invests in maintaining a robust sales force and executing various marketing campaigns, including advertising and promotional activities, to build brand awareness and drive demand. Furthermore, the logistics of distributing products both domestically and internationally represent a substantial expenditure.

- Sales Team and Regional Offices: Expenses related to salaries, commissions, and operational costs for a widespread sales team and multiple regional offices.

- Marketing and Advertising: Investment in advertising campaigns across various media, digital marketing, and promotional events to enhance market presence.

- Distribution and Logistics: Costs associated with warehousing, transportation, and managing a dealer network to ensure efficient product delivery.

- International Market Expansion: Additional costs incurred for adapting marketing strategies and distribution channels for global markets.

Employee Costs and Administrative Overheads

Employee costs, encompassing salaries, benefits, and other forms of remuneration for all staff from production to management, represent a significant portion of Time Technoplast's operational expenditures. In 2024, the company's total employee benefits expense was a key driver of its cost structure.

Beyond direct employee compensation, general administrative overheads also contribute to this category. These include expenses related to the functioning of the company's administrative departments, ensuring smooth day-to-day operations and corporate governance.

- Salaries and Wages: The primary component, covering compensation for all employees across various functions.

- Employee Benefits: Includes health insurance, retirement contributions, and other statutory or voluntary benefits provided to staff.

- Administrative Overheads: Covers rent for office spaces, utilities, office supplies, and other general administrative expenses.

- Training and Development: Investments made in enhancing the skills and capabilities of the workforce.

The company's cost structure is heavily influenced by raw material prices, which are tied to volatile commodities like crude oil. Manufacturing and utilities form another substantial expenditure, reflecting the scale of their operations. Investments in R&D, sales, marketing, distribution, and employee costs are also critical components, all contributing to the overall cost of doing business.

| Cost Category | Fiscal Year 2023 (₹ Crores) | Notes |

|---|---|---|

| Cost of Materials Consumed | 2,980.96 | Primarily polymers and crude oil derivatives. |

| R&D Expenses | 25.6 | Focus on new product development and certifications. |

| Employee Costs | Not specified, but a significant driver. | Includes salaries, benefits, and administrative overheads. |

| Sales, Marketing & Distribution | Not specified, but substantial. | Covers sales force, advertising, and logistics. |

Revenue Streams

Sales of industrial packaging products represent Time Technoplast's primary revenue driver, generating the bulk of its income. This segment includes a wide array of plastic containers like drums, jerry cans, pails, and Intermediate Bulk Containers (IBCs), crucial for sectors such as chemicals, fast-moving consumer goods (FMCG), paints, and pharmaceuticals.

The company boasts a significant market share, not just within India but also on a global scale, underscoring its leadership in this product category. For instance, in the fiscal year 2023-24, Time Technoplast reported substantial revenue from its industrial packaging division, reflecting its strong market position and consistent demand from diverse industries.

Time Technoplast's sales of composite cylinders represent a significant and rapidly expanding revenue stream. This segment includes Type-IV composite cylinders crucial for LPG, CNG, and emerging hydrogen applications. These advanced cylinders are supplied to major players in the energy sector, including oil marketing companies and gas distribution networks, as well as automotive original equipment manufacturers (OEMs).

The demand for these composite cylinders is driven by their lightweight nature and enhanced safety features compared to traditional steel cylinders. For instance, the market for composite LPG cylinders alone is projected to see substantial growth, with estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years, fueled by government initiatives promoting cleaner fuels and the adoption of advanced materials.

Time Technoplast generates significant revenue by supplying a wide array of plastic components to the automotive industry. This includes critical parts like fuel tanks, radiator tanks, and air ducts, all manufactured through their molding expertise.

These components are essential for vehicle assembly, directly supporting the manufacturing processes of major automotive brands. In 2024, the automotive components sector continued to be a robust revenue driver, reflecting sustained demand from vehicle producers.

Sales of Infrastructure Products

Time Technoplast generates significant revenue through the sale of infrastructure products, primarily HDPE (High-Density Polyethylene) pipes and DWC (Double Wall Corrugated) pipes. These products are essential components in a wide array of infrastructure development and construction projects, meeting the increasing need for durable and efficient piping systems.

The company's commitment to quality and innovation in this segment positions it to capitalize on ongoing infrastructure upgrades and new project developments. For instance, in the fiscal year 2023-24, the infrastructure sector in India saw substantial investment, driving demand for materials like those supplied by Time Technoplast.

- Revenue Source: Direct sales of HDPE and DWC pipes to various construction and infrastructure clients.

- Market Demand: Addresses the growing need for modern, reliable piping solutions in sectors like water supply, sewerage, and telecommunications.

- Financial Impact: This segment contributes substantially to the company's overall revenue, reflecting the robust demand in the infrastructure development landscape.

Sales of Lifestyle and Material Handling Products

Time Technoplast generates revenue through the sale of a variety of consumer lifestyle products, including items like mats, garden furniture, and disposable bins. This segment caters to everyday household needs and leisure activities, providing a consistent, albeit smaller, revenue contribution.

Beyond consumer goods, the company also profits from its material handling solutions. These products are crucial for logistics and industrial operations, offering a more B2B-focused revenue stream. The diversification across these product categories helps to broaden Time Technoplast's market reach and stabilize overall financial performance.

For instance, in the fiscal year ending March 31, 2023, Time Technoplast reported a total revenue of ₹2,438 crore. While specific breakdowns for lifestyle versus material handling products aren't always granularly detailed in public summaries, the company’s broader portfolio indicates the significance of these diverse sales channels.

- Consumer Lifestyle Products: Revenue from mats, garden furniture, and disposable bins.

- Material Handling Solutions: Income from industrial and logistics-focused products.

- Diversified Revenue: Contributes to overall financial stability and market presence.

Time Technoplast's revenue streams are diverse, spanning industrial packaging, composite cylinders, automotive components, and infrastructure products. The company also generates income from consumer lifestyle items and material handling solutions, demonstrating a broad market approach.

In the fiscal year 2023-24, Time Technoplast reported robust performance across its key segments. The industrial packaging division, a core revenue generator, saw sustained demand from sectors like chemicals and FMCG. Similarly, the composite cylinders segment, crucial for LPG and CNG applications, experienced significant growth, driven by the shift towards cleaner fuels.

The automotive components business, supplying parts like fuel tanks to major manufacturers, remained a strong contributor. Additionally, the infrastructure segment, focused on HDPE and DWC pipes, benefited from increased government spending on development projects. Overall revenue for the fiscal year ending March 31, 2023, stood at ₹2,438 crore, reflecting the company's broad revenue base.

| Revenue Stream | Key Products | Primary Customers | Fiscal Year 2023-24 Significance |

|---|---|---|---|

| Industrial Packaging | Drums, Jerry Cans, IBCs | Chemical, FMCG, Pharma | Primary revenue driver, strong market share |

| Composite Cylinders | Type-IV LPG, CNG, Hydrogen | Oil Marketing Companies, OEMs | Rapidly expanding, driven by cleaner fuel adoption |

| Automotive Components | Fuel Tanks, Radiator Tanks | Automotive Manufacturers | Robust demand from vehicle producers |

| Infrastructure Products | HDPE Pipes, DWC Pipes | Construction, Infrastructure Projects | Capitalizing on infrastructure upgrades |

| Consumer Lifestyle & Material Handling | Mats, Furniture, Bins, Logistics Products | Households, Industrial Operations | Diversifies revenue, broadens market reach |

Business Model Canvas Data Sources

The Time Technoplast Business Model Canvas is built upon a foundation of comprehensive market research, internal financial data, and operational performance metrics. These diverse sources ensure each component of the canvas is informed by accurate and relevant insights.